In India, the GST regime is designed to reduce the prices for consumers and make compliance more straightforward for businesses. Unfortunately, because of how the law is structured, individual states in India are likely to lose money. The government created the compensation cess to help those states stay afloat as the country adjusts to GST. If you run a business in India, that GST cess may affect your taxes and cash flow.

So what is GST Cess? In this article let us understand more in detail about GST Cess.

What is the GST Compensation Cess?

Under section 8 of the GST Act,2017, Cess under GST is a compensation cess levied on certain goods and services. It is levied on interstate and intrastate transactions of goods and services to compensate for the revenue losses that occurred to the States because of the implementation of GST in the country.

After implementing GST, only the states where the actual consumption of goods will receive the indirect tax revenue. Therefore, it results in a loss for the states whose income mainly comes from exporting goods and services. To compensate for this loss of revenue, the government has done an act under which a GST compensation cess would be charged on some specific items for 5 years, after which it will be removed completely.

Types of Cess in India

GST Cess Applicability

GST Cess would apply to both the supply of goods or services that the Central Government has notified. Also, inter and intra state supplies of goods and services would attract GST cess. Under GST, all taxable persons, except registered taxpayers under GST composition scheme, are expected to collect and remit GST cess.

The following goods will attract GST Cess :

Link to Compensation Cess (Rate) Notifications: Goods & Service Tax, CBIC, Government of India:: Compensation Cess (Rate) Notifications

Salient Aspects of GST Cess

The GST Cess of The Goods and Services Tax (Compensation to State) Act, 2017 provides the manner of ascertaining the amount of compensation payable to the state during the transition period of 5 years by the Central Government on account of revenue loss attributable to levy goods and services tax.

- To ascertain the Base year.

- To identify the revenue for the base year

- Computation of compensation and release of compensation

- Projected revenue.

How is the Compensation Cess Distributed to the States?

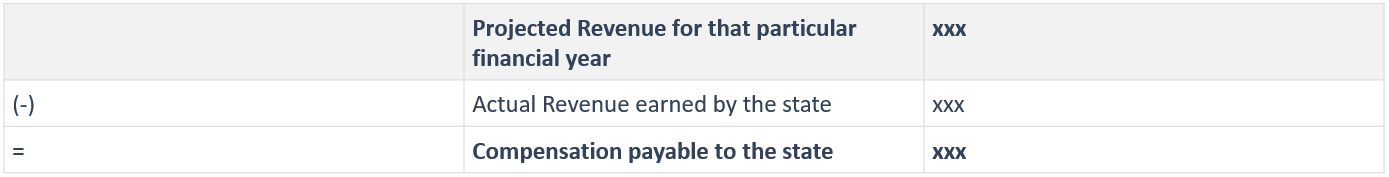

Below is the calculation for the amount of compensation to be distributed to each state.

Step 1: Base revenue = State Tax revenue in the financial year 2016-17.

Step 2: Consider the growth rate as 14% and calculate projected revenue for each financial year.

Projected revenue implies that this would be the revenue that a state could have earned if GST were not implemented. This calculation is done for five years since the compensation cess is to be in effect for the transition period of five years.

Step 3: Calculate the Compensation payable for each FY as follows

Such a provisional calculation is done, and the amount to the states are paid in every two months to the states. Then, the surplus at the end of the compensation fund of the transition period will be distributed between the states and center using an appropriate formula.

Input Tax Credit and GST Compensation Cess

If you are a producer, the input tax credit (ITC) can help you partially lessen the GST liability by paying the difference between the already paid tax on the raw materials of certain goods and that on the final product. In short, to reduce the final GST liability, the taxes paid on purchase(Input Tax), will be subtracted from the taxes paid on the final product(Output Tax)

Example: Let us consider, you are a producer and GST payable on the final product os Rs.500. But, you have already paid Ras.300 on the raw material purchase, and you claim Rs.300 as ITC(Input Tax Credit), and only pay the balance of Rs.200 as GST during supply time.

Similarly, on the GST Cess paid during the purchase of notified goods, the ITC can also be claimed. However, ITC claims in these cases can only be utilized to pay GST Cess and not SGST, CGST, or IGST.

How to Calculate GST Cess?

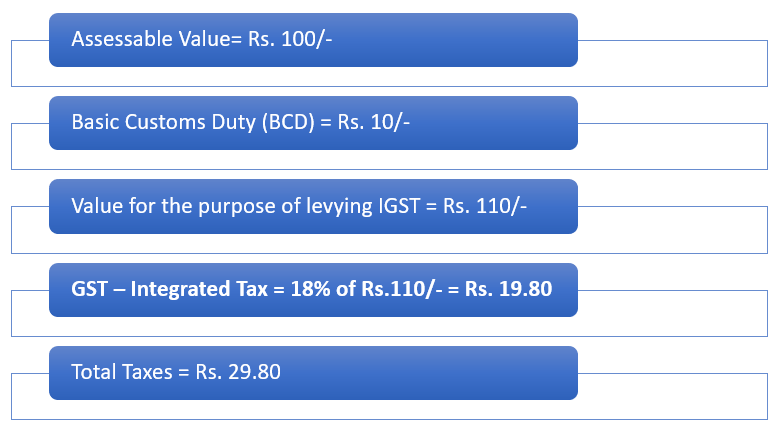

Cess must be calculated based on the taxable value of the supply of the goods or services that attract GST cess and provided in the GST cess rate schedule. If GST cess is applicable in India on goods imported, then the cess will be imposed and collected along with the IGST and custom duty.

For example:

- If the value of goods imported into India is Rs.100/-,

- GST rate is 18%, and

- Customs duty is 10%.

If the goods attract GST Compensation Cess, then GST Compensation Cess would be levied on Rs. 110/-, as Compensation Cess is not levied IGST

How Long Does the Compensation Cess Last?

The GST law is designed in such a way, where the compensation cess lasts for 5 years, i.e, the Cess is set to end in July 2022. This five years period gives states time to adjust and transition to the regime. However, as Cess has undergone many changes, the government may change it based on the GST council recommendation.

Summary

- In addition to regular GST, the GST compensation cess is levied on notified goods belonging to the luxury and demerit categories.

- It needs to be paid by all taxpayers, except for those who has exported the notified goods and opted for the GST composition scheme

- The GST compensation cess collection is currently applicable only for the first 5 years of the GST regime, until 1st July, 2022, to compensate the heavy manufacturing states for any losses due to the composition based on GST nature.

- Based on the methodology specified in the GST Act, 2017, the compensation cess is payable to states is calculated.

- Every 2 months, the compensation fund is collected and released.

- From the compensation fund, any unused money, at the end of the transition period, shall be distributed between the center and states as per the formula.

Let us see how compensation cess work in Deskera Books

Related Articles