Central Provident Fund or CPF is the Singapore government’s social security savings scheme funded by the employer and the employee.

Did you know that the total CPF Amount Balance in Singapore is ~ SGD435.4 Billion! Considering how CPF and other contributions are a part of the monthly payroll, the understanding of CPF rules is not that clear, even among HR professionals. We found in our internal research that nearly 64% of business owners and HR professional were not clear on all the aspects of CPF.

In this comprehensive guide to everything CPF, we explain the basics of CPF, how the CPF is allocated and distributed into your CPF accounts, the voluntary self-help group donations, along with the importance of CPF and how it affects every Singaporean's life.

We also cover the obligations for CPF contributions from an employer's perspective, beginning with calculating the CPF contributions for your employees to illustrating how to submit the CPF contributions via CPF e-Submit.

We will cover the following topics related to CPF in this guide.

1. A Brief Look at CPF

- What Is CPF?

- Why Is CPF Required?

- Who Is Eligible for CPF Contributions?

2. Calculating the CPF

CPF Allocations

- How Does CPF Contributions Work?

- How are Ordinary Wages(OW) Different from Additional Wages (AW)?

- What is the CPF Contribution Cap for employees?

- How to Calculate CPF for Singapore PRs and Singapore Citizens?

- How to Calculate CPF for Singapore PRs Who Have Obtained Their Residency Status Less than Two Years Ago?

CPF Allocations

- What Is CPF Allocation and Their Rates?

- How Is CPF Allocated Based on Age Range?

- What Are the CPF Interest Rates for Different Accounts?

- How To Obtain The Retirement Income?

- How much money does a CPF member get to withdraw in a lump sum when they turn 55?

3. Self Help Group Contributions and Employer Levies

- What Are Donation Funds?(SINDA/MBMF/CDAC/ECF)?

- What is the Chinese Development-Assistance Council (CDAC) Fund?

- What is Eurasian Community-Fund (ECF)?

- What is the Mosque Building & Mendaki Fund (MBMF)?

- What is the Singapore-Indian Development-Association (SINDA) Fund?

- What is Skill Development Levy?

- What Is Foreign Worker Levy?

4. CPF e-Submission and Payment

- What Is CPF e-Submission?

- How Do I Start Contributing CPF as a New Employer?

- What Is the CPF Submission Number?

- What Is Direct Debit? And How To Pay via Direct Debit?

- How Do I Submit CPF contributions via e-submit web?

- How To Apply For An Adjustment of CPF Contributions Paid?

A Brief Look at CPF

What Is CPF?

Central Provident Fund or CPF is the Singapore government’s social security savings scheme funded by the employer and the employee. It helps the working class pay for their medical, housing, and, most crucial, their retirement needs.

The employee and employer’s CPF contributions fit into three accounts: the MediSave Account, Special Account, and Ordinary Account.

The employee’s CPF contributions are automatically withheld from the salary, and the employer’s contribution supplements the employee’s contribution.

Permanent Residents and Singaporean Citizens will start contributing money to their CPF accounts as soon as they land their first job, whether it is permanent, part-time, casual or contractual.

The contributions are not mandatory if the employee works abroad; in all the other cases, they go into effect if the employee earns over $750 per month.

However, until the employee starts making over $750/month, only the employer will contribute to the CPF. The employee will also add between 5-20% of their salary to their CPF once it exceeds $750.

New Permanent Residents will have to contribute to CPF at a graduated rate for the initial two years, in essence, to adjust for the lower take-home pay.

Why Is CPF Required?

Central Provident Fund (CPF) is present to ensure that Singapore Residents (Singapore Citizens and Permanent Residents) save up for substantial things in life - healthcare, housing, and retirement.

Based on a study of Singaporeans’ financial planning attitudes, roughly 3 out of 10, between 30 and 39 of age, did not start preparing for their future financial needs.

The reasoning behind CPF’s existence is simple: it helps Singaporeans put aside money for their retirement needs and reduces the nation’s risk of having to bank on a declining working population to increase the number of senior residents.

CPF also helps maintain home ownership rates in Singapore as these funds can help purchase homes for Singaporeans.

Who Is Eligible for CPF Contributions?

All Singapore Permanent Residents and Singapore Citizens (SCs) contribute to CPF every month. The employee will receive and make contributions in their CPF accounts as long as they are:

- Working in Singapore with a contract of service.

- Employed under a casual, part-time, or permanent basis.

If self-employed, only MediSave contributions are mandatory (Only if the annual Net Trade Income is over $6,000)

There is a CPF online service that an employee can access with their SingPass ID, clicking on “My Messages” and viewing the category called “Others.”

However, voluntary contributions can also be made to individual CPF accounts.

The voluntary contributions will be distributed and credited to the MediSave, Special and Ordinary accounts based on the allocation rates expressed on the CPF website.

CPF’s contribution rates are the percentage of wages that the employer and the employee have to contribute towards the employee’s CPF savings.

SECTION 2: Calculation

How Does CPF Contribution Work?

