If you're seeking finance for your small business in the United States, CDFIs and MDIs are good options. Both these terms may sound unfamiliar to you, however, they can be a significant source of funding.

Moreover, CDFIs and MDIs have specific requirements, which must be fulfilled in order to obtain funding.

We'll look at how CDFIs and MDIs can help your small business acquire a PPP loan in today's article. In this article, you'll learn more about the MDIs and CDFIs PPP lender's resources for low-cost funding and how it might aid your small business.

Take a peek at the table of contents for what we'll be covering next:

- Understanding FIRREA

- Understanding Community Financial Institution

- Understanding PPP Loans

- What’s CDFIs?

- About CDFI Lender

- What’s MDIs?

- What can a CDFI do for Your Small Business?

- How do you apply for a CDFI loan?

- Is it feasible for CDFI and MDI to assist businesses in acquiring a PPP loan?

- Why Should Small Businesses Use CDFIs for PPP Loans?

- Challenges that you Must Consider

- When will I be able to locate a CDFI or MDI that will serve my location and necessitates?

- What’s Next After Locating CDFIs and MDIs that Fits?

- What’s the Next Step if CDFIs and MDIs in my location are not joining in PPP?

- Best Practices for Evaluating a Lender

- List of Community Financial Institution by State that Offers PPP Loans?

- Frequently Asked Questions (FAQs) Associated With Community Development Financial Institutions CDFI

- How Deskera Can Assist You?

Let’s dig in!

Understanding FIRREA

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) was passed by Congress in August 1989. To maintain, preserve, and provide for the Minority Depository Institution sector, Section 308 of FIRREA set the following stated goals:

- preserve and maintain the number of minority-owned depositories;

- preserve the minority status in the event of a merger or acquisition;

- give technical support to institutions that are not yet insolvent in order to prevent insolvency;

- encourage the creation of new minority-owned depository institutions; and

- provide for academic activities, training, and technical assistance

Understanding Community Financial Institution

A Community Financial Institution (CFI) is a financial system that serves underserved communities by providing financial services. These communities have access to financial services provided by CFIs.

CFIs are divided into three categories:

- CDFI: Community Development Financial Institution

- MDI: Minority Depository Institution

- CDC: Certified Development Company

Understanding PPP Loans

PPP is an acronym for Paycheck Protection Program. The Coronavirus Assistance, Relief, and Economic Security Act (CARES) developed the Paycheck Protection Program, which is a loan program.

Furthermore, the PPP loan has received an additional $284 billion in financing to assist small business owners in continuing to pay their employees amid financial difficulties caused by the coronavirus outbreak.

Moreover, these federally insured funds are intended to assist small firms in meeting their payroll obligations even when they do not have consistent cash flow. Small firms that satisfy the SBA's spending guidelines will have all of their debt canceled.

What’s CDFIs?

A Community Development Financial Institution (CDFI) is a financial institution that strives to ethical lending standards in order to serve low-income and disadvantaged communities and supports them to join economic mainstream.

To become a CDFI, an organization must be recognized by the US Department of Treasury and backed by the CDFI Fund, a government initiative that has contributed billions of dollars in community development since 1994.

This sort of financial assistance aims to assist low-income individuals and communities. It is divided into four sectors: banks, loan funds, credit unions, and venture capital, each with its own business strategies and legal frameworks.

- Community Development Loan Funds: assist low-income groups and individuals with financial goods such as housing, community service organizations, microenterprise, and small business loans.

- Community Development Credit Unions: Provide low-income persons with financial assistance in the form of inexpensive credit and other financial services.

- Community Development Venture Capital Funds: Small and medium-sized enterprises in underprivileged neighborhoods may benefit from Community Development Venture Capital Funds, which can provide equity funding to small and medium-sized firms in underserved communities.

- Community Development Banks (CDBs): lend and invest in communities to help them grow.

Furthermore, to be eligible for CDFI certification, a CDFI's main objective must be community development.

Although it cannot simply sell financial products; it must also provide economic and educational services. Therefore, it must target one or more clearly defined target markets and ensure accountability to those markets.

Remember that they can't be government-controlled or owned by one (except for Tribal governments.) Moreover, their mission-driven approach may be beneficial to owners who are having problems obtaining finance elsewhere.

About CDFI Lender

CDFIs or Community Development Financial Institutions, help revitalize economically challenged towns around the United States.

Through their development solutions, cheap loans, and financial aid, these specialist financial institutions are accredited to reach underprivileged groups (such as underprivileged people in largely black and Hispanic communities). This could also aid in the acquisition of inexpensive housing.

