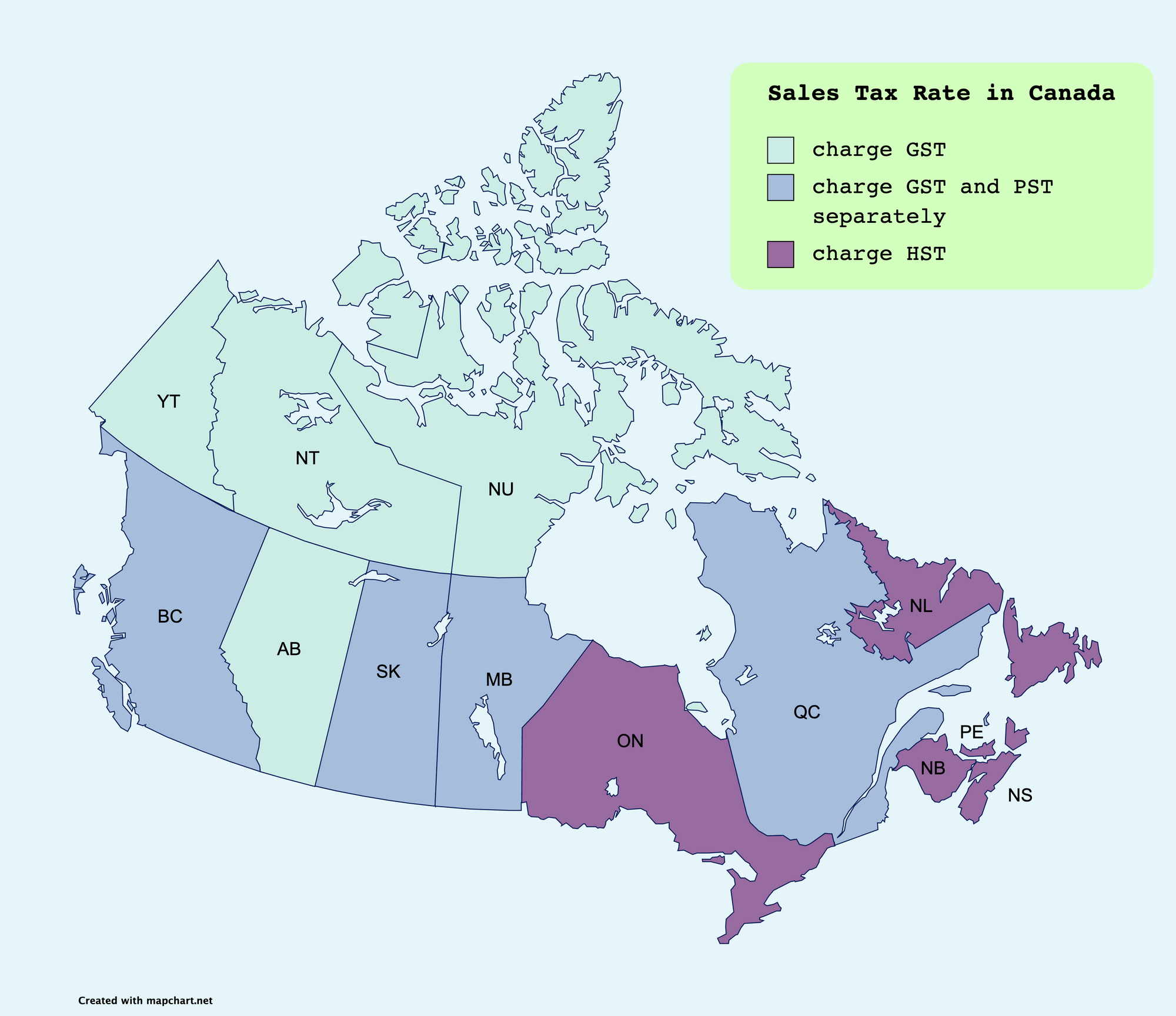

There are ten provinces and three territories in Canada. Consequently, GST in Canada is divided into a combination of GST, HST (Harmonized Sales Tax) and PST (Provincial Sales Tax). This guide will give the complete rundown on how and when each is used.

Types of Tax Rates in Canada

Before you start charging and collecting Goods and Service Tax (GST) from your customers, you need to know the different types of tax rates available in Canada.

There are three different types of tax rates, and they are Goods and Service Tax (GST), Harmonized Sales Tax (HST), and Provincial Sales Tax (PST).

Read more below to find out more.

Goods and Service Tax (GST)

One common sales tax across Canada is the Goods and Service Tax (GST).

The Goods and Service Tax in Canada is 5% on the supply of most goods and services purchased in Canada. You must charge and collect GST in each province unless you supply exempt or zero-rated goods and services to your customers.

Provinces that charge only GST (no PST) are Alberta, Yukon, Nunavut, and Northwest Territories.

Harmonized Sales Tax (HST)

In 1997, the Government of Canada had introduced the Harmonized Sales Tax rate, which combines both the Provincial Sales Tax (PST) with the Federal Goods and Services Tax (GST).

The Harmonized Sales Tax (HST) is a consumption tax levied at the point-of-sale, which adds a percentage to the selling price of goods and services collected from the customers.

The HST program aims to combine both federal GST and PST to become one standard rate to promote consistency and improve the efficiency of sales tax collection.

The participating provinces which agree to the HST program are as follows:

- New Brunswick - HST 15%

- Newfoundland and Labrador - HST 15%

- Nova Scotia - HST 15%

- Ontario - HST 13%

- Prince Edward Island - HST 15%

As a result, businesses operating under the HST program will have to submit one lump sum of the tax liability to the Canada Revenue Agency, instead of splitting the tax rate into GST and PST separately.

