Have you ever wondered why some businesses struggle to pay their bills despite making good sales? The answer often lies in poor cash flow management. Cash flow forecasting is a crucial financial practice that helps businesses predict their future cash position, ensuring they have enough funds to cover expenses and invest in growth. Without an accurate forecast, even profitable companies can face liquidity crises, leading to missed opportunities or financial distress.

Cash flow forecasting involves estimating the inflows and outflows of cash over a specific period, allowing businesses to plan ahead and make informed financial decisions. By understanding when money is expected to come in and go out, companies can prevent cash shortages, avoid unnecessary borrowing, and maintain financial stability. Whether you run a small business or a large enterprise, having a clear cash flow projection helps you stay prepared for seasonal fluctuations, unexpected expenses, and strategic investments.

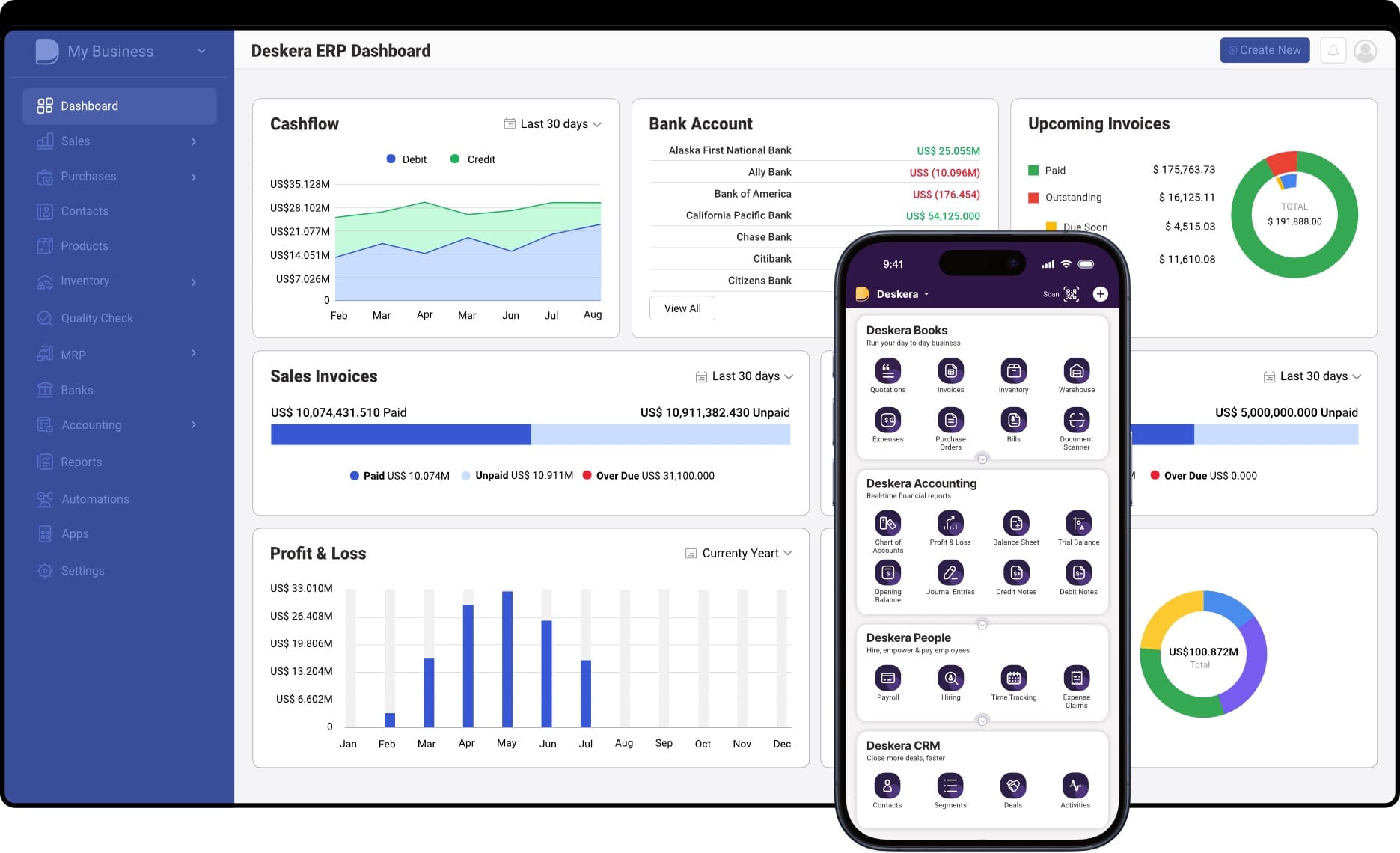

For businesses looking to simplify their cash flow forecasting process, Deskera ERP provides an all-in-one solution. With its real-time financial tracking, automated cash flow projections, and AI-powered insights, Deskera helps businesses gain better visibility into their financial health. By integrating accounting, invoicing, and expense management, it ensures accurate cash flow predictions, allowing companies to make data-driven decisions with confidence.

In this guide, we’ll walk you through the fundamentals of cash flow forecasting, its key components, forecasting methods, and best practices. By the end, you’ll have a solid understanding of how to create and maintain an effective cash flow forecast to keep your business financially strong.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the future movement of cash in and out of a business over a specified period. It provides businesses with a forward-looking view of their financial position, allowing them to anticipate potential cash shortages, plan for major expenditures, and make informed financial decisions. Unlike cash flow analysis, which examines past financial performance, cash flow forecasting focuses on predicting future cash availability to ensure business continuity and stability.

A well-prepared cash flow forecast helps businesses maintain liquidity by ensuring they have enough cash to meet operational needs while optimizing the use of surplus funds. By analyzing historical data and considering various financial scenarios, companies can develop projections that highlight both best and worst-case scenarios. This proactive approach helps businesses navigate uncertainties, prevent cash crunches, and seize growth opportunities when excess cash is available.

Cash flow forecasting can be categorized into short-term, medium-term, and long-term forecasts. Short-term forecasts, covering up to 30 days, help businesses manage immediate liquidity needs. Medium-term forecasts (one month to a year) assist in planning for upcoming financial commitments. Long-term forecasts, spanning multiple years, provide strategic insights into investment planning and capital expenditures. While longer forecasts may be less precise due to market uncertainties, they remain essential for shaping business strategy.

