Some statistics from 2019 reveal that over 50% of business owners try to sell their business themselves; however, they often fail because of the juggling of operations required while also learning how to sell their largest investment. Businesses are most likely the largest investments of the business owners as it was found that typically about 90% of a business owner’s wealth is in their business.

However, business owners do end up selling their own businesses, with one of the reasons being that it is rare for businesses to continue through various generations. Studies show that only about 30% of family-owned businesses survive the second generation, about 12% survive the third generation, and about 3% survive the fourth generation. In fact, a PWC survey showed that such a transition method of shifting the family business from one generation to the next had decreased by about 25% since 2010.

The one thing that is evident in these statistics is the opportunity that it presents to the entrepreneurs who want to own their own business and be the boss. If you are here on this page, then you are one such entrepreneur aspiring to have your own business.

While it is great to have your own business, building one from scratch becomes really hard. This becomes one of the reasons why entrepreneurs prefer to buy existing businesses. Other reasons for the same can be that through buying a business, they would be able to acquire an up and coming competitor or even just build their investment portfolio.

In fact, studies have revealed that each year, more than 500,000 businesses change hands, and this number is expected to only increase in the coming years as millions of baby boomers begin retiring and selling their businesses. This would benefit the entrepreneurs who want to have their own businesses but want to skip past some of the pain points and costs of starting a new business.

Whatever the reasons for buying an existing business may be, it follows a certain process that is long and complicated but which will help you save yourself from buyer’s remorse. This article will not only take you through this process but also acquaint you with the pros and cons of buying a business, along with comparisons with franchises and starting a new business. The topics covered in this article are:

- 7 Steps to Buy a Business

- Common Mistakes to Avoid While Buying a Business

- Transition Time While Buying a Business

- Pros of Buying an Existing Business

- Cons of Buying an Existing Business

- Franchising vs. Buying an Existing Business

- How Can Deskera Help?

- Key Takeaways

- Related Articles

7 Steps to Buy a Business

Most of the time, buying an existing business is less risky than starting one from scratch. This is because you would be buying a business that already has its own established customer base with customer loyalty and places where you can improve customer retention as well, has its own brand positioning statement through which it is recognized, employees who are already familiar with the business, and financial statements that are promising.

However, finding such an established business and buying it will not be a piece of cake and will involve several steps therein. These steps to buy a business are:

Step 1: Find a Business to Purchase

This first step in how to buy a business involves not only finding an available business but also one that is worth buying. While there tend to be a lot of businesses for sale, one which promises good returns on investment and a high net profit ratio are rare. Thus, through this step, you will have to find a business that is profitable and is not hiding any skeletons.

Some of the things that you should look for when you are ready to buy your business are:

- Positive cash-flow, or a trajectory that shows you the potential

- The business should be part of an industry that you are familiar with

- A diversity of consumers and stable groups of buyer personas, with no one client being more than 20% of revenue, roughly

- A long-term growth plan

- A business that you could see yourself enjoying

Some of the places that you can look into to find a business to purchase are:

- Online broker sites

- Local business brokers

- Local attorneys

- Local CPAs

- Franchisors

- Existing small business owners in your ideal industry

Make sure that you do not stop looking as soon as you have found a business that ticks all the boxes. Instead, look in as many places as possible before you start ranking your favorites.

A business would be perfect for you only when you choose the right type of business to buy for you. This involves matching your skills and experience with the business that you intend to buy. Additionally, some of the other things to consider to ensure you are making the right choice are:

- Size of the business that you are looking for in terms of:

- Number of employees

- Number of locations and sales

- Pinpoint the geographical location where you want to own a business. In that location:

- Assess the labor pool and costs of doing business in that area, including wages and taxes, to make sure that all of these factors are acceptable to you.

Once you have decided on these factors, you should start looking for businesses that meet your needs in the ways mentioned above. In addition to those ways, you can also run your own “want to buy” ad describing what you are looking for.

What is also true in regards to buying a business is that all of them might not be listed under the businesses that are up for sale, but if you make an offer to the business owners, then they might consider selling it. It is thus here that you should use your networking abilities and business contacts to get access to good prospects.

Note: If you hire a business broker to help you find the right business and negotiate deals on your behalf, then he or she will charge you a commission of typically 5% to 10% of the purchase price. Thus, if you are trying to save money, consider hiring a broker only when you are near the final negotiating phase. This would be helpful, too, considering brokers offer assistance in several ways.

However, the assistance that is offered by brokers, especially if you are a first-time business buyer, tends to be worth the cost.

This is because your broker will pre-screen businesses for you as they would refuse to sell businesses where the seller would not provide full financial disclosure because the business is overpriced. Thereby, by buying a business through a broker, you would be able to save yourself from these bad risks.

Additionally, once your broker knows your interests and skills, they might be able to pinpoint you to an industry that might be the ideal one for you but which you had failed to consider until then.

Once you have finalized the business you want to buy, your broker will play a major role in negotiating between you and the seller of the business, making sure both of you stay focused on the ultimate goal and smoothening over any difficulties that arise.

Lastly, brokers tend to be updated with the latest laws and regulations, affecting everything, from licenses and permits to financing and escrow, thereby reducing the risk of you neglecting a crucial form, fee, or step in the process. In fact, they would also know efficient ways of cutting through the red tape, thereby cutting off months from the purchase process.

Step 2: Value the Business

The 2nd step in how to buy a business is figuring out the worth of the business that you are interested in. This is an essential step because there are plenty of sellers who overvalue their business, and by understanding the worth of the business, you will be able to make sure that you are overpaying.

The two options that you have in regards to valuing the business that you are interested in are:

- Do it yourself

- Hire a professional

The most common problem with hiring a professional for the valuation of a business is that they can be expensive- up to $5,000 or more. However, this option is recommended if you are not confident about your abilities to make an objective assessment.

While each type of business is handled differently, and therefore there is no common path you can take in valuing a business, it is typically calculated either through net income, business revenue, or EBITDA.

However, a checklist of items that you should typically evaluate to verify the value of the business before buying it are:

- Inventory: You should refer to all the materials and products that have been inventoried for resale or use in servicing a client. During the examination of the inventory, you or a qualified representative should be present.

