As an employee, we all are curious about how our health insurance works? Group health plan coverage for state and local government workers is alluded to as public sector COBRA to recognize it from the requirements that apply to private businesses.

Combined Omnibus Budget Reconciliation Act, gives qualified workers and their wards the choice of continuing with health care coverage insurance when a worker loses their employment or encounters a decrease of work hours. In this guide we will cover the following topics:

- What is COBRA?

- Coverage Period

- Is COBRA coverage expensive?

- Qualifying for COBRA Health Insurance

- Notices Required of Qualified Beneficiaries

- Is COBRA insurance appropriate for you?

What is COBRA?

The Consolidated Omnibus Budget Reconciliation Act (COBRA) provides workers and their families who lose their medical benefits the option to decide to proceed with group medical benefits given by their group health plan for restricted timeframes in specific situations, for example, voluntary or involuntary employment loss, decrease in the hours worked, the shift between occupations, divorce, death, and other life occasions.

COBRA insurance might give you impermanent health coverage after you quit a job or because of another occasion that qualifies you. It's a government regulation that was made in 1985 that gives people who experience an employment loss or other qualifying occasion the choice to proceed with their present health care coverage inclusion for a restricted measure of time.

The law revised the Employee Retirement Income Security Act of 1974 (ERISA), the Internal Revenue Code, and the Public Health Service Act (PHS Act) to give the continuation of business-supported group health plan coverage that is terminated for particular reasons.

People who work for a state or local government employer, and their dependents, ought to know about their rights in regards to COBRA. A decent beginning stage is perusing the plan data, in some cases called a summary plan description or SPD given by the business.

In the event that data doesn't address your inquiries, you can contact the individual who deals with your medical benefits plan. Qualified people might be expected to pay the whole premium for coverage up to 102% of the expense for the plan.

COBRA by and large expects that group health plans supported by businesses with at least 20 workers in the prior year offer workers and their families the chance for a temporary extension of health coverage called continuation coverage in specific occurrences where coverage under the plan would some way or another end. COBRA traces how workers and relatives might choose continuation coverage. It likewise requires businesses and plans to give notice.

How does COBRA insurance function?

COBRA insurance broadens your health plan coverage when an employer's plan closes:

- Your insurance carrier, your employer, or both will give you data on COBRA coverage. Your insurance carrier is expected to remember COBRA rights data for your plan documents when you first enlist.

- You will have as long as 60 days to conclude whether you need to proceed with your health coverage under COBRA. On the off chance that you don't choose it, your health coverage will end on the day that your employer's plan coverage is finished.

- Assuming that you choose for continuation with coverage under COBRA, it will begin the day after your employer's plan coverage closes. It will offer the very same advantages you had under your employer's group plan. You can keep on seeing the same doctors and different suppliers and follow all the current plan details.

- COBRA coverage might keep going for 18 months or three years. It relies upon the kind of qualifying event that made you qualified for COBRA.

- COBRA might be ended early in the event that you don't pay your premiums or other fees for coverage. It might likewise be ended assuming you find a new line of work that offers health care coverage insurance before it runs out.

To take advantage of your COBRA insurance ensure you read the subtleties of your plan. Assuming you have questions, contact your insurance carrier.

What Is COBRA Continuation Coverage?

COBRA insurance covers you for similar benefits your employer’s health plan covered you for. COBRA doesn't cover supplemental coverage, for example, hospital care insurance, disability, life insurance, or different kinds of voluntary coverage.

Large businesses in the U.S., those with at least 50 full-time workers, are expected to give medical coverage to their eligible workers by paying a piece of insurance premiums.

- If a worker becomes ineligible to get a business' health care coverage benefits-which can occur for many reasons, (for example, getting laid off or falling under a base limit number of hours worked each week)- the business might quit paying its part of the employee's insurance premiums. All things considered, COBRA permits a worker and their dependents to hold similar insurance coverage for a restricted timeframe, if they will pay for it all alone.

