Creating a business budget allows businessmen to find whether their business will have enough revenue to pay off expenses in the future. A perfect budget acts as a root map for a company to ensure that they are proper and are on track with the budget.

A business budget helps firms manage their money efficiently. Preparing a budget to track actual revenue and spending throughout the accounting year helps gain greater control over the expenses. It helps everyone in an organization to work according to a proper plan and manage the expenses of the company.

What is a Business Budget?

A business budget is a detailed plan that states where the company will spend its money. Preparing a budget will allow the company to weigh down its expenses and benefits before committing assets. It also gives the business an idea as to how its future will look like.

Typically a business budget is prepared on an annual basis. But, if required it can also be prepared monthly or quarterly. It is a detailed plan which outlines how, when, and where you are planning to spend your money. A business budget helps the business to keep its costs under control and grow according to the plans.

Creating a perfect business budget helps firms eliminate their wasteful spending, develop plans to expand revenue, and work towards setting productive goals. Proper planning must include an outline of changes that a firm needs to make, potential changes of the market and clients, changes in the competition, operational changes if any, financial performance, investment details, etc.

Purpose of Business Budget

A good business budget serves as a benchmark for the firm to make sure that they are on track with its goals. It is an important instrument that can activate change. A budget can help to ensure the long-term success of your business. Certain points make it a necessity. The purposes of a business budget are as follows:

Forecasting the Earnings of a Business:

Creating a good business budget helps to estimate how much money the business will be able to make in the future as revenue, sales, and profit.

Plan the Expenditure:

Budget acts as a way to assign each job to the business spending so that there will be no unnecessary reason to spend money. Each penny spent will have a reason that eliminates wastage of money.

Holds Yourselves Accountable for Fluctuations:

A budget lets you evaluate the money planned to be spent with the actual money used. This helps you see if you are meeting the desired goals and have achieved the forecasted expectations.

Helps Prepare for Emergencies:

You never know what will come up during the life of a business and so it is always important to plan for the uncertainties in the business. A business budget can help you set aside some money to be used at the time of emergencies.

Attracts Investors Towards the Business:

Investors will need to see how their money will be used in a company. A well-prepared budget will show how a business is organized and committed. This helps the investors to analyze whether their money is used properly.

Helps to Allocate Resources:

Allocating business resources is one of the most critical purposes of preparing a budget. Therefore, it is important to differentiate between needs and wants. Budget planning can help to allocate new funds, reallocate existing funds, or change policies, practices, and priorities.

Steps to Create a Business Budget

Having a realistic business budget can act as a tool to help businesses to minimize cost issues, improve focus, and help efficiently use cash. Before focusing on the preparation of the budget, identify which aspects of the business needs improvement. This helps to decide how the business funds must be used. Based on this setup long and short-term goals are practical and purely based on the capacity of the firm to spend and save. Below are some steps that will help you get an idea of how to create a business budget.

Find Out the Sources of Income:

Do not overestimate the revenue this will lead to borrowing more cash to meet the operational needs of the company. It is better to refer previously recorded revenue of the company this will help to keep things realistic. Find out how much and from where the money is coming into the business. It is made on a monthly, quarterly, or yearly basis. Examine how your monthly income is fluctuating over time and look for seasonal patterns if any. A better idea about these changes will help you prepare for the bad income months by keeping small balances for emergencies.

Determine the Fixed Costs:

After finding out the incomes, it is time to get a hold on the costs of the business. For this start with the fixed costs. Fixed costs are those costs that do not change over time. For example, rent, salaries, tax rates, insurance policies, interest expenses, etc. Review these expenses and see which of them have stayed the same for each of the months. Add all the fixed costs together to get the total fixed costs that are incurred in the business.

Find Out the Variable Costs:

Variable costs are those costs that do not remain fixed and keep on changing month after month. These are the expenses that change in proportion to the production, output, sales, or usage. For example, owner’s salary, office supplies, piece-rate labor wages, commission, etc. When the business is having higher profits than expected then spend more on variables that will help scale up the business. On the other hand, when the profit is lesser than expected, consider cutting the variable costs until the business profit starts increasing.

Calculate One-Time Spends:

One-time spending is those expenses that come into a business without any notice. For example, expenditures incurred to rectify security breaches of computers in an IT company. These arise when you least expect them, and usually, businesses do not have money to settle these expenses. To prevent the fear of unexpected costs make sure to keep some extra money ready with you, this amount of money acts as a financial cover and protects your business from sudden and large financial burdens.