In return, the CRA will remit the appropriate amounts to participating provinces on your business behalf.

Provincial Sales Tax (PST)

Provincial Sales Tax, a province sales tax, is explicitly collected in a province, a separate tax from the Goods and Service Tax (GST).

Some of the provinces refused to participate in the HST program, and as a result, these provinces will have to collect and remit both GST and PST separately.

The provinces that are still charging provincial sales tax (PST) are:

- British Columbia: 7% PST on retail price

- Manitoba: 8% retail sales tax (RST) on retail price

- Saskatchewan: 6% PST on retail price

- Quebec: 9.975% Quebec Sales Tax (QST) on retail price

In Manitoba, Provincial Sales Tax (PST) is known as Retail Sales Tax (RST), whereas in Quebec, it is known as Quebec Sales Tax (QST).

The Tax Rate in Each Province in Canada

The table below summarizes the type of tax and the tax rate for each province in Canada.

You can use this chart to have a quick overview of the tax requirement of one province to another in Canada.

| Province/ Territory | Types of Tax | GST | PST | HST | Total Tax Rate |

|---|---|---|---|---|---|

| Alberta | GST | 5% | - | - | |

| British Columbia | GST + PST | 5% | 7% | - | 12% |

| Manitoba | GST + RST | 5% | 7% | - | 12% |

| New Brunswick | HST | - | - | 15% | 15% |

| Newfoundland and Labrador | HST | - | - | 15% | 15% |

| Northwest Territories | GST | 5% | - | - | 5% |

| Nova Scotia | HST | 5% | 7% | - | 12% |

| Nunavut | GST | 5% | - | - | 5% |

| Ontario | HST | - | - | 13% | 13% |

| Prince Edward Island | HST | - | - | 15% | 15% |

| Quebec | GST + QST | 5% | 9.975% | - | 14.975% |

| Saskatchewan | GST + PST | 5% | 6% | - | 11% |

| Yukon | GST | 5% | - | - | 5% |

Learn how to create a new tax rate in Deskera Books.

Factors that determine the GST/HST rate

You must be wondering which tax rate to charge your customers if they purchased from you. Could it be 0% tax rate, or 15% tax rate?

This is quite tricky, as there are a few factors that you need to consider when charging GST/HST.

Stated below are the three main factors you need to note down:

- type of supply - the kind of products and services you're selling

- where the supply is made - the customer's shipping address

- who the supply is made to - the type of customers you are selling your supplies to

Read more below to find out more.

Type of Supply

The type of supply refers to the type of goods and services you are selling to your customers.

The Canada Revenue Agency segregates the type of supply into three categories:

- taxable goods and services in Canada or imported to Canada include sales of clothing and footwear, car repair service, sales and lease of automobiles, sales of rentals of commercial real property, sales of a new housing, legal and accounting services, hotel accommodation, etc.

- zero-rates supplies are supplies with 0% rate such as basic groceries (milk, bread, vegetables), agriculture products (grain, raw wool, dried tobacco leaves), farm livestock, fishery products, prescription drugs/drug dispensing services, medical devices such as hearing aids, feminine hygiene products, exports, and transportation services outside of Canada

- Exempted supplies such as sales of housing that was last occupied by an individual, long-term rentals of residential accommodation (one month and more), residential condominium fees, health, medical, and dental services, child care services, domestic ferry services, legal aid services, educational services, etc.

If you supply zero-rated and exempted supply, there is no need to charge GST/HST rate from your customers.

Place of Supply

Due to the different tax regulations in each province, selling goods and services to another province or territory is not as straightforward for Canadian businesses.

You must charge either HST or GST/PST according to the destination provincial/territorial rates, which is also known as the place of supply.

Generally, the place of supply refers to the location of the purchasers (your customers).

For example, if your business resides in New Brunswick and sells tangible goods or services to your customers in Nova Scotia, you will charge 5% GST and 7% PST instead of the New Brunswick rate of 15% HST.

In circumstances whereby you are supplying basic groceries such as milk and bread to your customers in Alberta or Ontario, then there is no such need for you to collect GST/HST/PST. Groceries are zero-rated supplies. Hence no GST/HST/PST is imposed on these items.

Hence, if you are selling to customers residing in another province in Canada, you should apply their tax rate in your invoices rather than yours.

Note: As long as the destination address is outside of Canada, there will be no sales tax applied to the sales of goods and services outside of Canada's jurisdiction.

Who you supply to

There are certain groups of people in Canada that are exempted from remitting tax returns.

Here are the three groups of people that you need to pay attention to:

- GST/HST for digital economy businesses

As of April 19, 2021, Canada's Deputy Prime Minister and Minister of Finance has proposed a 3% of Digital Services Tax (DST) for the digital economy businesses that will come into effect on January 1, 2022.

The Digital Service Tax (DST) legislation will affect the digital platform operators that sell the website, electronic portal, gateway, store or distributor platform, etc., including non-resident vendors (foreign company) selling cross-border digital services.

Suppose the total taxable supplies are CAD 30,000 or more over 12 months. In that case, the non-resident vendor will have to register, charge and remit GST/HST to the Canada Revenue Agency (CRA).

To find out more about the latest GST/HST imposed on digital economy businesses, you can visit the CRA website. For non-resident digital economy businesses that wish to create GST/HST account, you can read more here.

2. Government officials or diplomats

Businesses will have to collect GST/HST for any supply of property and services to the federal government. The federal government refers to the government departments, branches, agencies and includes some corporations.

