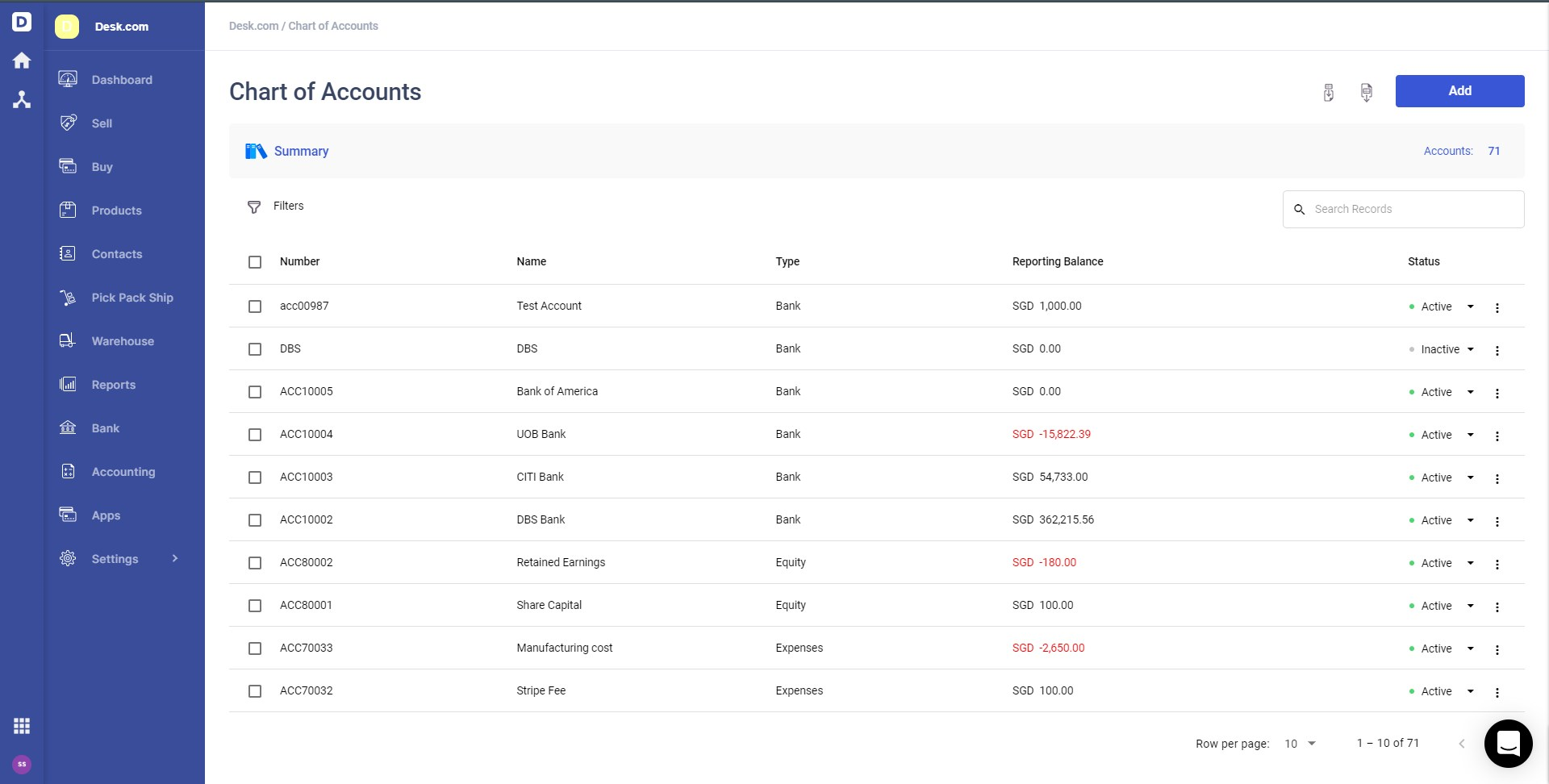

All accounting entries need to be tagged to general ledger accounts. A chart of accounts (COA) is a list of all such general ledger accounts. It contains details of each individual general ledger account including 'Account Code', 'Account Name', 'Account Type', and 'Account Balance'.

