Index

- Introduction

- Types of Due Diligence

- Accounting Due Diligence checklist

- Due Diligence procedures

- Audit vs. Due Diligence:

Due diligence is a review or examination of a company’s financial records before entering a transaction with counter parties. The purpose of due diligence is to confirm facts given by the company and ensure it abides by standard practices. If you’re an investor/prospective investor, you’re likely to perform due diligence via software.

Due diligence was a term first used in the USA, post the passing of the Securities Act of 1933, when making all financial statements transparent and available to all potential investors became mandatory for all brokers and dealers.

But law enforcers saw how claims of full disclosure might expose dealers and brokers to the chances of unfair prosecution for not disclosing facts they were unaware of. So a way for them to defend themselves legally was included. If these dealers and brokers performed a thorough investigation of the company’s financial records and made those results transparent, they would not be held accountable for any information they may have missed. And that’s how due diligence came into being.

Types of Due Diligence

When it comes to a thorough examination of a company’s assets, financial performance till date, capabilities, and their probable future, due diligence is an exhaustive process indeed. Still, when you use accounting software to execute a due diligence process, it becomes considerably less time consuming and more rewarding. In fact, many companies are making use of due diligence VDR solutions in addition to ensure safe and secure data sharing with investors.

There are more than twenty types of due diligence out there. Here are a few:

1.Accounting/Financial Due Diligence:

One of the primary and most important kinds of due diligence - financial due diligence seeks to investigate all of a company’s financial data and evaluates its performance. Financial due diligence focuses on the analyzation of the following areas:

- The company’s annual earnings

- Their assets

- Their financial statements for the past three or five years

- Their debts and credits

- Their profit margins

- Their estimations and plans based on projections and the foundation of those projections as well

- Their customer accounts

2.Administrative Due Diligence

The intent with administrative due diligence is to study the facilities of a company and see if all the active costs are presented in their financial statements or not. This sort of due diligence seeks out the following:

- The details of the facilities owned or held by the company.

- Occupancy rates

- The kind of operational expenses befalling the investor if or when the company plans to span out

3.Asset Due Diligence:

This sort of due diligence requires data on the following:

- A list of the company’s assets and their locations

- Lease agreements for equipment

- Documentation of the selling or buying of any major asset over the past three to five years

- Property and real estate deeds

- Any mortgages and title insurance

- User permits

4.Taxes Due Diligence

This form of due diligence reviews every tax a company is responsible for paying and makes sure they are, in fact, not choosing to omit any in their statements. Here’s what this one looks into:

- Official statements of income and sales tax, withholding, and any other tax returns in the past three to five years

- Details of any pending taxes

- Any still unresolved tax-related cases

- Any questionable interactions with the tax authorities in the past

Accounting Due Diligence Checklist

Here’s a checklist of points the due diligence software you’re using should be investigating.

Financial Information:

To assess an enterprise’s financial condition, make sure all of this data is getting looked into:

- Yearly statements of the past three to five years

- Nature of funds in the past three to five years

- Inventory turnover ratio for the past three to five years

- Audit reports for the past three to five years

- Tax returns in the past three to five years

- Financial statements to the Securities and Exchange Board of India

- Ups and downs of the net value, market value, and liquidation value in the past three to five years

- Capitalization of the company in the past three to five years and comparison with competing institutes

- Interest amount in the past three to five years

- CoA (Chart of Accounts)

- Price-to-earnings ratio

- Debt-to-equity ratio

- Inventory-to-sales ratio

Sales and Returns:

The software should have detailed information on the following to make a correct assessment:

- An idea of the market

- Earnings records of the past five years

- Earnings comparison with competing companies in the past five years

- Gross and net sale in the past three to five years

- Return rates on equity

- Selling expenses in the past five years

- Sales comparison with competing companies in the past five years

Facilities:

This information would help with assessments of future costs and property and instrument resale values:

- Real estate descriptions

- Location of all the real estate held by the company

- Valuation of real estate

- Cost at time of purchase

- Real estate tax assessments

- Age and condition of the building(s)

- Data of any and all insurances

- Building depreciation rates

- Yearly maintenance cost for all real estate

- Equipment description

- Valuation of equipment

- Cost at time of acquisition

- Age and condition of equipment

- Data of insurances

- Equipment depreciation rates

- Yearly maintenance costs for all equipment

- Expenses for facilities (maintenance, new acquisition) in the past three to five years

- Any issues with the facilities within the past years

- All new acquisitions in the past three to five years

- Any subleasing agreements with other parties

Assets:

