Whether you own a start-up or a large firm, running a business requires chunks of money. Expenses don’t end once your business is operational. But is there any way to manage them efficiently? Yes, budgeting is the solution.

Having a detailed and accurate budget is the key to success. Fiscal discipline and money management aren’t optional if you want your business to survive and thrive.

But if you want to get answers to the questions such as ‘how can you create a perfect budget, what are the tips that can enhance your budget?’, read this article.

What is a Budget?

A business budget is a spending plan or a strategy based on your income and expenses. It helps to define your available capital, estimate your spending, and predict future revenue.

With the help of a budget, you can plan your business activities in a better manner. It can help you achieve your short-term or long-term financial goals.

What is the Importance of a Budget?

Creating a budget gives you a better understanding of how much money you have, how you spent it, and how much money you will require in the future. Without a budget, you will never get to know how your business is performing. It can help you make better financial decisions, prepare you for emergencies, get you out of debt, and focus on your financial goals.

Let’s take a look at some of the key benefits of having a budget:

- Budgeting helps in controlling your spending

- It helps you in achieving your long-term business goals

- It keeps you organized and helps in the growth of your business

- It helps in evaluating your performance

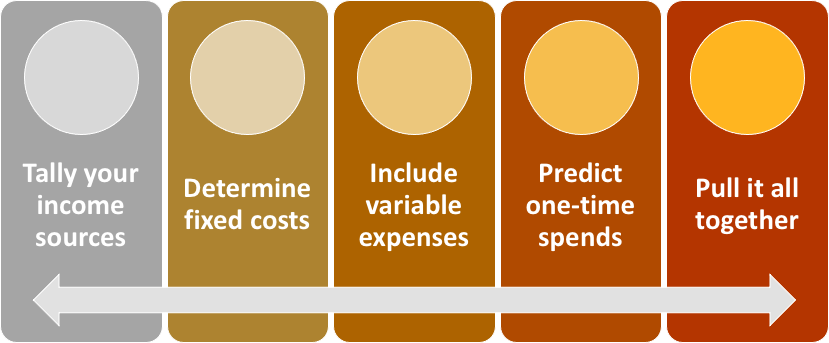

How to Create a Budget?

Take a look at the steps involved in creating a budget:

Tally your income sources

You need to figure out how much money your business is bringing every month, and where the money is coming from. You need to look at the total sources of income for your business. Tally all the sources to get a clear picture of your total monthly income.

Determine fixed costs

Once you know your income, it’s time to know about your costs especially the fixed costs. You must be wondering what exactly is a fixed cost? Well, it is the expense that remains fixed or the same every month. For example, rent, internet costs, payroll costs, etc.

Include variable expenses

Variable expenses are those which vary every month based on your business performance. These include usage-based utilities, shipping costs, travel costs, sales commissions, and a lot more. When your profits are higher, you can consider spending more on variable costs, but during lower profits, try to cut down on the variable expenses.

At the end of the month, calculate all your variable expenses. Doing this practice time and again will allow you to get a better idea of the performance of your business and you will be able to make better budgeting decisions accordingly.

Predict one-time spends

Apart from the fixed and variable expenses, certain business expenses happen rarely. Such expenses are known as one-time spending. You need to include these expenses as well while creating your budget.

For example, if you want to purchase a laptop for your business, it will be a one-time investment. Such kind of expenses should also be considered while generating a budget. Not only this, you should always add some buffer to cover these one-time expenses.

Pull it all together

Now you have gathered all the expenses, what’s next? You need to combine them to get an overview of your spending.

Consider your total income and total expenses, and then compare the cash flow in and cash flow out, if you want to determine profitability.

For example: if you have a total income of $20,000 and have total expenses of $15,000. Then, your total net income will be:

Total net income or net profit = Total income($20000)-total expenses ($15,000)= $5000

This way, you can easily calculate profitability and make the right financial decisions for your company.