As a feature of the American Rescue Plan Act of 2021, the central government will pay COBRA insurance premiums for people and their covered family members that lost their employment because of the 2020 financial emergency from April 1 through Sept. 30, 2021.

- Under the COBRA, previous workers, spouses, previous spouses, and dependent children should be offered the choice of continued health insurance coverage at group rates, which in any case would be ended.

While these people are probably going to pay more for health care coverage insurance through COBRA than they did as workers, on the grounds that the business will never again pay a piece of the premium costs, COBRA coverage may be more affordable than individual insurance plans would be.

It's critical to take note that COBRA is a health insurance coverage program and plans might take care of expenses toward physician recommended drugs, dental treatments, and vision care. Government COBRA prerequisites just apply to work-related group health plan coverage. They don't have any significant bearing on individual or association health insurance policies, and they don't matter to any non-medical advantages through the business, like life insurance.

Qualified beneficiaries are by and large qualified for continuing with similar coverage they had preceding the qualifying event, under similar principles. For instance, changes in the benefits that apply to dynamic workers will apply, as well as catastrophic and other benefit limits.

Coverage Period

Generally, COBRA coverage for the covered worker lasts at least 18 months. Still, the accompanying exemptions apply:

Disability Extension-29-Month Period: Special guidelines apply to specific disabled people and relatives. Assuming a qualified beneficiary to be qualified for disability benefits under Titles II or XVI of the Social Security Act, and is disabled whenever during the initial 60 days of COBRA coverage, then, at that point, that qualified beneficiary and every one of the qualified beneficiaries in their family might have the option to expand COBRA continuation coverage for up to an extra 11 months, for a total of 29 months.

Nonetheless, to have this right, qualified beneficiaries should notify the plan manager about the disability of determination within 60 days of the date of the determination and before the lapse of the 18-month time frame.

Medicare eligibility Special Rule for Dependent-18 to 36-Month Period: If a covered worker becomes qualified for Medicare benefits (either Part A or Part B) and later has an end of employment or a decrease of business hours, the time of COBRA coverage for the worker's spouse and dependent children goes on until some other time of the three-year time frame that starts on the date the covered worker became qualified for Medicare, or the 18-or 29-month duration that starts on the date of the covered worker's end of job or decrease of work hours.

Second Qualifying Event-18 to 36-Month Period: A spouse and dependent children who as of now have COBRA coverage, and experience a second Qualifying Event, might be qualified for a total of three years of COBRA coverage.

Second qualifying events might incorporate the demise of the covered worker, separate or lawful partition from the covered worker, the covered worker becoming qualified for Medicare benefits under Part A, Part B, or both, or a dependent child stopping to be qualified for coverage as a dependent under the group health plan. The accompanying circumstances should be met briefly in order to expand the time of coverage:

- The initial qualifying event is the covered worker's termination or decrease of hours, of job, which requires an 18-month time of continuation coverage.

- The second event that brings about a three-year most maximum coverage period happens during the underlying 18-month time of continuation coverage or within the 29-month time of coverage assuming a disability extension applies.

- The second qualifying event would have made an eligible beneficiary lose coverage under the plan without any initial qualifying event.

- The individual was an eligible beneficiary regarding the first qualifying event and is as yet an eligible beneficiary at the second event.

The individual meets any relevant COBRA notice prerequisite regarding a second event, for example, advising the plan manager of a divorce or a child ceasing to be ward under the plan within 60 days after the event. Assuming all conditions related to a second event are met, the time of continuation coverage for the impacted qualified beneficiary is stretched out from a year and a half (or 29 months) to three years.

Paying for Coverage

Group health coverage for COBRA members is typically more costly than health coverage for active workers since normally the business pays a piece of the premium for active workers while COBRA members by and large pay the entire premium themselves. COBRA coverage might be more affordable, however, than individual health coverage.