If the government supplies goods and services, then the federal government has to charge the GST/HST on its taxable supplies as well. However, several supplies provided by government entities are exempted from GST/HST, such as:

- the service of registering any property, filing of any documents in a property registration system

- the service of filing or procuring a document in a court

- the co-operation of furnishing information under the Privacy Act

- fire protection service

- law enforcement service

- the service of collecting garbage, including recyclable items

3. Indigenous people

Generally, most people will have to remit tax in Canada, except for the Indian, the Indian band, or the band-empowered entity.

Under the Indian Act, these groups of people (also known as the First Nation of Canada) do not have to pay GST/HST.

For example, if you're an indigenous people in Canada and bought a property on/off a reserve or have the property delivered to a reserve by a vendor, you are exempted from paying GST/HST.

As proof of your identity, you have to present a proper document that can be your status card, certificate, or Temporary Confirmation Registration Document (TCRD) to the vendor.

However, not all circumstances exempt the indigenous people from remitting GST/HST. If they are importing any taxable goods and services to Canada, they must pay GST/HST for the imported items.

Do I have to register for GST account in Canada?

Most businesses in Canada have a GST account except for those deemed small suppliers.

According to the Canada Revenue Agency (CRA), as long as your business taxable revenue before expenses exceeds $30,000 in the last four quarters, you must register for a GST account.

For public service bodies such as non-profit organizations, charities, colleges, and hospitals, you will need to register for the GST account once your taxable revenue before expense exceeds more than $50,000.

Need an accounting software to track your business activities in Canada? Read more below.

What is a small supplier?

A GST small supplier is the sole proprietor, partnership, or corporation, whose total taxable revenue expenses are $30,000 or lesser annually.

To determine if you fit the small supplier definition, you must include worldwide revenues from your sales of goods and services subject to GST/HST, including zero-rated sales and supplies and income from your associate. You may exclude financial services, goodwill, and sales of capital property in this computation.

However, the small supplier GST registration rule does not apply to all types of businesses, such as the taxi and limousine operators and non-resident performers who sell ticket admissions to seminars, performances, or other events.

These businesses will have to register for GST/HST even though their taxable revenue before the expense is lesser than $30,000 in the last four quarters.

Do I have to register for GST/HST account even if I'm qualified as small supplier?

If you fit into the small supplier GST registration rule, you can still voluntarily register for GST/HST account, without any restriction.

One of the advantage of signing up for a GST account is that you can claim Input Tax Credit (ITC) for your businesses' purchases. You can claim a refund for the sales tax on items purchased for your business.

Note: You cannot register for a GST/HST account if you only provide exempt supplies.

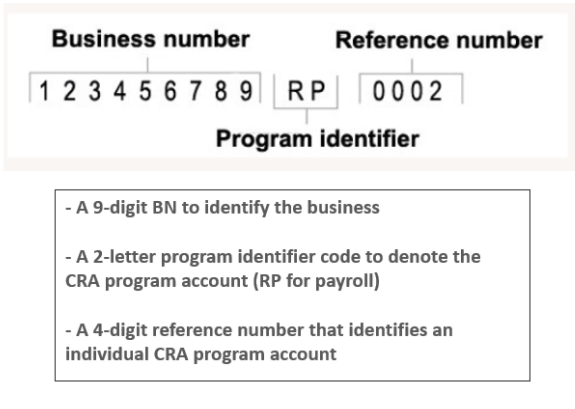

What is a GST number in Canada?

The GST number, is also known as your business number (BN), is a unique 15 alphanumerics tax number given to you by the Canada Revenue Agency during your account registration.

The GST number consists of three parts:

- The first part is the nine-digit Business Number (BN) that identifies with your business

- The second part is the two-letter identifier for the program type

- The third part is the four-digit number that is associate with the program account

You will have to show your GST number in all your invoices once you have your business number.

It's crucial to get your GST number right, as this number identifies other business dealings your company has with the CRA. And, you will be using the same business number to report your business income tax or using your payroll deduction account.

How to register for a GST Number in Canada?

Once your business taxable revenue hits over $30,000, you can immediately start applying for a GST number.

But, what are the easiest ways to register for a GST number, and how do you get this done?

In fact, it's pretty straightforward, easy, and hassle-free.

There are a few options you can sign-up for an account. You can choose from the options listed below:

- Make a call to the Canada Revenue Agency office at 1-800-959-5525. For Quebec province, please dial 1-800-567-4692 to contact the Ministère du Revenu du Québec (MRQ)

- Register online via the Business Registration Online web page. If you are based in Quebec, please visit the Revenu Quebec website

- Register using mail or fax to the nearest tax center

- Visit your local Canada Revenue Agency office

How to start charging and collecting GST/HST?

Once your GST/HST account is all set, you can start charging your customers on the GST/HST on the taxable goods and services you sell to them.

At this point, you need to charge the correct tax rate accordingly, depending on the place of supply, the type of goods and services you are providing, and to whom you're selling the goods and services.

The GST/HST you have collected will be remitted to the CRA by completing a GST/HST return. You can claim the input tax credits for the GST/HST you paid or owe on purchases and expenses you use, consume, or supply in your commercial activities using the GST/HST return form.

What is Input Tax Credit?

Input Tax Credit is the credit that you can claim from Canada Revenue Agency (CRA) for the sales tax you have paid on goods purchased to produce your goods and services.

If you pay GST or HST on goods and services for your business, you are eligible to claim some of these credits, which is a great way in helping to reduce your tax liability.

What are the requirements to claim ITC?

