Is your business financially stable, or is it relying too heavily on borrowed funds? The Debt to Equity Ratio (D/E Ratio) is one of the most crucial financial metrics that helps answer this question.

It measures the proportion of debt financing compared to shareholders' equity, giving investors, lenders, and business owners a clear picture of financial leverage and risk exposure. A well-balanced ratio can indicate stability, while an excessively high or low ratio may signal potential financial challenges.

Understanding the Debt to Equity Ratio is essential for making informed financial decisions. Businesses with a high D/E ratio often have greater financial risk, as they depend more on debt to fund operations.

On the other hand, companies with a low D/E ratio may be seen as financially stable but could be missing opportunities for growth by not leveraging external capital effectively. Striking the right balance is key to long-term success, and this guide will help you understand how to measure and optimize this ratio.

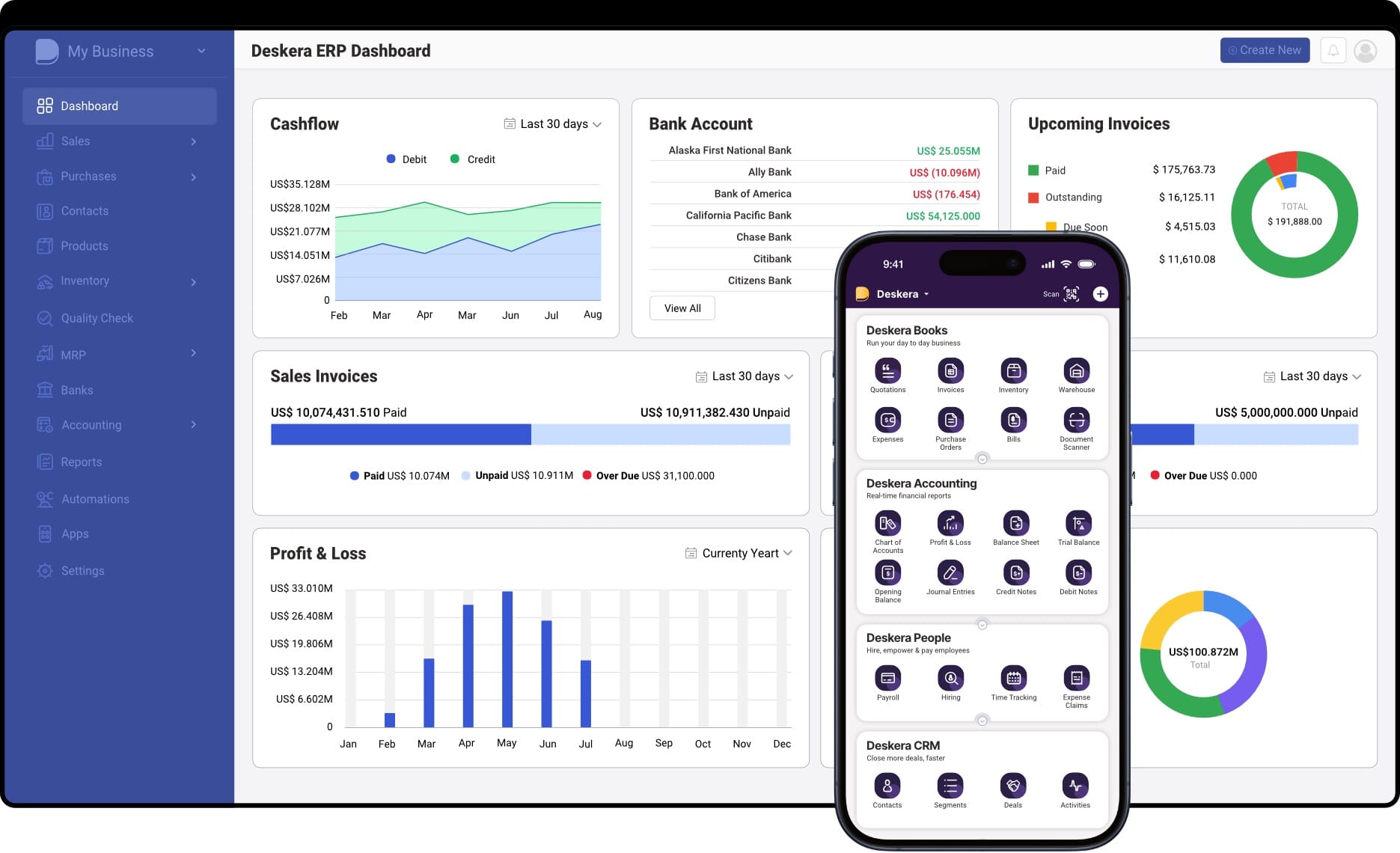

For businesses looking to manage their finances efficiently, Deskera ERP provides comprehensive financial management tools, including real-time insights into liabilities, equity, and cash flow.

With built-in accounting features, automated reporting, and AI-driven financial analytics, Deskera ERP helps businesses track their Debt to Equity Ratio with precision. By leveraging such advanced tools, companies can ensure financial stability while making data-driven decisions to optimize capital structure.

In this guide, we’ll break down the Debt to Equity Ratio, explaining its significance, calculation, interpretation, and impact on business financial health.

Whether you’re a business owner, investor, or financial professional, understanding this metric will enable you to assess risk, secure better financing, and drive sustainable growth. Let’s dive into the details of this fundamental financial indicator.

What is the Debt to Equity Ratio?

When people hear the word "debt," they often associate it with financial distress—credit card bills, high interest rates, or even bankruptcy. While excessive debt can certainly create financial risk, debt itself isn't always a bad thing, especially in the business world.

Companies often use debt strategically to finance operations, invest in growth, and expand market share. The key lies in maintaining a healthy balance between debt and equity—which is where the Debt to Equity Ratio (D/E Ratio) comes in.

The Debt to Equity Ratio is a financial metric that helps businesses, investors, and lenders assess how much of a company’s financing comes from debt versus shareholder equity. It is calculated using the formula:

