According to the Financial Times Lexicon, credit is: “Any sum of money advanced as a loan, or available for loan. Also, money received in an account— a positive accounting entry.”

Business Credit works as a high-powered tool that helps to grow your business on safe grounds. If you are planning to establish business credit for your firm, then you are definitely following the ideal approach for your business.

In this guide, we have covered certain important aspects of business credit that will help you for your business. It includes:

- What is Business Credit?

- How does Business Credit work?

- Build Business Credit Faster

- How to build business credit?

- Learn to establish business credit.

- Why is business credit important?

- Debt utilization and your credit scores.

- The truth about Business Credit repair.

- The 18 Best Ways to build business credit faster

- What is in your business credit file?

- How can Deskera help you

Let’s Explore!

What is Business Credit?

The ‘credit’ in Business credit defines money, loan, or product. It is almost similar to personal credit. But, there are a few factors that differ from personal credit such as credit limits, reporting policies, and much more.

Furthermore, Business credit helps to purchase or buy something and pay the amount for it later. Moreover, if you are a business entrepreneur, then you should apply for business credit. As a result, it will help you to obtain loans, credit lines, and much more. You can get the available cash flow that would help you to grow your business substantially.

Further, your business credit will have a credit score that will determine your ability to manage funds. Depending on your score, lenders or suppliers would approve your loans. Also, these vendors or suppliers show your reports to business credit bureaus that are responsible to assign you a business credit score.

How Does Business Credit Work?

One of the most significant distinctions between the company and personal credit is that business credit is linked to your EIN. As a result, as you engage in various financial activities related to your business. It includes opening a bank account, obtaining a credit card, and paying suppliers. Moreover, this information becomes part of your credit history. Further, it is reported to credit agencies specialize in business credit.

Note that Dun & Bradstreet (D&B), Experian, and Equifax are the three major commercial credit reporting companies. Each company gathers data from the vendors and creditors with whom you do business, as well as legal filings and public records. They next establish your business credit in the form of a numerical value: your business credit score, using a credit reporting algorithm.

Unlike a personal credit score, which is calculated using a common evaluation process, your company credit score will vary depending on the credit bureau. Further, each has its own method for determining your score.

Examine the following credit card report elements:

- Outstanding credit balances, credit usage, trends over time, payment behaviors, and the number of trade experiences

- Judgments or bankruptcies, as well as the recency, frequency, and cash amounts associated with liens, are all public records.

- Standard Industrial Classification (SIC) code, years on file, and company size are all examples of demographic data.

Note: When calculating your credit score, the credit bureau took the above variables into account. Furthermore, credit scores range from 0 to 100. In addition, the company credit score is not the same as the FICO score (ranges from 300 to 850).

Maintain a credit score for your firm that is near 100. A credit score of 75 or higher is considered desirable. The average business, according to Experian,

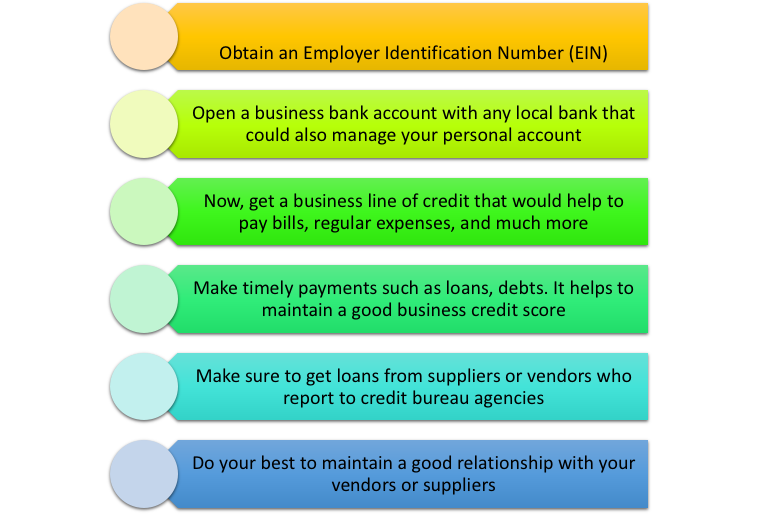

Build Business Credit Faster

There are a variety of strategies to build your business credit faster. Here is the list that you should follow to quickly build business credit. It includes:

- Obtain an Employer Identification Number (EIN).