What is Chart of Accounts

All accounting entries need to be tagged to general ledger accounts. A chart of accounts (COA) is a list of all such general ledger accounts. It contains details of each general ledger account, including 'Account Code', 'Account Name', 'Account Type', and 'Account Balance'. This is true for both single entry and double-entry accounting.

A typical journal entry is as shown below:

Debit "Account 2" $X

Credit "Account 1" $ X

In the example above, the part in the quotes ("Account 1" and "Account 2") is the general ledger account that is impacted. A list of these is what constitutes your Chart of Account and looks like this:

The chart of accounts is the place where you can:

- See all your general ledger accounts

- Add, edit, and manage the accounts

- View their balances

If you are moving to a new accounting system, the chart of accounts is the first thing you should setup.

What Are the Different Types of Accounts in a Chart of Accounts (COA)?

There are two primary types of accounts in a chart of accounts:

- Balance Sheet Type

- Income Type or P&L Type (P&L stands for Profit and Loss)

The type indicates which financial statement, balance sheet or income statement (aka Profit and Loss Statement), the account goes to. Consequently, the accounts are used for the corresponding transaction documentation.

In most accounting systems though, you may see other options when adding a new account in the chart of accounts. Examples include Assets, Liabilities, Income, Expenses, Cost of Goods Sold, Bank, etc. These are sub-types that are mapped to the Balance Sheet and Income types. These sub-types determine the location or appearance of the account in the corresponding financial statement. One common set of types and sub-types is shown below.

Chart of Accounts

Balance Sheet Type

Assets, Liabilities

Current Assets, Current Liabilities, Cash, Bank, etc

Income Statement Type

Income, Cost of Goods Sold, Expenses, etc

Accounting systems do this because:

- Generally accepted accounting principles (GAAP) determine the mapping between the sub-type like Income and Assets and Liabilities to the main type.

- Improve user experience and remove the extra step of mapping each sub-type to either Balance Sheet or Income Statement and have an additional field.

Some of the common sub-types you would encounter in a chart of accounts are given below.

Example of Balance Sheet Sub Types:

- Assets

- Liabilities

- Equity

- Cash

- Bank

- Current Assets

- Current Liabilities

Example of Income Statement Sub Types:

- Income

- Cost of Goods Sold

- Expenses

- Other Income

- Other Expenses

All your accounts are mapped to one of these sub-types, and your accounting system should take care of mapping the accounts to either balance sheet type or income statement type.

How to Create a Chart of Accounts

The chart of accounts should be created based on the industry and the accounting practices followed by the business. However, there are common themes across that one would come across. Let us take a look at some common general ledger accounts which you are bound to encounter in most chart of accounts.

- Accounts Receivable (aka Trade Debtors): This balance sheet type account captures the amounts of all unpaid invoices. This is mapped to sub-type Current Assets generally. Every time an invoice is created but is not marked paid, a journal entry is created, which debits the Accounts Receivable with the invoice amount. Depending on the business, the chart of accounts can have multiple accounts receivable, like Account Receivables - Local, Accounts Receivable - Overseas, and so on. An example is provided below where a sales invoice is created for $1,500, and the Accounts Receivable is debited.

Debit Accounts Receivable $1,500

Credit Sales $1,500 - Accounts Payable (aka Trade Creditors): This balance sheet type account captures the amounts of all bills that are yet to be paid by the company. Usually, this is mapped to sub-type Current Liabilities. Every time a bill is created but is not marked paid, a journal entry is created, which credits the Accounts Receivable with the bill amount. An example is provided below, where a bill is created for $1,000.

Debit Purchases $1,500

Credit Accounts Payable $1,500 - Sales: As can be seen from the 1st example, for recording any sales invoice, a corresponding 'Sales' or an equivalent account is needed. This is an income statement type account in the chart of accounts and is mapped to sub-type Income. The sales account appears in the profit and loss statement.

