The cost of goods sold (COGS) is a significant part of a business Income Statement and plays an essential role in calculating the net income for a business. Understanding the cost of goods sold (COGS) helps businesses to find out about their financial health and profitability.

Understanding the cost of goods sold (COGS) helps businesses to find out about their financial health and profitability. All businesses need to track direct or indirect costs incurred in getting their product ready for sales in the market.

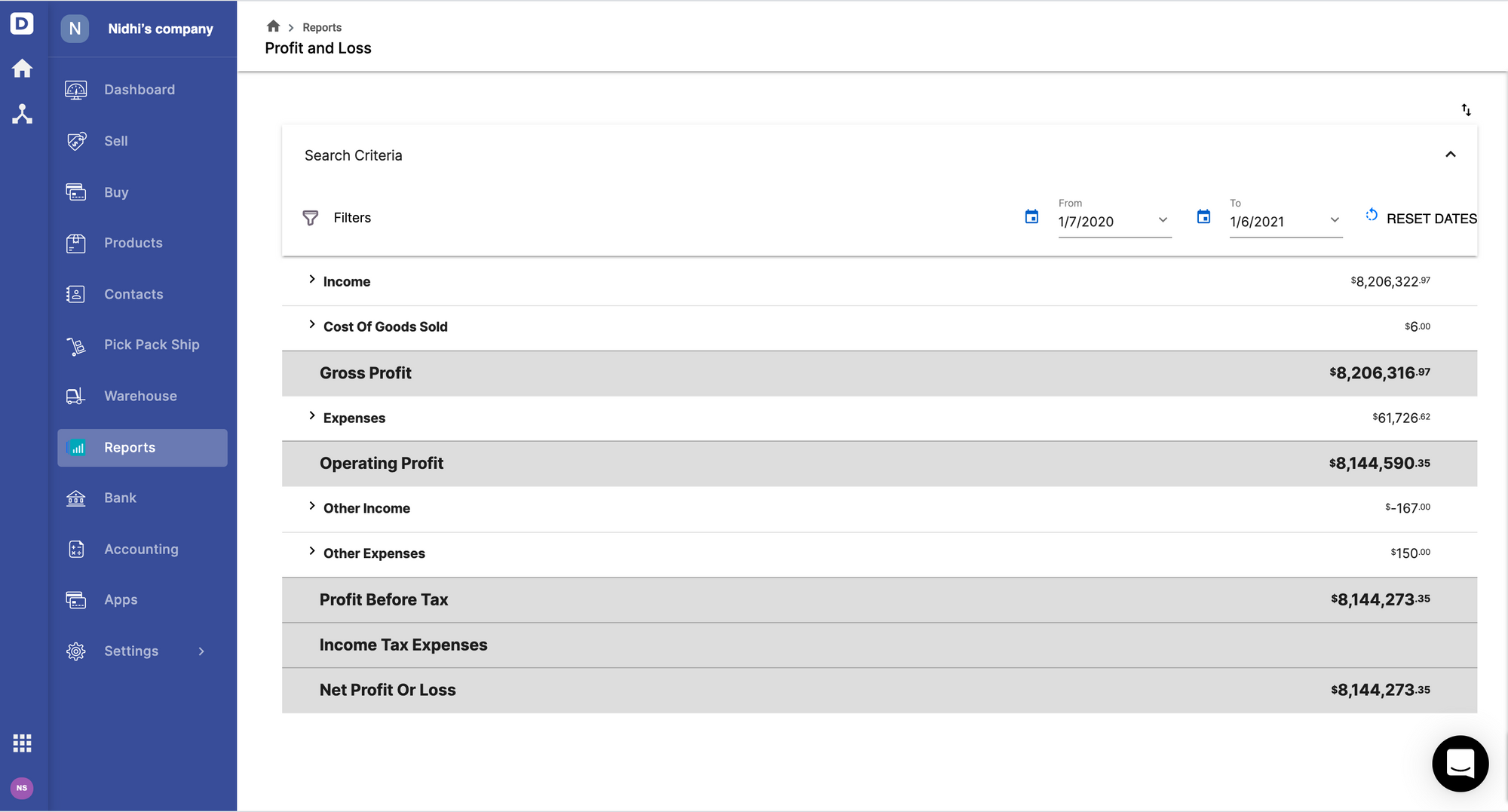

Cost of Goods Sold (COGS) is significant for every business, as this number appears in the company’s profit and loss statement (P&L) aka income statement and plays a vital role in calculating net income for a business. This information is also required for tax return filing as the cost of goods sold (COGS) contributes to the taxable income.

🧱 Fundamentals Friday 🧱

— Andy Gee 📊🤑 (@TheStacksMarket) August 14, 2020

🔘 Gross Income 🔘

= Sales - Cost of Goods Sold (COGS)

AKA Gross Profit❗️

No matter what type of business, the gross income is always the revenue (sales) minus the direct costs for making/acquiring that product (COGS)

For example...

[Mini Thread]

Understanding the concept of cost of goods sold (COGS) and its calculation will help businesses in reducing their total cost and calculate their gross income. Find out more about the Cost of Goods Sold formula and examples here.

Here in this article, we have explained all the basic concepts of cost of goods sold (COGS), which includes definition, calculation, journal entries, and examples.

We will be covering the following topics in this article:

What Is Cost of Goods Sold (COGS)?

What Is Included in Cost of Goods Sold (COGS)?

Information Needed to Calculate the Cost of Goods Sold(COGS)

How Do You Calculate the Cost of Goods Sold(COGS)?

How to Calculate the Cost of Goods Sold(COGS) in the Periodic and Perpetual Inventory Systems?

Examples of the Cost of Goods(COGS) Sold Calculations

How to Record a Cost of Goods Sold(COGS) Journal Entry?

Inventory Valuation Methods and Cost of Goods Sold(COGS)

Cost of Goods Sold(COGS) And Tax Calculation

What Ratios or Financial Metrics is Cost of Goods(COGS) Used In?