- Open a business bank account with any local bank that could also manage your personal account.

- Now, get a business line of credit that would help to pay bills, regular expenses, and much more.

- Make timely payments such as loans, debts. It helps to maintain a good business credit score.

- Make sure to get loans from suppliers or vendors who report to credit bureau agencies.

- Do your best to maintain a good relationship with your vendors or suppliers.

Following these steps would help you to establish business credit faster and also manage to improve your business credit score.

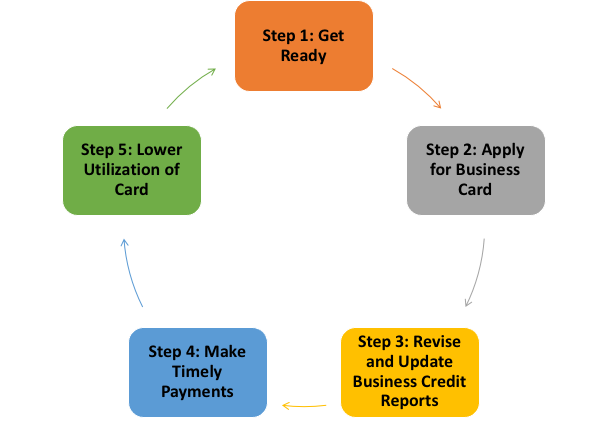

How to Build Business Credit

If you have decided to build business credit, then you are on the right track of business. Here are the 5 ways on how you can build it. Let’s check:

Step 1: Get Ready

After establishing your business credit, you have to incorporate a form of business. You can select from C corporation, S Corporation, LLC, or LLP. Then, register for the DUNS number. Later, provide your all details such as a business address, phone number, and so on.

Step 2: Apply for Business Card

Make sure to register for business cards to enjoy the perks of credit such as loans, credit lines, and more. Note that you have to stay alert about whom you want to take loans from.

Step 3: Revise and Update Business Credit Reports

Regularly reviewing your business credit reports is critical. It aids in the detection and correction of issues, the search for proof of fraud, and the examination of factors that may affect your business credit card score.

Step 4: Make Timely Payments

To calculate business scores, each credit bureau employs a different process. However, one factor that they all take into account is the payment history of creditors. A solid company credit score is ensured by a history of regular payments to creditors. Only those that pay on time receive a favorable score from Dun & Bradstreet. Therefore, make sure to make on-time payments to creditors. It will help you to improve your business credit score.

Step 5: Lower Utilization of Card

Reduce your company credit card usage by opening new lines of credit, paying off balances, requesting a larger credit line, and ultimately, paying your bills on time.

Furthermore, adding financial vendors or unlisted suppliers to your credit report might also help you improve your credit score.

Why Should I Learn How to Establish Business Credit?

When you learn to establish your business credit for your business. Then, you directly protect your personal assets. Even though things may go wrong at business, you will at least have protected your personal finances.

Furthermore, it builds a sense of discipline and dedication in you to stay strategic with your finances for both aspects— personal and business. All your expenses would become easy to track and manage efficiently. Also, monitoring and paying your taxes also gets easier. Also, it saves your time and energy.

Once you learn how to establish your business, you are on set to grow your business smoothly.

Why Building Business Credit Is Important

Building business credit is highly important as it showcases your ability to manage financial aspects to lenders or suppliers. Furthermore, a business score would help you to easily obtain a loan or credit line for your business ventures.

There are three main factors that make business credit important. It includes:

1. If you are applying for business loans, then you can easily solve your cash flow concerns with business credit. Moreover, having a good score would beat all odds related to finances. Also, it builds high chances to get the approval of small business loans.

2. Business credit scores help to secure better repayment terms with suppliers or vendors. Also, it supports obtaining trade credit. In addition, your lenders or suppliers would trust your financial management efficiency and will offer your flexible repayment models.