- Purchase/Accrued Purchase: As can be seen from the 2nd example, for recording any bill, a corresponding 'Purchases' or an equivalent account is needed. This is an income statement type account in the chart of accounts and appears in the profit and loss statement.

Depending on the type of inventory and/or the inventory valuation method used, this account may be a liability or an expense account. Generally, for perpetual inventory accounting and a tracked good or product (countable inventory), this is a Current Liability sub-type and is denoted as Accrued Purchases, else it is mapped to sub-type Expense and denoted as Purchase. - Inventory: Every time any tracked goods or products are either brought in or send out, the inventory account is impacted. The inventory account shows the total value of all the inventory recorded in the system. This is a balance sheet type of account with the usual sub-type being Current Assets in the chart of accounts. The example below shows the journal entries for goods received (brought in) for $100 and order fulfillment (send out).

Goods Received example

Debit Inventory $100

Credit Accrued Purchases $100

Fulfillment example

Debit Cost of Goods Sold $100

Credit Inventory $100 - Cost of Goods Sold (aka COGS): This account is present in the chart of accounts as an income statement type if perpetual inventory accounting is followed. In periodic inventory accounting, this is calculated on the income statement itself but is not visible in the chart of accounts. As the name explains, Cost of Goods Sold (aka COGS) is an account that shows you the cost of all the items sold, thus helping you arrive at the gross profit margin. You can read more about it in our detailed article on income statement and also on creating a multi-step income statement.

- Expense: This account is used to record the various expenses and shows the value of incurred expenses. Generally, the chart of accounts will have multiple expense accounts like Utility Expense, Advertising Expense, Wage Expense, Rent Expense, Misc Expense, etc. These show up on the income statement. The example below shows an expense for advertising being paid off via a bank.

Debit Advertising Expense $2,000

Credit Bank $2,000 - Cash: As the name suggests, this account shows the value of the total cash in hand available at any point in time. If you have a cash till or register, then the amount of money in the register shows up as a part of this account. This is a balance sheet type account in the chart of accounts. The example below shows how the Cash account is credited when a misc expense is paid off.

Debit Misc Expense $25

Credit Cash $25 - Bank: This is similar to the Cash account, but shows the value of your bank balance (money in the bank account). It is a balance sheet type. Usually, the chart of accounts will have different banks added with the name of the bank being the account name. The example below shows the journal entry when an invoice payment is received and deposited to the bank.

Debit Bank $3,000

Credit Accounts Receivable $3,000

The transactions mapped to the bank accounts are used in the bank reconciliation process.

- Owner's Equity: The company owes the owners money which they invested to start the company. Hence a liability account with sub-type Equity is shown on the balance sheet to account for this. The chart of accounts for a big corporation may show this as Stock Holder's Equity. Here is an example of the journal entry at the start of the company when the owner injects cash into the company.

Debit Cash $100,000

Credit Equity $100,000 - Sales Tax: The sales tax account shows the total amount of taxes collected in a given period. On the chart of accounts, this is generally mapped to Current Liabilities and is shown on the balance sheet. Depending on your tax residency, you may have additional tax accounts for purchasing, or differentiated by the type of product. The example below shows how a sales tax of $50 is captured when an invoice of $1,000 is generated.

Debit Accounts Receivable $1,050

Credit Sales $1,000

Credit Sales Tax $50

There are various accounts that you may come across when setting up your chart of accounts, but these common themes will be present in all of them.

