The Employees’ State Insurance Act, 1948 is one of the most important laws that provide social security. It contains six kinds of ESI benefits that injured employees can avail themselves of. All of these benefits must arise in the course of employment in order to enable workers to access them.

Section 46 of the Act describes all benefits that an injured employee can avail of. It is important to note that a worker can avail of these benefits in the course of employment only. In this article, we will learn all about these benefits in brief.

This article covers the following:

- Employee State Insurance Act

- Benefits under Employee State Insurance Act

- Sickness benefits

- Temporary Disablement benefits

- Maternity benefits

- How can Deskera assist you?

Employee State Insurance Act

An Act to provide for certain benefits to employees in case of sickness, maternity, and employment injury and to make provision for certain other matters in relation thereto.

Whereas it is expedient to provide for certain benefits to employees in case of sickness, maternity, and employment injury and to make provision for certain other matters in relation thereto.

This Act may be called the Employees' State Insurance Act, 1948. It extends to the whole of India. It shall come into force on such date or dates as the Central Government may, by notification in the Official Gazette, appoint, and different dates may be appointed for different provisions of this Act and for different States or for different parts thereof.

It shall apply, in the first instance, to all factories (including factories belonging to the Government) other than seasonal factories. Provided that nothing contained in this sub-section shall apply to a factory or establishment belonging to or under the control of the Government whose employees are otherwise in receipt of benefits substantially similar or superior to the benefits provided under this Act.

The appropriate Government may, in consultation with the Corporation and where the appropriate Government is a State Government, with the approval of the Central Government, after giving one month’s notice of its intention of so doing by notification in the Official Gazette, extend the provisions of this Act or any of them, to any other establishment or class of establishments, industrial, commercial, agricultural or otherwise.

Provided that where the provisions of this Act have been brought into force in any part of a State, the said provisions shall stand extended to any such establishment or class of establishments within that part if the provisions have already been extended to a similar establishment or class of establishments in another part of that State.

A factory or an establishment to which this Act applies shall continue to be governed by this Act, notwithstanding that the number of persons employed therein at any time falls below the limit specified by or under this Act or the manufacturing process therein ceases to be carried on with the aid of power.

In this Act, unless there is anything repugnant in the subject or context, appropriate Government means, in respect of establishments under the control of the Central Government or a railway administration or a major port or a mine or oil field, the Central Government, and in all other cases, the State Government “confinement” means labor resulting in the issue of a living child, or labor after twenty-six weeks of pregnancy resulting in the issue of a child whether alive or dead.

Contribution means the sum of money payable to the Corporation by the principal employer in respect of an employee and includes any amount payable by or on behalf of the employee in accordance with the provisions of this Act.

Corporation” means the Employees' State Insurance Corporation set up under this Act; “dependent” means any of the following relatives of a deceased insured person, namely.

(i) A widow, a legitimate or adopted son who has not attained the age of twenty-five years, an unmarried legitimate or adopted daughter; a widowed mother

(ii) If wholly dependent on the earnings of the insured person at the time of his death, a legitimate or adopted son or daughter who has attained the age of twenty-five years and is infirm;

(iii) If wholly or in part dependent on the earnings of the insured person at the time of his death:

(a) A parent other than a widowed mother,

(b) A minor illegitimate son, an unmarried illegitimate daughter, or a daughter legitimate or adopted or illegitimate if married and a minor or if widowed and a minor,

(c) A minor brother or an unmarried sister or a widowed sister if a minor) a widowed daughter-in-law,

(d) A minor child of a pre-deceased son,

(e) A minor child of a pre-deceased daughter where no parent of the child is alive, or

(f) A paternal grand-parent if no parent of the insured person is alive.

Duly appointed” means appointed in accordance with the provisions of this Act or with the rules or regulations made thereunder; ”employment injury” means a personal injury to an employee caused by accident or an occupational disease arising out of and in the course of his employment, being insurable employment, whether the accident occurs or the occupational disease is contracted within or outside the territorial limits of India.

Employee means any person employed for wages in or in connection with the work of a factory or establishment to which this Act applies.

(i) who is directly employed by the principal employer on any work of, or incidental or preliminary to or connected with the work of, the factory or establishment, whether such work is done by the employee in the factory or establishment or elsewhere.

(ii) who is employed by or through an Immediate employer on the premises of the factory or establishment or under the supervision of the principal employer or his agent on work which is ordinarily part of the work of the factory or establishment or which is preliminary to the work carried on in or incidental to the purpose of the factory or establishment;

(iii) whose services are temporarily lent or let on hire to the principal employer by the person with whom the person whose services are so lent or let on hire has entered into a contract of service; and includes any person employed for wages on any work connected with the administration of the factory or establishment or any part, department or branch thereof or with the purchase of raw materials for.

Be it the distribution or sale of the products of, the factory or establishment; or any person engaged as an apprentice, not being an apprentice engaged under the Apprentices Act, 1961, and includes such person engaged as apprentice whose training period is extended to any length of time; but does not include any member of the Indian naval, military or air forces; or

(b) any person so employed whose wages (excluding remuneration for overtime work) exceed such wages as may be prescribed by the Central Government a month.

Provided that an employee whose wages (excluding remuneration for overtime work) exceed eight such wages as may be prescribed by the Central Government] a month at any time after (and not before) the beginning of the contribution period shall continue to be an employee until the end of that period.

