Accrual accounting requires a business to coordinate with the costs it attracts with the incomes it creates through each accounting term. Tangible assets, like machinery or equipment, contribute toward incomes over many accounting periods. Then an organization distributes the resource's expense over its valuable life through depreciation. This results in a depreciation expense on the income statement in each accounting period equivalent to a part of the asset’s total cost instead of generating expenditure all at one go.

While there are numerous techniques of depreciation, we shall be focussing on the Double Declining Balance Method (DDB Method). Here’s what we see in detail in this post:

- A detailed description of the Double Declining Balance Method

- Formula, Calculation, and example of Double Declining Balance

- Reasons a company uses the method

- Benefits and Drawbacks of Double Declining Balance

- We shall also see the adjusting entries resulting from Double Declining Balance

- How Deskera can help your business with its Accounting software

What is Depreciation?

All physical assets run across decreasing their value over a period of time due to continuous use, deterioration, or obsolescence. Depreciation is the measure of this decrement.

In business, companies purchase equipment or physical assets that have a valuable life or a useful life. In this period of useful life, the asset’s value decreases due to various reasons. The company then needs to measure the value of the asset at the end of its useful life. This method of measuring the decreased value of the asset in the useful years is called depreciation.

Simple Illustration: A fisheries company buys industrial refrigerators worth $15,000 and expects to use them for 3 years. The company may decide to depreciate it by $2,000 every year under depreciation expense over the next 3 years, which is the useful life of the asset, in this case, refrigerators.

While depreciation is used for calculating the descending costs of tangible assets, Amortization is used in the case of intangible assets.

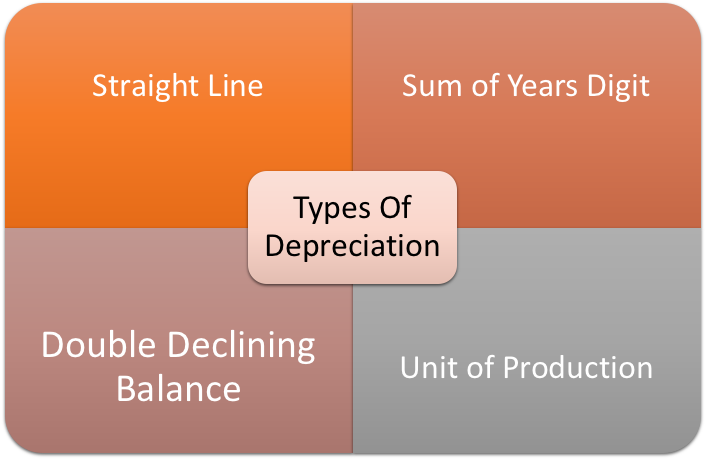

What are Different Types of Depreciation?

The four methods used in calculating depreciation are:

Straight-Line Depreciation

Using the straight-line depreciation method requires the estimation of useful life and salvage or residual value of the asset. The difference between the original cost of the asset and the salvage value gives the depreciable cost. This is the total amount of depreciation that needs to be expensed in equal amounts across its useful life.

Double Declining Balance Method

This method, being an accelerated method to depreciate an asset, allows for a speedy depreciation. It also aids in minimizing tax exposure. Companies usually opt for this method when they expect the asset to provide higher productivity in the initial years.

Unit of Production Method

This method uses an equal expense rate for every unit that is produced. This acts as a great advantage for the production lines or assembly. The formula takes into account the salvage value and the original price of the asset. The method assesses the depreciation expense for the given accounting period multiplied by the number of produced units.

Sum-of-Year’s Digits Depreciation

This method can be placed between the straight-line method and the double declining balance method, in terms of speed of depreciation. In this method, the yearly depreciation is separated into various fractions based on the number of years in the useful life. Examples of assets can be vehicles, electronics, buildings, furniture.

What is the Double Declining Balance Method?

Double Declining Balance or DDB refers to the accelerated method of calculating depreciation in which asset value gets depreciated at twice the rate as that in the straight-line method. Owing to an increased rate of depreciation, it is termed accelerated depreciation.

An accelerated depreciation does not imply a higher expense amount. The overall expensed amount will be the same; however, it will be more in the earlier years and less later.

Double Declining Balance Method Formula and Calculation

The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2. The double declining balance is expressed using the formula:

Let us see the meaning of each term separately.

Basic Depreciation Rate: It is the rate through which the asset depreciates using the Straight-line method.

