As a business owner, you have to figure out a plethora of things you have never done before. Creating a business budget is one of them. When you have just started your business, it can turn out to be an intimidating task for you as you have no idea where to find the right financial information — let alone learn the business finance jargon — and put all that data together in the right order!

This can turn out to be a nightmare for some people. According to a recent study, the majority of small-business owners don't even have a budget to start with. But if you want to be successful, creating a proper business budget is the critical component of that success.

The process of creating a business budget isn’t that difficult if done in the right way. In this article, we are going to discuss easy steps to create a business budget.

How do you Define a Business Budget?

A budget is a detailed plan that provides an overview of where you will spend your money monthly or yearly. It will help you forecast how much money you can earn, where to spend that revenue, and identify the difference between your plan and reality.

Why Do You Need a Business Budget?

You must be wondering why do you need a budget in the first place? Well, budgeting is about making an educated guess as to how the business finances would look like in the future. By analyzing the business performance during the previous months, you can make wise financial decisions for the future.

For example, if you had a few bad months, and you know that the coming months are going to be hard, then you can start minimizing business expenses wherever possible. On the contrary, if your business is booming, look out for similar practices to expand your business.

In other words, you don’t need any kind of magic to run your business, but you do need to know how to create a business budget. It will help you make your business profitable in the long run. Let’s take a look at some of the reasons why you need a budget:

- A budget makes your business more efficient.

- It helps to identify leftover funds that you can reinvest.

- It helps to predict slow months and keeps you out of debt.

- It plays a vital role in identifying how your business can become more profitable.

- It helps in controlling your business.

- You can get an estimate of your revenue in the future with the help of a budget.

Running a business becomes easier when you have a good budget in your hands. A business budget helps to ensure that you are spending money in the right place, at the right time in order to stay out of debt.

How to Create a Business Budget in Easy Steps?

Let’s take a look at some of the steps that can help you in creating your budget easily:

Examine your Revenue

The foremost step in creating a budget is to look at your existing business and find out all the sources of revenue. Once this is done, you can add all the sources together to get a clear picture of the amount of money that you earn on a monthly basis.

Now you need to calculate your income for multiple months, primarily for the previous 12 months. With this information, you can have a clear idea of how your monthly income changes over time, and identify the seasonal patterns. For example, your business might experience a fall after the holidays, or during the hot summer season.

Knowing about these seasonal changes can help you prepare in advance for such months, helping you sail through this phase.

List your Fixed Costs

The bills and expenses that are constant every month, refers to the fixed costs. The second step in the budgeting process involves listing all the fixed costs related to your business. Rent, supplies, payroll, taxes, insurance costs are some examples of the fixed costs.

Determine Variable Expenses

While figuring out the fixed costs, you will find out that there are some variable expenses as well, that keep on changing every month. Shipping costs, travel costs, utility costs, office supplies, and sales commissions are some of the examples of variable expenses.

When you have higher profits, you can spend more money on variable costs, while during lower profits, you can cut down on these expenses.

There are some expenses that are not necessary for your business operation but can add value to your business, such costs are known as discretionary costs. For example, the cost of education. These costs can be included under variable expenses.

Put Aside Some Contingency Funds for Unexpected Loss

Whether you are a beginner or an experienced businessman, you will be aware that one-time costs don’t come knocking on the door! They happen suddenly when you least expect them. You can prevent the fear of unexpected costs by keeping aside some contingency funds for such kinds of incidents.

Although you might think of spending your extra income on variable expenses, you need to put aside some funds for an emergency. That way you’ll be well prepared for any kind of equipment breakdown or any other unfortunate incident.

Create a Profit and Loss Statement

After collecting all the information related to income and expenses, it’s time to combine together everything to create a profit and loss statement.

Now get ready to calculate your net profit or net loss.

Net profit = Total income-total expenses

If the result is positive, then you will have net profit while if the result is negative, then you will have to bear the loss.

Remember that you cannot expect profit every time. So, you need to be prepared for every situation.

Outline your Future Budget

Whether you are a newbie or an experienced entrepreneur, predicting what will happen to your business in the future is educated guesswork.

