In B2B businesses, it is common to trade for goods or services on credit and pay for them later. For businesses, it's an effective tool to increase sales and encourage business growth.

But, we must accept that this selling model comes with a lot of risks. It can disrupt your cash flow and cut down your profits.

What is the point of selling products involving such a huge risk when you can't get your payment on time?

So, it is imperative to have effective customer credit control policies. It minimizes your financial risks. Having the right ERP software helps you manage your customer credit control effectively. And based on that, you can make wise credit decisions.

In this article, we will be discussing the following topics:

- What is Customer Credit Control?

- Why do Businesses Sell Products on Credit?

- What is Creditworthiness and How Can You Determine it?

- What are Credit Control Policies?

- How can ERP help in Customer Credit Control?

- Key Features of ERP that help in Customer Credit Control

- What are the Benefits of using ERP for Customer Credit Control?

- Customer Credit Control with Deskera

- Key Takeaways

What is Customer Credit Control?

Customer Credit control is the system to minimize businesses' financial risk. It does so by extending credit to the customers who can repay it quickly.

Credit is given to eligible customers who can pay and that too as per the payment terms.

Citing an example here:

Chris is a cafe owner who has been running it for the last three years. The milk delivery company provides him 10 liters of milk per day with a scheduled timeline of 60 days.

Now, Chris demands to increase the milk supply to 30 liters per day on credit. The milk delivery company agrees to it, but it reduces the payment term to 30 days.

After a few days, Chris again demands an increase in milk supply. The supplier agrees, but this time it puts a condition of immediate payment of 50%.

Why do you think the milk company put the above condition?

The company knows Chris, his business, his revenue, and his payment capacity well. It had set a credit limit for the cafe. Once Chris exceeded that limit, the delivery company didn't want to take a high financial risk.

It is called customer credit control.

In simple terms, it is a check on your business to protect it from late payment of invoices and nonpayments.

It ensures that you receive on time payment for all the goods and services you have sold to your customer. It also helps you maintain your cash flow and make well-informed decisions.

Credit Control is also known as Credit Management.

Why do Businesses Sell Products on Credit?

In today's highly competitive environment, almost every business believes in trade credit.

Trade credit is a system in which a customer can buy goods or services and pay the supplier later.

Businesses are ready to sell their products on credit to accelerate the sale of their products or services to potential customers or clients. It is an essential strategy if businesses want to increase their profit and also their market share.

Benefits for Customers

- Extending credit to customers makes the purchase of a good or service more accessible for customers.

- The 'buy now pay later' and 'payment in installments' strategies are more desirable purchase processes for customers.

- At the same time, these strategies also make the purchase affordable for the customers.

What is Creditworthiness and How Can You Determine it?

By assessing a customer's creditworthiness, you can determine the level of risk you will be taking by extending credit. At the same time, you can quantify credit limits for your customers.

Before extending goods on credit, you need to determine the creditworthiness of that customer. It is a necessary process.

In the example cited earlier, the cafe and the milk company were doing business together for quite some time. And the delivery company was familiar with its reputation and other details.

But if you have a new prospect or customer, how do you decide its creditworthiness?

