If your company wants to operate as a contractor or subcontractor on federally financed construction projects, you'll have to provide certified payroll records every week to prove you're paying your employees fairly. But, did you realise that certified payroll comes with a set of requirements that must be followed?

We'll go over the following points in this post to assist you in understanding what you need to do if you're working on a government contract. Continue reading!

Table of Content

- Certified Payroll: An In-Depth Overview

- The Davis-Bacon & Related Act

- How Does The Certified Payroll Work?

- How to Calculate The Certified Payroll?

- What is The Prevailing Wage?

- How to Fill Up The Certified Payroll, Form WH-347?

- Mistakes to Avoid While Filing the Certified Payroll

- Important Updates of 2021-22 Regarding the Certified Payroll

- Bottom Line

- Key Takeaways

Certified Payroll: An In-Depth Overview

Certified payroll is a firm's accounting of almost everything paid out on a contract done for a government customer at its most basic level. It's a precise record that shows how many hours each person worked, how much they were paid, and what jobs they did.

The major goal is to give the government a way to ensure that its contractors pay their employees "prevailing wages" in conformity with the law. These are the normal average pay for certain employees in a specific locality, such as a county or a big metro region.

The Davis-Bacon Act and Related Acts are the laws that underpin these standards. President Herbert Hoover signed this measure into law in 1931, which established the prevailing wage system as well as the certified payroll structure.

Certified payrolls are frequently a subset of a construction company's regular payroll. In actuality, it generally refers to a single task, such as a government contract or a public works project. And these one-of-a-kind payrolls necessitate their own reports.

Contractors that work on public works or government-funded construction projects are required to provide certified payroll reports on a weekly basis. This form of payroll necessitates a unique method that includes the inclusion of dates and a job code for each entry. This is used to create a report of hours worked and labour expenses for a certain task in a specific format.

The data in the report is presented on a daily basis for a week. During the same payroll cycle, many reports may be generated, and a single certified payroll report may cover two payroll days. According to the requirements, all of the elements listed below must be included in a certified payroll report, which is detailed in the federal WH-347 form.

· Every employee who works on site's name and ID number.

· The occupational categorization of each employee (e.g. carpenter, electrician, etc.).

· The total number of hours worked by each employee, including overtime.

· Every employee's rate of compensation, including fringe benefits, is based on the prevailing wage (or cash paid in lieu of fringe benefits).

· The total amount of money made by each employee.

· Deductions or withholdings made by each employee.

· The net salaries of each employee are paid.

In the above section, we read about the Davis-Bacon and Related Act. Let’s see what it is.

The Davis-Bacon & Related Act

The Davis-Bacon and Related Acts require certified payroll. During the Great Depression, Congress approved them to ensure that workers on public works projects were appropriately compensated.

These regulations now apply to the construction, alteration, or repair of public buildings or public works projects (including painting and decorating). Structures established for public use, such as schools and roadways, are referred to as "public works."

The Davis-Bacon Act states that you must follow certified payroll criteria if your company works on a government contract worth more than $2,000. The guidelines cover a worker's hourly rate of compensation as well as fringe benefits.

Penalties Involved In Case The Davis-Bacon Act is Violated

It might be difficult to submit detailed weekly reports on top of your standard payroll procedure. However, avoiding the severe repercussions of not adhering to prevailing wage and certified payroll requirements is essential.

The following are the consequences of breaking Davis-Bacon laws:

· Debarment: For a period of up to three years, you will be barred from taking on new contracts.

· Payments placed on hold: Contract payments may be held back to cover unpaid wages and award damages for overtime breaches.

· Termination: The federal contract has been terminated.

· Prosecution: Falsification of records may result in civil or criminal prosecution, with fines and jail possible penalties.

If the Wage and Hour Division finds that you have broken the law, you can appeal the decision to an administrative law judge. You can also appeal an administrative law judge's judgement to the Administrative Review Board (ARB), and if the ARB's decision isn't satisfactory, you can take your case to the federal courts.

How Does The Certified Payroll Work?

You must submit a prepared and signed certified payroll report (Form WH-347) for every week your firm undertakes contract work to comply with the Department of Labor's (DOL) certified payroll standards. Keep in mind that this is on top of the normal payroll paperwork.

If you're a subcontractor, give your report to the contractor you're working for; if you're a contractor, give it to the government agency that's contracting or funding the project. Reviewers will verify that you are paying each employee the prevailing wage rate to which they are entitled.