Under the CPF scheme, the employees earning over $750/month will have to contribute a fraction of their salary to their CPF account.

The rate of contribution differs based on age bands, slowly decreasing from the age of 55 onwards.

Employee CPF’s contributions are equaled by their employer, who has to contribute separately to the employee’s CPF account.

The contribution rate of employers will vary according to the age of the employee.

The CPF Contribution Rates are present in the table below:

| Employee Age (Years) | CPF Contribution Rates (for monthly wages ≥ $750) | ||

|---|---|---|---|

| Employer (% of wage) | Employee (% of wage) | Total (% of wage) | |

| 55 and below | 17 | 20 | 37 |

| Above 55 to 60 | 13 | 13 | 26 |

| Above 60 to 65 | 9 | 7.5 | 16.5 |

| Above 65 | 7.5 | 5 | 12.5 |

Addy is a Singapore citizen and earns a gross wage of $5000 per month and is 24 years old. Since he is under 55 years old, his CPF contribution rates are as follows:

Gross wage = $5000

Addy’s take-home pay: 80% of $5000 = $4000

Addy’s CPF contribution: 20% of $5000 = $1000

Employer’s CPF contribution: 17% of $5000 = $850

Total contribution to Addy’s CPF account = $1850

Note: Addy contributes only 20% of his gross salary; the amount added to his account exceeds 20%. That’s because his employer has to make an additional contribution equal to 17% of his gross wage.

For CPF contribution, the employee is deemed to be 55 years, 60 years, or 65 years in the month of their 55th, 60th, or 65th birthday.

The employee is deemed to be over 55, over 60 or over 65 from the month after his/her 55th, 60th or 65th birthday.

Example

An employee’s 55th birthday falls on January 13th, 2020.

How Are Ordinary Wages(OW) Different from Additional Wages (AW)?

Ordinary Wages: These are the wages that are due or granted wholly and exclusively based on the employee’s monthly employment or wages which are payable before the due date for payment of CPF contributions for that month.

Example: Basic monthly salary and fixed allowances.

Ordinary Wages that attract CPF contributions = $6,000/Month.(Max Limit)

Additional Wages: These are the wages that are not applicable exclusively for a month, or these are wages that are captured at different periods of more than a month.

Example: Annual bonus, Leave pay, Commission.

CPF contributions payable on Additional Wages are capped at $102,000 minus the total ordinary wages subject to CPF (for that year).

This Additional Wage ceiling is applied anew for each new employer in a year.

What Is the CPF Contribution Cap for Employees?

There is a specific limit to how much a Singaporean can contribute to their CPF accounts each month; that limit is called CPF Wage Ceiling.

There are two types of contribution caps:

Ordinary Wage Ceiling:

It is a CPF contribution limit on every Singaporean’s monthly salary and is currently capped at $6000, meaning any outlay over that won’t have a portion deducted for CPF.

Therefore only the initial $6000 of the monthly salary is subject to CPF contributions, which means the employer does not need to contribute to the CPF account if the employee earns above $6000.

Additional Wage Ceiling:

It is a CPF contribution cap on additional wage types, like bonuses.

The formula for Additional Wage Ceiling:

$102,000 – Ordinary Wages, which is subject to CPF for that year.

Example:

Addie earns = $7,500/month,

Annual Bonus = $15,000

How the Calculation works:

Ordinary Wage: The first $6,000 of the monthly income will be subject to CPF contribution.

Additional Wage: The annual bonus falls into this category

So the Ceiling = $102,000 – $6,000 x 12 = $30,000.

This means the annual bonus is also subject to CPF contributions below the CPF contribution cap.

Take a look at this Illustrated Example for more clarity:

How to Calculate CPF for Singapore PRs and Singapore Citizens?

Here is a detailed breakdown of how the above scenario is calculated with the inclusion of Additional Wage and getting the output for both Employer CPF and Employee CPF contribution.