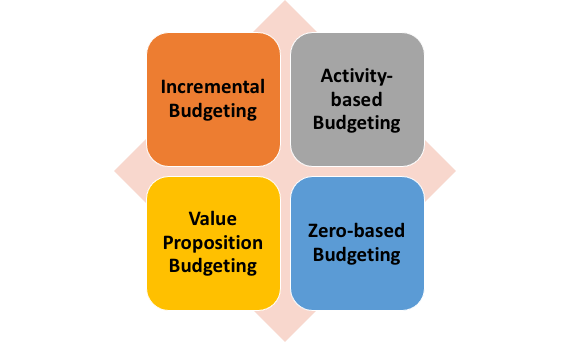

Types of Budgeting Models

Let us look at the various types of budgeting models below:

Incremental Budgeting

Incremental budgeting is a simple method that works by incorporating last year’s actual figures and adding or subtracting a percentage to obtain the current year’s budget. This form of a budget is the best to use if the primary cost drivers do not change from year to year.

Activity-based Budgeting

It works on a top-down budgeting approach that helps in determining the amounts of inputs required to support the targets or outputs set by the company. For example, a company keeps the output target as $100 million in revenues. The company will need to identify the activities required to be undertaken in order to meet the target. The cost of executing these activities will be calculated, this is known as activity-based budgeting.

Value Proposition Budgeting

There are various questions that need to be considered in value proposition budgeting:

- Why this amount is included in the budget?

- Does the product provide value for customers, staff, or other stakeholders?

- Is the value overweighing the cost of the product? If not, then how the cost is justified?

The value proposition is based on the mindset that everything that is included in the budget delivers value for the business. It aims to avoid any kind of unnecessary expenses.

Zero-based Budgeting

It is one of the most common budgeting processes that aims at starting the budgeting process from the scratch. It starts from the zero base. Managers should be aware of every single penny that has been spent. It is the best option for those companies where there is an urgent need for cost containment. Zero- based budgeting is an ideal option for companies that aim at financial restructuring. However, this process is a time-consuming process, hence used occasionally by the companies.

