If you are considering starting your business in Canada, or expanding your headcount, or just want to understand how payroll works in Canada, this article is for you.

By total area, Canada is the world's 2nd-largest country. The capital of Canada is Ottawa, and there are three most significant metropolitan areas, such as Montreal, Toronto, and Vancouver.

In the Westminster tradition, Canada is a parliamentary democracy and a constitutional monarchy. As the cabinet chair and head of government, monarch and prime minister serve.

Canada, which has a significant impact on its economy and culture, has a long and complex relationship with the United States.

The Canadian payroll has various components, and we will be covering all aspects in this article, including the different types of, work-permits, contributions, taxes, forms and also show you how to file them in a timely manner.

This guide will learn the basics of Canada payroll and statutory compliance, why it is essential, how it is done, how a successful payroll process looks, and more. Let's get started!

Doing Business in Canada

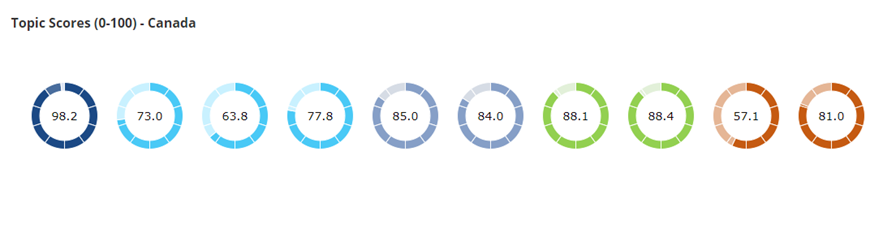

As per the latest edition of the World Bank Group's Doing Business 2020: Training for Reform report, Canada has ranked 23rd among 190 countries in doing business.

Click here to see all reforms made by Canada

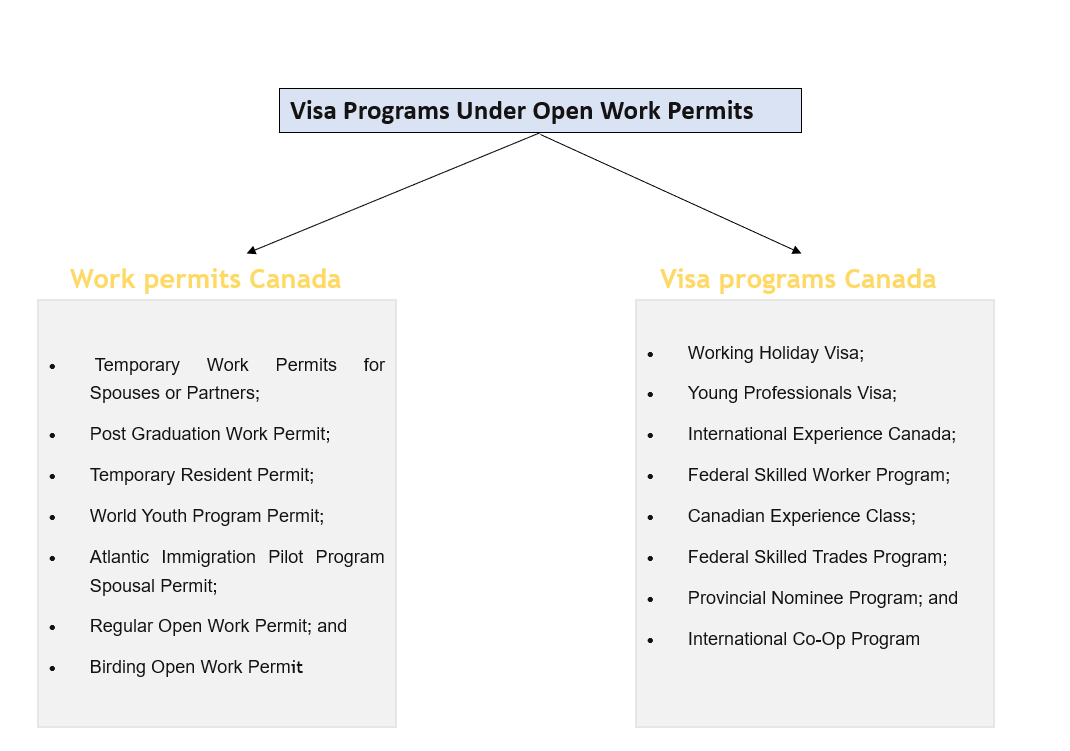

Types of Work Permits and Employment in Canada

To work in Canada, people interested have to fulfill some compulsory formalities. Depending on the work type interests, interestingly, the type of work permit is required. Thus, based on your occupation and your reason for entering the country, Canada has many types of work permits.

What Type of Work Permits Does Canada Have?

There are two types of work permits for people who want to migrate to Canada for work. It all depends on your qualification and the occupation you fall under. Considering this, you may fall under below main two categories,

- Open Work Permit and,

- Employer-specific work permit.

What Is An Open Work Permit?

For any immigrants who wish to work for an employer for a certain amount of time, an open to a work permit is issued by the Immigration office.

Open Work Permits (OWP) has two subcategories as Unrestricted Permit and Restricted Permits. The difference between these two categories is that the restricted permit will allow you to work in any location and occupation; however, the unrestricted permit does not. As the restricted permit allows you to work in a specific job, this does not give you much freedom of movement to work in different parts of Canada.

What Is an Employer-specific work permit?

Under an employer-specific work permit, you get the permit and permission to work depending upon the conditions mentioned on the work permit. It includes the employer's name, duration of work, and location where you will be working.

For making you eligible under the employer-specific work permit, your employer's responsibility is first to fulfill specific steps and formalities and offer you an employment number or a photocopy of a Labor Market Impact Assessment.

What Are the Common Work Permit Eligibility Criteria for All Applicants

For working in Canada, you must fulfill certain eligibility, irrespective of the type of work permit you are applying; below listed are the same,

- After the expiry of your work permit, convince the immigration department to leave the country.

- Make sure you carry evidence to prove that you have enough financial aid to take care of yourself and your family members while in Canada.

- Make sure you have a clean personal and family background with no criminal activity record.

- Making sure that you won't cause any danger to the security of Canada.

- Conducted the medical examination proving that you are in good health.

- As listed by the Canada immigration department, you are not planning to tie up with ineligible employers.

- Able to provide the documents ready, deemed by the necessary officials.

Documents Required For Working In Canada

Listed below are the documents that are important for getting a work permit in Canada,

- Introduction Letter

- Visa

- Passport

- Airline ticket

- Proof indicates that the applicant has fulfilled the requirements for the job applied, which can be proof of education and work experience.

- A copy of the Labor Impact Assessment sent by an employer

- Employment number

- Medical/health insurance drawn by employer

Different Kinds of Employment in Canada

1. Full-time employment

In Canada, full-time employment generally means working 30+ hours a week for a single employer and fulfilling your contractual duties. You will be eligible for a regular pay period, basic salary, vacation time, and other statutory benefits. For every pay period, expect payroll deductions to pay for Employment Insurance (EI), Canada Pension Plan (CPP), Income Tax, and, if applicable, Union Due.

2. Part-time employment

In Canada, any work that is less than 30 hours is considered part-time employment. These jobs are usually on weekends, evenings, half-day or daily part-timers in hospitality, retail, food stores, and service industry.

3. Contract Employment

Contract employment is for those people who are trying out different things and working in new environments. Contact employment is temporary work that includes casual, seasonal, short-term, freelance work. There are no EI and CPP deductions made for contract employment and are also exempted from tax.

4. Temporary work through a staffing agency

Temporary work is for those who want to expand their skills, network, try out a new industry or make extra income for holidays or college/school.

5. Voluntary work

If you are new in Canada, a recent graduate, or switching careers, volunteering is the best way to rack up experience. It will show your employers not only your ability but will show your concern for the well-being of others.

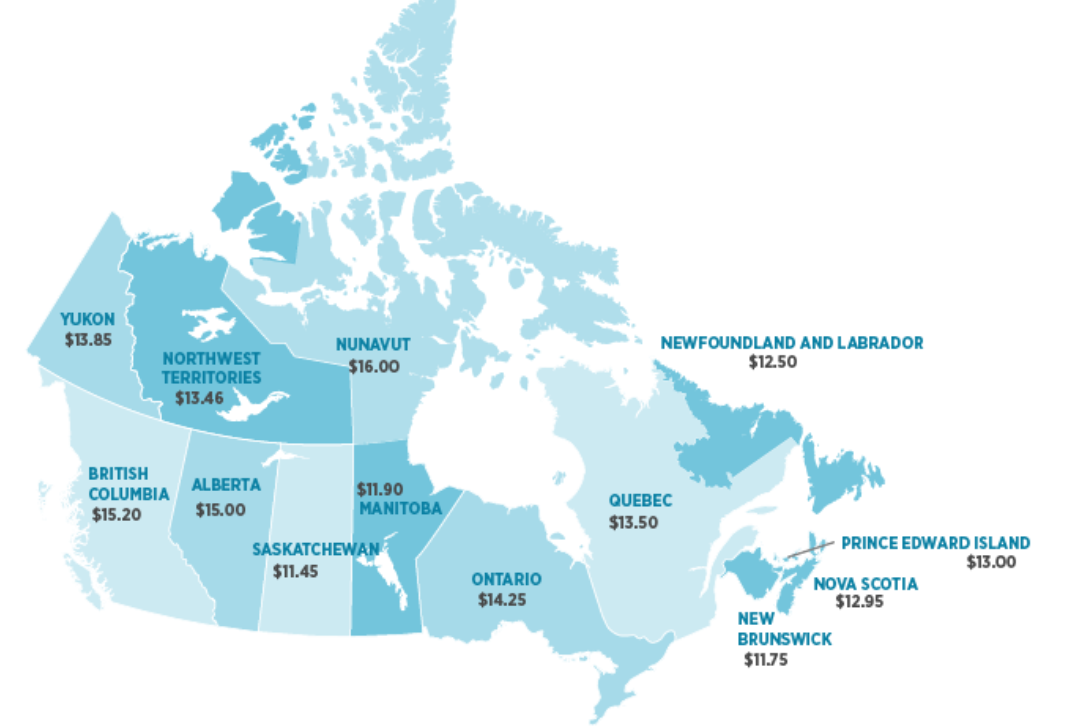

Minimum Wage Requirements in Canada

Minimum wage is nothing but where an employer can pay an employee at the lowest hourly pay rate. Their Canadian Employers must pay all employees at a set minimum wage by each province and territory. It is the employer's responsibility to adhere to the minimum wage requirements of their province or territory.

Table of Minimum Wage Rates

Current minimum wage rates in Canada with effect from June 1, 2021,

Setting up and Payroll Calculation for Small Business in Canada

As a small business owner, you will need to have a payroll if you hire employees to work under you. A payroll must consist of employees' information/name, Working hours, deductions, wages, and all records of payment made to them for every pay period and tax year.

It is pretty straightforward while setting up a new payroll account in Canada. Mistakes are and so can be tricky too. Thus to avoid these mistakes, to set up successful payroll attention to details is required from start to end.