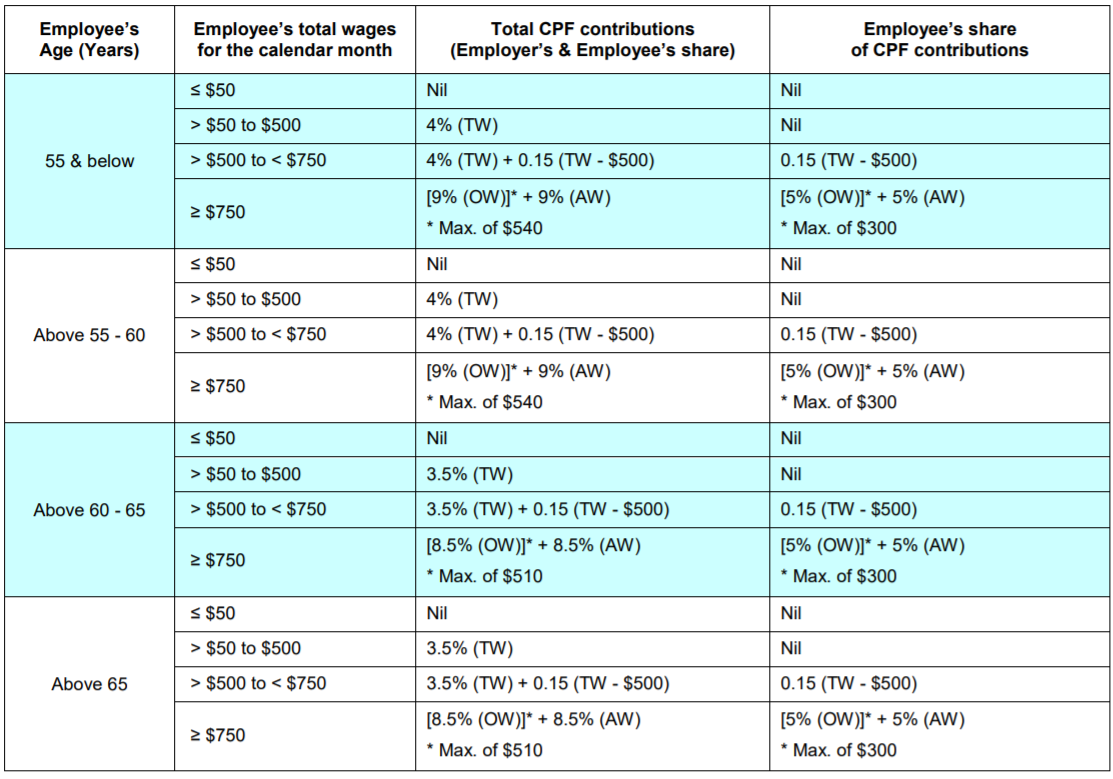

The following table is valid for employees who belong to the private sector and public sector non-pensionable employees and who is either

A Singapore Citizen

Or

A Singapore Permanent Resident from the third year of obtaining the residency status

Or

Singapore Permanent Resident in the course of the first two years of obtaining Residency status but who has collectively applied with the employer to contribute at full employee-full employer rates

Terms:

OW = Ordinary Wages (which is capped at $6,000/month)

AW = Additional Wages

TW = Total Wages = OW + AW

Steps to Compute CPF Contribution:

How to calculate CPF contribution based on the above table

- The total CPF contribution is calculated and is rounded to the nearest dollar. (For example, $0.5 should be considered as an additional dollar)

- Calculate the Employee’s CPF contribution( decimal values of the dollars should be dropped)

- The employer’s share is calculated based on this formula = Total Contribution - Employee’s Share

How to Calculate CPF for Singapore PRs Who Have Obtained Their Residency Status Less than Two Years Ago?

Singapore employers are not mandated to pay CPF for their foreign workforce. Nevertheless, after a foreign employee obtains Singapore Permanent Residency status, then the employer will need to pay their CPF contributions.

The CPF contributions are payable at lower rates (graduated employer-graduated employee contribution rates) during the first two years after obtaining Singapore Residency status.

There are two kinds of CPF contribution rates for this scenario

- Partial (Graduated) Employer and Employee Rates

- Full Employer and Partial (Graduated) Employee Rates

PS: Most companies use the Partial (Graduated) Employer and Employee Rates (1st option) by default.

Full Employer & Graduated Employee (F/G)

For example: If the employee is in Year 1 of SPR status then the CPF contribution is 5% (Employee) and 17% (Employer)

Graduated Employer & Employee (G/G).

For Example: If the employee is in Year 1 of SPR status then the CPF contribution is 5% (Employee) and 4% (Employer)

Please refer to this link for the CPF contribution rates from January 1st, 2016, for private and public sector non-pensionable employees.

Please refer to this link for the CPF contribution rates from January 1st, 2016, for public sector pensionable employees.

The table provides the CPF contribution rates of a Singapore Permanent Resident during the 1st year of SPR status.

Terms:

OW = Ordinary Wages (which is capped at $6,000/month)

AW = Additional Wages

TW = Total Wages = OW + AW

How to calculate CPF contribution based on the above table

- The total CPF contribution is calculated and is rounded to the nearest dollar. (For example, $0.5 should be considered as an additional dollar)

- Calculate the Employee’s CPF contribution( decimal values of the dollars should be dropped)

- The employer’s share is calculated based on this formula = Total Contribution - Employee’s Share

Feel like all the calculations are getting way too complicated then check our automated payroll system.

What Is CPF Allocation and Their Rates?

CPF Allocation is simply the distribution of a Singaporean's CPF contribution into 3 or 4 different accounts with varying proportions based on their age.

Whatever money is contributed to CPF, it is divided between the multiple accounts for a Singaporean who is 35 or below as long as the monthly wages are over $750.

