If there is one accounting notion that mostly confuses accounting beginners it’s learning how to make debit and credit entries.

Simply put, debits record money flowing into an account, while credits record cash flowing out of an account. These debit and credit changes happen every time a business makes a financial transaction.

But what exactly happens when you debit one account and credit the other? Why is it so important to properly record the debits and credits of your transactions?

In this guide, we will answer all of these questions, along with everything else you need to know about debit and credit for your small business accounting.

Read on to learn about:

- What Are Debits and Credits?

- The Equality of Debit and Credit

- Debit and Credit Accounts

- How to Record Debit and Credit

- 5+ Debit and Credit Examples

- Automate Debit and Credit with Online Software

What Are Debits and Credits?

The most common bookkeeping method for recording transactions in accounting is double-entry bookkeeping.

In double-entry, each transaction affects two accounts (hence the word double) where one is debited and the other credited.

In order to properly understand what it means to debit and credit, let’s first get some widespread misconceptions out of the way.

Debits and credits are neither good nor bad. They aren’t the same as adding or subtracting, either.

Debits and credits are words accountants use to reflect the duality of business transactions. They let you see where cash is coming from, and where it’s going.

If you need an analogy to better visualize the concept, think of debit and credits as heads and tails on a coin, since they are the opposite and equal sides of a financial transaction.

More specifically, a debit (Dr) is an entry that either:

- Increases an asset or expense

- Decreases a liability or owner’s equity

While a credit (Cr) entry does the opposite, meaning it either:

- Increases a liability or owner’s equity

- Decreases an asset or expense

Debits are always recorded on the left side of an entry. Likewise, credit amounts are entered on the right.

If you want to learn how debit and credit entries are used to generate financial statements at the end of the year, head over to our guide on the accounting cycle.

The Equality of Debit and Credit

In financial accounting, there are rules set in place that ensure that every financial transaction has equal amounts of debits and credits. One of the main principles behind this equality is related to the relationship between the accounting equation and debit and credit rules.

The accounting equation is the foundation to double-entry bookkeeping and expresses the relationship between these three financial components, as shown below:

Assets = Liabilities + Owner’s Equity

And according to the rules we previously explained, increases on the left side (for assets) are recorded by debits, while increases on the right side (for liabilities and equity) by credits, as illustrated below:

This is why debits and credits should always balance in the end.

If they don’t, double-check your recording to see where you might have made any accounting errors.

Pro-Tip

To avoid posting unbalanced debits and credits, streamline your finances with cloud accounting software.

With online software, you can directly integrate with your business bank account and automate journal entry creation. This way, every time a transaction occurs, the correct debit and credit balances are posted to corresponding Ledger accounts entirely on their own.

Debit and Credit Accounts

Every business has a specific chart of accounts for their General Ledger, depending on the types of financial activities they perform.

