According to research, around 10.28 lakh new members joined the ESI scheme in November 2021!

A person is working in an organisation in order to fulfil his objectives and he is provided with various medical benefits. But what will happen in case an insured person gets deceased during his employment period? Will the dependant get any benefit under the ESI scheme? The answer is yes. If a person gets deceased during an accident, the dependant can avail of the dependant benefit under the ESI scheme!

For this, he needs to fill out central form 15 for claim dependent benefit. The dependant(s) of a deceased insured person needs to submit a claim in the prescribed format and accordingly apply for the dependant's benefit on account of his/her death. Read on to know more about the ESI scheme and Form 15.

Table of Contents

- What is ESI Scheme?

- How does the scheme help the employees?

- Who administers the ESI Scheme?

- How is the scheme funded?

- What is the dependant benefit?

- For How long Dependant benefit is paid?

- Form 15-Claim Dependant Benefit

- Format of Form 15

- Are there any penalties for violating the ESI act?

- Key Takeaways

What is ESI Scheme?

The Employees’ State Insurance Scheme is a social security plan that falls under the Employees’ State Insurance Act. The aim of this act is to protect employees, as mentioned in the Employees’ State Insurance Act, 1948, against the impact of incidences of sickness, maternity, disablement, and death due to work-related injury. The objective of this act is to provide medical care to insured persons and their families.

The ESI scheme is applicable to the factories and other establishments such as hotels, restaurants, cinemas, shops, medical institutions, etc. with at least 10 workers. However, in some states, the threshold limit for employees is 20. Under this act, the existing wage limit for coverage under the Act is Rs 21,000/-per month (w.e.f. 01.01.2017)

How does the scheme help the employees?

The scheme aims at providing full medical care to the employee registered under the ESI Act, 1948. Under this scheme, financial help is provided to reimburse the loss of the wages of the deceased during the period of his abstaining from work due to sickness, maternity, and work-related injury. The scheme also provides medical care to his/her family members.

Who administers the ESI Scheme?

A statutory corporate body, known as the Employees' State Insurance Corporation (ESIC) administers the ESI scheme. The members of this scheme are Employers, Employees, the Central Government, the State Government, the Medical Profession, and the Hon’ble Members of Parliament. Director-General is the Chief Executive Officer of the Corporation and is also an ex-officio member of the Corporation.

How is the scheme funded?

The ESI scheme is a self-financing scheme and the ESI funds are collected from the contribution of employers and employees payable monthly at a fixed percentage of wages paid. 1/8th share of the cost of Medical Benefit is born by the State Government.

What is the dependant benefit?

Dependants' Benefit refers to the monthly pension payable to the eligible dependants of an insured person who dies due to work-related injury or occupational hazards. The first benefit payment is made from the Branch Office. The subsequent periodical payments are done through direct bank transfer (DBT) to the beneficiaries. Dependants’ benefits are paid at the rate of 90 percent of the wage in the form of monthly payments.

For How long Dependant benefit is paid?

According to Employees' State Insurance Corporation, the Dependent Benefit can be received by:

1. A widow can receive the benefit until death or remarriage at 3/5th of the full rate.

2. A widowed mother can receive the dependant benefit until death at 2/5th of the full rate.

3. Each child can receive the dependant benefit at 2/5th of the full rate each until he attains the age of 25 years.

4. Unmarried daughters can receive the benefit at 2/5th of the full rate until they get married.

5. In case the son or daughter is fully dependent on the earnings of the insured person at the time of his death, then they will continue to get the benefit even after the achieving age of 25 years or marriage.

In case the total dependants' benefit for all the dependents mentioned above exceeds at any time, the full rate, then the share of each of the dependents shall be proportionately reduced so that the total amount payable to them does not exceed the amount at the full rate.

In case, the deceased insured person does not have any of the dependents mentioned above, then his parents will get a 3/10 share and in case no parent is alive then his paternal grant parent will get 3/10 share of the full rate of dependent benefit.

