Are you an employer who has building and other construction workers working for you? Do you want to keep a record book that will have each detail about your building projects, as well as the role of the building and other construction workers in the same? Do you also want to maintain such a record to ensure that you are fulfilling all the statutory compliances?

If this is the scenario, then this is the perfect article for you, as it will guide you through Form 13-Wage Book, which is one of the compliance forms under the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996.

This Act was formulated to regulate the employment and conditions of service of building and other construction workers and to provide for as well as ensure their health and safety and other such connected matters. Form 13, being part of this Act, will have to be maintained by you as an employer on a weekly, fortnightly, and monthly basis.

This article will cover the following topics to be a comprehensive guide to Form 13- Wage Book for you:

- Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

- Form 13: Wage Book

- How Can Deskera Help You?

- Key Takeaways

- Related Articles

Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 is an Act that was formed to regulate the employment and conditions of service of building and other construction workers and to provide for and ensure their health, safety, and welfare measures, as well as for other matters connected therewith or incidental thereto.

This Act is applicable across India and is applicable to every establishment which employs, or had employed on any day of the preceding twelve months, ten or more building workers in any building or other construction work.

Statement of Objects and Reasons

This Act aims to protect more than 8.5 million workers in the country that are engaged in building and other construction works. Building and other construction workers are one of the most numerous and yet vulnerable segments of unorganized labor in India. Their work is characterized by casual nature, temporary relationship with the employer, lack of basic amenities, uncertain working hours, and inadequacy of welfare facilities.

Without any Act regulating the well-being of this unskilled segment of labor in India, even the number and nature of accidents are not shared or paid adequate heed to. This makes it difficult to fix responsibility for the same and take corrective actions to ensure that it does not happen again. Though there are several Central Acts whose provisions are applicable to the building and other construction workers, they do not safeguard all the vulnerabilities.

Through the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, these gaps are filled with its provisions, and all-round well-being and welfare is ensured. In fact, by amplifying the provisions of the Building and other Construction Workers (Regulation of Employment and Conditions of Service) Bill, 1988, welfare boards have been constituted in every state so as to provide and monitor social security schemes and welfare measures for the benefit of this segment of the labor force of the country.

Additionally, a cess has been levied on the cost of construction incurred by you as an employer on the building, and other construction works so as to ensure that there are sufficient funds for the welfare boards to undertake the social security schemes and welfare measures.

While these measures were in the form of first and second ordinances during a time when the Parliament was not in session, considering their emergency and importance, the President was pleasured to promulgate them, thereby giving continued effect to the legislative protection envisaged in these ordinances. It was finally the third ordinance of 1996, which was replaced by a Bill.

The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Bill was passed by both the Houses of Parliament and received the assent of the President on 19th August 1996. It came on the Statute Book as the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 (Act 27 of 1996).

Act 27 of 1996

The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Third Ordinance, 1996, which became a Bill on 19th August 1996, provides for the following matters:

- Provision to cover every establishment which employs or had employed on any day of the preceding twelve months, fifty or more workers in any building or other construction work.

- Define “appropriate Government” in respect of various establishments and also to enable the Central Government to notify and public sector undertaking in respect of which the Central Government will be the appropriate Government.

- Constitution of Central and State Advisory Committee to advise the appropriate Government on matters arising out of the administration of this Act.

- Constitution of Expert Committee to advise on matters relating to framing of rules by the appropriate Government.

- Registration of building workers as beneficiaries under this Act and provision for their identity cards, etc.

- Constitution of Welfare Boards by the State Governments and registration of beneficiaries under the Fund.

- Provide for finalizing and augmenting resources of the Welfare Board constituted by the State Governments.

- Fixing hours for normal working days, wages for overtime, weekly paid rest days, provision of basic welfare- amenities like latrines and urinals, drinking water, creches, canteens, first aid, etc., for the building workers and other construction workers.