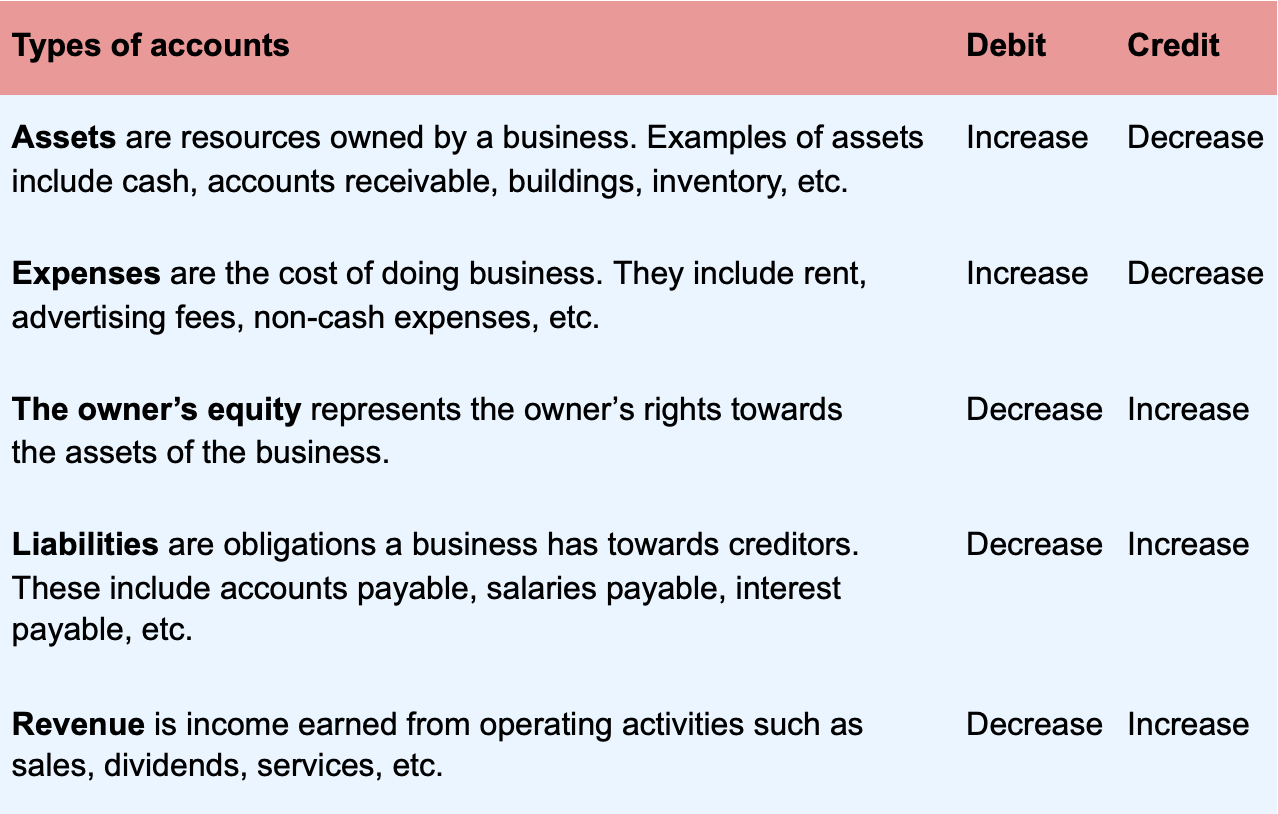

With that being said, the most common types of accounts businesses use are five: assets, expenses, liabilities, owner’s equity, and revenue.

In the table below, you can see the explanation for each type of account, along with their corresponding debit and credit changes:

How to Record Debit and Credit

To record debit and credit changes, you have to do a brief analysis of the business transaction by following these three steps:

- Figure out which accounts are affected.

- Determine whether the items have been increased and decreased, and by how much.

- Then lastly, translate the changes into debit and credits.

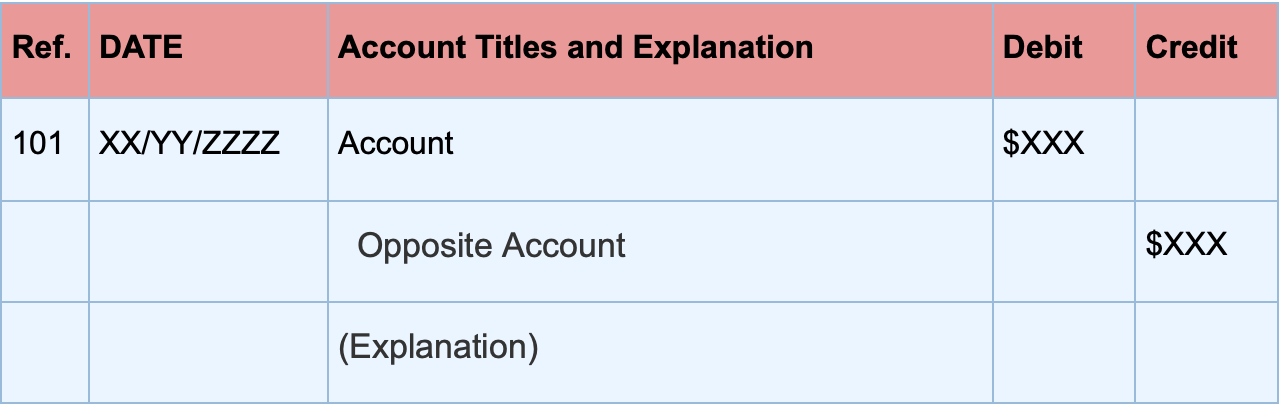

Once that’s done, make sure that the journal entry includes all of these appropriate elements:

- Reference number

- Date

- Account column

- Debit and credit columns

- A brief description of the transaction

This is a basic template of how these elements would look like as a journal entry:

To get a better understanding of how this record-keeping is done, let’s look at a few debit and credit business examples.