What’s MDIs?

MDIs (Minority Depository Institutions) are banking institutions that predominantly serve minority communities such as Hispanics, Asians, Blacks, and Native Americans, according to the Federal Deposit Insurance Corporation.

Also, it is a credit union or bank operated or managed by a person of color.

MDIs are crucial in assisting underserved communities in obtaining resources and establishing economic security and opportunity where it is most required.

According to studies, MDIs have a substantial social impact because they disburse more funds to POC individuals and enterprises than other financial institutions.

Although not all MDIs are funded by the federal government, some are. An institution is considered an MDI by the Federal Deposit Insurance Corporation (FDIC) if it fits one of two criteria:

- At least 51 percent of the voting stock is held by minorities who are also citizens or residents of the United States, or

- Minorities make up the majority of the target audience for the organization. Also, minorities make up the majority of the board of directors

The FDIC is required by law to support MDIs and assist in the establishment of new ones.

Note:

The FDIC's definition of a minority excludes managed and women-owned institutions.

What Can a CDFI do for Your Small Business?

CDFIs can be an excellent source of capital and investment for community-based organizations. It includes small businesses, microenterprises, and even charities. Some of them are also involved in commercial real estate and low-cost housing loans.

Microloans, or smaller loans to underserved firms, are a significant source of finance for small company loans through CDFIs.

Furthermore, technical support, which often includes— education and training to help the business owner efficiently deploy the funding and enroll for more standard small business loans in the future—is typically included in CDFI loans.

These loans' underwriting guidelines are usually more permissive. They may be able to work with borrowers who don't fit the typical target market for small business financing in terms of credit ratings, revenue, and other traditional small business financing criteria.

CDFIs may be able to aid with relief and recovery by providing loans and other resources. In 2020, many CDFIs aided businesses with COVID-19 relief and rehabilitation.

Some of these institutions offer working capital loans and/or startup finance. Others help small business owners refinance high-cost, predatory loans to save money and save their firm.

How do you Apply for a CDFI loan?

Finding the perfect CDFI partner for your small business may take some time and effort. However, if you succeed, the time you put in will be well good enough to justify it!

Larger, well-established firms with high credit scores are often not the major targets of these groups.

If, on the other hand, your company is having trouble obtaining low-cost small business loans, or if your company is located in a rural or underprivileged community, you might wish to consider CDFI financing.

Step One: Locating Community Development Financial Institutions in your location is the first stage.

Step Two: Go to the CDFI's website to see what kinds of loans and financial aid it provides. Each CDFI specializes in a different area.

Step three: Speak with the CDFI about the best manner to submit a formal application.

Is it Feasible for CDFI and MDI to Assist Businesses in acquiring a PPP loan?

Many minority-owned enterprises were denied benefits by financial institutions during the first phase of the PPP. This could be because their net profit was too low, or because banks thought they didn't have enough staff.

However, funding was made available through Minority Depository Institutions (MDIs) and Community Development Financial Institutions (CDFIs) in the second PPP round.

It further support BIPOC-owned small businesses (Black, Indigenous, and People of Color) in acquiring the financial support they needed to keep the global pandemic progressing.

The Consolidated Appropriations Act, which was enacted on December 27, 2020, included funding for CDFIs and MDIs. As a result, the government set aside approximately $3 billion for underprivileged communities.

In addition, the Small Business Administration (SBA) will design a new methodology to help small businesses meet the criteria for larger loans.

Why Should Small Businesses Use CDFIs for PPP Loans?

These financial institutions for community development work to ensure that underserved communities have access to loans. It became critical, however, as the COVID-19 pandemic began to affect small enterprises' finances.

In comparison to CDFIs, banks and financial unions have one advantage. Because they're smaller and connected to their communities, they can provide more personalized client care.

This is a significant benefit that can assist small business owners in answering any queries they may have when registering.

If you need money to establish or expand your microbusiness, you can also seek a Solopreneur loan.

Challenges that you Must Consider

Time is a severe challenge of employing a CDFI vs MDI. Because these organizations frequently have little resources, obtaining finance may take a bit longer than it might with a huge bank.

The funds given by the Consolidated Appropriations Act of 2021 are intended to assist CDFIs and MDIs in resolving their resourcing difficulties.

Another thing to keep in mind is that CDFIs tend to focus on extremely specialized groups; if your firm does not meet the demands of that specialized group, the CDFI may not even be suited for you.

When will I be able to locate a CDFI or MDI that will serve my location and necessitates?