Why Is Cost of Goods(COGS) Important?

Summary

What Is Cost of Goods Sold (COGS)?

Cost of Goods Sold (COGS) is the calculation of the total cost incurred in getting the product ready for sale in the market. However, COGS doesn’t include all the costs incurred while running the business. It mainly includes direct and indirect costs incurred in making the finished product. The cost of goods sold amount is deducted from the total sales amounts to calculate the total profit for the business.

What Is Included in Cost of Goods Sold (COGS)?

The cost of goods sold includes both direct and indirect costs incurred in making the product ready for sales in the market.

Direct Costs

Direct costs refer to the costs of making the finished goods. Here we have listed the direct costs that are considered during the cost of goods sold (COGS) calculations:

- Factory overhead like utilities for the manufacturing site

- Storage cost

- Cost of raw material

- Freight and shipping charges

- Direct labor costs

- Cost of inventory parts used to make the finished product

- Other supplies such as packaging material

Indirect Costs

Indirect costs are expenses that are not directly accountable for the cost of the finished goods. Indirect costs include personnel, administration, security, and other costs. Here we have listed the indirect costs that are considered during COGS calculation:

- Indirect labor cost which includes management cost

- Warehouse rent and other utility costs

- Additional overhead expenses

- Production equipment cost

Information Needed to Calculate the Cost of Goods Sold(COGS)

You need the following information to calculate the cost of goods sold:

Beginning Inventory or Opening Stock

Beginning inventory or opening stock is the total cost of all the inventory products at the beginning of the accounting period. The opening stock cost is required to calculate the cost of goods sold (COGS).

Cost of Purchases

Once you have opening stock cost, you need the total cost of all the products you bought and are available in your warehouse or store for sale. This cost of purchases includes the total cost of all the raw materials and parts you purchased to make the finished goods.