Here, Yearly Write-off is given by the expression:

Book Value = Initial Cost of the asset.

In simple terms, Book value is the cost you paid while purchasing the asset.

Example of Double Declining Balance Method

XYZ Pvt. Ltd. has purchased equipment worth $200,000 with a salvage value of $20,000. Its useful life is 5 years. So, using the double declining balance depreciation method, the calculation goes as:

Yearly Write-off = 200,000 / 5 = 40,000

Basic Depreciation Rate = 40,000/200,000 = 0.2

Double Declining Vs. Declining Balance Depreciation

Although both DDB and declining depreciation are considered accelerated methods; however, double declining balance uses a depreciation rate that is twice that in the simple declining depreciation.

We can understand this by illustrating the case of a company that identifies huge profits on asset sales. This implies that the company uses a double declining balance method. Using this, the company experiences lower net income for many years, but as the book value of the asset is lower than market value, the company achieves a larger profit when the asset is sold.

When is the Double Declining Balance Method used?

The double declining balance method is aptly used in cases when the assets tend to lose their value rapidly or become outdated. It is used in either of the 2 cases stated here:

- The asset is used more rapidly in the initial years of its useful life.

- When the company aims at identifying the expense in the initial stage to minimize profitability to defer taxes.

Some examples of the case are mobile phones, computer equipment, and other devices which utilize technology that rapidly and regularly changes.

Why would a company use double-declining depreciation on its financial statements?

While most companies would look to avoid using the double declining balance method for depreciating their assets, some may still go with it. The reason for not using it is that the method results in a lower net income in the early years of the asset’s life.

The reasons some organizations use it on their financial statements are:

- To have a constant number for depreciation expense.

- To get an estimate of the repairs and maintenance expense for the useful life of the asset.

Simply put, the early years of an asset records lesser repairs expense but the depreciation expense will be higher. Whereas, the later years record a higher expense for repairs and the depreciation will be lower. Logical as this may sound, the companies then conclude with a lower net income in the initial years of the asset’s life, when compared to the calculation through the Straight-line method.

Benefits of the Double Declining Balance Method

With a good look at the concept, let's set eyes on the benefits of the double declining balance method.

1. Upfront Recovery of the Purchase Cost

You get more cashback in tax benefits from the beginning, which can help balance the expense of purchasing a resource. In the case that you've applied for a line of credit or a loan, you could be paying off a bigger part of the loan in the earlier periods, consequently, decreasing the sum for every period you pay interest on.

2. Offset the Maintenance Costs

Most resources decrease in value over the long haul and may require a significant measure of support expenses to keep resources in reasonable use in later years. The maintenance costs would be deducted from the organization's reported benefits. In this way, an organization can allocate reduced depreciation in later years. This would avoid adding more expenses to lessen reported profits. The double declining balance strategizes depreciation costs in a declining format in later years. Doing so helps to counterbalance the expanded maintenance costs with fewer depreciation costs.

3. Maximizing Deductions on Tax

An asset that works smoothly in the early years yields better productivity for the company in those years. This results in improved profits. An evenly spread out depreciation amount results in a drawback when the depreciation expense is used as a tax deduction. The double declining method enables the companies to minimize tax payments as it maximizes the tax deductions. The method paves way for higher depreciation expenses for early years to counter higher income and profits in these durations.

Disadvantages of Double Declining Balance Depreciation

This section gives an insight into why some companies would not want to have a double declining balance method as an option to depreciate their assets.

- The double declining balance method is not permitted by the IRS for tax purposes.

- The double declining method is a bit more complicated than the straight-line method. It is advisable to consult an expert accountant if you are filing for the first time utilizing this method.

- This method makes it difficult to predict the income. Estimated quarterly taxes require you to predict the income every year. With the double declining balance method, the amount is different every year which makes it difficult to predict the income for that year.

- While double declining balance provides you the upfront recovery advantage, it can backfire in the unforeseen cases of sudden expenses or a slow year. You may face a raised tax bill in the future, which can be avoided by using the straight-line method.

- The other disadvantage is reduced net income owing to increased depreciation expense.

