Not all assets that a business owns are held for sale.

Property, buildings, equipment, vehicles, machinery, and other fixed assets, are purchased to conduct day-to-day operating activities, over an extended period of time.

Because of this extended usage time, and their high monetary value, these long-term assets don’t get fully charged right when they’re bought. Rather, their cost is spread out over their estimated useful life.

In financial accounting, this cost is known as a depreciation expense.

The chart or table where businesses keep track of the depreciation expense for each asset over the years is known as a depreciation schedule.

Deskera ERP offers a comprehensive solution for businesses seeking efficient management of their assets, including the creation and maintenance of depreciation schedules. Deskera ERP provides intuitive tools and features that simplify the process of tracking and calculating depreciation for fixed assets.

Additionally, AI-powered solutions such as ERP.AI can automate depreciation calculations, enhance data accuracy, and offer valuable insights, enabling smarter decision-making and optimized asset utilization.

In this guide, we’ll be explaining why a depreciation schedule is important, what assets you can depreciate, what are the different types of depreciation methods you can use, and everything else you need to know about creating a depreciation schedule for your small business accounting.

What Is Depreciation?

Depreciation represents how much an asset’s value has been used up. More specifically, it’s a method that allocates the costs of a fixed asset, over its expected useful life.

So, as it is purely an estimation, depreciation is a non-cash expense simply used for accounting purposes. The matching principle in financial accounting requires that business expenses incurred during one accounting period be recorded in the same period in which the related revenues are earned.

For instance, say a piece of manufacturing machinery is used to produce merchandise for three years. To comply with the matching principle, the company needs to match the cost of that machinery with the revenues generated from selling the merchandise. This is where depreciation comes into play - every year, for three years, the business has to devalue the machinery by recording an estimated depreciation expense.

The specific amount of depreciation expense to be recognized each year depends on the business, as there are many depreciation methods they can choose from. We’ll go through each, as well as explain their pros and cons, further down the guide.

If you want to learn how to record your depreciation expense, and all other financial transactions, as journal entries into your accounting books, head over to our guide on journalizing transactions.

What Kind of Assets Can You Depreciate?

For an asset to be depreciable it needs to fit the following criteria:

- You can’t claim the entire value of that asset in one single year.

- Your business needs to own the asset. Rented property, buildings, or equipment can’t be depreciated.

- You must use the asset to generate profit.

- The useful life or life expectancy of the asset must be greater than a year. Inventory, for instance, is typically purchased to be sold for less than a year, and thus can’t be depreciated.

More concretely, some common fixed assets that fit these criteria include vehicles, office equipment, real estate (except land), machinery, computers, and so forth.

What Is a Depreciation Schedule?

A depreciation schedule is a table you create to keep track of the depreciation of the expense of each of your fixed assets over the years. The main goal of a depreciation schedule is to give you the ability to track what depreciation you've already recognized and stay on top of your finances.

Typically, the depreciation schedule format will be as follows:

- Name and description of the asset, e.g: Property & Equipment

- Date of purchase

- Cost of the asset

- Estimated/expected useful life

- Salvage value/residual value, which is the estimated value that a fixed asset will have at the end of its useful life. Sometimes, the residual value may equal zero, in which case the value isn’t taken into account.

- Current year depreciation

- Accumulated depreciation, which is the total amount an asset has been depreciated up until a certain year or point.

- The depreciation method used. According to the Generally Accepted Accounting Principles (GAAP), you can choose from four depreciation methods: straight-line method, double-declining balance, sum-of-the-years’-digits, and units of production.

- Net book value, which is the price at which a business records an asset on its balance sheet.

These elements vary, depending on the amount of detail you want your schedule to provide, as well as the method you use to calculate the depreciation.

What is a Depreciation Schedule Calculator?

A depreciation schedule calculator is a tool used to calculate and generate a depreciation schedule for fixed assets. It automates the process of determining the depreciation expense for each period based on various depreciation methods, such as straight-line, double-declining balance, units of production, or others.