Here’s the information a due diligence provider should be used to examine a company’s assets:

- Their entire inventory and inventory location

- Catalog of raw materials

- Catalog of WIPs (Works in Progress)

- Catalog of finished products

- Their system of fixing prices

- Their account keeping system

- Their trademarks, patents, and copyrights

- The cash/cash equivalents- current liabilities ratio

- Analysis of their investments

- Inventory turnover ratio

- Asset turnover ratio

Liabilities of the Company:

For this process, the provider finds out about:

- All legal obligations of the company

- Current and past three to five years’ worth of state and federal tax status and payments made/still left to be made

- Terms and outstanding amounts of long and/or short term loans

- Debt-to-equity ratio

- Terms and outstanding amounts of debentures

- Interest and dividend arrears

- Contingent liabilities

- Any losses in the past few years

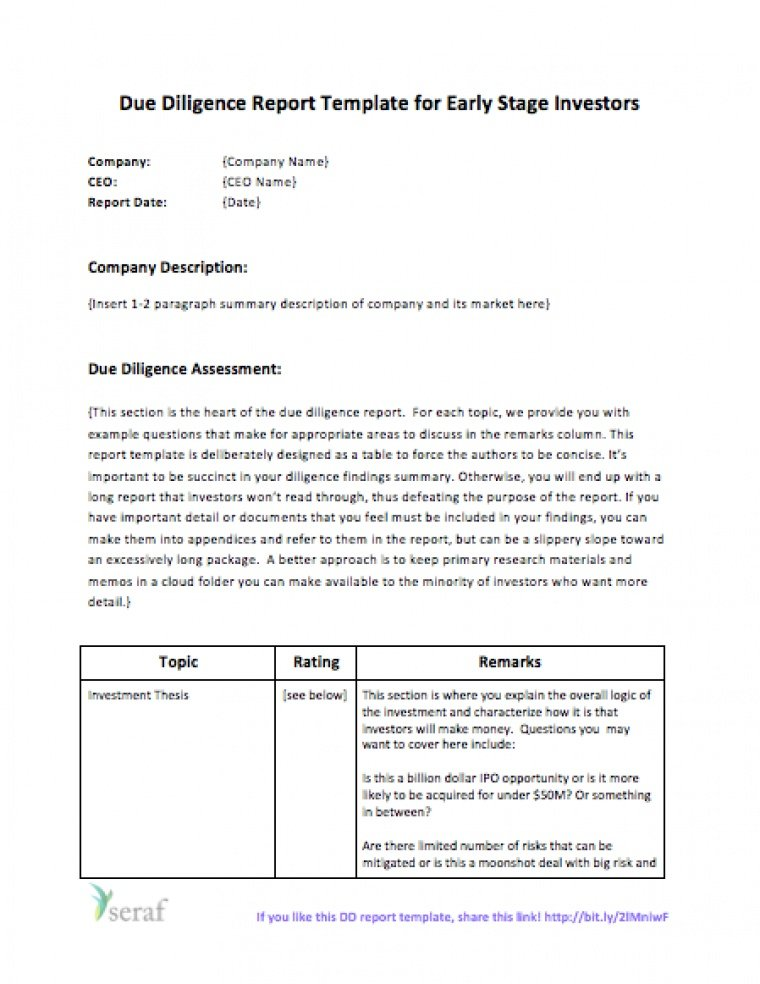

Due Diligence Procedures and Sample

Here’s a roundup of the steps a usual due diligence process follows.

- Determining Goals and Whether They Align with the Company:

This is the starting point for all projects. Once you provide goals and expectations and decide on the devices needed for them, the provider determines if they match with the company’s aims and projections.

- Analyzation the Company’s Capitalizations and Financial Scrutiny:

All financial statements of the company are gathered, investigated. You can see for yourself if all information on offer in the company's Confidential Information Memorandum (CIM) was legit or not. Plus, now you have an idea of their overall financial state.

- Gaining an Understanding of the Firm and Its Workings:

Through interviews and conversations with company representatives, operational information is collected and recorded, so the DD provider can answer specific queries and offer a close look at the company’s business practices.

- Legal Scrutiny:

A thorough examination of the legislative documents of the company is executed, and the details are recorded.

- Comparison with competing Firms and Industries:

A DD provider helps compare a company’s data with competitor data, to enable more perspective on its growth and its position in the industry in the past years.

- Risk Predictions and Management:

Through the DD Provider, you understand all risks the company might be facing in the coming years - both company-specific risks and industry-wide risks- and decide if you’re ready to take them on or not.

