The shape of your business finances is largely determined by the amount of capital you take on. The cost of debt furnishes you with the information which helps you determine if you can justify taking the debt. Calculating the cost of the debt also guides you in estimating the true cost of your business loan.

The term becomes increasingly significant when you want to calculate the potential income you are expecting from the loan. If your loan shows healthy potential, you know it is worth taking the debt; if not, then you might as well think of other options to accomplish your business goals.

Therefore, the cost of debt becomes a crucial terminology that must be understood in depth. You can take professional debt help services from experts.

This article focuses on how it can affect your business and how to calculate it.

Here’s what more we shall learn about cost of debt in the article:

- What is the Cost of Debt?

- How the Cost of Debt Works?

- Cost of Debt Formula and Calculation

- Examples of Cost of Debt

- What is the after-tax Cost of Debt?

- Example of After-tax Cost of Debt

- Why does Cost of Debt Matter to a small Business?

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is the Cost of Debt?

The effective interest paid by a company against its loans or debts is called the Cost of Debt. If there are multiple loans your business has taken out, the interest rate for each will be added up to calculate the final cost of debt for the company.

One may define the cost of debt in two different ways; as a pre-tax cost of debt, which is the company's debt cost before taxes are considered, or as an after-tax cost of debt. Debt costs before and after taxes differ primarily because interest expenses are tax-deductible.

How the Cost of Debt Works?

The capital structure of a company includes debt and equity. In a capital structure, a firm's operations and growth are financed through various sources of funding, which may include borrowing via bonds or loans. In order to understand the overall rate being paid by a company to use this type of debt, measuring the cost of debt is useful. A high debt cost can also provide investors with insight into a company's risk level compared to others. A higher debt cost indicates that the business is at a higher risk.

As observed earlier in the article, businesses can raise capital in two ways: with equity and with debt. The former involves a situation in which a venture capitalist or an angel investor invests money for a share of ownership.

The debt equity process involves a business obtaining financing for its operations. This typically involves a loan, a merchant cash advance, or invoice financing, among other things. Based on the loan agreement terms, loans are repaid with interest over many months or years.

Cost of Debt Formula and Calculation

Understanding your debt costs can help you understand the cost of being able to have easy access to credit. All you need to do to measure your total debt cost is simply add all your loans, credit card balances, and so on. Once you have calculated the interest rate expense for each year, add them all up. Finally, divide the total debt by the total interest to arrive at the cost of debt.

Cost of Debt Formula

Based on whether you are looking at the post-tax or pre-tax cost of debt, there are several ways to calculate the cost of debt. The following formula can be used to calculate the pre-tax cost of debt:

Step 1: Calculate your business's total interest expense, which can be estimated from the financial statements.

Step 2: Add up all the debts you have. You can access these figures from the liabilities section in your balance sheet.

Step 3: Now that you have all the digits ready, divide the total interest by the total debts you have, and you shall arrive at the value of the cost of debt for your business.

Examples of Cost of Debt

Suppose a business has debts from two sources: a small business loan of $300,000 which has a 6% interest rate from the bank. Another one is a $100,000 loan from a businessman with an interest rate of 4%.

Now, here is how the numbers, in this case, play out:

Total annual interest of both the debts

= [($300,000 x 6%) + (4% x $100,000)]

= $18,000 + $4,000

= $22,000

Total Debt amount = $400,000

So, Total Cost of Debt = $22,000 / $300,000

= 5.5%

The effective pre-tax interest rate the business pays to service all its debts is 5.5%.

What is the after-tax cost of debt?

Interest is deductible and has a tax impact. In this respect, the after-tax cost of debt is more important to most people than the pre-tax one. In the case of after-tax, you've added your taxes to your debt and that's what you're paying.

Here are the steps to calculate your after-tax cost of debt.

You multiply the effective tax rate by (1 - t). Here, t represents the company's tax rate.

So, the equation becomes:

After-tax Cost of Debt = Effective Tax Rate x (1- Tax rate)

Example of After-tax Cost of Debt

Assuming the value of effective tax rate we obtained from the previous example, if your business has a tax rate of say, 40%, then the after-tax cost of debt is calculated as follows:

After-tax Cost of Debt = 5.5% x (1 - 0.4)

= 5.5% x 0.6

= 3.3%

Your business has an after-tax cost of debt of 3.3%.

Why does cost of debt matter to a Small Business?

Almost all small businesses lookout for funds and debts in the beginning. As a matter of fact, U.S. Federal Reserve mentions that close to 45% of small businesses explore some ways to get a debt.

It, therefore, becomes extremely critical to have learned about the concepts of cost of debt for the sustainability of the business. Calculating these values helps them get a farsighted view of how promising the future looks, or what measures they must take to have a good run in the field.

