Did you know that effectively managing your current assets can significantly improve your business's financial health and operational efficiency? Current assets, such as cash, inventory, and accounts receivable, are the lifeblood of any business.

They help ensure liquidity, meet short-term obligations, and support day-to-day operations. Without proper management, businesses may face cash shortages, operational inefficiencies, or even struggle to remain competitive in the market.

Understanding and managing current assets is not just about keeping track of what you own—it’s about leveraging these resources to optimize cash flow and drive business growth. By ensuring that your cash reserves are sufficient, your inventory is well-balanced, and your receivables are collected on time, you can maintain financial stability while positioning your business for long-term success.

In today’s fast-paced business environment, relying on manual methods to manage current assets is no longer practical. This is where advanced tools, such as Enterprise Resource Planning (ERP) systems, play a crucial role.

For instance, Deskera ERP provides businesses with real-time visibility, automated workflows, and powerful reporting tools to streamline current asset management. With Deskera, you can track cash flow, monitor inventory levels, and manage receivables—all from a single platform.

In this comprehensive guide, we’ll delve into what current assets are, why they are vital for your business, and the best practices for managing them effectively. Whether you’re a small business owner or a seasoned executive, understanding how to optimize your current assets is key to maintaining liquidity and achieving sustainable growth.

What Are Current Assets?

Current assets are short-term resources or assets that a business owns and expects to convert into cash, sell, or use up within a year or a single operating cycle, whichever is longer. They are essential for maintaining daily operations, paying short-term debts, and supporting business liquidity.

Key Characteristics of Current Assets

- Short-Term Nature: Easily convertible into cash within a year.

- Liquidity: High liquidity compared to long-term assets like buildings or machinery.

- Operational Usage: Used to fund day-to-day business activities.

Examples of Current Assets

- Cash and Cash Equivalents: Physical cash, bank balances, and short-term investments.

- Accounts Receivable: Money owed to the business by customers for goods or services already delivered.

- Inventory: Raw materials, work-in-progress, and finished goods ready for sale.

- Prepaid Expenses: Payments made in advance for services (e.g., insurance premiums).

- Short-Term Investments: Marketable securities that can be liquidated quickly.

Current assets are a vital component of the balance sheet, and their effective management ensures smooth operations and financial stability. Businesses often use financial ratios like the current ratio and quick ratio to analyze the efficiency and liquidity of their current assets.

Current Assets vs. Non-Current Assets

Understanding the distinction between current assets and non-current assets is fundamental for assessing a company's financial position and ensuring effective asset management. These two categories of assets differ in terms of liquidity, usage, and how they are accounted for in financial reporting.

1. Definition and Key Differences

- Current Assets: Current assets are short-term assets that are expected to be converted into cash, sold, or consumed within one year or within the company’s operating cycle (whichever is longer). These assets are primarily used to fund day-to-day operations and cover short-term liabilities. Common examples of current assets include cash, accounts receivable, inventory, and marketable securities.

- Non-Current Assets: Non-current assets, also known as long-term assets, are those that provide value to a business for more than one year. They are not expected to be converted into cash or consumed in the short term. These assets are used for long-term operations, and include property, plant, and equipment (PPE), intangible assets (like patents or trademarks), and long-term investments. Non-current assets typically represent investments that support business growth and operational capacity over time.

2. Liquidity and Timeframe

- Current Assets: The key characteristic of current assets is their high liquidity. They are expected to be converted into cash or consumed within a short period, usually under one year. This makes current assets crucial for day-to-day operations and meeting short-term obligations, such as paying suppliers and covering operating expenses.

- Non-Current Assets: Non-current assets, by contrast, are less liquid and cannot be quickly converted into cash without potentially disrupting business operations. They serve a long-term purpose in supporting business growth, expansion, or production and are typically not involved in immediate cash flow generation.

3. Impact on Financial Statements

- Current Assets: Current assets are reported on the balance sheet under the "Assets" section and are listed in order of liquidity. Their primary purpose is to ensure a business can meet its short-term financial obligations, and they are a key part of calculating key financial ratios such as the current ratio (current assets divided by current liabilities) and quick ratio (liquid assets divided by current liabilities).

- Non-Current Assets: Non-current assets are also listed on the balance sheet but appear separately from current assets. They are considered vital for long-term operational efficiency, and their value is amortized or depreciated over time. Non-current assets influence financial ratios such as return on assets (ROA) and asset turnover to evaluate long-term profitability and operational efficiency.

4. Examples and Use Cases

- Current Assets: Common examples of current assets include:

- Cash and cash equivalents: The most liquid form of current assets, used to settle immediate liabilities.

- Accounts receivable: Money owed by customers for goods or services already provided.

- Inventory: Goods or raw materials intended for sale or used in production.

- Marketable securities: Short-term investments that are easily convertible into cash.

- Non-Current Assets: Examples of non-current assets include:

- Property, plant, and equipment (PPE): Tangible assets like buildings, machinery, and vehicles that are used in operations.