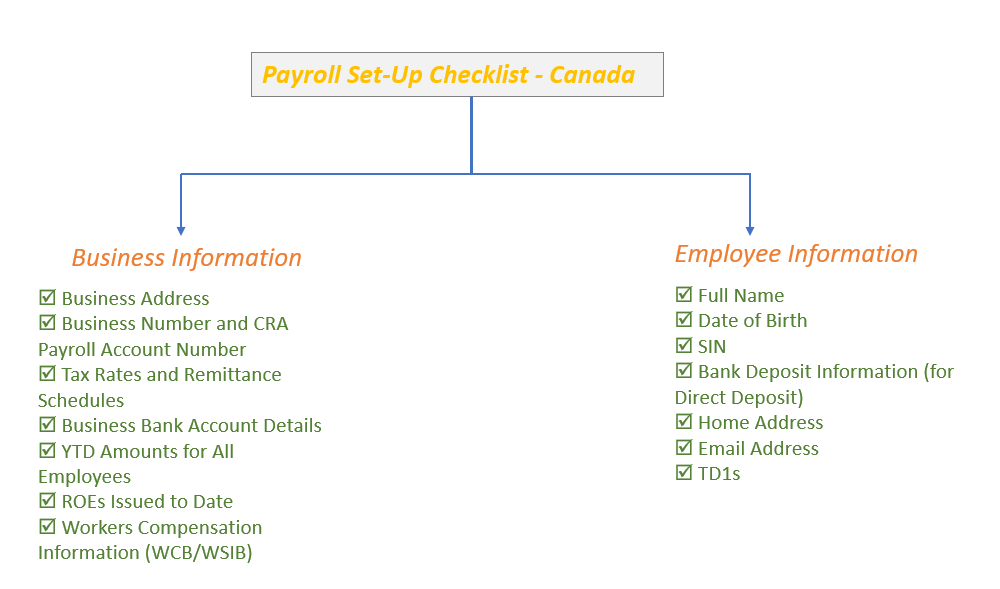

We have broken down the process to ensure you have all the required information you need before you kick start things into the new system. Let's take a sneak-peak at the pre-implementation checklist that will cover all vital information required to set up your business details and your employees.

A payroll Set-up Checklist in Canada

Before you even start up your new payroll account, it's essential to make sure that you have the following on hand,

This checklist will help you set up your company and essential information and add your employees to your new payroll system. However, this list may not be complete, as depending on your business type and the employees you hire, you may need additional information.

Setting up Your Company Details

The first step in setting up payroll in Canada is to set up your company details in your new payroll system with all the necessary information in front of you.

Mentioned below is the breakdown,

Business Address

The first thing you need to do to set up your company details is to add your business address correctly. Along with the address, you need to mention the street number/name, city, province, postal code, and telephone. In case your company has multiple locations, you can use headquarters as the primary address.

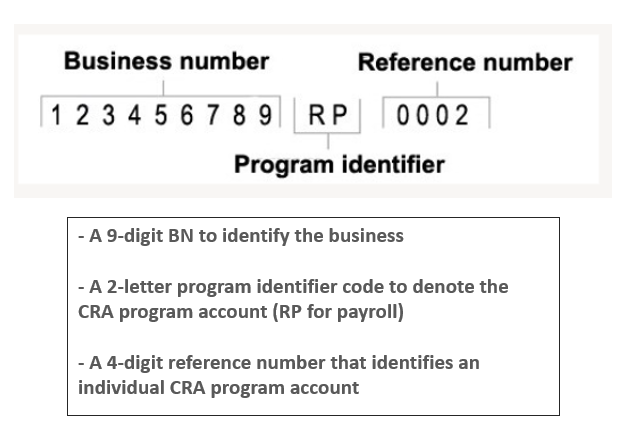

Business Number and CRA Payroll Account Number

Setting up your business address is the easiest part; from this step, things start to get more complicated. Next, you need to enter your Business Number (BN) & Payroll CRA Account Number. A BN is a 9-digit unique number that CRA assigns to your business that acts as a Tax ID. BN is not mandatory for every business, but you will need to get one if you are hiring employees.

Fortunately, BN registration is pretty straightforward, and the CRA allows you to finish the process online, either by mail/fax/over the phone.

Your BN is made up of the following, which is also part of a CRA Payroll Account Number,

How to Register for a Business Number (BN)?

There are different ways where CRA allows you to register for a BN Number.

Method 1 - Online

- With the CRAs online web portal, businesses can register with the required requirements. Click here to find more.

Method - 2 By Mail or Fax

- Go to Form RC1, Request for a BN and certain program accounts, if you need to print the form

- Next, fill the RC1 form, and after completion, mail/fax the form to your nearest tax service office/tax center.

Method 3 - By Phone

- To get the BN and register for the CRA program account using phone, you need to call 1-800-959-5525. Before you make a call, make sure you are prepared to answer the questions mentioned in RC1 Form Part A, Request for BN and Certain Program Accounts, and other questions in the form you want to open regarding the CRA program accounts.

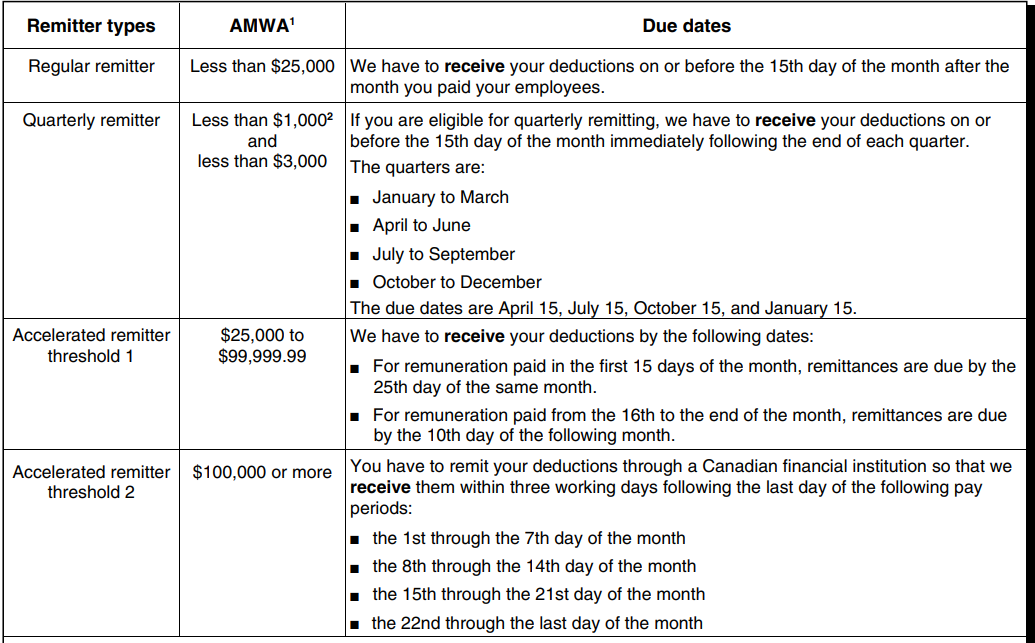

Remittance Schedule

In the next step, after entering your BN and CRA payroll account number, you will need to enter your Remittance Schedule. Understanding your remitter type can be easy.

Based on your (AMWA) average monthly withholding amount from the two calendar years. Your AMWA will be the total of (CPP), Canada Pension Plan, and (EI), Employment Insurance, and the Income Tax you need to remit for the year, divided by the number of months(Max 12).

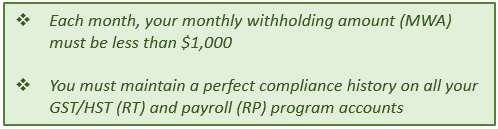

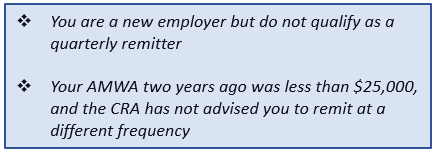

- Quarterly Remitters - New Small Employers

If you are a new small employer, instead of remitting a month, you can remit quarterly. The following qualification is required for quarterly remittance:

Due Date - CRA has to receive your deductions on or before the 15th day of the month after the month you have paid your employees.

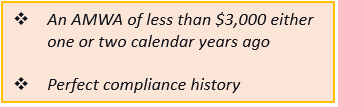

2. Quarterly Remitters: Small Employers

If you meet both of the following qualifications, you may still be able to remit quarterly instead of monthly, even if you're not a new employer.

Due Date - CRA has to receive your deductions on or before the 15th day of the month immediately following the end of each quarter. The quarters are,

- January - March

- April - June

- July - September, and

- October - December

3. Regular Remitters

You are a regular remitter if you satisfy the following qualifications:

Due Date - CRA has to receive your deductions on or before the 15th day of the month after the month you have paid your employees.

4. Threshold 1 Accelerated Remitters

Accelerated remitters may also fall into one of two groups,

If you have an AMWA of $25,000 to $99,999.99 for two calendar years, you are a threshold 1 accelerated remitter.

Due Date - CRA has to receive your deductions by the following dates,

- For remuneration paid to the first 15 days of the month, remittances are due by the 25th day of the same month.

- For remuneration paid from the 16th to the end of the month, remittances are due by the 10th day of the following month.

5. Threshold 2 Accelerated Remitters

If you have an AMWA of $100,000 or more two calendar years, you are a threshold 2 accelerated remitter.

Most businesses are non-accelerated remitters; however, you must constantly re-check before entering the information, as there are many penalties if the wrong threshold information is provided.

Due Date - You have to remit your deductions through a Canadian financial institution so that we receive them within three working days following the last day of the following pay periods,

- The 1st through the 7th day of the month

- The 8th through the 14th day of the month

- The 15th through the 21st day of the month; and

- The 22nd through the last day of month

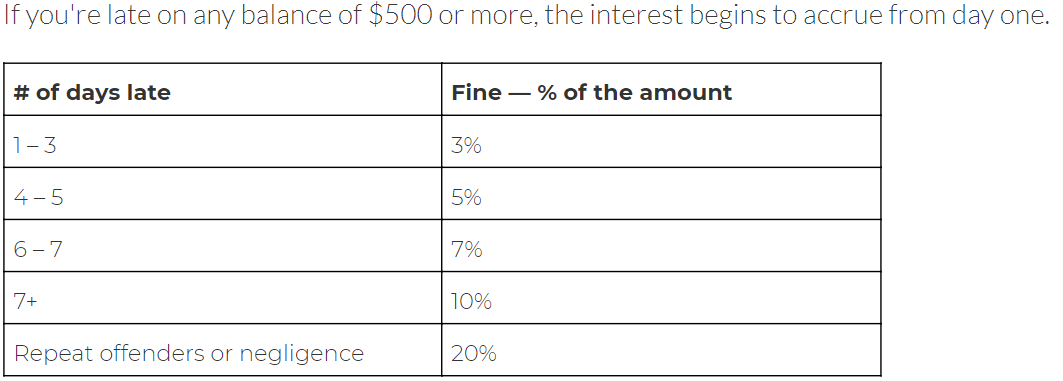

Penalties for Late Remittance Payment

- For 1-3 days late remittance payment - 3%

- For 4-5 days late remittance payment - 5%

- For 6-7 days late remittance payment - 7%

- For more than 7 days late remittance payment or never paid - 10 %

Submit Payroll Remittance Payments

To remit your remittance payments, following are the forms you need to fill out,

- PD7A (for monthly, regular, and quarterly remitters)

- PD7A(TM) or PD7A-RB (for accelerated remitters)]

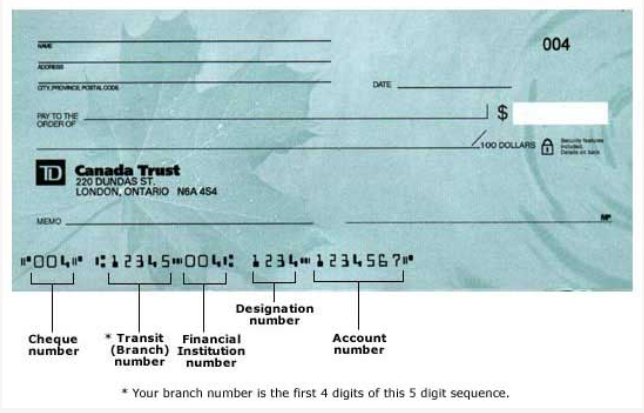

Bank Account

Apart from the business address and BN number required to set up the process, your Bank Account details are also crucial. If your banking information is incorrect, it will be tough to pay your employees correctly.