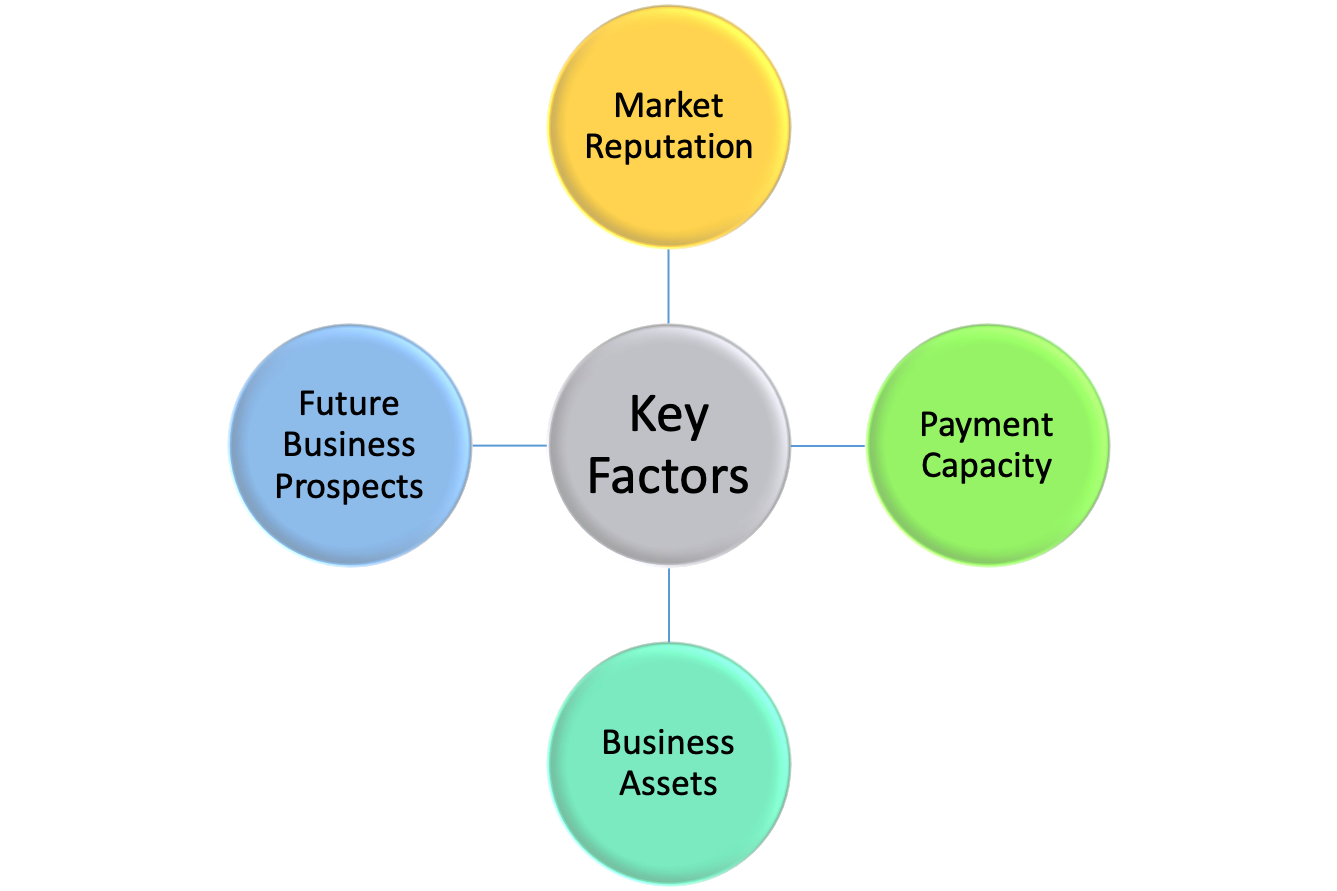

Key Factors to Consider while Assessing a Company's Creditworthiness

What is the market reputation of the customer?

It is critical to have an understanding of the customer's reputation and credibility. A thorough background check is a must. You can do that by speaking to business references, going through its payment history and outstanding.

What is the payment capacity of the customer?

You want to ensure that the customer is capable of paying your invoices as per the payment terms. You can make sound decisions if you clearly understand the customer's business cash flow, revenue, and debt-to-income ratio.

What are the customer's assets?

It plays a critical role when your customer turns out to be a defaulting customer. In case of nonpayment, the customer should be able to liquidate that asset.

What is the prospect of his business?

Understanding if the customer has a viable business and is facing challenges is essential. It gives you a fair idea of the worth of the company. If the customer's business is growing and the future looks promising, you have minimal financial risk.

What are Credit Control Policies?

Once you have determined the company's creditworthiness, you need to implement credit control measures while extending credit to minimize your financial risks effectively.

For this, a company must have a well-defined credit control policy. It depends on how much risk they are willing to take and accordingly design their credit control policy.

There are three types of policies that businesses can adopt as per their choice.

Restrictive Policy

As the name suggests, businesses who are willing to take minimum financial risk generally take this approach. For example, small business owners with limited cash flow would only like to extend credit to customers with solid creditworthiness. At the same time, businesses that have a monopoly in the market can also opt for a restrictive policy.

Moderate Policy

This approach is applicable for businesses that are willing to take relatively more risk. Here businesses might extend credit to customers with mediocre creditworthiness. For example, businesses keen on expanding their business and growing it might want to take that risk.

Liberal Policy

A liberal policy involves high risk. Companies following this kind of approach extend credit to most customers despite their poor creditworthiness. For example, large businesses with enough cash flow to increase their market share adopt a liberal policy.

How Can ERP Help in Customer Credit Control?

Once you have the credit control policy in place, you have to execute measures for effective credit control. And this is not possible without the help of an ERP.

ERP or Enterprise Resource Planning is a business management software that manages and simplifies your business's day-to-day operations. It takes care of your finances & accounts, sales, HR, and more. To know more about Enterprise Resource Planning, read through this article.