- Provision for temporary living accommodation to all building workers within or near the work site.

- Making adequate provisions for safety and health measures for construction workers, including the appointment of safety committees and safety officers and compulsory notification of accidents.

- Empowering the Central Government to frame model rules for safety measures headed by the Director-General of Inspection at the Central Level and Inspector-General at the State Level.

- Special provisions regarding fixing the responsibility of employers to ensure compliance with safety provisions and with regard to prevention of accidents, timely payment of wages, etc.

- Provision for penalties for contravention, obstruction, violation, and offense, taking cognizance by a court of an offense punishable under this Bill, and protection of action taken in good faith.

- Application of Workmen’s Compensation Act, 1923 to building and other construction workers.

- Empowering the Central Government to give directions to the States and to remove difficulties arising in giving effect to the provisions of this Act.

Important Provisions of Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

- This Act came into force on 1st March 1996 and extends to the whole of India.

- Applicability- The Act is applicable to every establishment which employs, or had employed on any day of the preceding twelve months, ten or more building workers in any building or other construction work.

- Beneficiary- In this Act, “beneficiary” means a building worker registered under section 12 of this Act.

- Board- In this Act, “board” means a Building and Other Construction Workers Welfare Board constituted under sub-section 1 of section 18 of this Act.

- Building Worker- In this Act, “building worker” means a person who is employed to do any skilled, semiskilled, or unskilled manual, supervisory, technical, or clerical work for hire or reward, whether the terms or employment be expressed or implied, in connection with any building or other construction work. It does not include any such person-

- Who is employed mainly in a managerial or administrative capacity.

- Who being employed in a supervisory capacity draws wages exceeding one thousand six hundred rupees per mensem or exercises, either by the nature of the duties attached to the office or by reason of the powers vested in him, functions mainly of a managerial nature.

- Central Advisory Committee- As per the provisions of this Act, a Central Advisory Committee shall be constituted by the Central Government, and would be known as the Central Building and Other Construction Workers’ Advisory Committee, to advise the Central Government on such matters arising out of the administration of this Act as may be referred to it.

This committee shall consist of a Chairperson as appointed by the Central Government, three members of the Parliament, of which two shall be elected by the House of People and one by the Council of States-Members, the Director-General-Member (ex-officio), and between nine to thirteen other members which will be nominated by the Central Government to represent the employers, building workers, engineers, associations of architects, accident insurance institutions, and any such other interests which ought to be represented by the committee.

- State Advisory Committee- As per the provisions of this Act, a State Advisory Committee shall be constituted by the State Government and will be known as the State Building and Other Construction Workers’ Advisory Committee. This committee will advise the State Government on such matters as are arising out of the administration of this Act as may be referred to it.

The members of this committee are a Chairperson as appointed by the State Government, two members of the State Legislature to be elected from the State Legislature members, a member to be nominated by the Central Government, the Chief Inspector-member (ex-officio), and between seven to eleven such other members who are nominated by the State Government to represent the employers, building workers, engineers, associations of architects, accident insurance institutions, and any such other interests which ought to be represented on this committee.

- Expert Committee- As per the provisions of this Act, the appropriate Government will also constitute one or more expert committees consisting of persons specially qualified in building or other construction work to advise that Government in making rules under this Act. The members of these expert committees shall be paid the prescribed fees and allowances for attending the meetings of the committees. If a member is an officer of Government or of any body corporate established by or under any law for the time being in force, then no fee or allowance will need to be paid to that member.

- Registration of the Establishment- As per the provisions of this Act, as an employer of an establishment in relation to which this Act is applicable is bound to make an application to the registering officer for the registration of your establishment within a period of sixty days from its commencement. The application of the same should be in the prescribed form with the prescribed fees and within such time and subject to such conditions as is applicable.

If there is any change in the ownership or management or other prescribed particulars in respect to your establishment, for example, a change in ownership or management, then such a change must be intimated by you to the registering officer within thirty days of such change taking place.