Example Output of a Depreciation Schedule Calculator

Enter Asset Details:

- Asset Description: Office Equipment

- Acquisition Date: 01/01/2020

- Original Cost: $10,000

- Salvage Value (if any): $1,000

- Useful Life (in years): 5

- Depreciation Method: Straight-Line

Calculate Depreciation:

| Year | Beginning Book Value | Depreciation Expense | Accumulated Depreciation | Ending Book Value |

|---|---|---|---|---|

| 1 | $10,000 | $1,800 | $1,800 | $8,200 |

| 2 | $8,200 | $1,800 | $3,600 | $6,400 |

| ... | ... | ... | ... | ... |

Summary:

- Total Depreciation Expense: $9,000

- Ending Book Value: $1,000 (at the end of the useful life)

Thus, here's how a depreciation schedule calculator typically works:

- Input Asset Details: Users provide information about the fixed asset, including its original cost, useful life, salvage value (if any), acquisition date, and chosen depreciation method.

- Calculate Depreciation: The calculator applies the selected depreciation method to compute the depreciation expense for each period (usually years) over the asset's useful life. It generates a schedule showing the depreciation expense for each period, accumulated depreciation, and the remaining book value of the asset.

- Generate Schedule: The calculator generates a structured depreciation schedule, usually in tabular form, displaying the depreciation expense, accumulated depreciation, and book value for each period.

- Summary: It provides a summary of the total depreciation expense incurred over the asset's useful life and the ending book value of the asset.

- Optional Features: Some depreciation schedule calculators may offer additional features, such as the ability to compare depreciation methods or scenarios, generate reports, or export data for further analysis.

Depreciation schedule calculators are valuable tools for businesses and individuals to accurately track and manage the depreciation of fixed assets for financial reporting, tax purposes, and decision-making processes. They streamline the calculation process, saving time and reducing errors that may occur when manually preparing depreciation schedules.

Methods of Depreciation

As mentioned, GAAP supports four main methods of depreciation: the straight-line method, the double-declining balance, the sum-of-the-years’-digits, and the units of production.

1. Straight-Line Method

The straight-line method is the simplest and most widespread way to depreciate fixed assets. Under this method, the value of your asset is split and depreciated evenly each year.

To calculate it, take the cost of an asset and then subtract it with the salvage value.

Then divide the resulting number by the total of years the asset is expected to be useful, as shown in the formula below:

Depreciation Expense = (Cost of Fixed Asset - Salvage Value) / Useful Life

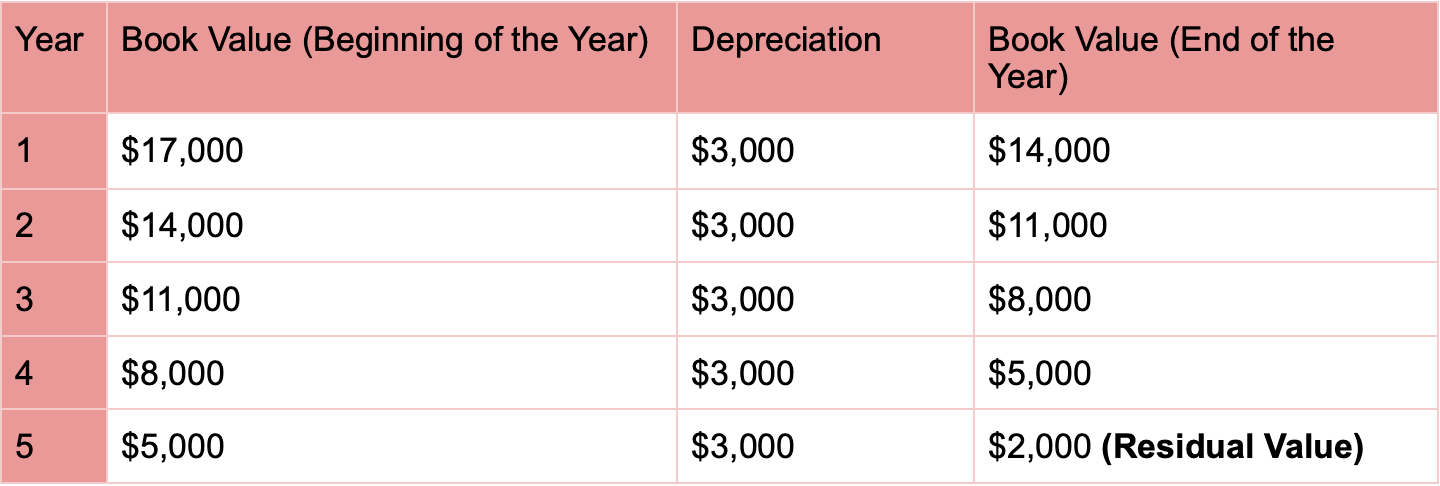

To illustrate how the straight-line method works, let’s take a concrete example.

Assume Company A purchases equipment for $17,000, with an estimated salvage value of $2,000, and useful life of 5 years.

Step One: First, you need to calculate the depreciation expense for every year.

Following the depreciation expense formula above:

Depreciation Expense = ($17,000 - $2,000) / 5 = $3,000

Step Two: Now, you can build a depreciation schedule. The depreciation schedule for the entire five years in this example would look like this:

Pro: the straight-line method is the easiest to use.

However, it has a few cons:

The calculation is purely based on guesswork and doesn’t take any other factors besides life expectancy into consideration. So, if for example, an asset depreciates more during the first year of its life than the last, or if a technological advancement causes it to become obsolete sooner, the straight-line method wouldn’t provide the most accurate calculation.

2. Double-Declining Balance

With a double-declining balance depreciation method, you write off a larger depreciation expense in the early years, and then a smaller one as years go by. More specifically, the double-declining depreciation rate is double the straight-line depreciation rate. The technique is commonly used for assets that quickly lose their value during the early years of their estimated useful life, such as vehicles, computers, and electronics.

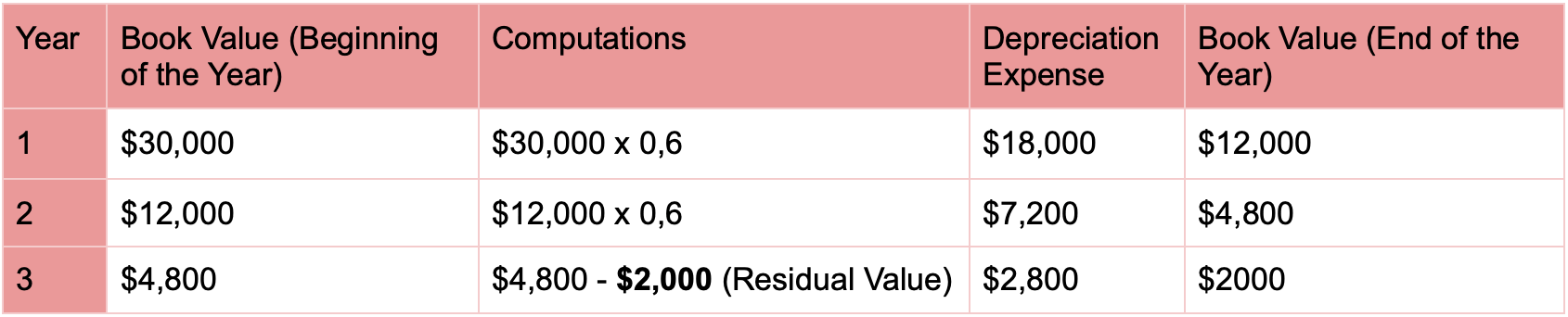

Let’s check out a practical example and see how the depreciation of an asset changes when using the double-declining method.

Company B purchases a $30,000 vehicle, that’s expected to depreciate over 3 years, and has a residual value of $2,000.