Debt to Equity Ratio = Total Liabilities / Shareholders’ Equity

A higher D/E ratio indicates that a company is more reliant on borrowed funds, which could signal financial leverage but also increased risk. Conversely, a lower ratio suggests that a company primarily uses its own resources, making it potentially more stable but possibly limiting growth opportunities.

What is considered an ideal ratio varies across industries—capital-intensive sectors like manufacturing typically have higher ratios compared to technology or service-based businesses.

By analyzing a company’s Debt to Equity Ratio, stakeholders can gauge its financial health, risk exposure, and ability to raise additional funds for expansion.

For businesses looking for better financial control, Deskera ERP provides real-time financial tracking, automated reporting, and AI-powered analytics to monitor liabilities, equity, and overall financial stability. With such tools, businesses can make data-driven decisions to optimize their capital structure and sustain long-term growth.

How to Calculate the Debt-to-Equity Ratio

The debt-to-equity (D/E) ratio is a key financial metric that helps assess a company’s financial leverage. It compares total liabilities to shareholders' equity, indicating how much debt a company uses to finance its operations.

Debt-to-Equity Ratio Formula

The standard formula is:

Debt to Equity Ratio = Total Liabilities / Shareholders’ Equity

Alternatively, a more detailed formula includes specific debt components:

Debt to Equity Ratio = Short Term Debt + Long Term Debt + Fixed Payment Obligations / Shareholders’ Equity

Both total liabilities and shareholders’ equity can be found on a company’s balance sheet. If shareholder equity is not explicitly stated, it can be calculated as:

Shareholders’ Equity = Total Assets - Total Liabilities

Example Calculation

Suppose a bakery business has:

- Total Liabilities = $4,000

- Shareholders' Equity = $3,000

Applying the formula: 4000/3000 = 1.333

This means the business has $1.33 in debt for every $1 of equity.

What Debt is Included?

The D/E ratio includes:

Considered Debt:

- Short-term liabilities (e.g., current portion of long-term debt, notes payable)

- Long-term debt (e.g., bonds payable, capital lease obligations)

Not Considered Debt:

- Accounts payable

- Accrued expenses

- Deferred revenues

- Dividends payable

Understanding the Ratio

- A higher D/E ratio suggests more reliance on debt, which may be favorable for stable companies but risky for struggling businesses.