During setting up your banking details, it is good to have a cheque on hand to complete the following:

- Bank name

- Transit number

- Account number

Setting up Your Employees

Once all your company details are fully set up, it is time to add your employees to the new payroll system. Like another payroll system, this should be pretty straightforward.

Employee Details

Following information, you need to enter for each employee:

- First and Last Name: As per their bank account details, this information should match the name

- Birthdate: Employees below 18 years of age are exempted from Canada Pension Plan (CPP) contributions.

- Home Address: this information will be visible on the employee's payslip and year-end report (i.e., T4).

- Province of Employment: Generally, employees will stay in the same province where they work. If employees live in a different province, apart from where they work, you need to ensure that correct information is entered into the system.

- SIN: Within three days, a SIN request must be issued for each new employee from the day the new employment begins.

- Email: To access online employee portals and receive email notifications when the payslips are available.

- Hire Date: pick the first day an employee began working at the company.

- Federal and Provincial/Territorial TD1 Forms: To define the amount of tax deducted from an individual's income, employment, or other income, such as pension income.

- Pay Group: select the payroll frequency for payment to employees

- Pay Rate: enter the employee's gross rate of pay.

- Pay Type: define if the employee is paid an hourly rate/annual salary.

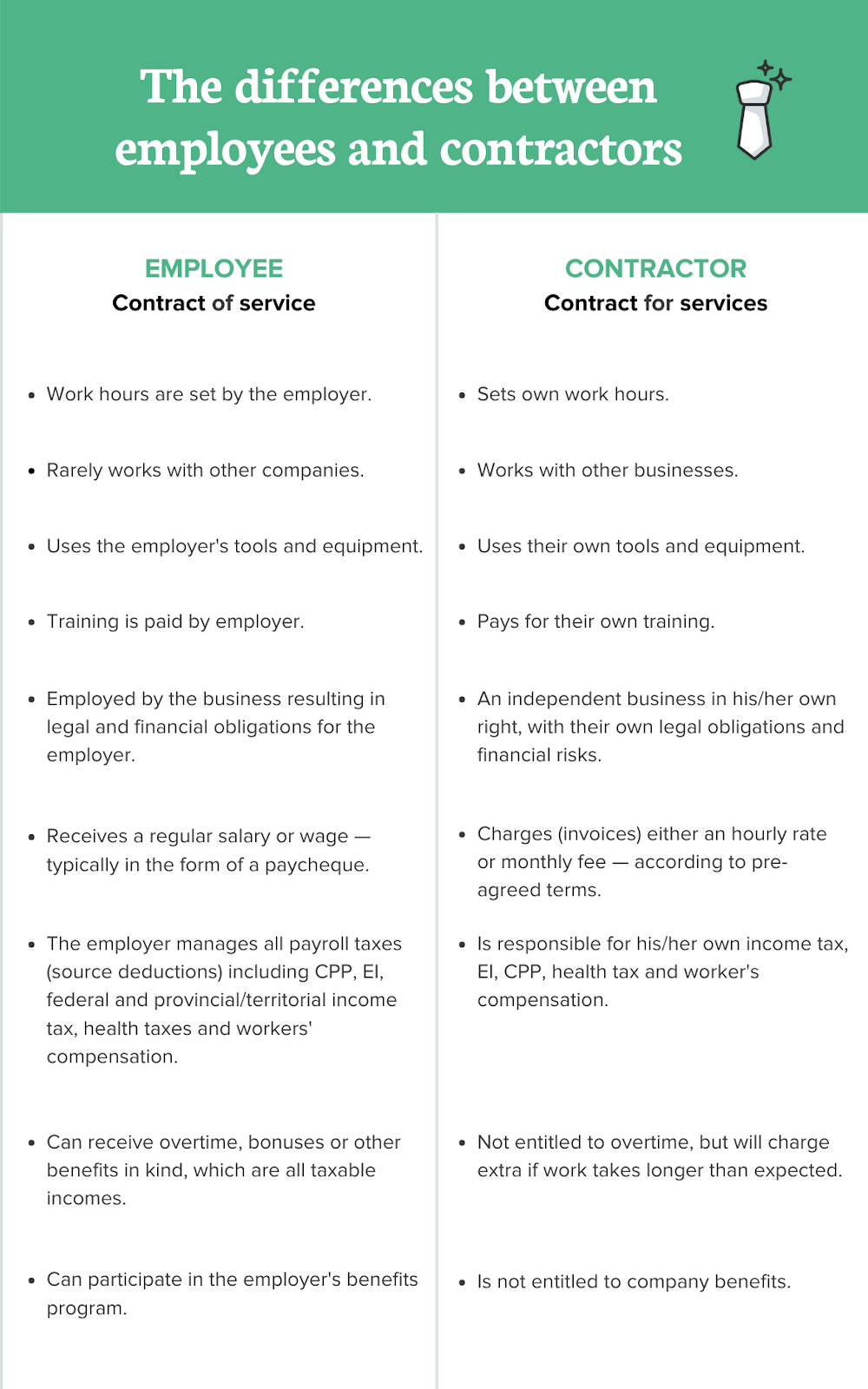

Note that if you are setting up an independent contractor instead of an employee, you may need some additional information, such as the CRA Number (if the contractor is associated with a business).

Major Difference Between Employees and Contractors

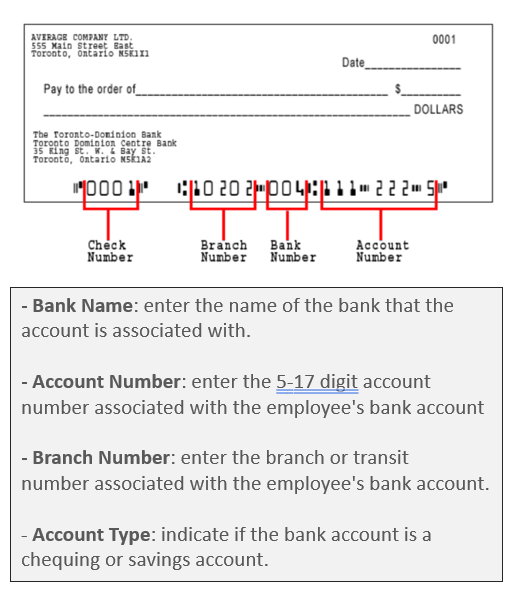

Employee Direct Deposit

Apart from all the basic employee information, you also need to set up your employee's bank account information and ensure they receive the direct deposits.

In addition to all the basic employee details, you'll also need to set up your employee's bank account information to ensure that they're able to receive direct deposits. You will need the below banking details for each employee to set up direct deposits.

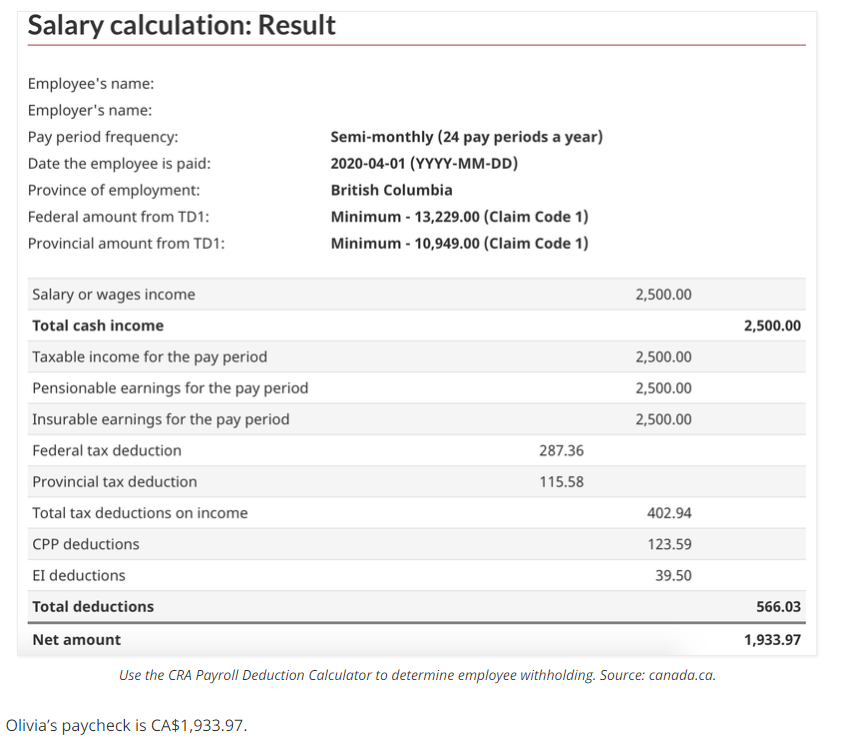

The business owners with their own payroll system, can use the the CRA Payroll Deduction Calculator for calculating their employees paychecks,

Example,

Olivia’s paycheck dated April 1, 2020 using the CRA online tool.

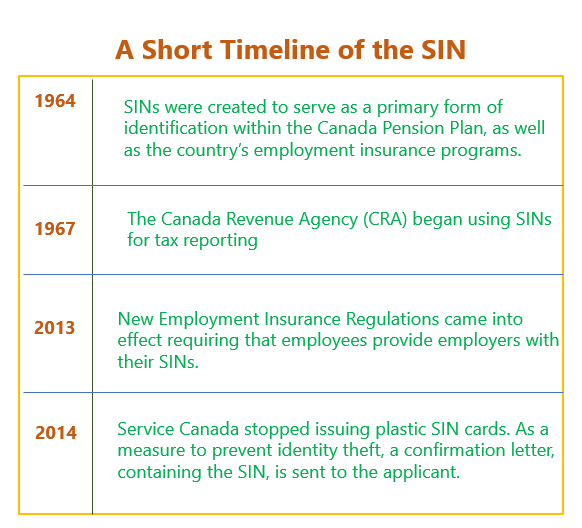

What Is a Social Insurance Number (SIN)?

Each individual residing or working in Canada must have a 9-digit identification number known as SIN, or Social Insurance Number, to get access to government benefits, file income tax, and, most importantly, get paid.

Employer’s Responsibilities

Requesting a SIN for employment - Within three days after their employment begins, each employee must receive a SIN as specified by the Canadian Government.

SIN for documentation- Employers need to use employee's SIN to provide ROE(Record of Employment), complete T4 for income tax purposes, and file payroll deductions such as EI and CPP.

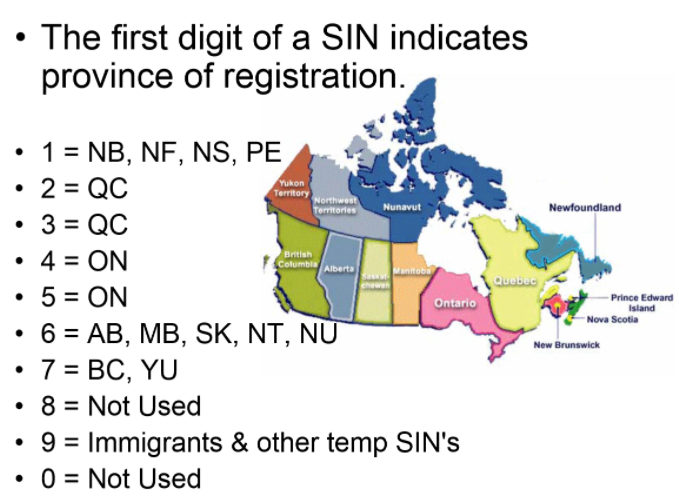

SINs starting with the number 9 - For the temporary foreign workers, with issued SIN starting with no 9, employers must guarantee that they must have valid documents allowing the right to work in Canada. Expiry dates for these SINs are issued by the Citizenship and Immigration Canada (CIC), which states how long each worker is legally permitted to be employed. If SIN is expired, then the employer will ask the employee to renew their SIN.