Here is a brief look at all the 4 CPF accounts:

| Ordinary Account (OA) | May be used for housing, insurance, investment, and education |

|---|---|

| Special Account (SA) | For old age and investment in retirement-related financial products |

| Medisave Account (MA) | For hospitalization expenses and approved medical insurance |

| Retirement Account (RA) | For retirement needs, Automatically created on your 55th birthday by merging your OA and SA monitised |

Ordinary Account (OA) :

The CPF funds allocated to the Ordinary Account (OA) can be used for the following four purposes: education, insurance, investment, and housing.

The most prevalent use of Ordinary Account (OA) among Singaporeans is to pay for their housing. The OA is permitted to be used for purchases of private properties and HDB public housing, subject to prevailing regulations.

There are minor differences when using the Ordinary Account funds to buy a private property vs. public flat, but the critical point to understand here is that OA money that will be used to purchase private property is required to be paid back into the CPF account when the property is sold.

But for HDB properties, this particular condition is not relevant.

In terms of insurance, the Ordinary Account is predominantly used to pay the premiums for DPS(Dependent Protection Scheme). This affordable term life insurance plan allows CPF members a basic life protection plan.

Education is another acceptable use of Ordinary Account funds. The CPF members can use their OA to pay for their own, their spouses, their children's, or their relative's subsidized tuition fees for pre-approved programs.

The money used for educational coursework must be remitted by the student one year after their graduation. Nevertheless, the CPF member can apply to waive the replacement if qualifying conditions have been met.

Lastly, OA can also be used for investment in various CPF-approved financial products. The Board does not guarantee a return on such investments, and a CPF member could lose money on their OA investments, and therefore CPF board will not hold any viability.

Special Account (SA) :

The Special Account (SA) of CPF has a limited range of uses compared to the Ordinary Account, purportedly because the money allocated to this account is to meet the CPF's member's retirement needs.

The SA Accounts with a view of being used for retirement income can be most notably invested in unit trusts, financial products, investment-linked policies, government bonds, treasury bills, and more.

All these investments would be low-risk as they are linked to retirement funds. Apart from the investments, the CPF member can top the Special Account with cash from the Ordinary Account, which is permanent and irreversible.

Medisave Account (MA) :

The Medisave Account (MA) of CPF is primarily used to cover healthcare and medical needs.

The coverage will take the shape of Medishield Life, a nationalized health insurance scheme that provides a wide range of benefits, including necessary medical procedures, day surgery, hospitalization fees, and specific out-patient outlay for a lifetime.

The insurance premiums for the Medishield Life can be completely paid with the Medisave Account.

Furthermore, the co-insurance, the deductibles, and any other leftover expense on the hospital bill can be compensated via the Medisave Account.

Retirement Account (RA) :

The CPF member on their 55th birthday will gain a new Retirement Account (RA), used to fund the CPF Life payouts, which is a lifetime annuity policy constructed to help members meet their old age and retirement needs.

When the Retirement Account is created, the funds in both the Ordinary Account and Special Account's funds are reallocated to the RA.

The united funds accrue interest in the Retirement Account till the time of monthly payouts when the CPF member reaches 65.

The monthly payouts depend on how much money is in the Retirement Account. The CPF member can also withdraw the funds upon meeting a specific criteria.

How Is CPF Allocated Based on Age Range?

Age is an essential factor in determining how much of the wage must be contributed to the CPF account.

The reason why CPF contribution is staggered is that more salaries are collected at the end of their employment as Singaporeans are safe and secure with their retirement future.

Let us take a look at the different age groups and their CPF contributions:

Age 35 and below

At the initial stage of an employee's career, the CPF contributions will measure up to 37% of their monthly wages, with 17% contributed by the employer and 20% contributed by the employee.

A massive piece of this, 23% of the employee's wages to be precise, goes towards their Ordinary Account (OA), which could be used for their first home purchase.

Age 35 to 55

If the employee belongs to the age range of 35 to 55, they will see a gradual shift in the allocation of contributions from their Ordinary Account to their MediSave Account (MA) and Special Account (SA).

Between the ages of 50 and 55, the MA and SA contributions will amount to 10.5% and 11.5% of monthly wages, respectively. These savings help in forming the foundation of the healthcare and retirement obligations of old age.

| Employee's age (years) |

Total contributions for monthly wages ≥ $750 (% of wage) |

CPF Allocation Rates from 1 Jan 2016 (for monthly wages ≥ $750) |

||

|---|---|---|---|---|

| Ordinary Account (% of wage) |

Special Account (% of wage) |

MediSave Account (% of wage) |

||

| Above 35 to 45 | 37 |

21 | 7 | 9 |

| Above 45 to 50 | 37 | 19 | 8 | 10 |

| Above 50 to 55 | 37 | 15 | 11.5 | 10.5 |

Age 55 to 65

When approaching the latter part of an employee's life, the percentage of wages received in CPF contribution would be reduced from 37% to 16.5%, with 9% of the contribution coming from the employer and a contribution of 7.5% by the employee when belonging to an age range of 60-65.

| Employee's age (years) |

Total contributions for monthly wages ≥ $750 (% of wage) |

CPF Allocation Rates from 1 Jan 2016 (for monthly wages ≥ $750) |

||

|---|---|---|---|---|

| Ordinary Account (% of wage) |

Special Account (% of wage) |

MediSave Account (% of wage) |

||

| Above 55 to 60 | 26 | 12 | 3.5 | 10.5 |

| Above 60 to 65 | 16.5 | 3.5 | 2.5 | 10.5 |

Above 65

Suppose the employee chooses to keep working after 65. In that case, the CPF contributions will be capped at 12.5% of their monthly wages, with 7.5% contributed by the employer and the rest by the employee. Only 1% of the salaries will be contributed to the Special Account and Ordinary Account, respectively.