- A lower D/E ratio means a company is primarily equity-financed, reducing financial risk but possibly limiting growth potential.

Since balance sheets may include non-debt liabilities and intangible assets, analysts often adjust the D/E ratio to get a more accurate picture of a company’s financial position.

Interpreting the Debt-to-Equity Ratio

The Debt-to-Equity (D/E) Ratio is a key financial metric that measures the proportion of debt used to finance a company’s assets compared to its equity. It indicates the company’s financial leverage and helps investors, lenders, and business managers assess financial risk and stability.

1. High Debt-to-Equity Ratio

A high D/E ratio can indicate financial risk but also potential rewards.

Potential Benefits:

- Companies can leverage debt to enhance returns on equity (ROE) if the borrowed funds are used effectively for expansion.

- Debt is often cheaper than equity financing, lowering the company's weighted average cost of capital (WACC).

Potential Risks:

- High debt levels mean greater financial obligations, and if revenues decline, the company may struggle to meet debt payments.

- Increased borrowing costs if lenders perceive higher risk.

Example: If Company X has ₹2 crore in debt and ₹1 crore in equity, its D/E ratio is 2. This could suggest aggressive growth or high financial leverage.

2. Low Debt-to-Equity Ratio

A low ratio indicates financial stability but might limit growth opportunities.

Potential Benefits:

- Lower financial risk and a stronger balance sheet attract investors and lenders.

- The company is less burdened by interest payments, ensuring long-term sustainability.

Potential Risks:

- The company may be too conservative and missing expansion opportunities.

- Over-reliance on equity financing can dilute shareholder value.

Example: If Company Y has ₹1 crore in debt and ₹5 crore in equity, its D/E ratio is 0.2. This suggests financial stability but a less aggressive growth strategy.

3. Negative Debt-to-Equity Ratio

A negative D/E ratio occurs when a company has negative equity, meaning liabilities exceed assets.

This could signal:

- High financial distress and potential insolvency or bankruptcy.

- The company has issued high dividends, reducing retained earnings.

What is a Good Debt-to-Equity Ratio?

- Ideal ratios vary by industry.

- General benchmark: A D/E ratio between 1.0 and 2.5 is considered balanced.

- Capital-intensive industries (e.g., manufacturing, utilities) tend to have higher ratios.

- Tech and service industries often maintain lower ratios.

Example:

- A transport company may have a higher D/E ratio due to investments in fleets.

- A software company may have a lower ratio as it relies less on debt financing.

The Debt-to-Equity Ratio is a crucial tool for assessing a company’s financial health. However, it should be analyzed in context, considering industry standards, growth stage, and market conditions. Monitoring the ratio over time helps identify trends in financial stability and risk management.

Why the Debt-to-Equity Ratio Matters

The Debt-to-Equity (D/E) Ratio is an essential financial metric for evaluating a company's capital structure, financial health, and risk profile. It helps investors, creditors, and business managers understand how much debt the company has relative to its equity. Here’s why it matters:

1. Assessing Financial Leverage

The D/E ratio directly measures a company's use of debt financing compared to equity financing. A higher D/E ratio means the company is using more debt to finance its operations, which can amplify profits but also increases financial risk. On the other hand, a low D/E ratio suggests a conservative approach, relying more on equity to fund operations.

2. Risk Management

The D/E ratio helps evaluate a company's financial risk. Companies with high debt levels may face significant challenges if they cannot meet their debt obligations, especially during economic downturns or periods of low profitability. A higher ratio often indicates that the company is more vulnerable to financial distress if cash flows fluctuate or interest rates rise.

3. Cost of Capital

The cost of capital plays a crucial role in the decision-making process. Companies with high debt levels may have lower costs of debt due to favorable interest rates.

However, the overall cost of capital (WACC) increases when debt levels become too high, as lenders and investors demand higher returns due to the increased financial risk. The D/E ratio helps companies manage their capital structure to minimize these costs while maximizing value.

4. Investor Confidence

Investors often look at the D/E ratio to assess the stability of a company. A low D/E ratio indicates that the company is less reliant on external debt, which can lead to greater financial security and a more predictable return on investment.