5+ Debit and Credit Examples

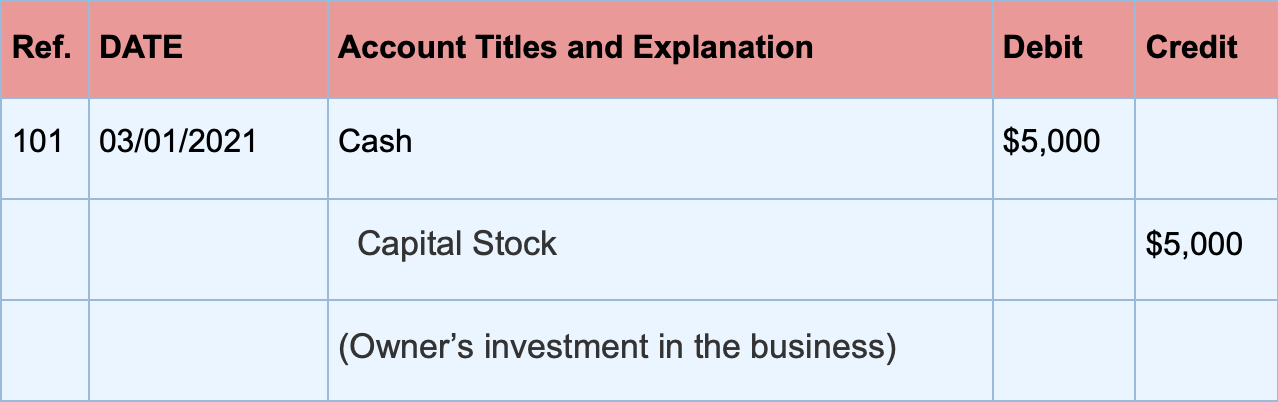

1. Owner’s Investment

On January 3rd, 2021, the owner of the company XYZ invests $5,000 in cash for capital stock.

Analysis: The asset Cash is increased by $5,000, and the owner’s equity Capital Stock is also increased by the same amount.

Debit and Credit Rules: Increases in assets are recorded by debits, so cash will be debited for $5,000. Increases in the owner’s equity are recorded by credits, so Capital Stock will be credited for $5,000.

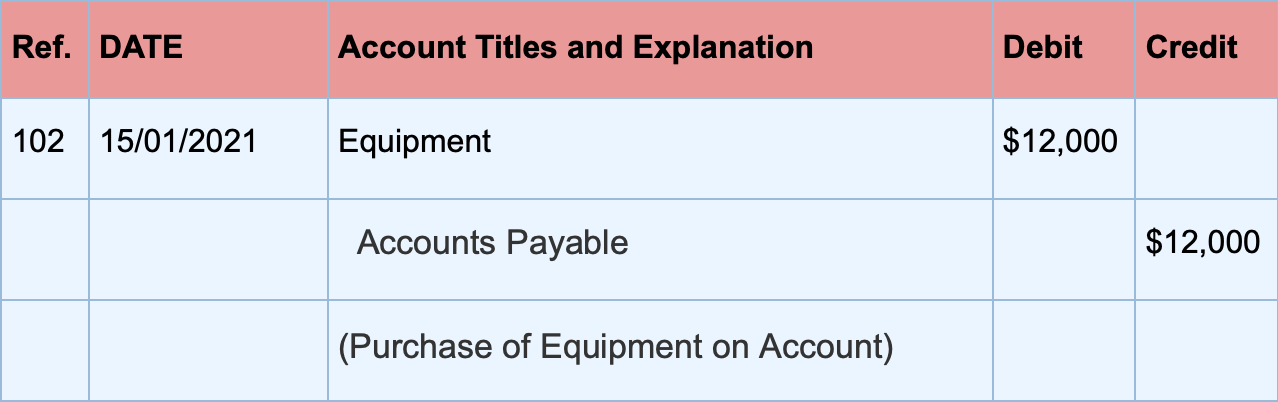

2. Purchase on Account

On January 15th, company XYZ purchases equipment on account for $12,000.