- Intangible assets: Non-physical assets such as patents, trademarks, and goodwill that provide long-term value.

- Long-term investments: Investments made with the intent to hold them for longer periods, like stocks, bonds, or real estate properties.

5. Role in Business Operations

- Current Assets: The management of current assets is crucial for maintaining liquidity and smooth daily operations. Businesses must ensure they have enough current assets to cover immediate liabilities, such as accounts payable and wages. Efficient management of current assets is vital for maintaining cash flow and operational efficiency.

- Non-Current Assets: Non-current assets, on the other hand, are essential for long-term growth and sustainability. They provide the infrastructure and intellectual property necessary to generate future revenue. Businesses must invest in non-current assets wisely to ensure continued operational capacity and long-term profitability.

Both current assets and non-current assets are vital components of a company’s financial health. While current assets focus on liquidity and short-term needs, non-current assets are important for long-term operational growth and stability. A balanced approach to managing both categories is crucial for ensuring both immediate financial flexibility and long-term success.

Tools like Deskera ERP can help businesses efficiently track and manage both current and non-current assets, providing real-time insights to optimize resource allocation and drive sustainable growth.

Types of Current Assets

Current assets are essential for businesses as they represent resources that are expected to be converted into cash or used up within a year or within the normal operating cycle, whichever is longer. These assets are crucial for a company’s day-to-day operations and play a significant role in maintaining liquidity and operational efficiency.

Below are the main types of current assets:

1. Cash and Cash Equivalents

Cash and cash equivalents are the most liquid form of current assets. They include physical cash, bank deposits, and other short-term, highly liquid investments that can be quickly converted into cash, such as Treasury bills or money market funds. This category is vital for meeting immediate financial obligations.

- Examples: Petty cash, bank balances, money market funds, short-term deposits.

2. Accounts Receivable (AR)

Accounts receivable represent money owed to a company by customers who have purchased goods or services on credit. These amounts are expected to be collected within a short period (usually within 30 to 90 days). Accounts receivable are a key indicator of a business's ability to collect payments and manage its credit policies.

- Examples: Outstanding customer invoices, trade receivables, accrued income.

3. Inventory

Inventory includes raw materials, work-in-progress, and finished goods that a company holds for sale or production. It is a vital asset for businesses that deal with manufacturing, retail, or wholesale, as inventory levels directly impact sales and production efficiency. Proper inventory management is crucial to avoid overstocking or stockouts.

- Examples: Raw materials, finished goods, work-in-progress inventory, and supplies.

4. Prepaid Expenses

Prepaid expenses are payments made by a company for goods or services that will be received in the future. These payments are initially recorded as assets and are gradually expensed over time as the benefit is consumed. Prepaid expenses can help companies manage their cash flow by securing necessary services or goods for future use.

- Examples: Rent, insurance premiums, subscriptions, and advance payments for services.

5. Short-Term Investments

Short-term investments are investments that are intended to be held for a year or less. These could include stocks, bonds, or other financial instruments that are easily convertible into cash. These assets are typically used to generate returns in the short term while maintaining liquidity.

- Examples: Marketable securities, short-term bonds, and short-term equity investments.

6. Marketable Securities

Marketable securities are financial assets that are easily tradable in public markets and can be converted into cash quickly, typically within 1 year. These investments are made with the intention of earning returns in the short term, but they can be quickly liquidated if necessary to meet current financial obligations.

- Examples: Stocks, bonds, treasury bills, or other securities that are traded publicly.

7. Other Current Assets

This category includes various assets that do not fall neatly into the above categories but are expected to be realized in cash or consumed within a year. This may include advances to suppliers, tax refunds due, or other miscellaneous assets that are expected to be converted to cash within the current operating cycle.

- Examples: Refundable deposits, advances to suppliers, tax credits.

Understanding the different types of current assets is crucial for effective financial management and liquidity planning. Businesses rely on current assets to fund daily operations and maintain solvency.

By managing these assets efficiently, companies can ensure they have enough cash flow to meet short-term obligations, invest in growth, and operate smoothly.

Tools like Deskera ERP help streamline current asset management, providing real-time insights into cash, receivables, inventory, and other critical assets, which helps improve decision-making and financial control.