Exempted employee” means an employee who is not liable under this Act to pay the employee's contribution family” means all or any of the following relatives of an insured person, namely:-

(i) a spouse;

(ii) a minor legitimate or adopted child dependent upon the insured person;

(iii) a child who is wholly dependent on the earnings of the insured person and who is-

(a) receiving education till he or she attains the age of twenty-one years,

(b) an unmarried daughter;

(iv) a child who is infirm because of any physical or mental abnormality or injury and is wholly dependent on the earnings of the insured person, so long as the infirmity continues;

(v) Dependent parents, whose income from all sources does not exceed such income as may be prescribed by the Central Government;

(vi) in case the insured person is unmarried, and his or her parents are not alive, a minor brother or sister wholly dependent upon the earnings of the insured person “factory” means any premises including the precincts thereof whereon ten or more persons are employed or were employed on any day of the preceding twelve months, and in any part of which a manufacturing process is being carried on or is ordinarily so carried on, but does not include a mine subject the operation of the Mines Act, 1952 (35 of 1952) or a railway running shed.

“Immediate employer,” in relation to employees employed by or through him, means a person who has undertaken the execution on the premises of a factory or an establishment to which this Act applies or under the supervision of the principal employer or his agent, of the whole or any part of any work which is ordinarily part of the work of the factory or establishment of the principal employer or is preliminary to the work carried on in.

Be it incidental to the purpose of, any such factory or establishment, and includes a person by whom the services of an employee who has entered into a contract of service with him are temporarily lent or let on hire to the principal employer and includes a contractor.

Insurable employment” means employment in a factory or establishment to which this Act applies. Insured person means a person who is or was an employee in respect of whom contributions are or were payable under this Act and who is, by reason thereof, entitled to any of the benefits provided by this Act;

Managing agent” means any person appointed or acting as the representative of another person for the purpose of carrying on such other person's trade or business, but does not include an individual manager subordinate to an employer; “manufacturing process” shall have the meaning assigned to it in the Factories Act, 1948.

Miscarriage” means expulsion of the contents of a pregnant uterus at any period prior to or during the twenty-six week of pregnancy but does not include any miscarriage, the causing of which is punishable under the Indian Penal Code “occupier” of the factory shall have the meaning assigned to it in the Factories Act.

“Permanent partial disablement” means such disablement of a permanent nature, as it reduces the earning capacity of an employee in every employment which he was capable of undertaking at the time of the accident resulting in the disablement.

Provided that every injury specified in Part II of the Second Schedule shall be deemed to result in permanent partial disablement, “permanent total disablement” means such disablement of a permanent nature incapacitates an employee for all work that he was capable of performing at the time of the accident resulting in such disablement.

Provided that permanent total disablement shall be deemed to result from every injury specified in Part I of the Second Schedule or from any combination of injuries specified in Part II thereof where the aggregate percentage of the loss of earning capacity, as specified in the said Part II against those injuries, amounts to one hundred percent or more.

Power shall have the meaning assigned to it in the Factories Act, 1948 “prescribed” means prescribed by rules made under this Act; Principal employer” means

(i) in a factory, the owner or occupier of the factory and includes the managing agent of such owner or occupier, the legal representative of a deceased owner or occupier, and where a person has been named as the manager of the factory under the Factories Act, 1948, the person so named.

(ii) in any establishment under the control of any department of any Government of India, the authority appointed by such Government on this behalf or where no authority is so appointed, the head of the department;

(iii) in any other establishment, any person responsible for the supervision and control of the establishment. “regulation” means a regulation made by the Corporation; “Schedule” means a Schedule to this Act.

Benefits

Subject to the provisions of this Act, the insured persons, 1[their dependents or the persons hereinafter mentioned, as the case may be, shall be entitled to the following benefits, namely:

(a) periodical payments to any insured person in case of his sickness certified by a duly appointed medical practitioner or by any other person possessing such qualifications and experience as the Corporation may, by regulations, specify in this behalf hereinafter referred to as sickness benefit.

Periodical payments to an insured woman in case of confinement or miscarriage or sickness arising out of pregnancy, confinement, premature birth of child or miscarriage, such woman being certified to be eligible for such payments by an authority specified on this behalf by the regulations (hereinafter referred to as maternity benefit.

(c) periodical payments to an insured person suffering from disablement as a result of an employment injury sustained as an employee under this Act and certified to be eligible for such payments by an authority specified on this behalf by the regulations (hereinafter referred to as disablement benefit)

(d) periodical payments to such dependents of an insured person who dies as a result of an employment injury sustained as an employee under this Act, as are entitled to compensation under this Act (hereinafter referred to as dependents benefit).

(e) medical treatment for attendance on insured persons (hereinafter referred to as medical benefit).

(f) Payment to the eldest surviving member of the family of an insured person who has died, towards the expenditure on the funeral of the deceased insured person or, where the insured person did not have a family or was not living with his family at the time of his death, to the person who actually incurs the expenditure on the funeral of the deceased insured person.

Sickness Benefits

Sickness Benefit represents periodical cash payments made to an IP during the period of certified sickness occurring in a benefit period when the IP requires medical treatment and attendance with abstention from work on medical grounds. Prescribed certificates are; Forms 8,9,10,11 & ESIC-Med.13.