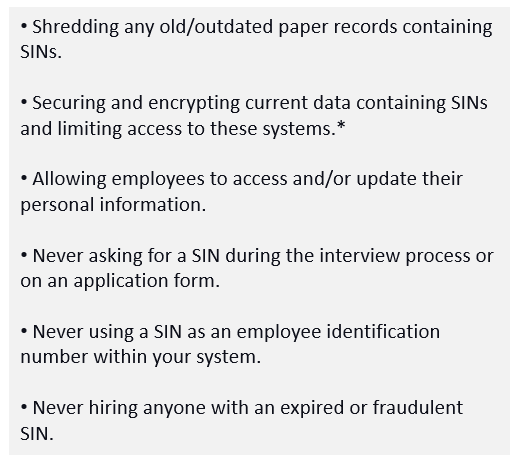

Information security- The employer has to protect their employee's security, personal information, including SINs. Here is the list of dos and don'ts for employers using, storing, collecting, SINs,

Verifying a SIN

To verify that your employee has provided a valid SIN here is a simple formula.

Step 1 - First you need to multiply each individual SIN number by 121 212 121

Here’s the math on that:

Step 2 - After receiving your new 9 digit number , you need to add all of the digits together. If you get the result multiple of 10, then the SIN is valid.

Source: Straightline International’s How to Validate SIN (Numbers)

Step 3 - You can always try an easy way and use the SIN verification tool, that is provided by the Canadian Payroll Association.

Employee’s (SIN Holders) Responsibilities

Who needs to have a SIN

All citizens, newcomers and temporary residents must have the SIN to get the government benefits and services like EI and CPP.

You also must require a SIN to,

- Be employed and get wages.

- Pay federal - income tax (IT).

- Where interest is earned, hold accounts and investments.

Protecting your SIN

Each individual's SIN provides you with access to a range of government benefits, as it is a form of government identification. If the SIN in the wrong hands, he/she can access the personal information fraudulently.

Here are the dos and don'ts for individuals to prevent identity and credit theft

Lost or stolen SINs

In this case, you need to report it to Service Canada's Social Insurance Registration office. Call at 1-800-206-7218 and then select the option '3' or call on 1-506-548-7961 if from outside Canada.

Fun Facts about SIN

In a SIN, the first number indicates the province in which it was registered (the numbers 0 and 8 are not used):

What Are the Components of Payroll in Canada?

To cover all government requirements and employee needs, payroll management covers multiple aspects of wage transactions. Below mentioned are the four main components that make up Canadian payroll,

- Gross income

- Employee benefits

- Employee insurance

- Payroll taxes

Gross Income

The total amount of wages in the pay period an employee has earned before deductions or taxes taken out is gross income or gross pay.

Gross Income calculation depends on if an employee is paid hourly or is a salaried employee. To get the gross income for an hourly employee, you need to multiply the pay rate for hourly by the total number of regular hours he/she has worked.

If the employee works overtime, then the overtime hours must be multiplied by the rate of overtime pay. After this, the two figures are added together to get the total gross income for employees.

For every payroll period, the gross pay is set for each salaried employee. If the employee received any bonuses, this amount must be added to the salaried employee's hourly and total gross income.

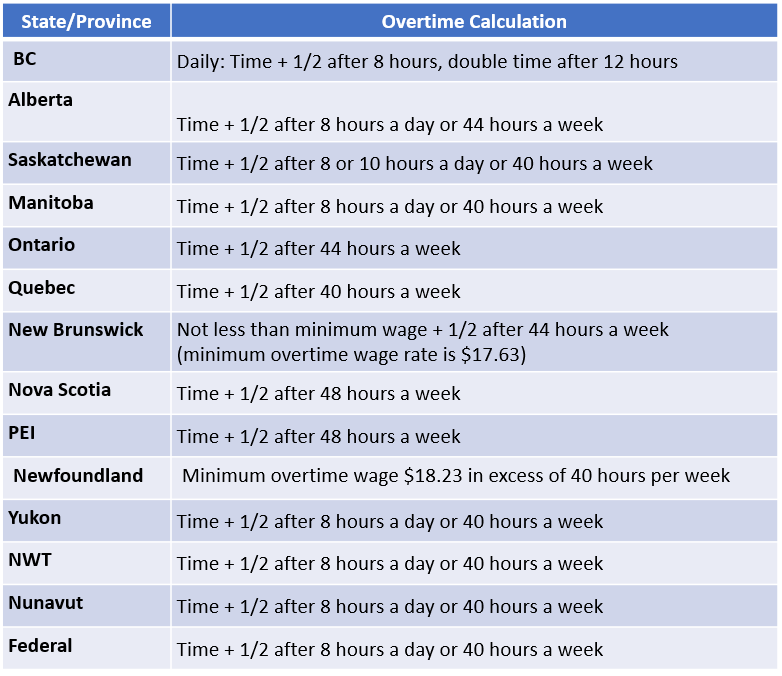

Federal and Overtime Calculations - Canada

Employee Benefits

Employee benefits must be deducted from the payroll and are a part of an employee's compensation package, which may differ from business to business. You may not have employee benefits attached to the payroll, as it all depends on the type of business.

This decision is taken into consideration during the hiring process. Employee benefits to your employees are one way of showing them that you have invested in them and attracting and retaining the workers for your business.

Employee Insurance

By law, Canadian employers are required to withhold the contribution towards CPP (Canadian Pension Plan) and EI (Employment Insurance) premiums for all employees between 18 to 70 years of age. Employers residing in Quebec contribute to the QPP ( Quebec Pension Plan) and do not contribute to CPP. EI is paid by both employers and employees, as these funds can be utilized for maternity/paternity leave, sickness and compassionate care.

Payroll Taxes

Tax deductions are mandatory from the payroll deductions, which must be taken out from the worker's gross income. From the taxation, the payroll tax is different from the federal income tax. As per the CRA's payroll deductions table, for each province, payroll deductions are different.

Through the Business Registration Online (BRO) service, the Canada Revenue Agency (CRA) has made it mandatory to set up an account with them to get the BN(Business Number). Before the first remittance due date, you must set up this account as an employer, which allows you to pay the Canadian Government's payroll taxes.

With the help of the payroll calculator, you can easily calculate the gross pay, deductions, net pay, and taxes for each employee. Good payroll software allows for automatic calculations, saving all information for further processing.

Income Types and Deduction Types in Canadian Payroll

In some cases, you need to account for additional income and deductions apart from the regular wages. Let's look at these in detail,

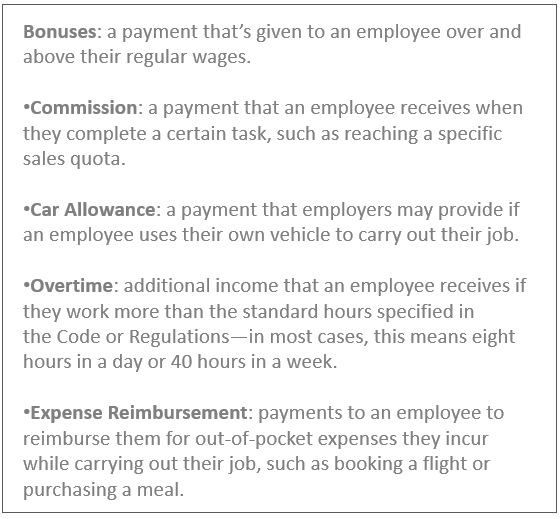

Income Types

Any income received in addition to your regular pay is known as payroll income. Listed below are some example,

Listed below are some of the common income types, but there are many more. These income types do not apply to each employee, so you will need to set these income types yourself in the payroll system.

Listed above are some of the common income types, but there are many more. These income types do not apply to each employee, so you will need to set these income types yourself in the payroll system.

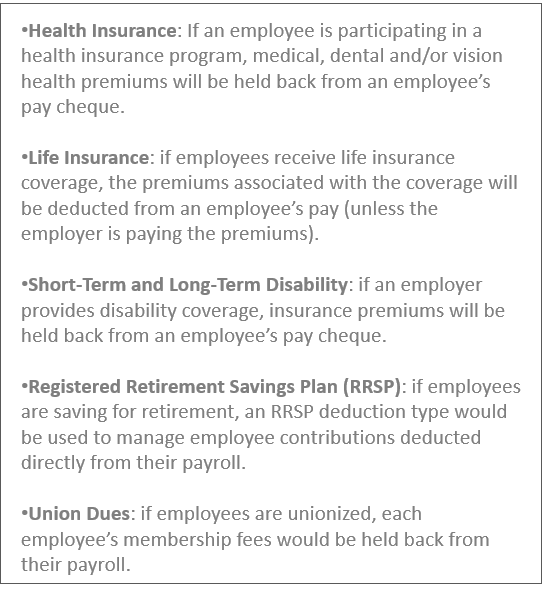

Deduction Types

Apart from the additional income type, setting up payroll also includes adding the deduction types.

During the payrun, a certain portion will always be deducted from the employee's income for payroll taxes. Thus, deductions refer to the amount an employee pays for covering the employment expenses. Listed below are some examples,

While these are some of the most common deduction types, some less common ones may also apply to your business.

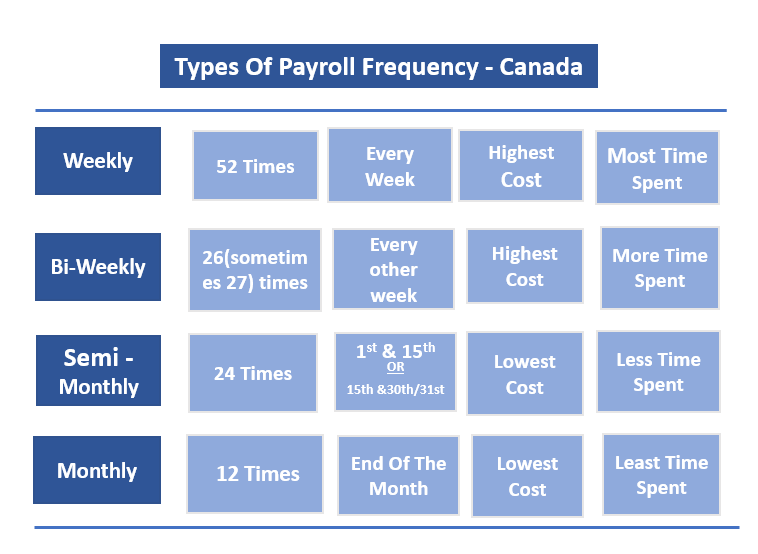

What Are the Types of the Payroll Schedule in Canada?

Payroll Schedule means how often you pay your employees. For the employees to know when exactly they can expect to get paid, each employer needs to follow a payroll schedule/frequency. However, there are a few more popular options than others, each with its benefits and drawbacks.

There are the four most common options,:

- Weekly

- Bi-weekly (once every two weeks)

- Semi-monthly (twice a month)

- Monthly

Payroll Tax And Income Tax Deduction in Canada

When people think of payroll, the immediate thing that comes to mind is paying the employees. In addition to paying your employees for their work, payroll also covers an employer's payroll tax obligations.

For each Canadian employer, it is essential to have a reliable hold of payroll taxes. This information is precious while making a switch to a new payroll system so that you can ensure that you are not underpaying/overpaying the CRA

Below, we will cover the basics of Payroll tax and Income Tax for each Canadian employer.

Difference Between Payroll Tax And Income Tax Deduction in Canada

Before getting into the facts, it is essential to know the key distinction between Income Tax and Payroll Tax in Canada. For every small business, income tax is a deduction type that the employer must take out of each payment made. The amount of withheld income tax can be found on the CRA payroll deduction tables.

The employer also needs to deduct federal taxes such as CPP contributions, EI premiums, and any provincial employer taxes(Source Deductions) if applicable. All these income taxes, federal and provincial taxes, are grouped as payroll taxes.

The difference between these two are, Income Tax needs employers to withhold from employees pay the amount, and CPP and EI need employee and employer contribution.