Funeral Expenses: An amount of up to Rs 10,000 is also paid to any family member or the person who actually bears the funeral expenses of the deceased.

Form 15-Claim Dependant Benefit

Format of Form 15

- Name of the Deceased Insured person

- Insurance Number

- Son/Wide/Daughter of

- Date of Death

- Last Employed as and by whom

- Name of the Dependant

- Sex

- Age

- Marital Status

- Relationship with the deceased

- Present Address

- Name of the Guardian in case of a minor

- Declaration

- Signature

All major dependants should sign individually and in the case of a minor dependant, the guardian should sign the form.

Are there any penalties for violating the ESI act?

In case any person is found making a false statement or representation in order to obtain the dependant benefit, then he shall be entitled to imprisonment for a term of up to six months or a fine up to Rs 2000, or both.

How Deskera Can help You?

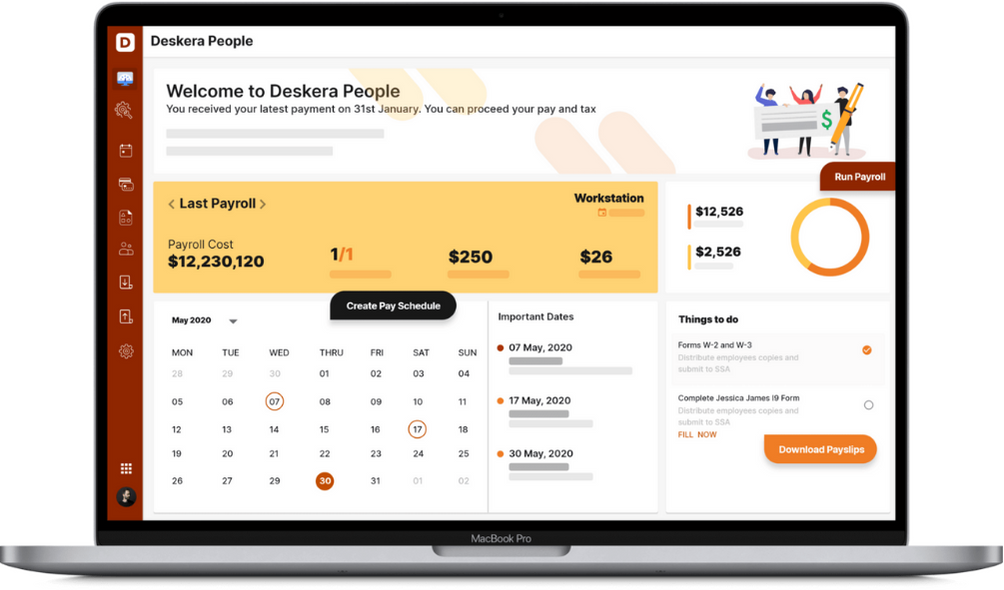

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- If a person gets deceased during an accident, the dependant can avail of dependent benefit under the ESI scheme

- The Employees’ State Insurance Scheme is a social security plan that falls under the Employees’ State Insurance Act

- The aim of this act is to protect employees, as mentioned in the Employees’ State Insurance Act, 1948, against the impact of incidences of sickness, maternity, disablement, and death due to work-related injury

- A statutory corporate body, known as the Employees' State Insurance Corporation (ESIC) administers the ESI scheme

- The ESI scheme is a self-financing scheme and the ESI funds are collected from the contribution from employers and employees payable monthly at a fixed percentage of wages paid

- Dependants' Benefit refers to the monthly pension payable to the eligible dependants of an insured person who dies due to work-related injury or occupational hazards

- The format of central form 15 claim dependant benefit has been discussed in this article

- In case any person is found making a false statement or representation in order to obtain the dependant benefit, then he shall be entitled to imprisonment for up to six months or a penalty up to Rs 2000, or both

Related Articles