The report necessitates particular payroll information. The easiest phase is generally gathering basic payroll information, such as pay rates, wages paid, and deductions because they must be approved before you can process payroll. Work categories and fringe benefit reporting, on the other hand, maybe more difficult.

How to Calculate The Certified Payroll?

The prevailing wage, which is deemed the standard rate for a government contract in that county, is used to compute certified payroll. The following elements (based on local standards) are taken into account when determining the prevailing wage:

· Professional classification (there are many different positions that may work on the same government project)

· Hourly compensation that is based on a basic hourly rate (you can use this wage determination directory to look up your county)

· Typical benefits of the role

· Overtime is anticipated.

After you've estimated the correct salaries, you'll need to reduce any deductions, such as union deductions and state and federal taxes, to arrive at the employee's net pay. When completing certified payroll for that week of the project, repeat this step for each employee (reminder: certified payroll is reported on a weekly basis).

In this section, we read a term i.e. prevailing wages. Let’s have an overview of this to understand certified payroll in a better way.

What is The Prevailing Wage?

The prevailing wage pay rates differ depending on the location of the work and the job description of your employees. The US Department of Labor can assist you in determining your pay. Each labour category's pay and fringe benefit rates are listed.

You must pay at least the prevailing salary, including fringe benefits, under the Davis-Bacon Act. Payment of fringe benefits to bona fide benefit plans, funds, or programmes or cash payments to covered workers in place of fringe benefits are also options for meeting your requirement to provide fringe benefits.

How to Fill Up The Certified Payroll, Form WH-347?

The processes for filling out federal Form WH-347 are outlined here.

1. Begin with a WH-347 form.

2. Choose a general contractor or a subcontractor.

3. Start with the first payroll number. This indicates the week of the government-funded contract you are on.

4. Insert the date of the workweek's conclusion.

5. Project or contract number: This number can be found on your government-funded contract.

6. Fill in the employee information.

7. Column 2: For contractors, this is an optional column.

8. Work Categorization: Enter the job classification of a specific employee. Refer to the contract requirements for job categories. Different job classifications might be assigned to the same individual.

9. Day and date: If it's Friday, May 5, you'd write "Fri" at the top and "5" at the bottom. Then put in the hours. The letters S and O stand for standard hours worked and overtime hours worked, respectively.

10. Columns 5-9: Fill in employee salary rates, including fringe benefits (note: total hours, the gross amount earned, total deductions and net wages paid are auto-filled if you submit Form WH-347 online).

11. To confirm, please sign. The prevailing salary rates and fringe benefits on Form WH-347 are correct.

Only include employees doing actual labour on-site while filling out the form, as they are the ones who are qualified for prevailing rates. Prevailing wages are not available to employees in the executive and administrative jobs.

Mistakes to Avoid While Filing the Certified Payroll

We recognise that maintaining your organization's survival is a primary responsibility (and every dollar matters in a small construction business), so here are a few pointers to assist you to avoid certified payroll blunders and staying in compliance:

· It's important to keep in mind that larger contracts may have additional restrictions. When workers work more than 40 hours per week on projects worth more than $100,000, they must be paid at least one-and-a-half times their ordinary pay rate. The Contract Work Hours and Safety Standards Act mandates this obligation.

· Employees on certified payroll are required to be paid weekly. While your organisation as a whole may pay employees biweekly or monthly, certified payroll personnel must be paid weekly.

· You must still present certified payroll records to the DIR whether you submit them to your union or another body. It's not unusual for businesses to submit their certified payroll to their union or Labor Compliance Program incorrectly, thinking they're good to go. To stay in compliance, regardless of whatever other agencies you supply these documents to, you must provide them to the DIR.

· Before submitting your certified payroll form, double-check it. When you sign off on a certified payroll report, you're certifying that all of the data is correct. As a result, if errors are discovered, you will be held accountable.

· Even if you don't generally pay yourself compensation, you must record certified payroll for yourself as a company owner if you worked on the project. Labour is merely considered part of the work that goes into getting a construction firm off the ground for many construction business owners, especially in the early years of the business, hence many business owners don't pay themselves out. However, you must record certified payroll for yourself on these sorts of jobs.