Additionally, to get the proper idea about the inventory segment of the business you are interested in, you should know its status in terms of what is present on hand and what was on hand at the end of the last fiscal year and in the fiscal year preceding it.

In fact, you should even have your inventory appraised because it is a hard asset, and you will need to know what dollar value you can assign to it.

Remember, when checking the inventory, you should measure its salability as well. How old is it? What condition is it in? What is its quality?

During buying a business, it is not mandatory to accept the value of inventory as given by the seller of the business. It is subject to negotiation. If you feel that the inventory under question is compatible with your target market or it is not in line with what you would like to sell, then you should definitely bring these points up for discussion during the negotiation.

- Equipment, Furniture, Fixtures, and Building: This includes all the office equipment, product, and assets of the business. To assess their values, you should get a list from the seller that details the name and model number of each piece of the equipment, then determine its present condition, market value when it was purchased and its present market value, and whether the equipment was purchased or leased.

You should also figure out how much the seller has invested in leasehold improvements and maintenance to keep the facility in good condition. Your last step here would be to determine the modifications that you will have to make to the building for it to suit your needs.

- Copies of all Legal Documents and Contracts: Contracts would include all the lease and purchase agreements, subcontractor agreements, distribution agreements, union contracts, sales contracts, employment agreements, and any other instruments used to legally bind the business.

You should also evaluate other legal documents during the valuation process of the business that you want to buy. These legal documents include but are not limited to fictitious business name statements, registered trademarks, articles of incorporation, patents, copyrights, etc.

In fact, if you are considering buying a business with valuable intellectual property, then you should have an attorney evaluate it. In the case of a real-estate lease, you will have to find out if the lease is transferable, its terms, how long it runs, and if the landlord needs to give his or her permission for the assignment of the lease.

- Incorporation: If the company is a corporation, then you should check to see what state it is registered in and whether it is operating as a foreign corporation within its own state or not.

- Tax Returns for the Past Five Years: One of the common trends in the small business owners using the businesses for their personal needs. This means that the seller of the business might have bought products for their personal use, even though they have charged them to the business, or they might have taken a vacation with the company funds, or gone to trade shows with their spouses, etc. Thus, in order to determine the actual financial net worth of the company you want to buy, you will have to use your analytical skills as well as your accountant's analytical skills.

- Financial Statements for the Past Five Years: To get the proper valuation of the business you want to buy, you should evaluate its financial statements for the past five years, in addition to all the books and financial records, and compare them to their tax returns. This will help you in knowing the earning power of the business.

In fact, with the help of an accountant who is familiar with the types of business that you are considering buying, you should examine the sales and operating ratios. The operating ratios should also be compared against the industry ratios.

- Sales Records: While the sales will be recorded in the financial statements, you should also evaluate the monthly sales records of the past 36 months or more of the business that you want to buy in order to know the revenue it will bring to you.

To do so, you should break down sales as per the product categories if there are several products involved, as well as by cash and credit sales. Another benefit of undertaking this process is that it will help you understand the current business activity as well as the business cycles that it will go through.

Once you have gotten the cycle, you should compare it with the industry standards in order to know how the business positions in the market and against its competitors. In addition to the monthly sales records, you should also get the sales figures of the ten largest accounts for the past 12 months.

Here, if the seller is uncomfortable with releasing the names of his or her clients, then he or she can assign them the codes and then share them with you. You need this data only to understand the sales pattern of the business.

- Complete List of Liabilities: To examine the list of liabilities of the business you want to buy and determine their potential costs and legal ramifications, you should consult an independent attorney and accountant.

When doing so, you should also find out if the business owner has used assets like accounts receivables and capital equipment as collateral to secure short-term loans and if there are liens by creditors against assets, lawsuits, or other claims.

Further on, your accountant should also check for unrecorded liabilities like out-of-court settlements being paid off, employee benefits claims, etc.

- All Accounts Receivables: When you want to buy a business, you should also go through all of its account receivables and break them down by 30 days, 60 days, 90 days, and beyond. Checking the age of the account receivables is crucial as the longer the period since when it is outstanding, the lower would be the value of that account.

Post this, you should make a list of the top 10 accounts and check their creditworthiness. If the client is creditworthy and the majority of the accounts are outstanding for more than 60 days, then by imposing a stricter credit collection policy will help in speeding up the collection of the receivables.

Thus, based on the account receivables, their age, and the creditworthiness of the clients, the valuation of the business in this department should be done.

- All Accounts Payable: Similarly, like in the case of accounts receivables, accounts payables should also be broken down by 30 days, 60 days, and 90 days. This is important as it will help you in understanding how well the cash flows through the company. For all the payables that are more than 90 days old, you should check to see if any creditors have placed a lien on the company’s assets. All of these details will go into determining the value of the business that you want to buy.

- Debt Disclosure: Here, all the outstanding loans, notes, and any other debts to which the business has agreed to are considered. In addition to this, you should also look for any business investments on the books that may have taken place outside of the normal area. Additionally, you should also look at the level of loans that the business has given to its customers as well.

- Merchandise Returns: Does the business have a high rate of returns? Has it gone up in the past year? If so, can you find out the reasons for the same and correct the problem(s)?

- Customer Patterns: If you want to buy a business, you must understand its customer patterns, as this will help you with its valuation as well. This means that you would want to know the specific characteristics of the business’s current customers. This involves: how are the first-time buyers? What is the rate of returning customers and customer retention? How many customers were lost over the past year? When is the peak buying season for the current customers? What types of merchandise of the business is most popular with its customers? And other such questions. The business metrics would be able to give you deep insights here.

- Marketing Strategies: By understanding the marketing strategies when buying a business, you would be able to better predict your gross profit as well as net income and, therefore, the valuation of the business.

Some of the questions that you should get the answers to are: How does the owner obtain customers? Does he or she advertise aggressively, offer discounts, or conduct public-relations campaigns?

To better understand the marketing strategies, you should all get the copies of all the sales literature in order to know the brand image that is being projected by the business. Through this, you would also be able to get better insights into the branding marketing campaigns carried out by the business.