The remaining 10.5% will go towards the Medisave Account to sustain the Basic Healthcare Sum (BHS) for whatever medical fees that the Singaporean may incur in old age. Once the Basic Healthcare Sum has been met, the remaining contributions will be allocated to your RA.

| Employee's age (years) |

Total contributions for monthly wages ≥ $750 (% of wage) |

CPF Allocation Rates from 1 Jan 2016 (for monthly wages ≥ $750) |

||

|---|---|---|---|---|

| Ordinary Account (% of wage) |

Special Account (% of wage) |

MediSave Account (% of wage) |

||

| Above 65 | 12.5 | 1 | 1 | 10.5 |

What Are the CPF Interest Rates for Different Accounts?

The various CPF accounts like SA, OA, MA, and RA accrue different interest rates.

As the CPF interest rates are quite confusing, we will help you understand how the interest rate in each account works.

Let us look at the prevailing interest rates for all the accounts first in the table below:

| Account | Interest rate (per annum) |

|---|---|

| OA | Up to 3.5% |

| SA | Up to 5% |

| MA | Up to 5% |

| RA | Up to 6% |

Ordinary Account (OA) of CPF earns up to 3.5% per annum.

The Ordinary Account funds accrue a maximum of 3.5% interest annually on the first $20,000 in this account. After the funds exceed the $20,000, the account would accrue 2.5% interest annually.

The interest rate of the OA is reviewed every quarter and is mandated to be a minimum of 2.5%, or the average interest rate of major local banks, whatever is higher.

Special Account (SA) and Medisave Account (MA) of CPF earn up to 5% per annum.

The funds in a CPF member's Special Account and Medisave Account accrue up to 5% interest annually, but only if the joint balance is $60,000 or below (with $20,000 from the Ordinary Account).

Beyond this, the Special Account and the Medisave Account grow at 4% annually.

The funds in the SA and MA are invested in the Special Singapore Government Securities (SSGS), which currently accrue either:

4% annual interest, or the one-year average yield % of 10-year Singapore Government Securities (10YSGS) in addition to 1%, whatever is the highest.

How To Obtain The Retirement Income?

The amount the CPF member gets when they retire is contingent on which CPF Retirement Sums is satisfied:

Basic Retirement Sum or Full Retirement Sum (FRS = BRS x 2) or

Enhanced Retirement Sum (ERS = BRS x 3).

Whenever a Singaporean turns 55, the OA and SA will combine to make the Retirement Account. The CPF member will draw a lump sum, leaving the retirement sum behind in the RA to build the retirement income.

Below is the table for the CPF Retirement Sums from 2016 to 2020.

| Year of 55th birthday | Basic Retirement Sum | Full Retirement Sum | Enhanced Retirement Sum |

|---|---|---|---|

| 2016 | $80,500 | $161,000 | $241,500 |

| 2017 | $83,000 | $166,000 | $249,000 |

| 2018 | $85,500 | $171,000 | $256,500 |

| 2019 | $88,000 | $176,000 | $264,000 |

| 2020 | $90,500 | $181,000 | $271,500 |

The monthly payouts when a Singaporean turns 65 will rely upon whether the amount that managed to accumulate in the RA meets the Full, Basic, or Enhanced Retirement Sum (whatever is the highest).

These monthly payouts will continue throughout the lifetime of the CPF member till the money technically runs out.

When the CPF member is turning 55 then the following table will indicate the monthly payouts when they retire at 65.

| CPF LIFE tier | Retirement sum amount (at age 55) | Estimated monthly payout (starting age 65) |

|---|---|---|

| Basic Retirement Sum | $88,000 | $730 to $790 |

| Full Retirement Sum | $176,000 | $1,350 to $1,450 |

| Enhanced Retirement Sum | $264,000 | $1,960 to $2,110 |

If the CPF member does not even manage to meet the Basic Retirement Sum, then the monthly retirement payouts will be prorated based on how much is there in the Retirement Account.

How Much Money Does a CPF Member Get to Withdraw in a Lump Sum When They Turn 55?

Under regular conditions, the CPF member will be mandated to leave at least the Full Retirement Sum in the CPF account, the rest of the amount can be withdrawn.

It is feasible to draw your Retirement Account savings up to the Basic Retirement Sum if the CPF member is a property owner, but it requires you some hoops to jump.

The Singaporean has to "pledge" the property to CPF, which means that a promise is made to pay the obligated amount (together with any CPF money used, with interest) back into the CPF Retirement Account if the property is sold.