To claim Input Tax Credit (ITC), you must register for the GST/HST account. If you do not have a GST/HST account, you cannot claim for the ITC. Simple as that.

Next, you will need to track all the eligible GST/HST expenses when making a business-related purchase. You need to record, track and save a record of the items purchased, such as a copy of the invoice, receipts, or contract.

Do keep track of the time frame for claiming Input Tax Credit (ITC). You can claim ITCs within four years of the due date of the original return. However, businesses with revenue greater than $6 million annually and some financial institutions will have a maximum two-year deadline.

**You can find the ITC claim on line 108 in your GST/HST return form.

What are the business purchases that qualify for ITC?

You need to check which business expenses you can claim for ITC and which expenses you cannot.

Based on the CRA's website, below are some of the operating and capital expenses that qualify ITC.

Qualifying Operating Expenses

- commercial rent

- equipment rental

- transportation fees such as delivery, freight, and express fee

- office maintenance and repair -

- office expenses - postage, computers, stationery

- travel- hotel, airfare, and car rentals excluding meals and entertainment

- home office expenses, only if this your principal place of business or this is the only space you earn your business income, and you use it regularly

Qualifying Capital Expenses

- photocopier machine, computers, cash registers

- machinery and vehicles

- furniture and appliances

- improvements to capital property

Non-qualifying Expenses

- Some capital property such as patents, franchises, concession

- Taxable goods and services bought or imported goods to provide exempt goods and services

- Membership fees

What is the GST/HST return report?

The GST/HST return report is the tax return report that you have to file and submit to the Canada Revenue Agency (CRA) on the deadline of your reporting period.

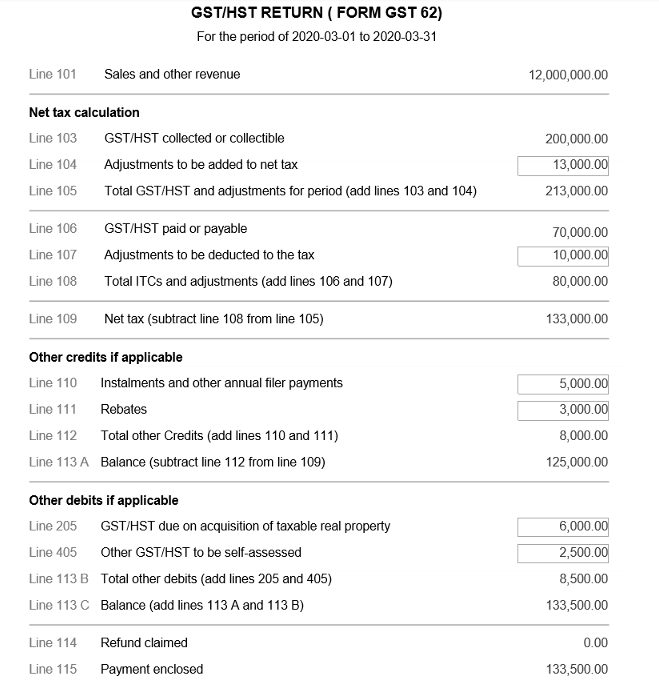

The image below is the sample of the GST/HST Return form in Canada.

In the first section of the GST/HST Return form, you are required to fill in the following information:

- Name - Enter your name here

- Business Number - Enter your GST number

- Reporting period - Indicate your financial reporting period

- Due date - Enter the due date of your filing

Once you have filled up your business information, you can proceed to the next section. Enter the value in each box in the Canadian dollar.

| Line Item | Explanation |

|---|---|

| Line 101 | The total amount of your sales and other revenue. In this line item, do not include provincial sales tax, GST or HST. If you are using the Quick Method of accounting, include the GST or HST. |

| Line 103 | Enter the total of all GST and HST amounts that you collected or that became collectible by you in the reporting period |

| Line 104 | Enter the total amount of adjustments to be added to the net tax for the reporting period (for example, the GST/HST obtained from the recovery of a bad debt). |

| Line 105 | Total GST/HST and adjustment for period (line 103 + line 104) |

| Line 106 | Enter the GST/HST you paid or that is payable by you on qualifying expenses (input tax credits – ITCs) for the current period and any eligible unclaimed ITCs from a previous period |

| Line 107 | Enter the total amount of adjustments to be deducted when determining the net tax for the reporting period (for example, the GST/HST included in a bad debt). |

| Line 108 | Total ITCs and adjustments (lines 106 + line 107) |

| Line 109 | Net tax (line 108 - line 105) |

| Line 110 | Enter any instalment and other annual filer payments you made for the reporting period. **If you are an individual with business income for income tax purposes and have a December 31 fiscal year-end, the due date of your return is June 15. However, any GST/HST you owe is payable by April 30. This payment should be reported on line 110 of your GST/HST Tax Return. |

| Line 111 | Enter the total amount of the GST/HST rebates, only if the rebate form indicates that you can claim the amount on this line. **: Some rebates can reduce or offset your amount owing. Those rebate forms contain a question asking you if you want to claim the rebate amount on line 111 of your GST/HST Tax Return. Tick yes on the rebate form(s) if you are claiming the rebate(s) on line 111 of your GST/HST Tax Return. If you file your return electronically, send the rebate application by mail to the Prince Edward Island Tax Centre. |

| Line 112 | Total other credits ( lines 110 + line 111) |

| Line 113A | Balance (line 112 - line 109) |

| Line 205 | Enter the total amount of the GST/HST due on the acquisition of taxable real property. ** Complete this line only if you purchased taxable real property for use or supply primarily (more than 50%) in your commercial activities and you are a GST/HST registrant (other than an individual who purchases a residential complex) or you purchased the property from a non-resident. If you qualify for an input tax credit on the purchase, include this amount on line 108. |

| Line 405 | Enter the total amount of other GST/HST to be self-assessed. **Complete this line only if you are a GST/HST registrant who has to self-assess GST/HST on an imported taxable supply or who has to self-assess the provincial part of HST |

| Line 113B | Total other debits (lines 205 + line 405) |

| Line 113C | Balance (lines 113A + line 113B) |

| Line 114 | Enter the amount of the refund you are claiming on line 114 if the result entered on line 113 C is a negative amount. |

| Line 115 | Enter the payment in line 115 if the amount in line 113C is a positive amount. |

When do I need to file GST/HST return?