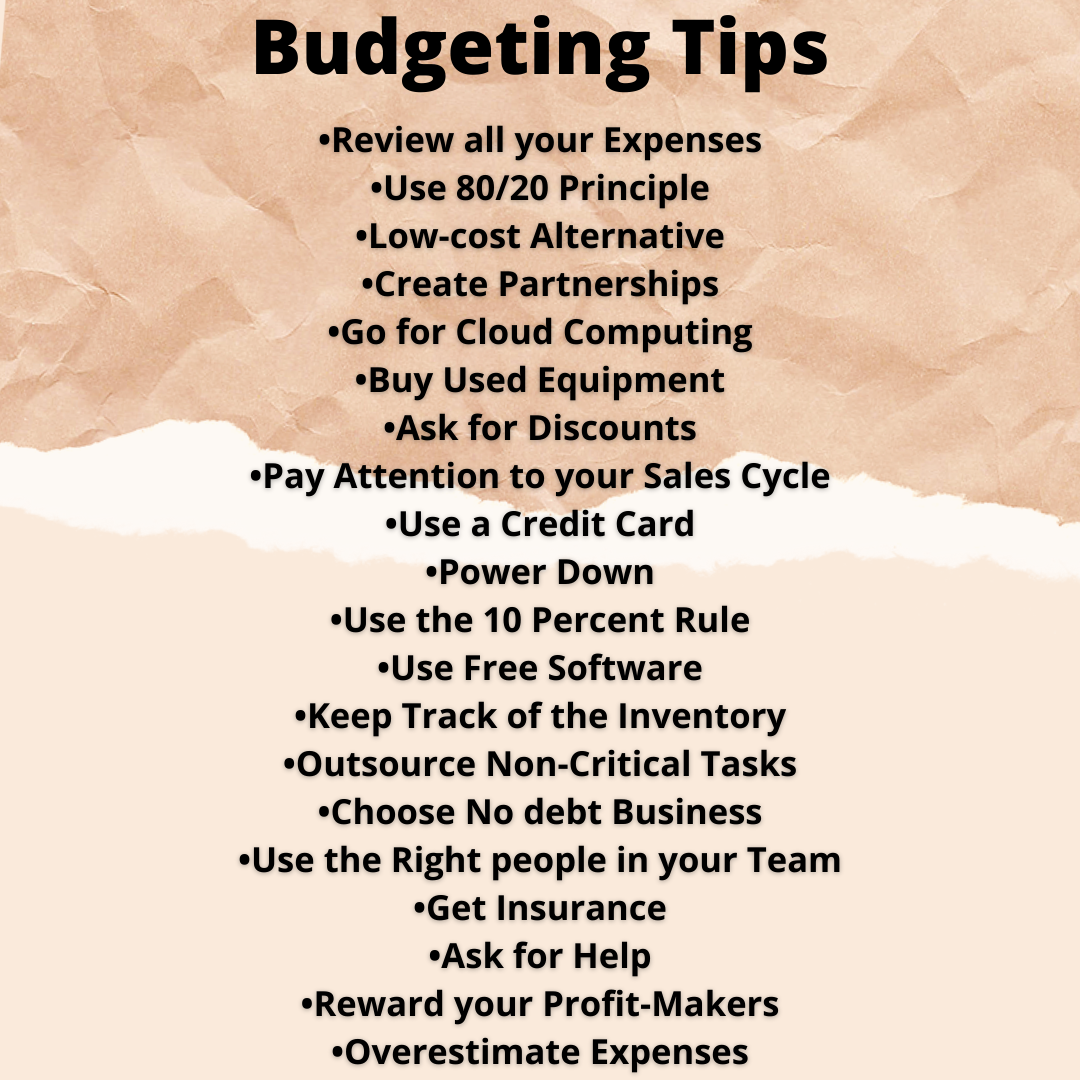

What are the Budgeting Tips

Let’s take a look at some of the budgeting tips for your business.

Review all your Expenses

Having track of your expenses is imperative. If you haven’t started tracking your expenses, you should start doing it now. To efficiently track your expenses, you can use good accounting software. It will help you categorize your expenses and help you to take necessary measures in order to reduce them.

Most of the time, businesses end up having expenses that you no longer need. That is why it is important to constantly review your expenses so that you cut down on unnecessary ones. For example, you once purchased a subscription to a magazine that no one reads now, so this kind of unnecessary expenses can be reduced.

Use 80/20 Principle

According to Pareto’s 80/20 principle, 80 percent of the outcome is generated by 20% efforts. You can easily apply this principle to the 80 percent of the activities that are not generating enough income for you. This will help you in saving your money for your business.

Use Low-cost Alternatives

Instead of using the traditional advertising methods, you can opt for new low-cost alternatives. For example, instead of buying traditional print or TV ads, you can choose tech-savvy tools such as Google Adwords, Facebook Ads to advertise your product to the target audience.

You can target users from a specific city, age group, demographics in order to get good returns on the investment.

Create Partnerships for Marketing

You can grab the opportunity to create partnerships with non-competing companies to promote your product. This will help to save your hard-earned money.

Go for Cloud Computing

If you want to save your time and resources, cloud computing is the key. Thanks to this technology, employees can now work remotely and use online collaboration tools to complete the assigned work. For example, you can use the tool Dropbox to share files and important videos. These days you can also use Google drive to share your documents. It allows you to share your data in a hassle-free manner.

For virtual meetings, you can use Skype, Zoom, or Google Meet. By switching to online methods, you can save a lot of money including travel expenses. Using these cloud business models will help you in cost-cutting your budget.

Buy Used Equipment

Do you know you can save up to 50 to 70 percent by opting for used equipment for your office including computer equipment, copiers, office furniture, etc.? You can negotiate directly with the seller and grab a great deal. For example, these days you can opt for classified sites such as OLX, Quickr to buy used equipment.

If you want to opt for traditional methods, you can look for local newspaper classifieds to find out used equipment.

Ask for Discounts

Many sellers don’t advertise, but they can offer discounts when asked to. So, always ask for discounts whenever you are buying something. There are times when you can even get a discount when you pay within the credit period.

Pay Attention to your Sales Cycle

Over the course of a year, many businesses go through busy and slow periods. If your business also has an off-season, you will need to keep a check on your expenses at that time. Slower periods can be used to plan the next sales boom.

You need to learn from your sales cycle, and use your downtime to enhance your marketing efforts so that you don’t have to face any difficulty. You need to identify ways that can help you to market your product in new and creative ways.

When you know that your business has slower times, you should always have the extra money in the bank during that time.