ERP plays a critical role in customer credit control. It allows you to set up several checks in the system to be at minimal financial risk.

Here are the key features of ERP that help in customer credit control.

Defines Credit Limit

ERP allows you to define credit limits for your customer or group of customers. Along with the credit limit, you can also keep a check on the maximum period of credit and the maximum number of invoices. You can set up all this information in the master data of the ERP. Once you save this data, ERP automatically updates the information and notifies when the customer reaches the defined limit.

You have defined a credit limit of USD 8000 for a company 'A.' The maximum invoice limit is 12 invoices in a year. You have already transacted with 'A' earlier with credit outstanding of 6000 dollars. Now when generating the eighth invoice of the year, the credit limit exceeds 1000 dollars. ERP immediately notifies you of it.

At that moment, it's solely your decision whether you want to go ahead with the trade or reject it.

Efficient Dunning Process

The finance & accounting module of ERP software helps efficiently manage your general ledger's account receivables. The ERP system maintains credit data which contains details of all unpaid invoices.

It automates the entire process of tracking invoice payment due dates, account receivables, customers' credit limits, etc. ERP software sends regular reminders to customers for payments, past due invoices, etc.

Even after several reminders, if the customer fails to make the payment, increasingly urgent reminders are generated in the system.

Automated reminders result in faster payment processing from customers, thus minimizing the risk of bad debts. At the same time, it continues to maintain good customer relationships.

Deeper Insights

ERP gives deeper insights through comprehensive reports. You can analyze these reports to understand the pattern, types of customers, defined credit limits, etc., of customers delaying payments. Based on these findings, you can change your credit control policy to ensure its effectiveness. For instance, you can redefine the kind of customers who may not be suitable for extending credit.

Warning Notifications

While ERP sends automated reminders to customers, it also sends cautionary messages to businesses extending credit. ERP has all the information related to the credit limit, payment days, and several invoices for each customer. As the transactions are near the defined limit, ERP sends cautionary warnings to the company. Thus, it acts as a checkpoint for your business. It ensures that you do not exceed the transaction limit and be a victim of bad debt.

Uniform Database

With a centralized database, there is only one source of information. Thus the organization's departments sync with each other—no more working in silos. Therefore, the decided credit limit and all the other relevant information of every customer is shared across every business department so that every division is well-informed. There is consistency and transparency among the various business units of the organization.

Quick and Accurate Decisions

ERP has a simple and user-friendly interface. All the information related to a customer is visible at a single glance on the customer activity dashboard. Therefore, you don't have to look around at different places for any information. At the same time, all the departments have access to the same data, so it is accurate and error-free.

What are the Benefits of using ERP for Customer Credit Control?

ERP, with its robust features, proves an excellent tool for customer credit control.

Here are the benefits:

Accurate Credit Information

With real-time visibility into customer's credit status, you and your employees are well-informed about each of them. Since the entire information is updated automatically, there is no manual error. And with a single source of information for every department, all the data is accurate. ERP also helps in data validation. ERP monitors all the overdue payments, customer credit limits and analyses the pattern of these customers.

Minimizes Risk of Bad Debts

ERP minimizes your financial risk by notifying you when a customer exceeds its specified credit limit.

Helps Maintain Cash Flow

For every business maintaining cash flow is essential. ERP helps you keep a healthy cash flow by reducing the financial risks of Accounts Receivable bad debt

Automates Credit Limit Checks

ERP automates the entire process of credit limit checks; thus, there are hardly any chances of errors. Since the process is automated, you and your employees can invest your time in other productive tasks.