3. Eventually, business credit helps to safeguard your personal credit. Make sure to avoid overspending using your personal credit. However, if you increase your credit utilization ratio, then it will negatively affect your personal credit score.

Debt Utilization and Your Credit Scores

Credit usage compares the amount you owe on your credit cards to the credit limitations on those cards. Furthermore, your credit usage would be 0 if you never used your credit cards and had no balance on them.

The two leading credit bureaus— Vantage and FICO state that credit utilization is another crucial factor while determining a credit score. Furthermore, if your utilization ratio is high, it could signal that you're overpaying, which could lower your score.

Moreover, make sure to pay more than the minimum amount each month. This method will help you to eventually pay your debts on time. And, your chances to get a poor score will most likely become low. Also, avoid overspending on your credit cards.

Following is the chart of the FICO Score list that you should consider for your reference:

Following is the chart of the VantageScore list that you should consider for your reference:

The Truth about Business Credit Repair

Credit repair companies offer to improve your business credit scores. Those who are struggling with poor credit scores often look for ways to get good scores to get back on track. However, you may find some legitimate business credit repair companies, while others are frauds.

Further, they offer to fix and improve your business credit in exchange for fees. They will ask you for a few things. It includes copies of your credit reports (including TransUnion, Equifax, or Experian).

They further check and review these copies and spot the disputed items. Eventually, when you agree to these disputed items, then they get in touch with credit reporting agencies and challenge them with these inaccurate data or information.

Here’s a list of how you can protect yourself from illegitimate companies. It includes:

- The business fails to advise you of your right to repair your credit for free.

- You are asked or advised not to contact credit reporting companies directly by the company.

- They demand money before services are provided.

- They suggest or demand that you engage in illegal practices. It includes file segregation (applying for credit using an Employment Verification Number rather than your Social Security Number). It may also include identity theft (using false information to apply for credit or claiming an accurate debt is fraudulent or wrong).

Additionally, credit repair software can be an invaluable tool for businesses looking to improve their credit scores independently. Compared to hiring a credit repair company, using software is often more cost-effective. After purchasing or subscribing to the software, businesses can use it to consistently monitor and amend their credit without incurring extra expenses. Furthermore, the software streamlines many aspects of the credit repair process, such as disputing inaccuracies, tracking improvements, and managing communications with credit reporting agencies.

The 18 Best Ways to Build Business Credit Fast

Following is the list of 18 best and proven ways that would help you to build your business credit to improve your business process. Let’s check:

#1 Register Your Business Entity

It is important to register as a business entity. Unincorporated company entities, such as a general partnership or a sole proprietorship, are the easiest to set up and manage paperwork for.

However, there is no legal or financial separation between the owner and the business in these structures. In this instance, you'll have to supply your personal social security number while working with a vendor or applying for a loan.

Therefore, you have to build your business credit to keep personal and financial matters separate. To do so, you have to decide and select one of these mentioned structures:

- C-corporation – A C-corporation separates you and your company legally and financially. Further, corporations are treated as legal cities in their own right, and a C-corporation is perfect for a company that plans to issue shares or goes public in the future.

- A limited liability corporation (LLC)— It is a type of established business entity. Further, it provides liability protection and financial separation between you and your firm. Also, it makes it easier to administer than a corporation and provides more tax flexibility.

- S-corporation — An S-corporation is a pass-through entity. In this, the profits of the firm are taxed exclusively at the individual level. S-corporations are also recognized legal entities in their own right.

- Limited-liability partnership (LLP) – A limited liability partnership (LLP) is An LLP is a type of registered business entity that is commonly used by professionals such as lawyers and doctors.

Ultimately, you can also seek advice from a business attorney or accountant if you're unclear about which entity type is best for your company.

#2 Get an Employer Identification Number (EIN)

After establishing business credit, you have to get an Employer Identification Number(EIN), which is assigned by the Internal Revenue Service(IRS). It is quite similar to Social Security Number (SSN). Generally, the IRS uses the EIN numbers to monitor and track businesses mainly for tax purposes.