Following we have discussed how you can easily locate a CDFI or MDI that serves in your area or location. Let’s learn:

Locating CDFI

This CDFI locator can help you locate a financial institution in your area. It will help you find a certified organization in your area and filter results based on the sort of service you're searching for (e.g. small business or venture fund). The web browser provides a list of CDFI contributors as well as contact details.

A CDFI exists in every state, including Guam, the District of Columbia, and Puerto Rico.

Locating MDI

Although there aren't as many MDIs as CDFIs, this list will help you find the nearest MDI to you. Check out:

However, if your location lacks CDFIs or MDIs, visit Benefits.gov to check if you are eligible for disaster, financial, medical, or other benefits.

Eventually, look into the Small Business Administration's Lender Match program, which integrates small businesses with SBA-approved lenders. Within two days, the Lender Match tool promises to engage small business owners with the right lenders (based on their particular needs).

What’s Next After Locating CDFIs and MDIs that Fits?

To learn more about what CDFIs and MDIs offer, qualifying restrictions, and the application procedure, contact the ones that appear to be the greatest fit for your needs.

We suggest calling a couple of different organizations to compare their lending processes and offerings.

What’s the Next Step if CDFIs and MDIs in my location are not joining in PPP?

No worries, there are certainly other options are available to you.

Outside of PPP, money targeted to help BIPOC enterprises and individuals in underprivileged communities was added in the Consolidated Appropriations Act of 2021.

Beyond the PPP:

- The SBA 7(a) microfinance loan program received $2.5 billion.

- CDFIs were given $12 billion, and a new Neighborhood Capital Investment program was established to help CDFIs and MDIs.

- Grants for low-income communities received $20 billion in EIDL financing.

This simply indicates that even though a CDFI or MDI does not participate in PPP, they may be able to help you with other lending options.

If your CDFI/MDI is unable to assist you, apply for an EIDL or approach the SBA.

Best Practices for Evaluating a Lender

While the conditions and interest rates of PPP loans are set and quite particular, it's always important to discuss them. In general, before proceeding with a loan, you should think about the following:

- What are the terms of repayment?

- Is there a "penalty" for paying off the loan sooner than expected?

- How long do you have to pay back the loan?

- What is the interest rate on the loan?

- When can you anticipate getting your money?

- What happens if you default on your loan?

- Is it important to provide a personal guarantee?

List of Community Financial Institution by State that Offers PPP Loans?

You can acquire the CDFI PPP Lenders you need through the SBA's Payroll Protection Program lenders. You can get assistance with your PPP application and have it filled out for you.

The following is a list of community development banks in each state. Here's where you can find CDFI banks in your neighborhood.

Bankers Small Business CDC of California

- San Diego, California is home to this CDFI.

- They provide assistance to businesses in California.

- Check the further information:

Visit www.cdcloans.com for more information.

Call Robert Villareal at 619-291-3594 for more information.

California Farmlink

- Aptos, California is home to this CDFI.

- They offer support to businesses in the state of California.

- Reggie Knox can be reached at 831-425-0303 for additional information.

- They provide customer assistance in Spanish.

Opportunity Fund

- This Community Financial Institution PPP is based in San Jose, California.

- They provide assistance to businesses in California.

- Online applications are available at www.opportunityfund.org.

- You can reach them at 888-720-3215 for additional information.

- They provide customer service in Spanish as well as specific CDFI PPP lenders applications and technical support.

CDFIs Serving Colorado

Check the following list of CDFIs PPP Lenders in Colorado:

- This CDFI is located in Denver, Colorado.

- They assist Colorado businesses.

- Online applications are available at www.coloradoenterprisefund.org.

- Contact at 303-860-0242 for further details and information.

- They provide Spanish customer service as well as PPP technical assistance on an individual basis.

Florida: CDFI PPP Lenders List Serving

Check the following list of CDFIs PPP Lenders in Florida:

Black Business Investment Fund

- Orlando, Florida is home to this CDFI.

- They provide assistance to businesses in Florida.

- For further information, go to:

- Visit www.bbifflorida.com for more information.

- Inez Long can be reached at 407-649-4780.

CDFIs Serving New York

Check the following list of CDFIs in New York:

Alternatives Federal Credit Union

- Ithaca, New York is home to this CDFI.

- They provide services to New York-based businesses.

- Visit the following website for further information:

- www.alternatives.org is their website.

- Kevin Mietlicki can be reached at 607-273-4611.

Ascendus

- New York City, New York is the location of this CDFI.