Bring Together All the Above 4 Stages Above:

After gathering all the required information regarding the incomes and expenses of the business, the next step is to create a forward-looking budget. A good budget balances a firm’s total income against its total expenses. For this purpose add all the fixed costs, variable costs, and one-time costs together. Then deduct the total from the total income. This will help to determine the overall profitability of the company.

Importance of a Business Budget

Creating a perfect business budget helps firms to understand how much income they have gained and how much did they spend. It also, helps the firms get an idea about the amount of money they will need in the future. An efficient budget can help businesses to make important decisions like cutting down unwanted expenses, hiring new staff members, purchasing new equipment, etc.

A business budget is a basis for the success of an organization. The following points will help you understand that a budget is an important element of the business.

- Controls finances of a business by estimating revenue, planning the expenditure, and restricting any unwanted spending

- Helps plan short-term and long-term goals for the growth of an organization

- It helps to know the financial health of the business

- It allows developing strategic plans for business expansions. Assists in preparing income, sales, and payroll taxes

- Attract people to invest in your company as a budget helps showcase where the money will be invested

- By having well-organized budgeted information, you can create accurate financial records

Different Types of Business Budgets

The final budget of a business is typically a blend of inputs from different other budgets developed at departmental levels. Below are the types of business budgets prepared by a company for its smooth functioning.

Master Budget

The master budget refers to a collection of lower-level budgets and is created by different organizational levels in a company. Management makes use of the budget to plan activities that are needed to achieve organizational goals. This budget uses data from cash forecasts, financial statements, and financial plans.

Operating Budget

An operating budget is an in-depth forecast of all expenses and revenues that a firm expects to get over a while. Firms usually formulate an operating budget at the end of the year to show expected activities during the subsequent year. It consists of fixed, variable, capital, and non-operating expenses. This information from this budget can be used to ensure whether the firm’s spending is according to the plans.

Cash Budget

A cash flow budget is an estimation of all cash receipts and payments that are anticipated to arise during a certain period. The estimates are made on a monthly, bimonthly, or quarterly basis. This budget is used to evaluate whether the company has required cash to continue its functioning throughout a given time frame. It helps determine the efficient allocation of cash.

Financial Budget

A financial budget refers to determining how much capital a firm will need to attain its long-term and short-term goals. The purpose of preparing a financial budget is to estimate the company’s cash, capital expenditures, and balance sheet items, including assets, liabilities, and owner’s equity. It gives an overall idea of the health and stability of your business.

Labor Budget

Businesses can find out how much it will cost to achieve the required goods production or service goals, both in financial and actual labor terms. Whenever a company is, planning to hire a new employee, they should consider creating a labor budget to determine how many laborers are required to achieve certain production levels.

Static Budget

Refers to a budget that incorporates the values of inputs and outputs that are conceived. It does not change throughout an accounting year. Usually prepared by nonprofit, educational, or government organizations who allocate a fixed sum to be used to undertake their activities. This budget is used to meet goals irrespective of any sales increase or decrease.

