Studies have shown that 7.5 million private-sector workers in California, which is about 57%, do not have access to a workplace retirement plan. This figure includes part-time and full-time workers.

This is sad because it has contributed to each generation retiring poorer than the last, with 55% of the young workers aged 25-44 having projected retirement incomes below 200% of the federal poverty level (which is a commonly used threshold for economic hardship). This is in comparison to 39% of the workers aged 45-54 and 33% of the workers aged 55-64.

So, if the employees have access to workplace retirement plans, then it has been observed that employees with incomes between $30,000 and $50,000 are fifteen times more likely to save for their retirement.

The solution to this problem came in the form of CalSavers retirement savings, which is a new retirement savings program that offers a chance to save to those individuals who are self-employed or whose employers don’t offer a workplace retirement plan and to others who want to save extra.

Under the CalSavers retirement savings, the contributions of the savers would be added to their Individual Retirement Account (IRA). Employers who do not offer their own plan are obligated to register for CalSavers by their deadline in order to facilitate their employees’ access to the program.

Almost 40% of participants of CalSavers retirement savings were able to delay claiming their Social Security by a year or more, thereby increasing their monthly benefits.

Additionally, young workers who were earning the bottom 50% of wages in their age cohort were able to increase their retirement incomes by roughly half as a result of the California state’s new minimum wage law and participation in CalSavers retirement savings.

These statistics are an indication of the good CalSavers is capable of doing. However, with benefits, there are always some or the other drawbacks, even if it is just the paperwork involved. But, you will know it all once you finish reading this article, which covers the following topics:

- What is CalSavers?

- How Does CalSavers Retirement Savings Program Work?

- What Types of Retirement Plans are Available Under CalSavers Retirement Savings Program?

- Which Businesses Qualify for the California Retirement Savings Program?

- Is CalSavers Mandatory for Employers and Employees?

- Who Can Contribute to CalSavers Retirement Savings Plan?

- Does CalSavers Retirement Savings Plan Offer Auto-Enrollment?

- Employer Responsibilities Under CalSavers Retirement Savings Plan

- Employers’ Restrictions Regarding CalSavers Retirement Savings Plan

- What are the Registration Deadlines for CalSavers Retirement Savings Plan?

- What if an Employer Does Not Comply?

- What are the Investment Options Available through CalSavers Retirement Savings Plan?

- What are the Pros and Cons of CalSavers Retirement Savings Plan for Employers?

- Is CalSavers Retirement Savings Plan the Only Option for Employers?

- FAQs about CalSavers Retirement Savings Plan

- How Can Deskera Help with CalSavers Retirement Savings Plan?

- Key Takeaways

- Related Articles

What is CalSavers?

CalSavers is California’s retirement savings program that is specially designed for the millions of Californians who do not have a way to save for their retirement at their jobs. It is thus sponsored by the State of California, facilitated by businesses, and funded by employee savings.

CalSavers was created by a legislation that was passed in 2016 that required the California employers who did not sponsor a retirement plan, to mandatorily participate in CalSavers. By doing this, employers without retirement plans for their employees will be facilitating their employees’ access to the program.

Thus, the main mission of CalSavers is to ensure that all Californians have a path to financial security in retirement by providing them a simple, portable, low-cost way for workers to invest in their futures. CalSavers retirement savings is also a go-to option for self-employed individuals, as well as for those who want to save extra.

CalSavers is an automatic enrollment to the Individual Retirement Account (IRA) with no employer fees or fiduciary liability and minimal administrative upkeep. This also makes it relatively simple for businesses to participate.

Resultantly, CalSavers also gives an opportunity to small business owners who otherwise would not have been able to afford the administrative expenses or overhead costs of a retirement plan to keep their employees engaged, attract new talent, as well as retain their top talents.

CalSavers is not operated at the expense of the taxpayers and is professionally managed by private-sector financial firms with oversight from a public board chaired by the State Treasurer.

How Does CalSavers Retirement Savings Program Work?

As per the California Law, it is required that employers who do not already offer retirement benefits to either sponsor a qualified retirement plan on their own or to enroll their employees in CalSavers, thereby also setting up an Individual Retirement Account (IRA) for each of their eligible employees.