Conversely, a high D/E ratio might raise red flags about the company's ability to weather economic challenges. Investors use this ratio to make informed decisions about the risk associated with investing in the company.

5. Creditworthiness

Lenders use the D/E ratio as a key indicator of a company’s creditworthiness. A high ratio may signal a higher risk of default, leading to tighter lending conditions, higher interest rates, or even rejection of loans.

Conversely, a low D/E ratio indicates the company has a stronger ability to repay debt, making it more likely to secure loans with favorable terms.

6. Growth and Expansion Potential

The D/E ratio can highlight a company's growth strategy. Companies with higher ratios may be aggressively pursuing growth by using debt to finance new projects, acquisitions, or infrastructure.

While this can potentially increase returns, it also amplifies risk. A balanced D/E ratio reflects a company that is cautiously growing while maintaining financial flexibility.

7. Industry Comparisons

It’s essential to consider the industry norms when evaluating the D/E ratio. Some industries, such as utilities or manufacturing, typically carry higher levels of debt due to significant capital expenditures. In contrast, industries like technology or services tend to have lower D/E ratios, as their capital requirements are generally smaller.

8. Understanding Financial Flexibility

A company’s ability to adjust to changing circumstances is influenced by its D/E ratio. A company with a high D/E ratio may find it difficult to obtain additional financing or may face higher borrowing costs. Companies with lower debt levels generally have more room to maneuver and can take on new debt if necessary to seize new opportunities.

Factors That Affect the Debt-to-Equity Ratio

The Debt-to-Equity (D/E) Ratio is a crucial indicator of a company's capital structure, but it can be influenced by several factors. Understanding these variables is key to interpreting the ratio and assessing a company’s financial health.

Here are the primary factors that affect the D/E ratio:

1. Company's Financing Strategy

A company’s approach to financing—whether it chooses to rely on debt or equity—has a direct impact on its D/E ratio. Companies that prefer debt financing to fund operations or expansion will naturally have a higher D/E ratio.

Conversely, companies that issue more equity (through stock issuance or retained earnings) will have a lower D/E ratio, reflecting a more conservative financial structure.

2. Industry Norms and Sector Characteristics

The industry in which a company operates can significantly influence its typical D/E ratio.

Capital-intensive industries like manufacturing, utilities, or telecommunications generally have higher debt-to-equity ratios due to large investments in infrastructure and equipment.

On the other hand, service-oriented industries or technology firms often have lower ratios since they have fewer capital expenses and may rely more on equity.

3. Economic Conditions

Macro-economic factors such as interest rates, inflation, and economic cycles can also affect the D/E ratio. For instance, in times of low interest rates, companies may be more inclined to take on debt as borrowing becomes cheaper.

During economic downturns, firms may focus on maintaining lower debt levels to reduce the risk of financial distress. Economic conditions also impact companies' ability to generate cash flow, which in turn affects their ability to service debt.

4. Company's Growth Stage

The stage of growth that a company is in plays a key role in determining its D/E ratio. Startups and early-stage companies often carry higher levels of debt as they seek to fund their growth strategies and establish themselves in the market.

In contrast, mature companies with stable cash flows may have lower debt levels and a more balanced capital structure, as they can rely more on retained earnings and equity financing.

5. Risk Appetite and Management's Approach

The company’s risk tolerance and management’s approach to leveraging debt influence the D/E ratio. Companies with aggressive growth strategies might take on more debt to finance expansion, while more conservative management teams may avoid excessive borrowing to ensure financial stability. The company’s corporate culture and its board of directors' philosophy also affect the level of acceptable risk.

6. Credit Rating and Lender Confidence

A company’s credit rating plays a significant role in determining how easily and at what cost it can take on debt. Companies with high credit ratings are able to access cheaper financing, making it easier for them to increase their debt levels without significantly affecting their cost of capital.

Conversely, companies with poor credit ratings may find borrowing more expensive, and they may avoid accumulating too much debt for fear of higher interest rates and loan rejection.