- Revocation of the Registration of the Establishment- The registration of your establishment can also be revoked as per the provisions of this Act if your registering officer is satisfied either on a reference made to him or her on this behalf or otherwise that you obtained the registration through misrepresentation or suppression of any material fact, or that your establishment is not complying with the provisions of this Act, or due to any other reason when the registration has become useless or ineffective. You would, however, be given an opportunity to be heard before your registration is revoked.

Note: If you do not have a registration (required as per the provisions of this Act) or your registration has been revoked, then you cannot employ building workers and other construction workers.

- Registration as Beneficiary- Under the provisions of this Act, every building worker registered as a beneficiary under this Act shall be entitled to the benefits provided by the Board from its Fund under this Act. To be registered as a beneficiary, the building worker needs to be at least eighteen years old but should not have completed sixty years of age. He or she should be engaged in any building or other construction work for at least ninety days during the preceding twelve months to become eligible to get registered as a beneficiary.

An application for the same will have to be filed along with the necessary documents and a maximum of fifty rupees as the fees. Once the officer concerned is satisfied with the application, the worker will be registered as a beneficiary. However, if in case he or she is not satisfied, an opportunity will be given to the applicant to be heard.

If any person is aggrieved by the decision of the officer, then he or she can file an appeal thirty days from the date of such decision to the Secretary of the Board or to any other officer specified by the Board in this behalf. The decision then taken by the officer or this Secretary will be final. A delay beyond thirty days for such an appeal will only be entertained if the Secretary or the officer concerned is satisfied that the workers were prevented by sufficient cause from filing it on time.

- Identity Card- Each beneficiary will be given an identity card by the Board with his or her photograph duly affixed thereon. This identity card should have enough space for entering the details of the building or other construction work done by him or her. The identity card will have to be authenticated by you as the employer.

- Cessation as Beneficiary- If the beneficiary attains sixty years of age, then he or she will cease to be a beneficiary. The same will happen if he or she has been engaged in building or other construction work for less than ninety days in a year. The calculation of these ninety days, however, should exclude any period of absence from their workplace due to any personal injury caused by an accident arising out of and in the course of his or her employment.

- Continuation of Benefits to a Beneficiary- However, if the beneficiary has been employed in building and other construction work for at least three continuous years before attaining the age of sixty years, then he or she will continue to get such benefits as may be prescribed.

- Register of Beneficiaries- As an employer, and as per the provisions of this Act, you are required to maintain a register in the prescribed form and which shows the details of employment of beneficiaries employed by you in building and other construction works undertaken by you. These can be inspected by the Secretary of Board or any other officer duly authorized by the Board for the same without any prior notice.

- Contribution of Beneficiaries- Each building worker who has been registered as a beneficiary under this Act will contribute to its Fund at such rate per mensem as it is specified by the State Government by notification through the Official Gazette. The Government may specify different rates of contribution for different classes of building workers.

The beneficiary is required to pay his share of the contribution until he turns sixty years old. If, however, the Board is satisfied that the beneficiary is unable to pay his contribution due to financial hardship, then his or her payment of contribution can be waived off for a maximum of three months at a time. The beneficiary can also authorize you to deduct his or her contribution directly from his or her monthly wages and to remit the same within fifteen days front of such deduction to the Board.

Note: If a beneficiary fails to pay his contribution for a continuous period of a year, then he or she will no longer be a beneficiary of the Fund unless the Board finds that there were reasonable grounds behind the failure in payment of the contribution and that the building worker is willing to deposit the arrears, in which case his or her registration to the Fund will be restored.

- Constitution of State Welfare Boards- Each State Government will constitute a Board to be known as the (name of the State) Building and Other Construction Workers Welfare Board to exercise the powers conferred on and perform the functions assigned to it under this Act. The Board shall be a body corporate by the above-mentioned name with perpetual succession, common seal, and right to sue and be sued.