Use a Credit Card

Creating a budget is not easy as you have to remember a plethora of things. Using a business credit card can be quite beneficial in this respect. In this way, you’ll get a clear understanding of all your expenses for that month and you will be able to chalk out a budget easily.

You will be able to analyze where you are spending more and where less. This will help you to make necessary adjustments in the budget accordingly.

Power Down

Saving electricity can turn out to be a huge saving for your business. For example, you can always turn off the HVAC when not in use. If you reside in an area which has freezing temp, you can look for methods through which the heat can be set so that the pipes don’t freeze or burst.

You can paint the flat roof with white paint in summers to drop the temperature up to 5 degrees. In the direct sunlight, you can even use curtains or blinds for extra cooling. These practices can help to prevent expensive electric bills, allowing you to make huge savings.

Use the 10 Percent Rule

According to this rule, anything can be cut by 10 percent without ruining it. Whether it is entertainment expense or the amount spent on new tools, you can try to cut down the budget by 10 percent. This will help you in better budgeting.

Use Free Software

These days a lot of free software is available that you can easily avail. Save your money by opting for free solutions rather than paying a hefty amount for them.

Opting for open source software can help you save a lot of money. For example, when you think of ordering laptops for your team, you can choose the ones that don’t have Windows OS as they are cheaper and can run on OS Ubuntu. Similarly, you can opt for an open source suite instead of Microsoft Office in order to save on licensing costs.

There are a plethora of open source software such as CRM, document management, and a lot more. Such types of software are easy to use and don’t cost much.

Keep Track of the Inventory

If you run an inventory-based business, then you should try to minimize the costs associated with the inventory and supply chain. This can be done by carrying less inventory which would result in less money tied up and more money in the bank.