If the CPF member is not a property owner or is unwilling to put a pledge, then there is no option except to leave the entirety of the Retirement Account untouched.

Concerning the Enhanced Retirement Sum, it is optional to leave that much money in the account, although the member will receive higher payouts.

Section 3: Self Help Group Contributions and Employer Levies

What Are Donation Funds?(SINDA/MBMF/CDAC/ECF)

What most people are unaware of is that employers are also expected to deduct from their employees wages for an individual account referred to as Self-Help Group (S.H.G) funds.

Initially, the fund was put up to cater to low-income households' financial needs for specific communities such as the Muslim, Indian, Eurasian, and Chinese.

The employees would have to remit monthly contributions for the funds that include the Chinese Development-Assistance Council (CDAC), Eurasian Community-Fund (ECF), Singapore-Indian Development-Association Fund(SINDA), and Mosque Building & Mendaki Fund (MBMF) funds.

As Singapore is a cultural hub where multiple ethnicities live, these SHGs funds strive to support them financially less privileged in different communities.

All these contributions are purely voluntary, dissimilar to CPF contributions, which is compulsory. The way to adjust (either a specific amount or decide not to donate) the employee's contribution is to fill out the corresponding forms of their SHG.

The employees should keep an eye on their payslips as they will contain the specifics of the fund, and the amount they contribute for SINDA, CDAC, ECF, and MBMF funds would be listed.

Most of the time, the rate remains fixed for many years.

What is the Chinese Development-Assistance Council (CDAC) Fund?

CDAC is a self-help group focused on helping the underprivileged of people from the Chinese community.

The fund was initially started on September 1st, 1992, where the naturalized Chinese Citizens living in Singapore will contribute a portion of their wages to CDAC.

| Total amount of an employee’s wages for the calendar month | Contributions payable |

|---|---|

| ≤ $2,000 | $0.50 |

| > $2,000 to $3,500 | $1.00 |

| > $3,500 to $5,000 | $1.50 |

| > $5,000 to $7,500 | $2.00 |

| > $7,500 | $3.00 |

For income earners within the range of $2000, they will contribute $0.50, while those receiving more than S $7500 will need to donate S$3.

What is Eurasian Community-Fund (ECF)?

The fund was started by the Eurasian community (European-Asian Association), generally called Eurasian, who is part of European and Asian descent.

The Singapore government sponsors the program to support the Eurasian community.

All employees in Singapore who work and reside within the Eurasian community would have to contribute towards the Eurasian Community Fund.

| Total amount of an employee’s wages for the calendar month | Contributions payable |

|---|---|

| ≤ $1,000 | $2.00 |

| >$1,000 to $1,500 | $4.00 |

| >$1,500 to $2,500 | $6.00 |

| > $2,500 to $4,000 | $9.00 |

| > $4,000 to $7,000 | $12.00 |

| > $7,000 to $10,000 | $16.00 |

| > $10,000 | $20.00 |

The workers' contributions will be required to pay $2/month for those who earn a monthly wage of $1000, while those making more than $10000 will need to contribute $20.

What is the Mosque Building & Mendaki Fund (MBMF)?

The MBMF is related to a religious support fund focused on upgrading or building mosques in Singapore.

The fund is also used to support Islamic religious programs and extend help to the Muslim community. Moreover, these funds are used to cater to the MEDAKI's social and educational programs to help Malay and Muslim communities.

All working-class Singapore Citizens who are Muslims are required to remit contributions to the MBMF.

| Total amount of an employee’s wages for the calendar month | Contributions payable |

|---|---|

| ≤ $1,000 | $3.00 |

| >$1,000 to $2,000 | $4.50 |

| >$2,000 to $3,000 | $6.50 |

| > $3,000 to $4,000 | $15.00 |

| > $4,000 to $6,000 | $19.50 |

| > $6,000 to $8,000 | $22.00 |

| > $8,000 to $10,000 | $24.00 |

| > $10,000 | $26.00 |

The people earning $1000 or less will contribute $3 while those earning more than $10,000 will contribute $26.

What is the Singapore-Indian Development-Association Fund (SINDA) Fund?

The fund was initially started in August of 1992, to cater to the Indian community's needs in Singapore.

The funds will be used to support the lesser privileged Indian families and boost the education level of the students of Indian origin, where the naturalized Indian Citizens living in Singapore will contribute a portion of their wages to SINDA.

The working class of the Indian community is expected to contribute every month to the Singapore Development Association Fund (SINDA), excluding the people on FWL(Foreign Worker Levy).

| Total amount of an employee’s wages for the calendar month | Contributions payable |

|---|---|

| ≤ $1,000 | $1.00 |

| >$1,000 to $1,500 | $3.00 |

| >$1,500 to $2,500 | $5.00 |

| > $2,500 to $4,500 | $7.00 |

| > $4,500 to $7,500 | $9.00 |

| > $7,500 to $10,000 | $12.00 |

| > $10,000 to $15,000 | $18.00 |

| > $15,000 | $30.00 |

The contributions range from $1 for people earning a monthly wage of $1000 or less, while those who make over $15000 would have to pay $30.