7. Profitability and Cash Flow

A company’s profitability and its ability to generate steady cash flow are critical factors in managing its D/E ratio. Profitable companies with consistent cash flow can service higher levels of debt, which leads to a higher D/E ratio.

Companies with fluctuating or unpredictable earnings may prefer to keep their debt levels lower to minimize the risk of not being able to meet debt obligations during lean periods.

8. Asset Base and Capital Expenditures

Companies with substantial assets or those engaged in capital-intensive projects may need to take on more debt to finance these investments. A company that owns valuable, easily sellable assets can afford to take on higher debt because these assets act as collateral, reducing the lender’s risk. Companies that regularly invest in research and development or large capital expenditures will often see their debt levels rise to fund these initiatives.

9. Dividend Policies

A company’s dividend policy can also impact its D/E ratio. Companies that pay high dividends may retain less equity, relying more on debt to finance operations or expansion. Conversely, companies that retain earnings for reinvestment rather than paying them out as dividends can keep their D/E ratio lower by relying on equity financing.

10. Regulatory Environment

Government regulations and tax policies can influence a company’s use of debt. For example, tax benefits on interest expenses may incentivize companies to borrow more, as the interest on debt is often tax-deductible. On the other hand, stringent debt regulations or limitations on borrowing may keep a company’s debt levels in check.

Limitations of the Debt-to-Equity Ratio

While the Debt-to-Equity (D/E) Ratio is a valuable tool for assessing a company's capital structure and financial leverage, it has its limitations. It's important to understand these constraints in order to interpret the ratio accurately and make well-informed financial decisions.

Here are some of the key limitations:

1. Doesn't Consider the Cost of Debt

The D/E ratio only compares the total debt to equity, without considering the cost of debt. A company may have a high D/E ratio, but if the interest rates on its debt are low, its financial risk could be relatively low as well.

On the other hand, a company with a low D/E ratio might have expensive debt that significantly impacts its profitability. The D/E ratio does not reflect these subtleties, making it an incomplete measure of financial risk.

2. Ignores the Type of Debt

The ratio does not distinguish between short-term and long-term debt, which can vary significantly in terms of risk. Short-term debt may be due in the near future, creating immediate financial pressures, while long-term debt typically has a longer repayment schedule.

A high proportion of short-term debt could pose more risk than a similar proportion of long-term debt, but the D/E ratio does not differentiate between the two.

3. No Insight Into Liquidity

The D/E ratio does not provide any insight into a company’s liquidity position or ability to meet short-term obligations. A company with a high D/E ratio could still be in a strong position to meet its debt payments if it has substantial cash reserves or liquid assets. Without considering liquidity, the ratio may not give a complete picture of a company’s financial health or ability to manage debt in the short term.

4. Can Be Manipulated

Companies can engage in creative accounting to adjust their debt levels, affecting the D/E ratio. For example, a company may sell off certain assets to reduce its debt or use off-balance-sheet financing to avoid showing liabilities. These practices can distort the true debt position, making the D/E ratio less reliable as an indicator of financial risk.

5. Varying Industry Standards

The D/E ratio is often compared to industry averages, but these averages can vary significantly between industries.

For example, capital-intensive industries like utilities, manufacturing, and telecommunications typically have higher D/E ratios due to the large investments required for operations, while technology or service companies usually have lower ratios.

Therefore, the ratio may not be as useful for comparison across sectors without taking into account the unique characteristics of each industry.

6. Does Not Reflect Future Debt or Growth Plans

The D/E ratio only reflects a company’s current debt situation, without accounting for future borrowing plans or growth projections.

A company with a low D/E ratio today might be planning to take on more debt to fund expansion, which would increase its financial risk in the future.

Similarly, a company with a high D/E ratio might reduce its debt levels as part of a debt-reduction strategy, making its future debt load less concerning.

7. Doesn't Reflect Asset Quality

While the D/E ratio shows the relationship between debt and equity, it does not consider the quality or liquidity of a company’s assets. A company with significant assets that are illiquid or difficult to sell may have difficulty raising funds in a crisis, even if its D/E ratio is relatively low. The ratio fails to capture the true risk associated with asset management and liquidity.