- Members of State Welfare Boards- The Board shall have a chairperson, a person nominated by the Central Government, and a maximum of fifteen other members who are appointed by the State Government, such that there is an equal number of members representing the State Government, the employers, and the building workers.

Note: At least one member of the Board must be a woman.

- Functions of the Board- Some of the main functions of the Board include:

- Provide immediate assistance to a Beneficiary in case of an accident.

- Sanction advances and loans to a beneficiary for construction of a house not exceeding such amount and on such terms and conditions as may be prescribed.

- Make a payment of pension to those beneficiaries who have completed sixty years of age.

- Give financial assistance for the education of the children of the beneficiaries as may be prescribed.

- Meet such medical expenses for the treatment of major ailments of a beneficiary or, such dependant, as may be prescribed.

- Pay such amount in connection with premia for Group Insurance Scheme of the beneficiaries at it may deem fit.

- Make a payment of maternity benefits to the female beneficiaries.

- The Board may also grant a subsidy or loan to you as an employer or to a local authority in aid of any scheme approved by the State Government for the purpose connected with the welfare of the building workers or other construction workers in any establishment.

- It shall constitute a fund called the Building and other Construction Workers’ Welfare Fund, which shall be credited to any grants and loans made to the Board by the Central Government, all contributions made by the beneficiaries, and all sums received by the Board from such other sources as may be decided by the Central Government.

Note: In any financial year, no Board shall incur expenses more than five percent of its total expenses towards allowances, salaries, and other remuneration to its members, officers, and other employees and for meeting the other administrative expenses.

- Number of Working Hours- The number of working hours on a normal day for building and other construction workers will be decided by the appropriate Government. These working hours should be inclusive of one or more specified intervals. It should also provide for a day of rest in each period of seven days, on which the building and other construction workers will be given a day off with payment of remuneration for the same. The remuneration on such a day off for rest should not be at a rate less than the overtime rate.

- Overtime- If any building and other construction workers on any day are required to work in excess of the decided number of working hours that constitute a normal day, then he or she will be entitled to wages at the rate of twice his ordinary rate of wages.

- Maintenance of Records and Registers- As an employer, and under the provisions of this Act, you are obliged to maintain registers and records that has all the details on the building workers employed by you, the work done by them, the working hours which constitute a normal day for them, tile wages paid to them, and the day of rest that is given to them in each period of seven days.

- Prohibition of Employment of Certain Persons- As an employer, you cannot employ in building, and other construction works an individual who is deaf or has a defective vision, or a tendency to giddiness, as this will make the individual as well as those around him or her prone to accidents.

- Drinking Water- As an employer of building and other construction workers, and as per the provisions of this Act, you are to make sure that there are effective arrangements to provide a sufficient supply of wholesome drinking water. These need to be arranged at several suitable points such that it is convenient and accessible to all those who are employed on that in-progress building and construction site. These places should be marked as “Drinking Water” in a language that is understood by the majority of the employees and in a legible way. Places of drinking water should not be situated within six meters of any urinal, latrine, or washing place.

- Latrines and Urinals- As an employer, it is also required that you provide sufficient latrine and urinal accommodation of such types as may be prescribed and in such a way that it is accessible to the building and other construction workers at all times.

- Accommodation- Under the provisions of this Act, and as an employer, you are required to provide, free of charges and within the work site or as near to it as possible, a temporary living accommodation to all building workers employed by you for such period as the building or other construction work is in progress. The temporary accommodation is required to have a separate cooking place and bathing, washing, and lavatory facilities.

- Creches- In every place where in more than fifty female building workers are ordinarily employed, as an employer, you will have to provide and maintain suitable room or rooms for the use of children under the age of six years of such female workers. These rooms should provide adequate accommodation and should be adequately lighted and ventilated. They should be maintained in a clean and sanitary condition and be under the charge of women trained in the care of children and infants.

