The current ratio is also called the liquidity ratio that measures a company's ability to meet short-term obligations or the obligations that expire within one year. It is to depict the short-term financial health of a company to investors, lenders, and analysts. It shows them how companies can maximize their current assets to pay off their current and other liabilities.

Here's what we have in store for you:

- Use of Current Ratio

- What are Current Assets?

- What are Current Liabilities?

- Understanding the Current Ratio

- Changes in the Current ratio over time

- Current Ratio vs. Other Liquidity Ratios

- Limitations on the use of Current Ratios

- What is an ideal current ratio?

- What Does a Current Ratio of 1.5 Mean

- Significance of the current ratio

- Advantages and Disadvantages of Current Ratio

Understanding Current Ratio

A current ratio that is above the industry average or in line with it is generally considered healthy. A current ratio below the industry average may indicate an increased risk of financial suffering or default. If a company's current ratio is very high compared to its peers, it can depict that the management may not be using its assets lucratively or efficiently.

The current ratio is an indicator of the current evaluation of all short-term assets and short-term liabilities, unlike other liquidity indicators. The current ratio is sometimes also referred to as the working capital ratio.

Use of Current Ratio

The current ratio formula and calculation of the current ratio helps analysts compare the company's current assets to the current liabilities.

Current assets that are listed on a company’s balance sheet include accounts receivable, inventory, cash, and other current assets (OCA) that are expected to be encashed or liquidated within a financial year.

Current liabilities include short-term debt, taxes, wages, accounts payable, and the short-term portion of long-term debt.

The formula to calculate the current ratio is

Current Ratio = Current assets/Current Liabilities

What are Current Assets?

The total current assets of a company given on a date for a specified period include all assets that are expected to be liquidated within one year. Examples are:

- Cash – petty cash, coins, undeposited cheques, current and financial savings money accounts, Legal tender bills, etc.

- Cash equivalents – Corporate or authorities securities with a maturity of ninety days or less

- Prepaid expenses – Unexpired insurance premiums or advance payments on future purchases

- Office supplies – Office resources such as pens, paper, and equipment expected to be utilized within a financial year

- Accounts receivable – Money that the customers owe to the business which is recoverable within a year (deducting expected bad debts)

- Marketable securities – Preferred stock, Common stock, Government and corporate bonds maturity less than a year

- Notes receivable – Debt that will mature within a year

- Inventory – Work-in-process, Raw materials, finished goods, manufacturing or packaging supplies

- Other receivables – employee cash advances, insurance claims, income tax refunds

What are Current Liabilities?

The total short-term debt of a company on a date that includes all business obligations payable within the year. Examples are:

- Notes payable – Interest and the principal amount of loans that will accrue within a year

- Accounts payable or Trade payable – Credit resulting from the purchase of raw materials, supplies, merchandise, or usage of services and other utilities

- Accrued expenses – Payroll taxes payable, interest payable, income taxes payable, and everything for which an invoice has not been generating but has been accrued for

- Deferred revenue – This is the revenue that has already been paid in advance to the company, which will be completed after meeting revenue recognition requirements

Understanding the Current Ratio

The current ratio calculates a company's capacity and potential to settle short-term debts or short-term liabilities using short-term or current assets such as inventories, cash, and accounts receivable.

- Companies with a current ratio that is less than 1.00 do not have the capital to meet their short-term debt when they are due at once

- On the other hand, if the current quota exceeds 1.00, it indicates that the company has the funds available to maintain its solvency

However, because the current ratio does not represent the bigger picture and is just a portrait of the current status of a company, and thus, it does not depict its long-term solvency or short-term liquidity.

Let us take the real-life example of a big firm – Best Price

Large companies like Best Price, have been able to exhibit much longer-than-average payment terms with their dealers. If a supplier doesn't offer credit to its customers, this can show on its balance sheet as a high payables balance relative to its receivables balance.

Large retailers have the capability to reduce their inventory using an effective supply chain, that depicts their current assets lower as compared to their current liabilities, resulting in a lower current ratio.

Theoretically, it is believed that if the current ratio is high, it has more potential to pay its liabilities, as it has a good proportion of current assets as compared to the value of current liabilities that the company possesses for that specified period.

However, a high current ratio, say over 2.00, could indicate the company can cover its current liabilities two times, and may also indicate that it is not using its current assets efficiently, but securing funding or working capital very well.

The current ratio is a great tool to calculate a company’s short-term solvency when placed in a situation that was historically normal for the company and its peers. You can also get more insights by iterating it over multiple periods.

Changes in the current ratio over time

Whether a current ratio is good or bad often depends on how it changes. There are chances that companies that appear to have a great current ratio may be heading into a situation where they are struggling to pay their invoices. On the contrary, there could be companies that appear to be struggling now may be well on their way to a better current ratio in the coming financial years.