The sickness benefit is 70% of the average daily wages and is payable for 91 days during 2 consecutive benefit periods.

The qualification of a person to claim sickness benefit, the conditions subject to which such benefit may be given, and the rates and period thereof shall be such as may be prescribed by the Central Government.

Maternity benefit is the qualification of an insured woman to claim maternity benefit, the conditions subject to which such benefit may be given, and the rates and period thereof shall be such as may be prescribed by the Central Government.

Disablement benefit is subject to the provisions of this Act

(a) a person who sustains temporary disablement for not less than three days (excluding the day of the accident) shall be entitled to periodical payment 5[at such rates and for such periods and subject to such conditions as may be prescribed by the Central Government;

(b) a person who sustains permanent disablement, whether total or partial, shall be entitled to periodical payment 6[at such rates and for such period and subject to such conditions as may be prescribed by the Central Government.

Presumption as to accident arising in the course of employment. For the purposes of this Act, an accident arising in the course of 9[an employee’s] employment shall be presumed, in the absence of evidence to the contrary, also to have arisen out of that employment

Accidents are happening while acting in breach of regulations, etc. An accident shall be deemed to arise out of and in the course of employment, notwithstanding that he is at the time of the accident acting in contravention of the provisions of any law applicable to him or of any orders given by or on behalf of his employer or that he is acting without instructions from his employer, if:

(a) the accident would have been deemed so to have arisen had the act not been done in contravention as aforesaid on or without instructions from his employer, as the case may be. (b) the act is done for the purpose of and in connection with the employer's trade or business.

Accidents happen while traveling in employer's transport.

(1) An accident happening while an employee is, with the express or implied permission of his employer, traveling as a passenger by any vehicle to or from his place of work shall, notwithstanding that he is under no obligation to his employer to travel by that vehicle, be deemed to arise out of and in the course of his employment, if-

(a) The accident would have been deemed so to have arisen had he been under such obligation; (b) at the time of the accident, the vehicle

(i) Is being operated by or on behalf of his employer or some other person by whom it is provided in pursuance of arrangements made with his employer.

(ii) Is not being operated in the ordinary course of public transport service.

(2) In this section, “vehicle” includes a vessel and an aircraft. Accidents happen while meeting the emergency.

An accident happening to an employee in or about any premises at which he is for the time being employed for the purpose of his employer's trade or business shall be deemed to arise out of and in the course of his employment if it happens while he is taking steps, on an actual or supposed emergency at those premises, to rescue, succor or protect persons who are, or are thought to be, or possibly to be, injured or imperiled, or to avert or minimize serious damage to property.

Accidents happen while commuting to the place of work and vice versa. An accident occurring to an employee while commuting from his residence to the place of employment for duty or from the place of employment to his residence after performing duty shall be deemed to have arisen out of and in the course of employment if there is a nexus between the circumstances, time and place in which the accident occurred, and the employment is established.

Dependent's Benefit

(1) If an insured person dies as a result of an employment injury sustained as an employee under this Act, whether or not he was in receipt of any periodical payment for temporary disablement in respect of the injury dependents' benefit shall be payable at such rates and for such period and subject to such conditions as may be prescribed by the Central Government] to his dependents specified in sub-clause.

In case the insured person dies without leaving behind him the dependents as aforesaid, the dependents' benefit shall be paid to the other dependents of the deceased at such rates and for such period and subject to such conditions as may be prescribed by the Central Government.

Occupational disease

If an employee employed in any employment specified in Part A of the Third Schedule contracts any disease specified therein as an occupational disease peculiar to that employment, or if an employee employed in the employment specified in Part B of that Schedule for a continuous period of not less than six months contracts any disease specified.

Therein as an occupational disease peculiar to that employment or if an employee employed in any employment specified in Part C of that Schedule for such continuous period as the Corporation may specify in respect of each such employment, contracts any disease specified therein as an occupational disease peculiar to that employment, the contracting of the disease shall unless the contrary is proved, be deemed to be an “employment injury” arising out of and in the course of employment.

Where the Central Government or a State Government, as the case may be, adds any description of employment to the employments specified in Schedule III to the Workmen's Compensation Act, 1923 by virtue of the powers vested in it under the subsection of Section 3 of the said Act, the said description of employment and the occupational diseases specified under that sub-section as peculiar to that description of employment shall be deemed to form part of the Third Schedule.

(ii) Without prejudice to the provisions of clause

(i)The Corporation, after giving, by notification in the Official Gazette, not less than three months' notice of its intention so to do, may by a like notification, add any description of employment to the employments specified in the Third Schedule and shall specify in the case of employments so added the diseases which shall be deemed for the purposes of this section to be occupational diseases peculiar to those employments respectively and thereupon the provisions of this Act shall apply as if such diseases had been declared by this Act to be occupational diseases peculiar to those employments.

(3) Save as provided by subsections 1 and 2, no benefit shall be payable to an employee in respect of any disease unless the disease is directly attributable to a specific injury by accident arising out of and in the course of his employment. The provisions of Section 51-A shall not apply to the cases to which this section applies.

Determination of question of disablement.