Step One: You need to find the accelerated depreciation rate. In the double-declining balance method, the accelerated depreciation rate is the normal depreciation rate multiplied by 2.

The normal depreciation rate equals:

Depreciation Rate = 1 / Useful Life = 1 / 3 years = 0,3 or 30%

To find the accelerated depreciation rate, you need to multiply the normal rate by two:

Accelerated Depreciation Rate = Depreciation Rate x 2 = 0,3 x 2 = 0.6 or 60%

Step Two: Now, you’ll need to compute the depreciation expense for each year, and build the depreciation schedule. We use the acquisition cost (cost of buying the vehicle) as a depreciable amount. In other words, if there is a residual value, it is not deducted from the acquisition cost at the beginning, but rather at the last year.

Step Three: As we’ve mentioned, in the final year, you don't multiply the book value (depreciable amount) with an accelerated depreciation rate. You only deduct the residual value from the depreciable amount.

Now you may be wondering: why and when should I use the accelerated method?

Its huge advantage: If you want to pay less in taxes, this method is your best option.

Why? Well, as the double-declining method increases the amount of depreciation you record, it can substantially reduce both taxable income and tax payments for a certain time.

However, if you’re a publicly owned company that wants to appear more profitable in the eyes of investors and stakeholders then we’d recommend using the straight-line method, instead.

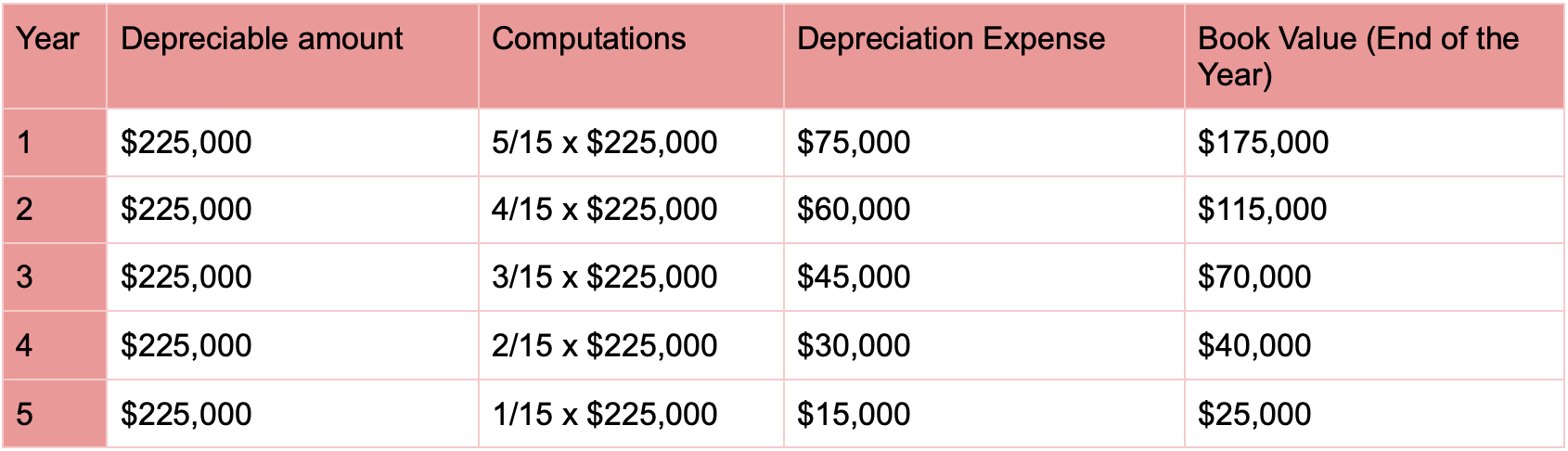

3. Sum-of-the-Year’s-Digits

Another accelerated method businesses may use for assets that tend to lose most of their value during the beginning of their useful lives, is the sum-of-the-year’s-digits (SYD).