The due date for filing your GST/HST return depends on your reporting period.

You can check the due date of your filing period on Form GST34-2. You must file a GST/HST return even if you do not have business transactions or no net tax to remit.

Refer to the table below for the different filing periods.

| Period | Filing/Payment deadline | Example |

|---|---|---|

| Monthly | One month after the end of the reporting period | Reporting period:June 30 Filing deadline:July 31 Payment deadline:July 31 |

| Quarterly | One month after the end of the reporting period | Reporting period:March 31 Filing deadline:April 30 Payment deadline:April 30 |

| Annually (except for individuals with a Dec 31 fiscal-year end and business income for income tax purposes) | 3 months after fiscal year-end | Reporting period:March 31 Filing deadline:June 30 Payment deadline:June 30 |

| Annually ( for individuals with a Dec 31fiscal year end and business income for income tax purposes) | Filing deadline: June 15 Payment deadline: April 30 | Reporting period:December 31 Filing deadline:June 15 Payment deadline:April 30 |

If your due date falls on the weekends or a public holiday, it is recognized by the CRA that your payment is on time if the CRA receives the tax return the next business day.

What is the late penalty incurred for GST/HST late filing?

Keeping track of your tax filing is your responsibility as a business owner in Canada.

If you miss your filing deadline, you are required to pay the penalty with interest if you owe anything to the Canada Revenue Agency (CRA).

The longer you take to clear the outstanding balance, the higher the penalty will increase.

Note: If you have zero balance in your GST/HST account and if the CRA still owes you a refund, no GST late penalties are imposed.

The late penalty charges follow the formula below:

A + (B × C)where: A is 1% of the amount owing

B is 25% of A

C is the number of complete months the return is overdue, to a maximum of 12 months

For example, if you owe $30,000 in GST/HST and are three months late in making the payment, you can use the formula above to compute the penalty.

A= 1% of $30,000 = $300

B x C= (25% of 300) = $75 x 3 = $225

A + B = $300 + $225 = $525

Hence, your late penalty is a total of $525 to be remitted to the Canada Revenue Agency.

In addition to the late submission penalty, you will also be charged;

- $250 if you receive a demand letter to file your GST/HST return

- $100 if you fail to file your GST/HST return electronically when required to do so and $250 for the subsequent occurrence

- for filing incorrect information to the CRA

Generate your GST/HST Return report using Deskera Books

PST Return Report - Saskatchewan (SK) Province

In Saskatchewan, PST is 6% of the taxable goods and services consumed or used here.

Businesses operating in Saskatchewan must obtain a PST number to collect, remit, and report PST on taxable goods or services sales.

If your business sells to a province with a PST rate, you have to collect PST from the customer and then file a PST return for the sales made in Saskatchewan.

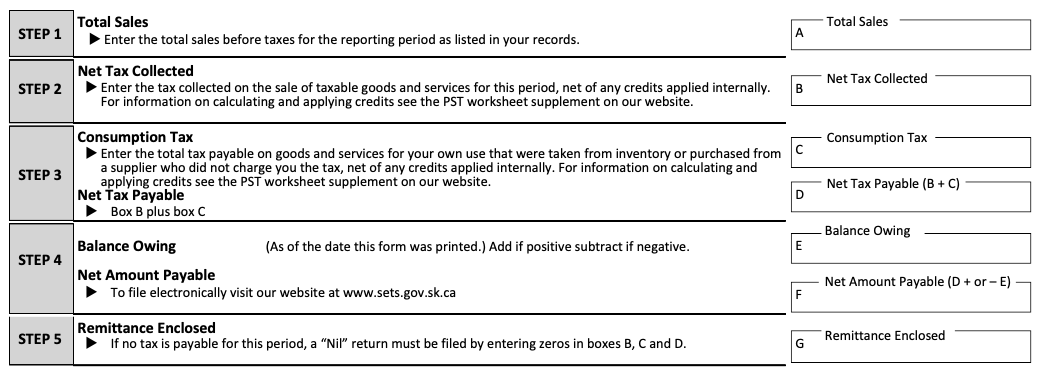

The PST Return form for Saskatchewan province is as per the image below;

Enter the amount in each box for your PST filing in this province:

- Box A - Total Sals

- Box B- Net Tax Collected

- Box C - Consumption Tax

- Box D - Net Tax Payable (B+C)

- Box E - Balance Owing

- Box F - Net Amount Payable

- Box G - Remittance Enclosed

If there is no tax payable, you must still enter $0 in Box A, Box B, Box C, and Box D or file a NIL return.

**In Saskatchewan, the business cannot claim back PST that they paid on purchases.

Filing Frequency in Saskatchewan

As a registered supplier or registered consumer, your filing frequency of tax return can be monthly, annually, or quarterly, depending on your tax collection:

- annually - If your tax payable is in the range of $0- $4,800 per year

- quarterly - If your tax payable is in the scope of $4,800- $12,000 per year

- monthly - If your tax payable is over $12,000 per year

Due Date of Filing PST return

Your PST return filing is on time if the Minister of Finance receives the return and payment by 20th of the month.