Note that you will be asked to provide your EIN or SSN number when you want to apply for a credit card or loan. In addition, if you have an EIN, your business credit will be attached to it. And, you can utilize this history to apply for credit and business financing.

However, single-owner LLCs, partnerships, or sole proprietorships can make use of the owner’s Social security number for tax purposes. It can only be done if you don’t have any employees. Though, you need an EIN apart from these types of businesses.

Even though to be on the safe side, you can still apply for an EIN number. Moreover, the biggest advantage of having an EIN is that it can assist you in establishing business credit. Furthermore, an EIN is free and simple to obtain through the IRS website.

#3 Open a Business Bank Account

Opening a business bank account is a significant step for certain reasons. It includes separating personal and business affairs, applying for loans or credit lines, and much more. Further, it will help to come under business credit bureaus radar that will review your profile and provide your credit score. This credit score will eventually offer various benefits for your business growth.

After you get an EIN, you should research your alternatives and open the finest business checking account for your firm. Of course, it's crucial to use your account after you've created it. Further, this bank account should only be used to pay for company expenses. It includes utilities and rent, as well as your business cell phone. As long as you pay for these purchases in full and on time, you'll be fine.

Overall, opening a business bank account will not only provide a bank reference for the three credit reporting agencies. But, it will also open doors to better credit accounts in the future. Note that the best small business lenders prefer borrowers who have had a business bank account.

#4 Establish a Dedicated Business Address and Phone Number

Many entrepreneurs tend to ignore this step as it may appear as a small step when applying for business credit. Instead, updating your business address and phone number would solidify your business credit profile. It further allows you to register with business directories.

In the next step, business credit agencies collect data and information from directories. Therefore, make sure to provide all details that could impact your business credit score.

Furthermore, you're also establishing your initial, easy trade credit relationship with the phone company. So, make sure to set up a relevant phone line for your business. This information is reported to credit bureaus and will assist you in establishing company credit.

#5 Apply for a Business DUNS Number

Make sure to register for DUNS— a Data Universal Number System, which is developed and managed by Dun & Bradstreet. It is a unique nine-digit number used for the identification process of business entities.

Note that the applying process is free and can be done on the Dun & Bradstreet website. Also, receiving your DUNS number may take up to 30 days.

Nevertheless, it is not mandatory to register for DUNS until and unless you want to apply for a federal government contract, SBA loans, or grant. In addition, every vendor or supplier (either national or international) makes use of a D&B credit score. Therefore, if you want to establish your business credit score, then registering for DUNS would be a good start.

#6 Establish Trade Lines With Your Suppliers

Maintaining and establishing solid relationships with vendors and suppliers is one of the finest practices. Furthermore, you'll establish company credit the same way you'll grow personal credit by bringing on a range of different suppliers, vendors, and lenders. However, it completely depends on your solid relationship with them.

As you purchase more supplies, merchandise, or other things from third-party vendors, those transactions might turn into relationships, which can help you grow business credit.

Moreover, as previously said, it will be especially favorable if your suppliers and vendors offer trade credit. It clearly means you can pay many days or weeks after receiving the things you requested.

This credit is similar to a loan, despite the fact that it is not provided by a typical lender. Paying your vendor or supplier on time and in full (maybe even early) will help you establish good business credit. It is similar to paying for your consumer credit cards on time, which helps to establish good personal credit.

Having said that, the trick is to find suppliers who will record your payments to business credit bureaus, as Horton did. Not all merchants do this, and if yours doesn't, your on-time (or early) payments won't help you establish credit.

As a result, note that well-known suppliers like Uline, Quill, and Grainger all report to corporate credit bureaus.

Ultimately, you'll be able to improve your business credit score if you pay these suppliers on time and in full.

#7 Get a Business Credit Card or Line of Credit

Certain small businesses or startups take the help of loans or credit lines to operate and grow their businesses. Fortunately, good business credit scores help businesses to smoothly run without facing any financial limitations.

Applying for a business credit card is the first profitable step to lead your business to cover daily business expenditures. And, it also safeguards your personal finances mingling with business financial affairs. Ensure to keep both personal and business finances separate to effectively manage both areas.