- First Aid- As an employer, you are to ensure that you provide the prescribed first aid facilities in all the places where building and other construction work is being carried on.

- Canteen- If you have employed at least two hundred and fifty buildings and other construction workers in a place, then you are to provide and maintain a canteen for their use.

- Notice of Certain Accidents- If any accident occurs in your establishment, which leads to death or causes a bodily injury to a person, who is then prevented from working for a period of forty-eight hours or more immediately following that accident, then as an employer, you are required to give notice to the authority for the same in a form, and within such time as may be prescribed. If such an accident has caused the death of five or more persons, then the authority will inquire about the accident within one month of receiving the notice of the same.

- Safety and Health- As per the provisions of this Act, the appropriate Government may also make rules regarding the measures to be taken for the safety and health of the building workers in the course of their employment with you, and the equipment and appliances to be provided to them to ensure their safety, health, and protection, during such employment. These rules can include, but are not limited to:

- Handling or use of explosives under the control of competent persons.

- Precautions to be taken in connection with the demolition of the whole or any substantial part of a building or other structure under the supervision of a competent person.

- Safe means of access to, and the safety of, any working place, including the provision of suitable and sufficient scaffolding at various stages where work cannot be safely done from the ground, or from any part of a building, or from a ladder or such other means of support.

- Erection, installation, use, and maintenance of transporting equipment like wagons, trucks, locomotives, and other vehicles and trailers. It also involves the appointment of competent persons to drive or operate such equipment.

- Erection, installation, use, and maintenance of hoists, lifting appliances, and lifting gear, including periodical testing and examination and heat treatment where necessary. It also involves the precautions to be taken while raising or lowering loads, restrictions on carriages of persons, and appointment of competent persons on hoists or other lifting appliances.

- Adequate and suitable lighting of every workplace and approach thereto, of every place where raising or lowering of operations with the use of hoists, lifting appliances, or lifting gears are in progress, and of all openings dangerous to building workers employed.

- The precautions to be taken to prevent inhalation of gases, dust, fumes, or vapors during any cleaning, grinding, spraying, or manipulation of only material. It also includes steps to be taken to secure and maintain adequate ventilation of every working place or confined space.

- Measures to be taken during stacking or unstacking, stowing or unstowing of materials, or goods or handling in connection therewith.

- Safeguarding of machinery, including the fencing of every fly-wheel and every moving part of prime mover, and every part of transmission or other machinery, unless it is in such a position or of such construction as to be safe to every worker working only of the operations and as if it were securely fenced.

- Precautions to be taken in case of fire.

- The safe transport of workers to or from any workplace by water and provision of means for rescue from drowning.

- The steps to be taken to prevent danger to workers from live electric wires or apparatus, including electrical machinery and tools and from overhead wires.

- The keeping of safety sheets, safety nets, and safety belts where the special nature or the circumstances of work render them necessary for the safety of the workers.

- The precautions to be taken with regard to concrete work, pile driving, work with hot asphalt, tar, or other similar things, insulation work, demolition operations, underground construction, excavation, and handling materials.

- Responsibility of Employer- As per the provision of this Act, it is your responsibility as an employer to provide constant and adequate supervision of any building or other construction work in your establishment so as to ensure compliance with the provisions of this Act relating to safety, and also for taking all the practical steps necessary to prevent accidents.

- Responsibility for Payment of Wages- As an employer, you are also responsible for the payment of wages on or before the prescribed date to each building and other construction worker employed by you.

- Responsibility of Payment of Compensation- In case of the disablement or death of a building or other construction worker, as an employer, you would be liable to make payment of the compensation in full or unpaid balance (if the contractor has failed to make payment of the compensation, or makes a short payment of the same), and then recover the paid amount from the contractor.

- Notice of Commencement of Building or Other Construction Work- As an employer, and as per the provision of this Act, you would have to inform the Inspector having jurisdiction in the area where the proposed building or other construction work is to be executed. The notice about such a proposed commencement should be sent thirty days in prior and should contain details like:

- The name and situation of the place where the building and other construction work are proposed to be carried on.

