When running a small business, expenses are inevitable. After all, you have to spend money to make money.

The good news is that as a business owner, you can take advantage of these expenses to decrease your tax liabilities.

When you’re well aware of what business expenses to deduct, you can potentially save your small business thousands of dollars in taxes.

In this guide, we will go through what a business expense is, where to record it, and how to maximize profit by recognizing your deductibles.

Read on to learn about:

- What Are Business Expenses?

- Business Expenses In the Income Statement

- Business Expenses and Taxes

- How to Manage Business Expenses

- Business Expenses FAQ

What Are Business Expenses?

Business expenses are all costs incurred in the ordinary course of business.

Common examples include employee payroll, marketing, advertising, rent, maintenance, utilities, and the depreciation of fixed assets. All of these costs are necessary to attract and attend to clients and hence are vital for the business’s ability to generate revenue.

In accounting, an important relationship between business expenses and revenue exists, recognized as the matching principle.

The matching principle states that expenses need to be recorded in the same time period as the related revenues.

For instance, assume that the salary for a company’s production team is earned in February, but not paid until early March. Based on the matching principle, expenses are recognized in February, not March, since February is the month in which the production team helped provide revenue.

This matching is important since it ensures a consistent recording of finances in a company’s financial statement.

Keep in mind that the matching principle only applies to the accrual basis of accounting, not cash-basis. With cash basis accounting, revenues and expenses get recognized when money exchanges hands instead.

Want to learn more about the process of analyzing and recording your financial data? Head over to our guide on the accounting cycle with examples for business.

Business Expenses In the Income Statement

The income statement is a financial document that summarizes a firm’s revenues and expenses, over a period of time. The statement subtracts business expenses from revenue, to figure out how much net income will be subject to taxation.

In case there’s a net loss and expenses exceed revenue, the loss is carried into the future, and the business doesn’t have to pay income tax that year.

Business expenses in the income statement are separated into three sections: cost of goods sold, operating expenses, and non-operating expenses.

The cost of goods sold includes every direct material and labor expense of the production process.

Operating expenses are the costs of running the daily activities of a business, such as salaries, marketing, maintenance, deprecation, utilities, rent, and so on.

While non-operating expenses (sometimes also labeled as other expenses) are all types of expenses that are unrelated to the core operations of a business. The monthly interest rate for taking out a business loan, for instance, is considered a non-operating expense.

Business Expenses and Taxes

We know that by deducting business expenses from revenue, we get our taxable net income. Not all expenses that a business makes qualify as deductibles, however.

For an expense to be considered deductible, it needs to be both:

- Ordinary

- Necessary

According to the IRS, an ordinary expense is one that is “common and accepted” in your trade or business. While a necessary expense is one characterized by being “helpful and appropriate” for your trade or business.

Depending on the types of expenses that you have to deal with while running the business, you might be able to deduct the full amount and hence pay less in taxes.

However, there are certain expenses you need to be aware of, that are not deductible.

Deductible Business Expenses

Let’s check out a list of expenses that meets the “ordinary and necessary” criteria set by the IRS.

#1. Promotional and advertising fees

- Cost of printing

- Social media campaigns

- Sponsoring an event

#2. Insurance

- Property coverage

- Work compensation coverage

- Employee life insurance

- Auto insurance for business vehicles

#3. Employee Payroll

This isn’t applicable for the business owner, a partner, or a member of a limited liability company.

- Salaries or wages

- Vacation time

- Retirement plan

- Benefit programs

#4. Bank Fees

- Monthly service fees

- Transfer fees

- Overdraft fees

#5. Depreciation

When you purchase long-term assets you have to use depreciation to devalue them, instead of expensing them right away.

Depreciable assets include:

- Equipment

- Buildings and property (except land)

- Vehicles

#6. Interest on loans

You can deduct interest expense if:

- You’re legally liable for the debt

- The loan will be repaid

- The loan isn’t provided by a related party, such as a family member

#7. Utilities and maintenance

- Electricity

- Water

- Waste disposal

- Heating

- Repairs

- Anti-virus software

#8. Rent

- Office rent

- Storage rent

- Factory rent, any property the business rents in order to operate

Pro-Tip

Don’t want to manually reconcile every expense between your books and business bank account? Use the cloud accounting tool Deskera to integrate directly with your bank account. Now, anytime you make a business expense, the transaction is automatically recorded and posted into your accounting books.

