Why is managing your company finances to optimize cash flow essential for you as a small business owner? To answer this and many other questions, we have prepared this comprehensive guide to understand cash flows, the Cash Flow Statement and its relevance for your business.

What we will cover in this guide:

- What is cash flow?

- Why is managing my cash flow important?

- Why should I worry about cash flow if I am profitable?

- How can I improve my cash flow?

- What is a Cash Flow Statement and how is it made? With examples.

- What are the different ways of preparing a Cash Flow Statement?

- A comparison of Direct & Indirect method of Cash Flow Statement preparation

- What is Free Cash Flow (FCF) and how is it calculated?

- Cash Flow Statement templates for free download

What is Cash Flow?

Cash flow is defined as the movement of cash in (or out) of your business. A cash inflow means that money is going into your business, during events such as receiving payment from customers or taking on a bank loan to fund your business.

On the other hand, cash outflow occurs when money is moving out of your business, such as when you invest in equipment essential to your business, or when you buy product inventory from your suppliers.

Companies should monitor the movement of cash in their business closely and ensure that there is a higher cash inflow than outflow.

Why is Managing My Business Cash Flow Important?

Managing and maintaining a positive cash flow ensures that you have enough money to pay for monthly expenses, such as your store’s rental and utility bills. This is crucial, especially for newly founded small businesses that rely heavily on the availability of cash to survive.

Isn’t Being Profitable Enough to Ensure Success?

Even profitable businesses might not necessarily enjoy a high cash inflow.

Cash flow only takes into account cash on hand, and not accounts receivables and accounts payable. It is not uncommon for businesses to run on credit terms where sales are recorded when the invoice is issued, increasing your accounts receivable for the customer. This, in turn, is reflected in your income statement as profit gained, even when you have not received any payment.

Therefore, profitable businesses with large amounts of uncollected payment tied in their accounts receivable may suffer from excessive cash outflows. When left unchecked, this may result in having to take up additional bank loans or overdrafts to maintain business operations and output.

How Can I Improve My Cash Flow?

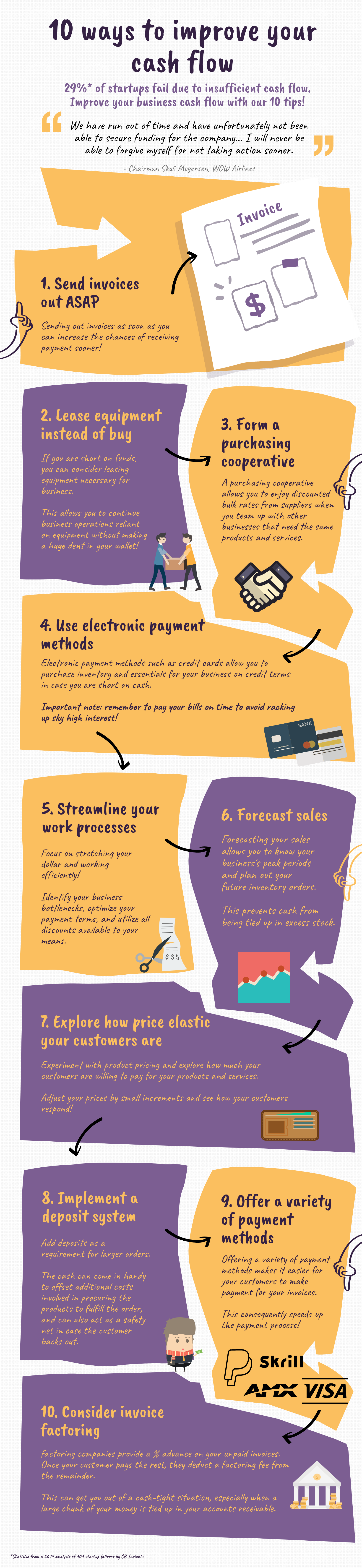

29% of startups fail due to insufficient cash flow

Here’s an info graphic showing ten ways to improve your small business’s cash flow!

The ten ways mentioned range from simple do-it-yourself measures such as adopting a shorter time-frame to issue invoices and optimization of business processes, to involving third parties such as other businesses and factoring companies.

- Send out invoices asap

- Lease equipment instead of buying

- Form a purchasing cooperative

- Use electronic payment methods

- Streamline your work processes

- Forecast sales

- Explore how price elastic your customers are

- Implement a deposit system

- Offer a variety of payment methods

- Consider invoice factoring

What is the statement of cash flows?

The cash flow statement is one of the most crucial financial documents that capture the cash inflows and outflow of the business. Every small business should strive to include this vital report in their accounting processes.

