The use of credit cards as a payment method has been growing among people. It allows easy access to one’s finances, and they often come with exclusive benefits like discounts and Airmiles. The growth of online shopping has further escalated its popularity.

Credit card payments offer a convenient, quick, secure way to process a payment. It’s also favorable for businesses as they’re able to tightly manage their cash flow. Businesses risk losing out on customers by not accepting card payments as people are now less likely to carry physical cash.

This blog is meant to serve as a guide to accept credit card payments for Small and Medium scale businesses. Read on to find out the benefits, dos, and don’ts of accepting credit card payments.

Benefits of Accepting Credit Card Payments

Regardless of the kind of business you run, choosing to accept credit card payments is a personal choice. There are many benefits offered by availing of this mode of payment.

1. Stay Competitive

You risk losing customers to your competitors if you have limited payment modes. With the increasing use of credit cards, customers often expect it to be an acceptable mode of payment and will be discouraged from buying if it’s not possible. When you accept credit card payments, you are on a level playing field with competitors.

2. Boost Sales

Customers are shying away from cash purchases and often plan to pay in other ways. You automatically grow your potential customer base when you widen the scope of payment methods to include credit and debit cards. The revolving line of credit also encourages customers to spend more.

3. Gain Credibility for Your Business

By choosing to accept credit card payments for your business, you can help garner the trust of customers. Adding the logos of the different credit cards that are accepted on your website or cash register can legitimize your business in the eyes of prospects.

How To Accept Credit Card Payments

How often will you need to process credit card transactions? How many transactions will be done online, over the phone, or in-person? Is the payment processor compatible with your website?

These questions and more need to be taken into consideration when you accept credit card payments. The process in itself is simple and straightforward, especially when considering how essential it can be to grow your business.

1. Choose How You Want to Accept Credit Card Payments

There are three main types of transactions that can be processed using credit cards:

- In-person

- Online

- Mobile

In-Person

Transactions based in your brick-and-mortar store will require a countertop card payment terminal or point of sale (POS) system. Upon purchase, the customer will swipe, tap, or insert their card into the terminal to initiate the payment process. The processing fees are usually lower for using countertop card payment terminals as there is less risk of fraud.

Online

Online transactions don’t require physical hardware like card terminals. Instead, you could either opt for a payment gateway through a merchant account/payment service provider or purchase a virtual payment terminal.

A merchant account should enable online payments and have a payment gateway. Payment service providers often already include both these features. These need to be integrated with your e-commerce store.

Virtual payment terminals such as Shopify and Square can be ideal for supporting payments done over the phone. They essentially use software that allows your computer to function as a credit card terminal. You will need to manually enter the customer’s credit card details to process the transaction.

Mobile

If you run a mobile business such as a food truck or farmer’s market stall, then processing payments through a smartphone or tablet would be more convenient. As the transactions are in person, the processing fees would be lower compared to online payments.

Most POS providers like Shopify and PayPal offer inexpensive mobile card readers and related apps. Most readers accept the swipe and chip cards, while the NFC readers are still quite limited.

2. Deciding A Payment Processing System

Your choice of payment processing system largely depends on the volume of transactions your business handles and the kind of process charges offered by different systems.

What kind of credits do you want to accept: Visa, Mastercard, American Express (Amex)? The processing fees depend on the transaction types and the credit card networks. Ideally, you should compare the fees you will be required to pay by different processing systems. This will prevent you from incurring any unforeseen charges.

Generally, there are two options for choosing a payment processing system: merchant accounts and payment processing provider (PSP).

Merchant Account

A merchant account is, simply put, an account you open with the bank to accept credit card payments. It is ideal if you expect your small business to grow rapidly and the volume of credit transactions with it.

They usually have a lower cost and offer support services like e-commerce payment setup. You will also be provided with necessary equipment such as mobile card readers and credit card terminals.