Cost of Labor

The cost of labor includes the direct labor cost incurred in producing or manufacturing the final product.

Cost of Packaging Materials and Other Supplies

These costs include the cost of packaging boxes and other packaging supplies used for making the product ready for sale in the market.

Other Costs

These include the shipping, freight charges and other utility expenses such as office rent, electricity, water bill, etc.

Ending Inventory or Closing Stock

Ending inventory or closing stock is the total value of inventory stock available for the sales in the market.

How Do You Calculate the Cost of Goods Sold(COGS)?

Once you have gathered data for all the mentioned fields in the previous section, you are ready to calculate your cost of goods sold (COGS). To calculate the cost of goods sold (COGS) for periodic inventory system, we need to select the accounting period for which you want to calculate the cost of goods sold (COGS).

Example- You run a bakery, and you have decided to calculate the cost of goods sold for the past month. Here you will start by finding out the data for the following fields:

- The total value of the opening stock at the beginning of the month. This includes the cost of total packets of bread ready for sales in the store or shop.

- You need to calculate the total direct costs to make the bread, such as shipping, freight charges, raw material such as flour, sugar, butter cost, etc.

- You can also add any additional inventory purchases done during the month, such as sugar, baking powder, and then subtract the remaining inventory left at the end of the month.

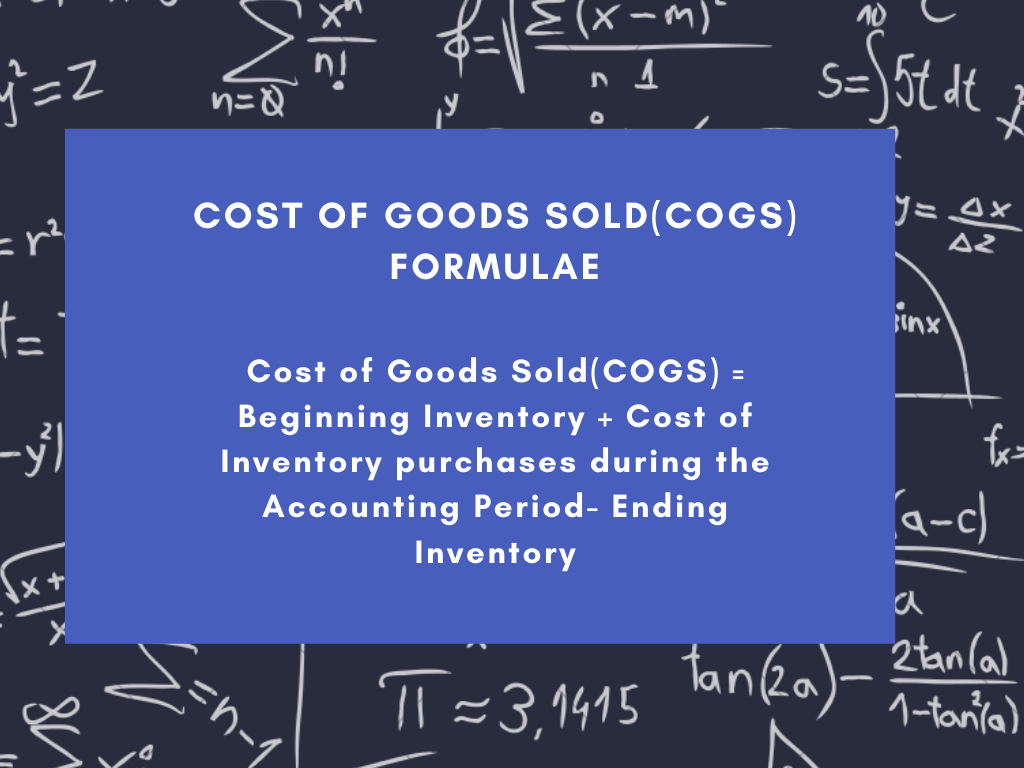

Cost of Goods Sold(COGS) Formulae for Periodic Inventory-

Cost of Goods Sold(COGS) = Beginning Inventory+ Cost of Inventory purchases during the Accounting Period- Ending Inventory

Calculating the Cost of Goods Sold

The cost of goods sold(COGS) is calculated by the above formulae where the cost of inventory products for sale at the beginning of the accounting period is added to the cost of the inventory purchases and then ending inventory at the end of the accounting period is subtracted.

