Index:

- Introduction

- Elements of Contribution Margin

- What is the significance of Contribution Margin?

- How is Contribution Margin used by companies?

- How is the Contribution Margin calculated? How can it be improved?

- Contribution Margin vs Gross Margin

- Contribution Margin Ratio

- Contribution Margin Income Statement

When running a business, profitability is one of the key goals kept in mind. Of course, it is extremely desirable, and so is looking at the profit of each product or service the company offers. This is precisely where the contribution margin comes into play.

The contribution margin refers to the contribution of one product or unit to the overall profit generated by a company. It is the incremental capital that is generated by selling one unit or product after reducing the costs incurred by the company. In simpler terms, it is the selling price minus the variable cost per unit. The contribution margin is also known as dollar contribution per unit and provides a means to show the profit potential of a particular product. It shows that portion of sales that helps in covering the said company’s fixed costs. The remaining revenue is the profit that has been generated.

Elements of Contribution Margin

Contribution margin has three basic elements:

Sales revenue

Sales revenue is the total revenue generated by the sale of a product or unit at its selling price. It includes the cost price as well as the escalated value associated with the product or unit at the point of selling.

Fixed and Variable costs

Fixed costs are business costs that remain the same, unaffected by the number of products you purchase. Some common examples are rent and admin salaries. Variable costs are those expenses that are directly affected by the number of goods you produce and the services you employ, such as raw materials and marketing expenses.

Profit generated

Profit generated is the total profit generated per unit or product. This indicates the profitability of the goods or services. It is calculated by subtracting the fixed and variable costs, that is the expenses incurred from the total revenue generated.

What is the significance of Contribution Margin?

Contribution margin is a vital accounting metric for any company to operate effectively and sustainably. Calculating the contribution margin requires some effort and data sourcing. However, it is important as it lays the foundation for a company’s break-even analysis. The analysis is then used in the overall cost and sales planning for products.

The contribution margin helps in determining the fixed expenses and the profitable elements coming from the sale of a particular product. It also helps in predicting the expected profit levels and in defining the sales commission structure that will be paid to distribution agents and team members.

How is Contribution Margin used by companies?

Contribution margin and its detailed analysis essentially help managers make decisions while driving business operations. This can include:

- How to price a product or service,

- How to construct a sales commission structure, and even

- Whether to add or eliminate a product line.

The most common use of the contribution margin is to analyze the profitability of a product and decide whether to continue its production. If the contribution margin of a product is negative, it indicates that the revenue generated by the product of the said category isn’t enough to cover the fixed and variable costs. The business then decides whether to increase the selling price of the product or to discontinue it.

How is the Contribution Margin calculated? How can it be improved?

Calculating the contribution margin for any product or service provided by a company is simple:

Contribution Margin = Total revenue generated - variable costs

For example, if a product is priced at $10, and the total expenses incurred in the production and marketing of that product amounts to $6, then the unit contribution margin comes to $4.

One of the most important ways in which this calculation can be improved is by defining your business’ fixed and variable costs. Differentiating between a fixed cost and a variable cost can be challenging sometimes as the line between the two can be blurred under different circumstances.

For example, if you add an extra machine to the production process to temporarily increase the output, it can be quite confusing. This is because this expense falls under both categories and can affect the overall contribution margin associated with a product.