Below is break down,

EI - Employer pays the amount 1.4x withheld from the paycheque of employees

CPP - Employer needs to match the deducted amount from the paycheque of employees.

Check the CRA's T4032 Payroll Deductions Tables for provincial and territorial payroll taxes.

Payroll Taxes & Deductions

The tax deducted from the employee's paycheque and includes income tax and many other deductions are known as Payroll Tax in Canada.

Payroll tax in Canada is deducted and contributed towards two major government services.The payroll tax is deducted in Canada and contributed to two major government services: Employment Insurance (EI) and Canada Pension Plan (CPP).

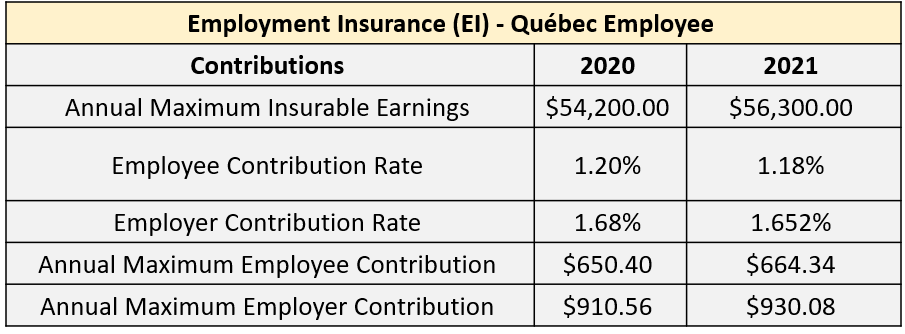

Are you in Quebec? Quebec employers have to deduct contributions for the Quebec Pensions Plan instead of the CPP.

What Is Employment Insurance (EI)?

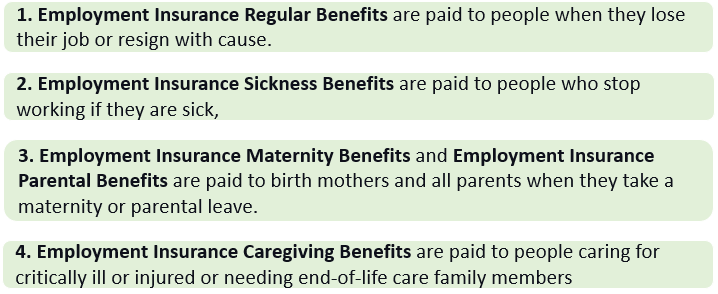

Employment Insurance (EI) is the money paid to eligible employees from the Federal Government who have stopped working. When an employee stops working, Employment Insurance provides a partial income replacement for the following reasons,

- Without cause, when an employee is terminated

- With a cause (Constructive Dismissal) if an employee resigns

- Due to sickness, when an employee stops working

- If an employee has taken parental leave or maternity leave and stop working

- If an employee stops working as they have to take care of their family.

Listed below are different kinds of Employment Insurance (EI),

Employment Insurance (EI) Regular Benefits

Employees are eligible for Employment Insurance Regular Benefits if:

- If employees are employed in insurable employment

- Through no fault of their own if they lost their jobs.

- For at least seven days in a row the last calendar year if employees are without work and pay.

- whichever is shorter, if they have worked for the necessary number of insurable employment hours in the previous calendar year or since the beginning of their last EI claim

- If ready to work and capable of working each day.

They are actively looking for work (you must keep a written record of employers you contact, including when you got them).

What Are the Maximum EI Contributions?

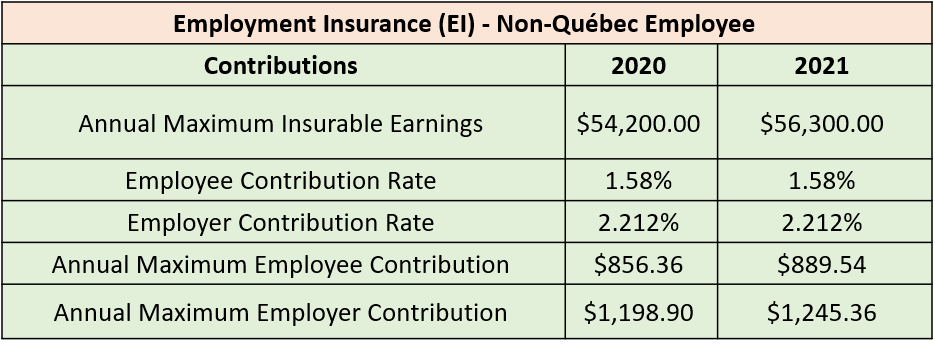

Employment Insurance (EI) may be seen as "free" money. However, it is the contribution that the Canadian employee and employer pay both. Every year, To calculate the amount of EI, the Government of Canada provides the maximum insurable earnings and rate for employers that they should deduct from their employees.

What happens when someone begins a new job?

In case at any time during the year, if an employee starts at a new company, their maximum annual premium will reset. It means that the new employer will also need to deduct the EI premiums regardless of what has been paid by the previous employer, even if the maximum premium amount was hit.

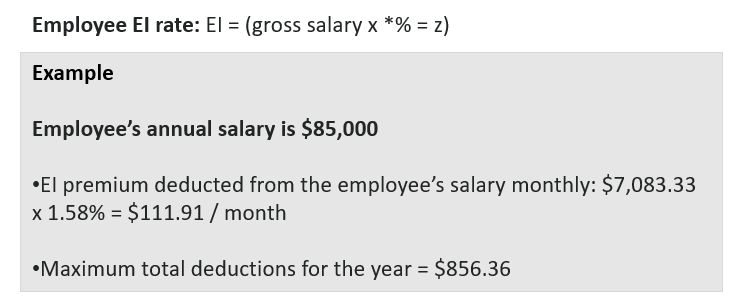

How to Calculate Employment Insurance (EI)?

For Employment Insurance (EI) to calculate the deduction amount, you need to multiply the salary for that period as per the rate set by the Canada Revenue Agency (CRA).

The maximum annual insurable earnings amount for 2021 is $56,300, and the rate is 1.58%. Each year both the figures are updated by the CRA. Employers are also responsible for contributing 1.4 times the employee's contribution amount.

What Is a Record of Employment (ROE)?

As per Service Canada, a ROC(Record of Employment) is one of the most important documents that employees apply for Employment Insurance (EI) benefits. Despite its importance, not everyone knows exactly what an ROE is and when to issue it.

So, What exactly is ROE?

Information is provided on a person's employment history, including how long they worked and how much they earned with an employer id known as ROE. To determine whether a person is eligible to receive the EI benefits, like the amount they will receive and how long they will be paid, this information is used by Service Canada. The Canadian Service also uses ROEs to make sure no one misuses EI funds.

When Is the ROE To Be Issued?

Every Canadian employer must issue an ROE to an employee each time if he/she experiences the interruption of earnings. An interruption earning may occur when,

- An employee quits.

- An employee is terminated or laid off.

- Whichever is shorter, if they have worked for the necessary number of insurable employment hours in the previous calendar year or

- If an employee's salary falls below 60% of regular weekly earnings. It may be because of illness, injury, pregnancy, etc

If any of the above circumstances occur, you need to complete an ROE for the employee. If you are switching payroll providers you should also file ROEs.

How to Issue a Record of Employment

When it comes to issuing ROEs there are two methods to do so. Using your online Service Canada account, or as a paper document you can submit your employee’s ROE form . Let us take a look at the process for each method in brief,

Submitting a ROE Online

There are several options for submitting your ROEs electronically provided by Service Canada. If you run your own payroll, you can take benefit is ROE Web online by either:

By a payroll service provider using bulk transfer technology known as SAT (Secure Automated Transfer) an ROE can be submitted on your company's behalf.

Submitting a Paper ROE

You can also complete, submit and file ROEs as a paper document, for which first you need to request the correct forms from your Employer Contact Center.

Paper ROEs will consists of three separate copies,

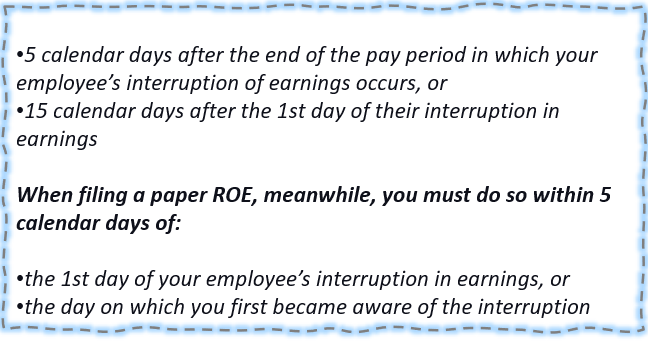

Record of Employment (ROE) Filing Deadlines

With Service Canada the deadline for filing a Record of Employment varies depending on if you have opt for the Electronic or Paper method of the form.

If you use the Electronic ROE filing method, then you must do it within the 5 calendar days at the end of the pay period in which your employees interruption of earning occurs. If your employee pay cycle is monthly, in this situation the ROE filing deadline is,

What Is the Canada Pension Plan (CPP)?

The CPP (Canada Pension Plan) is a pension program designed to help Canadians provide income for their retirement or disability and is administered nationally. The Liberal Government of Lester B. Pearson CPP was established in 1965.

Except for the Quebec province, it is the compulsory plan, where all Canadian employees and employers will contribute to its pension plan known as Quebec Pension Plan (QPP).

Canadian who are employed between the age of 18 to 70 will need to contribute towards the Canada Pension Plan/Quebec Pension Plan unless they are already getting a pension from the plan.

CPP contributions are related directly to the annual earnings. Canada Pension Plan contributions are directly related to annual earnings. According to the cost of living each year, the basic exemptions, max contribution limit, and benefits are adjusted.

To get the CPP benefits, a person will need to meet special thresholds to qualify,

- Should be at least 60 years of age,

- You have made at least one valid CPP contribution throughout the year.

Click here to know more about CPP eligibility.

Employer Responsibilities for Deducting CPP

As a Candian employer, it is your responsibility to deduct the appropriate Canada Pension Plan (CPP) contributions, along with the EI and Income Tax; the employee provides that,

- Who is not disabled

- Is between the age 18 and 70 years of age

- if between 65 and 70 years of age, has not elected to stop contributing to CPP. In short, you can choose to no longer pay into the CPP if you are still working at age 65.

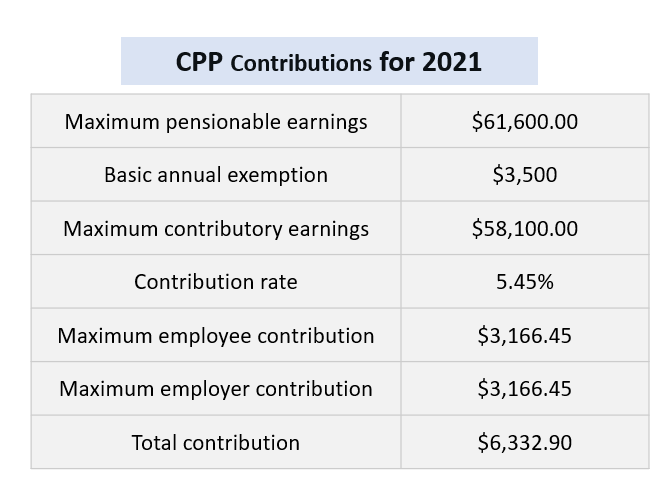

Canada Pension Plan (CPP) Contribution Rates

Between the employers and employees, CPP contributions are split 50/50.

The deduction rates depend on the pensionable earnings of the employee, up to the maximum annual contribution.