How to Calculate the Cost of Goods Sold(COGS) in the Periodic and Perpetual Inventory Systems?

According to the periodic inventory system, an occasional physical count of inventory is done to determine the ending inventory and cost of goods sold(COGS). In contrast, the perpetual inventory system keeps continuous track of the inventory balances. In the periodic inventory system, there is no cost of goods sold accounting entry until the physical count is done.

Under the perpetual inventory system, the cost of goods sold journal entry is made after each sale. Conversely, under the periodic inventory system, the cost of goods sold is calculated by adding total purchases to the opening inventory and subtracting the ending inventory.

Examples of the Cost of Goods(COGS) Sold Calculations

Here we have explained the calculation for the cost of goods sold(COGS) with an example.

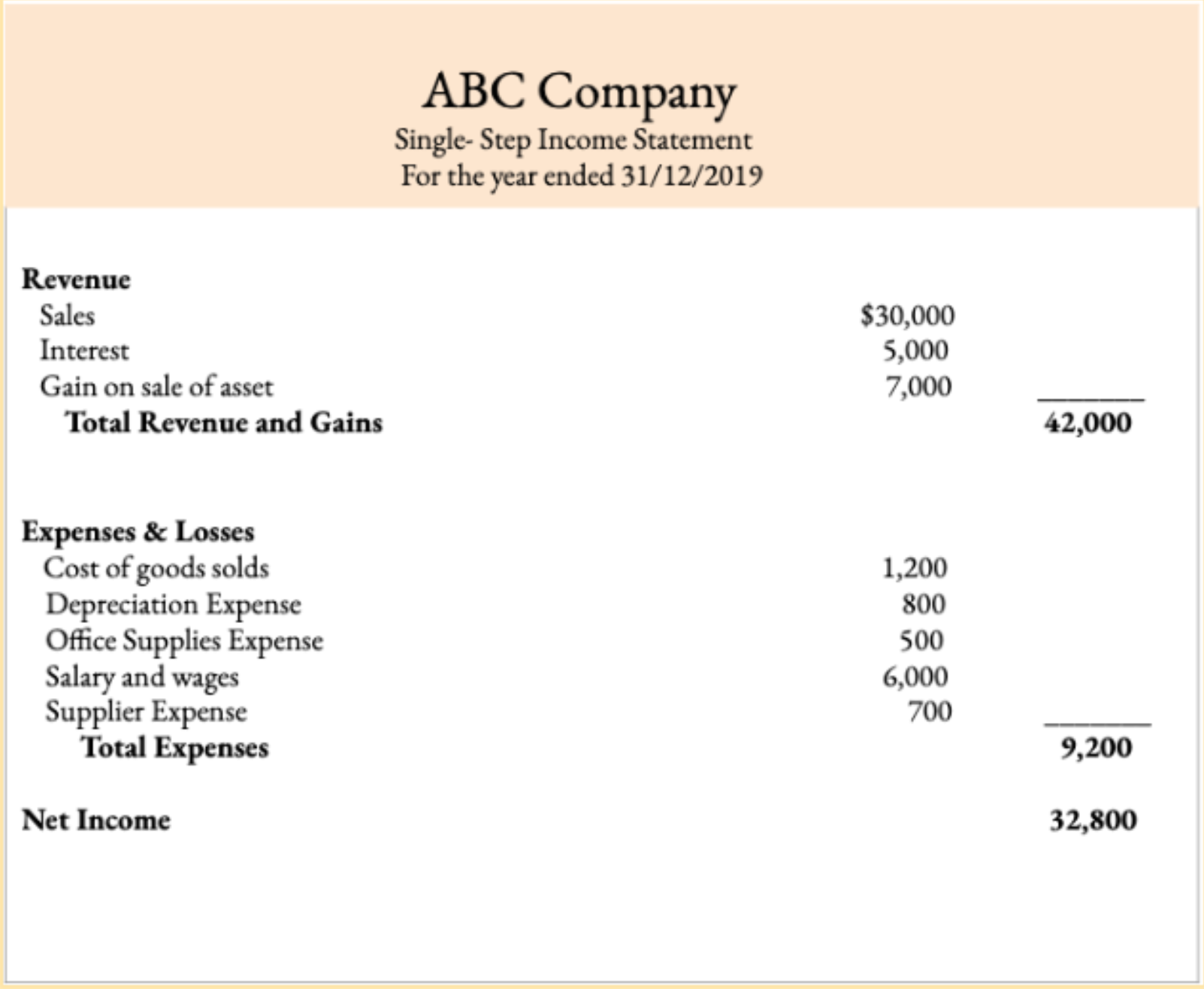

For example-ABC Company sells books. Their previous financial year ended on 31 December 2019. On 1 January 2020, the opening inventory balance is $10,000. During the year, ABC company purchased 10,000 books costing $20,000. Here the cost of each book was $2.

ABC company sold each book for $3. Total sales amount is 10,000 books*$3 which is $30,000. On 31 December 2020, 5,000 unsold books were remaining in inventory bought at $2 each.

Let us calculate the cost of goods sold and gross profit for ABC company.

Cost of Goods Sold = Beginning Inventory+ Cost of Inventory purchases during the accounting period- Ending inventory