Analysis: The asset Equipment increases at a cost of $12,000 and a liability Accounts Payable (AP) of $12,000 also increases.

Debit and Credit Rules: Equipment is debited for $12,000, and AP is credited for $12,000.

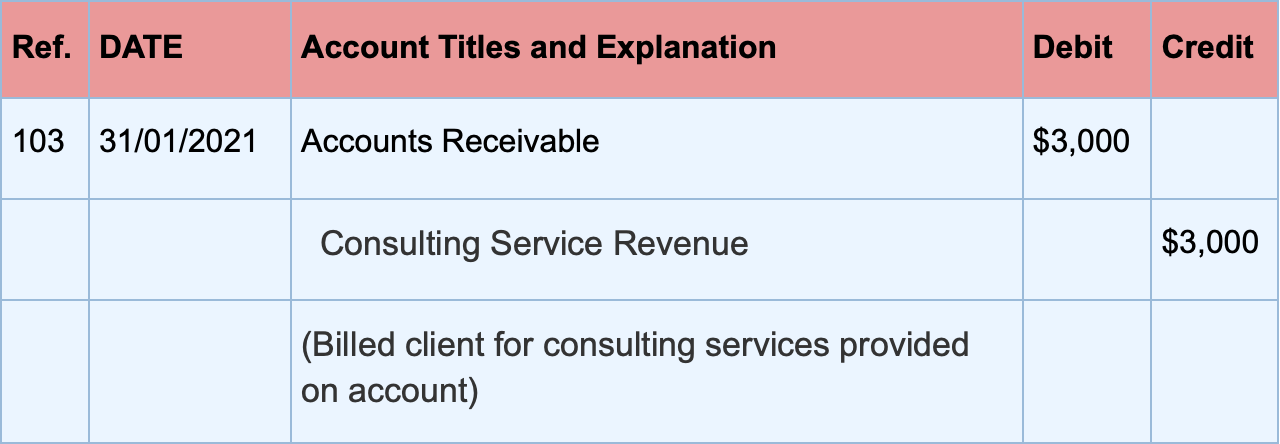

3. Uncollected Revenue

On January 31st company XYZ issues a sales invoice for $3,000 worth of consulting services provided on account.

Analysis: The asset Accounts Receivable (AR) increases by $3,000, and the revenue Consulting Service Revenue also increases by $3,000.

Debit and Credit Rules: A debit to AR for $3,000, and a credit to Consulting Service Revenue for $3,000.

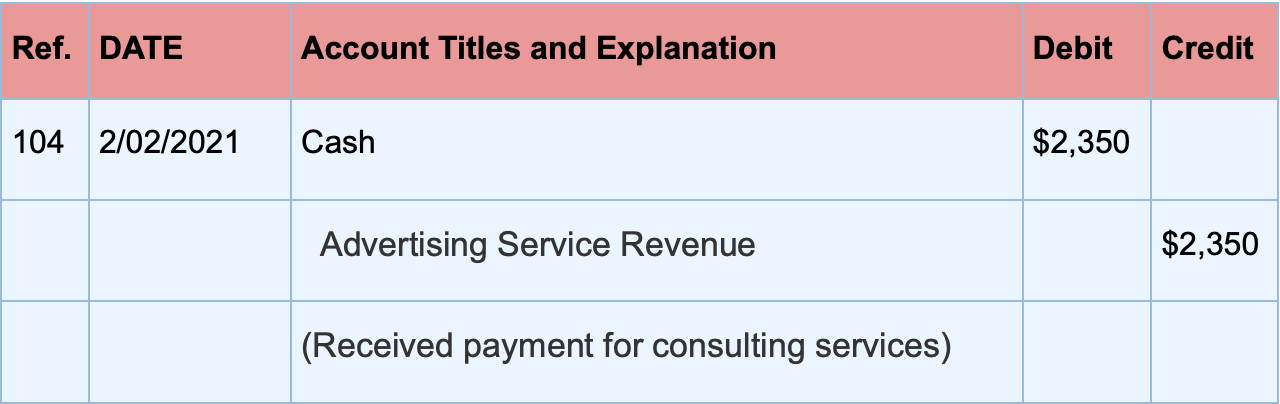

4. Earned and Received Revenue

On February 2nd, the company collected $2,350 for advertising services.