Non-Deductible Business Expenses

Here’s a list of some of the business expenses that you can’t claim:

- Government fines

- Illegal activities such as bribes

- Lobbying costs

- Contributions to political parties

- Tickets to events or concerts

How to Manage Business Expenses

1. Create a Business Bank Account

One of the very first actions you need to take after starting a business is opening a business bank account. This ensures that your business expenses won’t get mixed up with your personal ones.

You’ll keep track of your performance better to make sure there’s no overspending and also ease the tax filing process.

Want to learn more about managing your small business finances? Head over to our step-by-step guide on small business accounting.

2. Prepare Budgets

As the saying goes, the best way to predict your future is to create it.

If you plan ahead and create realistic budgeting, managing expenses and making invoice payments will eventually feel like a breeze. Always be aware of how much money you’re making, and decide business expenditures accordingly.

3. Take Advantage of Deductibles

Knowing your deductibles can hugely reduce tax liabilities, and save your business a lot of money.

If you’re in doubt about recognizing and recording deductibles, consider checking in with a tax accountant to make sure your business is not missing out on any valuable tax savings.

4. Use Cloud Accounting Software

By adopting cloud accounting software you get to keep tabs on all of your expenses, in a single dashboard.

So, instead of manually noting financial transactions in physical books and spreadsheets, all of your data will be digitally stored in the cloud, easily manageable and accessible from anywhere.