- Beginning Inventory = $10,000

- Purchases = $20,000

- Ending Inventory = $10,000

Cost of Goods Sold = $10,000 +$ 20,000 — $10,000= $20,000

Gross Profit= $30,000 (Total Sales Amount) — $20,000(Total Cost)=$10,000

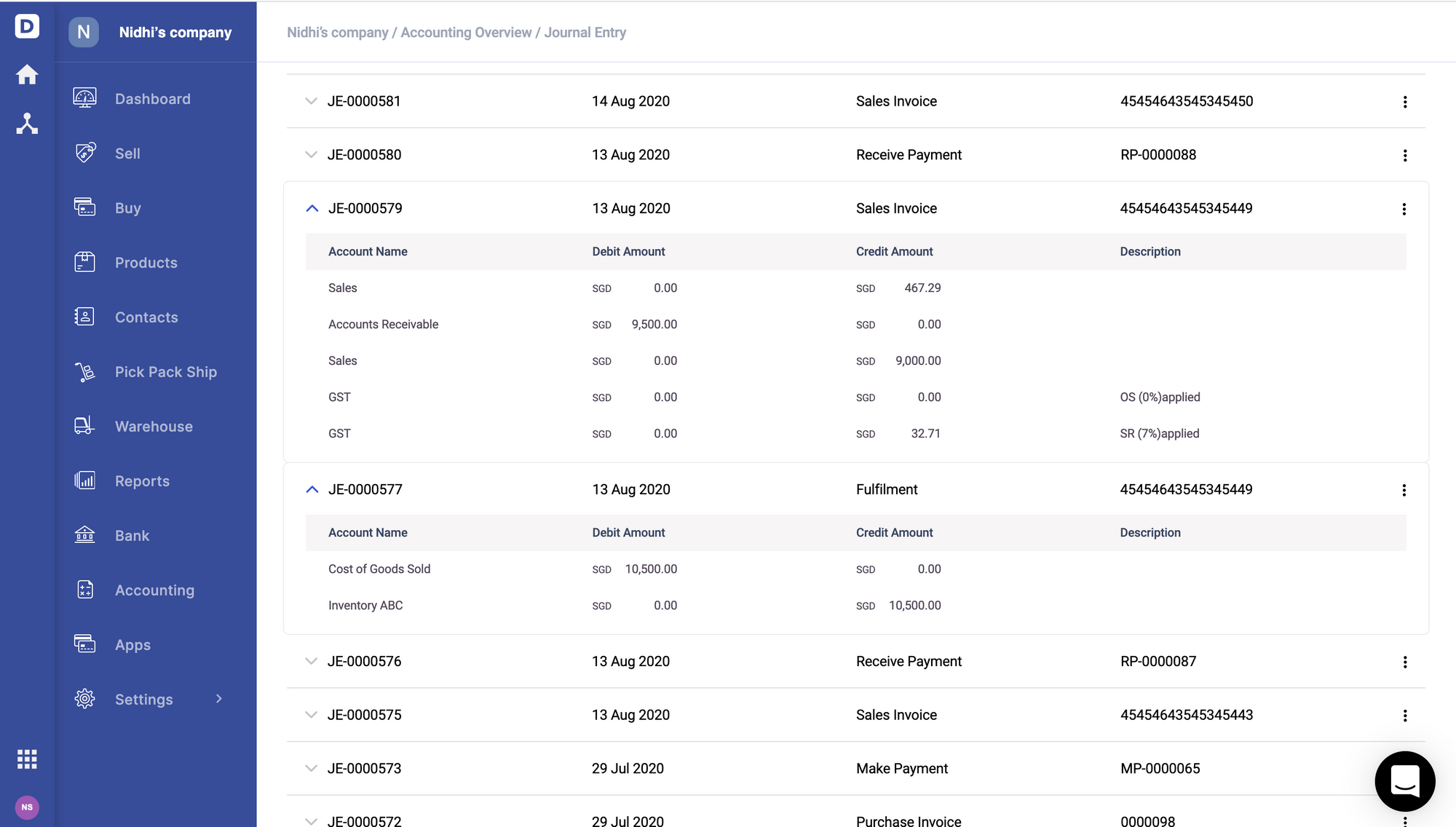

How to Record a Cost of Goods Sold(COGS) Journal Entry?

Once you have calculated the cost of goods sold for your business, the next step is to post the journal entry to your accounting books. When adding a COGS journal entry, you need to debit the COGS account and credit your purchases and inventory accounts.

Cost of Goods Sold(COGS) Journal Entry-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Cost of Goods Sold | XXX | |||

| Inventory | XXX | |||

When you receive goods and purchase invoice from your vendors, journal entry should be posted to update account payables and inventory accounts. However when you fulfill goods to you customers and send sales invoice, your account receivables and cost of goods sold(COGS) will be updated.

Inventory Valuation Methods and Cost of Goods Sold(COGS)

The total value of the cost of goods sold depends on the valuation method which you have selected for your organization. Here we have explained the COGS calculation for all three inventory valuation methods- first In, first out (FIFO), last in, first out (LIFO), and the average cost method.

First In, First Out (FIFO)

According to First In, First Out (FIFO) valuation method, the goods purchased earliest are sold first in the market. As the prices mainly tend to increase over time, a company that has selected the FIFO valuation method will sell its least expensive products first in the market, which leads to lower COGS than those businesses which use the LIFO valuation method.

Last In, First Out (LIFO)

According to Last In, First Out (LIFO) valuation method, the last goods added to the inventory are sold first in the market. As the prices mainly tend to increase over time, inventory items with higher cost prices are sold first in the market, which leads to a higher COGS amount.

Average Cost Method

The average cost valuation method considers the average price of all the goods in stock, regardless of its purchasing time. Considering the average cost prevents COGS from being impacted much by the high cost of a few inventory items.