Here's a table that details CPP contributions for 2021:

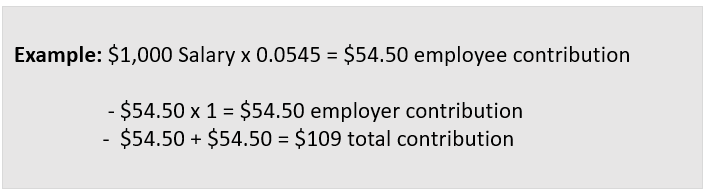

Each month the amount you contribute will depend on your total earnings.

For example, in 2021, the maximum CPP contribution set by the Government is 5.45% of the employee's gross income.

As the employers need to match, another 5.45% of your earnings will need to be contributed by the employers.

So, overall, 10.9% of your gross income will go towards the CPP in 2021.

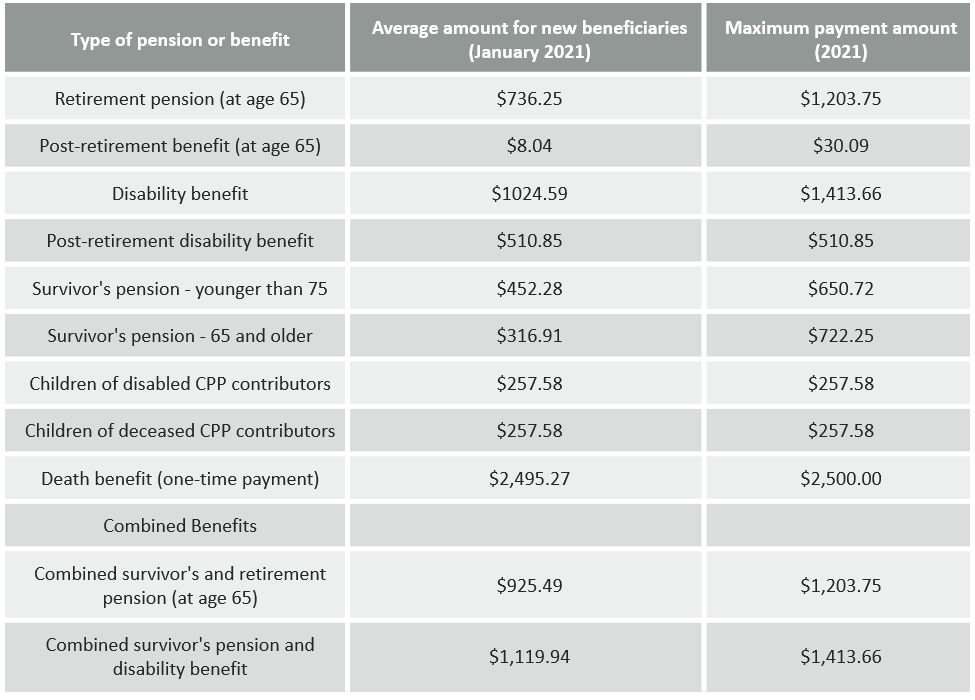

How Much CPP Can You Get?

Below is a table that shows the average monthly and maximum CPP payment amounts,

For 2021, the maximum monthly amount you could receive as a new recipient starting the CPP at age 65 is $1,203.75.

How Do I Apply for CPP?

There are two ways to apply for Canada Pension Plan(CPP), Online or with a paper CPP application form.

- Most people apply for the CPP online as it is straightforward,

- First, open a My Service Canada Account (MSCA) if you do not have one.

- The estimated CPP amount you will be able to see in your MSCA.

- On your CPP application form, answer all the questions.

- After the application is submitted, you will receive a notification that it has been received.

- Within 14 days, you will receive the decision.

2. You can also apply for CPP with a paper application if:

- If you have been denied or ever received a CPP benefit

- If you reside outside Canada

- If your finance is managed by a third party(Like a power of attorney)

Steps to apply with a paper CPP application

- You need to download the Canada Pension Plan application form.

- Print the form, complete it, and you can either drop off at your nearest Service Canada office or mail it to the most immediate Service Canada office on this list.

- If you are requesting the child-rearing provision, you will need to submit a few personal details, which are easy to fill in.

Details Required for Canada Pension Plan Application

A CPP application requires the below details,

- Your SIN number

- Your current bank account details

- Your SIN number of spouse's, in case you are looking to pension share

- To request the child-rearing provision* on your CPP application form, you will need your children's SIN number and birth certificate.

CPP Payments Dates, 2021

Here are the CPP payment dates 2021:

- January 27, 2021

- February 24, 2021

- March 29, 2021

- April 28, 2021

- May 27, 2021

- June 28, 2021

- July 28, 2021

- August 27, 2021

- September 28, 2021

- October 27, 2021

- November 26, 2021

- December 22, 2021

How to Calculate CPP?

The employer will deduct CPP contributions from their wages for the employed between 18 to 70 years of age. The CPP contribution rate for 2021 is 5.45%, and the max pensionable annual earnings amount is $61,600.

Same as EI, both the figures are updated by the CRA each year. Employers are accountable for matching their employee's contributions.

When and How Must a Business Remit Payroll Deductions in Canada?

Canadian Payroll Taxes by Province and Territory

The table below provides links to the federal and provincial or territorial taxes that fall under the umbrella of payroll taxes.

Income Tax Deductions

Income tax refers to the annual tax imposed by the government directly on personal and business income. This amount deducted is based on your employee’s total claim amount on their Form TD1. As the employer, you’ll have to submit your employees claims for both federal and provincial taxes.

Federal and Provincial Tax Rates in Canada

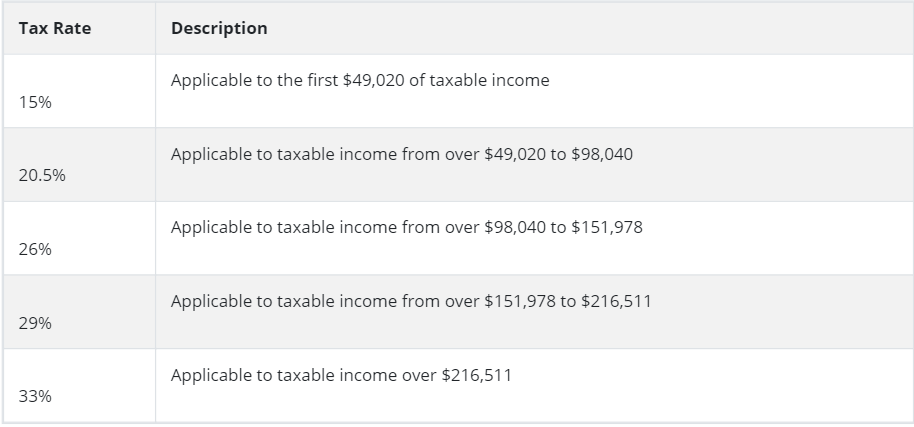

Following a progressive system Personal income is taxed both federally and provincially. The following chart states the federal and provincial tax brackets for 2021.

Federal Tax Brackets 2021

Provincial Tax Brackets 2021

To review a specific provincial tax rate, please visit the Government of Canada’s website.

Year-End Payroll Checklist for Canadian Businesses

As a small business owner, if you are going through the year-end payroll process for the first time, it is very much essential for you to know the objectives and tasks related to the year-end payroll processing.

Every month as a part of payroll processing, you can usually remit employees' deductions and contributions to the CRA.

To make sure you have remitted the right amount to the CRA you need to perform the reconciliation process. It is done with the help of the T4 Slip and Summary that will reconcile the actual amount remitted with the amount you were supposed to remit. If any shortfalls will need to be paid to the CRA, and if any overpayments will get refunded.

For example, the T4 slips for 2020 have to be filed and sent to your employees by the end of February 2021.

Please refer to the Employer's guide from the Canadian Government to learn more regarding payroll deductions and remittance.

Below mentioned are the details regarding the T4 slip and T4 summary

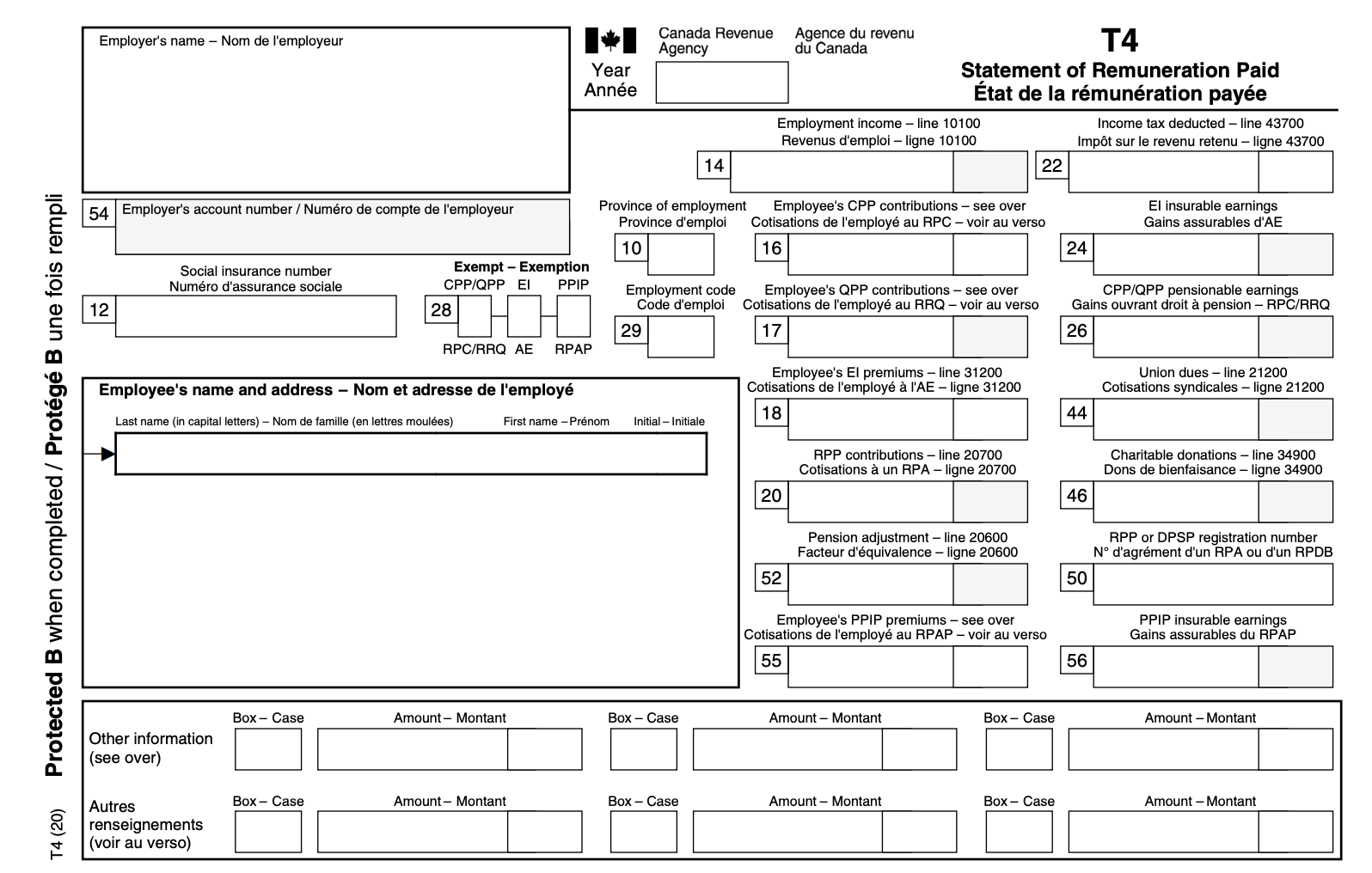

What Is a T4?

A T4 is a remuneration paid statement, an information slip showing the money employees earned and how much was withheld and remitted for the tax purpose to the Government. It is also the form used to file the income tax each year.

For both of the following instances, every years T4 slips are required:

- If employees have been paid more than $500

- There are deductions for CPP/QPP contributions, EI premiums, Provincial Parental Insurance premiums, and income tax from an employee's pay.