Remember, when looking at the literature, you should pretend to be a customer who is being solicited by the company. You should then assess how it makes you feel. This will further help you in understanding how the company is perceived by its market.

- Advertising Costs: When buying a business, you should also analyze its advertising costs. Often, it is better and more profitable for a business to postpone its profit at the year-end, until the next year, by spending a lot of money on advertising during the last month of the fiscal year.

- Price Checks: One of the other important things to look into for the valuation of the business is its prices. You can do this by evaluating the current price lists as well as the discount schedules for all your products, the date of the last price increase, and the percentage of increase.

In fact, you can even go back and look into the previous price increase to see what was the percentage of increase at that time. The benefit of doing this is that through this, you will be able to determine whether you will be able to raise the prices again or not.

Remember to compare the prices and every detail about it with that of the industry standards.

- Industry and Market History: In order to be able to value your business properly as a part of the steps for buying a business, you should analyze the industry and the specific market segments of the business targets.

Such an analysis will help you find out if the sales in the industry as well as in the market segment have been declining, growing, or have remained stagnant. This will help you in determining the future potential for earning profit.

- Location and Market Area: Evaluation of the location of the business and the market area surrounding it is especially important for retailers as they get their majority of the business from the primary trading area.

Thus, you should conduct a thorough analysis of the business’s location and the trading areas surrounding that location, including the demographics, economic outlook, and competition.

In case it is a service business that you want to buy, then based on the locations of the various accounts, you should find out if there are any special requirements for delivering the product or any transportation difficulties encountered by the business in getting the product to the market.

- The Reputation of the Business: The image of the business in the eyes of the suppliers as well as customers is very important for it to have a successful future. Thus, depending on the type of image that a business has, it can either be an asset or a liability. Thus, this is an important factor to look into during the valuation of the business. To know the reputation of a business, you should interview its suppliers, customers, and the bank, as well as the other business owners in the area.

- Seller-Customer Ties: It is crucial for you to know of all the customers who are related or have any special ties to the present owner of the business. Such ties are usually an asset, and by trying to understand them, you might be able to ensure that the relationship carries on even when you become the owner of the business.

Some of the questions that you must get answers to in order to better understand the ties of such customers with the business are: How long has such an account been with the company? What percentage of the company’s business is accounted for by this particular customer or set of customers? Will this customer continue to purchase from the company if the ownership changes?

- Inflated Salaries: Inflated salaries can be detrimental to the overall financial health of the business, and thus they should be looked into. Some salaries may be inflated, or perhaps the current owners may have a relative on the payroll who isn’t working for the company. All such possibilities should be properly evaluated.

- List of Current Employees and Organizational Chart: The current employees of the business, especially the key personnel, can be a valuable asset. Thus, you should look into the list of current employees, along with the organizational chart, in order to understand who is responsible to whom.

Additionally, you should also know the management practices of the company and know the wages of all the employees, as well as their length of employment.

You should also examine any management-employee contracts that exist aside from a union agreement, as well as the details of employee benefit plans, health, life, and accident insurance, profit-sharing, vacation policies, and any employee-related lawsuits against the company.

- OSHA Requirements: You should also find out if the business’s facility meets all the occupational safety and health requirements and whether it has been inspected or not. If you have doubts regarding this, you should ask the Occupational Safety and Health Administration (OSHA) to help you with the inspection.

This step is important because as a prospective buyer of a business that most possibly will come under the scrutiny of OSHA, you need to be certain that you are not buying an unsafe business. Thus, by taking OSHA’s help with the inspection, you would be able to protect your position.

- Insurance: Here, you will be establishing the type of insurance coverage that is being held for the operation of the business and all of its properties, as well as who is the local company representative and the underwriter and how much the premiums are.

During the valuation phase, this item is important to be checked as some businesses are under-insured and operating under potentially disastrous situations in case of fire or any such major catastrophe. Thus, if you become a part of an under-insured operation, you can be wiped out in cases of major losses. Such under-insured businesses are valued lower due to their vulnerabilities.

- Product Liability: Product liability insurance is especially important if you are purchasing a manufacturing company. This is because, in such cases, the insurance coverage can change each year dramatically, and this will have a huge impact on the cash flow of the company and, therefore, on its overall value.

Deciding upon the price of an existing business is one of the most emotionally charged decisions. Thus, while the owner of the business would have valued it in one manner, you, as a buyer, would definitely have another viewpoint about its valuation. Thus, when both the parties are dealing with different perspectives, usually the one who is best prepared is the one who will have the most leverage when the process of buying a business enters the negotiation stage.

What you need to remember here is that most of the sellers determine the price of their business arbitrarily or through a special formula that may be applicable to that industry only. Thus, there usually aren’t many solid facts upon which their decision is based.

Thus, the nature of the price makes it very hard to pin it down and, thus, harder for the buyer to assess. There tend to be several factors that influence price, for example, economic conditions. When the economy is expanding, businesses tend to sell for a higher price, whereas during recessions, they tend to sell for a lower price.

Another example of a price determining factor is motivation. The motivation referred to here is the seller’s motivation to want an out. If the seller of the business has several personal financial problems, then by playing the waiting game, you might be able to buy it at a discounted rate. Using the same logic, you should never let the seller know how badly you want to buy their business, as this will affect their prices adversely.

Beyond these factors, the several different methods that you can use to determine the value of a business are:

1.Multipliers: In this method, the value of the business is determined by using a multiplier of either the monthly gross sales, or monthly gross sales plus inventory, or after-tax profits. While this method sounds complex and even accurate, to begin with, on looking deeper, you will realize that it actually has very little to substantiate the arrived at price. This is because most multipliers are not based on fact.

For example, individuals within a specific industry may claim that certain businesses sell at two times their annual gross sales plus inventory or three times their annual gross sales. Thus, depending on the formula that is used by the existing owner of the business, the gross sales are multiplied by the appropriate number, and a price is generated.

For example, a business is earning $100,000 a year, and the formula that is used by the seller uses the multiple of gross sales at 30% based on the industry average. Thus, the price of the business generated by him or her would be:

100,000 x 0.30 = $30,000

While you can check the monthly sales figure by looking at the income statement, how can such a number (multiplier) be an accurate number, considering that it has been determined arbitrarily, with usually no formal survey being performed and verified by an outside source to arrive at these multipliers.