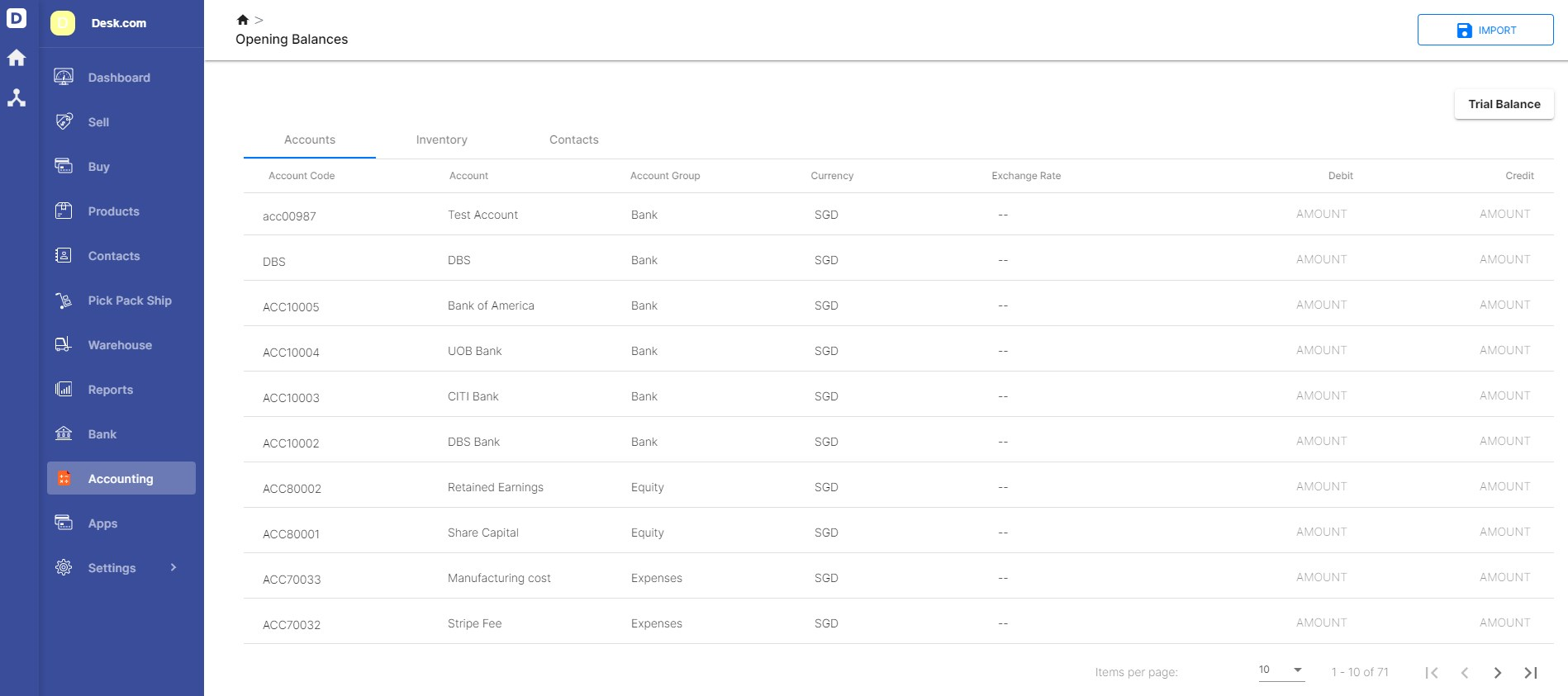

Chart of Accounts Opening Balance

When using any accounting software, you would need to enter your chart of accounts and the opening balance for the individual accounts in the system. This is required because the accounting system will need the starting values to debit or credit the consequent transaction journal entries like invoices, payments, expenses, etc.

Without the opening balances in chart of accounts, the balance sheet and income statement can show wrong numbers, and misreporting the financial statements is a legal offense.

Typically you'd import the opening balances for your accounts, AR, AP, and inventory so that your chart of accounts is up to date.

How Deskera Books Help You With Chart of Accounts

Deskera Books pre-populate your default chart of accounts with the most used options, so you do not have to worry about mapping or to use the right term. If you have an existing chart of accounts, it can be imported easily via excel or CSV.

While adding a contact or a product, the default account values are mapped automatically, so your accounting is always correct.

You can also import or add the opening balances to all your accounts, ensuring that your data is up to date.

If you are looking for an online accounting software to help with your accounts, then start with our free trial now and see how easy it is with Deskera Books.

Related Articles

Here are some other articles related to chart of accounts that you may find interesting.