Cash accounting, or cash basis of accounting, is the simplest method businesses can use to recognize their finances.

Under cash accounting, revenue is recorded when cash is received, and expenses only after the cash is paid.

So, in simpler words, cash accounting only deals with the recording of cash transactions.

For small businesses that handle few financial activities, this method can be really advantageous as business owners won’t have to spend too much time or resources on their financial reporting.

However, cash accounting comes with a few drawbacks, and may not be suitable for every type of small business.

In this guide, we will be going through the details of what cash accounting is, its pros and cons, and whether or not it’s the right choice for your small business accounting.

Read along to learn about:

- What Is Cash Accounting?

- Who Uses Cash Accounting?

- Advantages of Cash Accounting

- Disadvantages of Cash Accounting

- Cash Accounting Example

- Automate Accounting with Deskera

What Is Cash Accounting?

Cash accounting is one of the bases of accounting businesses can use to record their financial transactions. A basis of accounting is the timing of documentation businesses choose to record their revenue and expenses.

Under cash accounting, revenue and expenses are recognized only when cash exchanges hands. So, revenue is recognized when a customer sends the payment, and expenses are recorded only after the business pays for the bill.

This method is most commonly applied by small businesses with very few transactions and no inventory.

But why don’t public companies and larger businesses opt for the method, as well?

Corporations, public companies, businesses that sell inventory, and those who generate more than $25 million for 3 consecutive tax years, are legally obliged to use another basis of accounting known as accrual accounting.

Cash Accounting vs Accrual Accounting

Accrual accounting is the accounting method that recognizes revenue and expenses immediately as they occur, regardless of when cash is exchanged.

So, if a business was to sell merchandise on credit, the earned revenue would be recorded at the time of purchase, rather than when the invoice payment is received in the future. This allows businesses to always be aware of their outstanding receivables and payables, and never miss a payment date.

The vast majority of businesses, especially large public companies, use accrual accounting as their accounting method. It’s extremely difficult for these types of firms to keep track of finances and meet reporting requirements with just cash accounting.

At the same time, accrual accounting is in compliance with accounting standards adopted by the government, which makes the method suitable for every type of business, regardless of size or industry.

With that being said, cash accounting is way simpler to manage than accrual accounting.

Cash accounting only records cash inflows and cash outflows and uses a single entry system. In a single entry bookkeeping method, each transaction results in just one transaction entry.

Accrual accounting, by comparison, uses five different account categories that are recorded through a double-entry bookkeeping system. In double-entry, for every recorded transaction, at least two accounts are affected and as a result, there is always a debit and a credit entry.

So, in order for a business to manage their money with accrual accounting, they would need help from a trained professional with an adequate understanding of financial accounting.

Whereas cash accounting can easily be managed by anyone, using a spreadsheet, no professional knowledge necessary.

If you want to learn more about double-entry and whether or not it’s the right bookkeeping method for your small business, head over to our guide on double-entry bookkeeping.

Who Uses Cash Accounting?

The most common types of businesses and industries that opt for cash accounting include the following:

- Sole proprietorships and partnerships, as these types of ownership, don’t have to publish any of their financial statements.

- Businesses that use single-entry bookkeeping, instead of double-entry bookkeeping. As previously mentioned, double-entry is only used in accrual accounting.

- Small businesses with few transactions and employees.

- Businesses with no inventory.

- Businesses that don’t sell or buy goods and services on credit.

- Businesses that require payment at the time of sale, through cash, bank transfer, checks, or credit/debit cards.

For these business categories, cash accounting works best as it doesn’t prevent cash flow issues from crippling their day-to-day operations.

Advantages of Cash Accounting

Ease of Use

The main advantage of cash accounting is its ease in use and maintenance.

Cash accounting requires little to no understanding of financial accounting principles.

The only bookkeeping that needs to be done is the recording of revenue when cash is received, and the recognition of expenses when they get paid. Hence, only one account is affected, so there is no need for a double-entry bookkeeping system.

Less Costly

Because of how simple cash accounting is, it’s also less costly to implement, as businesses can manage it by themselves through a notebook or spreadsheet, without the need for a trained accountant.

Disadvantages of Cash Accounting

Inaccurate Bookkeeping

Now, although the method is the simplest to manage, it’s not the most accurate.

Cash accounting can easily distort the idea of how a business is profiting and spending. Let’s illustrate with an example.

Say that for the month of January a small business receives $500 from sales, and purchases $200 of materials whose invoice will arrive in two weeks. With cash accounting, the profit for the month of January would be $500, even though $200 was spent on purchasing materials.

During the time span that the sales invoice hasn’t been received, or paid yet, the business can appear better off financially than it actually is, and easily overspend an extra $200 they can’t afford.

Doesn’t Comply with GAAP

Another disadvantage of cash accounting is that it doesn’t meet the Generally Accepted Accounting Principles (GAAP) decided by the US commission.

Thus, it can’t be used by public companies or other organizations that file for audited financial statements.

No Built-In Error Checking

A double-entry accrual method works in a way that assets always equal liabilities and owner’s equity. This equality is known as the accounting equation. Any variation from the equality of this equation is evidence that an accounting error has been made.

This type of in-built error formula does not exist in cash accounting.

So, say the business owner incorrectly writes down that $20,000 was received in revenue when the correct value is $2,000.

In cash accounting, this mistake would not be identified until the business receives a bank statement that shows an unexpected low account balance. Whereas in accrual accounting, this mistake would result in an incorrect sum of debits and credits, and the error would be easily revealed on its own.

Cash Accounting Example

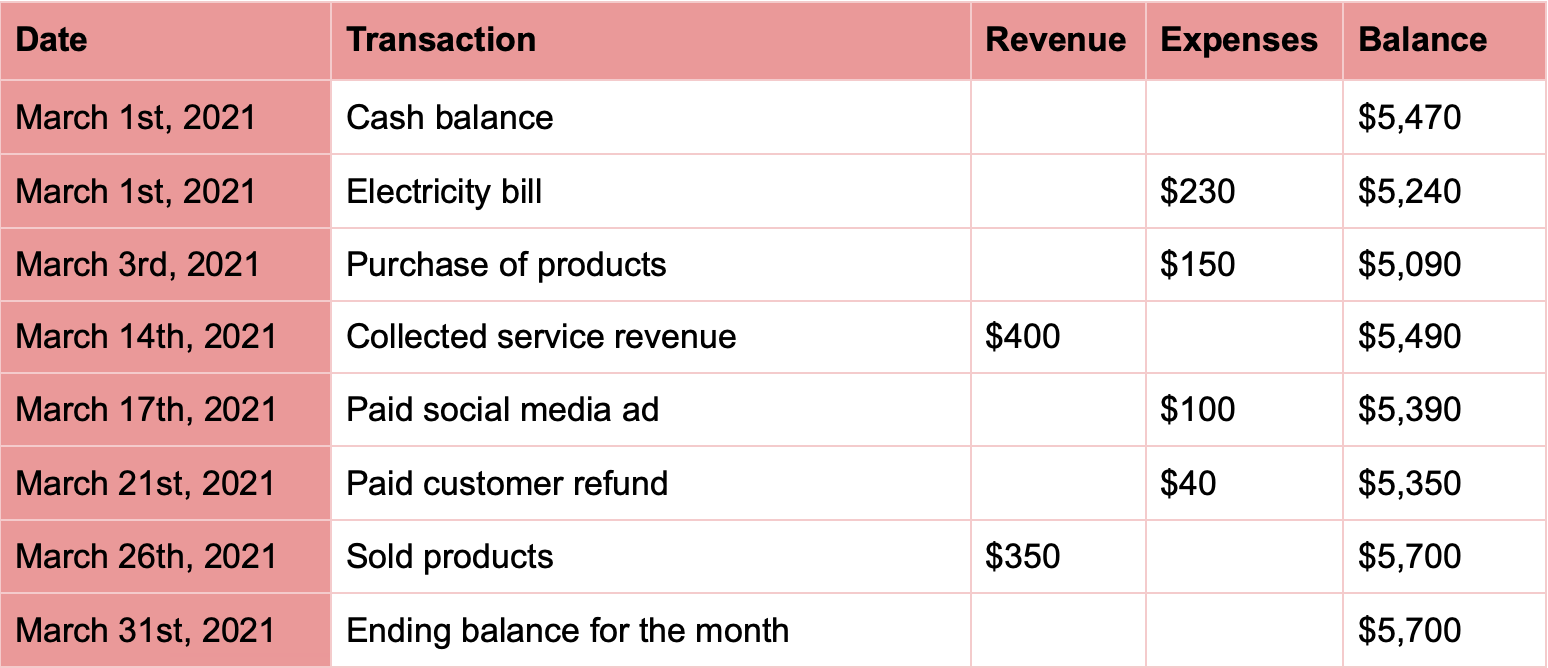

To illustrate how cash accounting is done, let’s assume that for the month of March, a small business completes the following cash transactions:

- The cash balance from the previous month is $5,470.

- March 1st, pays electricity bill for the month of February, $230.

- March 3rd, purchases and pays for $150 worth of products.

- March 14th, collects $400 worth of service revenue.

- March 17th, pays $100 for social media advertisement.

- March 21st, pays for a customer refund, $40.

- March 26th, sells $350 worth of products.

This is how the cash accounting single entry would look like on a spreadsheet, for these transactions:

This is one of the simplest, most minimalistic ways you can display your revenue and expenses, using cash accounting.

If you want more detailed documentation of your finances, feel free to separate your business expenses and revenue by type, and add any other additional columns.

Automate Accounting with Deskera

Cash accounting may be easy, but it comes with plenty of drawbacks and prevents your business from financially growing. That’s why most companies, even small startups, opt for accrual accounting instead.

Now we know what you may be thinking: isn’t accrual accounting difficult to implement?

Manually, yes, but with accounting software like Deskera, you can completely automate your accrual accounting, in just a few clicks.

Deskera is cloud accounting software, designed specifically for small business owners, who are looking for an intuitive tool to manage their finances.

You won’t need any accounting knowledge to use the platform, as the software guides you through its features and streamlines most of the accounting processes for you.

Through direct bank account integration, any payments or purchases are immediately posted as a journal entry into the appropriate ledger accounts.

The software also comes with a document generator tool, that you can use to create and issue your invoices, bills, receipts, quotations, and so much more.

Not convinced Deskera is the right choice for your business?

Then, don’t take our word for it!

Try the software out yourself by signing up for our free trial. No credit card details needed.

Key Takeaways

Cash accounting is the easiest, most straightforward method of recording your finances. It only requires single-entry bookkeeping of cash transactions.

Although it is simple to manage and oversee, cash accounting can distort the financial position of your business, and cause you to overspend or understate your profit. That’s why the vast majority of businesses nowadays use accrual accounting instead.

With accounting software like Deskera, implementing accrual accounting is as easy as 1-2-3. The software comes with in-built accounting features that automate the entire process for you.

Related Articles