If the due date falls on a public holiday, you can still file and remit the payment the following business day, before the close of business.

Penalty for late PST submission

A penalty of 10% of the tax payable will be imposed for late submission, up to a maximum of $500, for each return period.

Aside from the penalty, interest at the prime rate and 3% will be charged from the tax date that has been remitted.

How to file PST return?

Stated below are a few ways that you can file your PST return in Saskatchewan:

- File using Saskatchewan eTax Service (SETS), which is an online service that helps you file your PST return conveniently

- Using mail - make cheque payable to the Minister of Finance and send the completed form along with payment to the following address;

3. Walk-in to the tax office

4. Make payment through online banking

RST Return Report - Manitoba (MB) Province

You need to collect RST for sales within Manitoba.

Once RST is collected, you must remit it to the province.

To do this, you must first be registered as a vendor. You can register for an RST account online.

Unlike GST, there is no small supplier classification for filing an RST return in Manitoba.

You can download a copy of the RST Form in Manitoba for your reference.

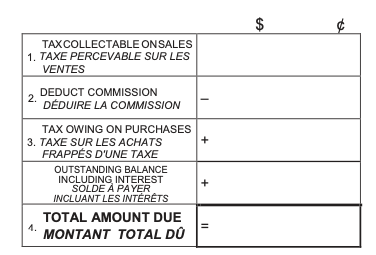

Enter the amount in each of the boxes in the RST Report:

- Box 1 - Tax collectable on sales

- Box 2- Commission

- Box 3 - Tax owing on purchases

- Box 4 - Outstanding balance, including interest

- Box 5 - Total amount due

Filing Frequency in Manitoba

The filing frequency of RST in Manitoba is based on the average RST collected per month:

- monthly - the tax collected is $5,000 or more

- quarterly - the tax collected range from $500 to $4,999

- annually - the tax collected less than $500

Due Date of Filing RST return

The RST return due date is no later than 4.30 pm on the 20th of the month, following the reporting period.

Some examples of the filing period;

- Monthly - covers the previous calendar month RST transactions. For instance, in March, you must complete the tax return and make payment by March 20 for the February month

- Quarterly - covers the previous three months' RST transactions. For example, in April, you need to cover the tax return for sales transactions from January 1 to March 31, which you must complete and remit by April 20

- Annually - covers the calendar year and are due by January 20.

Penalty for late RST submission

If you failed to file the RST return and make payment by 4.30 pm on the due date, a penalty of 10% will be imposed on the tax due. The minimum penalty is $10.

The consequences of filing a late RST return also include forfeiting the commission allowable for the filing period.

How to file RST return in Manitoba?

Effective January 2021, paper filing for monthly RST returns is no longer permissible in Manitoba. However, you can still use the paper filing for any quarterly or annual RST returns.

You have the option to file and pay tax returns using Manitoba's TAXcess service, the Taxation Division's online system.

Visit the site at manitoba.ca/TAXcess to register for an account.

QST Return Report - Quebec (QB) Province

If you are a business in Quebec, or a supplier selling taxable goods and services in Quebec, you have to register for the Quebec Sales Tax (QST) account.

You can register for your QST account here.

Once you have registered for your QST account, you must follow the rules specified by Revenu Quebec when reporting and remitting your QST.

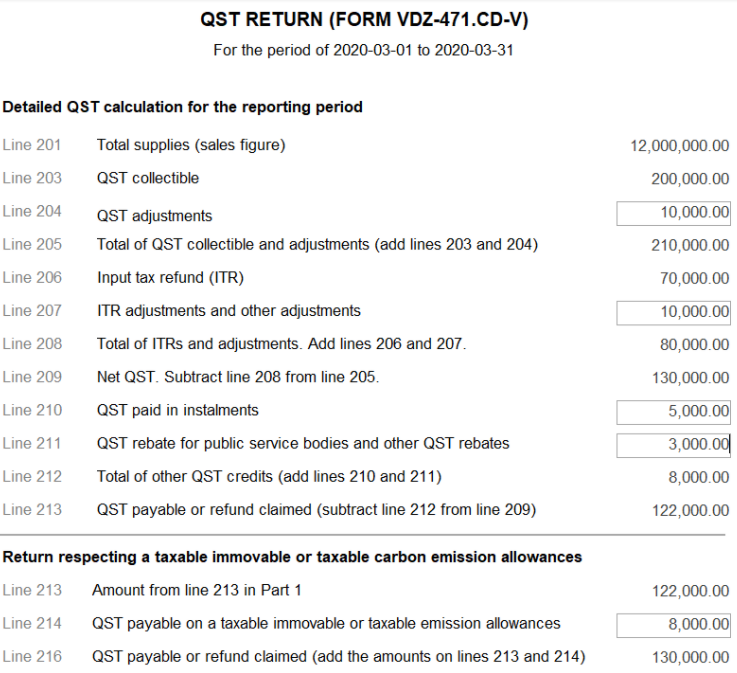

You can refer to the sample QST Return report below.