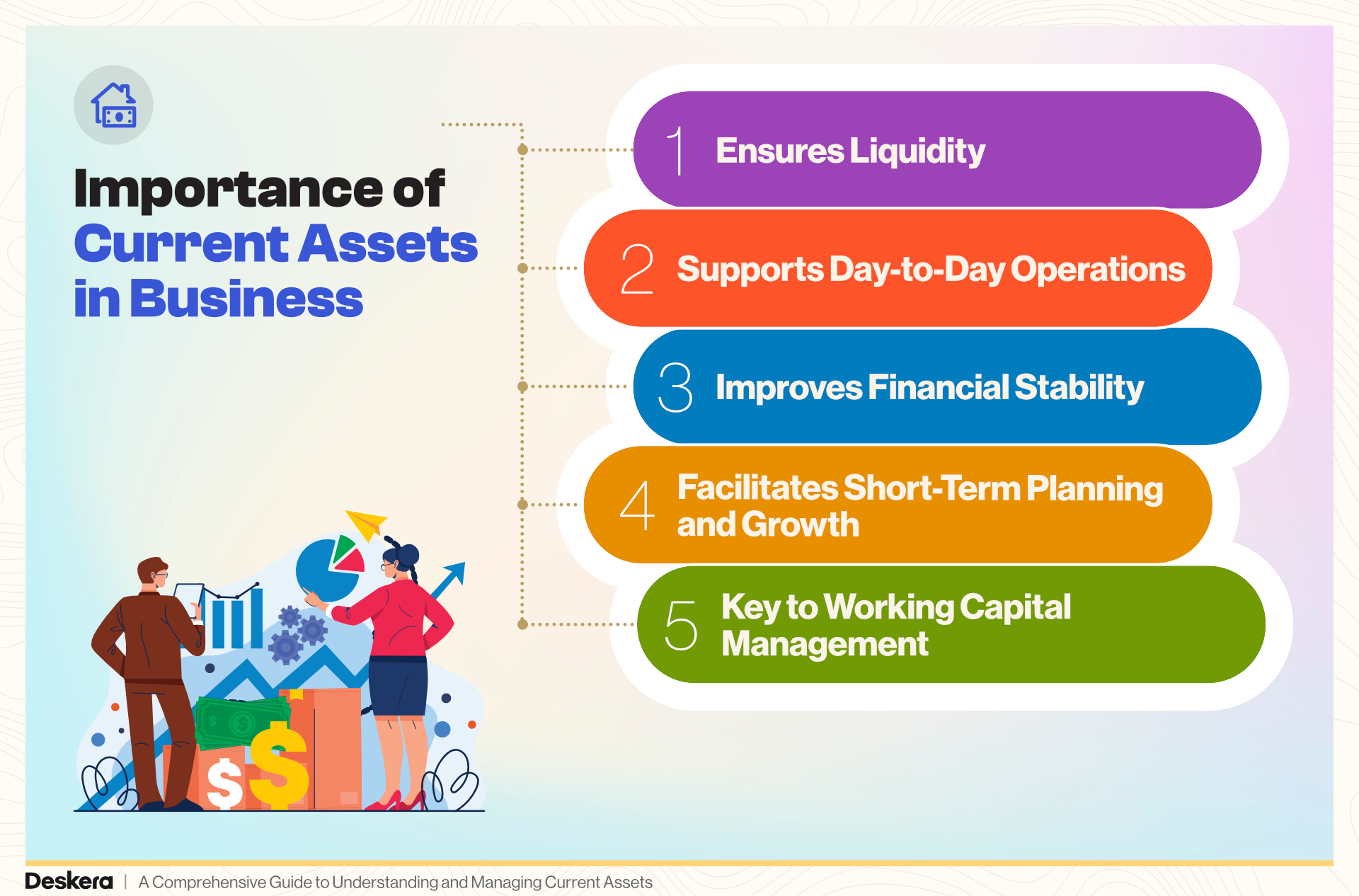

Importance of Current Assets in Business

Managing current assets effectively is crucial for any business to ensure smooth operations, maintain financial health, and achieve long-term stability. These short-term resources are the backbone of day-to-day operations and play a key role in keeping businesses agile and competitive.

1. Ensures Liquidity

Current assets play a critical role in maintaining a business's liquidity. By providing readily available resources like cash, marketable securities, and receivables, businesses can meet their short-term obligations, such as paying suppliers, employee salaries, and utility bills. This liquidity is essential for maintaining operational stability and avoiding cash flow disruptions.

2. Supports Day-to-Day Operations

The availability of current assets, such as inventory and cash, ensures that businesses can run their daily operations without interruptions. For instance, sufficient inventory helps fulfill customer orders on time, while cash and cash equivalents ensure the business can cover routine expenses seamlessly.

3. Improves Financial Stability

Efficient management of current assets strengthens a company’s financial position. By maintaining optimal levels of cash, inventory, and receivables, businesses can avoid both shortages and excesses. This balance not only enhances financial stability but also reduces unnecessary costs, such as excessive inventory holding or delayed payments.

4. Facilitates Short-Term Planning and Growth

Current assets enable businesses to make short-term investments and decisions. Surplus cash can be invested in marketable securities or used to fund urgent opportunities like bulk purchases at discounted rates. By effectively managing these assets, businesses can respond to market demands quickly and position themselves for growth.

5. Key to Working Capital Management

Current assets are a fundamental part of working capital, which is the difference between current assets and current liabilities. Effective management of current assets ensures businesses maintain a healthy working capital ratio, which is crucial for sustaining operations and earning the confidence of stakeholders, such as investors and lenders.