Once you have created your profit and loss statement, a historical document showing the past of your business, it’s time to create your budget. With the help of this document (P&L statement), you will be able to understand your business in a better way by identifying which investments are worth repeating and which can be avoided.

In your P&L statement, look for the following:

- Any big supplies or purchases that generate a loss

- Seasonal trends affecting your business

- The profit that has been higher than the previous year.

For example, if you run a popsicle stand, you will notice that higher profit occurs in the summer when the kids are out and the temperature is hot. When you have a clear idea about your profitable months, it will help you predict how your coming years will look like! This information can be further used to make important financial decisions, for example, when can you hire more staff to improve profitability?

How to Make your Budget more Efficient?

Everyone can create a budget, but making it efficient is not everyone’s cup of tea. Most business owners ignore this aspect which results in a loss. But how can you make your business more efficient? Let’s take a look at some of the budgeting tips:

Invest in Accounting Software

Investing in accounting software can be quite beneficial for you to track income and expenses and create your P&L statements automatically. A plethora of solutions are available for this.

Hire an Accountant

A professional accountant can help you manage your budget, and bring your business on track. He can also make sure that you pay the necessary taxes.

Break Down the Budgeting Process

Break the process of creating a budget into small steps — managing a business budget is much easier when you do pieces of the work over time and handle a little bit each day or every week.

Carry Out the Procedures Well in Time

It is imperative for you to put all the budgeting procedures in place so that you can easily find the numbers you need and locate the required money.

Not every business owner loves budgets and finances. However, budgeting is part of life when you own a business. So, knowing step by step guide to creating a business budget and managing it efficiently will make your job easier.

What Questions Do you Need to Ask Yourself While Creating a Business Budget?

Let us look at some questions to look at while creating a business budget:

Are you aware of the key drivers of your business growth?

Knowing the key drivers of your business growth is quite essential for the constant success of your business. Make sure all your management teams are aware of the key drivers so that the budget can be created accordingly.

Do you have the KPIs you need to make data-driven decisions?

You should be familiar with the financial reports of your business that are being generated on a monthly basis, to allow you to get an insight into the real numbers. This way you will be able to improve business performance and profitability.

Do you have a handle on your cash flow management?

Just making a profit isn’t enough to guarantee long-term success – a cash flow management strategy should be incorporated to improve cash flow in your business. This will help in the consistent growth of your business.

Do you revise or review your budget?

Revising or reviewing your budget is quite important if you want to gain a competitive edge in the industry.

Do you have written business goals?

You should be clear with your business goals if you want to achieve success. If you are not aware of your goals, how will your team move ahead to achieve them! That is why having clearly defined written business goals is imperative.

How can Deskera Help you in your Business?