Adjusting Entries on Balance Sheet, Income Statement, and Cash Flow statement

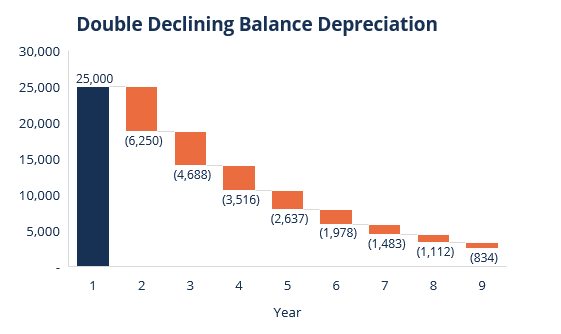

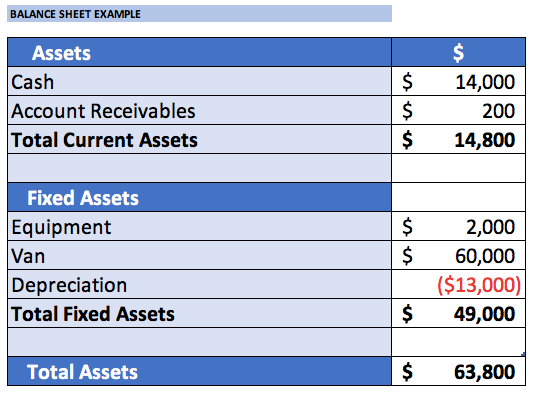

To understand the adjusting entries for depreciation, we look back at our example above. This is the table that shows the depreciation account of the balance sheet for 5 years of the asset’s life.

Let’s look at the way the entries are made on the Balance sheet, income statement, and cash flow statement.

- The amount at which the company purchases the equipment, $200,000, the cash and cash equivalents are reduced by $200,000. This is then moved to the Equipment line of the balance sheet.

- The cash flow statement shows outflow cash of $200,000 at the same time.

- This step shows that $80,000 is charged to the income statement as depreciation in the first year, with $48,000 in the second year, $28,800 in the third year, and so on, for the 5 years. While the amount is paid altogether at the time when the equipment was purchased, the amount is expensed over time.

- The depreciation expense is entered in contra account of the balance sheet, each year, like equipment, plant, or property. This amount reduces the carrying value of the asset and is called accumulated depreciation. So, in this example, the accumulated depreciation in the 1st year will be $80,000 and $48,000 in the 2nd year and so on for the remaining years.

- At the end of the useful life of the equipment, the asset has a carrying value of $20,000. At this point, if the organization sells the equipment above its residual value then it registers a profit in the income statement, else a loss.

- The revenue or the amount received after the sale of the equipment is entered as a cash inflow in the cash flow statement. A similar entry will be made in the cash and cash equivalents line of the balance sheet.

How can Deskera help your Accounting and Business?