Customer Credit Control with Deskera ERP

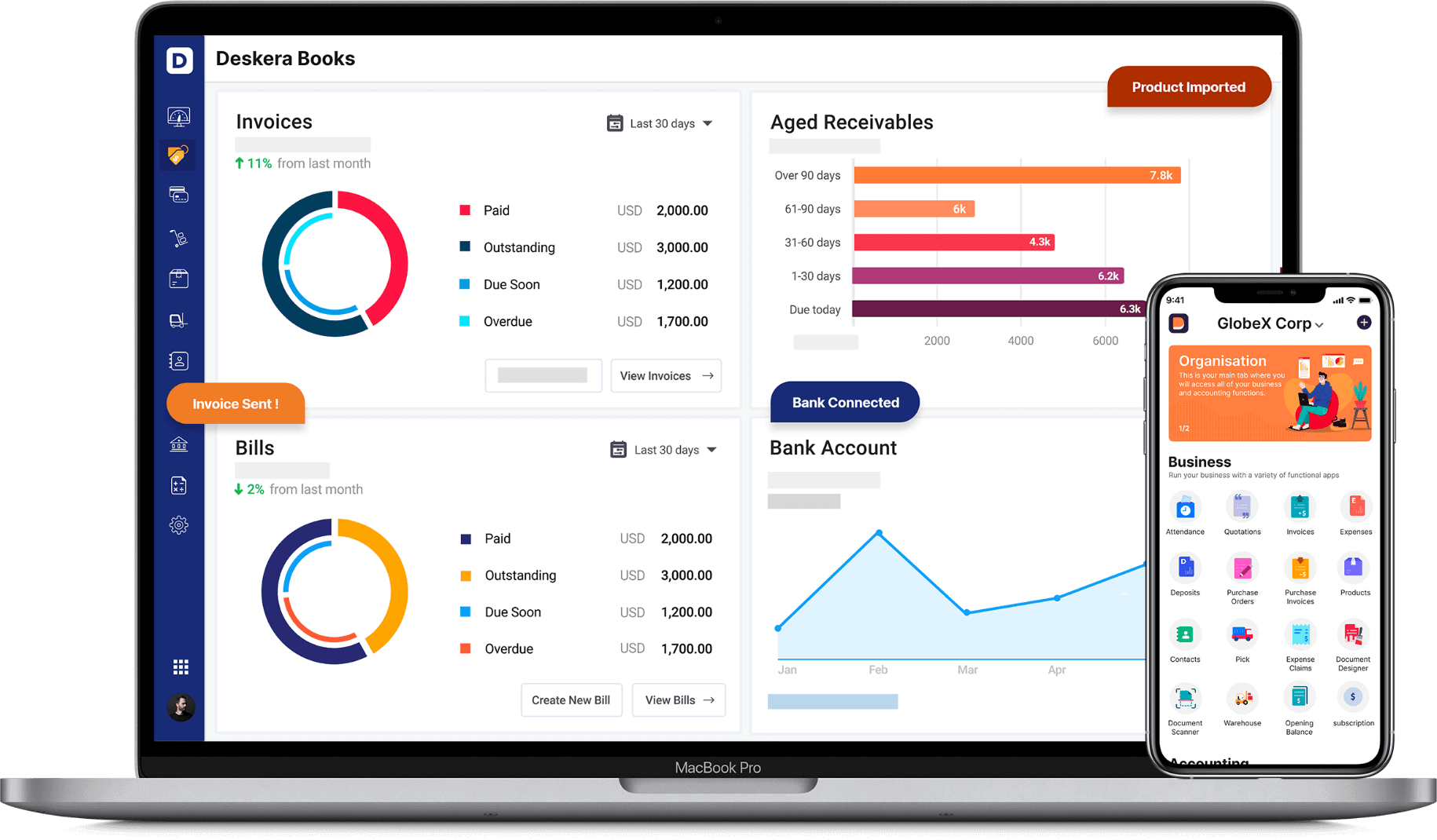

You can manage your outstanding with ease using Deskera all-in-one.

Deskera all-in-one solution is a cloud-based software suite consisting of Books, CRM, and People modules.

Deskera Books helps you receive your customers' timely payments to ensure your suppliers are paid on time and the cash flows are kept in check. You can easily track out standings from your customers.

Deskera Books provides Aged Receivables reports in real-time. Each invoice reflects its due days on the sales dashboard. You can send instant emails to your clients sharing their invoice details and payment reminders.

Key Takeaways

Businesses use various innovative ways to increase the sale of their goods and services. Trade credit is one of those ways. However, this method has its risks. Therefore, before extending credit to customers, it is imperative to check their credit history and have a credit control policy in place. A credit control policy is vital for businesses to safeguard their interests. ERP plays a critical role in implementing effective credit control in a company.

Here are the key takeaways from the article:

- In B2B businesses, it is common to trade for goods or services on credit and pay for them later.

- Customer Credit control is the system to minimize businesses' financial risk by extending credit to the customers who can repay it quickly.

- Trade credit is a system in which a customer can purchase goods or services and pay the supplier at a later scheduled date.

- Businesses sell their products on credit to accelerate the sale of their products or services to potential customers or clients.

- The 'buy now pay later' and 'payment in installments' strategies are desirable purchase processes for customers.

- You can determine the risk of extending credit and quantify credit limits for your customers by assessing their creditworthiness.

- There are three types of policies that businesses can adopt as per their choice-Restrictive, Moderate, and Liberal.

- ERP plays a critical role in customer credit control as it allows you to set up several checks in the system, so you are at minimal financial risk.

- An ERP system provides accurate credit information, minimizes the risk of bad debts, helps maintain cash flow, and automates credit limit checks.