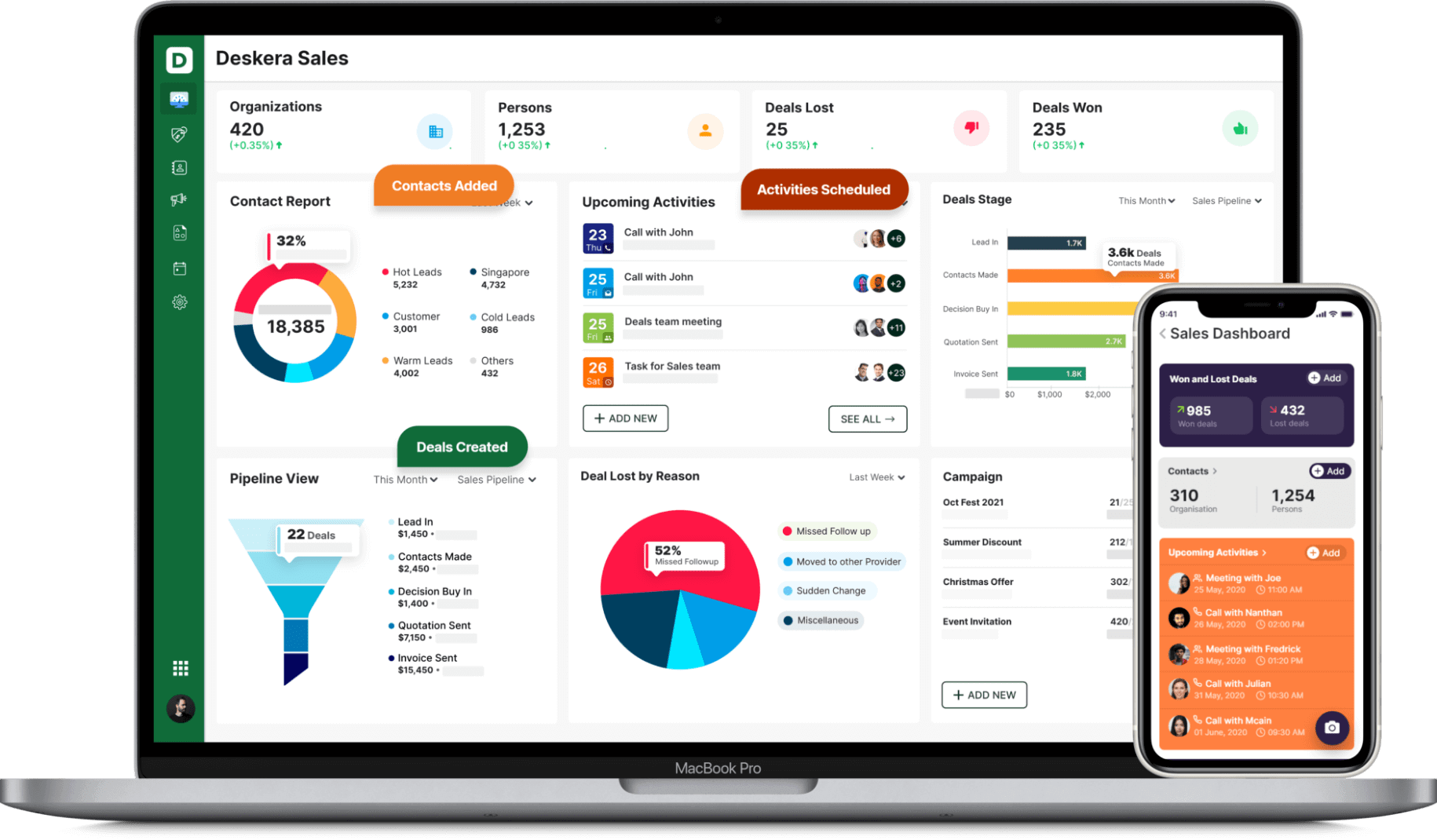

If you are looking for the best platform to manage your finances and budgets, Deskera can help you. Be it matters related to invoicing, inventory, CRM, accounting, or HR & payroll, you will get all the required information at Deskera. With the help of Deskera’s blogs, you can easily get a better understanding of various business topics such as How to Budget for Better Business Planning, Guide to Affiliate Marketing, and the list goes on. Deskera Books can help you become aware of online invoicing, accounting & inventory that can be quite beneficial for your business.

Deskera works on a cloud-based business model to simplify business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be a blessing in disguise if you want to improve your cash flow and budgeting for your business.

What’s more? Deskera helps in creating and managing invoices on behalf of your business which can then be sent out immediately. With the help of Deskera books, a payment link can also be attached with your invoice. This payment link will have many options available like Stripe, VIM, PayPal, and a lot more.

Not only this, but you can also set reminders with the invoices that are not being paid out with the help of Deskera Books. In certain cases, with recurring invoices, Deskera Books can become very handy especially with a payment link added to the invoice.

In addition to this, you can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. With the help of such cloud systems, you can improve cash flow for your business directly as well as indirectly.

With Deskera by your side, you can manage your inventory, CRM, and HR. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

With Deskera’s All-in-one-platform, you can make your business stand out from the crowd.

Key Takeaways

- A budget is a detailed plan that provides an overview of where you will spend your money monthly or yearly.

- Budgeting is about making an educated guess as to how the business finances would look like in the future.

- Having a budget is quite important for the success of a business.

- It helps in making your business more efficient.

- Steps for creating a business budget have been discussed in the article.

- There are various tips that you can follow to make your business more efficient.

Related articles