A commission, or referral fee, is a percentage of the value of an order that you receive. Commission rates vary based on the type of sale you make and the product you sell.

In the simplest definition, the commission is money paid out to a selling agent. For example, if you were selling cars and your selling agent was paid 5%, you would get 95% of the sales price.

If you make a sale, you get some portion of the money from the purchaser. This can be anywhere from 10% to 100%, although most people are paid between 25 and 50%.

For example, if you are insured by an insurance company for $2,000 and your agent sells you additional coverage for $1,000 (the same amount you are already insured for), your broker will receive a commission of $1,000 from the insurance company in addition to the $2,000 he or she receives from you.

You've heard the term "commission" before but don't quite understand what it means. Maybe you've ever wondered how commissions work. Well, now you don't have to wonder. We'll be exploring exactly what a commission is, and how they work.

Here are key points covered in the article:

2) What commission is widely available across different verticals?

4) What commission means in a financial market?

5) What commission means in terms of investments?

Commission - An Overview

A commission is a fee paid to an agent for services rendered in selling something or based on performance. When it comes to real estate, commissions are often divided between the listing agent and buyer's agent.

The value is often specified in an employment contract. For example, salespeople often earn commissions. The commission may be expressed as a percentage of the revenue that results from all sales made by the employee. In some cases, it may be described as a percentage of all revenue earned by the employer when the employee was employed.

Commissions can also be paid to those who provide services, such as real estate agents or financial advisors. These professionals are paid when they help their clients buy or sell homes or achieve financial goals through investments. Commissions paid to these service providers are sometimes referred to as contingent fees because they are not always paid. For example, if a real estate agent does not find a home for her client within an agreed-upon time frame, she does not receive any money for her work.

What Commission is widely available across different verticals?

In the business world, a commission is a fee paid to an employee upon completion of a task, usually selling a certain amount of goods or services. Employers sometimes use commissions as incentives to increase employee productivity. In other cases, employers pay employees salaries and commissions simultaneously.

Commissions are prevalent in retail industries, especially sales-based jobs in which results are easily quantifiable. Commission structures are also common in real estate and insurance sales jobs.

The commission structure varies depending on the company and the industry. Some companies offer higher commissions for beginners to get recruits started. In other cases, employees may receive a small base salary and then more effective commission rates as they sell more of their product or service.

Most sales-based companies have a commission pay structure to help motivate employees to sell more and help the company increase its profits.

In personal finance, brokers often charge commissions when they buy or sell stocks on an investor's behalf.

What is a Commission?

A commission is a fee paid to a salesperson or agent for services rendered in completing a sale. A commission may be based on a flat fee arrangement, or it may be calculated as a percentage of the revenue generated from the sale.

Sales professionals often use commissions to determine their income and as an incentive to increase sales and market share. Companies use commissions to indicate how well the sales team is performing and as an incentive to increase revenues.

A commission is a service charge assessed by a broker or investment advisor as compensation for buying or selling securities. A commission is charged by an agent (such as a stockbroker) who facilitates a transaction between a buyer and seller. For example, an investor who wants to buy 100 shares of ABC stock at market price must pay the broker or agent who handles the trade a fee for placing the order.

Depending on the salesperson's contract with their employer, commissions may be based on revenue earned from the sale of goods or services. In retail stores, for example, salespeople are often paid commission to encourage them to sell add-on items to customers. The store benefits from increased revenue and higher overall profit margins, while the employee receives a larger paycheck based on the additional revenue they generated.

What Commission means in a Financial Market?

In the context of financial markets, a commission is a fee charged by a broker to execute buy or sell orders submitted by an investor.

For securities trading, a commission is a compensation paid to an agent for transacting a trade on behalf of a client.

A financial services professional who works for a registered broker-dealer and charges commissions for carrying out buy and sell orders is called a commissioned broker or, simply, a broker.

Commissions are usually charged as a percentage of the total transaction value. For example, if you make ten trades per week in your brokerage account at $1 per trade, you would pay $10 per week in commissions.

Suppose you buy or sell securities through an online discount brokerage firm or via an electronic communication network (ECN). In that case, you may also come across per-trade commissions and monthly platform fees. These commissions are more familiar with online brokers and include fixed rates that do not vary based on transaction size.

What Commission means in Terms of Investments?

A commission is a service charge assessed by a broker or investment advisor in return for providing investment advice or handling the purchase or sale of a security.

Commission-based compensation can create an incentive for brokers to push products that generate the highest fees, which may not necessarily be in the client's best interest. The fiduciary standard requires that advisors act in their clients' best interests. Still, brokers are only held to a suitability standard--meaning they're only required to recommend investments that are suitable for their clients based on factors such as age, risk tolerance, and net worth.

Brokers receive commissions from product manufacturers in exchange for recommending and selling their products. These commissions can range from a few basis points to several percentage points of the total amount invested.

For example, variable annuities often use a multi-tiered commission structure, which could include an initial sales charge of 4%, an annual trail commission of 1%, and additional bonuses paid to brokers if the client holds the annuity for more than five years.