While it is comparatively more affordable in terms of per-transaction fees, merchant accounts often come with other attached fees such as setup fees, equipment fees, and early cancellation fees.

Payment Processing Provider (PSP)

Some of the popular PSPs are PayPal, Shopify, and Square. They offer a streamlined payment processing system that transfers the paid amount directly into the business owner’s account on the system.

The POS system offered by these providers is also designed to assist in services other than payment processing. The Square POS app functions include tracking inventory, managing staff, and transferring funds to your bank account.

PSPs are ideal for startups, and very small businesses as their fees are more transparent and pliant. Unlike merchant accounts, they usually do not involve contracts that span several years that are difficult to cancel.

When selecting the payment provider of your choice, ensure that you have the required hardware and software to complete the process.

3. Setup the Payment Terminals

The final step is to set up the payment terminals within your business. For a physical, fixed store, this involves setting up the hardware and installing the necessary software for your payment processing system.

For online stores, you would need to set up the payment gateways on your website. This might require assistance from your PSP or a website developer. Ecommerce platforms such as Shopify and Square automatically integrate the payment gateways with your site.

Credit card transactions have gradually evolved over the years. From strictly chip readers, to swipe, and now NFCs. It is important to be trained in how the processing systems work and how to make the best use of them.

Credit Card Processing Fees for Small Businesses

Credit card processing comes with attached charges for the various services provided such as fraud checks and verifying customers’ bank funds. These security measures are vital to prevent losses for the business. These functions are completed in a few seconds of the card being swiped/inserted/tapped, making it a quick and efficient process.

Usually, the processing fees are not charged monthly. Rather, they are levied per transaction. That is why it is important to identify your volume of credit card transactions when deciding which payment processing service to use.

The processing fees differ depending on the type of credit card - Visa, Mastercard, Amex - and the card processing provider. Amex is known to charge higher processing fees, which discourages many businesses from accepting them.

There are two major processing fees that small businesses online should evaluate when they accept credit card payments:

1. Interchange Rate

This is essentially the fee leveraged by credit card companies for using their products. Globally, there are four major credit card companies: Visa, Mastercard, Amex, and Discover.

The fees could also vary depending on the type of transaction. Card companies consider in-person transactions safer, so the processing fees would be lower. Over-the-phone and online payments have a higher chance of being fraudulent, and, therefore, would have relatively higher charges in place.

There are certain industries and businesses that these companies consider high-risk. These industries include online gaming, timeshares, debt services, and bail bonds. The companies will either refuse to work with a high-risk merchant, or they will charge a hefty fee to process payments.

2. Markup Fee

The payment processor charges an additional fee, a markup, with the standard interchange rate. This is a means for the process to earn income from each transaction you make.

The fee once again depends on risk factors and the kind of payment plan you have opted for. Some common payment plans are:

- Tiered Plan

- Interchange Plus Plan

- Flat Rate Plans

Preventing Credit Fraud

While credit cards are a quick and fairly secure payment method, there are still cases of fraudulent activities that have cost payment processors and businesses losses. Most incidences involve identity fraud, chargebacks, and duplication.

Causes of Fraud

There are human and technical reasons for fraud. It is important for a merchant to take the necessary steps to prevent these cases from occurring. Identifying the various methods of credit card fraud can help develop the best solutions to prevent them. Some of the causes include:

- As customers use credit cards at multiple physical and online terminals, there’s a risk of breaching the larger remote network. This leaves room for fraud risks like chargebacks and account takeovers

- Phishing uses identity theft to commit fraud. Emails may be sent to customers under the name of their bank, card provider, or merchant. Clicking the links attached to the email will open a pathway for hackers to access private information about the customer and their credit card

- Hackers install malware onto the customer’s device that can detect keystrokes when entering information on the merchant’s website. While the customer should be wary of such situations, merchants and PSPs need to upgrade their security measures to counter these attacks

How To Prevent Fraud

Fraud solutions heavily rely on technology. As more businesses begin to accept credit card payments, there have been significant developments in fraud prevention strategies like fraud detection, multi-step authentication, transaction verification, etc.