To use the method, first, you need to add up the years of the asset’s expected life. So, assume an asset that costs $225,000, has a five-year useful life. The calculation would be:

1 + 2 + 3 + 4 + 5 = 15

Then, for the first year you need to divide the asset’s useful life - in this case, 5 - by the sum of 15. Then you multiply that value by the total depreciable amount (which in our case is $225,000), as shown below:

5 years / 15 x $225,000 = $75,000

So, for the first year, depreciation would amount to $75,000. The formula stays the same for the subsequent years, the only thing that changes is the numerator - it’s reduced by one each year.

This is how the full depreciation schedule would look like:

The pro here is that businesses may benefit from the SYD method as the practice results in a larger tax guard in the first few years of the asset’s life, similar to the double-deciding balance.

4. Units-of-Production

Depreciation under the units-of-output method is based on some measure of output rather than the passing of time. That’s why, when depreciation is based on units of output, more depreciation is recorded during the cycles when the assets are used up the most.

To calculate it, step one involves measuring the units of production rate.

The formula goes as follows:

Units of Production Rate = (Cost Basis – Salvage Value) / Estimated Units

So, if a business were to purchase a delivery truck that costs $10,000, with a salvage value of $1,000, which is expected to retire after it has been driven 30,000 miles, the units of production rate would be:

Units of Production Rate = ($10,000 - $1,000) / 30,000 = $0,3 Depreciation per Mile

Step two involves calculating the depreciation expense, which comes from multiplying the actual units produced with the units of production rate. If during the first year, the delivery truck drove $5,000 miles, then the depreciation expense would be:

Depreciation Expense = 5,000 miles x $0,3 = $1,500

The same calculations are repeated at the end of each year until the asset reaches its estimated salvage value.

Now, because the units-of-production method depends on the measures of output that a vehicle or equipment incurs during the year, you can’t create a depreciation schedule purely out of estimation. The schedule is generated at the end of each year, based on the exact percentage that an asset’s capacity was used up during that year.

What are the pros and cons of this type of depreciation?

Well, the units-of-production method ensures that expenses and revenues are properly connected, and comply with the matching principle. However, the method can only be used if the total number of output units can be approximated with great precision.

Additionally, the method is also limited to assets such as vehicles and certain types of machinery. Buildings, computers, and furniture, for example, do not have well-defined units of output and thus can’t be calculated through this depreciation method.

What Does a Depreciation Schedule Determine?

A depreciation schedule determines the allocation of the cost of a tangible asset over its useful life. This schedule is used in accounting and tax reporting to systematically write down the value of an asset over time. The main purposes of a depreciation schedule include:

- Expense Allocation: It spreads the cost of an asset over multiple accounting periods, matching the expense with the revenue generated by the asset.

- Tax Deductions: It allows businesses to claim depreciation as a tax deduction, reducing taxable income.

- Asset Management: It helps in tracking the value of assets, planning for replacements, and managing asset lifecycles.

- Financial Reporting: It provides a clear picture of the asset's value over time, which is important for accurate financial statements and for stakeholders.

The schedule includes details such as the asset's initial cost, its useful life, the chosen depreciation method (e.g., straight-line, declining balance), and the annual depreciation expense.

Tax Depreciation Schedule

A tax depreciation schedule is a detailed document that outlines the depreciation of assets for tax purposes. It is used to calculate the allowable tax deductions for the depreciation of assets over their useful life. This schedule is essential for businesses to comply with tax regulations and to optimize their tax liabilities.

Here are the key components and purposes of a tax depreciation schedule:

Key Components

Asset Details:

- Description: A brief description of the asset.

- Purchase Date: The date when the asset was acquired.

- Cost: The initial cost of the asset.

Depreciation Method: The method used to calculate depreciation (e.g., straight-line, double-declining balance, units of production, sum-of-the-years'-digits).

Useful Life: The estimated period over which the asset is expected to be useful.

Depreciation Rate: The rate at which the asset depreciates each year.

