Around 9 out of every 10 Americans i.e., 89% would be stressed if they found they had filed their income taxes incorrectly. The greatest concern is getting audited i.e., 28% of them, followed by paying more subsequent to file i.e., 21% of them. Preparing documents for your small business taxes can be overwhelming, so recruiting a tax expert or tax accountant is an extraordinary method for saving time and creating peace of mind this tax season, however, you most don’t want to show up to your tax appointment with nothing.

This article focuses on simplifying your small business taxes by learning exactly the tax forms and information your accountant needs to file your tax return. Here are the topics covered:

- What is a business tax form?

- List of Documents

- What and when you'll pay

- The most effective method to record a business tax return

- Key takeaways

What is a business tax form?

Assuming you own a business, you really want to document an organization expense form. A business tax return reports your organization's pay, income, tax deductions, and tax payments. All organizations should document tax forms. Also, you are answerable for filing your return every year with the IRS to find out your business' tax liability.

The specific form you file relies upon your sort of business entity and which deductions you claim on the return. For instance, you might have the option to claim the home office tax deduction by attaching Form 8829, Expenses for Business Use of Your Home, contingent upon your business.

List of Documents

Take responsibility for your small business taxes by gathering these records and data ahead of time. With only a tad bit of planning, you can assist your accountant with saving you time and cash when you file this tax season. You'll have to give your accountant these records and documents, regardless of what kind of business entity you operate:

1. Yearly Financial Business Reports

A financial statement imparts the monetary well-being of a business and normally incorporates a balance sheet, a cash flow statement, and an income statement which are critical to your accountant, yet the person in question will probably demand a list of your organization's expenses and assets also.

Your accountant will require copies of your fundamental financial reports for the year. These by and large include:

- Profit and Loss Report, or the Income Statement, or profit and loss statement show how much profit or loss your business experienced over the course of the year as well as a more detailed look at expenses and incoming revenue.

- Balance Sheet: calculate your liabilities and assets as well as compute your business' net worth. The balance sheet also shows the owner’s equity at a particular time frame.

- Statement of Cash Flows: gives a detailed look at the transactions that straightforwardly influence cash flowing all through your business. The cash flow statement sums up how well your organization deals with its money position, and how well the organization creates money to pay its commitments or fund its expenses.

- Supporting documents: Any reports that help the data in your other financial records. If there should be an occurrence of an audit, supporting documents back up the cases on your tax forms.

You ought to have the option to print these fundamental financial reports from almost any accounting software program; however, report availability changes from one programming to another. Contact your accountant or tax preparer to check whether there are any extra reports they could need or view as supportive.

2. Financial records

Prior to recording your return, you need all the financial records, like financial statements and supporting reports e.g., receipts. While your financial statements give an outline of significant data, your accountant will likewise require more detail to ensure accuracy and to check any deductions you might be qualified for. Make certain to give the accompanying:

- Loan data - If you applied for a line of credit in the previous year, keep the agreement with you, and bring any installment or interest records.

- Asset data - Bring in receipts for any assets, similar to goods, property, or equipment you've traded over the course of the year.

- Income and expense data - Your accountant needs to check the income amount, sales invoices, bank statements, and receipts for installments will be vital.

- Deductible data - Health protection, IRA contributions, mortgage interest, travel, home office, and beneficent giving can be generally deducted from your business charges. Ensure you furnish your tax preparer with full data for these to lessen your tax payments.

- Estimated tax records - If you've settled quarterly taxes, make certain to give records of what you've as of now paid during the year.

3. Financial records relating to deductions

Each of these connects with a deduction that your business might actually claim on its next return. In spite of the fact that your accountant probably won't wind up requiring them, ensure you're clutching them for good measure:

Workspace Deduction: If you have a different workspace that is utilized solely for business, you might be qualified for the workspace deduction. The workspace deduction is vigorously investigated by the IRS. Hence, ensure you have legitimate documentation.