In summary, current assets are vital for ensuring smooth operations, maintaining liquidity, and supporting a business’s financial stability. With tools like Deskera ERP, businesses can efficiently track and manage current assets in real time, ensuring optimal resource utilization and driving sustainable growth.

Challenges in Managing Current Assets

Managing current assets effectively is essential for business stability, but it comes with several challenges that can impact liquidity and operations. Poor management can lead to inefficiencies, financial strain, and missed opportunities for growth.

1. Inefficient Cash Flow Management

Maintaining an optimal cash balance is often challenging. Businesses may face issues like cash shortages that hinder daily operations or excessive cash reserves that result in missed investment opportunities. Striking the right balance is critical to ensure smooth operations and business growth.

2. Delayed Accounts Receivable Collection

One of the most common challenges is late payments from customers. Slow collection cycles can disrupt cash flow, limiting the company’s ability to meet its short-term obligations. Businesses often struggle to set efficient credit policies or enforce timely payment terms without impacting customer relationships.

3. Inventory Mismanagement

Holding too much inventory ties up working capital, increases storage costs, and risks obsolescence. On the other hand, insufficient inventory can lead to stockouts, delayed orders, and dissatisfied customers. Achieving the right inventory balance is a constant challenge, especially in dynamic markets.

4. Poor Visibility and Tracking

Lack of real-time visibility into current assets, such as cash, receivables, and inventory, can lead to inaccurate decision-making. Businesses relying on manual processes often struggle to monitor and analyze these assets effectively, resulting in inefficiencies.

5. Managing Prepaid Expenses and Short-Term Investments

Businesses often overlook prepaid expenses and short-term investments, leading to missed opportunities for optimizing their use. Poor tracking of these assets can result in expired benefits or underutilized resources.

6. Fluctuating Market Conditions

External factors such as economic slowdowns, inflation, or changing demand patterns can impact the value and management of current assets. Businesses must remain agile and adapt quickly to external challenges to maintain stability.

In conclusion, overcoming these challenges requires strategic planning and the right tools. Solutions like Deskera ERP provide businesses with real-time tracking, automated workflows, and data-driven insights to manage current assets efficiently.

By leveraging technology, businesses can streamline cash flow, optimize inventory levels, and improve receivable collections, ensuring financial stability and growth.

Best Practices for Managing Current Assets

Effectively managing current assets is vital for maintaining liquidity, optimizing operations, and driving business growth. By adopting the following best practices, businesses can ensure their short-term resources are utilized efficiently and sustainably.

1. Optimize Cash Flow Management

Maintaining an ideal cash balance is essential to cover daily operational expenses and unforeseen emergencies. Businesses should forecast cash flow regularly, track incoming and outgoing payments, and minimize idle cash by investing surplus funds into short-term opportunities.

2. Streamline Accounts Receivable Process

To improve cash flow, businesses must ensure timely collection of receivables. Implementing clear credit policies, sending timely invoices, and offering incentives for early payments can significantly reduce collection delays. Automation tools can further simplify tracking and follow-up processes.

3. Maintain an Optimal Inventory Level

Balancing inventory is key to avoiding excess stock or stockouts. Businesses should leverage demand forecasting tools, monitor inventory turnover, and adopt Just-in-Time (JIT) inventory practices to minimize storage costs while meeting customer demands efficiently.

4. Invest in Real-Time Tracking and Automation

Manual processes often lead to errors and delays in managing current assets. Using modern ERP systems like Deskera ERP allows businesses to gain real-time visibility into cash, inventory, and receivables. Automated workflows streamline processes and ensure accurate tracking, enabling data-driven decisions.

5. Regularly Monitor Key Performance Metrics

Analyzing financial ratios like the current ratio, quick ratio, and inventory turnover ratio helps businesses assess the efficiency of current asset management. Regular performance reviews provide insights into areas for improvement, ensuring resources are utilized optimally.

6. Efficiently Manage Short-Term Investments

Surplus cash should be strategically invested in short-term opportunities, such as marketable securities, to maximize returns while maintaining liquidity. Regular monitoring ensures these investments align with the business’s cash flow needs.

7. Forecast and Plan for Seasonal Changes

Many businesses experience seasonal fluctuations in cash flow and inventory demands. By planning for these variations in advance, businesses can allocate resources efficiently, preventing shortages or overstocking during peak and off-peak periods.

8. Enhance Collaboration Between Departments

Coordination between finance, sales, and procurement teams ensures that current assets like inventory and receivables are managed efficiently. Improved communication helps align inventory levels with sales forecasts and cash flow requirements.

By adopting these best practices, businesses can optimize their current asset management, reduce inefficiencies, and improve financial stability. Tools like Deskera ERP provide the technological support needed to automate processes, monitor assets in real time, and make data-driven decisions—ultimately driving growth and operational success.