Annual Depreciation Expense: The amount of depreciation expense allocated to each year.

Accumulated Depreciation: The total amount of depreciation expense that has been recorded to date.

Book Value: The asset’s value after subtracting accumulated depreciation from the initial cost.

Purposes

Tax Deductions: Allows businesses to claim depreciation as a deductible expense, reducing taxable income and thereby lowering tax liabilities.

Compliance: Ensures that businesses comply with tax regulations and standards set by tax authorities.

Financial Planning: Assists in budgeting and financial planning by providing a clear picture of the asset’s depreciated value over time.

Accurate Reporting: Helps in preparing accurate financial statements by reflecting the decrease in the value of assets.

Audit Trail: Provides documentation and evidence of depreciation calculations, useful during tax audits.

Example of a Tax Depreciation Schedule (Straight-Line Method)

| Year | Asset Description | Purchase Date | Initial Cost | Useful Life (Years) | Depreciation Expense | Accumulated Depreciation | Book Value |

|---|---|---|---|---|---|---|---|

| 2023 | Office Equipment | 01/01/2023 | $10,000 | 5 | $2,000 | $2,000 | $8,000 |

| 2024 | Office Equipment | 01/01/2023 | $10,000 | 5 | $2,000 | $4,000 | $6,000 |

| 2025 | Office Equipment | 01/01/2023 | $10,000 | 5 | $2,000 | $6,000 | $4,000 |

| 2026 | Office Equipment | 01/01/2023 | $10,000 | 5 | $2,000 | $8,000 | $2,000 |

| 2027 | Office Equipment | 01/01/2023 | $10,000 | 5 | $2,000 | $10,000 | $0 |

In this example, the office equipment with an initial cost of $10,000 and a useful life of 5 years has an annual depreciation expense of $2,000. This expense is used to reduce taxable income each year, and the accumulated depreciation and book value are tracked over the asset's life.

Asset Depreciation Schedule

An asset depreciation schedule is a detailed document that outlines the depreciation of specific assets owned by a business or individual over time. It provides a systematic breakdown of how the value of each asset decreases over its useful life.

Here's what you might find in an asset depreciation schedule:

Key Components

Asset Details:

- Identification number or code for each asset.

- Description or name of the asset.

- Date of acquisition or purchase.

Cost Information: Original cost of the asset, including any associated expenses like installation or delivery costs.

Depreciation Method: The method used to calculate depreciation (e.g., straight-line, declining balance, units of production).

Useful Life: The estimated period over which the asset is expected to be used or provide benefits to the business.

Depreciation Rate: The rate at which the asset depreciates each year, determined by the chosen depreciation method.

Annual Depreciation Expense: The amount of depreciation expense allocated to each year.

Accumulated Depreciation: The total amount of depreciation expense that has been recorded for the asset up to the current period.

Book Value: The asset’s value after subtracting accumulated depreciation from the original cost.

Disposal Information (if applicable):

- Date of disposal.

- Sale price or salvage value.

- Any gain or loss on disposal.

Purposes

Asset Management: Helps in tracking the value of assets over time and planning for replacements or upgrades.

Financial Reporting: Provides accurate information for financial statements, including balance sheets, income statements, and cash flow statements.

Tax Compliance: Assists in complying with tax regulations by accurately reporting depreciation expenses for tax deduction purposes.

Decision Making: Provides data for making informed decisions about asset utilization, replacement, or disposal.

Audit Trail: Serves as documentation for internal and external audits to demonstrate compliance with accounting standards and regulations.

Example of an Asset Depreciation Schedule

| Asset | Purchase Date | Original Cost | Useful Life | Depreciation Method | Depreciation Rate | Annual Depreciation Expense | Accumulated Depreciation | Book Value |

|---|---|---|---|---|---|---|---|---|

| Computer | 01/01/2020 | $1,000 | 5 years | Straight-line | 20% per year | $200 | $800 | $200 |

| Vehicle | 01/01/2019 | $20,000 | 8 years | Double-declining balance | - | Varies | $13,567 | $6,433 |

In this example, the computer depreciates by $200 each year using the straight-line method, while the vehicle's depreciation is calculated using the double-declining balance method, resulting in a varying annual depreciation expense.