Additionally, even if the multiplier was accurate, there is such a large spread between the low and high ends of the range that it usually serves as only a ballpark figure. This remains true irrespective of whether you use a profit multiplier or a sales multiplier.

In fact, in the case of profit multiplier, the figure becomes even more skewed because the businesses rarely show their original profit due to tax reasons. Thus, the resulting value of the business is either very small, or the owner has to use a different profit factor to arrive at a higher price. Thus, if you come across a seller who is using a multiplier method, use that price only as an estimate and nothing more.

2.Book Values: This is a fairly accurate way of determining the price of a business. To get the price of the business based on the book value, you will have to find out the difference between the assets and liabilities of the company to get its net worth. Usually, the balance sheet has this done already. The net worth is then multiplied by one or two to arrive at the book value.

Remember, the assets will tend to include leasehold improvement, unsold inventory, equipment, real estate, accounts receivable, fixtures, and supplies. Liabilities can be anything and might even include the business itself. However, usually, liabilities include uncollected taxes, liens, lawsuits, bad investments, judgments, unpaid debts, and anything that will create a cash drain upon the business.

However, as you might have realized, things get tricky here because, in the balance sheet, the fixed assets are usually listed by their depreciated value and not by their replacement value. Therefore, there isn’t a true cost associated with the fixed assets, which ends up creating inconsistent values. In fact, if the assets have been depreciated over the years to a level of zero, then you would not have anything on which to base a book value.

3.Return on Investment: This is one of the most common means of judging a business, as this will tell you what profit you will realize from the business after the debt services and the taxes. Remember, while return on investment is the amount of the business, profit is the yardstick by which the performance of the business is measured.

Usually, a small business should return anywhere between 15 and 30 percent on investment. This is the average net in after-tax dollars. Depreciation, which is a device of tax planning and cash flow, should not be counted in the net because it should be set aside for replacing equipment.

Businesses are bought when they show the potential of earning money for you. You can thus determine the value of a business by evaluating how much money you are going to earn on your investment. To begin with, the business should have the ability to pay for itself. Post this, if it can give you a return of 15 percent or more on your investment, then you have a good business. It is this return on investment that will determine the price of the business.

Remember, if the seller is financing your purchase of the business, then your operating statement should have a payment schedule that can be taken out of the income of the business to pay for it.

While you would be hearing price-earnings ratios being tossed around, like, for example, a business making two, three, or ten times the profit, but what is forgotten in respect to that is that it refers to companies that are listed on the stock exchange.

In the case of small businesses, such a ratio has a limited value, whereas, in the case of big businesses, it can earn 10% on its investment and still be extremely healthy. Similarly, in the case of big supermarkets, which can be earning only a net 2% or 3% on their sales, but their small percentage will represent enormous volume.

Remember, typically, small businesses should earn a bigger return because the risk of the enterprise is higher, and thus while buying a small business, you should focus on its return on investment and whether it is realistic or not. If the price is realistic for the amount of money you have to invest, then that small business would be a viable business for you.

4.Capitalized Earnings: While valuing a business based on capitalized earnings is similar to the return on investment method of valuation, the difference here is that normal earnings are used to estimate projected earnings. This is then divided by the standard capitalization rate.

The capitalization rate is determined by learning what the risk of investment in the business would be in comparison to other investments like stock in other companies or government bonds.

For example, if the rate of return on investment in government bonds is 18 percent, then the business should provide a return of 18 percent or better on the investment into it. Thus, to determine the value of a business based on capitalized earnings, the formula that you should use is:

Projected Earnings x Capitalization Rate = Price

For example, you analyze the market, the competition, the demand for the product, and the organization of the business. Post this, you determine that the projected earnings could increase to $25,000 per year for the next three years. Thus, if your capitalization rate is 18 percent, then the value of the business would be:

$25,000/ 0.18 = $138,888

Generally, in cases of buying a business, a good capitalization rate is considered to be between 20 to 40 percent. Thus, if the seller of the business is asking for more than what you have valued through capitalized earnings, then you will have to try and get the prices reduced through negotiation.

5.Intangible Value: One of the practices followed by business owners is that they try to sell the goodwill of their business as an asset. Normally, in everyday accounting procedures, most companies put down perhaps one dollar as the value of goodwill.

However, what is undisputed is the value that goodwill has, especially if it has built regular trade and a strong base of accounts. But, in the financial statements of the business, it is the financial value of the accounts and not their psychological value that should be placed.

Based on this understanding, goodwill as such is not an asset, and you, as a buyer, would continue to assess the business based on the return on investment. In fact, if you get involved with acquisition and merger, then certain rules will change.

For instance, if you buy out your competition, merge all your facilities, and double your volume, then the labor and overhead factors are much lower. Thus, even if the seller was losing around 5 percent per year and after you bring them into your company, which is making 15% per year, then this merging might allow you to increase your sales and end up making 20%.

Step 3: Negotiate a Purchase Price

Once you have decided that you want to move forward with the business acquisition and you also have an idea about the business’s value, it is time to negotiate the price with the seller of the business.

Typically, this needs to be done by making an unbinding offer either in the verbal or written format. If your offer is close to what the seller had in mind and is willing to sell, then he or she will start negotiating with you.

Similar to most of the business transactions, here, too, you will keep on going back and forth, negotiating different purchase prices and terms before you come to a tentative agreement with the seller. This hence means that if later you find something during the due diligence process of buying a business that changes your opinion regarding the value of the business, then these terms can be changed.

During this phase of negotiation, you will also have to decide whether you will be purchasing the assets or you will make it a stock sale. Most of the sellers prefer stock sales due to tax purposes. However, in-stock sale, you will agree to take on any outstanding legal liability because the company operations will continue as is, now with you as the new owner. In fact, some of the business sellers will even give you a discount on the purchase price for agreeing to a stock sale.

Step 4: Submit a Letter of Intent (LOI)

As soon as you have a general idea of the terms and structure of the business purchase, you will submit a letter of intent. This letter will outline everything that you have previously negotiated with the seller, including the purchase price.