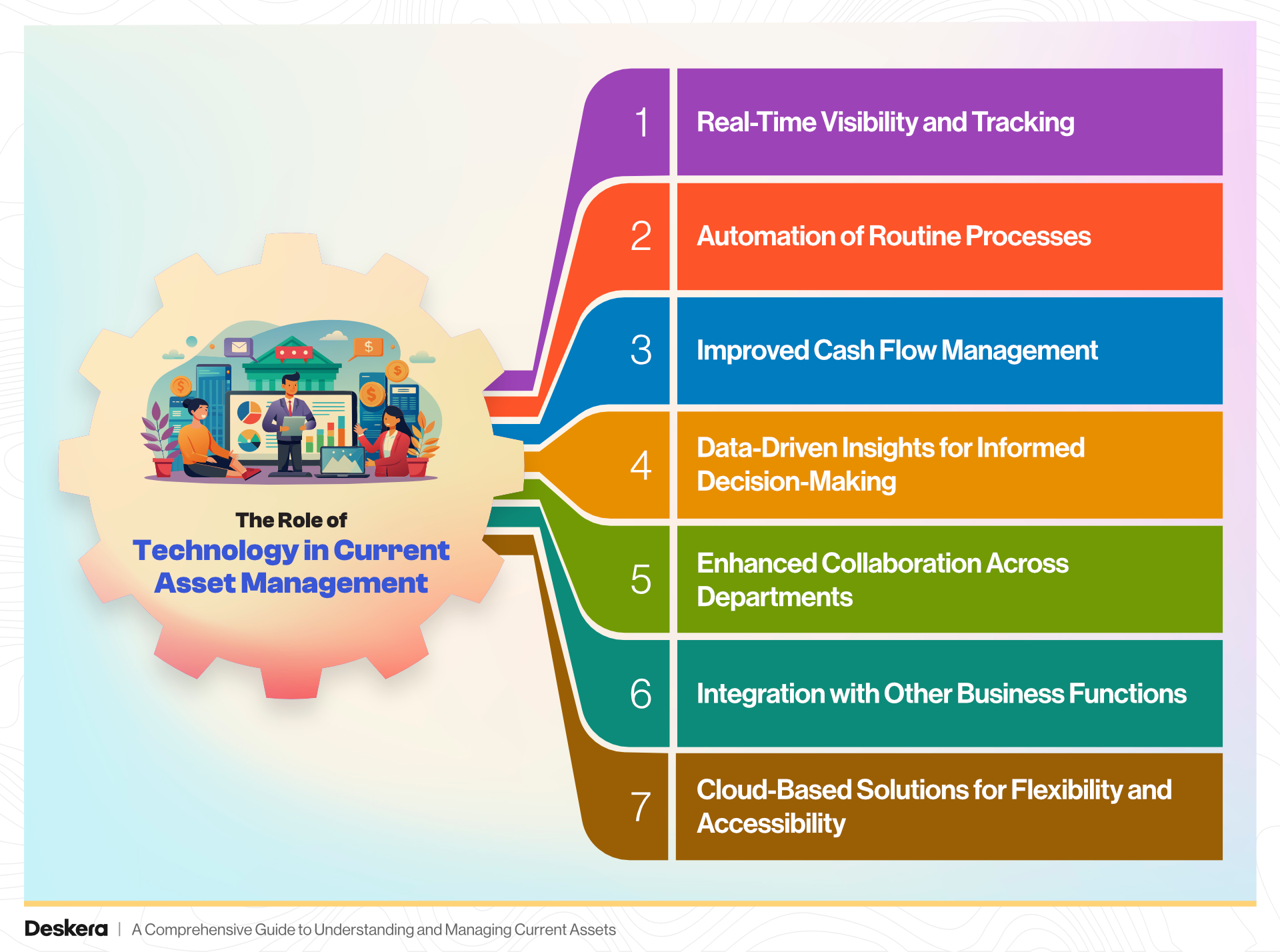

The Role of Technology in Current Asset Management

In today’s fast-paced business environment, technology plays a critical role in streamlining the management of current assets. With the complexity of operations, manual tracking and outdated processes often lead to inefficiencies, errors, and missed opportunities.

Modern technologies, such as Enterprise Resource Planning (ERP) systems, cloud computing, and automation tools, provide businesses with the necessary tools to manage their current assets more effectively and make data-driven decisions.

1. Real-Time Visibility and Tracking

Technology enables businesses to gain real-time visibility into their current assets, including cash, inventory, accounts receivable, and prepaid expenses. Advanced ERP systems, like Deskera ERP, offer integrated dashboards that provide up-to-the-minute insights into the status of each asset.

This visibility helps businesses make informed decisions, track cash flow, and ensure inventory levels align with demand, reducing the risk of overstocking or stockouts.