If CalSavers is the option you have opted for as an employer, then your employees will be contributing to the CalSavers retirement savings plan via payroll deductions.

If they change their jobs throughout their careers, then they would be able to take their savings with them. This feature is known as portability, and it is offered by CalSavers retirement savings plan.

While several retirement plans do offer flexibility, CalSavers is different there because it has mandated that the plan uses the following default features unless otherwise stated:

- Employee payroll deductions are adjustable and automatic, and employees may opt-out. Similar to other state retirement plans, the employee deductions are automatically set to 5% of your employee’s gross pay. Additionally, your employees will also be able to adjust the setting of their contributions to a higher or a lower percentage of their pay. Lastly, if they choose to, your employees will also be able to opt-out of the CalSavers retirement savings program.

- CalSavers is a Roth IRA program. This means that the employee deductions are placed into a Roth IRA. However, the participants of CalSavers may also opt for recharacterizing their contributions to a Traditional IRA. Considering, however, that Roth IRA comes with an annual contribution limit of $6,000 in 2022 and $7,000 if the age of your employees is 50 or older, high-earning employees are subjected to a reduced contribution limit.

- CalSaver is Portable. This means that if your employee changes his or her job, they will be able to keep their CalSavers account as this retirement plan is designed in a manner that it can move with your employee throughout their working life.

What Types of Retirement Plans are Available Under CalSavers Retirement Savings Program?

Considering that CalSavers retirement savings are available as a Roth Individual Retirement Account (IRA), it means that your employees will contribute to it via payroll deductions on a post-tax basis. When they retire thus, their income from the savings account will generally be tax-free.

Additionally, participants of CalSavers will also be able to recharacterize their account to a traditional IRA. In this type of retirement plan, the contributions would be made pre-tax. At the time of the withdrawal, they will therefore be taxed.

Which Businesses Qualify for the California Retirement Savings Program?

Employers who have at least five full-time employees or part-time employees based in California qualify for the California retirement savings program and can hence participate in CalSavers. However, they can also choose another retirement savings provider plan. This eligibility of the employers is applicable in the case of non-profit as well as profit businesses.

However, what is evident here is that as long as eligible businesses offer another qualified retirement plan, CalSavers retirement savings plan is voluntary for them. Some of the qualified retirement plans include:

- 403(a) Qualified Annuity Plan or 403(b) Tax–Sheltered Annuity Plan

- 408(k) Simplified Employee Pension (SEP) plans

- 408(p) Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA Plan

- 401(a) Qualified Plan (including profit-sharing plans and defined benefit plans)

- 401(k) plans (including multiple employer plans or pooled employer plans)

- Payroll deduction IRAs with automatic enrollment

Is CalSavers Mandatory for Employers and Employees?

Employers' participation in the CalSavers retirement savings plan is voluntary. However, for those employers who qualify for it but still decline to join it will have to sponsor an alternative retirement plan through the private market, or they will be penalized for not abiding by the state laws regarding retirement plans.

For employees, however, CalSavers is optional, and if their employers have enrolled in it, they can opt out of it at any time.

Who Can Contribute to CalSavers Retirement Savings Plan?

Employers cannot contribute to the CalSavers retirement savings plan. Only your employees, who qualify for it, would be able to do that. The qualifications for the same are:

- Are 18 years or older

- Have the employee status under the Unemployment Insurance Code Section 621

- Receive a Form W-2, Wage and Tax Statement with California wages from an eligible employer

- Are a sole proprietor or partner in a partnership that is an eligible employer

In the CalSavers retirement savings plan, individuals might also be able to participate independently of their employer. In such cases, they will have to:

- Meet the age requirements

- Have a source of income and a bank account

- Provide all personal information required to administer the program

- Make an initial contribution as low as $10. Recurring contribution options are available as well.

Does CalSavers Retirement Savings Plan Offer Auto-Enrollment?

All the employees who work for the eligible employers are automatically enrolled in the CalSavers retirement savings plan at the 5% default contribution rate. This increases by 1% each year, up to a maximum of 8%.