(a) whether the relevant accident has resulted in permanent disablement; or

(b) whether the extent of loss of earning capacity can be assessed provisionally or finally; or

(c) whether the assessment of the proportion of the loss of earning capacity is provisional or final; or

(d) in the case of provisional assessment, the period for which such assessment shall hold good shall be determined by a medical board constituted in accordance with the provisions of the regulations, and any such question shall hereinafter be referred to as the “disablement questions.”

Review of dependents' benefits

(1) Any decision awarding dependents' benefit under this Act may be reviewed at any time by the Corporation if it is satisfied by fresh evidence that the decision was given in consequence of non-disclosure or misrepresentation by the claimant or any other person of a material fact (whether the non-disclosure or misrepresentation was or was not fraudulent) or that the decision is no longer in accordance with this Act due to any birth or death or due to the marriage, re-marriage of the infirmity of, or attainment of the age of eighteen years by the claimant.

(2) Subject to the provisions of this Act, the Corporation may, on such review as aforesaid, direct that the dependents' benefit is continued, increased, reduced, or discontinued.

Medical benefit

(1) An insured person or (where such medical benefit is extended to his family) a member of his family whose condition requires medical treatment and attendance shall be entitled to receive the medical benefit.

(2) Such medical benefit may be given either in the form of out-patient treatment and attendance in a hospital or dispensary, clinic, or other institution or by visits to the home of the insured person or treatment as an in-patient in a hospital or other institution.

(3) A person shall be entitled to medical benefit during any period for which contributions are payable in respect of him or in which he is qualified to claim sickness benefit or maternity benefit or is in receipt of such disablement benefit as does not disentitle him to medical benefit under the regulations.

Provided that a person in respect of whom contribution ceases to be payable under this Act may be allowed medical benefit for such period and of such nature as may be provided under regulations.

Provided further that an insured person who ceases to be in insurable employment on account of permanent disablement shall continue, subject to payment of contribution and such other conditions as may be prescribed by the Central Government, to receive medical benefit till the date on which he would have vacated the employment on attaining the age of superannuation had he not sustained such permanent disablement.

Provided also that an insured person who has attained the age of superannuation, a person who retires under a Voluntary Retirement Scheme or takes premature retirement, and his spouse shall be eligible to receive medical benefits subject to payment of contribution and such other conditions as may be prescribed by the Central Government.

In this section, “superannuation,” in relation to an insured person, means the attainment by that person of such age as is fixed in the contract or conditions of service as the age on the attainment of which he shall vacate the insurable employment or the age of sixty years where no such age is fixed and the person is no more in the insurable employment.

The scale of medical benefit

(1) An insured person and (where such medical benefit is extended to his family) his family shall be entitled to receive the medical benefit only of such kind and on such scale as may be provided by the State Government or by the Corporation, and an insured person or, where such medical benefit is extended to his family, his family shall not have a right to claim any medical treatment except such as is provided by the dispensary, hospital, clinic or other institution to which he or his family is allotted, or as may be provided by the regulations.

(2) Nothing in this Act shall entitle an insured person and (where such medical benefit is extended to his family) his family to claim reimbursement from the Corporation of any expenses incurred in respect of any medical treatment, except as may be provided by the regulations.

What are the Contributory Conditions?

The contribution condition required to be fulfilled for admissibility of sickness benefit during any benefit period is that contributions should have been paid in respect of an insured person in the corresponding contribution period for not less than 78 days.

How much is the Standard Benefit Rate?

The daily rate of Sickness Benefit during any benefit period is the “standard benefit rate” this rate corresponds to the average daily wage of an insured person during the corresponding contribution period and is roughly half of the daily wage rate.

The benefit is paid for Sundays also. 28 wage groups have evolved for working out the daily rate of Standard Sickness Benefit. Standard Benefit rates for 28 wage groups are shown in Annexure ‘A’.

What is the duration of the Sickness Benefit?

Sickness benefit is payable for a maximum period of 91 days in any two consecutive benefit periods. The benefit is not paid for an initial waiting period of 2 days unless the insured person is certified sick within 15 days of the last spell in which Sickness Benefit was paid.

What are the Contributory Conditions? Except in case of disability from the administration of drugs/injections, the insured person should have been in continuous employment for a period of 2 years and should have contributed for at least 156 days in 4 preceding contribution periods.

How much is the Benefit rate?

The daily rate of Extended Sickness Benefit is 40% more than the Standard Sickness Benefit rate admissible.

How long is the Benefit available?

After exhausting Sickness Benefit payable for 91 days, the ESB is payable up to a further period of 124/309 days that can be extended up to 2 years in special circumstances.

Thus, together with the Sickness Benefit for 91 days, it puts a claimant on benefit for an aggregate period of 400 days for all specified diseases and two years in suitable chronic cases on the recommendation of competent authority.

Qualifying Conditions

(i) To become eligible for Sickness Benefit, an IP should have paid a contribution for not less than 78 days during the corresponding contribution period.

(ii) A person who has entered into insurable employment for the first time has to wait for nearly 9 months before becoming eligible for sickness benefit because his corresponding benefit period starts only after that interval.

(iii) Sickness Benefit is not payable for the first two days of a spell of sickness except in case of a spell commencing within 15 days of closure of an earlier spell for which sickness benefit was last paid.