Anti-fraud technologies are capable of flagging anomalies in a card user’s transactions and device history. They also notice unusually large transactions or order volumes and purchases from unauthorized locations and blacklisted websites. Fraud detection tools also cover network scanning and processing analysis.

Small businesses can use these key strategies to prevent credit cards frauds:

1. Protect the POS

Card skimming is one of the more common fraud attempts faced by businesses. It usually takes place at the POS device or through malware on a POS system. There are also devices that can capture data from credit card EMV chips.

To reduce this risk, it is advised to lock the POS system when the store is closed. The manager will be the one person with access to the system during this time.

It is also recommended to inspect the POS system a few times a week to catch anything that may be out of the ordinary. Exposed wiring, bulky fitting, loose housing, or anything along those lines could be a sign of tampering.

Timely updates of the POS system could also ensure the security measures are of the latest to protect against fraud threats.

2. Be Vigilant

A major disadvantage when you accept credit card payments as an online merchant is the risk of card-not-present (CNP) fraud. This can be curbed by having the customer input the customer verification value number (CVV) on their card. Some merchants also request the ZIP code associated with the credit card as an extra verification measure.

Credit card chargebacks are also recurring fraud attempts, where the customer files a fake dispute claim with the bank and gets a refund. The business will lose out on that payment and face additional fees from the payment processing provider.

Make your return and dispute easy and clear for your customers. This includes adding an FAQ page for returns, following up with customers, automating returns, and asking for reviews after the return.

There are also chargeback management platforms that offer real-time reporting of and alerts about potential issues.

3. Train Your Staff

Employee habits could pose a risk for your business. They should be trained to identify potential threats and how to respond to them appropriately.

They should be educated on the consequences of downloading attachments from an unverified source. Accessing a public Wi-Fi network through the system should also be discouraged.

Conclusion

The sweeping revolution in payment technology has been a game-changer for SMBs. Credit card acceptance can provide a great avenue to uplift profitability and growth while catering to customers who are increasingly leaning towards electronic forms of payment over dealing in cash.

The process to accept credit card payments is simple. However, one must be wary about the charges that will be incurred based on the transactions.

Credit card fraud should be considered when adding this mode of payment too. Preventive measures need to be taken to protect your business and customers.

To make things easier, experts online software offer digital payment-related solutions which can automate collections and payments while ensuring security, speed, and ease of tracking.