The participants of the CalSavers retirement savings plan can change their contribution level and rate of increase or opt-out of the program altogether.

Employer Responsibilities Under CalSavers Retirement Savings Plan

While CalSavers retirement savings plan is designed to keep the administrative burdens of retirement plans at a minimum, employers do have some responsibilities for the same. Typically, these are:

- Register and add all participant data for all eligible employees

- Provide program information to all new and current employees. This is, however, optional.

- Manually enroll the participants and make annual auto increase deferral adjustments.

- Submit and track payroll contributions

- Track and honor opt-out requests.

Employers’ Restrictions Regarding CalSavers Retirement Savings Plan

Unlike some of the other types of retirement plans, or employee benefits plans or insurance like long-term disability insurance, employers who have registered with the CalSavers retirement savings plan may not match employee investments or make non-elective contributions.

In fact, the state of California further prohibits employers from:

- Providing advice to employees about investment options

- Managing employee investments or account information on their behalf

- Persuading employees to opt-out of CalSavers retirement savings plans

- Deducting contributions from non-participating employees

What are the Registration Deadlines for CalSavers Retirement Savings Plan?

Businesses who are eligible for the CalSavers retirement savings plan can register for it at any time. However, they will have to abide by the following deadlines for the same:

- Eligible employers with more than 100 employees - September 20, 2020

- Eligible employers with more than 50 employees - June 30, 2021

- Eligible employers with five or more employees - June 30, 2022

Note: The size of the business is determined on the basis of the average number of employees reported to the Employment Development Department on the four DE9C filings from the previous year.

What if an Employer Does Not Comply?

If an employer does not comply with the regulations regarding the retirement plan, does not offer a retirement plan by the deadline, nor does he or she sign up for the CalSavers retirement savings plan, then he or she may face financial penalties.

According to the California state law, employers that fail to allow eligible employees to participate in CalSavers retirement savings plans are subject to a penalty of $250 per eligible employee if the non-compliance extends 90 days or more after the notice.

If that employer is found to be in non-compliance 180 days or more after the notice, then he or she would become responsible for an additional penalty of $500 per eligible employee, for a total of $750 per employee.

What are the Investment Options Available through CalSavers Retirement Savings Plan?

The CalSavers retirement savings plan is an automatic enrollment payroll deduction IRA that offers a wide variety of investment options. These are:

- The initial contribution of the participants is automatically invested in the CalSavers Money Market Fund unless otherwise selected by the participants. A money market fund invests in low-risk investments like Treasury securities. It thus often emphasizes safety over profits.

- After 30 days, the contributions are allocated to a CalSavers Target Retirement Fund based on the participant’s age and other such factors. However, the participants can also choose to invest in other investment options like:

- An environmental, governance, and social fund that invests in equity securities of global companies that follow sustainable business practices.

- A core bond fund composed of the U.S. investment-grade bond market.

- Global equity funds that invest in an index of foreign and domestic equity markets.

- A money market fund that aims to preserve capital and invest in dollar-denominated securities.

What are the Pros and Cons of CalSavers Retirement Savings Plan for Employers?

While the most obvious argument in favor of CalSavers retirement savings plan is that it improves employees’ accessibility to retirement plans, there is more to it than just that.

Recent data from the CalSavers retirement savings board show that elements of the state-run program have indeed benefited certain small businesses and their employees:

- Proving this is the statistics of 2021, when the number of active participants of CalSavers retirement savings plans more than doubled to 218,000 total savers who were contributing a total of $187 million, excluding withdrawals and investment returns.

- Additionally, in the same year, the registered employers offering the CalSavers retirement savings plan as an option tripled to more than 23,000.

While these increases were observed, there were several prevailing discrepancies that were observed through the other data points. These were:

- The average contribution per participant of the CalSavers retirement savings plan was just $150 per month. This was despite a total contribution level of $16 million among active accounts per month in 2021. In contrast, participants in Human Interest 401(k) plans contribute 10% of their gross income (including employer match) on an average.

- It was found that at the end of the year and among new savers, 58% of funded accounts had balances of only $500 or even lesser.