This period of 2 days is called the "waiting period." This provision should be clearly understood by IMOs/IMPs as actual experience shows that such IPs who want to avail medical leave on flimsy grounds generally come for First Certificate/First & Final Certificate within 15 days of the earlier spell, usually on unpaid holidays and/or on each weekly off, etc., to avoid loss of benefit for 2 days due to fresh waiting period.

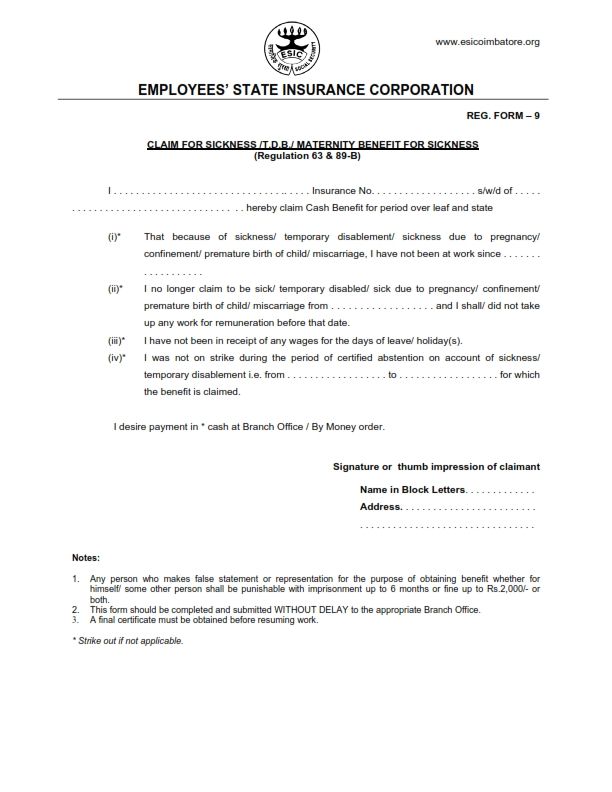

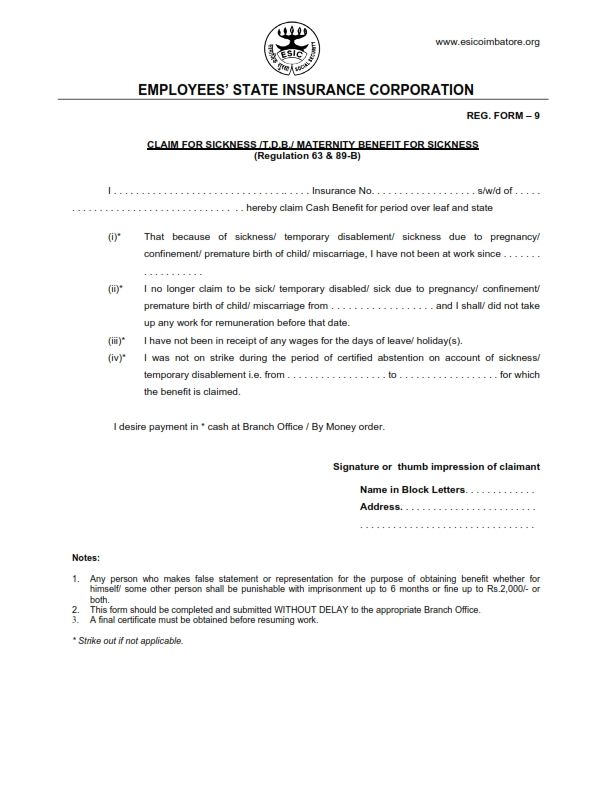

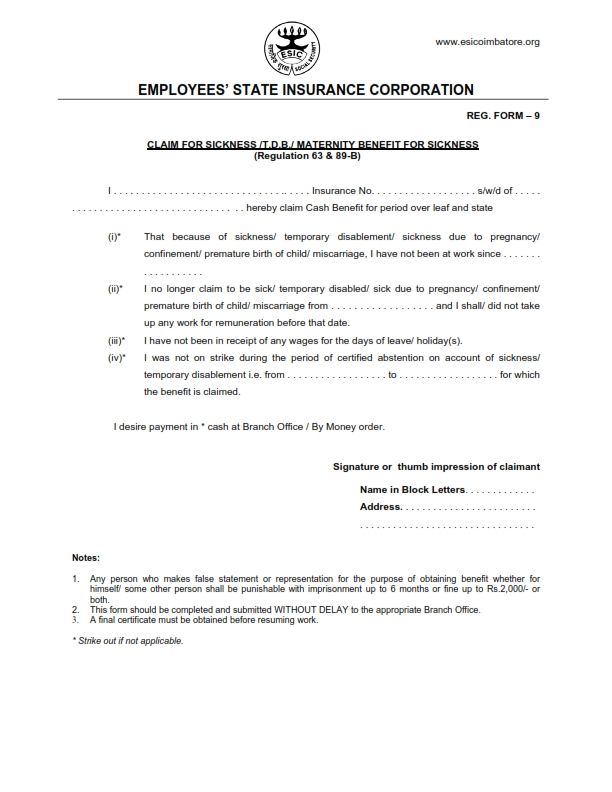

How to Claim Sickness Benefit?

A claim for Sickness Benefit should be supported by a Medical Certificate issued by an Insurance Medical Officer/Insurance Medical Practitioner in the appropriate Form.

