Capital is the asset that allows your business to produce a product or service to sell to customers. Capital can be held through financial assets or raised from debt or equity financing.

In this article, we will summarize and go through what capital means for your business and how to raise capital for your company

- What Is Capital?

- Understanding Capital

- Business Capital Structure

- Different Types of Capital

- Ways To Raise Capital

- Key Takeaways

What Is Capital?

Capital refers to the financial sources that businesses use to fund their operations like machinery, cash, equipment and other resources. Capital is the term for financial assets, such as funds held in deposit accounts or funds obtained from a special financing source.

Companies typically focus on four types of capital:

- Working Capital

- Equity Capital

- Debt Capital

- Trading Capital

Capital is a vital source of financing across all types of businesses because companies need these resources to operate. Most companies raise capital by issuing stocks and bonds to investors who purchase these financial instruments with cash or other assets.

It is essential to differentiate money from capital . Capital is more durable and is used to build wealth. Machinery, equipment, patents, trademarks, patents, brand names, buildings, and land are a few examples. Property rights give capital value and allow it to generate revenues and build wealth over time.

Capital assets are assets of a company found on the current or long-term part of the balance sheet. Capital assets can include cash, cash equivalents, marketable securities, manufacturing equipment, production facilities, and storage facilities.

Understanding Capital

Business depend on its ability to sell products, get paid and meet obligations in order to reload inventories, expand and grow the business. To build up working capital, the current assets must be greater than your current liabilities.

For simplicity, capital is the amount of financial resources needed to implement and execute a business plan.

Companies and individuals hold capital and capital assets as part of their net worth. In the viewpoint of financial capital economics, capital is an essential part of running a business and growing in an economy.

Businesses have capital structures that include debt capital, equity capital, and working capital for daily expenditures. Capital can be used to measure wealth and a resource that increases wealth through direct investment or capital project investments.

Capital is cash or liquid assets held or obtained for expenditures of the business. In terms of financial economics, it may be expanded to include a business's capital assets.

A company's capital is used to provide ongoing production of goods and services to run the business and bring in profit. Businesses use capital to invest in all kinds of things for the sole purpose of creating value for a business. Labor costs and building expansions are two areas where capital is often allocated to.

Investing through capital, a business directs their money for further investments that earn a higher or greater return than the capital's costs. The financial capital analysis for businesses always done by closely analyzing the balance sheet.

Business and financial capital are viewed from the standpoint of a firm's capital structure. Most banks are required to hold a specified amount of capital as a risk mitigation requirement by the central banks and most banking regulations.

Most private companies are responsible for assessing their capital thresholds, capital assets, and capital needs for corporate investment.

Business Capital Structure

All businesses need capital to operate and create profitable returns. A Balance sheet analysis is central to the review and assessment of business capital.

A company's balance sheet provides a capital structure for metric analysis. Debt financing provides a cash capital asset that needs to be repaid over time through scheduled liabilities.

Equity financing provides cash capital that is reported in the balance sheet's equity portion with an expectation of return for the investing shareholders.

Debt capital usually comes with lower relative rates of return but with strict provisions for repayment. Some of the metrics for analyzing business capital include the average cost of capital, debt to equity, debt to capital, and return on equity.

Different Types of Capital

Here are the four types of capital in more detail:

Debt Capital

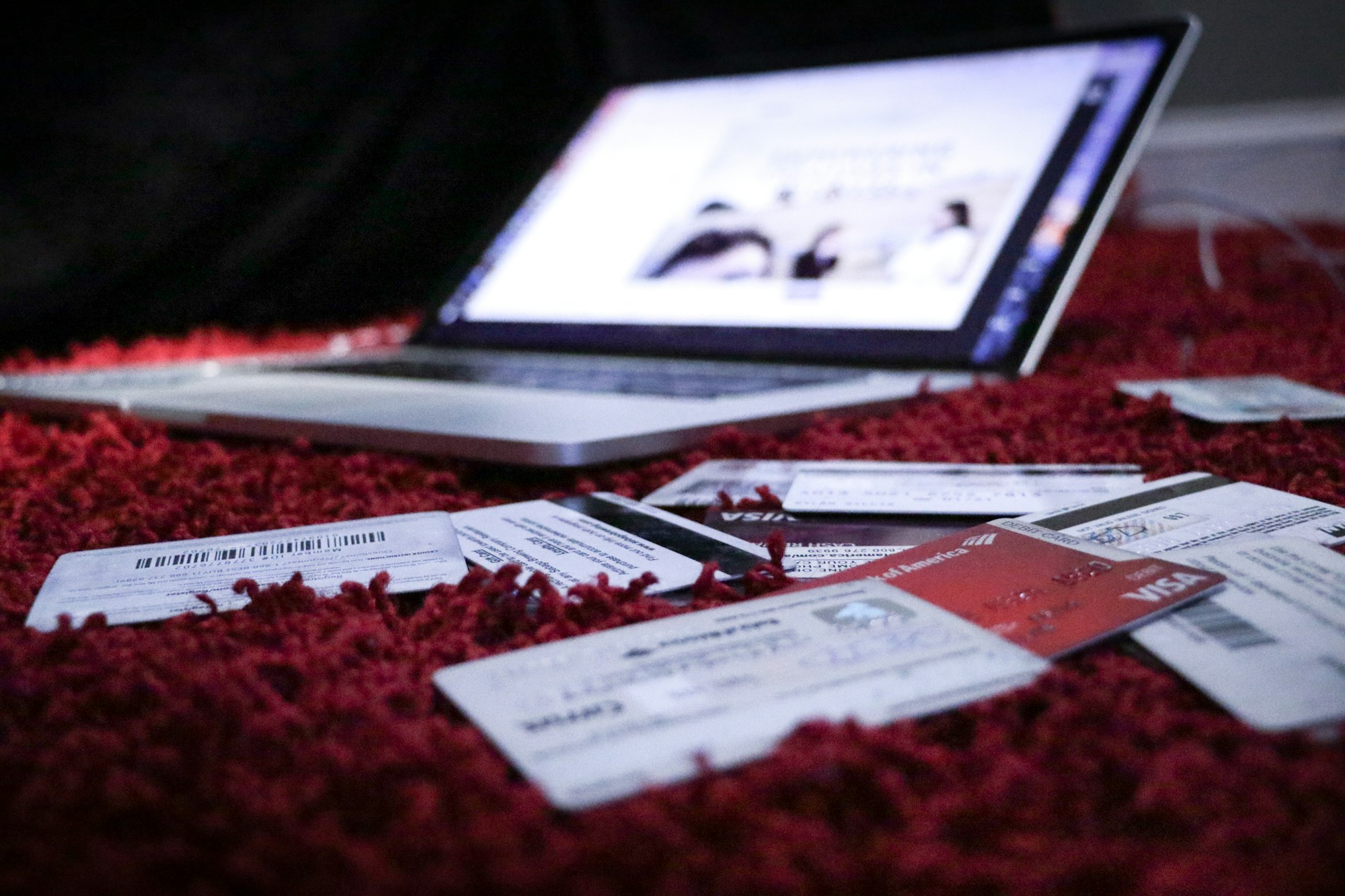

Businesses usually acquire capital through the assumption of debt. Debt capital is obtained through both private and government sources. Most sources of capital can include family, friends, financial institutions, online lenders, insurance companies, credit card companies and loan programs.

Individuals and companies must typically have a good credit history to obtain debt capital. Interest usually vary depending on the type of capital obtained and the borrower's credit history. Debt capital requires regular repayment with interest.

Equity Capital

Equity capital can come in several forms. They are of three types - private equity, public equity, and real estate equity. Usually, private and public equity are structured in the form of shares. Private equity is not raised or opened up to the public markets. Private equity comes from selected investors or business owners. Meanwhile, public equity capital occurs when a company lists a public market exchange and receives equity capital from shareholders.

Working Capital

Working capital includes a business's most liquid capital assets available for fulfilling daily obligations. It is calculated on a regular basis.

The formula below are used to calculate working capital:

Working Capital = Current Assets – Current Liabilities

Working Capital = Accounts Receivable + Inventory – Accounts Payable

Working capital measures a company's short-term liquidity. It is also estimated as its ability to cover its debts, accounts payable, and other obligations that are due within a year.

Trading Capital

Trading capital equates to the amount of money allotted to buy and sell various securities. Trading capital are held by individuals or firms who place a large number of trades on a daily basis

Investors add to their trading capital by employing a variety of trade optimization methods. These methods help to make the best use of capital by determining the ideal percentage of funds to invest with each trade. Traders need to determine the optimal cash reserves required for their investment strategies to be successful.

Ways To Raise Capital

Bootstrap Your Business

Provided that your business is not operating in an industry that requires an excessive amount of startup capital, you can potentially fund your own venture. Investing your own money will usually make investors and lenders more willing to partner with you down the line.

Launch a Crowdfunding Campaign

Crowdfunding helps you to connect with like-minded people with who you wouldn’t usually be able to engage. It helps you can gauge interest in your product and understand what’s resonating with people. This will help you improve your product per feedback.

Apply For a Loan

Traditional financing products are the easiest way small businesses fund their operations. Applying for a loan is the simplest way to go.

Raise Capital by asking Friends and Family

Raising capital through family and friends is a viable option other than bootstrapping.

Find an Angel Investor

Angel investors could be a good source of capital for your company. Angel investors are individuals who's net worth exceed $1 million or an annual income of more than $200,000. Your pitch is crucial to attaining funding from investors.

Get Investment from Venture Capitalists

Venture capitalists (VCs) usually invest in slightly more mature companies than angel investors. Venture capitalists have a responsibility to achieve absolute returns for the business or fund. They would want scalable and cash-flow positive companies with proven and scalable products.

Key Takeaways

- Capital is a term for financial assets, such as funds held in deposit accounts and funds obtained from special financing sources

- Financing capital usually comes with a cost

- The four major types of capital include debt, equity, trading, and working capital

- Companies must decide which types of capital financing to use as parts of their capital structure