- An opt-out rate of about 30% by the participants of the plan was observed. This percentage is higher than the average of similar 401(k) plans. For instance, Human Interest sees participation rates of 87% when auto-enrollment is included in the 401(k) plan design.

These statistics prove that while CalSavers retirement savings plan is better than nothing, it does lack in terms of flexibility and plan design options that your employees deserve. This is because:

- While CalSavers retirement savings plans offer investment options, its funds represent only a fraction of the open market.

- CalSavers charges participants between 0.825% to 0.95% in asset-based fees.

- CalSavers retirement savings plan offers a Roth IRA option, which for 2022 allows contributions of up to $6,000 only if your employees earn $129,000 or less per year. If your employees are married and filing jointly, then this earning limit is increased to $204,000. Additionally, it also lets you add a catch-up contribution of $1,000 more, i.e., up to $7,000 in total, if your participating employees are 50 years of age or older.

Is CalSavers Retirement Savings Plan the Only Option for Employers?

While the core benefits of CalSavers retirement savings plan is that it is an affordable and convenient way to handle the retirement of your employees, it is not the only option that you have at your disposal.

In fact, there are several new and old retirement plan providers out there who offer a range of products, including but not limited to retirement savings plans such as 401(k)S, IRAs, defined benefit pensions, and more.

As an employer, it becomes your responsibility to offer your employees with tools that will help them save for their future. Thus, before deciding the kind of coverage you want to offer your employees, it is critical that you weigh your options while also understanding your and your employees’ needs to make the right decision.

FAQs about CalSavers Retirement Savings Plan

Some of the frequently asked questions about CalSavers retirement savings plan are:

- Why is California sponsoring its own retirement plan?

In order to address the looming retirement savings crisis, California is one of the several states in the United States that is sponsoring its own retirement plan. Plans like CalSavers are enacted based on studies that show that only 28% of businesses with less than ten employees provide retirement benefits.

- When did CalSavers start?

As a part of a phased rollout over three years, CalSavers was officially launched by the California state government in July 2019. In the first phase, eligible businesses with more than 100 employees were required to register. In the second phase, the registration was followed by eligible businesses with more than 50 employees, and in the third and last phase, businesses with five or more employees are required to register.

- Is CalSavers legal?

While CalSavers has faced its own legal challenges, the Ninth Circuit Court of Appeals ruled in favor of the state-run program on May 5, 2021. Further on, on June 15, 2021, it denied the appellant’s request for rehearing.

- Can self-employed individuals participate in CalSavers?

While there is no legal requirement or mandate for employers with less than five employees to join CalSavers, or offer alternative retirement benefits plans, they can become its members. This thus includes sole proprietors and partnerships.

How Can Deskera Help with CalSavers Retirement Savings Plan?