In the first case, a situation like this can hamper the company's reputation while in the next case, improved current ratios may indicate a prospect to invest in undervalued stocks of that company.

Let us take an example

We have two companies – Company X and Company Y and both have the same current ratio of 1.00.

Over time, company X is running too much debt or is running out of cash. If it gets worse, both can turn into solvency issues. On the other hand, consequently, company Y is seen in a positive trend, which may indicate faster turnover, better paybacks, or that the company was able to reduce debt.

Another factor to consider is that if the current ratio of a company – let’s say company X, in this case, is more volatile, and shifts from 1.35 to 1.05 in a year, it indicates increased operational risk and can undermine the value of the company.

Current Ratio vs. Other Liquidity Ratios

Other similar liquidity metrics can complement the latest current analysis. It helps the investors understand the current state of a company's assets and liabilities from different angles and how these accounts change over time.

- The quick ratio, also known as the acid-test ratio, is a comparison of a company's easily liquidated assets to short-term liabilities. The liquidated assets include accounts receivable, cash, and short-term investments, excluding prepaid expenses and inventory

- The cash asset ratio or cash ratio is just like the current indicator, wherein the company's marketable securities and cash is compared to its short-term liabilities

- The operating cash flow ratio compares the active cash flow which is retrieved from CFO - the company's operating activities (CFO) to its short-term liabilities

Limitations on the use of Current Ratios

Let us look at the limitations of current ratio:

1. When comparing different companies to each other

The current ratio figures are limited. Companies vary widely from industry to industry. Comparing current metrics from companies in different industries may not provide productive insights.

For example, in the manufacturing industry, it may be more common to give a customer 90 days or more of credit, but in the retail industry, short-term payback is more important. Paradoxically, the manufacturing company that is giving more credit days, may have a stronger current ratio because of higher assets or higher working capital. It usually makes more sense to compare companies in the same industry.

2. Another drawback of using the current ratios is that it isn’t specific

For example, There are two companies – A and B, and both have the same current ratio of 0.80 in each quarter. The situation of the companies may look similar, but the quality and liquidity of their assets can vary significantly in the following cases:

If company A has much more inventory than Company B which cannot be monetized in the short term. This inventory can be obsolete or undesirable and can ultimately reduce its value on the balance sheet.

If company B has more cash or more accounts receivable, that can be recovered faster than clearing the inventory. Even if the current assets remain the same for both the companies, yet company B will be in a more fluid and solvent condition.

If Company A and Company B have very different short-term debts. Company A has more accounts payable, whereas Company B has a higher amount in short-term debt or notes payable. In this situation, the accounts payable would need to be cleared before clearing the notes payable. In addition, the wages payable in the short-term of Company A are lower than the other company.

Both companies appear to be similar, but in this example, Company B may be in a more fluid and solvent position.

What is the Ideal Current Ratio?

An ideal current ratio depends on the company's industry and historical development.

However, as a general rule, a current ratio below 1.00 indicates that a company may have difficulty achieving its short-term commitment, and a current ratio above 1.50 generally indicates enough liquidity.

What Does a Current Ratio of 1.5 Mean?

A current ratio of 1.5 implies that the business enterprise has 1.50 of current assets for every $1.00 of current liabilities.

For example, company A has cash worth $50,000 plus $100,000 in accounts receivable. Its present-day liabilities, of accounts payable, stands at $100,000. In this situation, the current ratio of company A will be 1.5, which is by dividing its current asset ($150,000) by its current liabilities ($100,000).

Significance of the Current Ratio

- The current ratio is among the most important financial indicators that denote the liquidity of a company. It is one of the key financial metrics and is also called the liquidity ratio

- The current ratio is a major indicator to assess a company's business in terms of how robust the company is handling its outstanding debt

- Assessing the current ratio is imperative for creditors, corporate investors, top management of the company, and suppliers to make financial decisions. A current ratio is a fundamental tool for evaluating the feasibility of business profits

Advantages and Disadvantages of Current Ratio

Below are the main strengths and weaknesses of calculating the current ratio:

Pros:

- The current ratio is one of the easiest liquidity indicators which is quite simple and comprehensive to understand

- The current ratio will help you assess the operational cycle and the company's working capital needs in each quarter or financial period

Cons:

- The calculation of the current ratio considers some of the non-liquid assets that cannot be converted into cash. The liquidity of these assets remains low which can affect the calculation of the current ratio

- The current ratio does not depict a meaningful comparison when it is compared between two companies belonging to different industries

Conclusion

The current ratio is a liquidity determinant that compares the total current assets to the short-term liabilities/debts of a company. This current ratio helps assess the short-term health and liquidity of a company. The current ratio is usually defined as assets that can be converted into cash within one year and liabilities that can be repaid within one year.