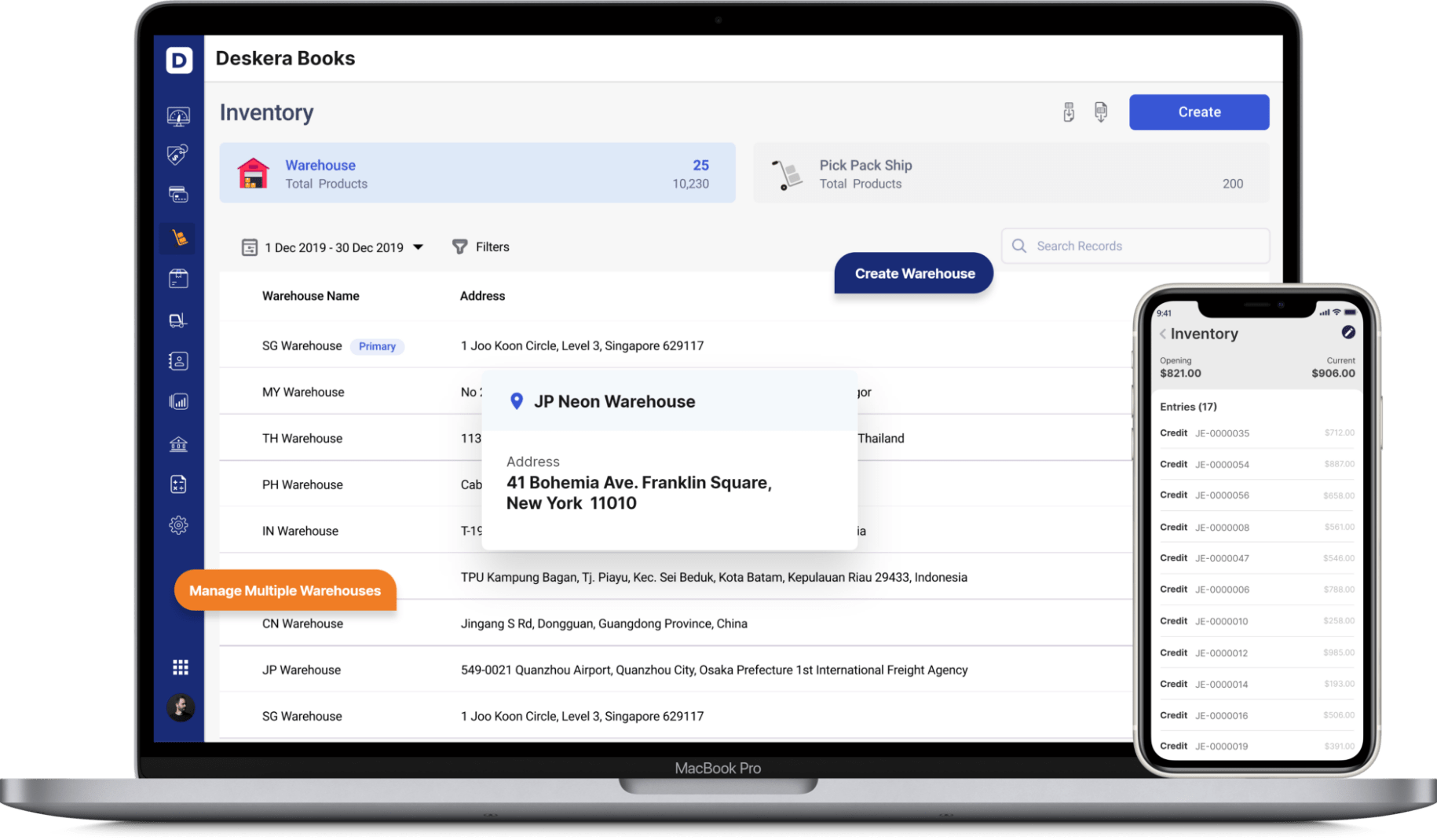

You should start monitoring the inventory so that you can have control over your spending. If you find difficulty in managing the inventory, you can prefer inventory management software for efficient tracking.

Outsource Non-Critical Tasks

These days a number of tasks can be outsourced. You can hire freelancers for various short-term projects from sites such as Upwork, Fiverr, etc. Be it designing a company logo, social media marketing, maintaining accounts, or generating sales lead, hiring freelancers will serve the purpose.

This will help you cut down your budget to a large extent. Do you know you can save up to 60% on your operating expenses when you outsource, without compromising on quality?

Choose No debt Business

Nothing can be better than running a business without any debt. However, if you still need debt for your business, make sure you take a loan that can be easily repaid. Never be late on your loan payments as it can affect your credit score and create hassles for you.

That is why you should always try to plan ahead of your loan repayments in your monthly or yearly payments.

Use the Right people in your Team

Traditionally, budgets are generated by managers, but you should always remember that there are other people in your organization as well who might have valuable insights that can help you in creating a better budget.

You can bring your employees to the budget meetings to know what they are thinking and if their opinions are helpful for your business or not. This will surely help you in budgeting.

Get Insurance

Most businessmen feel that insurance is an expense that can be skipped. However, this is not true. If you skip this expense in the beginning, you might end up paying a huge expense later on; it is better to be safe than sorry!

That is why it is advisable to include insurance costs in your budget rather than repenting later on for the unexpected huge loss that can occur!

Ask for Help

Don’t be shy in seeking help whenever required. Whether you need help from a professional accountant or a bookkeeper, you should never think twice. Take advice from your relatives or friends and choose the best professional accounting services.

You can even consult professionals in helping you chalk out a budget for you. Since they would have more knowledge in the finance industry, they will be able to give better advice related to budgeting.

Reward your Profit-Makers

Spending to save does make sense sometimes. You should adopt a proactive approach in rewarding the employees or the customers who help you in making your business profitable. This can be done by indulging in gestures such as offering an occasional free lunch or a treat in order to encourage and boost the morale of the employees.

You can even offer bonuses to a handful of employees who succeed in meeting their set targets. Another thing that you can do is to offer deep discounts to loyal customers to retain them.

Even if you are spending some money on these activities, it will bring you more profits in the long run.

Overestimate Expenses

If you have a small business, overestimating expenses is a good option. If you budget for things being more expensive than they actually are, this will help you become prepared for the future. This is a survival tactic that will help you hedge against the risk or failure.

Underspending is much easier to handle when it comes to doing the accounts than spending too much.

This is the reason why budgeting slightly above the anticipated line is beneficial.