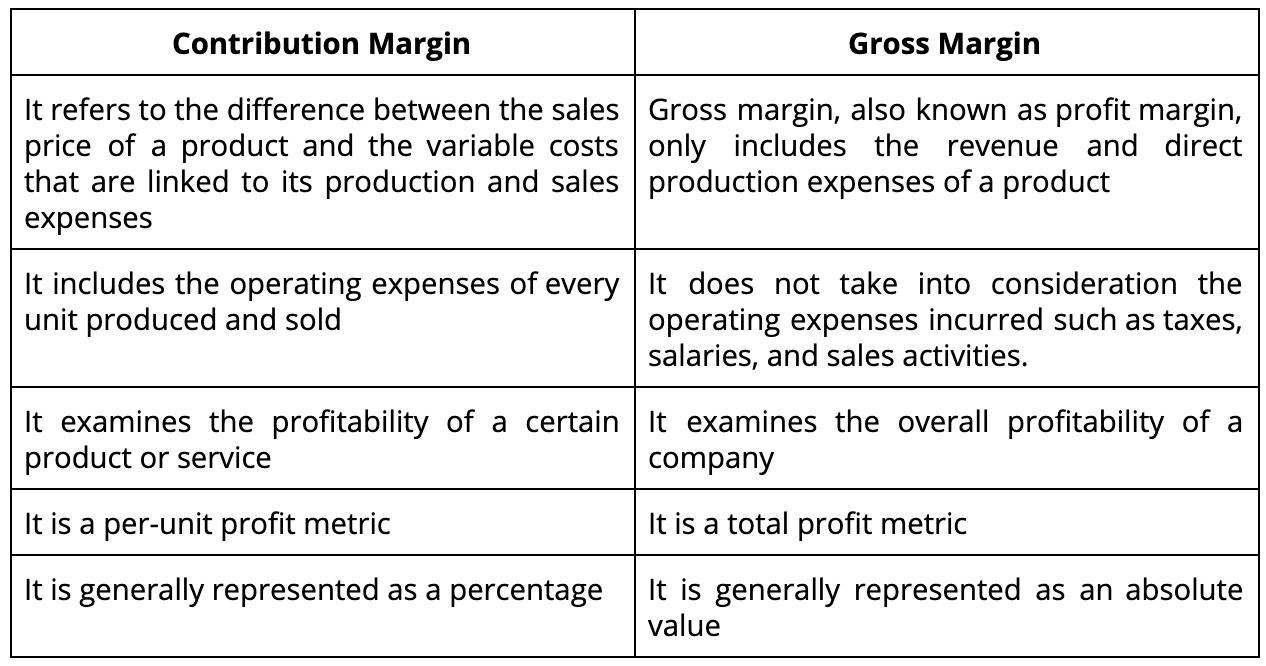

Contribution Margin vs Gross Margin

Contribution Margin Ratio

The Contribution Margin Ratio comprises a formula that helps companies calculate the percentage of contribution margin, including expenses minus fixed costs, relative to the net sales in percentage terms. The formula shows the total ratio of sales income remaining to cover the fixed expenses and the profit generated after covering all the variable costs incurred.

The ratio can be calculated by using the following formula:

CM ratio = (Sales revenue) - (variable costs) / (sales revenue)

or

CM ratio = Contribution Margin/ Sales

The higher the margin, the better the profitability of a product. Companies often push to increase this ratio as much as possible in order to derive maximum profits with minimum expenses.

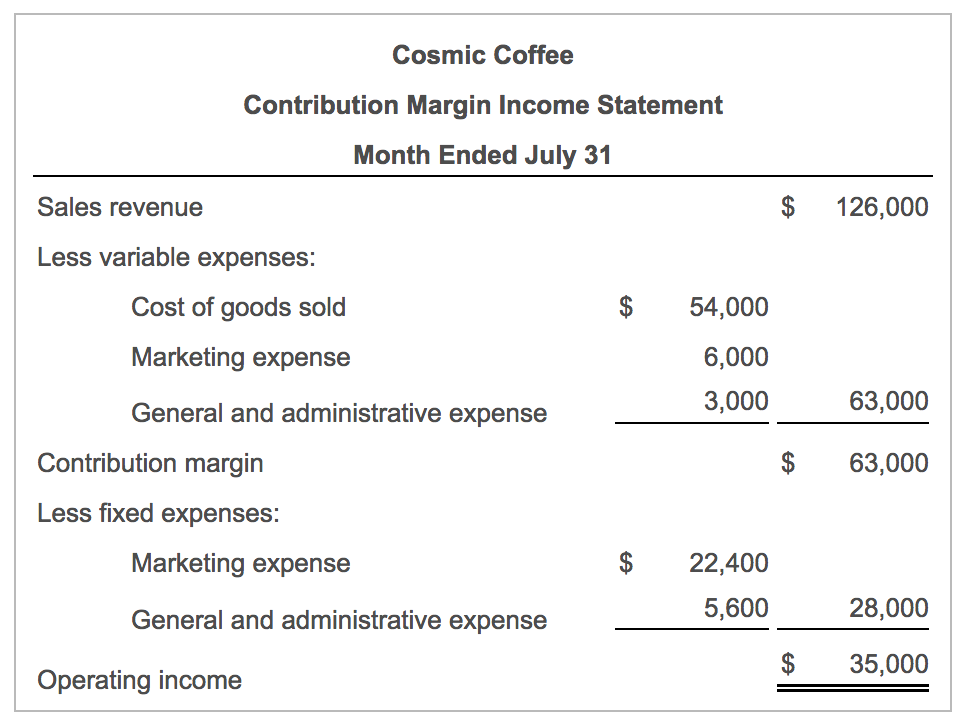

Contribution Margin Income Statement

An income statement is one of the most vital financial statements for preparing and reporting a company’s financial performance over a specific period. It is also known as the profit and loss statement, as it states the revenue and expense incurred over a specified accounting period. A contribution margin income statement, therefore, is an income statement that adjusts all variable expenses from the sales values, to determine the contribution margin.

A contribution margin income statement is distinct from a regular income statement in the following ways:

- The fixed costs are situated lower down in the income statement.

- Variable expenses are clubbed with variable production expenses, and

- Contribution margin replaces the gross margin in the contribution margin income statement.

A contribution margin income statement provides useful insights on the business’ operations, the amount required to break-even, and the costs to keep an eye on.

When it comes to profitability, metrics such as Contribution Margin, Contribution Margin Ratio, Gross Margin, and Income Statement are imperative in:

- Understanding the overall financial health of a company,

- The potential its products and services have, and

- The important decisions that have to be taken to optimize its operations and minimize the costs incurred.

With Deskera Books, it’s not only possible, but convenient to determine and act on these important accounting metrics to ease your business operations.