Refer to the table below to find out more about the explanation of each line item in the QST Return form.

| Line Item | Explanation | |

|---|---|---|

| Line 201 | The total amount of sales and other revenue | |

| Line 203 | The amount of QST collectible for the reporting period | |

| Line 204 | The amount of QST adjustment | |

| Line 205 | The sum of line 203 and line 204 | |

| Line 206 | Enter the amount of Input Tax Refund (ITR). For GST filing, it is the same as Input Tax Credit (ITC). | |

| Line 207 | Enter the ITR adjustment and other adjustments | |

| Line 208 | Total of ITR and other adjustments; The sum of line 206 and line 207 | |

| Line 209 | Net QST; Subtract line 205 from line 208 | |

| Line 210 | The sum of QST paid in instalment | |

| Line 211 | Sum of QST rebate for public service bodies and other QST rebates | |

| Line 212 | Total of other QST credits | |

| Line 213 | Total of QST payable or refund; Deduct line 209 from line 212 | |

| Line 214 | QST payable on a taxable immovable or taxable emission allowances | |

| Line 216 | QST payable or refund claimed (add the amounts on lines 213 and 214) |

Filing Frequency in Quebec

Your reporting period follows the calendar quarter.

Hence, your first reporting period begins when you register for the QST account and ends on the quarter's last day.

Due Date of Filing QST return

Check your reporting period and the deadline for the QST submission as per the table below.

| Reporting period | Filing frequency and payment deadline |

|---|---|

| Jan 1 - March 31 | April 30 |

| April 1 - June 30 | July 31 |

| July 1 - September 30 | October 31 |

| October 1 - December 31 | January 31 |

Penalty for late QST submission

Anyone who neglects or failed to file a QST return is liable to a penalty of $25 per day until the return is filed.

The penalty can go up to a maximum of $2,500 according to the QST tax regulation.

As a business owner, if you forget or neglect to collect any tax amount, you are liable to 15% of the amount in question. And those who failed to pay or remit an amount within the specified period will be imposed:

- 7% of the amount, if the payment is lesser than seven days late

- 11% of the amount, if the payment is in between 8 to 14 days late

- 15% of the amount, if the payment is more than 14 days late

On a serious note, it is an offense to file fake returns. So, you have to ensure that the amount entered in each box is 100% accurate.

How to file QST return in Quebec?

There are two methods to file your QST return:

- you can use the online services from Revenu Quebec. Sign up for a business account using the link here

- you can file your return using mail. You have to complete the GST/HST-QST Return (form FPZ-500-V) that was sent to your by the Revenu Quebec

PST Return Report - British Columbia (BC) Territory

If you own a business in British Columbia, you must collect, report, and pay all the Provincial Sales Tax (PST) and Municipal and Regional District Tax (MRDT), if necessary.

There are two types of tax return reports:

- Provincial Sales Tax (PST) Return report

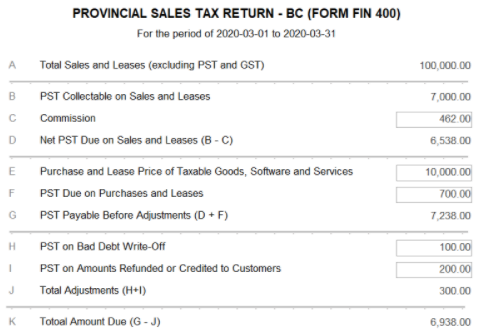

In the PST Return Report in British Columbia, there are a few line items that you will need to fill in.

We will explain to you the meaning of each box in this report.

| Box | Explanation |

|---|---|

| Box A | Enter the total of your sales and leases in Canada, which include taxable, non-taxable, and exempt sales in leases. |

| Box B | Enter all the PST that you have collected or levied but not collected (e.g credit sales). This is inclusive of 0.4% tax on energy products and the $1.50 passenger vehicle rental tax |

| Box C | Enter the commission for this reporting period |

| Box D | Net PST due on sales and leases; Deduct Box B from Box C |

| Box E | Enter the amount used for registrant’s consumption on which no PST has been paid |

| Box F | Enter PST on purchases and leases for registrant’s consumption |

| Box G | PST payable before adjustment; Add Box D and Box F |

| Box H | Enter the PST on bad debt write off |

| Box I | Enter the PST on amounts refunded or Credited to customers |

| Box J | Total Adjustment; Add H and Box I |

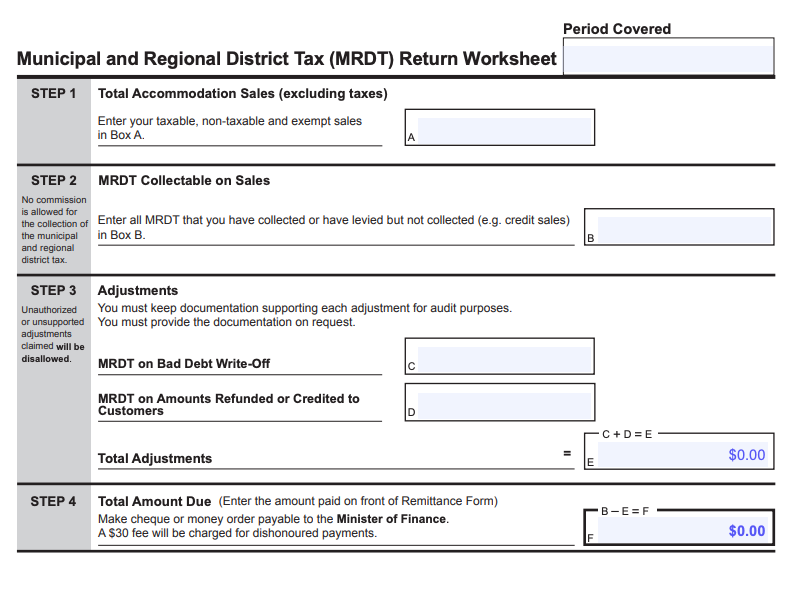

2. Municipal and Regional District Tax (MRDT) return

MRDT only applies for any sales of short-term accommodation in British Columbia. So, if you sell accommodation, you must register for the PST and MRDT in British Columbia, unless exempted.