- They provide services to New York-based businesses.

- To learn more, go to www.ascendus.org.

- Paul Quintero may be reached at 646-833-4514.

Boc Capital Corp

- Brooklyn, New York is home to this CDFI.

- They assist New York firms.

- You may learn more about capital by visiting:

- Visit www.bocnet.org for more information.

- Nancy Carin can be reached at 718-624-9115.

Community Capital New York

- This CDFI is located in Elmsford, New York.

- They provide assistance to New York-based businesses.

- Visit the following website for further information:

- Visit www.communitycapitalny.org for more information.

- Kimberlie Jacobs can be reached at 914-747-8020.

Renaissance Economic Development Corporation

- The CDFI is located in New York City, New York.

- They assist New York firms.

- To apply, fill out an interest form on the following website, which is available in both English and Spanish:

- PPP Loan Interest – Renaissance EDC

- For further information, go to:

- Visit www.renaissance-ny.org for more information.

- Jessie Lee may be reached at 212-964-6022.

- They provide Spanish customer service as well as PPP technical assistance on an individual basis.

PPP loans in Texas: Community Development Financial Institutions (CDFI PPP Lenders)

Check the following list of PPP loan lenders in Texas:

BCL of Texas

- Austin, Texas is home to community financial institutions and PPP lenders.

- They provide assistance to Texas businesses.

- Online applications are available at www.bcloftexas.org.

- Raquel Valdez can be reached at 512-912-9884 for additional information.

- They provide Spanish customer service as well as PPP technical assistance on an individual basis.

PeopleFund

- Austin, Texas is the location of this CDFI.

- They provide assistance to Texas businesses.

- You can learn more about CDFI loans by visiting:

- Visit www.peoplefund.org for more information.

- Gustavo Lasala can be reached at 512-222-1002.

- You can provide your information on their voice mail system and they will give you a call.

Banks that serve many states on a list of CDFIs

Following are the certified CDFIs or PPP lenders in a number of states.

Lendistry

- This CDFI is located in Los Angeles, California.

- California, Georgia, Maryland, and Pennsylvania are among the states where they assist firms.

- For further information, go to:

- Visit www.lendistry.com for more information.

- 562-242-2900 is the number to call for Everett Sands.

Rural Community Assistance Corporation

This CDFI is located in West Sacramento, California.

- Mexico, Arizona, Colorado, Utah, California, Hawaii, Idaho, Nevada, New Arkansas, Montana, Oregon, Washington, and Wyoming are among the states where they provide funding.

- Visit their website to discover more about them and their application process:

- Visit www.rcac.org for further information.

- Reach them at 916-447-9832 or at 916-320-9805.

Clearinghouse CDFI

- Lake Forest, California is home to this CDFI.

- Companies in California, Arizona, Nevada, and New Mexico benefit from their services.

- Visit learn more:

- go to www.clearinghousecdfi.com.

- Douglas Bystry can be reached at 949-859-3600.

LiftFund

- This CDFI is located in San Antonio, Texas, and will assist you with obtaining funding:

- Mississippi, Arizona, Alabama, Oklahoma, Georgia, Kentucky, Florida, Louisiana, Tennessee, Missouri, New Mexico, South Carolina, and Texas are the states where they support businesses.

- For further information, go to:

- Visit www.liftfund.com for more information.

- Contact at 888-215-2373, ext. 111.

Note: Voice mail facility is also available. And, you can submit your information and they will contact you later.

DreamSpring

- Albuquerque, New Mexico is home to this CDFI.

- Businesses in Georgia, Colorado, New Mexico, North Carolina, Arizona, Nevada, and Texas benefit from their services.

- Online applications are available at www.dreamspring.org.

- Marisa Barrera can be reached at 800-508-7624 for additional information.

- They provide Spanish customer service as well as PPP technical assistance on an individual basis.

Pursuit

- New York City, New York is the location of this CDFI.

- They provide services to companies in Pennsylvania.

- New Jersey, and New York.

- Alternatively, you can apply online at www.pursuitlending.com.

- Steve Cohen can be reached at 800-923-2504 for further information.

- They provide Spanish customer service as well as PPP technical assistance on an individual basis.

Note: According to the recorded message, the easiest way to get help is to email paycheckprotection@persuit.com.

Frequently Asked Questions (FAQs) Associated With Community Development Financial Institutions CDFI

Following we have discussed some major frequently asked questions associated with Community Development Financial Institutions CDFI. Let’s discuss:

Que 1: What Community Financial Institutions Perform?