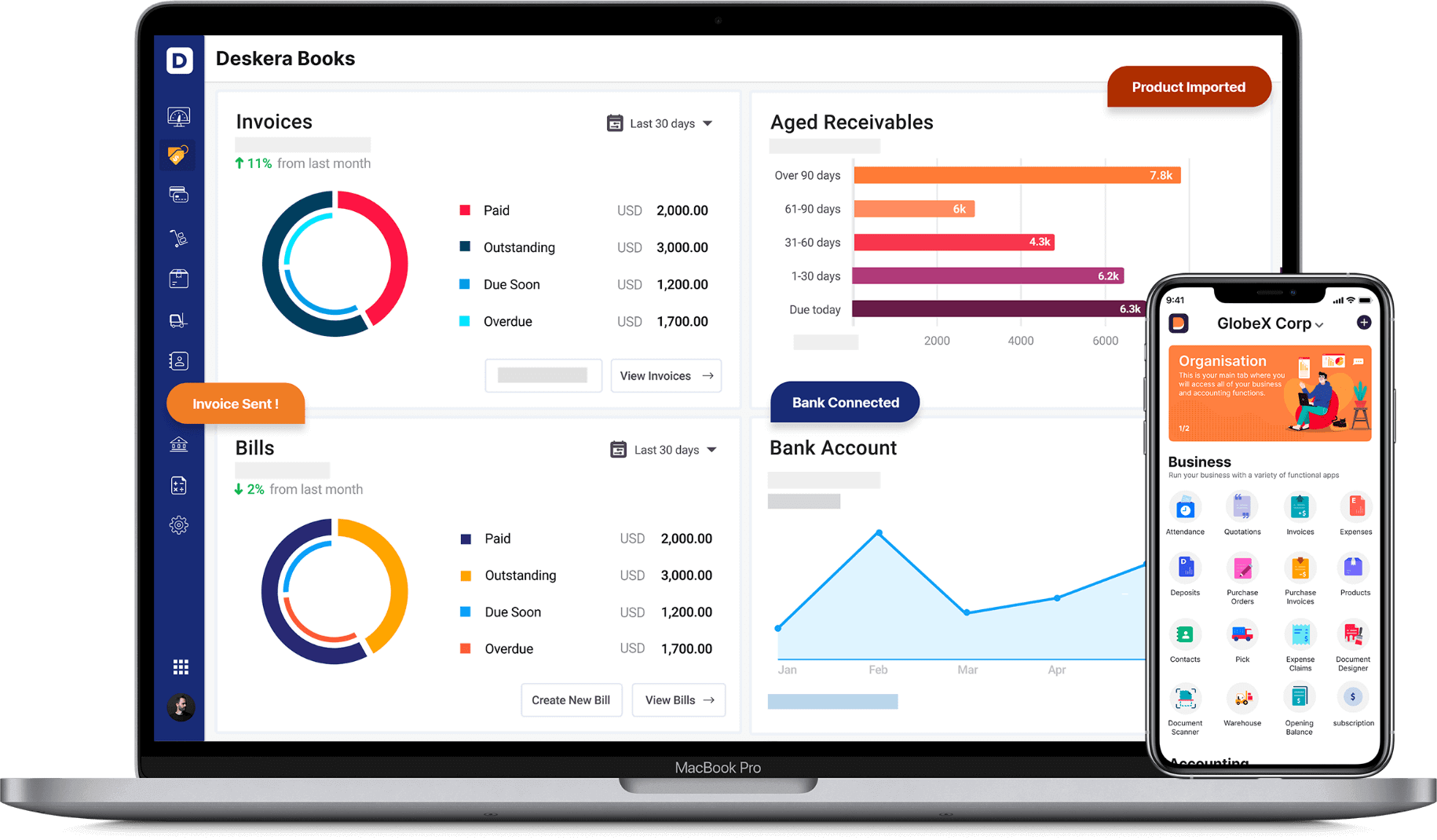

How Can Deskera Help You With Accounting of Your Expenses?

To make accounting of your business and expenses a hassle-free process, you should use Deskera Books. Deskera Books is online accounting software that will make your processes of financial reporting, budgeting and auditing easier, faster, and more efficient.

Deskera Books also comes with pre-configured tax codes, accounting rules, and charts of accounts. This will make sure you do not miss out on the benefits from tax-deductible expenses. Additionally, it will keep track of all your expenses and keep your financial statements and financial KPIs updated in real-time.

Lastly, you can even make your bookkeepers or accountants, or CPAs a part of your Deskera Books account by giving them access through an invitation link.

Key Takeaways

A business budget is a detailed plan which states where the company spends its money. These are detailed plans outlining how, when, and where you spend the business income and are prepared on a monthly, quarterly, or yearly basis.

Purpose of business budget:

An efficient budget acts as a road map for the business and helps gain control over its expenses. Below are some points that make it a necessity.

- Forecast earnings of the business

- Plan business expenditure

- Help businesses prepare for emergencies

- Attract investors towards the company

- Helps to allocate resources

Steps to create a business budget:

Business budget acts as a tool to help businesses minimize cost issues, improve focus, and help efficiently use cash. Before focusing on the preparation of the budget, identify which aspects of the business needs improvement. It helps decide how business funds should be utilized. The steps are as follows:

- Finding out the sources of income of the company

- Determine fixed costs of the business

- Finding out variable costs

- Calculate one-time spending of the firm, if any

- Bring together all the incomes and expenses identified in the above 4 stages

Importance of a business budget:

Creating a perfect business budget will help firms understand how much income they have gained and how much they spend. It is a basis for every company’s success. Below are some of the points why a firm must prepare a budget.

- Helps to plan and control the finances of the firm

- Control unwanted spending

- It Helps set group objectives towards which the business needs to work

- It helps in strategic planning

- Attracts investors to invest in the firm

- It creates accurate financial records

- Helps in strategic planning

- Attracts investors to invest in the firm

- Creates accurate financial records

Related Articles