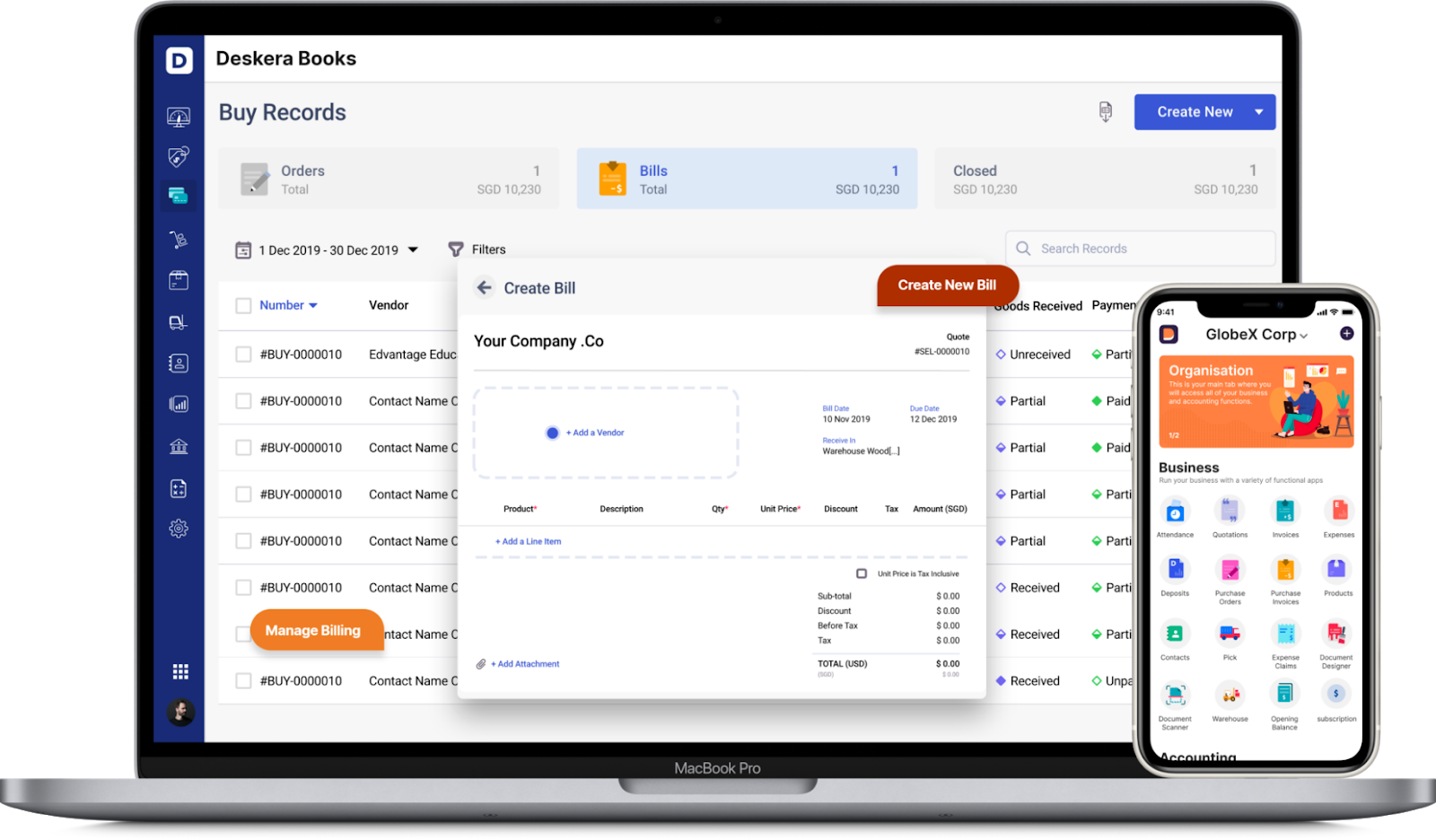

The best all-in-one accounting software for small business today is Deskera.

With Deskera, dealing with expenses is as easy as 1-2-3!

Using the platform, you can send purchase orders, overview your bills, and make invoice payments within seconds.

Struggling to meet your outstanding invoice payments on time?

Deskera Books’ automated alerts will notify you to make payments on time, so that you don’t miss a due date again.

And if you have paper receipts to record, just snap a picture, and the appropriate details such as vendor, date, and price are automatically recognized and input for you.

Handling tax calculation has never been so easy.

All you have to do is choose the country where the business is located, input your information, and the software will automatically calculate your taxes in accordance with the national tax code.

So, what are you waiting for? Access the platform anytime, anywhere by simply downloading the Deskera mobile app.

Take advantage of our free trial, and start automating your accounting right now!

Business Expenses FAQ

#1. Can I Deduct Personal Expenses for Business?

Generally speaking, no, you can’t deduct any personal or family expenses.

However, if you have an expense that you use for both business and personal purposes, you can measure and deduct the business part.

For instance, if you use a personal vehicle for business transport purposes, the expenses incurred during work hours can be deducted.

#2. Is Lunch a Deductible Business Expense?

Meals are considered deductibles when you are traveling for business purposes, at a business conference, entertaining a customer, or when you provide employees with lunch during their normal workday.

#3. What Are Accrued Expenses in Accounting?

An accrued expense is an expense that is earned and recognized in the accounting books before it gets paid.

Examples of accrued expenses include interest, payroll, utilities, etc.

#4. Do Expenses Have a Credit or Debit Balance?

Expenses are almost always debited because they cause the owner’s equity to decrease, which has a normal credit balance.

If you want to learn how to record debit and credit entries, check out our double-entry bookkeeping guide for small businesses.

Key Takeaways

Hopefully, this guide helped you fully understand what business expenses are, and why recognizing deductibles is important for maximizing profit.

Before leaving, here’s a quick recap of the main points we’ve covered:

- Business expenses are the costs of the assets a business uses to generate revenue. They’re summarized in the income statement along with revenues, to figure out the net income or loss for the year.

- For an expense to be deductible it needs to be both ordinary and necessary.

- Deductible expenses include expenses for advertising, insurance, employee payroll, bank fees, deprecation, loan interest, utilities, maintenance, and rent.

- Non-deductibles can be government fines, illegal activities, lobbying costs, or political contributions.

- Creating a business bank account, preparing income and expenditure budgets, properly using deductibles, and automating your finances can help you track and manage business expenses better.

Related Articles