• Bank and financial records

• Legal and professional expenses

• Utility costs

• Travel costs: Businesses can write off meals and travel costs. This deduction additionally can be a warning for an IRS review contingent upon whether expenses show up "sumptuous or excessive." For this explanation, make certain to bring all receipts and any travel tickets to your tax preparer.

• Mileage records: If you utilize your vehicle for business purchases, you additionally might be qualified for a vehicle deduction. Make certain to follow all of your mileage over time and carry this log to your accountant or tax professional, alongside any receipts connected with car expenses.

• Charitable donations/contributions: If your organization makes charitable donations, make certain to bring all records connected with your donations, including receipts and any statements you might get.

- Investments

- Education expenses

- Instruction costs

- Real estate taxes

- Medical expenses

- Travel expenses

- Vehicle payments and taxes

- Foreign earned income and taxes paid

- Energy efficiency property expenses

Assuming you take care of these basics covered, you're for the most part there. However, there are a couple of particulars your accountant will require contingent upon your entity type. Ensure you are taking all of the small business tax deductions your business meets all requirements for by checking our total costs of doing expenses deduction list.

Assuming you are concerned that taking a deduction might bring about an audit, have confidence, taking the tax deductions you meet all requirements for is an extraordinary method for saving money on your tax form.

4. Asset records

Your accountant should be familiar with any assets you've purchased, sold, or devalued during the last year. Bring any receipts, records, or reports connected with your assets and fixed assets. Your accountant will probably give you these, yet we'll incorporate them here for good measure:

- Sales proceeds from any assets disposed of during the fiscal year, alongside the date of purchase, cost, accumulated depreciation, expenses of the sale, and trade-in allowance

- Prior year depreciation schedules that include: prior depreciation, date of acquisition, asset cost, and business use percentage

- All assets obtained within the year with trade-in allowance, date of purchase, cost, and business use percentage

5. All the required Business Tax Forms

Given you've recorded them previously, these will contain a large portion of what your accountant should get things going, including the tax forms your business is expected to finish up relies totally upon your business type. These are the forms that might be expected for your business:

- Freelancers & Sole Proprietors: 1040, Schedule C, Schedule C-E Z, 1040-SE

- C corporation-specific tax forms: C corps use Form 1120 to report their income.

- Partnerships: Partnerships document the U.S. Return of Partnership Income or basically, Form 1065, and every individual from the partnership likewise documents a Schedule K-1, notwithstanding their personal tax return Form 1040.

- S Corporations: 1120-S, Schedule K-1, 940, 941, 943. Assuming you documented one final year, try to give it to your accountant.

- Limited Liability Corporations (LLCs): 1065, 1120-S, Schedule K

- Single Member Limited Liability Corporations (LLCs): 1040, Schedule C, Schedule E, Schedule F

- You'll have to record a Form W-2 for every employee, to report any wages, tips, and other pay you paid them during the fiscal year-make sure to get those together well ahead of tax time. On the off chance that you kept charges from a worker's paycheck, you could likewise have to document Form 940 and Form 941.

To be sure about which forms your organization is expected to document, visit the IRS's Forms and Instructions for Filing and Paying Business Taxes page. Here you will observe specific forms and instructions for every business type. Carry the important forms to your accountant to document your tax return. Note that your tax filing date might be impacted by your business type.

6. Business Loan Information

You'll likewise require data on business credits. Assuming you've acquired another loan somewhat recently, carry the loan agreement with you. Additionally, bring records of any credit installments as well as accrued interest. This will guarantee that your accountant is up to date on your organization's complete assets and liabilities.

Because of the COVID-19 pandemic, numerous entrepreneurs took advantage of loan and grant programs including the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL), and the EIDL Advance.

Through the PPP program, qualified organizations got loans that could be forgiven whenever utilized for qualifying costs, including finance costs, utilities, and lease installments. Regardless of whether your loan was forgiven, these assets are not counted in with the taxable income of your business.