It will also state your intent to buy the seller’s business. A Letter of Intent is thus a non-binding agreement that will further the business acquisition process and will show the seller that you are ready to commit and move forward in the process.

One of the advantages of the Letter of Intent is that, typically, it will give you the exclusive rights to buy the business. The time period for the same is usually up to 90 days. During this period, the seller has to act in good faith to close your transaction if you are able to meet the terms of your LOI.

Step 5: Complete Due Diligence

Once the LOI is signed by you, as well as by the seller of the business, you will get access to more information about the business. This step in how to buy a business is important because when you first show interest, mostly, you would have only gotten an overview of how the business is performing. But once you enter this stage in buying a business, you will get access to any financial information or legal information that you find necessary before closing the transaction.

These are the documents that you should ideally review before closing the deal:

- Organizational documents for the business (for example, incorporation documents, business licenses, certificates of good standing, etc.)

- Previous three years of business tax returns

- Current year income statements, balance sheets, and cash flow statements

- Revenue broken out by customer for the last three years.

- Information on existing business debt

- Legal records for pending litigation, if any.

- Customer lists with proprietary information are blocked out as necessary.

- Marketing and advertising materials

- Existing contracts and can these be assigned to the new owner?

- Commercial lease or other property documents

- Employee and manager information

- Rent rolls if the property has tenants

- Uniform franchise disclosure document (if the business is a franchise)

Step 6: Obtain Financing

An almost simultaneous process along with due diligence is working on financing for the transaction. This is an important step in buying a business because most of the businesses are purchased with a combination of equity and debt, i.e., the part amount you will arrange for and the rest you will be paying through a loan.

There are a lot of options for loans like SBA loans, traditional bank loans, and using a Rollover for Business Startups (ROBS). If your 401K is strong, then going for a ROBS is the best solution, as, through this, you will be able to finance your purchase of the business without having to pay back debt or interest.

If you are short on cash, some of the alternatives that you can look into are:

- Use the Seller’s Assets: As soon as you buy the business, you will own the assets, which is why it makes sense to use them for financing your purchase. To do so, you should begin by making a list of all the assets that you are buying (along with any attached liabilities) and then use them to approach finance companies, banks, and factors (which are companies that buy accounts receivable).

- Buy Co-op: If you cannot afford to buy the business by yourself, then you should opt for co-op, which is to buy the business with someone else. One of the ways through which you can get a co-op buyer is by asking the seller for the list of people who were interested in buying the business but faced a shortage of money. In such cases, you need to ensure that your lawyer writes up a partnership agreement before you enter the partnership agreement. This should include a buyout clause.

- Use an Employee Stock Ownership Plan (ESOP): ESOPs will offer you a way to get capital immediately by selling stock in the business to the employees. Here, even if you sell non-voting shares of stock, it will give you the finances while helping you retain control. In fact, by offering to set up an ESOP plan, you might be able to get the business for as little as 10% of the purchase price.

- Lease with an Option to Buy: Some of the sellers might let you lease the business with an option to buy. Here, you make a down payment, become the minority stockholder after it, and operate the business as if it is your own until you can buy it.

- Assume Liabilities or Decline Receivables: You can reduce the sales price by either assuming the business’s liabilities or having the seller keep the receivables.

Note: Before you reach the step of due diligence in the process of buying a business, you should check whether you have the option of seller financing or not, as if you do, then several of your financial burdens of finding a loan would be alleviated.

Seller financing is a loan that is provided by the owner of the business. However, this usually takes a lot of documentation from you, as the new business owner, and from the business itself, due to which this process needs to be worked through in the step of due diligence. Only by doing that will you be able to ensure that your lender is ready to fund when you need to close the transaction.

Step 7: Close the Transaction

If there were no unwanted surprises during the due diligence, and you want to buy the business, then it is time to close the transaction. This is the step wherein you will draft a purchase agreement and agree to every term of the deal with the seller.

To help you negotiate in this part of the process of buying a business, you should hire a lawyer. If nothing, a lawyer would be able to review your purchase agreement and ensure that you are getting what you negotiated through the contract.

Once the purchase agreement is signed by both the parties, you will be ready to choose a closing date and have your lender fund your purchase. Typically, your funds will go into the escrow (i.e., a bank or law firm that will hold the money for safekeeping) on the day you are supposed to close and until all the documentation is final.

Only after both the parties give their approval will the money be given to the seller, and you will own the business outright. As soon as the closing is finalized, you will need to apply for any necessary business licenses to ensure that your business operations undergo a smooth transition.

Remember, while some states will let you operate with the existing licenses during the transition period, it is an important step that you must remember to carry out. However, if your business acquisition is a stock purchase, then you may not have to worry about getting business licenses as the business entity continues to remain the same.

Note: The documents, agreements, and the notes that you should have before you officially buy a business are:

- Bill of Sale- When buying a business, it is the bill of sale that will prove the actual sale of the business, thereby officially transferring the ownership of the business’s assets from the seller to you.

- Adjusted Purchase Price- Adjusted purchase price is the final count of the cost of your purchase, including all prorated expenses like utilities, inventory, and rent.

- Lease- If, when buying a business, you are also taking over its lease, then you should make sure that your future landlord knows about the same. On the other hand, if you are negotiating a new lease for your business, then double-check that everyone understands its terms.

- Vehicle Documentation- If the business you are buying comes with vehicles, then you will have to transfer its ownership with the local DMV. Here, thus, you will have to ensure that all the right and relevant forms are completed by the time of sale.

- Patents, Trademarks, and Copyrights- When buying an existing business, you will need certain forms to get all the patents, trademarks, and copyrights transferred to you- the new owner.

- Franchise Paperwork- You should check all the statutory requirements that you will need to fulfill and, therefore, the paperwork that you will need to complete to be able to buy a franchise.

- Non-Compete Agreement- Not only is this a standard practice but also a good idea to ask for a non-compete agreement from the former owner. Due to this, the former owner will not set up a competing shop right across the street.