Cost of Goods Sold(COGS) And Tax Calculation

The cost of goods sold(COGS) amount is required for tax reporting. COGS is used to calculate the total taxable income for a business. COGS also shows insight into the company’s financial health.

All businesses must report their cost of goods sold and then deduct it from the total sales amount to write off the expense. If a company has a very high cost of goods sold(COGS), then they need to pay fewer taxes, but this also means that the company is not profitable. The cost of goods should be minimized to increase profits but also should be calculated by adding all the direct and indirect costs to reduce the taxable amount.

What Ratios or Financial Metrics is Cost of Goods(COGS) Used In?

Here we have listed the financial ratios where the cost of goods sold(COGS)is required:

Gross Margin

The gross margin is calculated by deducting the company’s cost of goods sold (COGS)from the net sales revenue. The higher the gross margin, the business is more profitable. The decline in gross margin is a warning sign for businesses.

Gross Margin Formulae-

Gross Margin = (Sales Revenue — Cost of Goods Sold (COGS)) / Sales Revenue

Cost of Goods Sold (COGS) Ratio

COGS ratio is calculated by dividing the Cost of Goods Sold (COGS) by net sales. The low COGS ratio is a sign of good financial health, and it means that the cost of producing the goods is low compared to the net sales.

Cost of Goods Sold (COGS) Ratio Formulae-

Cost of Goods Sold (COGS) Ratio = Cost of Goods Sold (COGS) / Net Sales

Gross Markup

Gross markup is calculated by dividing gross profit by the cost of goods sold ratio. High gross mark up is a sign of good financial health. It means that the company is making a profit and selling the product above its production cost.

Gross Markup Formulae-

Gross Markup = Gross Profit / Cost of Goods Sold (COGS) Ratio

Inventory Turnover Ratio

Inventory turnover refers to the number of times inventory items are sold or consumed during an accounting period. A high inventory turnover means that the company sales are good, and low inventory turnover is a sign of weak sales and excessive inventory.

Inventory Turnover Ratio Formulae-

Inventory Turnover Ratio= Cost of Goods Sold(COGS) / Average Inventory = COGS / ((Starting Inventory + Ending Inventory) / 2)

Why Is Cost of Goods(COGS) Important?

The cost of goods sold (COGS) is a significant part of a business Income Statement and plays an essential role in calculating the net income for a business.

Understanding the cost of goods sold (COGS) helps businesses to find out about their financial health and profitability. The cost of goods sold (COGS) also contributes to the taxable income.

The cost of goods sold (COGS) is not only used for calculating the taxable income and net income. It is also used in calculating the gross profit margin for your business. The cost of goods sold (COGS) ratio provides insight into the health of a business.

Every industry has some ideal standards for the cost of goods sold (COGS). Every business must try to follow these ideal COGS. If any business COGS is too high, that means that business is not efficient and less creditworthy.

Summary

Every business needs to track and understand the cost of goods sold. Even if your company offers services and not goods as it has a cost of services that need to be calculated. The cost of goods sold (COGS) is a significant ratio considered by lenders to find out about the financial health of a business. A company where COGS is more than sales is a warning sign for the company’s bad financial health. It means that company cost is more than the company sales.

How Deskera Books Help You With Cost of Goods(COGS)?

Deskera Books is all you need for automated bookkeeping and inventory management. Whenever goods fulfillment is done, the accounting cost of goods sold (COGS) journal entry is automatically posted in the system. Also, this will automatically update your financial statement and tax reports in Deskera Books. Deskera Books enables you to save more time without the need to create a manual entry for each transaction. The built-in compliance helps you to generate automated accounting and tax reports.

Learn More about Deskera Books Features:

- Inventory with Deskera Books

- Journal Entries with Deskera

- Making Purchases with Ease

- Warehouse Management with Deskera

- Opening Balances with Deskera

- Invoicing with Deskera Books

Sign up for a 30-day free trial of Deskera Books now!

Related Articles