After applying, you have to make sure to make timely payments to improve your business credit score. Also, borrowing or repaying funds should be done efficiently. Further, make sure that you stick to this rule and it will be beneficial for a longer period of time.

#8 Borrow From Lenders That Report to the Business Credit Bureaus

You are on the right track of business if you have a good business credit report. It automatically clears all the roadblocks to gain financial loans or lines of credit from vendors or suppliers. To make sure that your financial report is being assessed by the agencies.

Therefore, you have to work with lenders who report to business credit bureaus— D&B, Equifax, or Experian. Note that some other online lenders or suppliers generally miss filing reports to the business credit agencies. So, it is your responsibility to review lender’s policies before establishing business credit from loans.

#9 Keep Business Information Current With the Bureaus

Note that every credit bureau agency— D&B, Equifax, or Experian— has a different model for scoring business credit. They have their own set of rules and regulations when it comes to collecting data and information to provide the overall score.

Furthermore, vendors or suppliers check reports based on different types of data and information. Therefore, all you can do is gain a good business credit score. So, make sure to regularly maintain and revise your business report.

Additionally, these business credit agencies allow updating business information from time to time. It includes basic information about the organization, number of employees, financial data, and much more. Improving and updating all the required fields would help you to get a better score.

Besides, you need to avoid causing any errors or miscalculations that would affect your credit report score. Ensuring your credit report regularly would diminish the possibility of any errors.

In case you aren’t making any use of monitoring tools, then you can use a good rule of thumb to monitor your business credit report. However, if you spot any errors then you can immediately verify with your relevant business credit bureaus.

#10 Getting Small Business Financing

For any entrepreneur, it is crucial to build business credit to establish a stronger foundation for their business venture. If you are looking for lenders or vendors to provide your loan or line of credit, then you should have a good track of credit score.

In addition, if you have a good business credit history, then you can easily apply for financing from vendors or suppliers. They will determine your capacity for money management and reliability to pay debts on time.

According to the SBA, “Businesses have 10 to 100 times greater credit capacity compared to personal credit.” Here’s an example for your reference: Suppose you are applying to the SBA’s loan program, then they will determine your business credit score and will check if you qualify for the loan. Unfortunately, if your score is equal to or less than 140, then you won’t get qualified for further process.

Having a business credit will help you to secure your financing for business matters. Also, you will have the advantage of applying for a loan whenever you want to. But, make sure to keep your business credit score apt to have easy access to obtain funds and suppliers’ trust.

#11 Supporting Relationships With Suppliers and Vendors

Having good relationships with vendors or suppliers would significantly promote your business growth.

Vendors or Suppliers want to work with business owners who are reliable and have a good credit report. As a result, they easily offer you trade credit when you have a good track record and make timely payments. In addition, you will most likely avoid spending upfront payments for products or services.

In case you manage to secure net-60 or net-90 with vendors or suppliers (who will further report to credit agencies) you could effectively establish your business credit. And, it will also improve your business credit score.

#12 Protecting Your Personal Credit

Building and managing your business credit card definitely helps to safeguard your personal credit. Moreover, personal credit shields your finances if you have a low business credit report. Although, it is not an ideal method and should be only used when entangled in some critical situation.

Furthermore, you need to ensure to separate your business and personal credit to avoid landing into financial constraints. In most cases, if you are using personal funds for business affairs, then you are damaging your personal credit scores. Consequently, it will impact your scores and recovery may take a longer period.

#13 Put your business on the map

Having a business card does not directly put you on the map. Instead, there are certain things that you need to effectively build business credit. Following is the list of points that support your business venture:

- Register your business name to create a legal entity.

- Provide your business address.

- Obtain your business phone number.

- Decide your business entity such as S or C corporation, LLC, or more.

- Acquire your license and permits.

- Obtain your Employer Identification Number (EIN).

- Open a business bank account.

- Obtain D-U-N-S number.

- Establish business credit.

- Get your Insurance.