The MRDT tax is up to 3% on the purchase of accommodation imposed in certain designated areas, collected on behalf of municipalities, regional districts, or eligible entities, in addition to the 8% PST.

You can refer to the MRDT Return form below.

Enter the amount in Canadian dollar the value of each box:

| Box | Explanation |

|---|---|

| Box A | Enter the total accommodation sales, excluding taxes |

| Box B | Enter all MRDT that you have collected or have levied but not collected (e.g credit sales) |

| Box C | Enter the MRDT on bad debt write-off |

| Box D | Enter the MRDT on amounts refunded or credited to customers |

| Box E | Total adjustments; Add Box C and Box D |

| Box F | Enter the total amount due. Note that a $30 fee will be charged for dishonoured payment |

Filing Frequency in British Columbia

The filing frequency for the PST report depends on your ongoing reporting period.

Your ongoing reporting period is assigned to you during your PST registration, which starts the first day of your registration month.

You must follow the assigned reporting period as a guideline of when you report and pay your taxes.

The chart below shows how your PST collectable determines your ongoing reporting period.

| PST collectable per year | Ongoing reporting period |

|---|---|

| More than $12,000 | Monthly only |

| More than $6,000 up to $12,000 | Monthly or quarterly |

| More than $3,000 up to $6,000 | Quarterly or semi-annual |

| $3,000 or less | Quarterly, semi-annual or annual |

Due Date of Filing PST return

You have to complete your tax return and ensure that the payment is made on or before the last day of the following month, after the end of your reporting period.

In circumstances where your due date falls on weekends or a statutory holiday in British Columbia, you can still file and make payment on the first business day following the due date.

Penalty for late PST submission

You are subject to 10% penalty, interest and loss of commission if you failed to file and remit your tax return.

How to file PST return in British Columbia?

Listed below are the few options for reporting and paying PST and MRDT, if required:

Note: If your business is earning $1.5 million or more in sales and leases in the past 12 months, then it's mandatory that you file and pay your tax return electronically.

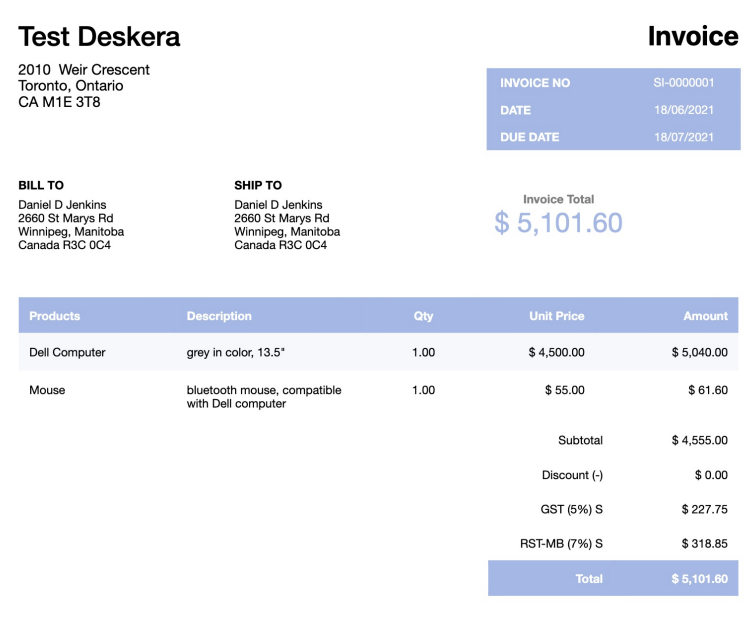

Invoicing in Canada Using Deskera Books

You know it's invoice time when you sell your goods and services to your customers either in the same province or in another territory, in Canada.

Invoicing is a crucial business activity as it informs your customers how much they should pay you and the tax component they are paying - hence you have to get this right.

Using the invoicing feature in Deskera Books, you can specify your customers' location and charge the correct tax rate using the tax configuration in the system. Hence, you and your customers will how much GST/HST/PTS are collected from them.

Here are the essential pieces of information that you can include in your invoice if you are charging GST, HST, or PST using Deskera Books:

- Your company name and address

- The date when you issue the invoice

- Your business number (GST Registration Number)

- The purchaser's name and address

- Term of Payment

- The name of the products or services purchased and their description

- Cost of each product and quantity purchased

- Total amount payable

- Tax component, whether items subject to GST at 5% or HST at the provincial level or that the items are exempt, and the total amount of GST/HST charged in the invoice

Learn more about the invoicing feature using Deskera Books.

Key Takeaways

And that is a wrap. From this article, you can take away the following points:

- What is the sales tax in Canada?

- What are the factors that determine the GST/HST rate?

- What is the sales tax rate in each province and territory in Canada?

- Do you have to register for GST/HST in Canada?

- How can you register for the GST/HST?

- When is the due date for filing GST/HST return?

- What is the late penalty incurred for GST/HST late filing?

- PST Return Report - Saskatchewan (SK) Province

- RST Return Report - Manitoba (MB) Province

- QST Return Report - Quebec (QB) Province

- PST Return Report - British Columbia (BC) Territory

- Invoicing in Canada Using Deskera Books

You may also want to check out our guide on running payroll in Canada.

With Deskera, you can easily apply the Canada GST tax rates to your transactions and generate a proper sales invoice. You get all GST, PST, HST calculations and the tax reports immediately.

Go ahead and give it a spin.