· Make sure you're not on autopilot when it comes to paying your employees each month. Employees on the job might vary month to month, and prevailing wage rates can fluctuate year to year, among other things. Make careful to account for any changes that may have occurred each week when doing payroll to ensure that your certified payroll is performed appropriately.

Keep in mind that you won't be able to make adjustments to your certified payroll if you make a mistake. You can, however, submit a new record with the proper information, and it will be prioritised. It's worth noting that you just need to submit revised information for the impacted employees; the rest of the report will remain unchanged.

Important Updates of 2021-22 Regarding the Certified Payroll

There were no substantial payroll changes in 2020 or 2021. In 2018 and 2019, the most current adjustments were implemented. In 2018, the United States Congress examined ways to improve the country's transportation infrastructure. They also introduced S.2302, America's Transportation Infrastructure Act, in 2019.

The legislation intends to support roadways as well as enhance and improve road and bridge safety. The measure passed the US House of Representatives, despite opposition from the White House and Senate Republicans. At this time, the act's outcome is unknown.

If the law is passed, $287 billion would be invested in repairing and maintaining US roads, highways, and bridges. As a result, it will have a good effect on construction companies that bid for government-funded projects.

Bottom Line

It's critical for people in the construction and repair industries to understand how to file certified payroll reports. This sort of paperwork is required by the US Department of Labor to verify that contractors pay workers fairly on government-funded public works projects.

Filling out reporting forms takes a great deal of focus and understanding. Even seasoned contractors may find this method to be difficult and perplexing. They can employ a decent collection of software applications to help them with certified payroll submission. They assist in reducing the number of mistakes, keeping track of each employee's working time, and much more.

How Can Deskera Assist You?

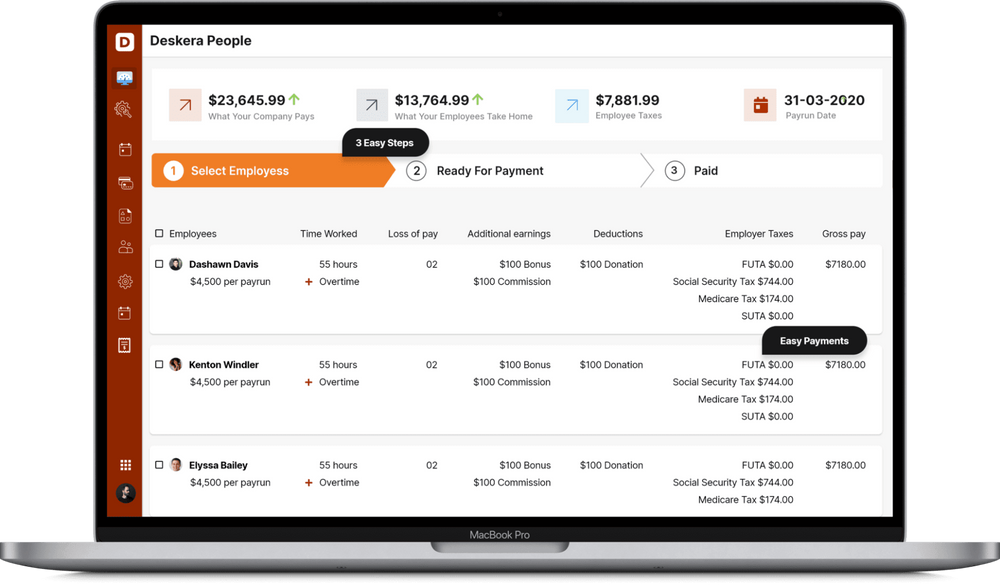

Employees plan vacations around holidays; this may also include taking some extra leaves, so managing their payrolls can be a lot of work. Imagine software that could do that for you. Yes, Deskera can help you with that. Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

· If your company wants to operate as a contractor or subcontractor on federally financed construction projects, you'll have to provide certified payroll records every week to prove you're paying your employees fairly.

· The major goal of certified payroll is to give the government a way to ensure that its contractors pay their employees "prevailing wages" in conformity with the law.

· Certified payrolls are frequently a subset of a construction company's regular payroll.

· If you're a subcontractor, give your weekly report to the contractor you're working for; if you're a contractor, give it to the government agency that's contracting or funding the project.

· You must pay at least the prevailing salary, including fringe benefits, under the Davis-Bacon Act.

· Filling out reporting forms takes a great deal of focus and understanding. Even seasoned contractors may find this method to be difficult and perplexing.

Related Articles