The accuracy of cash flow forecasting depends on the quality of input data and the collaboration between finance teams and other departments. Businesses often use variance analysis to compare actual cash flow against forecasts, refining predictions over time. With the right tools and financial planning strategies, companies can leverage cash flow forecasting to mitigate risks, improve cash management, and ensure long-term financial health.

Objectives of Cash Flow Forecasting

Cash flow forecasting serves as a crucial financial planning tool that helps businesses anticipate future cash movements and make informed decisions. The primary objectives of cash flow forecasting include ensuring liquidity, improving financial planning, optimizing working capital, and enabling strategic decision-making. By accurately predicting cash inflows and outflows, businesses can maintain financial stability and avoid unexpected cash shortages.

- Financial Reporting – One of the key objectives of cash flow forecasting is to project cash levels for financial reporting periods such as month-end, quarterly, or annual reviews. Accurate forecasts provide businesses with a clear picture of their financial health, helping stakeholders, investors, and management make informed decisions.

- Liquidity Management – Effective cash flow forecasting helps businesses maintain sufficient liquidity to cover expenses and avoid cash shortages. By predicting when customer payments will arrive and when obligations need to be met, companies can identify potential cash surpluses or deficits and take proactive measures to optimize their cash position.

- Financial Planning and Budgeting – Cash flow forecasting is central to financial planning, allowing businesses to evaluate historical data, market trends, and operational needs to set realistic financial goals. This ensures better resource allocation, efficient budgeting, and improved financial performance monitoring.

- Scenario Planning – Businesses use cash flow forecasting to model different financial scenarios, including best-case and worst-case situations. This approach helps organizations determine how much cash is required as a safety buffer while avoiding excessive reserves that could be put to better use elsewhere.

- Working Capital Management – Forecasting helps businesses optimize their working capital by managing accounts receivable and payable cycles efficiently. By understanding expected cash inflows from sales and outflows for operational expenses, businesses can improve cash conversion cycles and enhance overall financial efficiency.

- Debt Management – Accurate cash flow projections help businesses plan for debt repayments, ensuring they meet financial obligations on time. This minimizes the risk of defaulting on loans, maintains positive relationships with creditors, and enhances a company’s creditworthiness.

- Investment and Expansion Decisions – By assessing future cash availability, businesses can make strategic investment decisions, such as capital expenditures, acquisitions, or market expansion. Forecasting helps companies evaluate the feasibility of these investments while balancing risk and return.