Fortunately, you can claim deductions for any qualified costs of doing business paid for utilizing your PPP funds. It doesn't make any difference in the event that your loan was forgiven or not - all qualifying small business expenses paid for with these assets can be written off, so try to bring receipts, invoices, and other documentation to your accountant to claim these deductions and lower your tax liability.

Assuming you got an EIDL or EIDL Grant, these funds won't be added to your taxable income. Qualifying expenses of doing business paid to utilize your EIDL or EIDL Grant can be written off on your tax return to bring down your tax liability.

7. Identification and Personal Information

To set up your taxes an accountant needs specific identification details from you that can check your identity. Your accountant will require your social security number and the social security number of every one of your dependents. Consistently the IRS sends back many tax returns on the grounds that the names and social security numbers on the form don't match.

You may likewise need to bring a second type of identification proof like a driver's permit, military ID, or any state-issued picture ID card. You should provide your tax accountant with essential individual data including your legal name, current address, and social security number. Assuming you have an Employer Identification Number (EIN), you should give that, alongside your legal business name.

8. Income and Expense Records

To confirm the income amount on your profit and loss statement, you should give your accountant income records. Make certain to have these records available. For your tax accountant to confirm your organization's expenses and find you the right deductions, you'll have to bring a few kinds of expense records too, including:

- Receipts

- Credit card statements

- Bills

- Bank statements

Make certain to keep these expense records, particularly your organization's business receipts, efficient. Not only will your accountant thank you for not giving them a box full of receipts. The additional time your accountant needs to spend on your tax return, the more cash you pay, so make everything as consistent and simple for them as could really be possible.

9. Stock & Bond Information

Bring data related to all stocks and bonds your business has accomplished or sold during the year. You'll likewise require a record of any owner’s investments made into or withdrawn from the organization during the year.

As the owner of a sole proprietorship or LLC, you presumably pay yourself by making withdrawals from the business. Your accountant will need to be aware of these withdrawals made to you personally, in addition to any data on any investments made by you. Contact your accountant directly before your tax appointment to see if there is any other information they require.