2. Automation of Routine Processes

Automating routine tasks, such as invoicing, inventory tracking, and receivables follow-up, can drastically improve efficiency. By leveraging automation, businesses can reduce human error, speed up processes, and free up valuable time for strategic decision-making.

For example, automated alerts for overdue accounts receivable can prompt timely collections, while automated inventory updates can reduce manual entry errors.

3. Improved Cash Flow Management

Technology tools such as cash flow forecasting and management software can provide accurate, real-time projections of available cash. By analyzing trends and predicting future cash needs, businesses can better manage liquidity, ensuring that they have the right amount of cash on hand to cover short-term obligations.

Cloud-based solutions can also synchronize cash management across multiple departments and locations, ensuring consistent financial control.

4. Data-Driven Insights for Informed Decision-Making

Advanced analytics and business intelligence (BI) tools can analyze vast amounts of financial data, providing businesses with insights into their current assets’ performance.

Metrics such as the current ratio, inventory turnover, and accounts receivable aging help businesses evaluate how well they are utilizing their resources. These insights empower managers to make proactive decisions, optimize asset allocation, and identify areas for improvement.

5. Enhanced Collaboration Across Departments

Modern technology fosters better collaboration between different departments within an organization. Finance, sales, and operations teams can access the same information in real time, ensuring alignment on asset management.

For instance, sales teams can provide accurate forecasts to help inventory management adjust stock levels accordingly, while finance can track the financial health of the business based on the status of current assets.

6. Integration with Other Business Functions

ERP systems integrate current asset management with other key business functions such as procurement, production planning, and sales. By creating a unified system for managing all aspects of the business, companies can reduce inefficiencies, improve decision-making, and align their strategies.

With Deskera ERP, businesses can streamline their processes by connecting current asset management with supply chain operations, financial management, and customer relationship management.

7. Cloud-Based Solutions for Flexibility and Accessibility

Cloud-based platforms enable businesses to manage their current assets from anywhere at any time. With cloud computing, businesses can easily scale their asset management systems as they grow and access the latest updates and features without the need for costly infrastructure. This flexibility allows for remote work, quick decision-making, and seamless collaboration across multiple locations.

In conclusion, technology plays a transformative role in managing current assets by providing businesses with the tools to automate processes, gain real-time insights, and make data-driven decisions.

Solutions like Deskera ERP offer a comprehensive, integrated approach to current asset management, helping businesses optimize their resources, improve cash flow, and enhance overall efficiency. With the right technological tools, businesses can stay ahead of the curve and ensure long-term financial stability.

How to Analyze Current Assets: Key Ratios

Analyzing current assets is essential for understanding a company’s liquidity, operational efficiency, and ability to meet short-term obligations. One of the most effective ways to evaluate the financial health of a business is by using key financial ratios that focus on current assets. These ratios provide valuable insights into a company's cash flow, operational performance, and overall financial stability.

1. Current Ratio

The current ratio is one of the most commonly used financial metrics to measure a company’s ability to cover its short-term liabilities with its short-term assets. It indicates the company’s overall liquidity position and helps assess whether it has enough resources to meet obligations due in the next 12 months.

Formula: Current Ratio = Current Assets / Current Liabilities

Interpretation:

- A ratio above 1 indicates that the company has more current assets than current liabilities, suggesting it can cover its short-term obligations.

- A ratio below 1 signals potential liquidity issues, as the company may not have enough short-term assets to meet its liabilities.

2. Quick Ratio (Acid-Test Ratio)

The quick ratio is a more stringent measure of liquidity than the current ratio. It excludes inventory from current assets, as inventory may not always be easily convertible to cash in the short term. The quick ratio focuses on the company’s most liquid assets, such as cash, receivables, and marketable securities.

Formula: Quick Ratio = Current Assets - Inventory / Current Liabilities

Interpretation:

- A quick ratio above 1 suggests that the company has enough liquid assets to cover its short-term liabilities, even without relying on inventory.

- A quick ratio below 1 could indicate potential liquidity concerns, as the company may not be able to meet its obligations without selling inventory.

3. Cash Ratio

The cash ratio is an even more conservative measure of a company’s liquidity, as it considers only the most liquid assets: cash and cash equivalents. This ratio evaluates a company’s ability to cover its current liabilities with its available cash.

Formula: Cash Ratio = Cash and Cash Equivalents / Current Liabilities

Interpretation:

- A higher cash ratio suggests that the company is in a strong position to meet short-term obligations with cash alone.

- A cash ratio of less than 1 may signal potential liquidity issues, although some businesses may operate efficiently with a lower cash ratio by managing other assets.

4. Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio measures how quickly a business collects its outstanding accounts receivable. It reflects the efficiency of the company's credit policies and the effectiveness of its collections process. A high turnover ratio indicates that the company is efficient at collecting payments from customers.

Formula: Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Interpretation:

- A high accounts receivable turnover ratio indicates that the company is quickly converting receivables into cash, which is crucial for maintaining liquidity.