What is Skill Development Levy?

The Skill Development Levy (SDL) is a fee enforced upon all the employers under Skill Development Levy Act.

The levy is controlled and managed by the SkillsFuture Singapore Agency (SSG).

All employers, whether a statutory board or private entity, are liable to pay the Skill Development Levy (SDL) every month for each of their employees (both locals and foreign employees).

The SDL contribution is not related to any other form of payment made by the employers to other statutory boards like CPF and is payable even with SDF training assistance.

The levy acquired from the employers is siphoned to a Skill Development Fund (SDF), which is deployed to support upgrading programs for the Singapore workforce, and expedite training grants for employers.

The scheme allows the Workforce Development Agency to finance their education centers to serve Singapore employers and the workforce.

The statutory SDL contribution rate is 0.25% of an employee's monthly remuneration, maxed out at $11.25 per month with a minimum levy of $2 or 0.25% whichever is higher.

Below is an example of how Skill Development Levy is calculated

$1 to $800 = $2 Levy

$800 to 4,500 SGD = Salary x 0.25% (e.g. $3,000 salary = $7.5 levy)

Above $4,500 SGD = $11.25 Levy

Skill Development Levy Calculator

Here are a few more examples of SDL calculations

| Worker | Gross Wages (Monthly) | SDL Payable | Remarks |

|---|---|---|---|

| A | $150.80 | $2.00 | Minimum of $2 is payable |

| B | $609.50 | $2.00 | Minimum of $2 is payable |

| C | $2000 | $5.00 | 0.25% levy |

| D | $4500 | $11.25 | 0.25% levy |

| E | $4502 | $11.25 | First $4500 levied at 0.25% |

| F | $10000 | $11.25 | First $4500 levied at 0.25% |

What Is Foreign Worker Levy?

The Foreign Worker Levy(FWL), generally known as 'levy,' is a pricing mechanism to administer the extent of foreign workforce in Singapore. The levy is not applicable to Singaporeans (Singapore Citizens and Permanent Residents).

Who Should Pay For Foreign Worker Levy?

The employers are mandated to pay Foreign Worker Levy (FWL) for their employees possessing a Work Permit (WPH).

The levy is liable from the day the Work Permit or Temporary Work Permit is issued, whichever is earlier.

And it ends when the permit is expired or has been canceled.

How Is The Levy Amount Calculated?

Four parameters contribute to the amount of levy to be paid for the work permit holders.

The four factors are:

- Company Sector

- Workers on Man-Year Entitlement (MYE) or (MYE - waiver scheme)

- Worker's Qualification

- Dependency Ceiling

Dependency Ceiling:

The most critical factor for the FWL would be the Dependency Ceiling.

This ceiling would dictate what levy should be appropriated for Work Pass Holders. It is mutually dependent on the sector the organization operates.

It is either a percentage-based tier system that is contingent on a company's dependence on foreign employees (aka dependency ceiling) or based on a ratio of the number of foreign workers to the total workers in the company.

Worker's Qualification

The workers are classified into two types, skilled and unskilled. For almost all sectors, this is the only criteria that would affect the amount of levy mandated for the Work Pass Holders.

Company Sector

For the intentions of the Foreign Worker Levy, five sectors will affect how much the levy will be for WPHs.

Services Sector – Market-Based Skills Recognition Framework (Services)

PS:The Daily levy rate exclusively applies to Work Permit Holders, who did not work for a full calendar month.

The daily levy rate = (Monthly levy rate x 12) / 365 (rounded up to the nearest cent.

The table below outlines the current Foreign Worker Levy Rates:

CPF e-Submission and Payment

What Is CPF e-Submission?

CPF e-Submission is a complimentary service that is provided by the CPF Board, where all employers can submit their employee's CPF contribution details and make the payment electronically.

The Singapore government encourages employers to use CPF e-Submit@web to submit their CPF contribution details and pay via Direct Debit electronically.

Employers are strongly encouraged to use CPF e-Submit@web to e-submit their CPF contribution details and make payment via Direct Debit.

Equipped with either CorpPass/SingPass, the employers can submit and pay their CPF contribution.

Let's now take a look at how the employers can go about paying and submitting their CPF Contributions.

How Do I Start Contributing to the CPF as a New Employer?

The employer should be able to submit their CPF contribution and their details using CPF e-Submit@web after the first hire. To apply either a SingPass/CorpPass and UEN (Unique Entity Number) is necessary.

After the application has been approved, an email will be sent as notification. Apart from this, a hardcopy welcome letter will be delivered with the Direct Debit Authorisation Form and the CPF Submission Number (CSN)

The government provides a grace period of 14 days to pay the CPF contributions after the end of each month for which the contributions are due.

The CPF should be paid on the next working day if the last day of the grace period falls on a public holiday, Saturday, and Sunday.