Fixed Asset Depreciation Schedule

A fixed asset depreciation schedule is a structured document that outlines the depreciation of fixed assets owned by a business. Fixed assets, also known as long-term assets or property, plant, and equipment (PP&E), are tangible assets with a useful life extending beyond a single accounting period.

A depreciation schedule for fixed assets provides a systematic breakdown of how the value of each fixed asset decreases over its useful life. Here's what you might find in a fixed asset depreciation schedule:

Key Components

Asset Identification:

- Identification number or code for each fixed asset.

- Description or name of the fixed asset (e.g., machinery, buildings, vehicles).

Acquisition Details:

- Date of acquisition or purchase.

- Original cost of the fixed asset, including any additional costs such as installation or delivery fees.

Depreciation Method:

- The method used to calculate depreciation (e.g., straight-line, declining balance, units of production).

Useful Life:

- The estimated period over which the fixed asset is expected to be used or provide benefits to the business.

Depreciation Rate:

- The rate at which the fixed asset depreciates each year, determined by the chosen depreciation method.

Annual Depreciation Expense:

- The amount of depreciation expense allocated to each year.

Accumulated Depreciation:

- The total amount of depreciation expense that has been recorded for the fixed asset up to the current period.

Book Value:

- The fixed asset’s value after subtracting accumulated depreciation from the original cost.

Disposal Information (if applicable):

- Date of disposal.

- Sale price or salvage value.

- Any gain or loss on disposal.

Purposes

Financial Reporting:

- Provides accurate information for financial statements, including balance sheets, income statements, and cash flow statements.

Asset Management:

- Helps in tracking the value of fixed assets over time and planning for replacements or upgrades.

Tax Compliance:

- Assists in complying with tax regulations by accurately reporting depreciation expenses for tax deduction purposes.

Decision Making:

- Provides data for making informed decisions about fixed asset utilization, replacement, or disposal.

Audit Trail:

- Serves as documentation for internal and external audits to demonstrate compliance with accounting standards and regulations.

A fixed asset depreciation schedule is an essential tool for managing and accounting for fixed assets effectively. It ensures accurate financial reporting and compliance with accounting standards and tax regulations.

Example of a Fixed Asset Depreciation Schedule

| Asset | Acquisition Date | Original Cost | Useful Life | Depreciation Method | Depreciation Rate | Annual Depreciation Expense | Accumulated Depreciation | Book Value |

|---|---|---|---|---|---|---|---|---|

| Machinery | 01/01/2020 | $50,000 | 10 years | Straight-Line | 10% per year | $5,000 | $10,000 | $40,000 |

| Vehicles | 01/01/2021 | $30,000 | 5 years | Double-Declining Balance | - | Varies | $16,800 | $13,200 |

| Buildings | 01/01/2019 | $500,000 | 25 years | Straight-Line | 4% per year | $20,000 | $80,000 | $420,000 |

In this example:

Machinery:

- Acquired on 01/01/2020 for $50,000.

- Useful life: 10 years.

- Depreciation method: Straight-line.

- Depreciation rate: 10% per year ($50,000 * 10% = $5,000).

- Accumulated depreciation after two years: $10,000.

- Book value after two years: $40,000.

Vehicles:

- Acquired on 01/01/2021 for $30,000.

- Useful life: 5 years.

- Depreciation method: Double-Declining Balance.

- Depreciation rate: Varies (calculations not shown in this example).

- Accumulated depreciation after two years: $16,800.

- Book value after two years: $13,200.

Buildings:

- Acquired on 01/01/2019 for $500,000.

- Useful life: 25 years.

- Depreciation method: Straight-Line.

- Depreciation rate: 4% per year ($500,000 * 4% = $20,000).