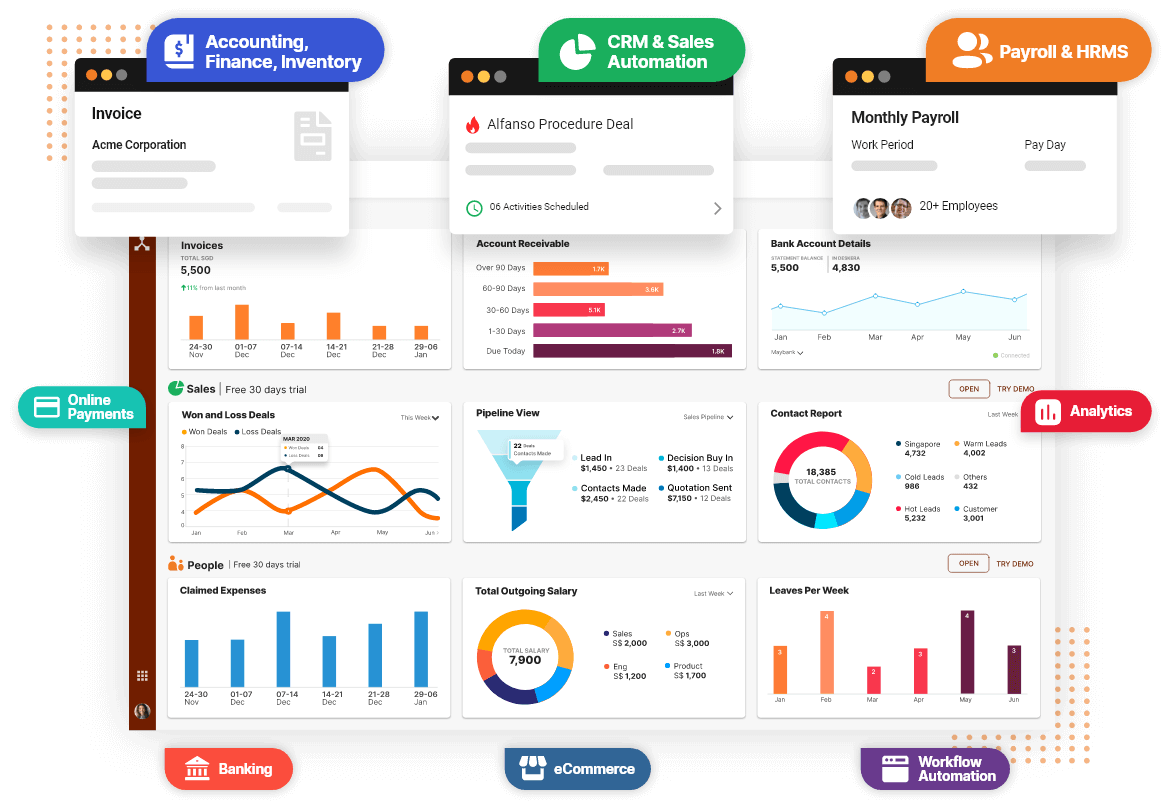

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

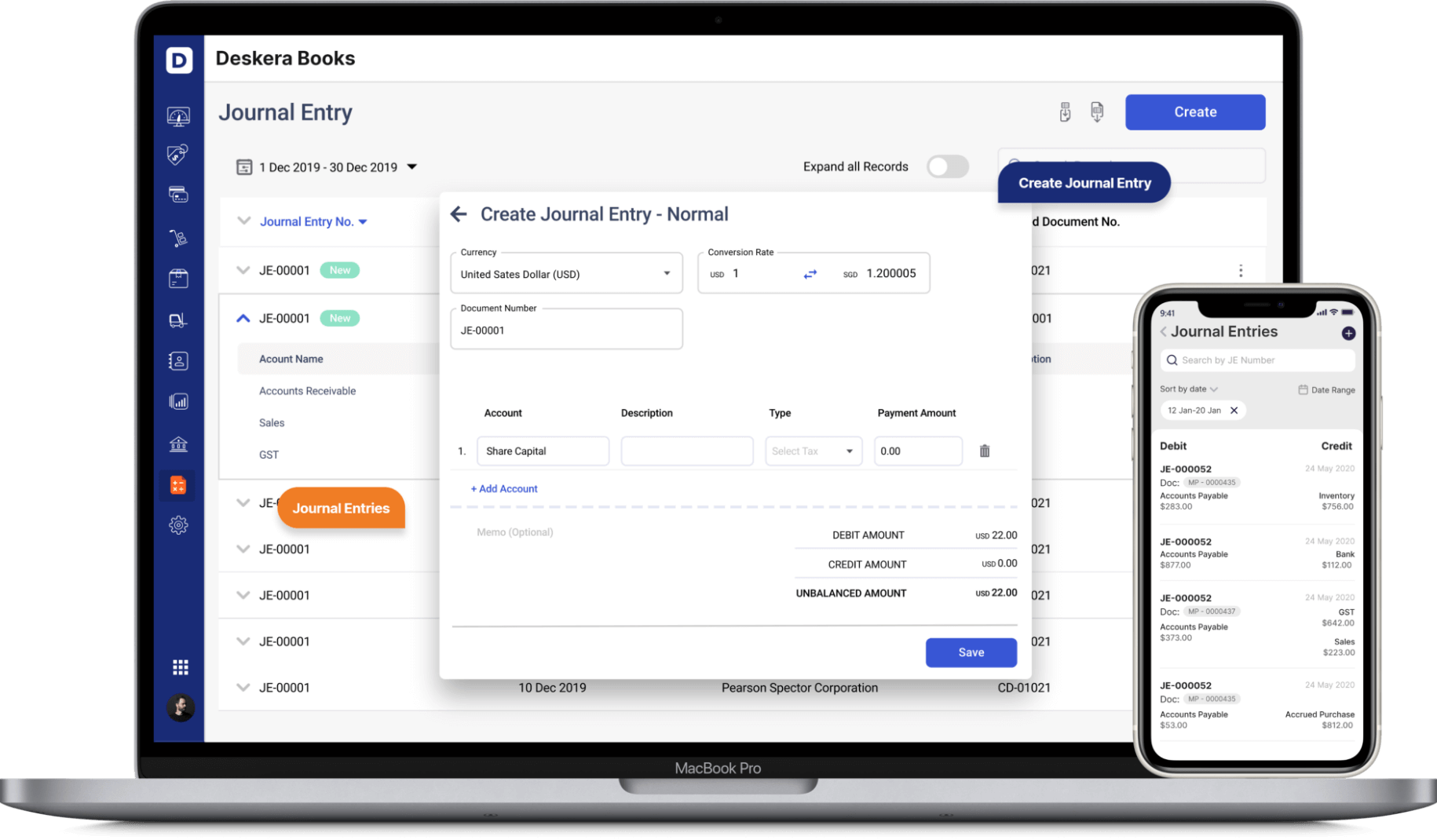

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

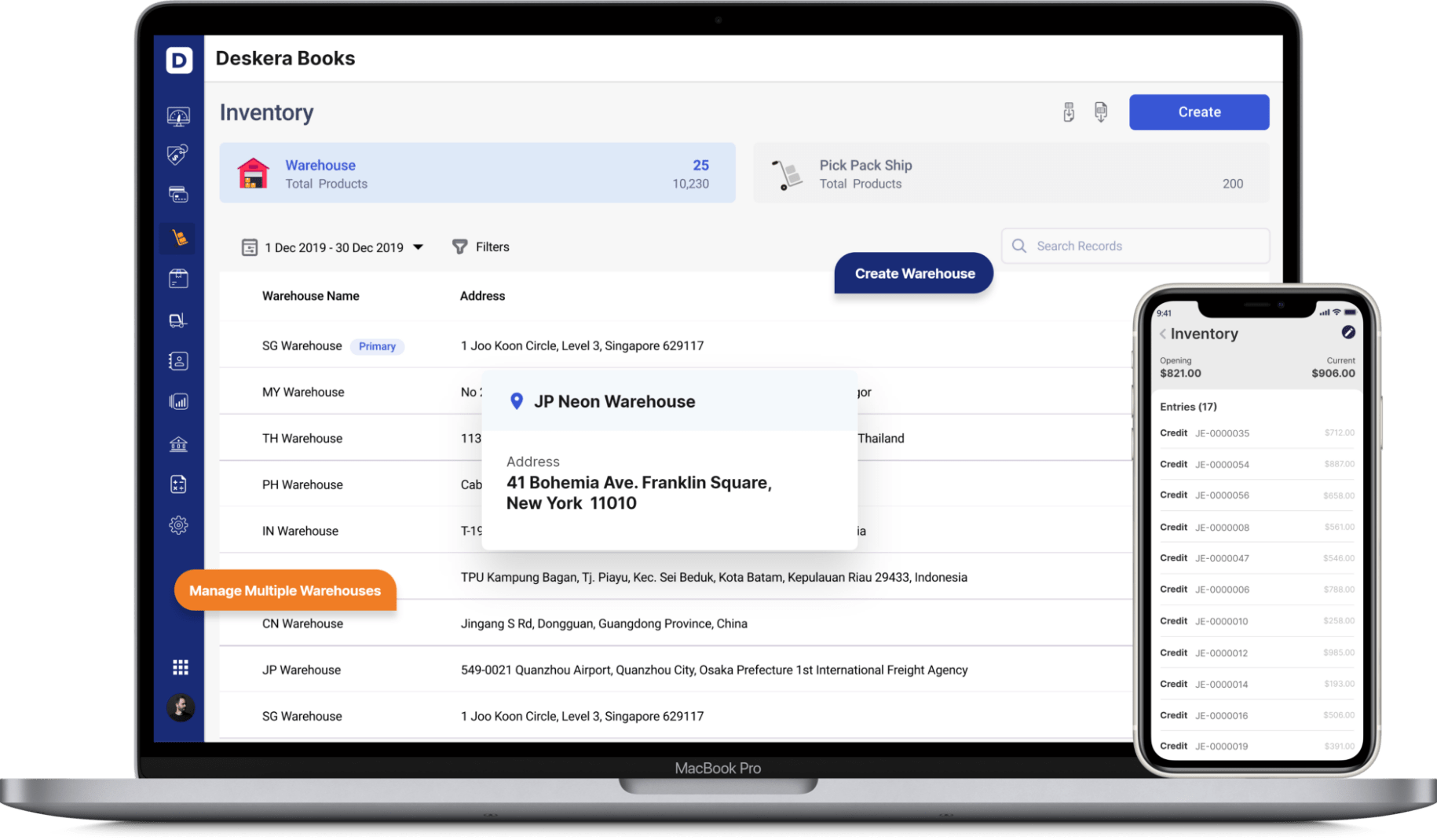

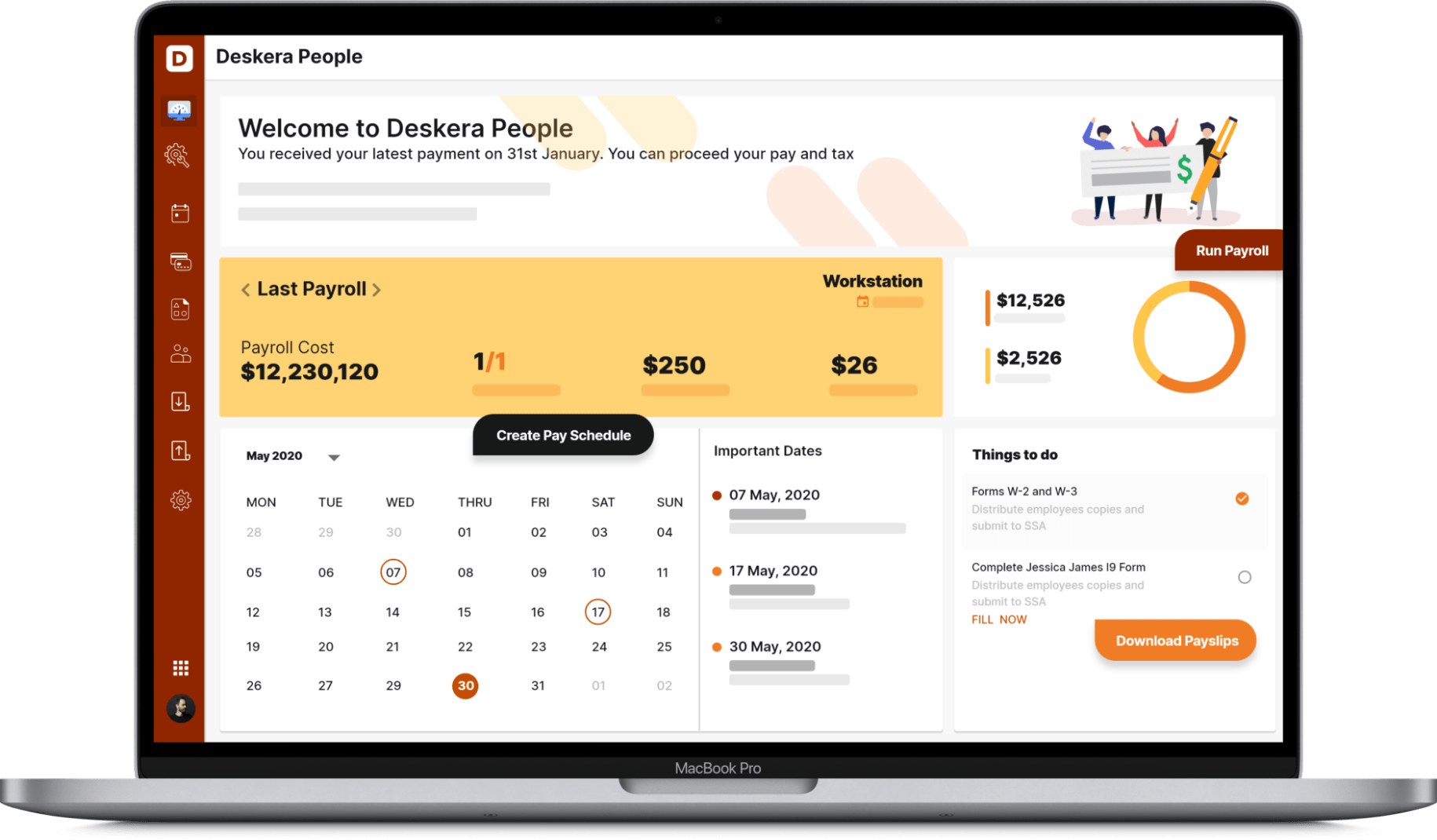