- Each employee needs t4s if they are current, inactive/terminated.

- T4 slips for the past calendar year are due to the employees and the CRA by the last business day in Feb, following the calendar year immediately.

You also need to create a T4 for every province and territory where the employee earned income.

What Information Is Included in a T4 Issued by an Employer?

The details included in the Employer's T4 form are generally the taxable income, benefits, allowances, deductions, and pension plan contributions.

Here's a breakdown of some of the main boxes within a T4:

Employer's Name

Employer name is your company name. Make sure the company name is correctly spelled in your business registration forms and reporting documents that got to the CRA.

Employer Name and Address

To match everything in the CRA system, this field needs to be correct. It must be the same name as mentioned in your payroll system. Format of this must be first name and initial. You can also just use the initials for the first and middle initial.Enter the full address of employees, including Canadian territory/province and zip code.

Year

It is the calendar year from January to December, for which the employee's income is reported. It is the year where the wages to the employees are paid.

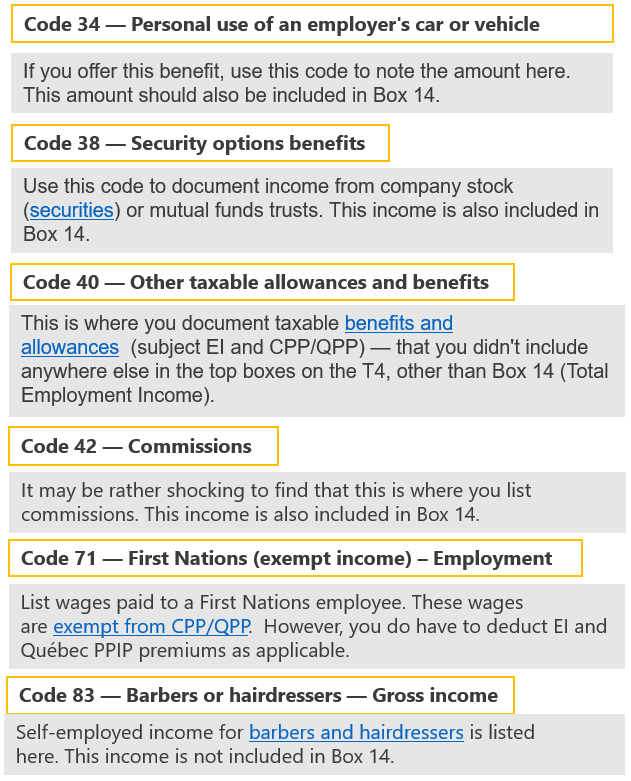

Bottom rows — Other Information Areas

At the bottom of the T4 form, there are two rows of empty boxes available. You need to enter codes that the CRA likes you to break down for other specific income types.

- Like the boxes at the top of the T4, these boxes are not pre-numbered. Instead, you enter the relevant codes and amounts(Full list of T4 codes.)

- For one employee, if you have more than six codes, you will use T4 second. However, at the top of the second T4, you need to identify business details and employee identification.

Some of the most common codes for the other information area in the T4

Click here to download the T4 2021 form.

Types of T4 slips

Customized T4 slips

For those who complete a large number of slips, we accept specific slips other than our own. To ensure accuracy, follow the guidelines for producing customized forms at www.cra.gc.ca/customized or see Information Circular IC97-2R, Customized Forms.

Slips for filing over the Internet

For information about completing and filing T4 slips over the Internet, go to www.cra.gc.ca/iref.

Slips for filing on paper

You can order single-page slips that have two slips per page intended for laser or inkjet printers, for typing, or to be filled out by hand, at www.cra.gc.ca/forms or by calling 1-800-959-2221.

You can print .pdf copies of T4 slips from our Web site that you complete by hand. In addition, you can use fillable T4 slips on our Website. After completing them, you can print them on plain white paper. For information, go to www.cra.gc.ca/fillable.

Guidelines to Complete Your T4 slips

- Fill in the T4 slips clearly and in alphabetical order.

- All amounts need to be reported in dollars and cents.

- Pension adjustment reported in dollars only, which is an exemption.

- All amounts will be reported in Canadian Dollars.

- Between the numbers, don't use hyphens or dashes.

- No need to add $ to any amounts.

- Don't show negative amounts.

- Leave the box blank rather than enter "nil" or all zeros if you don't have an amount or it doesn't apply.

- Don't change the box headings — this is the CRA's form, not yours.

T4 Filing Methods

Listed below are the T4 filing methods,,

Electronic filing methods

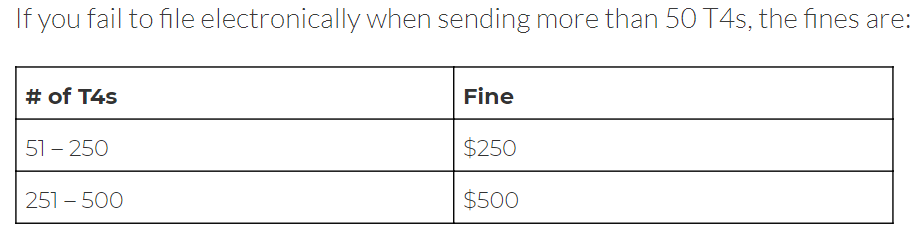

From January 11, 2021, internet filing will be available. If you file 50+ information returns (slips) for a calendar year, you need to file information returns by Internet.

Go to Filing Information Returns Electronically (T4/T5 and other types of returns), for more information.

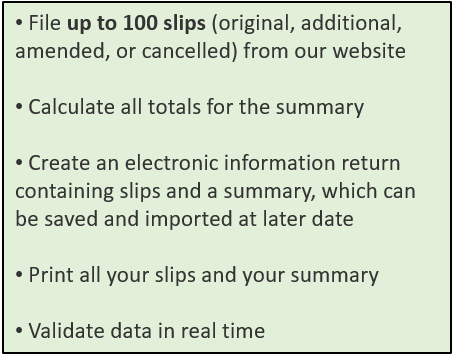

Filing by Web Forms

Web-based forms application is free and secure. To use it, you just need an internet connection. Following the step-by-step instructions, using the web form, you can file an information return easily,

Once the information return is submitted, you will get a confirmation number, proof of acknowledgment.If you want to use the web forms, you need to have a web access code and its associated web code access.

For more information, see Web access code. To start using this application or get more information, see Filing Information Returns Electronically (T4/T5 and other types of returns).

Filing by Internet file transfer (XML)

With a maximum of 150 MB file size, the internet file transfer will allow you to send an original/amended return. For this, you need a web browser to connect Internet. Then, your software will print, create and save all your detailed electronic returns in - XML format.

If you use payroll software to manage your business, you can file up to 150MB using an internet transfer file. Multiple returns can be filed in one submission, as long as the total submission doesn't exceed the restriction to 150MB.

If your return is more than 150 MB, you can either compress your return or you can divide it so that each submission is no more than 150 MB.

To know more about this filing method go to Filing Information Returns Electronically (T4/T5 and other types of returns).

Filing on paper

On paper, you can file up to 50 T4 slips. However, it is strongly recommended to file online using Internet transfer files or webforms.These options are explained under Electronic filing methods.

If you need paper copies, you need to order a maximum of 9-digits page slips at Forms and publications or call at 1-800-959-5525.

If you choose to file your return on paper, mail it to:

Jonquière TC

T4 Program

Post Office Box 1300 LCD Jonquière

Jonquière

QC G7S 0L5

For each employee, please fill out one copy of the T4 slip and include it with your T4 Summary during filing.

For two different employees, enter the information in one sheet. You need to keep this information from the T4 slips and the T4 Summary or copy these forms for your files.

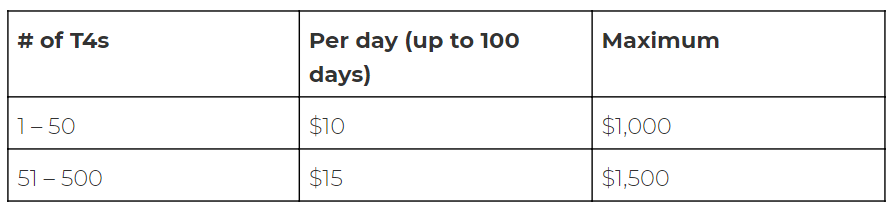

T4 Penalties

You don't want to miss the last business day of February.

Based on the number of returns fines are ca;culated. Here are the fines for late T4s:

T4 Summary

During your T4s submission you must also include T4 Summary of Remuneration Paid, which is a top-level summarized report of your business listed in each of the employees T4s. You need to submit one for each Payroll Account Number, in case you have more than one Payroll Account Number.

The T4 summary reports provide information such as,

- insurable earnings for all employees, which is good to know for EHT limits.

- Total Contributions for CPP, EI, and income tax that the CRA is expecting that the employer submits.

- These totals are made up of both the employees’ contributions and the employers’

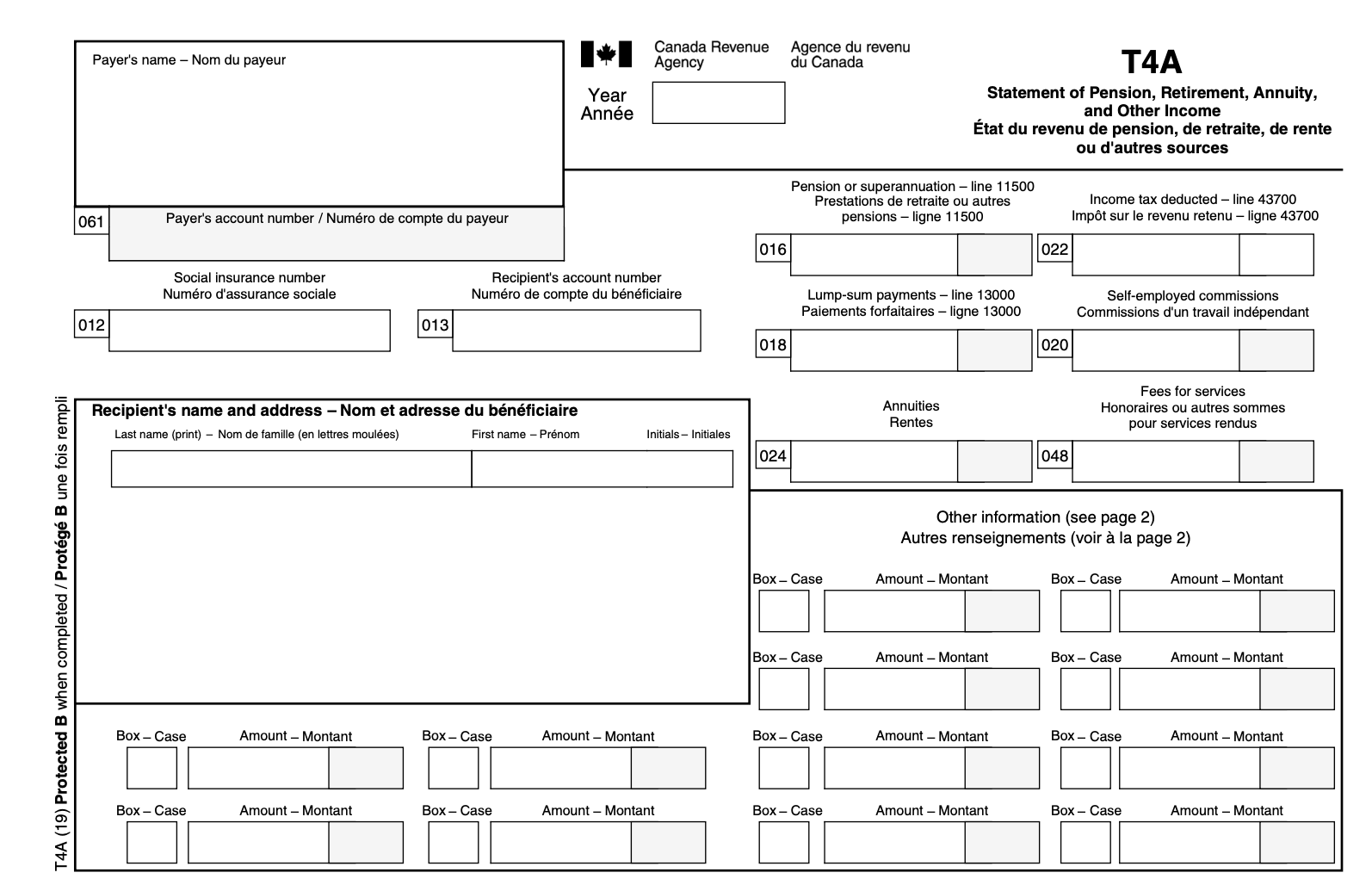

Issuing T4As for Contractors

One of the most common reasons you'd issue a T4A would be to provide year-end documentation to a contractor as a small business employer.