How Can Deskera Help SMBs

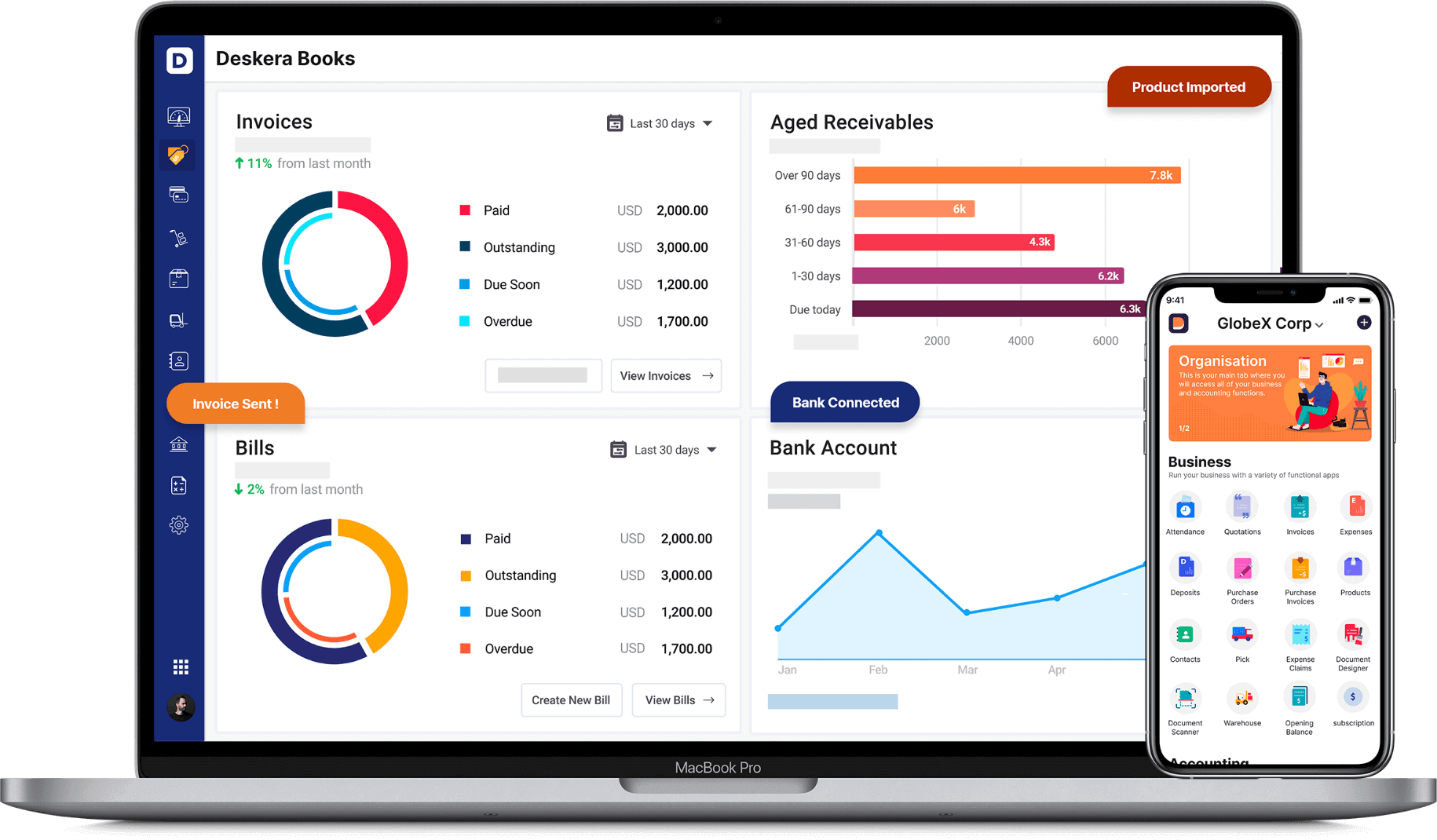

Deskera is a software that specializes in meeting all of your needs. Deskera Books is one that is devoted to making life easier for small businesses and focused on meeting all their financial needs

Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables, and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

Following the US accounting rules, it will process all these financial transactions and make financial statements like balance sheets, profit and loss statements, cash flow statements, income statements, and so on.

It would be all of this data, updated in real-time, which will facilitate Deskera Books to complete filing for your income tax returns. Deskera Books has one more benefit that it also allows you to transfer your data from your previous accounting software by updating the details in the spreadsheet available on Deskera Books.

Additionally, the entire setting up process on Deskera Books is super easy, with you having to only sign-up using your email address or social authentication, and half of your work would be done. Once you have registered on Deskera Books, you would get pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to mention a few vital features. Lastly, your accountants can be added to your Deskera Books account for free by just inviting them to use the system.

With so many features at your disposal, making your accounting, reporting, and compliance easier, what are you waiting for?

Key Takeaways

- Credit card payments are a great way to expand the customer base and control cash flow for small and medium businesses

- Adding the payment method is simple and the necessary hardware and software will be provided by the payment processing services

- Credit card processing involved per-transaction charges that need to be evaluated based on your business needs

- Fraud prevention is key to ensuring the safety of your business and their customers

- Online and over-the-phone transactions are riskier and have relatively higher charges

Related Articles