- A low ratio may suggest inefficiencies in the collections process or that the company is offering excessive credit to customers.

5. Inventory Turnover Ratio

The inventory turnover ratio measures how efficiently a company is managing its inventory by calculating how many times the inventory is sold and replaced over a period. A high turnover ratio indicates that inventory is moving quickly, which helps improve liquidity by converting stock into cash.

Formula: Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

Interpretation:

- A high inventory turnover ratio is generally favorable as it indicates efficient inventory management and quicker sales.

- A low ratio may suggest overstocking or slow-moving inventory, which can tie up cash and reduce liquidity.

6. Working Capital

Working capital is a simple, yet effective metric used to assess the operational efficiency and financial health of a business. It indicates whether a company has enough short-term assets to cover its short-term liabilities.

Formula: Working Capital = Current Assets - Current Liabilities

Interpretation:

- A positive working capital indicates that the company has enough short-term assets to cover its liabilities, suggesting strong liquidity.

- A negative working capital may indicate financial trouble, as the company may struggle to meet its short-term obligations without additional financing.

7. Days Sales Outstanding (DSO)

The days sales outstanding (DSO) ratio measures the average number of days it takes for a company to collect payment after making a sale. This metric is important for assessing the effectiveness of a company’s receivables management.

Formula: DSO = ( Accounts Receivable / Total Credit Sales ) x Number of Days in Period

Interpretation:

- A lower DSO indicates that the company is collecting receivables quickly, which helps improve cash flow and liquidity.

- A higher DSO may suggest issues with collections, potentially leading to cash flow problems.

Analyzing current assets using these key financial ratios provides valuable insights into a company’s liquidity, operational efficiency, and overall financial health. By monitoring ratios like the current ratio, quick ratio, and inventory turnover, businesses can ensure they have the resources needed to meet short-term obligations and optimize their operations.

Tools like Deskera ERP can help streamline the process of tracking and managing current assets, providing real-time insights and reports that support data-driven decision-making. Through effective management and analysis of current assets, businesses can enhance their financial stability and drive long-term success.