- Consultation and/or Employment Agreement- In case the seller of the business is staying on as an employee, then this document should be drafted and then filed as an agreement too.

- Asset Acquisition Statement- It is the IRS Form 8594, which will list all the assets that you have acquired, and thus this document is very important in the “buying an existing business” checklist for your tax returns.

- Bulk Sale Laws- These laws deal with the sale of business inventory and are designed to prevent the business owners from evading creditors by transferring ownership of the business to someone else. To comply with these laws, you will have to notify the local tax or financial authority about the pending sale.

Common Mistakes to Avoid While Buying a Business

When you are buying a business, some of the common mistakes that you should make sure to avoid making are:

- Do not be too anxious: The first trick in how to buy a business is not to become too anxious while buying it, as this will affect the price. If you become anxious, then you will end up making some other major mistakes.

While oftentimes business consultants are called in by anxious buyers to salvage the situation, more often than not, they are not called until a deal has been closed. Once your signature goes on the dotted line, you are stuck with the purchase.

Thus, it is important to remember that impatience or anxiety is not going to help you buy a business. You should rather take your time and reflect on the business that is for sale. Irrespective of what a business seller, business broker, or any other person may tell you, the majority of the time, you will have time to reflect.

In fact, if the business has been in the market for purchase for a while, then chances are that your seller would be the anxious one, and in that case, you should use the seller’s anxiety to your advantage.

- Buying on Price: If, as a buyer, you do not consider the return on investment, then you are making a major mistake. In fact, if you are going to invest, for example, $20,000 in a business that returns a 5% net, then you would be better off putting your money in commodities and stocks, the local S&L, or municipal bonds. This is because any type of intangible security will produce more than 5% returns.

- Cash Shortage: One of the mistakes that you should avoid making as a buyer of a business is using all of your cash for the down payment on the business.

While cash management is fundamental for the short-term success of a business, whether it is a start-up phase or a new or existing business, business buyers usually fail to predict future cash flow and possible contingencies that might require more business capital.

Further on, this is a mistake you will need to set aside some revenue for building the business via marketing and PR efforts like affiliate marketing, sustainable marketing, landing pages, email marketing, influencer marketing, social media marketing, and so on, as is relevant to your business, and will match its brand positioning statement.

Thus, keeping aside some capital is vital. In fact, the common contingency percent is 10%, though this does vary from industry to industry. Additionally, you should also set aside some sum as working capital. Most often, the working capital should be set aside such that it can cover around three months’ worth of expenses of your business.

- Buying all the receivables: While it generally makes sense to buy all the receivables, except those that are older than 90 days or 120 days, one of the most common mistakes made by the buyers of business is that they end up buying even those receivables that are older than 90 days. This becomes risky because the older the account, the more difficult it usually is to collect it.

Instead, you should protect yourself by having the seller warrant the receivables. This means that for all the receivables that are not collectible, they can be charged against the purchase price of the business. Thus, for receivables beyond 90 days, you should give those to the owner and see if he or she can collect them.

- Failure to verify all data: One of the common mistakes made by the buyers is that they accept all the information and data given to them by the seller at face value, without any verification by their own accountant, preferably a CPA, who can audit financial statements.

Most of the time, the sellers want to get their cash out of business as soon as possible. On the other hand, buyers frequently allow the sellers to take all the quick assets of their business like cash, receivables, and equipment inventories, while sometimes bringing in equipment.

In fact, the seller talks the buyers into anything as soon as they know how badly the buyer wants the business.

- Heavy payment schedules: One of the common mistakes made by business owners is overestimating the revenue during the first year of their business. Due to this, they take on unduly large payments to finance buyouts. This becomes a problem because, generally, the revenue does not pan out as planned.

In the first year of the business’s operation, with you as its owner, you are likely to experience numerous non-recurring costs like employee turnover, reduced customer loyalty or customer retention, lack of proactive customer service due to the changes in the business operation, equipment failures, and so on.

It is because of this reason that your business buyout payment schedule should begin fairly light, only to then get progressively heavier. This should be negotiated with the seller and should not be difficult to arrange.

- Treating the seller unfairly: One of the common misperceptions as well as mistake is that just because someone is selling their business to you, they are at your mercy. This ends up making the buyer of the business rigid, cold, and hard-headed.

In such circumstances, sellers with savvy will throw out such buyers and ask them to never return. Thus, what you need to remember while buying a business is that just because you are going to buy a business and you have the finances to do so does not mean that you would not have to give anything during the negotiation.

Transition Time While Buying a Business

For the employees of any business, the transition to new ownership tends to be a major change for them. Thus, as the new owner of the business, you should make sure that you start the transition process before the deal is done so that it is as smooth as possible.

During this time period, you should also ensure that the owner feels good about what is going to happen to his or her business after he or she leaves. Chances are, this will end up reassuring the existing employees about the change in ownership too.

Additionally, to ensure a smooth transition, you should also talk to the key employees, suppliers, and customers of the business, before you take it over completely. When talking to them, you should share your plans and ideas for the future of the business. The importance of doing this is that by having these key players on your side, running the business will become a lot easier.

Remember, most of the sellers will help you in the transition period, during which they will also train you with the operations of the business. The transition period ranges from a few weeks to six months to, sometimes even longer than that.

Post the training period referred to above, the sellers will usually be available for phone-to-phone consultation for another period of time. However, what needs to be remembered is that you and the seller of the business should discuss how the training will be handled and write it into your contract. This will prevent misunderstandings regarding the same.

However, if you buy the business lock, stock, and barrel, then by simply putting your name on the door and running it as before will most likely lead to a fairly smooth transition. In contrast, if you buy only part of the business’s assets like its client list or employees and then make a lot of changes in how things are done, then you are most likely going to face a more difficult transition period.

One of the tendencies followed by new business owners is that they have unrealistically high expectations that they will be able to make the business immediately profitable.

While a positive attitude is a must for running a successful business, having an overconfident attitude or an “I am better than you” attitude will lead to either a loss of your confidence when your expectations are not met or resentment from the employees that you have acquired because employees are indeed the backbone of any business and better than you attitude is never good for teamwork.