Wrapping Up

A commission is a fee paid to a person or company for executing a transaction, such as selling real estate, insurance, or securities. The payment can be based on either a fixed or variable amount and is typically a percentage of the total sale. Commission payments are frequently based on certain milestones being reached, such as attaining a certain number of sales.

How Deskera can help you?

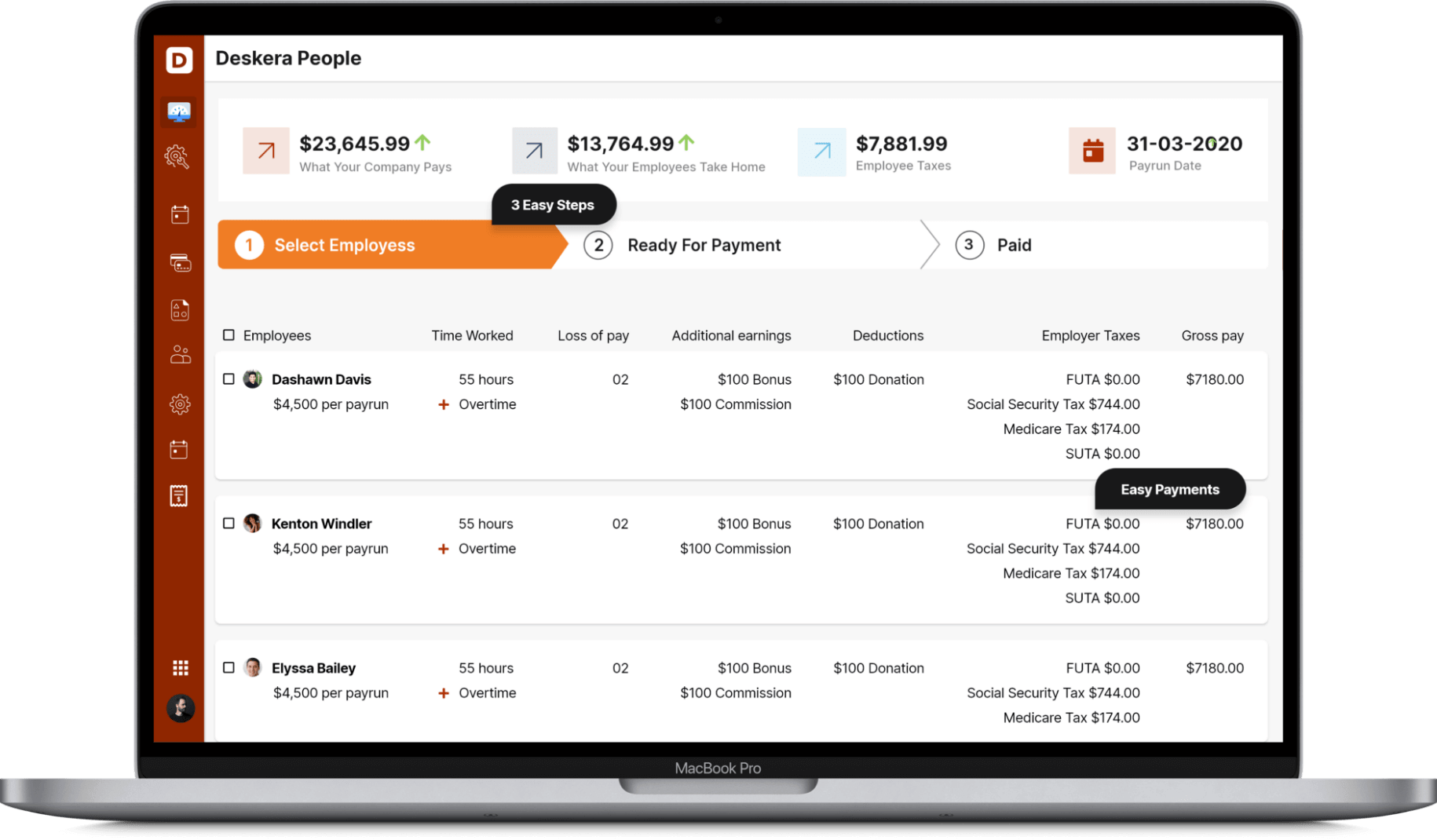

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- A commission is essentially a piece of a deal—the portion of the sales price that the retailer takes off the top before paying the merchant

- The merchant keeps the rest of the wholesale, which is called value-added. A commission is usually a percentage of the total sale price. When you think about it, it makes sense to pay someone for helping you make money

- The work involved in selling products can be substantial, and there's no way to know how much your product will sell for until it's time to sell. It costs you money to have an inventory, ship things, market them, and so on — all things that make up your overhead costs

- In addition, you have expenses like rent or office space and other costs related to your business that are not part of a commission

- Commission rates vary among online merchants, but commissions usually range from 10% to 25%

Related Articles