Even while startup fees can be expensive, the majority of them can be used to lower your business taxes. There are various strategies to reduce your tax liability by deducting business expenses from your small business revenue.

Certain startup-related costs can also be written off, however the regulations are more complicated than those that apply to operational expenses. To understand how business startup deductions work, you need to know which expenses are deductible and how to do that with no income. Following are the topics covered:

- What Are Business Startup Costs?

- Understanding Deductions

- Can I deduct start up costs with no income?

- How to Take Business Startup Deductions?

- Key takeaways

What Are Business Startup Costs?

Startup costs for new firms can be used to offset company taxes. These initial costs must be used to start an active trade or business, or to research starting or purchasing an active trade or business, in order to be deducted.

These costs are separated into two categories:

• Start-up costs for the business, such as utility and lease deposits, website development fees, and startup advertising campaign costs

• The costs related to forming a corporation, partnership, or limited liability business, such as state incorporation fees, the cost of drafting legal documents, and the cost of hiring an attorney to assist with all of these duties.

For the purpose of deducting beginning expenditures, it's crucial to figure out when your business officially launched. Typically, you can add expenses for researching business purchases one year prior to the beginning date.

Understanding Deductions

In some cases, business deductions might match dollar-for-dollar reductions in your revenue. You could be eligible to deduct some startup and organizational costs on your tax return this year if you spent money last year before starting a firm. To claim them, you must adhere to tight IRS rules, though. Here are the guidelines.

Special First-Year Deductions

In the first year of operation, you can choose to deduct up to $5,000 in organizational expenditures and $5,000 in starting costs. The amount that your startup or organizational costs total more than $50,000 is deducted from each $5,000 deductible.

The majority of business owners don't want to wait that long to receive the tax benefit from these initial charges, but you can wait until you sell your company or shut it down before recovering your startup costs.

Allowable Business Startup Deductions

It can be incredibly thrilling to launch a new business. Despite the enthusiasm that surrounds a startup, there are some expenses related to starting a new firm. Based on these costs, you might be able to lower the amount of tax you pay. The IRS lists three types of starting expenses that qualify as tax deductions. IRS Publication 535 describes these deductions in great detail in Chapters 7 and 8. The most important lesson here is that starting expenses must be connected to one of three things:

The Internal Revenue Service (IRS) permits certain tax deductions for three distinct types of startup costs for businesses:

Creating the business: Creating a trade or business (or investigating the creation or acquisition of an active trade or business). These expenses can involve market research, examining the availability of items and personnel, or checking out suitable business locations.

These expenses include feasibility studies, market and product analyses, competition research, labour supply analysis, travel for site selection, and other expenses related to starting a new business. These expenses are related to researching the formation of an active trade or business.

Launching the business: Any expenses you incur prior to opening your doors for business are included in this category, with the exception of equipment, which must be depreciated. This implies that you can deduct a portion of the expenditure over time. Employee training, travel costs to find suppliers and distributors, advertising costs, and consultancy fees are examples of allowable costs in this area (such as attorney or accountant fees).

This includes all expenses incurred to get your business up and running, such as those related to finding suppliers, hiring staff, training them, advertising, and professional fees. Since equipment acquisitions are depreciated in accordance with standard business deduction laws, the associated costs are not included.

Business organization costs: These are the expenses related to forming your company as a corporation, limited liability company (LLC), or partnership, among other legal entities. These expenses would include director fees, accounting fees, legal and state fees, as well as costs associated with holding any organizational meetings.

You may also write off these expenses if you formally organize your company as a partnership or corporation before the conclusion of your first fiscal year in operation. Legal fees, state organization fees, wages for temporary directors, and organizational meetings are frequently related costs with incorporating. The cost of creating a partnership agreement also includes filing, accounting, and legal fees.

You need to keep one thing in mind. Only if you have started the firm may you deduct these costs. This means that any expenses related to firms that never truly began can never be deducted.

Fixed cost

Fixed costs are continuing costs incurred by a business that must be incurred on a regular basis, such as monthly rent. These prices often don't vary all that much. Typical fixed expenses include:

Payments for insurance

Businesses must be insured, just like cars. You and your company are covered by business insurance in case of numerous lawsuits, losses, and other situations. In summary, business insurance can protect you from costly legal expenses and settlements in the event of an accident or litigation, much like auto or health insurance. Fun? No. Necessary? Absolutely.

The cost of insurance varies based on the plan you select. They might cover things like commercial property insurance, errors and omissions insurance, workers' compensation insurance, and general liability insurance. Your choice of insurance is influenced by the kind of your company, the sector you operate in, the number of employees, and other risk variables.