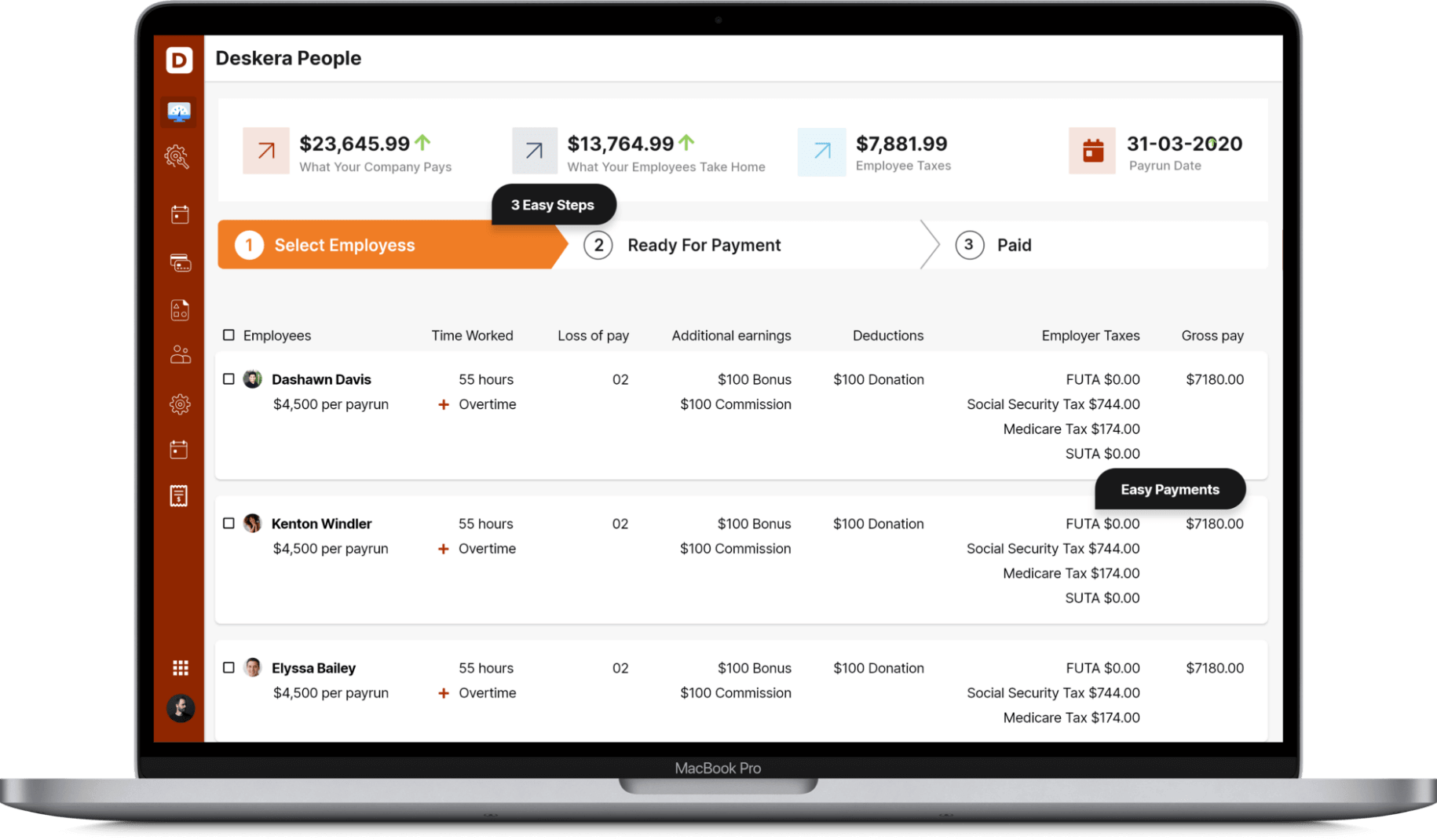

10. Business’s Payroll Data

Contact your accountant directly before your tax appointment to check whether there is some other data they require. Your tax professional or accountant will likewise require your payroll information from the year. Bring copies of your worker's W-2s, W-3s, and 1099-MISCs.

Additionally, accumulate health care coverage records, as these can be considered as business deductions and any data with respect to bonuses. Deskera Payroll Software makes this data promptly available. Look at our top payroll software to make collecting this data more straightforward for the next tax season.

11. Opening & Ending Inventory Total

A few tax documents require a COGS Cost of Goods Sold closing balance for the year. You should as of now have taken an opening balance of your stock toward the start of the year. Presently do another inventory count and carry the outcomes to your accountant so they can appropriately finish up your tax return.

12. Form 1098 for mortgage interest and property taxes

On the off chance that you claim a primary or second home for business, you should conclude what part is utilized for business and which is utilized as your own residing space. Think about it thusly, assuming that your workspace represents 15% of your home, you can claim the usual deductions for 85% of your home loan interest and claim the leftover 15% as an expense of doing business.

In the present circumstance, it's reasonable you got an IRS Form 1098 from your home loan organization toward the year's end that sums up your mortgage-interest and property-tax payments throughout the year.

Your accountant might ask you for this form to claim the mortgage-interest deduction that all property holders are qualified for, and your accountant will involve this form as a feature of your workspace deduction. Assuming that you carry multiple mortgages, make certain to give Forms 1098 to each mortgage.

What and when you'll pay

Another thing to consider is the cutoff time for documenting your small business tax return. Which taxes you pay, in addition to how and when you pay them, all rely upon which kind of business you operate.

The forms you use to record your government tax return will be different relying upon whether your business is organized as an S corporation, sole proprietor business, C corporation, limited liability company, partnership, and so on

As a rule, the five sorts of business taxes include:

- Excise taxes

- Income taxes

- Self-employment taxes

- Estimated taxes

- Employment taxes

Also, your tax rate can change in view of your total gross taxable income and unearned income, in addition to whether you're married recording mutually or independently, whether you are the head of the family with dependent children, whether you paid into government social security, etc. After you've sorted out all of your earnings and deductions, these will be the forms you need to record and the dates you want to document them by for every business type:

- A partnership also files for each partner on Form 1065 with Schedule K-1 on March fifteenth or the fifteenth day of the third month after the finish of your organization's tax year.