By achieving these objectives, businesses can strengthen financial stability, improve decision-making, and ensure long-term growth. Implementing a robust cash flow forecasting process empowers organizations to proactively manage their finances and navigate economic uncertainties with confidence.

Cash Forecasting Periods

Selecting the right cash forecasting period is essential for balancing accuracy and long-term financial planning. The further into the future a forecast extends, the more uncertainty it carries.

Businesses typically use different forecasting periods depending on their financial goals, operational needs, and risk management strategies. The four main types of cash forecasting periods are short-term, medium-term, long-term, and mixed-term forecasting.

- Short-Term Forecasting (2 to 4 Weeks)Short-term cash flow forecasting focuses on immediate financial needs, typically covering the next two to four weeks. It ensures businesses have enough cash to meet upcoming obligations such as payroll, loan repayments, and vendor payments. This type of forecasting requires detailed, day-to-day financial data, including invoicing, foreign exchange transactions, and short-term liabilities.

- Medium-Term Forecasting (2 to 6 Months)Medium-term forecasting extends between two to six months into the future, helping businesses plan for upcoming expenses, debt repayments, and potential liquidity issues. One of the most commonly used models in this category is the 13-week cash flow forecast, which offers a structured way to monitor cash flow movements while ensuring the business stays financially stable.

- Long-Term Forecasting (6 to 12 Months or More)Long-term forecasting focuses on broader financial planning, typically covering six months to a year or more. This period is used for annual budgeting and assessing whether the company has the cash reserves needed to support growth initiatives such as hiring, acquisitions, or expansion. It relies on data from profit and loss forecasts, internal budgets, and macroeconomic factors to anticipate financial trends.

- Mixed-Term Forecasting (Combination of Forecasting Periods) Some businesses use a mixed-term approach, combining short-, medium-, and long-term forecasts for a more dynamic financial strategy. For instance, a company may use weekly cash forecasts for the first three months, followed by monthly forecasts for the next six months. This approach helps businesses maintain financial flexibility while managing both immediate and long-term liquidity needs.

By choosing the appropriate cash forecasting period, businesses can improve financial stability, optimize cash flow management, and make informed decisions that support sustainable growth.

Different Methods of Cash Flow Forecasting

Cash flow forecasting methods vary based on the level of detail, accuracy, and business objectives. The two primary approaches are direct forecasting and indirect forecasting, each serving different financial planning needs.

1. Direct Cash Flow Forecasting

Direct forecasting focuses on short-term cash flow predictions, usually covering periods of a few weeks to a few months. It relies on actual cash inflows and outflows, making it a highly accurate method for managing liquidity.

- Best for: Short-term planning (e.g., payroll, vendor payments, operational expenses).

- Data sources: Accounts receivable, accounts payable, bank statements, and treasury reports.

- Advantages: High accuracy for immediate cash flow management.

- Disadvantages: Limited long-term financial insights.

2. Indirect Cash Flow Forecasting

Indirect forecasting is used for long-term financial planning and strategic decision-making. Instead of tracking actual cash movements, it relies on projected financial statements such as income statements and balance sheets.

- Best for: Long-term forecasting (6 months to several years).

- Data sources: Profit and loss statements, budgets, financial models, and historical trends.

- Advantages: Helps with financial planning, growth strategies, and investment decisions.

- Disadvantages: Less accurate in the short term due to reliance on assumptions and estimates.

3. Rolling Forecasting

Rolling forecasting is a dynamic approach where businesses continuously update their cash flow projections instead of sticking to a fixed period.

- Best for: Companies with fluctuating cash flow patterns.

- Advantages: Ensures up-to-date financial planning by regularly revising forecasts.

- Disadvantages: Requires constant monitoring and adjustment, making it resource-intensive.

4. Scenario-Based Forecasting

Scenario-based forecasting helps businesses prepare for different financial situations by modeling best-case, worst-case, and base-case cash flow projections.

- Best for: Risk management and contingency planning.

- Advantages: Allows companies to anticipate potential cash shortages and take preventive measures.

- Disadvantages: Requires extensive data analysis and multiple forecasting models.

5. Statistical Forecasting

Statistical methods use historical data and predictive analytics to project future cash flows. These models apply techniques such as regression analysis and time-series forecasting.

- Best for: Businesses with stable financial trends and access to large datasets.

- Advantages: Data-driven and minimizes human biases in forecasting.

- Disadvantages: May not account for sudden market changes or external factors.

Each method has its advantages depending on the business's needs. Companies often use a combination of these approaches to create more accurate and flexible cash flow forecasts.

Key Elements to Consider in Cash Flow Forecasting

Effective cash flow forecasting requires businesses to analyze various components to ensure financial stability and liquidity. Below are the key elements that play a critical role in predicting future cash flows:

1. Opening Cash Balance

The opening cash balance represents the amount of available cash at the beginning of the forecasting period. This includes funds in bank accounts, petty cash, and any immediately accessible financial assets. It serves as the foundation for forecasting future cash flows and helps businesses determine how much liquidity they have at the start.

2. Cash Inflows

Cash inflow refers to the total funds expected to be received during the forecasting period. Sources of cash inflows include:

- Sales revenue – Cash payments from customers, both immediate and credit-based.

- Investment income – Returns from investments, dividends, or interest.

- Loans and credit facilities – Funds received from bank loans or credit lines.

- Asset sales – Proceeds from selling company assets.

- Government grants or subsidies – Any financial support from government programs.

Accurate forecasting of cash inflows helps businesses assess their financial standing and ensure they have sufficient liquidity for operational needs.

3. Cash Outflows

Cash outflow includes all expenses and financial obligations that must be paid within the forecast period. Key outflow categories include:

- Operating expenses – Rent, utilities, payroll, supplier payments, and other routine business expenses.

- Loan repayments – Scheduled debt payments, including interest.

- Capital expenditures – Investments in equipment, infrastructure, or expansion projects.

- Tax payments – Corporate taxes, VAT, and other regulatory obligations.

By forecasting cash outflows, businesses can ensure they have enough liquidity to meet obligations and avoid financial shortfalls.

4. Vendor Payment Terms

Understanding and managing vendor payment terms is crucial in maintaining a balanced cash flow. Businesses should:

- Negotiate extended payment terms to improve liquidity.

- Align payment due dates with expected cash inflows.

- Take advantage of early payment discounts when financially feasible.

Proper vendor management helps smooth out cash flow fluctuations and reduces the risk of liquidity issues.

5. Market Trends and Seasonal Variations

External factors such as market trends, economic conditions, and seasonal demand impact cash flow. Businesses should analyze historical patterns and adjust their forecasts accordingly to prepare for potential fluctuations.

By incorporating these key elements, businesses can enhance their cash flow forecasting accuracy, optimize financial planning, and ensure long-term stability.

Benefits of Accurate Cash Flow Forecasting

Accurate cash flow forecasting is essential for businesses to maintain financial stability, optimize resource allocation, and plan for future growth. Below are the key benefits:

1. Improved Liquidity Management

By predicting cash inflows and outflows, businesses can ensure they have sufficient liquidity to cover operational expenses, debt obligations, and unexpected costs. This prevents cash shortages and minimizes financial risks.

2. Better Financial Planning and Budgeting

Cash flow forecasting provides valuable insights into future cash positions, enabling businesses to create realistic budgets, set achievable financial goals, and allocate resources more effectively.

3. Enhanced Decision-Making

With accurate forecasts, businesses can make data-driven decisions about investments, cost-cutting measures, expansion plans, and hiring strategies, ensuring financial sustainability.

4. Minimized Risk of Cash Shortfalls

Accurate forecasting helps businesses identify potential cash deficits in advance. This allows them to take proactive steps, such as securing short-term financing or adjusting payment schedules, to avoid liquidity crises.

5. Strategic Investment Opportunities

By understanding future cash positions, businesses can evaluate investment opportunities, such as acquisitions, new product launches, or infrastructure upgrades, without jeopardizing their financial health.

6. Efficient Debt Management

A clear cash flow projection helps businesses manage loan repayments, avoid late payment penalties, and maintain good relationships with creditors by ensuring timely payments.

7. Strengthened Vendor and Supplier Relationships

Forecasting enables businesses to plan vendor payments effectively, negotiate favorable terms, and avoid late payments, which can enhance supplier trust and potentially lead to better deals.

8. Business Growth and Expansion

With a solid understanding of their cash position, businesses can confidently pursue growth strategies, such as market expansion, hiring, and technological advancements, without overextending financial resources.

9. Crisis Preparedness and Scenario Planning

Cash flow forecasting allows businesses to prepare for different financial scenarios—best-case, worst-case, and base-case—helping them build contingency plans and stay resilient during economic downturns.

10. Increased Stakeholder Confidence

Accurate cash flow forecasts provide financial transparency, boosting confidence among investors, lenders, and other stakeholders, which can improve access to funding and business partnerships.

By leveraging accurate cash flow forecasting, businesses can enhance financial stability, make strategic decisions, and ensure long-term success.

Limitations of Cash Flow Forecasting

While cash flow forecasting is a crucial financial tool, it comes with certain limitations that businesses should be aware of:

1. Uncertainty and Inaccuracy

Forecasts rely on estimates, which may be affected by unexpected economic conditions, market fluctuations, or operational disruptions. As a result, the accuracy of cash flow predictions decreases over longer timeframes.

2. Dependency on Assumptions

Cash flow forecasts are based on assumptions about future sales, expenses, and external factors such as interest rates or currency exchange rates. If these assumptions are incorrect, the forecast may not reflect the actual cash position.

3. Difficulty in Predicting Customer Payments

Delayed payments from customers can significantly impact cash flow. Even if invoices are issued on time, businesses cannot always predict when customers will settle their dues, leading to discrepancies in forecasts.

4. Impact of External Factors

Economic downturns, inflation, changes in government regulations, supply chain disruptions, or industry-specific challenges can all affect cash inflows and outflows, making forecasts unreliable.

5. Limited Historical Data for New Businesses

Startups and small businesses may not have sufficient historical data to create accurate cash flow forecasts, making it difficult to predict future trends with confidence.

6. Static Nature of Forecasts

Traditional cash flow forecasting methods may not account for sudden changes in financial conditions. Without frequent updates, forecasts can quickly become outdated and ineffective.

7. Complexity in Large Organizations

For large businesses with multiple revenue streams, international transactions, and complex financial structures, consolidating accurate cash flow forecasts across various departments and regions can be challenging.

8. Errors in Data Collection and Processing

Inaccurate financial data entry, errors in accounting software, or miscalculations in spreadsheets can lead to incorrect cash flow predictions, resulting in poor financial decisions.

9. Lack of Real-Time Insights

Many businesses still rely on manual forecasting methods that do not provide real-time data. This delay can make it difficult to respond quickly to cash flow issues.

10. Over-Reliance on Forecasting Tools

While advanced forecasting software can improve accuracy, it still requires accurate input data and human oversight. Over-reliance on automation without proper validation can lead to misleading forecasts.

Despite these limitations, businesses can improve cash flow forecasting accuracy by regularly updating their forecasts, using reliable data sources, and incorporating scenario analysis to prepare for uncertainties.

How to Create a Cash Flow Forecast

Creating a cash flow forecast involves estimating future cash inflows and outflows over a specific period. Follow these steps to build an accurate and useful forecast:

1. Determine the Forecasting Period

Decide the time frame for your forecast based on your business needs. The common forecasting periods are:

- Short-term (2-4 weeks) – For managing immediate liquidity and payments.

- Medium-term (2-6 months) – To plan for upcoming expenses and cash needs.

- Long-term (6-12 months or more) – For budgeting and strategic planning.

2. Establish the Opening Cash Balance

Identify the amount of cash available at the beginning of the forecasting period. This includes:

- Cash in bank accounts

- Petty cash

- Any undeposited checks

3. Estimate Cash Inflows

Predict all sources of incoming cash for the forecasting period. Key inflows include:

- Sales Revenue – Based on expected payments from customers (consider payment terms).

- Accounts Receivable – Expected collections from outstanding invoices.

- Loans and Credit Lines – Funds received from financing.

- Investment Income – Dividends, interest, or proceeds from asset sales.

- Other Income – Grants, tax refunds, or rental income.

Tip: Analyze past trends and seasonal variations to improve accuracy.

4. Forecast Cash Outflows

Identify all expected expenses and outgoing cash. Key outflows include:

- Operational Expenses – Rent, utilities, salaries, and supplier payments.

- Accounts Payable – Scheduled payments to vendors.

- Loan Repayments – Principal and interest on borrowed funds.

- Taxes and Government Payments – Income tax, sales tax, or VAT.

- Capital Expenditures – Purchases of equipment, inventory, or expansion costs.

- Other Costs – Insurance, marketing, or unexpected expenses.

Tip: Consider historical payment trends and vendor payment terms to predict timing.

5. Calculate the Net Cash Flow

Use the formula:

Net Cash Flow = Total Cash Inflows - Total Cash Outflows

If the result is positive, you have a cash surplus. If negative, you may need to secure additional funds or delay expenses.

6. Determine the Closing Cash Balance

Calculate the ending cash balance using:

Closing Cash Balance = Opening Cash Balance + Net Cash Flow

This helps assess whether you have enough cash to cover obligations for the next period.

7. Review and Adjust Regularly

Cash flow forecasts should be updated frequently based on actual data and business changes. Regular reviews help:

- Identify discrepancies between projected and actual figures.

- Adjust for unexpected changes in cash flow.

- Make proactive financial decisions.

8. Use Cash Flow Forecasting Tools

Consider using software like:

- Spreadsheet Models (Excel/Google Sheets) – Flexible but requires manual updates.

- Accounting Software (Eg. Deskera) – Automates forecasting based on financial data.

- Treasury Management Systems – For large businesses managing complex cash flows.

A well-prepared cash flow forecast helps businesses manage liquidity, anticipate challenges, and make informed financial decisions. Regular updates and scenario planning ensure adaptability to changing business conditions.

Best Practices for Cash Flow Forecasting

Accurate cash flow forecasting helps businesses maintain financial stability, avoid liquidity crises, and make informed decisions. Below are key best practices to enhance the accuracy and reliability of cash flow forecasting:

1. Define Clear Objectives

- Determine the purpose of the forecast—whether for financial reporting, liquidity management, debt repayment, or investment planning.

- Align the forecasting period (short, medium, or long-term) with business needs.

2. Use Reliable Data Sources

- Base forecasts on historical cash flow trends and real-time financial data.

- Ensure consistency by integrating information from accounts receivable, accounts payable, sales reports, and budgeting systems.

3. Separate Fixed and Variable Cash Flows

- Identify fixed expenses (rent, salaries, loan payments) that remain constant.

- Monitor variable expenses (inventory purchases, marketing, utilities) that fluctuate based on business activity.

4. Factor in Seasonal and Market Trends

- Adjust forecasts for seasonal demand fluctuations or economic changes that could impact cash inflows and outflows.

- Review past performance during similar periods to enhance accuracy.

5. Maintain Conservative Estimates

- Overestimate expenses and underestimate revenue to create a buffer for unexpected shortfalls.

- Prepare for late customer payments by factoring in delays in accounts receivable.

6. Regularly Update the Forecast

- Conduct weekly, monthly, or quarterly updates based on new data.

- Compare actual cash flow with forecasts to identify discrepancies and refine predictions.

7. Perform Scenario Planning

- Develop best-case, worst-case, and baseline scenarios to anticipate risks.

- Use different assumptions for sales growth, inflation, interest rates, and currency fluctuations to test financial resilience.

8. Leverage Automation and Forecasting Tools

- Use accounting software (like Deskera) or cash flow forecasting tools to automate data collection and analysis.

- Cloud-based financial tools provide real-time cash visibility and reduce manual errors.

9. Align Forecasting with Business Strategy

- Ensure forecasts support strategic goals like expansion, investment, or debt repayment.

- Adjust cash flow plans to match changing business priorities.

10. Establish Emergency Liquidity Plans

- Maintain a cash reserve or access to a credit line to handle unforeseen cash shortages.

- Establish contingency plans to delay non-essential expenses or accelerate receivables if necessary.

Implementing these best practices ensures that cash flow forecasting is accurate, actionable, and aligned with business objectives. Regular updates and scenario analysis help businesses stay agile, optimize liquidity, and make informed financial decisions.

The Role of Technology in Cash Flow Forecasting

Technology plays a critical role in enhancing the accuracy, efficiency, and reliability of cash flow forecasting. With advancements in real-time data access, predictive analytics, automation, and artificial intelligence (AI), businesses can make more informed financial decisions and proactively manage their cash flow.

1. Real-Time Data Access & Forecasting

- Modern financial systems provide instant access to live sales, expenses, and payment data.

- Businesses can update forecasts dynamically as new financial data becomes available.

- Real-time tracking helps detect potential cash flow issues early and allows for proactive financial planning.

2. Advanced Predictive Analytics & Machine Learning

- AI-powered predictive models analyze historical data and market trends to improve cash flow forecasts.

- Statistical forecasting techniques help identify spending patterns, revenue cycles, and seasonal fluctuations.

- Businesses can make data-driven adjustments to optimize their liquidity.

3. Increased Automation for Efficiency

- Automation eliminates manual tasks like data collection, entry, and formatting, reducing errors.

- Automated cash flow reports and dashboards provide instant financial visibility.

- Treasury management systems streamline bank reconciliations, invoice tracking, and expense monitoring.

4. AI & Machine Learning for Enhanced Forecasting Accuracy

- AI continuously analyzes multiple live data streams for real-time re-forecasting.

- Machine learning detects patterns, anomalies, and potential risks that might be overlooked by humans.

- AI can adjust forecasts dynamically based on market shifts, customer behavior, or economic conditions.

How Deskera ERP Can Help with Cash Flow Forecasting

Deskera ERP provides automated, real-time financial insights that enhance cash flow forecasting accuracy. Its integrated accounting, invoicing, and financial management features allow businesses to monitor cash flow trends, predict future liquidity, and optimize financial planning.

1. Real-Time Cash Flow Tracking

- Deskera ERP provides a real-time view of cash inflows and outflows, helping businesses monitor their financial health at any moment.

- Automated dashboards offer cash position visibility, reducing manual tracking efforts.

2. Automated Invoice Management & Receivables Forecasting

- The system tracks pending invoices and payment due dates, reducing uncertainty in cash inflow projections.

- Businesses can set up automated payment reminders to ensure timely collections and minimize late payments.

3. Expense Management for Accurate Cash Outflow Predictions

- Deskera ERP helps categorize and forecast expenses, ensuring businesses have enough liquidity to meet obligations.

- Automated expense tracking reduces the risk of underestimating cash outflows.

4. Budgeting & Scenario Planning

- Businesses can create multiple cash flow scenarios (best-case, worst-case, and baseline) to assess financial risks.

- Integration with sales and operational data enables data-driven forecasting for better financial planning.

5. AI-Powered Insights & Forecasting Tools

- Deskera’s AI Assistant, David, analyzes past trends and market conditions to improve cash flow predictions.

- Predictive analytics help businesses adjust to market fluctuations and optimize liquidity.

6. Integration with Bank Feeds for Real-Time Reconciliation

- Deskera ERP connects with bank accounts to reconcile transactions in real-time, ensuring forecasts are based on up-to-date financial data.

- Automated reconciliation minimizes errors and enhances forecasting accuracy.

7. Customizable Financial Reports

- Generate custom financial reports, including cash flow statements, profit & loss reports, and balance sheets, for a comprehensive financial overview.

- Reports help stakeholders make informed decisions regarding liquidity and investments.

Key Takeaways

- Cash flow forecasting helps businesses manage liquidity, plan finances, analyze different scenarios, optimize working capital, and make informed investment and debt management decisions.

- Forecasts can be short-term (2–4 weeks) for managing immediate expenses, medium-term (2–6 months) for ensuring liquidity stability, and long-term (6–12 months) for strategic growth planning. A mixed-term approach combines different periods for comprehensive financial oversight.

- Businesses can use direct forecasting for short-term cash flow accuracy and indirect forecasting for long-term financial planning based on historical trends and financial statements.

- A reliable cash flow forecast should include opening cash balance, projected cash inflows (sales, investments), and expected cash outflows (expenses, debt payments). Vendor payment terms also play a crucial role in maintaining cash flow stability.

- Effective forecasting improves financial stability, risk management, and decision-making, helping businesses avoid cash shortages, optimize investment opportunities, and ensure timely debt repayment.

- Forecasts can be affected by market uncertainties, unexpected expenses, and data inaccuracies. Businesses should continuously update their forecasts to mitigate these risks.

- Businesses should start by gathering historical data, categorizing cash inflows and outflows, using forecasting tools, and regularly updating projections to adapt to changing financial conditions.

- Leveraging real-time data, automating the process, incorporating scenario planning, and aligning forecasts with business goals can enhance forecast accuracy and effectiveness.

- AI, machine learning, real-time data access, and automation have revolutionized cash flow forecasting, making it more accurate, efficient, and adaptive to market changes.

- Deskera ERP offers real-time financial tracking, automated forecasting tools, and AI-driven insights to help businesses streamline their cash flow management efficiently.

Related Articles