This basic formula allows you to calculate your cash on hand:

Operating cash flow + Investing cash flow + financing cash flow = Cash on hand

There are three components of this formula:

1. Operating cash flow

It is defined as the movement of cash that contributes to the main costs associated with operations of the business, such as the purchase and sales of products and services. Employees' salaries and wages are also included in operating activities.

One of the signs of a bustling business is a high positive operating cash flow.

2. Investing cash flow

Cash movements that contribute to the purchase or sale of long-term assets such as property, equipment, and office supplies fall under investing activities.

Investing cash flow usually sums up to a negative value, symbolizing that the company is investing in more assets to grow the business. However, a positive value can occur when the company sells off obsolete long-term assets.

3. Financing cash flow

Financing activities are activities involving a change in the business’s equity capital and any debts. These include the borrowing or pay off of bank loans, investor payouts, and issuing or buyback of company shares.

Financing cash inflows are the result of taking bank loans and investor capital to invest back into the business while financing cash outflows can be due to the paying off of bank loans and stockholders.

By adding these values under the three categories, you can view the total net cash movement of the business for the period indicated.

Preparing Your Statement of Cash Flows - Direct vs. Indirect

There are two ways of preparing a cash flow statement - direct and indirect. Both ways differ in the steps taken to calculate the operating cash flow.

The direct method involves adding up all cash payments and receipts that fall under operating activities and uses the opening and ending balances of various accounts to get these figures. Due to the nature of the direct method, it comes in handy when reporting direct sources of cash, which serves as a useful metric for potential investors and creditors.

On the other hand, the indirect method uses net income (taken from the income statement) that is then adjusted to account for non-cash changes by accrual-type accounts, such as accounts receivable and depreciation.

Regardless of the method used, the calculated operating cash flow will be the same. The means of calculating investing and financing cash flows are the same for both techniques.

Most businesses use accrual accounting instead of the cash-basis accounting system. As a result, many prefer the indirect method. For them, it is easier to obtain the net income than to list all instances of cash inflows and outflows as the income statement and balance sheet are commonly generated accounting documents.

Businesses that use accrual accounting also do not collect and store cash-based transactional data at the individual customer or supplier level, making it impractical to use the direct method.

Lastly, the Financial Accounting Standards Board (FASB) also requires businesses using the direct method to disclose the reconciliation of net income to the operating cash flow. Users of the indirect method are not required to do so as it is already part of the calculation process, which further discourages businesses from utilizing the direct approach.

A Comparison of Direct Method vs Indirect Method

The main difference between direct and indirect cashflow methods is in recording cashflow from operating activities.

In the direct method, the operating activities include cash payments and receipts only.

Under the indirect method, the operating activities section has adjustments for non-cash expenses, like depreciation, added. Changes to assets and liabilities form a part of the operating activities in the indirect method of cashflow reporting.

Most companies use the indirect method of cashflow reporting.

What is Free Cash Flow (FCF)?

Free cash flow (FCF) is a useful metric for investors and creditors to determine a business’s growth and success. It is defined as the cash leftover after deducting capital expenditure (CapEx) from cash generated from business operations.

The formula to calculate FCF is:

FCF = Operating cash flow (OCF) - Capital Expenditure (CapEx)

OCF can be taken from the cash flow statement and represents cash generated from primary business operations.

CapEx is defined as money spent on long-term assets, upgrades, and investments (Property, Plant, and Equipment (PPE)).

The value of CapEx can also be extracted from the cash flow statement. Depending on accounting practice preferences and business nature, you can choose to use either gross capital expenditure (PPE expenditure without accounting for the cost of sale or disposal of PPE) or net capital expenditure.

The information found in your balance sheet and income statement can also be used to calculate your capital expenditure. To get your CapEx, deduct the current value of PPE from your previous PPE value (taken from the balance sheet), and add depreciation, amortization, and other non-cash expenses (found in the income statement).

As financing activities involve payouts to investors and creditors, FCF is indicative of a business's capacity to pay off debts and reward its investors. An FCF that increases over time is attractive to investors as it is indicative of rising share value and earning potential.

*For the calculation of FCF, we use Net CapEx to capture a more realistic picture of available FCF. You may adjust the formula accordingly if you prefer to use gross CapEx.

Cash Flow Statement Templates for Your Business (It's Free!)

We have crafted some simple cash flow statement templates that are free to use for your small business needs.

In these free templates, you can find both direct and indirect methods of calculating cash flow statements. We also included a section that calculates free cash flow* and simple horizontal analysis of net cash flow change across different consecutive periods.

The templates include the following:

1. Annual Cash Flow Statement (Split by Month)

2. Annual Cash Flow Statement (Split by Quarter)

3. Three Year Cash Flow Statement

Let the Accounting Software Handle It For You

As cash flow statements can be tedious to craft, and excel sheets are fickle by nature, a growing number of businesses are turning to online accounting software to manage their transactions and generate their cash flow statement.