Once the CPF contribution payment is processed, an email notification with an electronic Record of Payment link is sent.

The record can be used to check for any discrepancies and be presented to the CPF board as proof for later adjustment applications.

What Is the CPF Submission Number?

The CPF submission number is the Unique Identity Code that is used to transact with the CPF board.

For Employers, the CPF Submission Number comprises the Unique Entity Number (UEN) + CPF Payment code, where the UEN is a unique company code assigned to businesses registered in Singapore.

What Is Direct Debit? And How To Pay via Direct Debit?

Direct Debit

Direct Debit is probably the most suitable path to pay your CPF contribution payments to the CPF Board.

Employers are urged to use CPF e-Submit@web to submit CPF contributions and make payments via Direct Debit.

When Will Direct Debit Deduction Take Place?

A direct debit would happen after the submission of CPF contribution details. Moreover, you can select your favored deduction date at the time of your CPF submission.

The available deduction dates will rely upon when the government receives the CPF contributions.

Note:

All employers will have a grace period of 14 days after the month's end to pay the CPF contributions. The final day of the grace period is the 14th day of the month.

If the 14th day falls on a Saturday, Sunday, or public holiday, the grace period will be extended to the next working day.

How Do I Submit CPF contributions via e-submit web?

Here are the steps to take you through submitting your CPF: (Source: cpf.gov.sg)

Step 1: Go to cpf.gov.sg on your favorite browser and Select Employer.

Step 2: Click on the "Perform CPF e-Submission" module at the bottom of the page.

Step 3: Select either "CorpPass" or "SingPass based on what is available and your preference.

Step 4: On the New Page, click on "CPF eSubmit@web" under Submit Contribution.

Step 5: The CPF submission report would open up, and the user needs to fill in the Month and Year for which you are making CPF contributions.

Step 6: Select "Continue" after choosing either Submit Via Employee database or Submit via Blank Form.

Step 7: Key in the CPF Account No., Name of Employee (as stated in NRIC), and other details of your employee.

Step 8: Select the Detail button to key in other required information (see next step).

Step 9: Please key in the Date of Birth (DD/MM/YYYY), Citizenship and Employment Status of your employee. Select Save to proceed.

Step 10: Repeat Steps 7, 8 & 9 for all employee records. After all the employee records have been generated, select Continue.

Step 11: If there are employees who should be excluded from this submission, please click on the checkboxes to deselect them.

Step 12: Otherwise, select Continue

Step 13: Confirm the CPF contribution to be Paid, and edit if required. The CPF to be paid is calculated based on the citizenship, wages, and date of birth that have been keyed in the previous screens.

Step 14: Next, scroll down to the contribution summary and key in the contribution details for other payments, if applicable. Select Continue.

Step 15: Check your submission. Select eNETS or Direct Debit to finish the transaction. For Direct Debit payment, select your favored deduction date by clicking on the calendar icon.

Step 16: You have completed your CPF e-Submission. You may print a copy of this onscreen acknowledgment. You will also receive a copy of this acknowledgment via email.

Step 17: You may view and check your submission after it is completed.

Step 18: Proceed to Logout.

How To Apply For An Adjustment of CPF Contributions Paid?

The application for adjustment can be made via the Online Application service if you have a CPF Submission Number and a CPF Submission Number (CSN).

This adjustment must be tendered to the Board within a year from the date of payment of CPF contributions.

Please note that:

- The form can not be applied for refund applications or to make good any underpayment of CPF contributions.

- This adjustment is subject to the availability of funds in the employee's CPF accounts.

- Employers have to notify the employees affected by the modification.

If any fault is found in the CPF contributions paid, the employer can ask for a CPF adjustment within a year from the date of payment.

The errors may be due to:

- Wrong payment type:

An employer intended to pay CPF contributions for his employee, but accidentally indicated the payment amount under Foreign Worker Levy instead.

2. Wrong contribution month/year paid for:

An employer intended to pay CPF contributions for January 2015, but accidentally indicated the 'month/year paid for' as of February 2015.

3. Wrong CPF Submission Number (CSN):

An employer intended to pay CPF contributions for employees of XYZ Company (CSN 234567891A-PTE-01) but accidentally indicated another company, for example, ABC Company (CSN 123456789D-PTE-01).

4. CPF payment made to wrong employee's account:

An employer intended to pay CPF contributions for the employee, Tan Ah Er (S1234567B), but accidentally indicated the employee as Tan Ah Yi (S0123456A).

Summary:

The guide comprehensively covers all things CPF from the employer's and the employee's point of view. Assuming you have gone through the nitty-gritty of calculating the CPF based on various factors and its submission process it tends to get tedious and extremely complicated. This is why adopting a cloud-based product like Deskera would make your life easy.

Deskera provides an automated solution for all your payroll needs, just input your employee information, compliance details, select your pay schedule, and that is all. Make payroll a breeze for your organization. Spend more time on your most valuable asset, people, not the administration work that comes along with it.

Sign up for a free trial of Deskera People now!

Related Articles: