There are certain financial terms that every businessman should be familiar with to run their organizations successfully. CAPEX and OPEX are the two main terms that are used to classify cash flow, within financial management.

Capital expenditures or CAPEX refers to the major purchases that a company makes. These assets are designed to be used in the long run. While operating expenses or OPEX refers to the day-to-day expenses incurred by a company.

Therefore, it is an added advantage to have a good understanding of the difference between CAPEX and OPEX, before diving into strategic investments and capital expenditure project management.

What is CAPEX?

CAPEX refers to capital expenditure. It is financing used by businesses to secure physical assets or upgrade current assets. Capital expenditures are those funds that a company makes use of to acquire, improve, or maintain its physical assets.

Physical assets can be property, plant, and equipment. The fixed assets purchased are intended to benefit the organization for more than a year. If the useful life of the asset exceeds one year, which is typical, then the cost is expensed using depreciation from three to twenty years after the purchase date. In the case of real estate, the depreciation can be for over twenty years.

CAPEX can also be financed externally. This is usually done through collateral securities or debt financing. To increase capital investment, businesses take loans, issue bonds, or use other debt instruments.

CAPEX Generally Takes Two Forms

Maintenance Capital Expenditure

These are cash expenditures incurred to purchase new capital assets to maintain, restore or replace the useful life of existing capital assets. It is a type of recurring expenditure.

Expansion Capital Expenditure

These are cash expenditures incurred to expand or increase the efficiency of the existing capital assets. Expansion capital assets are bought by the company in order to grow the business.

Pros and Cons of CAPEX

CAPEX improve the earning capacity and efficiency of a firm. It helps to gain a competitive edge within the market or industry. Makes the company’s balance sheet better in terms of finance, which helps attract investors towards the firm’s investment. It also helps to avail bank loans easily.

Along with the pros CAPEX has certain corns too. It needs very clear planning and budgeting as it affects the businesses in the long run. If raised through borrowed funds it will lead to heavy interest charges. Once made, the CAPEX decision cannot be reversed. A failed planning will result in the sale of assets at lower rates causing heavy losses to the company.

What is OPEX?

OPEX or operating expenses refers to those costs incurred by a business to run its day-to-day operations smoothly. These expenses should be ordinary and customary for the industry in which the firm operates. OPEX items are generally short-term and are used within the year of their purchase.

These types of expenses are generally shown on the income statement of an organization. Operating expenses are deducted from the gross profits of the company when they occur. Its depreciation is fully deductible in the respective year.

It is essential for every firm to identify its operational activities, primary revenue-producing activities, and other non-financing activities before calculating its operating expenses. OPEX primarily covers the commercial activities of a company.

The workflow of goods or services purchased as an OPEX item will be as follows:

- Costs are assigned to the operating expenses budget

- Expenses are tracked in the profit and loss statement

- Monthly expenses are tracked and deducted at the time they are incurred, instead of depreciation over several years

It is important to note that the operational activities vary based on the industries a firm works. Operating expenses in an industry may be financing or investing expenses in another. For instance, purchasing a building is considered as a financing activity in most industries while it is an operating activity for a real-estate firm.

Pros and Cons of OPEX

Operating expenses are important to an organization as they help assess the firm’s cost and stock management efficiency. These costs or expenses do not relate to the production of a product. It highlights the level of cost that is required for a company to generate revenue. A relatively higher OPEX indicates that the company is less efficient.

It is unreasonable to use OPEX as a metric to compare firms even in the same industry as it is an absolute number and not a ratio. Even though OPEX is seen as a measure of financial performance, it is important to note that it varies across industries.

Examples of CAPEX or Capital Expenditures

In short terms, capital expenditures are cash spent to purchase fixed assets that are expected to provide utility for the business for more than one accounting year. Following are some examples of CAPEX.

- Manufacturing plants

- Land and building improvements

- Computers and office equipment

- Furniture and fixtures

- Vehicles and trucks

Examples of OPEX or Operating Expenses

In simple terms, operating expenses are costs incurred by a company to run its day-to-day operations. They are short-term expenses and are usually spent within the accounting year in which they were purchased. Given below are some examples of OPEX.

- Accounting, legal, license fees

- Advertising and marketing expenses

- Insurance

- Salaries and wages (except direct labor for production employees)

- Rent, rates, and property taxes

- Travel expenses

- Maintenance and repairs

- Vehicle expenses

- Utilities

Calculation of Capital Expenditure (CAPEX)

Below is an Example of How CAPEX is Calculated for the Year Ending 2020 and 2021

Calculation of Operating Expenses (OPEX)

Below is an Example for OPEX Calculation of an Online Shopping Platform for the Year Ending 2020 and 2021

Difference between CAPEX and OPEX

Capital expenditures are funds or expenses that are used to purchase fixed assets and will be used beyond the accounting year in which they are bought. While operating expenses are the daily expenses needed to run a company smoothly.

CAPEX costs are paid all at once but the returns take a long time to realize and hence are a long-term expense. It basically lasts for about 3 - 20 years. On the other hand, OPEX is short-term and is usually used up within the accounting year in which it is purchased. This means that they are paid within a week, month or year.

Capital expenses cannot be deducted from income for tax purposes while operating expenses can be deducted from taxes. CAPEX is listed in the investing activities of a company and is shown in a cash flow statement and OPEX is shown on the income statement of a company.

A CAPEX decision must be approved through several layers of management, this leads to delay in the purchasing process. Adding an OPEX item takes less time when compared with CAPEX as long as the item is included in the budget.

CAPEX or OPEX, Which one is Right for Your Business?

It is not possible to select one among CAPEX and OPEX. Both are two sides of the same coin and have their own importance in the business. Instead of wasting time making a decision to choose among them, companies must choose which area to be put under CAPEX and which needs to be put under OPEX. Proper forecasting must be done in order to invest the funds in capital expenditure while properly estimating operating expenses that will be incurred in the near future.

Regardless of what expenses you choose, you must have control over the infrastructure of your company, whether in a CAPEX model of premises or an OPEX model rented place. This will give you the ability to make decisions that will impact the overall growth of your business.

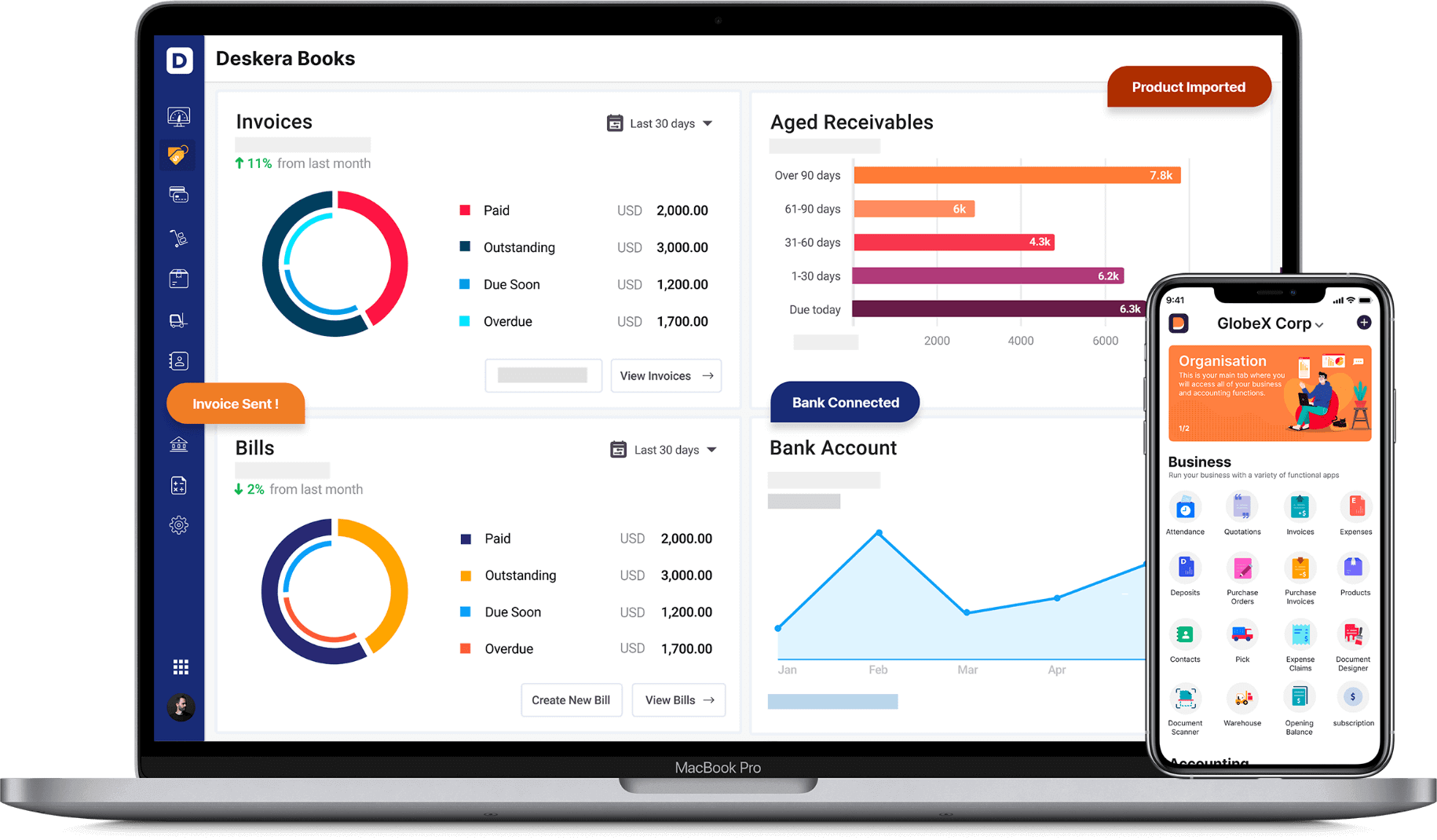

How Can Deskera Help You With Accounting?

To make accounting of your expenses a hassle-free process, you should use Deskera Books. Deskera Books is online accounting software that will make your processes of financial reporting and auditing easier, faster, and more efficient.

Deskera Books also comes with pre-configured tax codes, accounting rules, and charts of accounts. This will make sure you do not miss out on the benefits from tax-deductible expenses. Additionally, it will keep track of all your expenses and keep your financial statements and financial KPIs updated in real-time.

Lastly, you can even make your bookkeepers or accountants, or CPAs a part of your Deskera Books account by giving them access through an invitation link.

Key Takeaways

CAPEX and OPEX are 2 financial terms that every businessman must be familiar with to smoothly run an organization.

CAPEX stands for capital expenditures and is a major asset purchase that a company makes and is utilized for the long term. They can also be financed externally by using collateral securities or debt financing.

Capital Expenditure = Property, Plant, and Equipment (For the Current Period) - Property, Plant and Equipment (For the previous Year) - Depreciation (For the Current Period)

There are 2 forms of CAPEX. They are:

- Maintenance Capital Expenditures

- Expansion Capital Expenditures

CAPEX increases earning capacity and efficiency of the business. Helps gain a competitive edge. Helps attract investors toward the firm. Helps avail bank loans easily. While there are certain flaws like it needs very clear planning as it affects the business in the long run. The decision if fails will result in the sale of assets. Hence result in losses. When raised through borrowed funds it leads to interest charges.

OPEX stands for operating expenses and is the money spent by a company on a daily basis and is short-term in nature. These are ordinary and customary to the company. They are used up within one accounting year.

Workflow of the OPEX item will be as follows:

- Costs are assigned to the OPEX budget

- Expenses are tracked in the P&L statement

- Monthly expenses are tracked and deducted at the time they are incurred, instead of depreciation over several years

OPEX helps assess a firm's cost and stock management efficiency. It does not relate to the production of a product. Highlights the level of the cost required for a company to generate revenue. Higher OPEX indicates a company’s lesser efficiency. While it is unreasonable to use OPEX as a metric to compare firms. CAPEX varies across industries.

Operating Expenses = Revenue - Operating Income - Cost of Goods Sold

Below are examples of Capital Expenditure

- Manufacturing plants

- Land and building improvements

- Computers and office equipment

- Furniture and fixtures

- Vehicles and trucks

Following are examples of Operating Expenses

- Accounting, legal, license fees

- Advertising and marketing expenses

- Insurance

- Salaries and wages (except direct labor for production employees)

- Rent, rates, and property taxes

- Travel expenses

- Maintenance and repairs

- Vehicle expenses

- Utilities

Below are the differences between CAPEX and OPEX.

- CAPEX refers to the funds used to purchase fixed assets while OPEX refers to funds needed to run day-to-day operations.

- CAPEX is a long-term expense and its effect lasts from 3 - 20 years. On the other hand, OPEX is a short-term expense and lasts only for only 1 year.

- CAPEX cannot be deducted from income for tax purposes. But, OPEX is fully tax-deductible.

- A CAPEX decision has to get approval from many layers of management making the purchase pra process late. Purchasing an OPEX item takes less time when compared with CAPEX purchases.

Whatever the differences are we cannot select one among CAPEX and OPEX. Both have equal importance in the growth of a business. It is better to invest funds in CAPEX only after proper forecasting along with estimating OPEX expenses that will be incurred in the future.

To conclude, it is always good to understand both capital expenditures and operating expenses that affect a business. This will help to run a company smoothly.

Related Articles