- The name and address of the person who is undertaking the building and other construction work.

- The address to which communications relating to the building and other construction work may be sent.

- The nature of the work involved and the facilities, including any plant and machinery provided.

- The arrangements for the storage of explosives, if any, to be used in the building and other construction work.

- The number of workers likely to be employed during the various stages of building and other construction work.

- The name and designation of the person who will be in overall charge of the building and other construction work at the site.

- The approximate duration of the work.

Form 13: Wage Book

The Form 13: Wage Book is one of the forms of compliance under the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996. The details that are included in this form are:

- Establishment and employer particulars

- Nature of building work

- Number of days worked

- Rate of wages

- Gross wages payable

- Deductions

- Fines

- Subscription towards provident fund

And so on. This will have to be maintained by you as an employer. As an employer, you shall record and maintain a register for the week or fortnight, or month ending with a wage book in the given format.

FORM 13

[See Rule 50(a)]

Wage Book

Name and Address of the Establishment where building or other construction work is carried on

__________________________

__________________________

__________________________

Name and Permanent Address of Establishment

___________________________

___________________________

___________________________

Nature of Building or other construction work ______________

Name and Permanent Address of Employer _____________

For the week/fort night/month ending.............. .........................

- No. of days worked

2. No. of units worked in case of piece rated workers

3. Rate of daily/monthly wages/ piece rate

4. Amount of overtime wages

5. Gross wages payable

6. Deductions, if any, on account of the following:

(a) fines:

(b) damage or loss:

(c) loans and advances:

(d) subscription towards provident fund:

(e) subscription towards the Building Workers Welfare Fund

(f) any other deductions e.g. subscription to co-operative society or account of loans from co-operative society/housing loan or contribution to any relief fund as per provisions of clause (P) of sub-section-7 of the Payment of Wages Act or for payment of any premium of Life Insurance Corporation.

7. Net amount of wages paid

Initials of the Employer or his Representative____________

How Can Deskera Help You?