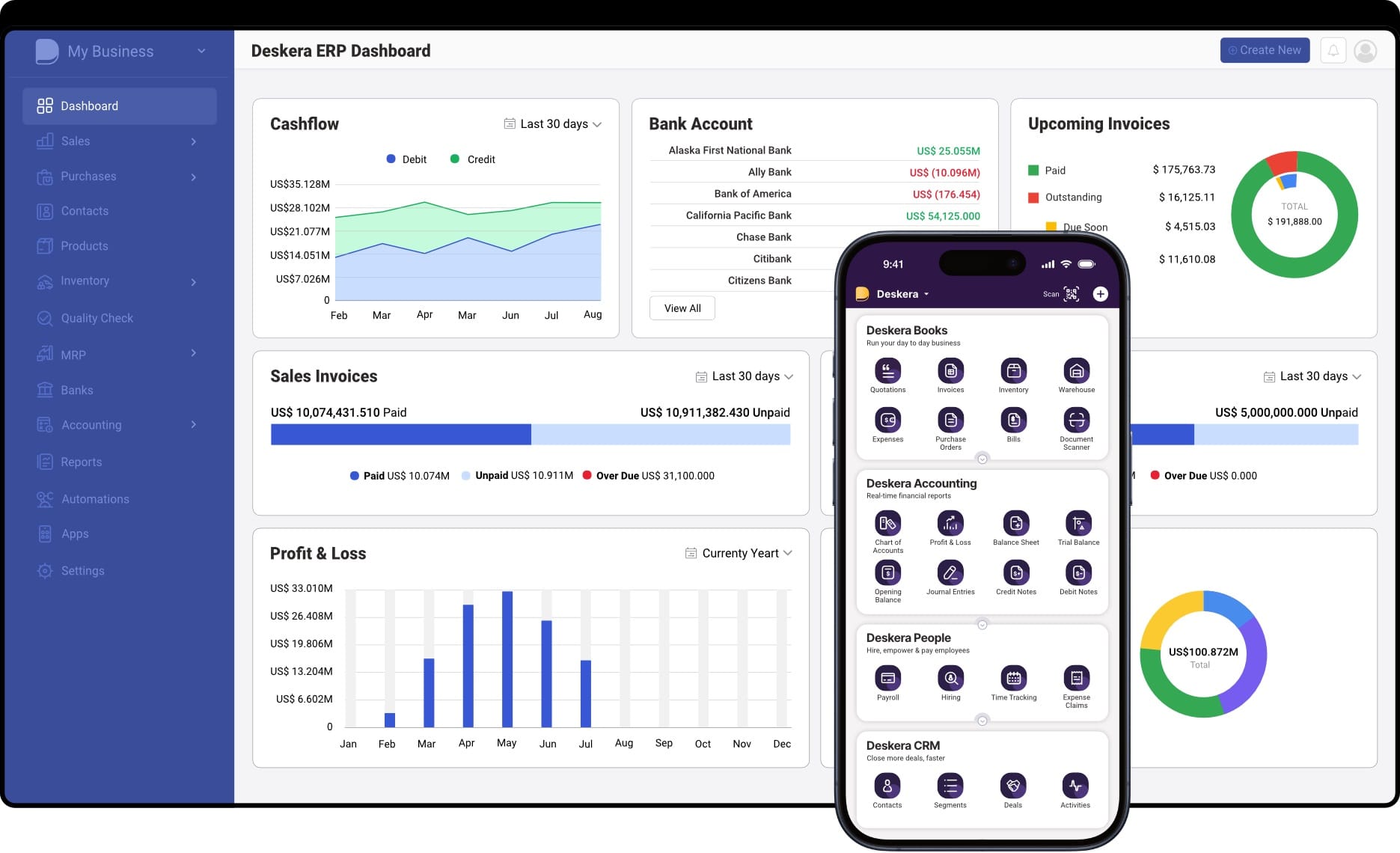

How Deskera ERP Can Help You Manage Current Assets Effectively

Deskera ERP provides businesses with a comprehensive, integrated solution to manage current assets efficiently. By automating and streamlining financial and operational processes, Deskera ERP helps improve liquidity, enhance cash flow, and optimize asset management.

Here are some ways Deskera ERP can support your business in managing current assets:

1. Real-Time Tracking and Reporting

Deskera ERP allows businesses to track and manage their current assets in real time, providing up-to-date insights into cash, accounts receivable, inventory, and other liquid assets. With accurate, real-time data, you can make informed decisions about your liquidity and take proactive measures to address any short-term financial gaps.

2. Automated Accounts Receivable Management

With Deskera ERP’s accounts receivable module, businesses can automate invoicing, track outstanding payments, and send timely reminders to customers. This helps improve the accounts receivable turnover ratio, ensuring faster collection of payments and enhancing cash flow. Automation reduces the risk of human error and ensures that payments are processed efficiently.

3. Inventory Management and Optimization

Deskera ERP’s inventory management capabilities help businesses track stock levels, manage reordering, and reduce excess inventory. By improving inventory turnover rates, businesses can reduce the amount of cash tied up in stock, ultimately improving liquidity. The system also helps forecast demand, preventing stockouts and reducing excess inventory that can slow down cash flow.

4. Financial Dashboards and Key Performance Indicators (KPIs)

Deskera ERP provides customizable financial dashboards that give businesses a clear overview of their current assets, liabilities, and key financial metrics. KPIs such as the current ratio, quick ratio, and working capital can be easily monitored, enabling business leaders to make quick adjustments to improve liquidity and financial performance.

5. Seamless Integration Across Functions

Deskera ERP integrates financial, sales, procurement, and inventory functions in one platform, providing a holistic view of your current assets. This seamless integration ensures that asset data is consistent and accurate across all departments, reducing discrepancies and improving decision-making.

By leveraging Deskera ERP, businesses can gain better control over their current assets, optimize their financial operations, and make data-driven decisions to support both short-term and long-term success.

Key Takeaways

- Current assets are resources that a company expects to convert into cash or use up within one year or within its operating cycle, whichever is longer. These assets are essential for day-to-day operations and help maintain business liquidity.

- Current assets differ from non-current assets in that they are expected to be converted into cash or used up within a year, while non-current assets, like property and equipment, have a longer-term value and are not readily liquidated.

- The main types of current assets include cash and cash equivalents, accounts receivable, inventory, prepaid expenses, short-term investments, and marketable securities. Proper management of these assets ensures businesses can meet short-term liabilities and support growth.

- Current assets are crucial for maintaining a company’s liquidity, enabling it to meet short-term financial obligations, manage day-to-day operations, and support growth. Proper management of current assets is key to business stability and financial health.

- Effectively managing current assets can be challenging due to issues such as liquidity constraints, overstocking or understocking inventory, slow accounts receivable collections, and fluctuating cash flow, all of which can negatively impact business performance.

- Adopting best practices like regular monitoring, streamlining accounts receivable processes, optimizing inventory levels, and forecasting cash flows helps ensure efficient management of current assets, improving liquidity and financial stability.

- Technology plays a pivotal role in current asset management by automating processes, providing real-time insights, and enhancing decision-making. ERP systems like Deskera ERP streamline asset tracking, inventory management, and accounts receivable, optimizing cash flow and operational efficiency.

- Key ratios such as the current ratio, quick ratio, and accounts receivable turnover ratio are essential tools for evaluating a company’s liquidity and efficiency in managing current assets. Monitoring these ratios helps businesses ensure they can meet their short-term obligations.

- Deskera ERP offers integrated solutions to track, manage, and analyze current assets efficiently. It provides real-time data on cash, receivables, and inventory, automates key processes, and improves decision-making, ultimately enhancing liquidity and operational efficiency.

Related Articles