A CDFIS, or Community Development Financial Institution, provides financial assistance to enable economic growth, development, and opportunities.

Que 2: Can MDI can also be CDFI certified?

Yes, MDI can also be CDFI certified.

Que 3: What is a Small Business Administration Microlender?

These are microlenders who receive SBA funding to help freshly founded, starting, and developing businesses.

Funding, training, and technical support from the Small Business Administration are all available.

Que 4: Are CDFIs eligible to receive payments from the Payment Protection Program?

PPP money can be disbursed with the help of certified CDFIs. As a result, CDFI lending benefits small businesses, microenterprises, and low-income neighborhoods; you can even apply for housing affordability.

Que 5: Are CDFIs governed?

Some community development financial institutions are regulated financial entities. It includes financial credit unions and community development banks.

Furthermore, non-regulated institutions, such as loan funds or venture capital funds, may be among the others.

How Deskera Can Assist You?

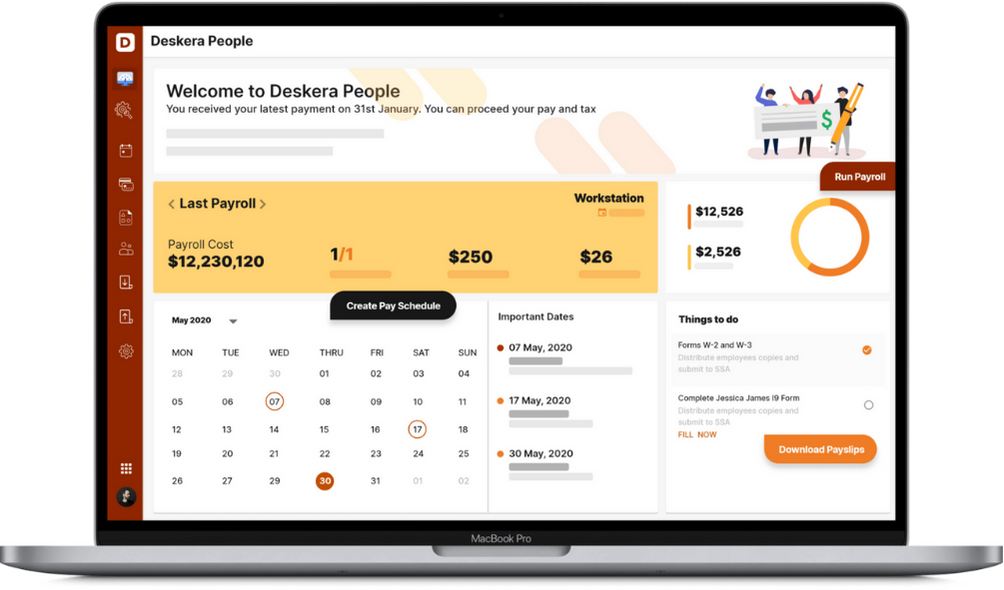

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Final Takeaways

Following we have listed some crucial points for your future reference. Let’s learn:

- A Community Financial Institution (CFI) is a financial system that serves underserved communities by providing financial services.

- PPP is an acronym for Paycheck Protection Program. The Coronavirus Assistance, Relief, and Economic Security Act (CARES) developed the Paycheck Protection Program, which is a loan program.

- A Community Development Financial Institution (CDFI) is a financial institution that strives to ethical lending standards in order to serve low-income and disadvantaged communities.

- MDIs (Minority Depository Institutions) are banking institutions that predominantly serve minority communities such as Hispanics, Asians, Blacks, and Native Americans, according to the Federal Deposit Insurance Corporation.

- Microloans, or smaller loans to underserved firms, are a significant source of finance for small company loans through CDFIs.

- To learn more about what CDFIs and MDIs offer, qualifying restrictions, and the application procedure, contact the ones that appear to be the greatest fit for your needs.

- Funding was made available through Minority Depository Institutions (MDIs) and Community Development Financial Institutions (CDFIs) in the second PPP round.

- If your CDFI/MDI is unable to assist you, apply for an EIDL or approach the SBA.

- If your location lacks CDFIs or MDIs, visit Benefits.gov to check if you are eligible for disaster, financial, medical, or other benefits.

- Look into the Small Business Administration's Lender Match program, which integrates small businesses with SBA-approved lenders. Within two days, the Lender Match tool promises to engage small business owners with the right lenders (based on their particular needs).

- Some community development financial institutions are regulated financial entities. It includes financial credit unions and community development banks.

Related Articles