The next section brings forward some of the commonly sought answers. Let’s take a look.

FAQs

What Causes Debt Costs to Increase?

Based on the lender's risk, here are the reasons why the cost of debt increases:

- Longer payback period: It indicates a higher risk if a loan is outstanding for a long duration. Additionally, it also affects the time value of money.

- Higher risk of the borrower: A borrower with a higher risk implies a higher cost of debt. This is because there may be chances that the repayments may not be done in full.

- Unsecured debts: Collateral for loans lowers the cost of borrowing. On the other hand, unsecured debts will be more expensive.

Why should I measure the Cost of Debt?

Essentially, the interest rate demanded by creditors is the cost of the debt. When the creditors give a loan, they estimate the risks and the borrower's chances of repayment of the debt. Various factors like the inflation, risk, and time value of the money need to be taken into account, which helps the business and creditors determine if the process is worthy enough. This is the reason for measuring the cost of debt.

What Is the Agency Cost of Debt?

The agency cost of debt refers to the dispute that arises between shareholders and debtholders of a public company. This happens when lenders limit a firm's access to capital. If the debtholders believe that the management takes actions that benefit equity shareholders rather than debtholders, it results in agency cost of debt. Debtholders will therefore impose covenants or constraints on capital use.

What Is the Difference Between Cost of Debt and Cost of Equity?

In order to operate on a daily basis, businesses need both debt and equity capital. Companies typically pay more for equity capital, which is also not tax-favored. Yet, too many debts increase the risk and also affect the creditworthiness of the business. Consequently, businesses strive for optimal WACC or a weighted average cost of capital across debt and equity.

How can Deskera Help You?

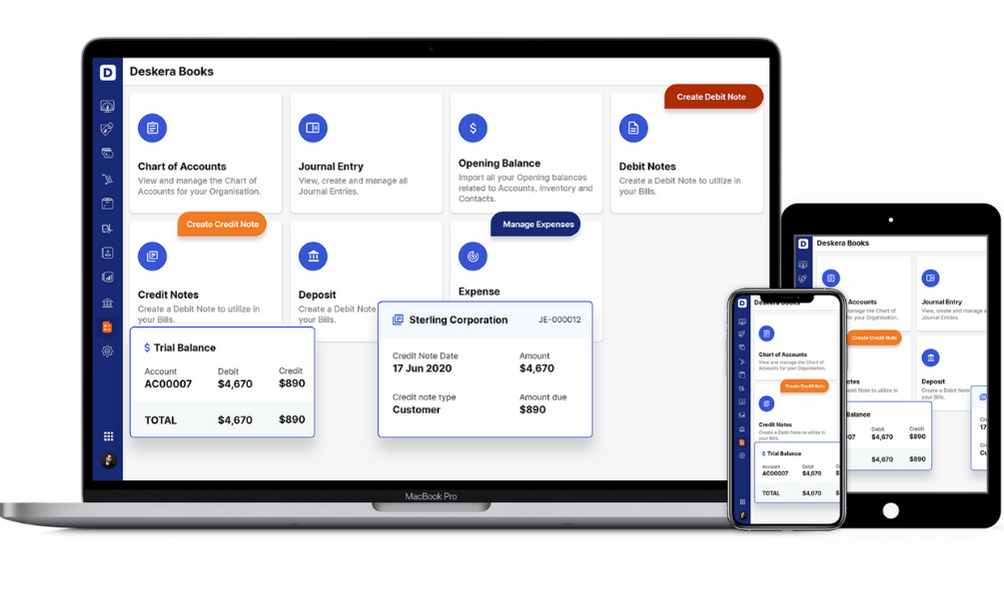

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- The effective interest paid by a company against its loans or debts is called the Cost of Debt

- The cost of debt furnishes you with the information which helps you determine if you can justify taking the debt

- It also helps creditors assess if the business they offer money to, is at a higher risk

- In addition to debt, equity is another component of a company's capital structure.

- In order to calculate the cost of debt, you need to find the average interest rate on all of a company's debt.

- One may define the cost of debt in two different ways; as a pre-tax cost of debt, which is the company's debt cost before taxes are considered, or as an after-tax cost of debt

- In order to understand the overall rate being paid by a company to use this type of debt, measuring the cost of debt is useful

- A high debt cost can also provide investors with insight into a company's risk level compared to others

- As observed earlier in the article, businesses can raise capital in two ways: with equity and with debt. The former involves a situation in which a venture capitalist or an angel investor invests money for a share of ownership

- You may calculate the cost of debt by dividing the total interest by the total debt

- Longer payback period, Higher risk of the borrower, Unsecured debts are some factors that cause an increase in the cost of debt

Related Articles