Medical Certificates are issued at intervals of not more than seven days, except in cases of prolonged sickness, where Special Intermediate Certificates may be issued at longer intervals not exceeding four weeks.

On the back of each certificate, except the Special Intermediate Certificate, a Claim Form is printed. The Claim Form is essentially a declaration in regard to the abstention of the claimant from work during the period of the claim.

Separate Claim Forms are also available. The Claim Form should bear signatures/thumb impression of the claimant and should be submitted to the Local Office personally, by post, through a messenger, or by a deposit in certificate boxes, wherever provided.

All claims should be preferably submitted to the Local Office within three days. The Receptionist at the Local Office renders all assistance in filling in the claim on your behalf.

Note:

1. If any employee misrepresents this form then they may get Imprisonment for 6 months or Rs. 2000 fine and in some cases both punishments will be given to such employees.

2. ESIC Form 9 should be submitted to respective ESIC office with out any delay.

3. Insured person must collect the final acknowledgement before resuming to his job.

Temporary Disablement Benefit

TDB is payable to an employee who suffers employment injury (EI) or Occupational Disease and is certified to be temporarily incapable to work.

"Employment Injury" has been defined under Section 2(8) of the Act, as a personal injury to an employee caused by accident or occupational disease arising out of and in the course of his employment, being in insurable employment, whether the accident occurs or the occupational disease is contracted within or outside the territorial limits of India.

(b) Certificates Required for TDB:

Accident Report in form 16, Form 8,9,10, 11, and ESIC Med.13.

(c) Eligibility for TDB :

The benefit is not subject to any contributory conditions. An IP is eligible from the day he joins insurable employment.

(d) TDB Rate is 90% of average daily wages.

(e) Duration of TDB :

There is no prescribed limit for the duration of TDB. This is payable as long as temporary disablement lasts and significant improvement by treatment is possible. If a Temporary Disablement spell lasts for less than 3 days (excluding the day of the accident), IP will be paid sickness benefit if otherwise eligible.

A special point for IMOs/IMPs is that some IPs may resist taking a Final Certificate, especially before 3 days, for fear of loss of TDB.

What are ‘Occupational Diseases’?

Occupational Diseases are diseases that are susceptible to being traced back to their occupational origin. These are specified under Schedule III of the Employees’ State Insurance Act, which enumerates the compensable Occupational Diseases, and the corresponding industrial processes involving exposure to the diseases are thus recognized without any further evidence.

What are the Benefits granted?

Temporary Disablement Benefit is paid periodically in arrears as evidence of incapacity (medical certificate) is produced. Permanent total disablement and permanent partial disablement benefits are paid in the form of pensions.

Current employment for wages or engagement in any gainful activities is no bar to payment of permanent disablement benefits. An insured person suffering from an occupational disease is also entitled to full medical care.

How much is the Benefit Rate? The daily benefit rate for permanent total disablement and temporary disablement is 40% more than the Standard Sickness Benefit rate and is roughly equivalent to about 70% of the wage rate.

For permanent partial disablement, the rate of benefit is proportionate to the percentage of loss of earning capacity. The benefit is paid for Sundays also.

What are the Contributory Conditions?

There are no qualifying conditions as to the length of employment or the number of contributions paid. Protection accrues from the very moment of entry into insurable employment.

What is the duration of the Benefit?

Temporary Disablement Benefit is paid as long as disablement lasts. There is a waiting period of 3 days (excluding the day of the accident), but if incapacity exceeds this period, the benefit is paid from the very first day. The permanent disablement benefit is paid for the lifetime of the beneficiary.

How is Permanent Disablement assessed?

There is indeed no way of adequately compensating a permanently disabled employee and yet some method of determining whether an employment injury has resulted in permanent disablement and of assessing the extent of permanent damage caused by that employment injury has to be adopted for the purpose of determining the scale of compensation for the loss of earnings.

This is done by evaluating loss of earning capacity with reference to general disability for all work. The evaluation is done by a Medical Board whose decision can be appealed against to a Medical Appeal Tribunal presided over by a judicial officer, with a further right of appeal to the Employees’ Insurance Court or directly to the Employees’ Insurance Court.

Pending an appeal, payment for permanent loss of earning capacity as recommended by the Medical Board is made, subject to adjustment later. Loss of wages and expenditure on conveyance occasioned by attendance before the Medical Board are compensated by the Corporation in accordance with rates framed for the purpose.

Where the assessment of loss of earning capacity by the Medical Board is not of a final character, the beneficiary is required to appear again before the Medical Board for a review of the assessment.

Can the decisions of the Medical Board or of the Medical Appeal Tribunal be reviewed?

Yes. If the Medical Board or the Medical Appeal Tribunal is satisfied by fresh evidence that a decision was given because of non-disclosure or misrepresentation of a material fact, it can review its earlier decision at any time.

A Medical Board can also review its earlier assessment of the extent of disablement if it is satisfied that there has been substantial and unforeseen aggravation of the results of the relevant injury, and substantial injustice would be done by not reviewing it.

Such review, however, cannot be made earlier than 5 years or, in the case of the provisional assessment, earlier than 6 months of the date of assessment to be reviewed.

Is lump sum Benefit allowed in place of Pension?