8. Overlooks Profitability

The D/E ratio does not take into account a company's profitability or ability to generate income from its assets. A company with a high D/E ratio may still be able to comfortably service its debt if it is highly profitable and generates significant cash flow. On the other hand, a company with a lower D/E ratio but weak profitability could face challenges in managing its debt.

9. Doesn't Account for Non-Debt Financing

The D/E ratio focuses strictly on debt as a source of financing, ignoring other methods such as leasing, equity financing, or grant funding. These alternative financing methods may reduce the need for traditional debt and can affect the company's financial structure and risk profile, but the D/E ratio does not capture their impact.

10. May Not Reflect Tax Benefits

In some regions, companies may benefit from tax deductions related to interest payments on debt. A higher D/E ratio could be seen as beneficial in such cases, as the debt is tax-deductible.

The D/E ratio doesn't factor in such tax implications, potentially overstating the risk of a highly leveraged company in jurisdictions where these tax benefits apply.

How to Improve Debt-to-Equity Ratio

The Debt-to-Equity (D/E) Ratio is a key financial metric used to assess a company’s leverage by comparing its total debt to its equity. A high D/E ratio can indicate a company is heavily reliant on debt for financing, which might increase its financial risk.

Conversely, a low D/E ratio suggests lower reliance on debt, often seen as a sign of financial stability. If your D/E ratio is higher than desired, improving it can help reduce risk, attract investors, and improve your company's financial standing.

Below are several strategies to improve your D/E ratio:

1. Increase Equity Financing

One of the most direct ways to improve your D/E ratio is by increasing equity financing. This involves raising capital by issuing new shares or attracting investors. The additional capital from equity increases the denominator in the D/E ratio equation, thereby reducing the overall ratio.

Some methods include:

- Issuing new stock: If the company is publicly traded, it can issue more shares to raise funds.

- Attracting investors: Private companies can seek venture capital or other investors who are willing to invest in exchange for ownership equity.

- Retaining earnings: Rather than paying out all profits as dividends, a company can choose to reinvest them into the business, increasing retained earnings and equity.

2. Pay Down Debt

Reducing debt directly impacts the numerator in the D/E ratio formula, lowering the ratio. Paying down high-interest short-term debts should be prioritized, as it not only improves the D/E ratio but also reduces overall financing costs.

Strategies to reduce debt include:

- Refinancing existing debt: Refinancing at lower interest rates or converting short-term debt to long-term debt can reduce immediate financial pressure.

- Selling non-core assets: Selling off non-essential assets can generate cash to pay down debt.

- Strategic debt repayments: Focus on repaying high-interest debts first to reduce the financial burden.

3. Restructure Existing Debt

Debt restructuring can help lower the interest burden and lengthen repayment periods, making debt more manageable. In some cases, creditors may agree to lower the interest rate or extend the repayment timeline. This can reduce the overall debt level on the balance sheet and improve the D/E ratio.

- Debt consolidation: Combine multiple debts into a single, lower-interest loan.

- Debt-for-equity swaps: Offer creditors equity in exchange for debt forgiveness. This can effectively reduce debt while also increasing equity.

4. Increase Profits

Increasing profitability enhances retained earnings, which directly boosts equity. A higher level of equity will lower the D/E ratio. Strategies for improving profits include:

- Increasing revenue: Launching new products, expanding into new markets, or enhancing sales efforts.

- Cost-cutting: Streamlining operations, reducing overheads, or improving operational efficiency.

- Improving cash flow management: Ensuring timely invoicing and collections, reducing inventory costs, and managing working capital more effectively.

5. Consider Alternative Financing

Exploring non-debt financing options can reduce a company’s reliance on debt and improve its D/E ratio. Alternative financing options include:

- Leasing: Instead of purchasing equipment or real estate outright, companies can lease assets, thus avoiding taking on additional debt.

- Grants or subsidies: For businesses in specific industries or sectors, securing government grants or incentives can help increase equity without increasing debt.

- Crowdfunding: Leveraging platforms for raising capital can attract investors and avoid adding debt to the balance sheet.