Deskera Books is a cloud-based accounting and inventory software that gives you the freedom to run your business while it takes care of all the accounting and financial details.

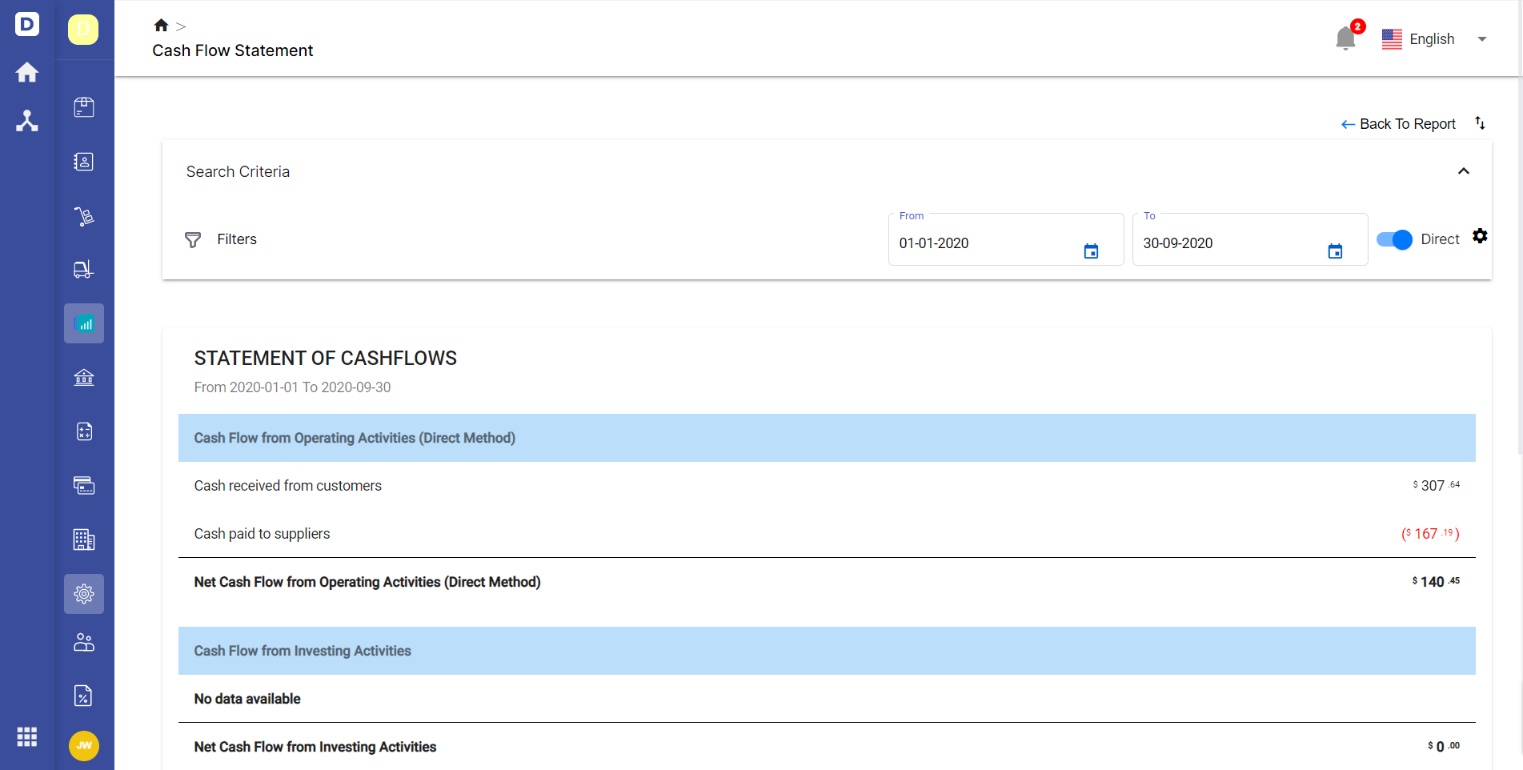

Under Financial Reports, the user can quickly view their cash flow statement based on the data available in the system. You can also toggle between the direct or indirect method seamlessly!

If you create additional accounts in Deskera Books, you can also customize the settings to map those accounts under a specific cash flow category. You can even determine the description written in the cash flow statement for that account!

Deskera Books also enables you to access other crucial financial reports at your fingertips, such as Balance Sheet and Income Statement.

Showcasing accurate financial reporting and various other features, Deskera Books is the ideal business accounting solution for small businesses with real time view of important reports like Cash Flow, Profit & Loss, Balance Sheet and Trial Balance.

Sign up today for a free trial of Deskera Books and create a Cash Flow Statement for your business.