- Accumulated depreciation after two years: $80,000.

- Book value after two years: $420,000.

This schedule provides a clear breakdown of each fixed asset's depreciation over time, helping in financial reporting, asset management, tax compliance, and decision-making processes.

How AI Is Transforming Asset Management

AI automates depreciation schedules based on asset class, useful life, and tax rules. It can even suggest optimal depreciation methods—straight-line, double declining, or units-of-production based on your financial goals.

AI also tracks changes in asset condition, usage, or market value to update forecasts in real time. For growing businesses, this level of automation means better decision-making, enhanced audit readiness, and improved long-term asset visibility.

Automate Your Depreciation Schedule with Deskera

Don’t want to manually calculate and record your depreciation schedules by hand or on Excel spreadsheets? Then go digital with cloud accounting software like Deskera!

With our Depreciation Schedule, it only takes a few seconds to set up and automate your asset depreciation.

All you have to do is enter the name of the fixed asset you want to depreciate, the method of depreciation, the time interval you want to expense it in, and press Post.

The software will then automatically create your depreciation schedule, and post the correct journal entry, with the corresponding debit and credit balances.

Give Deskera a try out yourself right away, by signing up for our completely free trial. No credit card details necessary.

Frequently Asked Questions

1. Do All Fixed Assets Have to Be Depreciated?

Generally yes, but there are a few exceptions.

Every depreciable asset is a fixed asset, but not all fixed assets can be depreciated. Land, for example, is a fixed, non-depreciable asset as its value doesn’t diminish over time. Invaluable collectibles such as artwork or sculptures, can’t be depreciated either.

2. What Causes Depreciation?

The main reason depreciation occurs is due to the wear and tear of assets. After a certain period of usage, an asset itself or its parts need to be replaced or upgraded.

Depreciation also occurs due to new technological advancements, which may cause inefficiencies and reduce the usability and popularity of older machinery and equipment.

Other possible causes of depreciation include the expiration of usage rights, the perishability of assets with a short life span, and the depletion of natural resources.

3. What’s the Difference Between Depreciation and Amortization?

Accumulated depreciation is the process of depreciating tangible assets over their expected useful life. Whereas amortization spreads the cost of intangible goods that last more than a year, such as patents, trademarks, and copyrights.

4. Is Accumulated Depreciation an Asset?

No, accumulated depreciation is not an asset. For an account to be considered an asset account, it needs to be able to provide economic benefit and earn the company a profit.

Accumulated depreciation is in fact, a contra-asset account, as it’s created to reduce the value of an asset. It’s used to recognize the loss of usability of a long-term entity so that expenses are recognized at the time they occur.

If you want to know more about the different types of accounts and how to record them, check out our double-entry bookkeeping guide with practical examples.

Key Takeaways

And that’s a wrap! We hope this guide helped you understand all of the basics of the depreciation schedule, and how you can create one for your small business’s assets.

For a quick recap, here are some of the main points we’ve covered:

- Depreciation represents how much an asset’s value has been used up. For an asset to qualify as a depreciable one it needs to have a useful life greater than a year, the business has to own it, and it should be used to generate profit.

- The depreciation schedule is the table that keeps track of the depreciation expense over the years. It includes elements such as the date of purchase, cost of the asset, estimated/expected useful life, salvage value, current year depreciation, accumulated depreciation, the depreciation method used, and the net book value.

- There are four main methods of depreciation: the straight-line method, double-declining balance, sum-of-the-year’s-digits, and the units-of-production.

- If you’re looking to decrease your taxable income and pay less in taxes at the end of the year, the double-declining and sum-of-the-year’s-digits are of best use. The opposite applies to the straight-line method.

- For vehicles and other machinery that have a measure of output, the unit-of-production depreciation is the most accurate.

- With Deskera ERP, users can easily input asset details such as acquisition date, original cost, useful life, and depreciation method, allowing the system to automatically generate accurate depreciation schedules.

Related Articles