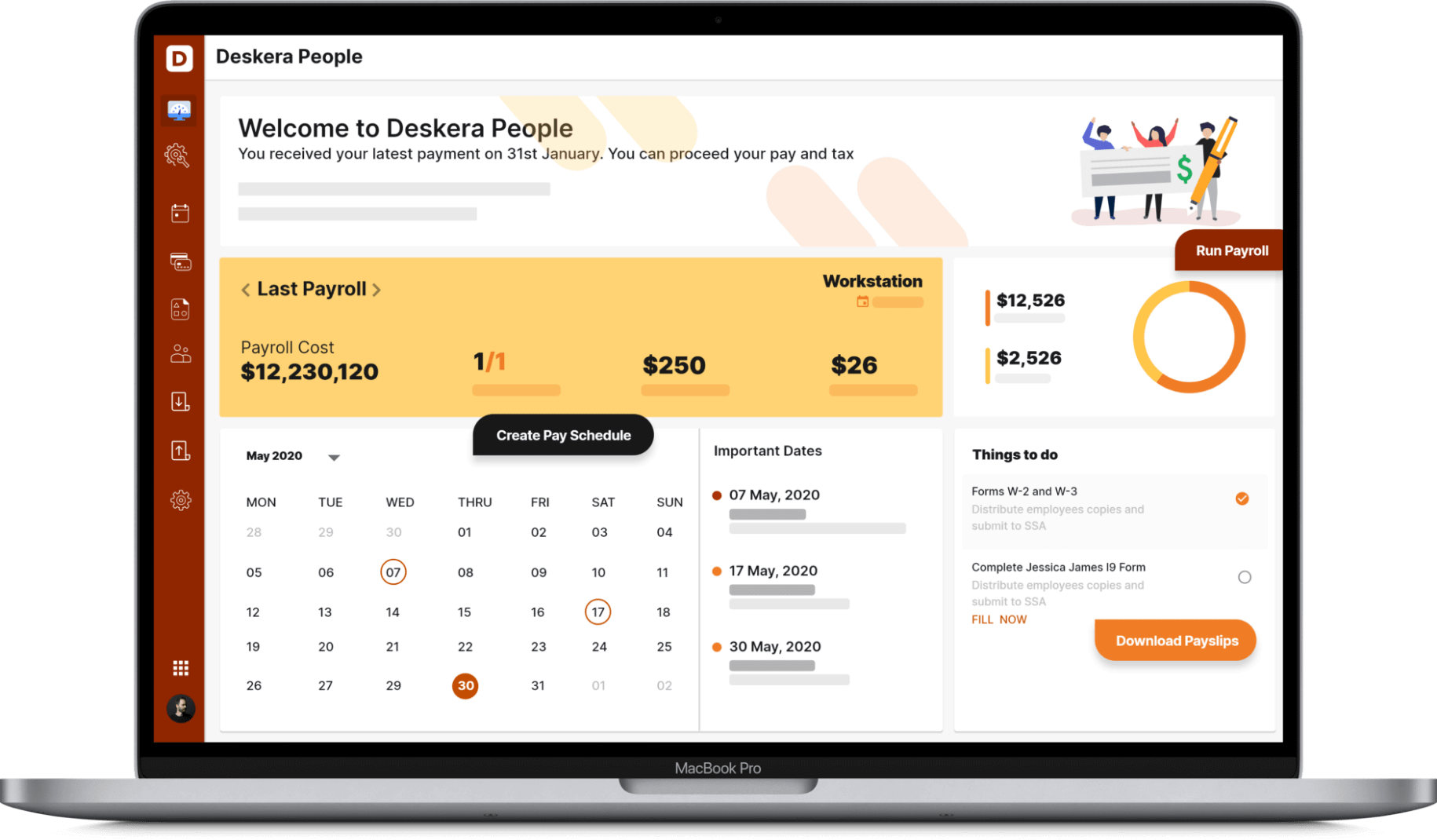

Deskera People is the cloud-based software that you should rely upon when it comes to automating your payroll processes related to CalSavers retirement savings plan that your employees are participants of.

With Deskera People, you would be able to create and assign custom pay components to an employee based on your requirements. This means that you would be able to set up not only employee bonuses but also voluntary deductions for contributions to their CalSavers retirement savings plan.

Additionally, Deskera People will also help you maintain your statutory compliances as it comes inbuilt with statutory and tax compliances for the USA. Thus, by using this software, you would be able to further reduce your administrative costs, as well as avoid penalties related to retirement mandates of California.

Key Takeaways

CalSavers, a retirement savings plan, is drawn up to address the retirement benefit crisis of the state of California by being a retirement savings plan that is more accessible to the employers as well as their employees. CalSavers retirement savings plan focuses on having less administrative or overhead costs for the employers while also keeping the employees engaged.

In fact, CalSavers retirement savings plan is just facilitated by the businesses, while the contributions are made by the employees. It thereby lets businesses retain their top talents, maintain their key performance indicators, business metrics, the health of their financial statements, and also maintain their customers’ loyalty and customers’ retention.

All in all, they can maintain their gross profits and even increase their net profit ratio while simultaneously complying with the state retirement mandates without having to make expensive contributions.

As for your employees, they have a simple, portable, and low-cost way of investing in their future through the CalSavers retirement savings plan. However, it does have its limitations in terms of lack of flexibility, investment options, contribution limits, and 0.825% to 0.95% in asset-based fees.

Thus, before you make your final decision as an employer in regards to the retirement plan you want to offer to your employees, you should shop around and research the other available retirement plan options and weigh all the pros and cons of each.

Related Articles