Rent

You might require office space depending on the type of business you run. In the first year or two, it's great if you can operate your firm from home. However, if you anticipate growth and a need for office space in the future, start budgeting and preparing as soon as you can. Office space is pricey.

Want to buy a house? Commercial real estate typically carries a higher price tag and higher taxes than residential regions. Decide whether and where you can afford real estate by doing your research as soon as feasible.

Rent must be considered a fixed expense if you want to use an office or retail space for your setup. You must determine how much room you can handle and the kind of space your company will demand in order to do this. The cost of renting can then be determined. Your mortgage will be a set expense if you decide to buy rather than lease the office space.

Over the past few years, co-working facilities have proliferated. If you need office space but can't afford the hefty rent, a co-working facility can provide it for you at a much lower cost. Although providers have sites around the country, local co-working spaces are also accessible.

Payroll

Salaries for all employees are a crucial cost that must be accounted for in every business plan. This entails setting up payroll for you as well as any partners, co-founders, and staff. Choosing when to hire employees versus when to hire a freelancer or provider is difficult in the first year of payroll. No matter what choice you make, creating payroll is crucial.

Payroll software greatly aids in cost planning, which makes payroll simpler.

Marketing costs

Physical marketing materials like signs and banners might be included in the marketing expenses for your company. Additionally, they can deal with digital marketing, such as running ads on websites like Facebook or LinkedIn.

Depending on the kind of business you're running, your monthly marketing expenses may change. For instance, you probably won't need to print flyers every month if your firm is distant. Some marketing expenses, such as developing your website or ordering business cards, can be one-time expenses.

Taxes

Your company's taxes are determined by your revenue, deductible expenses, and the location of your company. Real estate taxes on the property may also be due if you use it as designated office space for your company.

Starting your fiscal year as soon as your firm does is convenient. Calculating how much tax you must pay will be simple for you if the two overlap. To properly assess your personal taxes, business taxes, and fiscal year returns, it is advisable to use a CPA's services.

Legal and professional services

To make sure your plan is safe and compliant; some organizations might need accountants, subject matter specialists, or market research. Particularly if you're selling a service, this is true. Even if you're launching a small, straightforward store, you'll probably require a business plan. Depending on how much planning is necessary, this could cost you several hundred to several thousand dollars.

A lawyer could also be a smart financial decision. They can assist you choose a business structure, create a separate corporate entity, or guide you through the incorporation procedure, among other things. In the long run, hiring an attorney to handle these kinds of tasks for you can save you a tonne of time and money.

Paying back loans

If you started your business with a small business loan, you'll need to set aside a portion of your revenues to pay back the loan. The Small Firm Administration (SBA), which can provide affordable rates to make it simpler to start a business, offers loans to some enterprises.

The type of loan repayment schedule you have agreed upon with your loan provider will determine the amount you need to set aside for repayment. You should budget for interest since you'll probably have to pay it in addition to the principal.

Software

The majority of organizations rely on software to manage their daily operations or deliver services. For instance, business owners employ a variety of well-liked accounting applications to monitor spending, cash flow, and profitability. Systems for managing client relationships (CRM), Google Drive, Microsoft Office, internet hosting, and employment software are examples of further popular software.

Website design

The majority of profitable companies now choose to establish an online presence to increase their market reach. In general, websites are a terrific tool to build your brand online. A good business website should be simple to use and provide quick access to details about your goods and services as well as ways to get in touch with your staff.

You might want to think about putting money into your company's online appearance by hiring expert design services because it should also seem professional.

Utilities

One of the necessary costs you will have to pay for when starting your business is utilities. The lights must be turned on, am I correct? These expenses cover your office space's gas, power, water, phone, and internet expenditures. You could need to pay for additional utility costs, such as HVAC systems, depending on where you live.

Office supplies

Office supplies are necessary for even the smallest businesses. Even though a box of pens may only cost a few dollars, reams of paper, staplers, pens, and office supplies may add up over the course of a year.

Variable costs (or one-time costs)

For the first few months after the business's launch, these costs may even exceed the revenue. However, don't worry! You can better prepare for these fees by being aware of what they are. Typical one-time expenses include:

Permits and licenses

Even if you choose not to incorporate, you must still pay for state and federal licenses and permits. Your location, industry, and business type will all affect the types of permissions and licenses you require. For instance, licenses and permits for sales tax are typically paid for by retail businesses, and trade-specific licenses are necessary for service-oriented industries.

Improvements to the selected location

You might initially need to make an investment in furniture and other goods depending on what kind of new business you establish and where you open shop. Some of these costs will be one-time, while others, like those for office supplies and stationery, will be ongoing.

Additionally, improvements rely on the kind of your company. Consider opening a new restaurant as an illustration. In such instance, you might need to spend money making the necessary site renovations, such as installing commercial-grade ovens, counter-tops, and other pertinent upgrades.