Yes. At the option of the beneficiary, a permanent disablement pension, where the daily rate payable is not significant, can be commuted for a lump sum payment subject to the fulfillment of the following two conditions:–

(i) That the permanent disablement has been assessed as final, and (ii) The daily rate of permanent disablement does not exceed Rs. 5/- and the total commuted value does not exceed Rs. 30,000/- (effective from April–03).

How to Claim a Disablement Benefit?

Temporary Disablement:

(i) Notice of the injury should be given either orally or in writing personally or through an agent, to the employer/foreman/duty supervisor, or particulars of the injury should be entered in the Accident Book kept in the factory personally or through an agent.

(ii) A medical certificate of incapacity should be obtained from the Insurance Medical Officer/Insurance Medical Practitioner.

(iii) The claim form printed on the back of the medical certificate should be filled in and submitted promptly to the Local Office along with the medical certificate.

(iv) A final certificate should be obtained from the Insurance Medical Officer/Insurance Medical Practitioner and submitted to the Local Office before the resumption of duty.

Permanent Disablement:

(i) If suffering from permanent effects of employment injury, the insured person should make an application to the Regional Office of the Corporation for reference of his case to the Medical Board (a reference to the Medical Board is made otherwise also by the Regional Office).

(ii) Where the loss of earning capacity has been assessed and communicated to the insured person, he should submit a claim in the appropriate form to the Local Office.

(iii) After the claim has been admitted, the beneficiary should submit at six-monthly intervals (with the claim for June and December every year) a life certificate in appropriate form duly attested by the prescribed authority.

Maternity Benefit

Maternity Benefit is cash payable to an insured woman for the specified period of abstention from work for confinement or miscarriage or for sickness arising out of pregnancy, confinement, premature birth of a child, or miscarriage.

“Confinement” connotes labor resulting in the delivery of a living child or labor after 26 weeks of pregnancy, whether the resultant issue is alive or dead. “Miscarriage” means expulsion of the contents of a pregnant uterus at any period prior to or during the 26th week of pregnancy. Criminal abortion or miscarriage does not, however, entitle to benefit.

Maternity Benefit is payable to an Insured Woman in the following cases subject to contributory conditions:-

- Maternity Benefit is payable for a maximum period of 26 weeks up to 2 surviving children in case of confinement of which not more than 8 weeks shall precede the expected date of confinement, on the production of forms 17, 18, 19, 20, and 21.

- Miscarriage or Medical Termination of Pregnancy (MTP)-payable for 6 weeks (42 days) from the date following a miscarriage.

- Sickness arising out of Pregnancy, Confinement, or Premature birth-payable for a period not exceeding one month on the basis of Forms 7, 8, 9, and 10.

- In the event of the death of the Insured Woman during confinement leaving behind a child, Maternity Benefit is payable to her nominee on the production of Form 24 (B).

- The maternity benefit rate is 100% of average daily wages.

What are the Contributory Conditions?

The contribution condition is the same as for Sickness Benefit.

How much is the Benefit?

The daily benefit rate is double the Sickness Benefit rate and is thus roughly equivalent to the full wages. The benefit is paid for Sundays also.

What is the duration of the Benefit?

The Benefit is paid as follows:–

(a) For confinement:– For a total period of 12 weeks beginning not more than 6 weeks before the expected date of childbirth. If the insured woman dies during confinement or within 6 weeks thereafter, leaving behind the living child, the benefit continues to be payable for the whole of the period. But if the child also dies during that period, the benefit will be paid up to and including the day of death of the child.

(b) For Miscarriage:– For a period of 6 weeks following the date of miscarriage.

(c) For Sickness arising out of pregnancy, confinement, premature birth of a child, or miscarriage:– For an additional period of up to four weeks. In all the cases, the benefit is paid only if the insured woman does not work for remuneration during the period for which the benefit is claimed. There is no waiting period.

How to Claim Maternity Benefit?

Where an insured woman wishes to claim Maternity Benefit after confinement or for miscarriage, she should obtain from the Insurance Medical Officer/Insurance Medical Practitioner a certificate of confinement or miscarriage and submit it to her Local Office personally or by post along with a claim for Maternity Benefit.

The claim form also contains a declaration of abstention from work. If Benefit is desired before confinement, a Notice and Certificate of Pregnancy and a Certificate of Expected Confinement obtained from the Insurance medical Officer/Insurance Medical Practitioner are also required to be submitted.

For claiming Benefits in the event of death of an insured woman leaving behind a child, her nominee, and if there is no such nominee, her legal representative should submit personally or by post to the Local Office of the deceased insured woman, a claim for the Benefit together with a certificate of death of the insured woman.

An insured woman claiming Maternity Benefit for Sickness arising out of pregnancy, confinement, premature birth of a child, or miscarriage should submit her claim in the manner as for sickness benefit. Where a claim to Maternity Benefit is not submitted along with prescribed certificates referred to above, the Corporation has the discretion to accept other evidence in lieu thereof.

What is Medical Bonus?

Medical Bonus is a lump sum payment made to an insured woman or the wife of an insured person in case she does not avail of the medical facility from an ESI hospital at the time of delivery of a child. This bonus of Rs. 250/- has been increased to Rs. 1000/- from 1st April 2003.

For Quicker and Better Service Its Best to Have the Following

- Identity Card is your visa to social security; protects it from loss or damage.