Premiums for COBRA continuation coverage can't surpass 102% of the cost for the plan for similarly situated people who have not encountered a COBRA qualifying event. The cost for the plan is both the part paid by workers and any piece paid by the employer before the qualifying event. The COBRA premium can rise to 100% of that combined amount in addition to a 2 percent regulatory charge.

For instance, if the cost of giving medical benefits coverage to a similarly situated worker who has not encountered a COBRA qualifying event is $400 each month, $100 of which is paid by the worker and $300 of which is paid by the employer, the plan might charge an individual a COBRA premium of up to $408 each month which is 102% times $400.

The business isn't liable for any part of the person's COBRA premium, however may assume it wishes, to pay a part, or all, of the eligible beneficiary's premium. For qualified beneficiaries getting the 11-month disability-based extension of coverage, the premium for those extra months might be expanded from 102% to 150 percent of the plan's total cost of coverage as long as the debilitated qualified beneficiary takes an interest in the additional coverage.

Non-disabled qualified beneficiaries might take part in the additional coverage regardless of whether the disabled qualified beneficiary. On that occasion, the plan can't charge the non-disabled qualified beneficiaries that take an interest in the 11-month expansion more than the 102% rate for the whole time of coverage, including the nineteenth through the 29th month of coverage.

COBRA charges might be expanded on the off chance that the expenses for the arrangement increment for similarly situated non-COBRA beneficiaries, at the same time, for COBRA purposes, such charges commonly should be fixed ahead of every year premium cycle. The plan should permit you to pay premium consistently, assuming you wish, however may give you the choice to make payments at different stretches, for instance, week after week or quarterly.

You or somebody on your behalf should make the initial premium payment within 45 days after the date of your COBRA election; the payment for the most part should cover the period from the coverage loss date during that time in which the initial payment is made. In any case, in the event that you just need COBRA coverage for a brief timeframe, for example, a couple of months, you can pay just for those months from the coverage loss date.

After you make the initial premium payment, resulting expenses normally paid consistently are viewed as timely whenever made by the date due or within a grace period time of 30 days after the date due or a longer period as applies to or under the plan. Payment is viewed as made on the date it is sent to the plan.

On the off chance that you don't make premium payments by the first day of the time of coverage, the plan has the choice to drop coverage until payment is received and afterward reestablish the coverage retroactively to the start of the time of coverage assuming payment is made within the grace period.

Then again, the plan can hold any claims got during the grace time and afterward process them assuming that the premium payment is made within the grace period, or deny them and end coverage viable the first day of the time of coverage for which payment isn't made within the grace period.

Assuming the amount of the payment you make to the plan is mistaken however isn't fundamentally exactly the amount due, the plan accepts the payment as fulfilling the plan's prerequisite for the amount that should be paid. On the other hand, the plan is expected to advise you of the deficiency and grant a sensible period, for this reason, 30 days is thought of as sensible to pay the distinction. The plan isn't committed to sending monthly premium notifications or payment coupons.

COBRA beneficiaries stay subject to the standards of the plan and in this way should fulfill all costs connected with co-payments and deductibles.

Is COBRA coverage expensive?

COBRA can be altogether more costly than what you paid under your manager's plan. Why? Under COBRA you pay 100 percent of the cost for the health plan. This incorporates any costs your employer recently helped pay. This additional cost can make this coverage more costly for you, despite the fact that it's a similar health plan.

Qualifying for COBRA Health Insurance

COBRA health coverage must be utilized in specific circumstances. These circumstances are at times called, qualifying events. There are various plans of rules for various workers and others who might be qualified for COBRA coverage. As well as meeting these models, qualified workers can commonly just get COBRA coverage following specific qualifying events, as mentioned below.

- Employers with at least 20 full-time workers are generally commanded to offer COBRA coverage. The working hours of part-time workers can be clubbed together to make a full-time-equivalent worker, which chooses the general COBRA applicability for the business. COBRA applies to plans presented by private-sector employers and those supported by most local and state legislatures.