For their self-employment taxes, the contractor will use T4A

- You must issue a T4A, if you pay a contractor $500 or more for their services.

Payer's and recipient's information

The same rule will apply for T4A as they do for a T4. Here, in this case, you are the payer, and the recipient is the contractor.

Bottom of T4A — Other information area

Using Code 28: Other Income, this is the most common place small business employers pay to contractors. Refer to the complete list of income codes for a T4A.

For the same contractor if you have more than 12 codes, create a second T4A. The only thing you need to repeat is your business and the contractor's identifying information.

Here are the same rules and guidelines that apply to a T4 and T4A.

Following Are Some Useful T4A Reference Pages From the CRA

- T4 Information for Payers

- Guide to Filling Out the T4A Slip

- Full List of T4A Income Codes

- How to Change or Fix T4A Slips

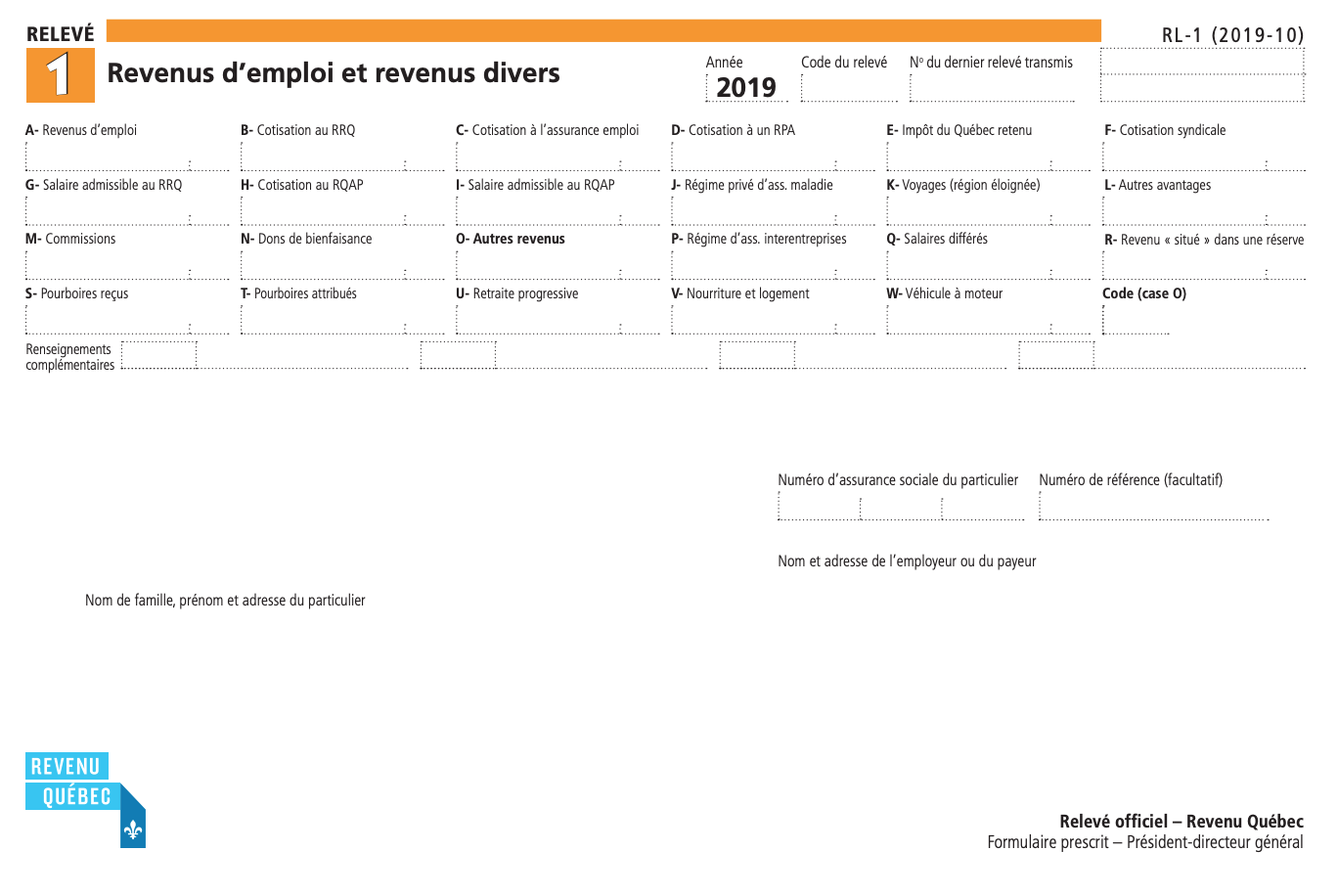

What Is a Relevé 1 (RL-1)?

You will need to issue an RL-1 Employment and Other Income slip, in case your business is located in Quebec or if your employers are based in Quebec. You need to file an RL-1 slip if you have paid wages, tips, gratuity, fees, scholarship or commission as an employer.

Note: As the RL-1 only covers reporting in Québec, you also have to complete T4s and T4s for your federal reporting

The Kinds of Source Deductions an RL-1 documents

In RL-1, the amounts documented is related to Quebec-specific taxes, which includes,

- QPP and Quebec Income Tax

- QPIP premiums

- Contributions to:

- Health Services Fund contributions

- Labour Standards

- Workforce Skills Development and Recognition Fund (WSDRF)

- Recognition Fund (WSDRF)

What Is included in a RL-1 issued by an employer

On the RQ site, you can skip around RL-1 pages or this PDF guide to the RL-1 is pretty helpful.

Taxable benefits included in box A or box R, as applicable:

Refer to the GUIDE TO FILING THE RL-1 SLIP: EMPLOYMENT AND OTHER INCOME

RL-1 Penalties

When preparing RL-1 slips, you must make a reasonable effort to obtain the information that is required to be shown on the slip. You are liable to a penalty of $100, if you fail to provide required information.

Following are some useful RL-1 reference pages from the CRA and RQ

- Employer's Guide to Payroll Deductions and Remittances (CRA)

- RL-Guide PDF — English | French (RQ)

- RL-1 Employer's Kit — English | French (RQ)

- RL-1 Slip Overview — English | French (RQ)

Everything You Need to Know About the TD1 Form

TD1, Personal Tax Credits Return, is a type of form required for calculating how much tax from the payment should be withheld. If you, as an employer, run payroll in Canada or are a pension payer, you will be asked to fill TD1 form to figure out the total tax to be remitted from payouts that need to be sent back to the CRA, Canada Revenue Agency.

During the onboarding process, any employee who has held legal employment from 9-5 office jobs must have already signed and filled out one of these forms.

TD1, Personal Tax Credits Return, is a type of form required for calculating how much tax from the payment should be withheld. If you, as an employer, run payroll in Canada or are a pension payer, you will be asked to fill TD1 form to figure out the total tax to be remitted from payouts that need to be sent back to the CRA, Canada Revenue Agency.

The primary purpose of the TD1 form is to collect the proper taxes from each employee. The TD1 allows the CRA to estimate the amount of tax a person will owe accurately at the end of the fiscal year and pull it from each pay cheque.

During the onboarding process, any employee who has held legal employment from 9-5 office jobs must have already signed and filled out one of these forms.

Who Should Fill Out Form TD1?

The following individual must fill out the TD1 form:

- Individuals Starting at a new job

- Change in the job with new income needs to update existing form information

- Increasing the amount of tax deducted at the source

- Starting to receive pension payouts

- When you want o to claim a deduction for living in a prescribed zone

Employees do not need to fill in a new TD1 form every year unless there is a change to their tax credit amount. If the employee has to change the tax credit amount, they must complete and submit the new form to their employer within seven days.

What Are Tax Credits?

The amount that reduces the tax payable on your taxable income is known as Tax Credits. You can reduce your income tax with the more tax credits you apply.

If you are eligible for the tax credits, easily you can earn the tax-free allowance amount, approx. CAD 11,000. You need to pay taxes your surpass this figure.

Filling out a TD1 Form

All new employees must fill the TD1 form upon starting a new job. A new hire must complete both federal and provincial TD1 forms if more than the basic personal amount has been claimed. In Quebec only, employees need to use federal TD1 form and TP1015.3-V, Source deduction returns provincial form.

- The employee needs to follow certain instructions on each line on both federal and provincial forms to fill the form.

- Then, these amounts on these lines are added together and totaled. On the last line of page 1 on the TD1 form, this sum is entered that says "Total Claim Amount."

- For the TD1 federal form, employees will add lines 1-12 together, and the total amount will be added to line 13.

- For the TD1 provincial form, the number of lines will differ depending on your province/territory location.

- Government has worksheets online for both federal and provincial that aid employees in calculating their claim amounts.

- Lastly, the total amount entered on these forms will determine the income tax amount deducted per pay period from the employee's gross pay.

Paper TD1 or Electronic?

From January 20, 2020, employers are not expected to provide TD1 paper forms to their employees. Now, employers are expected to give all new employees this online web page link to fill it out independently.

Federal and Provincial Tax Credit amount

Federal TD1 Changes for 2021

If the employee’s taxable income from all sources for the year will be $151,978 or less. Employees with an income greater than $151,978 can complete TD1-WS Worksheet to calculate their partial claim.

Provincial TD1 Changes for 2021

*If the employee’s taxable income from all sources for the year will be $25,000 or less. Employees in Nova Scotia with an income greater than $25,000 can complete TD1NS-WS Worksheet to calculate their partial claim.

**If the employee’s taxable income from all sources for the year will be $151,978 or less. Employees in Yukon with an income greater than $151,978 can complete TD1YT-WS Worksheet to calculate their partial claim.

Access all the Government of Canada’s TD1 forms here

Key Takeaways

With the points mentioned above, you have understood how the Canada Payroll works, with the various elements like Employment status, work permits, Contributions, taxes, forms, deductions and filing.

Following are the topics we have covered in this article:

- Work permit and Employment Types

- Canada minimum wages

- Setting payroll in Canada for small business

- What is SIN

- Payroll Components in Canada

- Deduction types in Canadian Payroll

- Payroll Tax and Income Tax in Canada

- What is EI and CPP

- What is ROE

- Federal and Provincial Tax Rates in Canada

- Year-End Payroll Checklist for Canadian Businesses

- What Is a T4?

- T4 Summary

- Issuing T4As for Contractors

- What Is a Relevé 1 (RL-1)?

Selling in the Canada ? Head over to our guide on GST, PST and HST in the Canada.

Conclusion

Once you have all of these things in place, you are ready to answer “how to do payroll in Canada”! If you’re looking for a reliable payroll service provider that offers insight into all other areas of your business, from HR to payments, Deskera People is here for you! Try it for free now!

Get your free trial of Deskera People today

Please refer below articles to know how Canada Payroll works using Deskera People