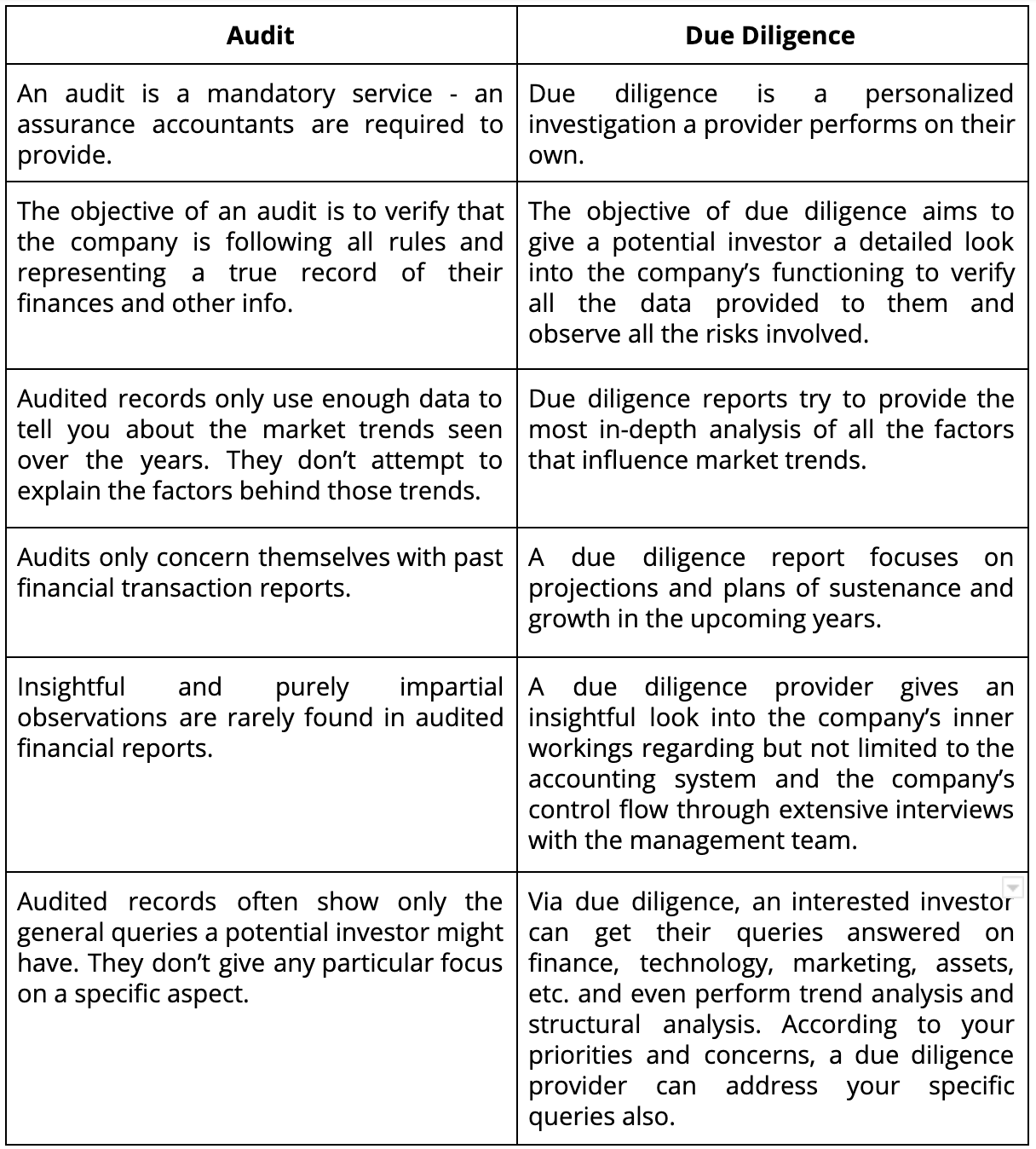

Audit vs. Due Diligence:

While making due diligence and audit out to be the same process is a common mistake, they do have distinct characteristics and are fundamentally quite different. Let’s take a look at the key differences between the two, shall we?

An audited financial report is an assurance that the organization has indeed given honest documentation of their finances and stayed true to all the rules and processes. But for an investor to make a knowledgeable investment decision, there’s no good enough alternative to a personalized due diligence review of the company. It’s why Deskera Books delivers detailed reports and analysis so crucial to small businesses, and so crucial to due diligence tasks.