- A multiple-member LLC documents their return from Form 1065 with Schedule K-1 for every individual from the LLC. These are expected on March fifteenth for income got the prior year.

- A sole proprietorship and single-member LLC utilizes a Schedule C and records with the personal taxes on April fifteenth for the prior year.

- Corporations document on structure 1120. There is no K-1 for shareholders as corporations settle their own taxes. The due date for recording taxes is April 15, or four months after the finish of the tax year.

- Self-employed individuals pay quarterly taxes on Form 1040-ES. Dates for documenting are April fifteenth for the first quarter, June fifteenth for the subsequent quarter, September fifteenth for the second from the third quarter, and January fifteenth for the final quarter, except if the fifteenth falls on an end of the week or holiday. For this situation, you will file the following workday.

- S corporations record returns on Form 1120 S, with Schedule K-1, for every shareholder. These returns are expected on March fifteenth or 90 days after the finish of the tax year.

Keeping this large number of forms and figures sorted out can be testing, however, you don't have to bear the mental burden alone. A tax professional can help as long as you give the right records.

The most effective method to record a business tax return

Once more, tax return forms change by business structure. However, the overall process incorporates four standard steps:

1. Collect records

How to document business taxes relies upon the data you have, in addition to your business structure. Before you start the process, collect the fundamental documents referenced above.

2. Decide your business structure’s tax form

Once you have prepared your desk work to go, you need to know which form to file. Remember that people use Form 1040, U.S. Individual Income Tax Return, to document their personal taxes. Be that as it may, what forms should your organization utilize?

3. Learn cutoff times, filing strategies, payment arrangements, and extensions

After you complete the tax documents, you should record the forms with the IRS. Like with the kind of form you file, your tax filing due date relies upon your business structure. A few years, the cutoff time falls on an end of the week or occasion. Assuming the tax form cutoff time falls on an end of the week or holiday, your cutoff time is the following workday.

Extensions: Consider documenting a business tax extension in the event that you want to push back your tax return cutoff time.

Filing strategies: You can document your small business tax return via mail or through the IRS's e-file system. Contingent upon your business, you may be expected to e-File. Also, you can make tax payments through the IRS's Electronic Federal Tax Payment System (EFTPS).

Assuming that you record Form 1065, you may likewise demand a six-month expansion on Schedule K. Be that as it may, the half-year extension doesn't change the date you should circulate tax document K-1 to every single applicable individual i.e., March 15.

Payment arrangements: Assuming that you are unable to pay your taxes, contact the IRS to make payment plans.

4. Consult a specialist

Still uncertain of how to record your business taxes? Consider employing an accountant or other tax professional to help you get ready and record your tax forms. Professional advisors can assist you with precisely documenting, claiming deductions, and deducting write-offs.

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- An experienced small business accountant can have your state and government tax returns arranged quickly and accurately and furthermore save you a lot of time. Ensuring they have the data they need to do your taxes precisely and effectively is critical to set aside your money.

- Sum up and tally records at every possible opportunity and double-check your outcomes. Invoices, cheques, business expenses all ought to be classified and added up to. Sort all your data slips by type. Having your tax accountant do the tallying and organizing is a costly approach.

- Many individuals believe they don't have to record a return in the event that they made under $5,000 or then again on the off chance that their business didn't create a profit. Both the cases are misleading. You actually need to record no matter what the sum you made, regardless of whether it was a loss. For this situation, you can utilize that amount to offset any other income.

- In the event that you have a few businesses, remember you will require separate revenue and expense figures for every business, as business pay must be recorded by the individual businesses on the T1 form.

Related Articles