- In case of loss of Identity Card, report the matter to your Local Office/Dispensary.

- Fill in all Claim Forms properly; avoid mistakes.

- Count your money before leaving the Local Office cash counter.

- Apply for examination by Medical Board immediately after your TDB terminates.

- Follow referral procedures for treatment except in emergencies, when the time factor is critical.

- If you have a grievance, contact the Local Office Manager/Dispensary in charge to which you are attached for quick redressal.

- Be courteous with ESI staff and expect courtesy and compassion from them always.

How Can Deskera Assist You?

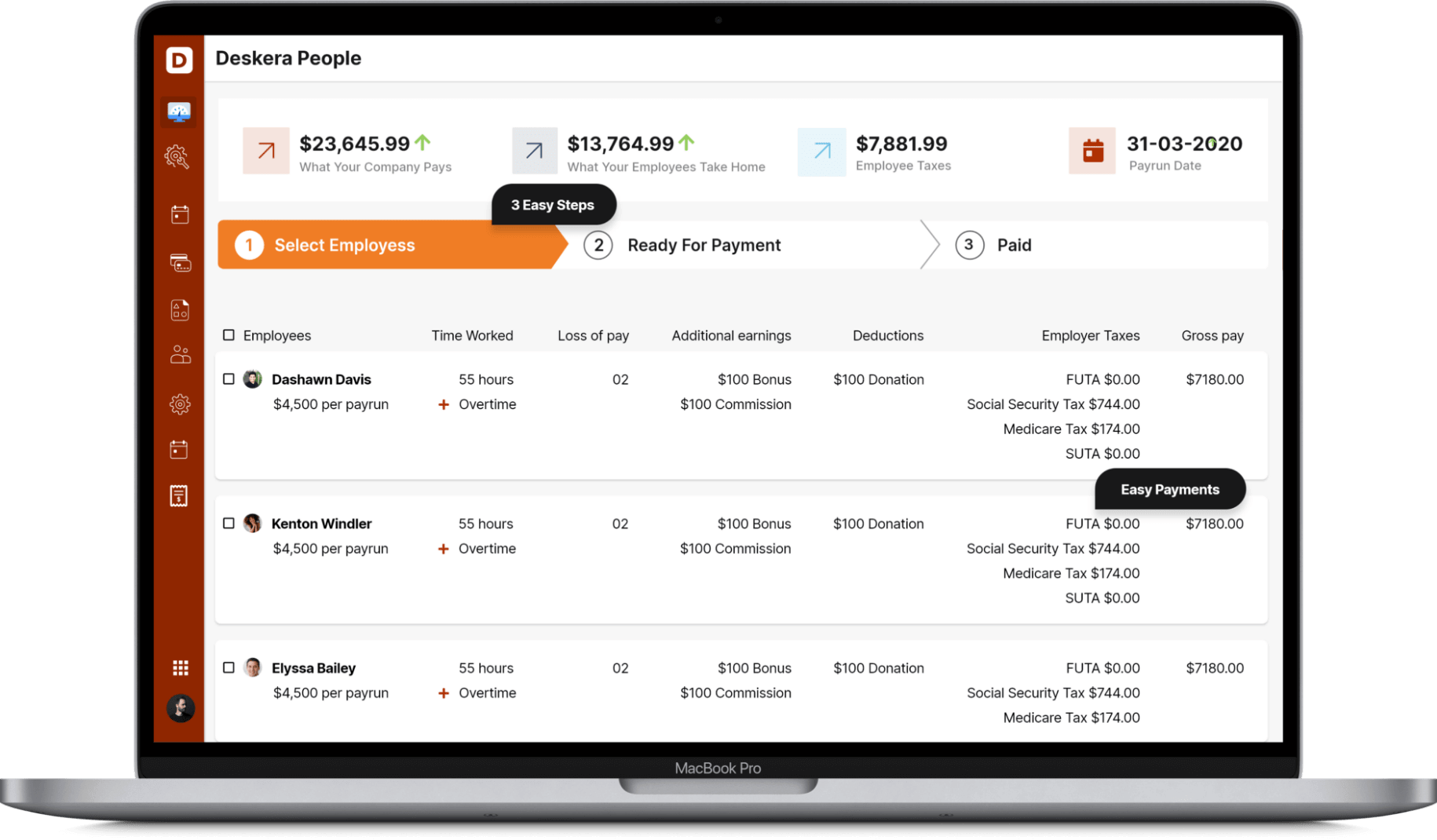

Want to manage your employees under one roof a software. Look no further than Deskera. Whether it is HR & payroll, or you employee information. Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- Employee State Insurance Act is an act to provide for certain benefits to employees in case of sickness, maternity, and employment injury and to make provision for certain other matters in relation thereto.

- Sickness Benefit represents periodical cash payments made to an IP during the period of certified sickness occurring in a benefit period when the IP requires medical treatment and attendance with abstention from work on medical grounds.

- TDB is payable to an employee who suffers employment injury (EI) or Occupational Disease and is certified to be temporarily incapable of working.

- Maternity Benefit is cash payable to an insured woman for the specified period of abstention from work for confinement or miscarriage or for sickness arising out of pregnancy, confinement, premature birth of a child, or miscarriage.

Related Articles