Therefore, you should look at your employees as valuable assets. In fact, what is true when you are buying a business from an existing owner is that the existing employees will know far more about the business than you. Their knowledge and expertise will help you in getting up to speed with the operations of the business.

You should always make it a point to treat all your employees with respect and appreciation as this will smoothen your transition period and ensure the success of your business, therefore improving your financial KPIs, business metrics, and such relevant key performance indicators.

Remember, it is only natural for employees to feel worried about their job security when a new owner takes over. This uncertainty and worry will become overwhelming for them if you do not share your plans with them.

It is thus important that you keep your staff involved in your planning and keep the communication open so that they know what is happening at all times. Not only will this help your employees to remain motivated, but it will also help them perform better, which would ultimately be more profitable for you.

While taking on an existing business is not easy, you will get to the point where you are able to run things like a pro if you are patient, adaptable, considerate, honest, and hard-working, to mention just a few key qualities and habits that would be required of you.

Pros of Buying an Existing Business

The pros of buying an existing business are:

- Existing Customers- One of the biggest benefits of an existing business is that it comes with its own existing customer base. This means that you would not have to spend resources on testing your product or service, generating leads, branding, and so on. Instead, you would be able to directly focus on growing the existing customer base or market share.

- Easier to Get Financing- Quite often, it is easier to secure financing for an existing business than for a start-up because an existing business will have a proven track record on the basis of which financing can be received.

- Better Survival Rate- In the initial few years, several new businesses fail. In contrast, a study published in the Industrial and Corporate Change showed how business takeovers have a higher survival rate than new venture start-ups. This thus becomes a very big benefit in favor of buying existing businesses.

- Reduce Startup Time- While buying an existing business does involve significant upfront costs, one of the major pros of doing so is that you will be able to start turning a profit faster because you would not need to spend time purchasing inventory, hiring employees, finding suppliers, etc.

- Established, Trained Employees- One of the other benefits of buying an existing business is that, just like existing equipment or inventory, having existing trained employees will also be an asset for you as they would know how the company operates. This will save you valuable time that you would have to otherwise spend on hiring and training. In fact, this would be especially helpful to you if you are familiar with the industry that the business is a part of.

- Existing Cash Flow- An existing business has all its operational processes and staffing already going, as well as an existing customer base, which is why you will be able to generate cash flow on day one. This is in stark contrast to a new business, which can take months or even years to turn a profit.

- Established Brand- One of the other pros of buying an existing business is that it will have its own established brand as well as market presence. This will save a significant amount of your time, money, and energy that would otherwise have been spent on trying to grow your brand and draw your buyer personas and, therefore, prospective customers’ attention to your products and services.

Cons of Buying an Existing Business

The risks or the cons involved in buying an existing business are:

- High Upfront Costs- Buying a successful business is expensive, whereas buying a struggling business is not so expensive and will definitely cost you less. However, in the case of the latter, you will have the risk of acquiring a tainted brand, an unhappy customer base, or a dying product or service.

- Unknown or Hidden Problems- Irrespective of how thorough you try to do your due diligence, in buying an existing business, you will always have the risk of the seller having misrepresented financial data, glossed over problems, or did not provide a complete picture of the overall business operations.

- Outdated Technology or Processes- All the business owners who are well aware of the fact that they will be retiring or selling their business in the near future will not be motivated to invest in new equipment, technology, and processes. Thus, when you buy such businesses from such owners, you will have to invest significant money and time into upgrading these elements after closing the deal.

- Existing Company Reputation- The established brand reputation of any company can be a double-edged sword. This is because when it comes to brand reputation, legal troubles, bad customer service, employees, customers, and the public at large may have negative associations with the business. As the new business owner, you will have to overcome these perceptions.

- Challenging to Make it Your Business- When you buy an existing business, you are also buying an existing company culture, vision, mission, and values. In order for the business to reflect your goals and turn a struggling company culture around, it will take a lot of work.

Franchising vs. Buying an Existing Business

Usually, the most challenging part is starting a business from scratch. In comparison, franchising or buying an existing business can simplify the initial planning process. However, before you decide which is the right option for you among the two, you should know their basics.

The main difference between franchising and buying an existing business is the level of control that you will have over the business. In the case of a franchise, there would be a business owner- “the franchisor” who will sell the rights to their business name, logo, and model to an independent entrepreneur- “the franchisee.”

The two common forms of franchising are:

- Product/Trade Name Franchising- Here, the franchisor owns the right to the name of the trademark of a business and sells the right to use that name and trademark to a franchisee. Normally, this style of franchising focuses on supply chain management. Here, the typical practice is that the products are manufactured or supplied by the franchisor and delivered to the franchisee to sell.

- Business Format Franchising- Here, the franchisor and the franchisee will have an ongoing relationship. Under this form of franchising, the focus is normally on full-spectrum business management. Here, the typical practice involves the franchisor offering services like site selection, training, marketing plans, product supply, and even helping in getting the funding.

Thus, when you buy a franchise, you get the right to use the name, the logo, and the products of a larger brand. Thus, in the case of franchising, you will be able to get the benefit of brand recognition, promotions, and marketing.

However, this also means that you will be obliged to follow the rules of the larger brand about how you should run your business. Also, the most common businesses which can be franchised are those that tend to be a restaurant, hotels, and service-oriented businesses.

In contrast, when you buy an existing business, you will be taking over the full ownership of the business. This means that you would have more control over your business but with less guidance.

In the case of buying an existing business, the largest advantage would be having an existing blueprint that will mostly include important factors like defined operating expenses, fully trained employees, and an established customer base. In this case, almost any kind of business could be bought or sold.

However, if you buy an existing business, you would not have anyone to guide you through it, as you would have complete control over its direction. This means that you would have no set vision, infrastructure, or external guidance, which will most likely make your business struggle before you have found out the best way to run things.

The three factors that you should consider before franchising or buying a business are:

- Quantify your Investment- You should review your financial landscape so that you can decide how much you are willing to spend to purchase and ultimately manage the business. This amount would help you determine the type of businesses or brands that are best for your budget.