Analysis: The asset Cash and Repair Service Revenue increase by $2,350.

Debit and Credit Rules: Cash will be debited at $2,350, while Advertising Service Revenue credited for $2,350.

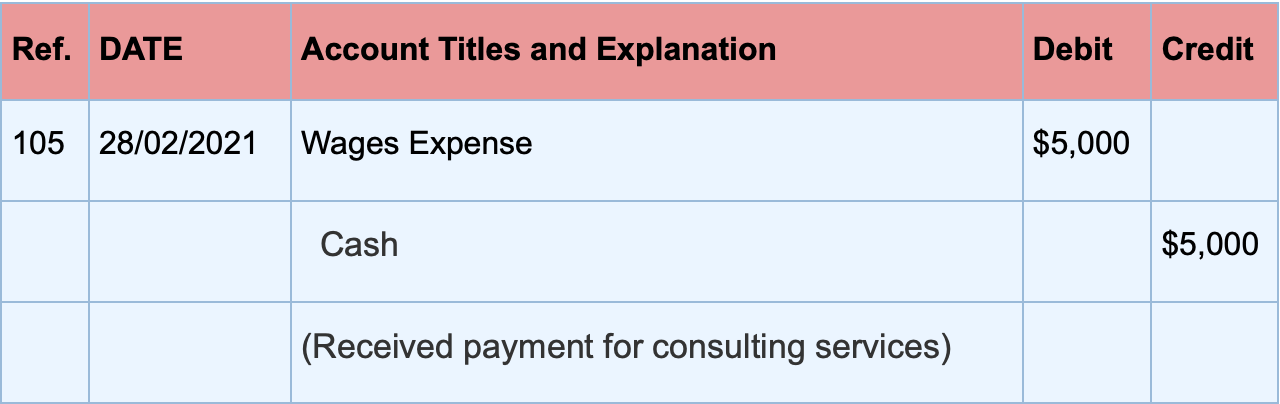

5. Paid Wages to Employees

On February 28th the company paid $5,000 worth of wages to employees.

Analysis: Employee wages are expenses, so expenses increase by $5,000. The asset Cash also decreases by that same amount.

Debit and Credit Rules: The Wage Expense account will be debited for $5,000, whereas Cash will be credited for $5,000.

Automate Debits and Credits with Online Software

Do you need a simple solution to automate recording your debit and credit entries? Give online accounting software like Deskera a try!

Deskera is an intuitive, super easy-to-use software that automates your entire double-entry bookkeeping, in a matter of seconds.

You can use Deskera to integrate directly with your business bank account, or multiple bank accounts. This way anytime a purchase or payment occurs, the software automatically posts the respective journal entry with the appropriate debit and credit amounts into the Ledger.

The same process applies to issuing invoices.

After you make an invoice, the corresponding debit and credit entries are added by the system to Accounts Receivable, Sales, Cash, and so on.

The best part? You can access the software from any device with an internet connection, by simply downloading the Deskera mobile app.

Try the software out yourself right away, by signing up for our free trial.

Key Takeaways

And that’s a wrap!

Here are some of the main points we’ve covered:

- Debit is cash that flows in the business, credit is cash that flows out.

- A debit entry increases an asset or expense account, or decreases a liability or owner’s equity. A credit does the opposite.

- Debits are always on the left side of the journal entry, and credits on the right.

- Happiness for an accountant is when debits equal credits. If they’re not equal, you’ve probably made a mistake.

- To record debits and credits first figure out which accounts are affected, then determine whether there’s an increase or decrease (and by how much), and lastly, translate the changes into debit and credit.

- Use accounting software like Deskera to completely automate debit and credit entries for your business.

Related Articles