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

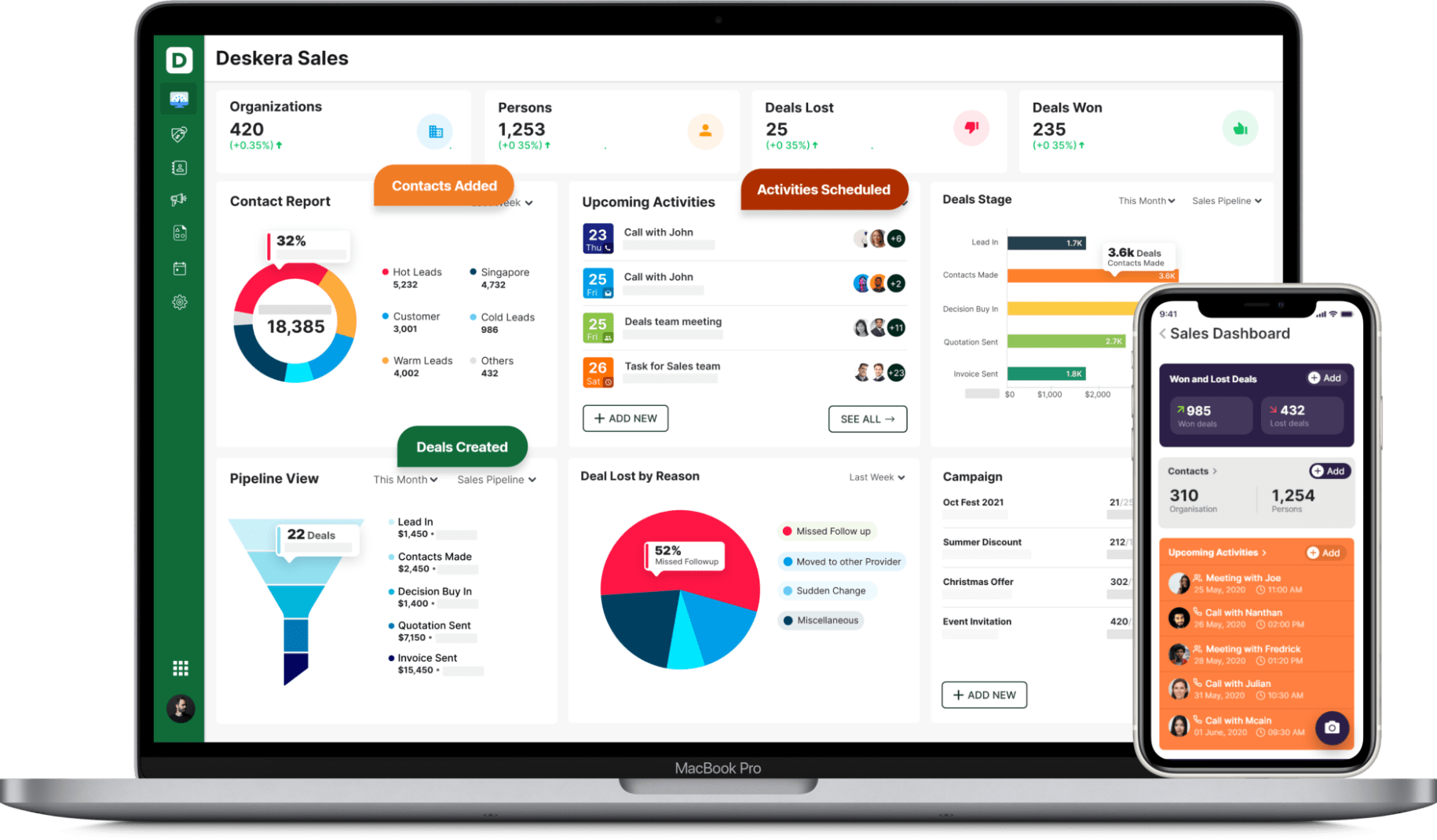

With Deksera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

After brainstorming over the concept of the double declining balance method, here are the points to note:

- The double declining balance method speeds up the depreciation strategy that is utilized to depreciate a resource or asset over its useful life.

- It is more complicated than the straight-line depreciation technique and requires significant accounting skills to carry out the process accurately.

- The double declining balance method helps in deferring tax payment by recording lower profits in the early years of the asset’s useful life.

- The difference between double declining balance and the simple declining balance method is that double declining balance uses a depreciation rate that is twice that in the simple declining depreciation.

Related Articles