#14 Establish and maintain vendor credit

Having good relationships with vendors or suppliers would significantly promote your business growth.

Vendors or Suppliers want to work with business owners who are reliable and have a good credit report. As a result, they easily offer you trade credit when you have a good track record and make timely payments. In addition, you will most likely avoid spending upfront payments for products or services.

In case you manage to secure net-60 or net-90 with vendors or suppliers (who will further report to credit agencies) you could effectively establish your business credit. And, it will also improve your business credit score.

#15 Pay on time all the time

It should be your top priority when dealing with business credit affairs. Moreover, it clearly defines your reliability and management abilities with money matters such as paying off debts.

Furthermore, if you have any delayed or missed payments history, then it could severely affect your business credit card score. Ultimately, it will negatively influence your overall business credit profile.

#16 Open a business credit card

Opening and using a business credit card would offer certain benefits for you and your company — including rewards. Undoubtedly, you should have at least one business credit card. You can also have more than one as well depending upon your interests and needs.

Make sure to review all the features before choosing the right business credit card for your business. It includes purchase protection, annual fees, sign-up bonuses, spending limits, online account access, interest rate, rewards, and other associated features.

#17 Separate business and personal expenses

Incorporating personal and business expenses may seem tempting, however, it may drag to complications.

Owning a business card would help you to segregate both your business and personal finances. Furthermore, it offers convenience when it comes to managing and tracking financial records. Also, it provides flexibility and saves you time and energy. Nonetheless, it also helps to manage your taxes.

#18 Monitor your credit

Make sure to access and monitor your business credit regularly. It assists to examine problems, manage and track reports, and detect suspicious activities (if any occurs). Nevertheless, checking your business credit profile would help you to take timely actions and safeguard your account. In case you incur any fraudulent activities, contact your reporting agency as soon as possible.

What’s in Your Business Credit File?

We have listed all the five categories of business credit files that are included in detail. Let’s check:

- Payment History: Make sure you pay your bills on time because it will affect your credit score. Any late or missed payments, as well as bankruptcy, may have a negative impact on your credit record.

- Age of Credit History: Lenders look at the age of your current account. Your credit ratings will also improve if you have managed your credit accounts effectively for a longer period of time.

- Current amount of indebtedness: It specifies how much of your available credit you're using. This is referred to by the lenders as your credit use ratio. It also notifies lenders if you're staying inside your credit limit or if you're already in financial trouble.

- Credit mix and experience: It assesses how well you've handled different types of credit. Mortgage, credit card, vehicle loan, and personal loan are all examples. Your overall score improves if you can demonstrate that you can safely manage both installment and revolving accounts.

- New credit accounts: If you've opened a lot of new accounts recently, you're more likely to be viewed as a credit risk. Credit bureaus, on the other hand, are getting better at recognizing that customers shop around and that this isn't always a bad thing.

How Deskera Can Help

Deskera offers you to learn the concepts of business and get acquainted with the top software applications for startups and can also help with accounting for startups. You may refer to Deskera’s blogs to get a better grip over business topics such as How to understand a balance sheet, Main financial statements, Why are income statements important.

Besides, you may also learn a lot from the Best Marketing Blogs 2020 and the user-friendly CRM, Business Expense, Accounting Cycles.

Take your business to the next level with Deskera All-in-One. It is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all under one roof. With Deskera Books, you can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business dashboard apart from many other features.

Key Takeaways

Finally, we have reached the end of this comprehensive guide. We have summarized all the important points for your reference below:

- Business credit helps to purchase or buy something and pay the amount for it later

- Business credit will have a credit score that will determine your ability to manage funds.

- Dun & Bradstreet (D&B), Experian, and Equifax are the three major commercial credit reporting companies.

- it builds a sense of discipline and dedication in you to stay strategic with your finances for both aspects— personal and business.

- Credit repair companies offer to improve your business credit scores

- Beware of fraud credit repair companies.

- 5 things include in your business credit file: Payment History, Age of credit history, Current amount of indebtedness, Credit Mix and experience, New credit accounts.

- Maintain good relationships with vendors or suppliers that would significantly promote your business growth.