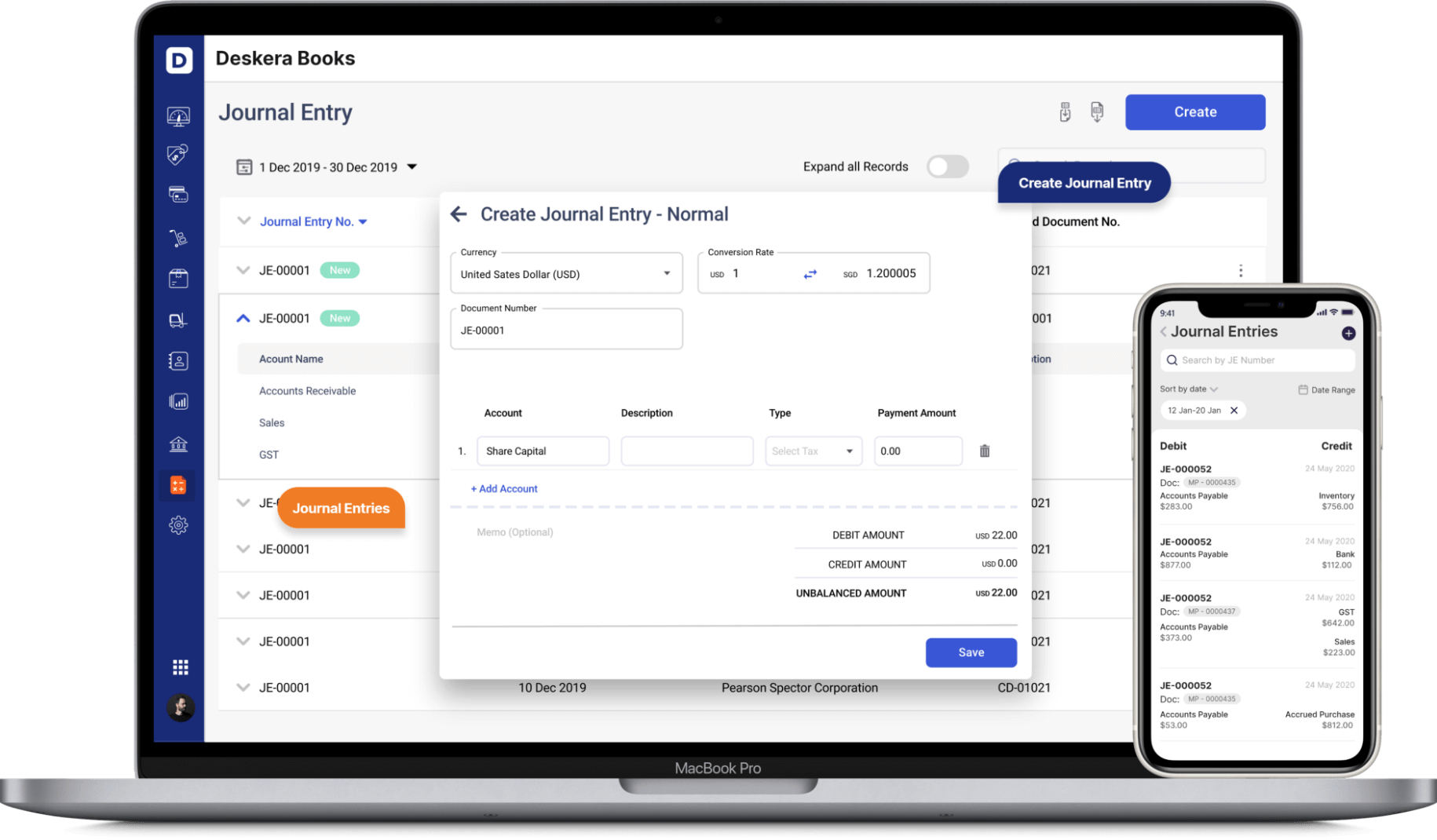

How Can Deskera Help You in Budgeting?

Deskera is the best platform for managing your financials and budgets. Be it invoicing, inventory, CRM, accounting, or HR & payroll, Deskera can help you in every aspect. Deskera’s blogs can help you get a better overview of the business topics such as What is Performance Marketing, What is Content Marketing, and the list goes on. Deskera Books can help you get a clear understanding of online invoicing, accounting & inventory that can help to grow your business.