The current ratio helps the relevant stakeholders to better understand the position of a company and its ability to use working capital to meet short-term debt and compare it with peers. There are certain weaknesses while comparing current ratios across industry groups, like not getting access to recent information and the over-generalization of the balance between certain assets and liabilities. However, to date, the current ratio is an important parameter to calculate the immediate financial consistency of a company.

How can Deskera Help You?

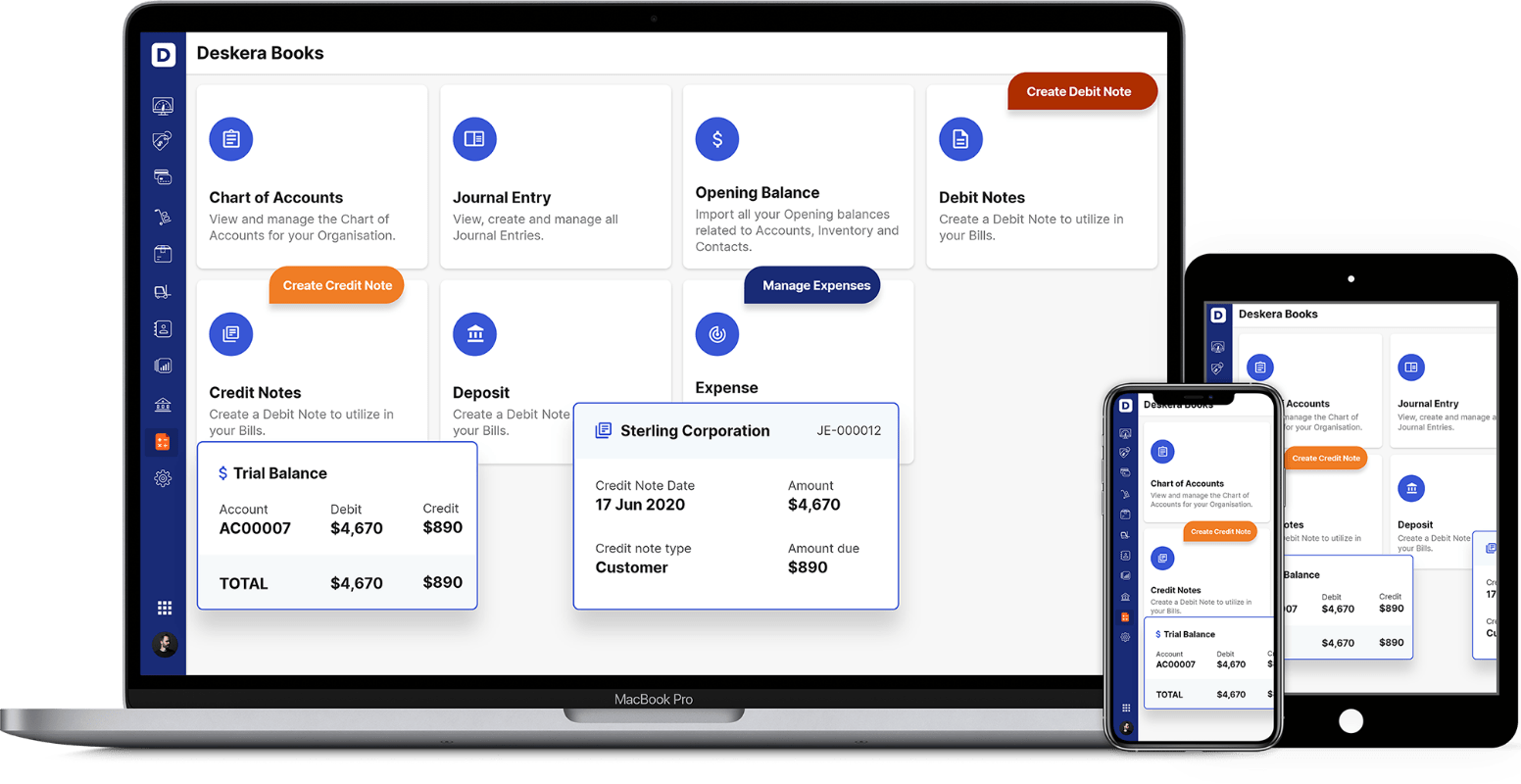

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client's requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Key Takeaways

- The Current Ratio is an important indicator of a company's liquidity situation and is therefore highly considered by both analysts and investors

- As a rule of thumb, the current ratio should be more than 1, but it's recommended to compare it with similar companies belonging to the same industry for meaningful insights

- If the current ratio is below the industry average, it is considered acceptable or healthy

- However, a very high current ratio to the industry average may not be considered adequate as it essentially suggests that the company cannot use its assets efficiently

- Conversely, if your current ratio is well below the industry average, it may indicate a potential risk of default

Related Articles