Fees for incorporation

You must pay the fees and expenditures associated with founding a limited liability company or incorporating your business. Each state has a different set of filing costs for articles of incorporation and organization.

Logo design

Your company's branding must include logo designs because they increase brand recognition. Different designers receive payment for their work on logo designs. Investing in a quality logo design is essential since it helps your business make a great first impression and reinforces your brand identification.

Brochures and business cards

Even though you may believe you can get by without them, there may come a time when you will wish you had a business card or brochure to hand out. Networking and word-of-mouth are particularly crucial during the initial phase.

Paying for the assistance of graphic designers, consultants, and printing businesses constitutes taking care of this component. The type, quality, and quantity of paper and ink used will affect the material costs for brochures and business cards. If you want the brochures to look professional and have enough information, you will also need to employ a decent content writer.

Down payment on rental property

You'll probably need to make a down payment on the property if you plan to rent office space.

Non-qualifying costs

Taxes, deductible interest, and expenses for research and experimentation are not included in start-up costs. Costs associated with becoming eligible for that sort of business, which you cannot amortize or deduct (getting a real estate license, for example)

• Costs associated with attempting to purchase a particular business

• Interest, taxes, or costs associated with research and development

• Setup fees paid by individual business owners (such as shareholders, partners, or LLC members).

These expenses might qualify as different kinds of deductions.

Can I deduct start up costs with no income?

If any of the following apply to how to file business taxes with no income:

• You weren't actively involved in a trade or business.

• You were getting ready to launch your business.

Instead of filing business taxes with no income, you can either deduct or amortize start-up costs after your business is up and running. You should file and claim your costs if you aggressively pursued your profession or business but didn't make any money. Ex: Your payment is made after the work is finished.

Even if you haven't gotten any revenue yet, you should still file. When filing taxes and having no income, you might report a loss on Schedule C to offset other revenue.

A significant tax deduction can be obtained by owning your own firm. If you currently own an operational business, you may be able to deduct some expenses you incur sooner rather than later as well as perhaps some expenses from prior years. In any event, in order to deduct business expenses, your business must be operational.

Identification

Business start-up costs are deductible, but only if your Endeavour to launch a company is successful. Normally, you had to deduct start-up expenditures over a period of at least 60 months after you started to earn money. The IRS updated its rules in 2008 to permit business owners to write off up to $5,000 in start-up expenses during the first year of operation.

Qualified Expenses

Any startup-related costs for your firm, whether general or for a specific product, such as market research to gauge demand for your good or service, are tax deductible. You may also have to pay for business advertising, employee salaries and wages, employee training costs, and travel expenses to find vendors and clients.

Although they can be deducted on other areas of your tax return, interest, taxes, and costs associated with research and development do not qualify as start-up expenses.

2010 Changes

As of 2010, if your expenses total less than $60,000, you may deduct up to $10,000 paid or incurred after 2009. The remaining costs can be amortized over the following 180 months.

Reporting

On line 27 of Schedule C on your 1040, claim company startup costs. Amounts that have been amortized should be carried to line 27 of your Schedule C from Form 4562, Part VI. When filing an amended return using Form 1040X, note that it was "Filed pursuant to section 301.9100-2" if you neglected to choose to amortize expenses or deduct start-up charges.

How to Take Business Startup Deductions?

Although you might be able to write off some of the initial costs for your firm, there can be some restrictions. The first year's deduction for startup-related business costs is limited to $5,000. If your costs are $50,000 or less, this cap will apply. Therefore, if your beginning costs are more than $50,000, the excess is deducted from your first-year deduction.

For instance, your first-year deduction will be decreased by $3,000 to $2,000 if your startup costs total $52,000. You would completely lose the deduction if your spending were more than $55,000. The remaining costs may then be spread out evenly over a period of 15 years beginning with the second year of operation.

Claiming the Deduction on Your Tax Forms

The first-year deduction must be disclosed on your business tax form if you decide to claim it. That would be Form 1120 of a corporate tax return, Schedule C for a sole proprietor, K-1 for a partnership, or Schedule C for a S company. The amortized deduction is claimed on Form 4562, Depreciation and Amortization, in succeeding years.

If you are a lone proprietor, the deduction is then transferred to your Schedule C under other expenses, or to your partnership or corporate income tax form. Throughout the amortization term, you can still deduct it as an additional cost.

When Should You Claim the Deduction?

The tax year that the business started operating is eligible for the business starting deduction. Consider amortizing the deductions to offset gains in later years if you expect to show a loss in the first few years. In your first year of business, you would have to file IRS Form 4562 for this. Different amortization schedules are available for selection, however once chosen, a timetable cannot be changed. Before choosing this course of action, speak with your tax advisor.