Government workers are covered by regulations like COBRA. Moreover, many states have local regulations like COBRA. These normally apply to health insurers of businesses having less than 20 workers and can be called mini-COBRA plans.

- The COBRA-qualified workers should be signed up for an organization-supported group health insurance plan anticipate the day preceding the qualifying event occurs. The insurance plan should be successful on over half of the employer's typical business in the past scheduled year.

- You have probably been laid off, terminated, resigned, quit, or had your work hours cut to the point that your employer is not generally expected to cover you under a group health plan.

- The employer should keep on offering its current workers a health plan for the departing employee to fit the bill for COBRA. If there should arise an occurrence of the business leaving the business or the employer no longer offering insurance to existing workers, for example, assuming the number of workers dips under 20, the withdrawing worker may as of now not be qualified for COBRA coverage.

- The qualifying event should bring about a loss of the worker's health care coverage. The kind of qualifying event decides the list of qualified recipients, and conditions fluctuate for each sort of recipient.

- Assuming you are a ward of somebody who meets all requirements for COBRA in light of the above-mentioned points, you might be qualified, as well.

- Assuming you are a spouse who divorces or documents for lawful detachment from the worker, you might qualify.

- A life partner of a worker who expires may likewise meet COBRA qualification.

- On the off chance that you are uncertain whether you meet COBRA qualification necessities, you can contact your manager's HR division. You can likewise contact the insurance carrier for the health plan.

Notices Required of Qualified Beneficiaries

A worker or qualified beneficiary should inform the plan manager of a qualifying event within 60 days after divorce or legitimate partition if that outcomes in loss of plan coverage or a child's ceasing to be covered as a dependent under the plan's guidelines.

Assuming that a second qualifying event is the demise of the covered worker or the covered worker becoming qualified for Medicare benefits, a group health plan might require qualified beneficiaries to advise the plan manager within 60 days of those events, also. Normally, the business is answerable for informing the plan manager of an event that is the demise of a covered worker or the covered beneficiary becoming qualified for Medicare benefits.

Notwithstanding, on the off chance that the covered workers have been terminated, the business may not be in a situation to know about those events. On the off chance that the arrangement doesn't need a qualified beneficiary to advise the plan within 60 days of a second qualifying event that is the demise of the covered worker or the covered beneficiary becoming qualified for Medicare benefits, a qualified beneficiary ought to give that notification by the later of the last day of the 18-month period or the date that is 60 days after the date of the second event.

Is COBRA insurance appropriate for you?

COBRA has upsides and downsides, contingent upon your circumstance. It gives you a similar coverage you had under your manager. This implies you can keep your medical coverage plan even after you leave a job. Do you hope to be out of a job for an extended period timeframe? Assuming this is the case, coverage under COBRA implies you can keep on seeing your doctor and get similar wellbeing plan benefits. Be that as it may, COBRA might set you back much more and it's accessible for a restricted measure of time.

How Can Deskera Help you?