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow and budgeting for your business.

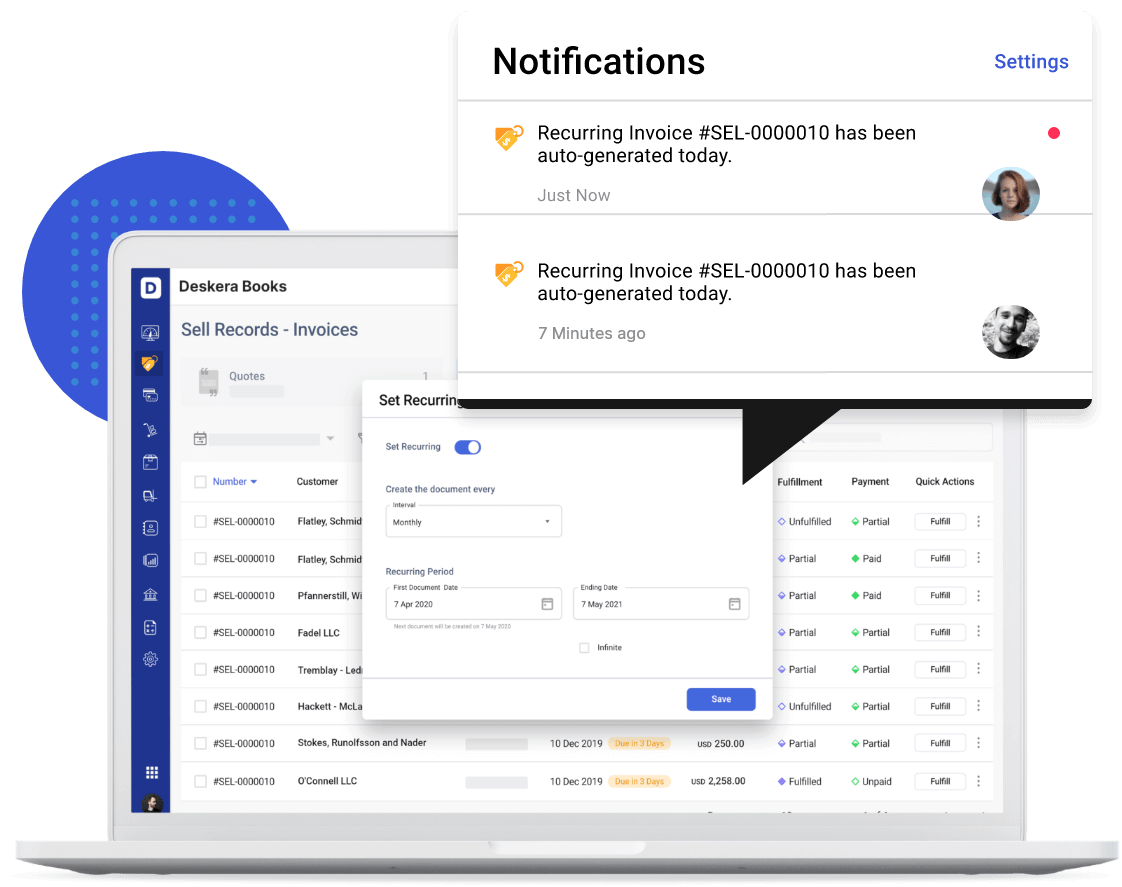

One of its usability lies in creating invoices on behalf of your business which can then be sent out immediately. Through Deskera books, a payment link can also be attached with your invoice. This payment link will have many options available like Stripe, VIM, PayPal and more being constantly added to the Deskera platform.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Budgeting for Your Business Just Got Easier or Faster Sign Up For Deskera Books Click here for free trial

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

With Deskera’s All-in-one-platform, you can make your business gain a competitive edge in the industry.

Key Takeaways

- A business budget is basically a spending plan or a strategy based on your income and expenses.

- Creating a budget helps you keep a track of how much money you have, how you spent it, and how much money you will require in the future.

- There are various steps in creating a budget which have been discussed in the article.

- There are different types of budgeting models including incremental budgeting, activity-based budgeting, value proposition budgeting, and zero-based budgeting.

- Various budgeting tips have been discussed in this article.