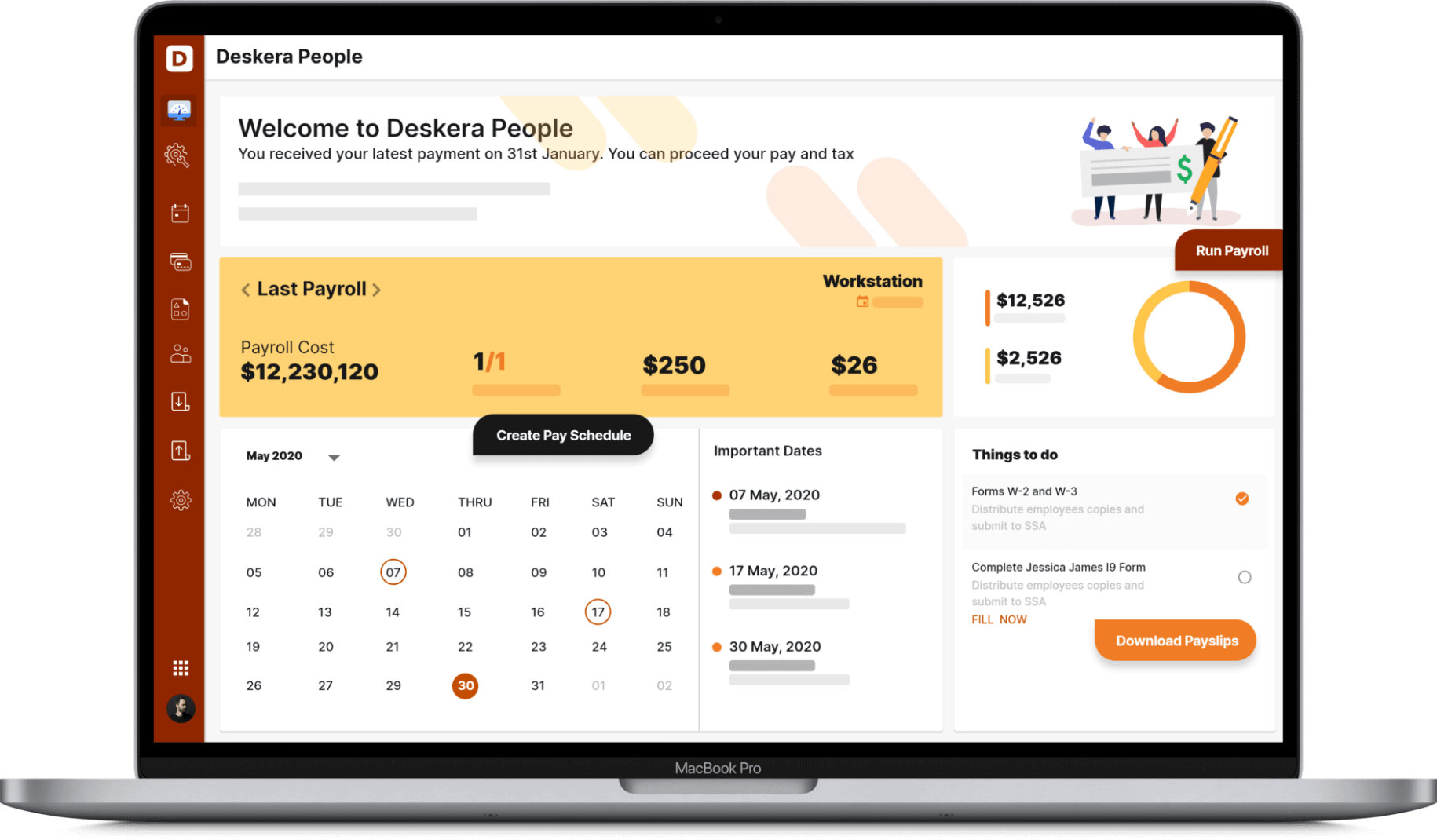

Deskera People is software that will help you to export and integrate your peoples’ data on one platform. Coming with its desktop version, as well as a mobile app, Deskera People is easily accessible irrespective of where you are.

Designed to answer the HR and HR-related compliance requirements of any establishment, Deskera People will let you view all the essential information of your employees with the employee grid. It also comes with sorting options embedded in each column of the grid, which will make it easy for you to access the information that you are looking for.

With Deskera People, you would be able to efficiently manage all your records and registers related to your different building and construction sites and the respective building and other construction workers employed therein. This will make it easier for you to fill up the Central Form 13: Wage Book.

In addition to a powerful HRMS, Deskera also offers integrated Accounting and CRM software for driving business growth.

Key Takeaways

Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 was set up to regulate the employment of building and other construction workers and their conditions of service. It was also set up to ensure their safety and health and their overall well-being.

Form 13: Wage Book is one of the forms of compliance under this Act which needs to be maintained by employers, recording the following details:

- Establishment and employer particulars

- Nature of building work

- Number of days worked

- Rate of wages

- Gross wages payable

- Deductions

- Fines

- Subscription towards provident fund

And so on. This is maintained on a weekly, fortnightly, and monthly basis in the prescribed format.

Contravention or failure to comply with any provisions of the Act or any rules made thereunder, and where no express penalty is provided for such failure or contravention, will be punishable with a fine up to one thousand rupees for every such failure or contravention. However, in case of continuing failure or contravention, it will be punishable with an additional fine of up to one hundred rupees for every day during which such contravention or failure continues after the conviction for the first contravention or failure.

Thus, the provisions, rules, penalties, and compliances under this Act all serve the purpose of securing the well-being of building and other construction workers.

Related Articles