Before you decide to claim your starting expenditures, be sure to speak with a certified tax professional or counselor.

What If You Don't Start the Business?

The fees you incurred would be regarded as personal costs if you spent money researching starting a business but ultimately decided against moving further. Sadly, these costs are not tax deductible. However, costs associated with your endeavor to launch a firm may qualify as capital expenses, which you may be able to write off as a capital loss.

Can I still deduct these expenses if I don't start a business?

You will incur two types of fees if your startup or business fails:

1. You regard preliminary costs to be personal expenses; hence they are not deductible as business costs. These would include expenses incurred prior to deciding whether to buy or establish a firm, expenses incurred during a general search, or expenses incurred during an initial analysis of options.

2. Beginning costs are costs associated with an unsuccessful attempt to launch a particular business; these costs can be written off or amortized in the same manner as startup costs.

Failure of business

If the business venture or for-profit transaction proves to be unsuccessful and the corporation discontinues the search or investigation as a result, investigative and other pre-opening expenses will be fully deductible by the corporation as a business loss (rather than subject to these amortization provisions) (Rev. Rul. 56-520).

For non-corporate taxpayers doing a trade or business, a similar rule is in effect. Non-corporate taxpayers who are not actively engaged in a trade or business at the time the expenditures are incurred are not permitted to deduct unsuccessful startup costs, unless a specific business or investment has been found by the time the search is given up.

The expenses are not considered to be usual and necessary company expenses or expenses for the generation of income, but rather are considered nondeductible personal expenses (Rev. Rule. 77-254, 79-346, and 71-191). Therefore, non-corporate taxpayers who are not in business but who anticipate spending a lot of money researching (or looking for) a new firm might think about incorporating just to carry out the research.

If profitable, the corporation would run the new venture. In the event of failure, the stockholders may be required to incur an ordinary loss on the sale of their small business (Section 1244) stock.

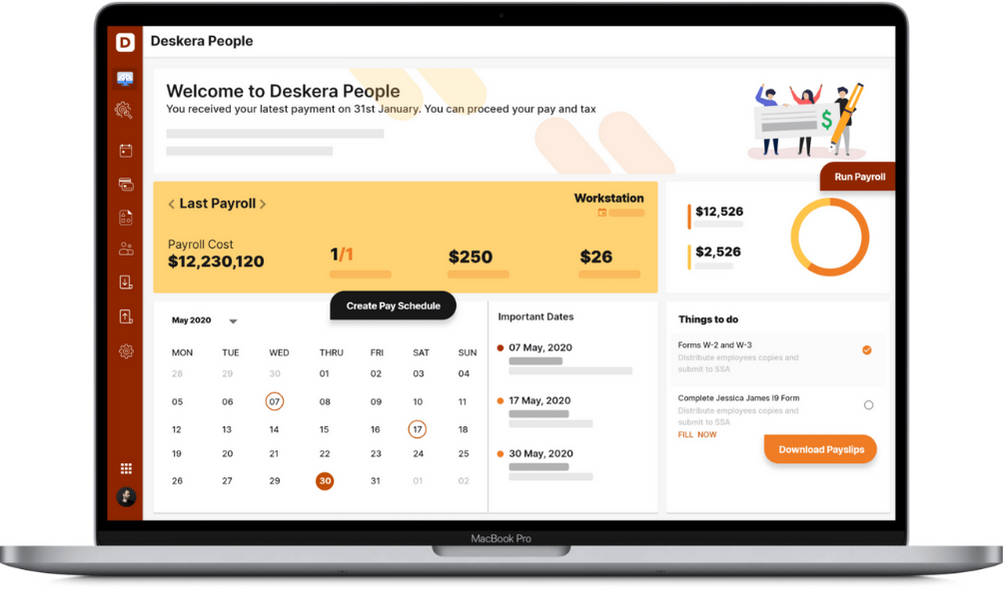

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- While most starting expenditures must be spread out over several years, some can be written off in the first year of operation. We'll give some clarification on what these deductions involve despite the fact that it is difficult.

- It is much more difficult to write off starting costs than it is to deduct business expenses. This is especially true once your company has started operating. It's always a good idea to speak with a tax advisor who specializes in small business taxation; even if you think you understand the process well enough to get by on your own. This person can assist you in overcoming any challenges so that you file your taxes correctly.

- Don't stress too much about whether an expense is deductible as an organizational expense or a startup cost. It's your responsibility to gather all of the startup charges for your firm, and your tax expert can determine whether or not they are valid and how to apply them to lower your business tax payment.

- The IRS permits specific tax deductions for starting, operating, and establishing a business. If the firm fails to take off and you are unable to launch it, you cannot claim the initial expenditures.

Related articles