- Consider your talents and lifestyle- When deciding on the business you want to buy, you should analyze your skills and experience, as post this, you will be able to eliminate unrealistic business ventures. For instance, if you prefer hands-on assistance, then franchising should be your choice. However, if you are an experienced business owner, then you should consider buying an existing business.

- Review the full landscape- This means that you should look at the existing infrastructure and make sure that you understand everything that comes along with the purchase. While reviewing the full landscape, you should not be hesitant to ask questions about contracts, leases, existing cash flow, and inventory. The more insights you have, the better will be your decision.

How Can Deskera Help?

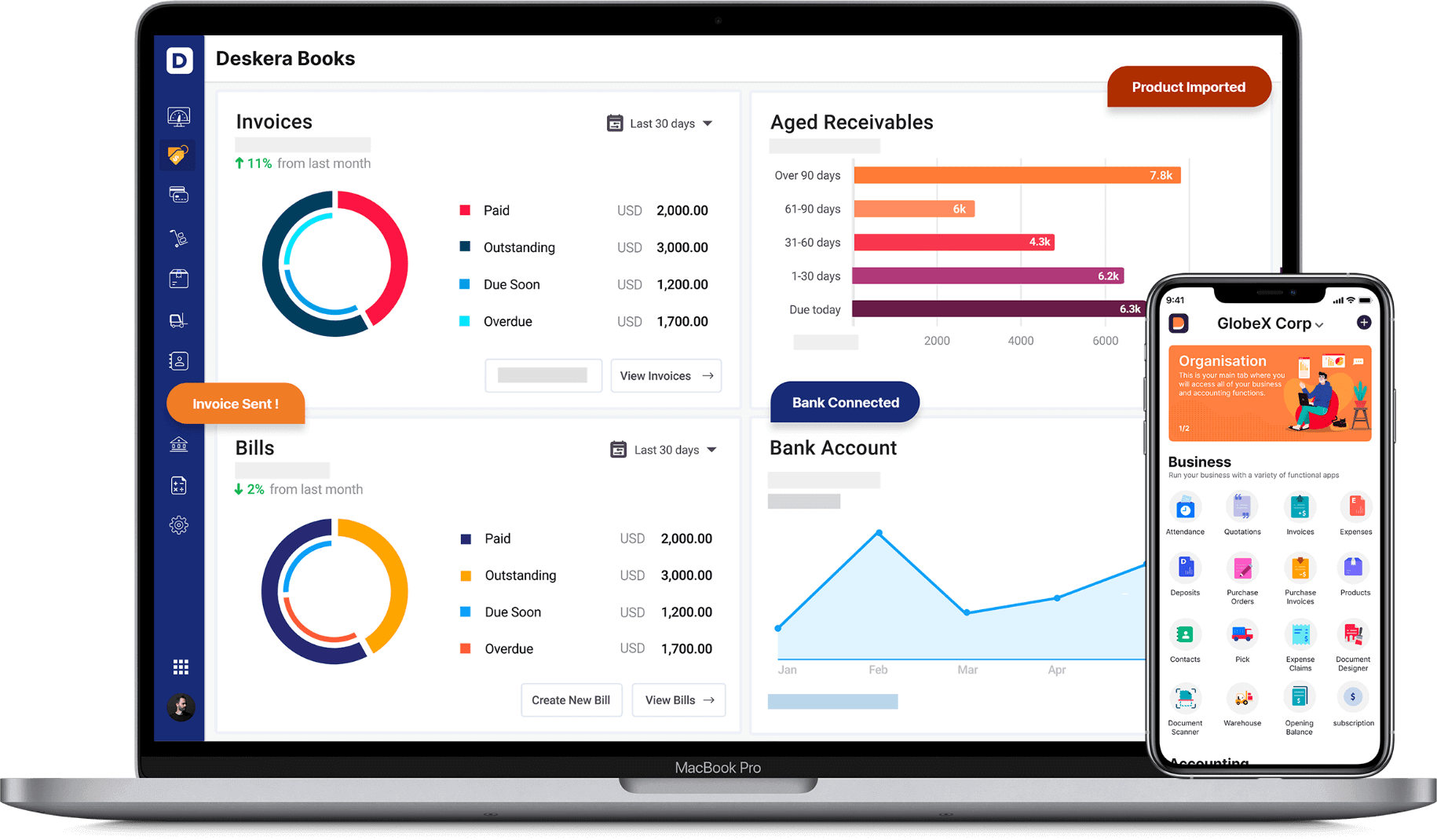

It is Deskera Books, cloud-based accounting software that would be the most helpful to you here. Deskera Books is equipped with features that will automate all your accounting tasks, including invoicing, expenses, billing, taxes, payments, bank reconciliation, reporting, approval flows, and more.

The dashboard of this software will look into all the transactions and operations performed by a business and give your insights and analytics about the same. This will help you not only with the due diligence of the business you are interested in but also help you assess your business’s performance once you become its owner.

In fact, with Deskera Books, you would be able to focus on running your business, as it will do all the heavy lifting behind the scenes just for you. This includes, but is not limited to, management of charts of accounts, journal entries, general ledgers, and tracking of all changes via audit trail.

Key Takeaways

Owning your own business can be as rewarding as it can be challenging. If you are looking to buy a business, then you are looking for the freedom to run your own company and blaze your own trail.

What is important in the process of buying a business is that you choose a business that is the right fit for you. Usually, this would belong to an industry that you are familiar with and even understand and with which your skills and experiences align.

Additionally, you should also consider the size of the business that you are looking for in terms of employees, the number of locations, and sales. Then you should select the geographical location where you want to buy a business and also assess the labor pool and costs of doing business in that area, including the wages and taxes, so that you can ensure that all of these factors are acceptable to you.

Then, you should look for businesses that interest you. Once you have found it, you should understand why the business is for sale, the vision and mission of the seller, the USP of the business- especially its major source of revenue and how it is standing apart from its competitors, and then set up the financing and close the deal.

Make sure that you do not rush through any one of these steps and that you are well researched and prepared for each of the steps in the process of buying a business. What will be a major help to you in this process is Deskera Books and its analytical skills, which will give you important insights regarding the business you want to buy, and later manage. In fact, it will also help you meet all the statutory requirements for the same.

Related Articles