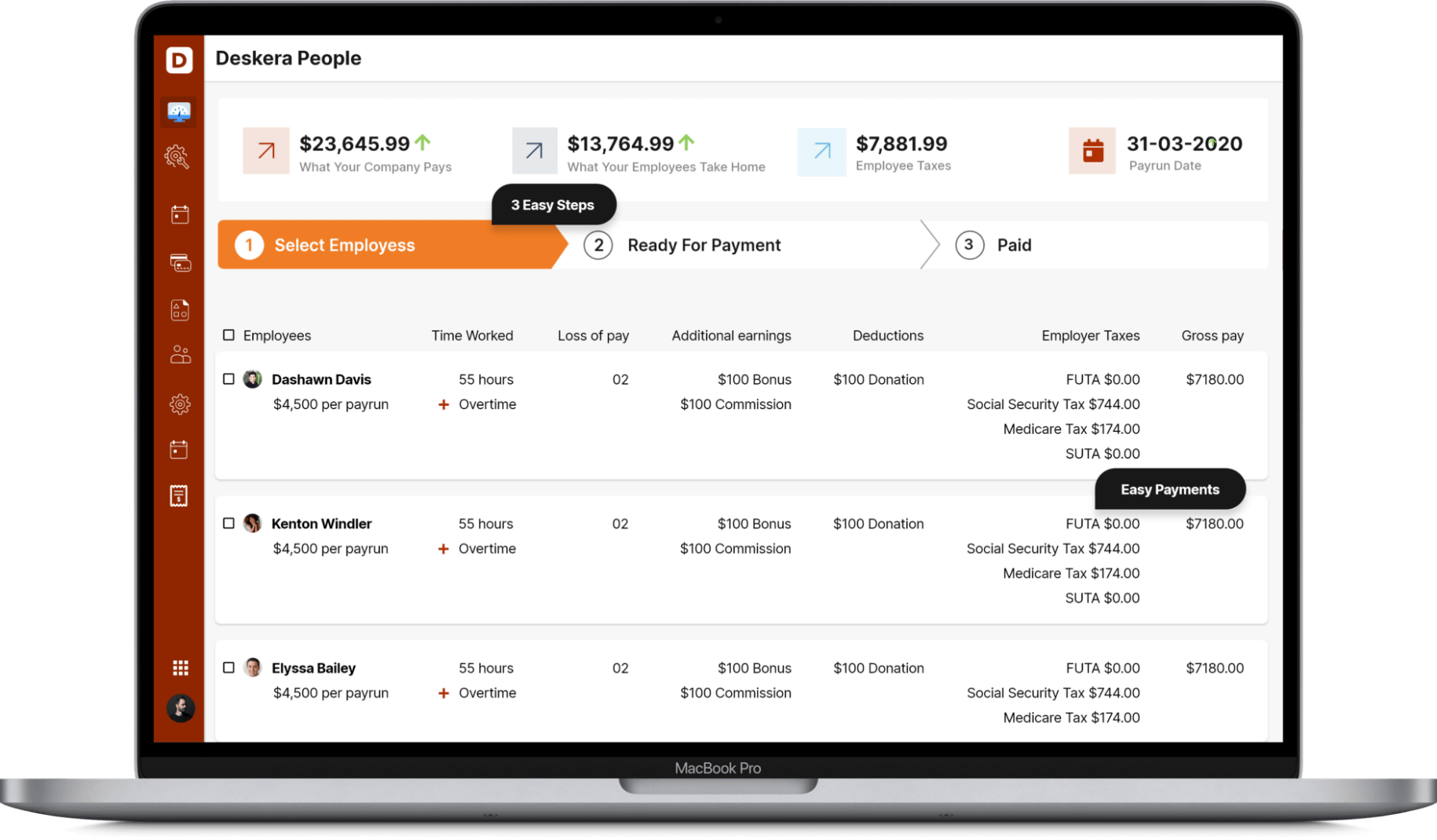

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Conclusion

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a health care coverage program that permits qualified workers and their wards the continued benefits of health insurance coverage when a worker loses their employment or encounters a decrease in work hours.

Key takeaways

- Assuming you have lost your medical coverage because of employment loss during the 2020 financial emergency, you meet all requirements for a "special enrollment" period on the government exchange, which allows you 60 days to enlist. This might be a method for tracking down a less expensive medical coverage choice than COBRA.

- People who accept their COBRA benefits are being exploited have a private right of action. The COBRA regulation just applies to group health plans kept up with by managers with at least 20 workers in the earlier year.

- Health care coverage insurance from COBRA reaches out for a restricted time of 18 or three years, contingent on applicable situations.

- The cost of COBRA coverage is generally high in light of the fact that the recently unemployed individual pays the whole expense of the insurance employers as a rule pay a huge part of medical services charges for workers.

Related articles