6. Sell Non-Essential Assets

If a company holds valuable but non-essential assets, selling them could generate cash to pay down debt, thereby improving the D/E ratio. This can also help streamline operations by removing unnecessary assets from the balance sheet.

7. Optimize Working Capital

Improving the efficiency of working capital management (the difference between current assets and liabilities) can free up cash to reduce debt. Some ways to improve working capital efficiency include:

- Faster inventory turnover: Reducing inventory holding costs by turning over products more quickly.

- Improved receivables management: Ensuring that payments from customers are collected more quickly.

- Paying suppliers strategically: Extending payment terms with suppliers, if possible, without incurring penalties.

8. Engage in Strategic Partnerships or Mergers

Entering into strategic partnerships or mergers with other companies can increase equity and potentially reduce the need for debt. A merger with a financially stronger company can improve the equity base and improve the D/E ratio. Alternatively, forming partnerships can bring in additional capital or resources, thereby improving financial leverage.

How Deskera ERP Can Help Improve Your Debt-to-Equity Ratio

Managing a healthy Debt-to-Equity (D/E) Ratio requires efficient financial oversight, strategic debt management, and optimized cash flow. Deskera ERP provides businesses with the tools to track financial metrics, automate accounting, and optimize working capital, ultimately helping to improve the D/E ratio.

Here’s how Deskera ERP can assist:

1. Real-Time Financial Reporting and Analysis

Deskera ERP provides real-time financial dashboards and automated reports, allowing businesses to monitor debt levels, equity status, and overall financial health. With instant access to financial data, companies can make data-driven decisions to manage debt and equity more effectively.

2. Automated Debt Management

The platform helps businesses track, schedule, and manage debt repayments, ensuring timely payments and avoiding unnecessary interest expenses. By automating loan tracking, companies can reduce reliance on short-term debt and improve their financial leverage.

3. Enhanced Cash Flow Management

A strong cash flow helps businesses reduce debt dependence and improve equity reserves. Deskera ERP streamlines:

- Accounts receivable: Automating invoice reminders to improve collection efficiency.

- Accounts payable: Managing supplier payments strategically to optimize cash outflow.

- Expense tracking: Identifying cost-saving opportunities to enhance profitability.

4. Efficient Working Capital Optimization

Managing working capital effectively can reduce the need for external debt financing. Deskera ERP helps businesses:

- Track inventory levels to prevent overstocking or understocking, reducing holding costs.

- Improve supplier negotiations to secure better payment terms.

- Optimize procurement processes to maintain a healthy balance between expenses and revenues.

5. Streamlined Equity and Investment Tracking

Deskera ERP enables businesses to track retained earnings and reinvest profits, thereby increasing equity. It also provides tools to manage investor relations and equity financing, allowing businesses to attract new investments while maintaining accurate financial records.

6. Automated Profitability Analysis

With built-in financial reporting and forecasting, businesses can analyze profit margins, cost structures, and revenue trends. By improving profitability, a company can increase retained earnings, ultimately strengthening the equity portion of the D/E ratio.

Key Takeaways

- The Debt-to-Equity (D/E) Ratio measures how much debt a company uses compared to its equity, providing insights into financial leverage and risk.

- This ratio is crucial for investors, creditors, and management as it helps assess a company’s ability to meet its financial obligations and maintain long-term stability.

- A high D/E ratio indicates greater reliance on debt, which can boost returns but also increases financial risk. A low D/E ratio suggests financial stability but may signal missed growth opportunities.

- The ideal D/E ratio varies by industry—capital-intensive businesses like manufacturing typically have higher ratios, while service-based companies often maintain lower ones.

- While useful, the D/E ratio alone doesn’t provide a complete financial picture; it should be analyzed alongside other financial metrics like cash flow and profitability.

- Companies can enhance their D/E ratio by reducing debt, increasing equity through retained earnings or investments, and optimizing cash flow management.

- Deskera ERP plays a critical role in helping businesses maintain a balanced Debt-to-Equity Ratio by optimizing financial management, improving cash flow, and ensuring efficient debt repayment strategies. By leveraging Deskera’s automation and real-time insights, businesses can enhance financial stability, reduce risk, and position themselves for long-term growth.

Related Articles