Are you a small business owner who wants to learn how to do your own books? Do you want to have a good understanding of the basic terminology behind bookkeeping duties?

Then you’ve come to the right place!

In this guide, we will be walking through all of the bookkeeping basics you need, in order to set up and manage your small business accounting.

The main points we will be covering today include:

- What Is Bookkeeping?

- Bookkeeping vs Accounting - Differences Explained

- Importance of Bookkeeping For Businesses

- How to Set Up Bookkeeping (Step-by-Step)

- 9+ Small Business Bookkeeping Tips

- Bookkeeping FAQ

What Is Bookkeeping?

Bookkeeping is the day-to-day process of recording and managing a company’s financial transactions.

Generally speaking, bookkeeping deals with recording transactions, sending invoices, paying back vendors, preparing financial statements at the end of the year, and much more.

Through these bookkeeping activities, your business can figure out how profitable it is, and make key decisions on sales planning, product offerings, and many other financial aspects of the business.

What Does a Bookkeeper Do?

Bookkeepers are individuals who practice and specialize in bookkeeping.

The main duties of a bookkeeper include:

- Categorizing and journalizing transactions, to make sure every transaction is accounted for correctly

- Processing payments from customers

- Reconciling bank accounts

- Preparing key accounting reports

- Handling your bills and invoice payments

Bookkeeping vs Accounting - Differences Explained

On the surface, bookkeeping and accounting may seem very similar. However, the terms are not interchangeable, as they have two different purposes and deal with separate financial activities.

Bookkeeping handles the day-to-day operations such as identifying, tracking, and recording financial transactions.

More specifically, a bookkeeper puts every financial transaction through a multi-step accounting cycle. The accounting cycle starts with gathering the documentation for each transaction, translating these transactions into journal entries, and organizing them based on the business’ chart of accounts.

Then, at the end of a specific time period, usually the end of the fiscal year, the previously arranged transactions are used to generate financial statements.

This is when an accountant takes over, to summarize and analyze the data provided by bookkeepers. Accountants make sense of the numbers displayed on the financial statements, to provide business owners with valuable financial insights.

So, in brief, the objective of bookkeeping is to accurately keep track of financial activities, and then, it’s the accounting process’s duty to analyze that data and turn it into valuable information for the business.

Importance of Bookkeeping For Businesses

1. Accurate Records

As a small business owner, it’s important that you’re always in control of your business’ finances. Bookkeeping helps you accurately achieve just this.

With bookkeeping, financial information is recorded chronologically, through a systematic method that tracks down every aspect of a transaction.

This method allows you to always be aware of your inventory levels, outstanding invoices, sales numbers, tax payables, and every other financial operation your business takes part in.

2. Minimize Error

If you wait for the end of the year to review and handle your financial transactions, there's no way to know if you or your bank have made any mistakes.

But when your financial books are kept complete and tidy, on a daily basis, you won’t have to worry about dealing with any accounting errors.

And if you’re using bookkeeping software, the automated system will solve any issues for you, as it notifies whenever an account is out of balance, or if a transaction has been kept inaccurately.

Check out our guide on how to issue a credit note when there is an error in your books, such as an invoice mistake.

3. Take Advantage of Tax Deductibles

Business expenses that you can deduct from your taxable income, are known as deductibles. These include insurance, employee payroll, interest expenses, and almost every other type of ordinary and necessary expense that a business might incur.

Bookkeeping allows you to keep an accurate and complete recording of these expenses so that you’ll then be able to pay less in taxes at the end of the year.

If you want to know more about deductibles and how to record them, head over to our guide on business expenses.

4. Better Financial Decisions

An important part of bookkeeping is generating financial statements at the end of the year.

These statements can be extremely helpful in easing financial decisions and achieving higher profits. You can get information on what products are selling best, which segments are growing, which ones might need re-investments, and so much more.

At the same time, financial statements provide businesses with information on income and sales that can be used to forecast budgeting and keep expenses in line.

5. Preferred by Investors

If you want to borrow money from somebody that isn’t family, you’ll need an accurate bookkeeping system set in place.

Investors, financial institutions, creditors, won’t invest in your business or let you take out loans unless you can provide well-organized documents proving that the business is profitable and able to repay.

How to Set Up Bookkeeping (Step-by-Step)

Now that you know the definition of bookkeeping and why it’s so important, let’s dive into the first steps you’ll need to take in order to set up bookkeeping for your small business.

1. Separate Business and Personal Expenses

Once you’ve opened a new business, the very first thing you need to do is separate your business money and personal money, by opening a business bank account.

This will not only keep your finances from getting mixed up, but it will make it way easier for you to keep track of how much the business is profiting.

And to top it off, you’ll look more professional to clients, and ease your tax filing process.

2. Decide on a Basis of Accounting

The timing when businesses record their revenue and expenses into their accounting books is known in bookkeeping as the basis of accounting.

There are two main types of accounting basis businesses can choose from: the cash basis of accounting or the accrual basis of accounting.

Cash accounting recognizes transactions only when cash is exchanged. While accrual accounting is more complex, as it records revenue the moment money is earned, and expenses right when they get billed.

Let’s explain these differences through an example.

Assume your company sells a product to a customer on credit, and the payment is due in two weeks’ time.

If your business works under cash accounting, this transaction would be recorded only when the payment is received, after two weeks. Under accrual accounting, on the other hand, you’d record the revenue earned right when the customer is billed, regardless of there not being a cash exchange.

So, now you may be wondering: which method should I choose?

Well, generally, cash accounting is only used by small businesses that deal with very few transactions and don’t sell on credit.

Whereas other types of businesses, that handle more transactions and inventory, opt for accrual accounting, instead.

In fact, public companies, those generating more than 25 million in revenue, and businesses that sell inventory are legally required to use accrual accounting.

If you’re still indecisive on what method to choose for your small business, head over to our guide on the basis of accounting for more tips.

3. Pick a Bookkeeping Method

There are two main bookkeeping methods: single-entry and double-entry bookkeeping.

In single-entry bookkeeping, transactions are recorded through only one entry. More specifically, a single entry includes the date, short description, and value of the transaction, along with the remaining cash balance of the business’ bank account.

Double-entry bookkeeping, on the other hand, is more complex. Every transaction is recorded as a journal entry that affects at least two accounts, where one is debited and the other is credited.

We’ll explain debit and credit entries in detail, as we go along.

Now, with single-entry bookkeeping, businesses follow the cash basis of accounting. Whereas with double-entry, businesses have to follow the accrual basis of accounting.

That’s why you should only go for single-entry bookkeeping if:

- You’re dealing with very few financial transactions

- You don’t own inventory

- You don’t sell on credit

- You deal with transactions in cash

And, double-entry is the method for you if:

- Your business deals with inventory

- You want clear and accurate bookkeeping

- You want to analyze your financial performance and explore methods to expand financially

- You sell goods and services on credit

4. Choose the Right Bookkeeping Tools

Another important decision you need to make when doing your bookkeeping is regarding the kind of accounting system you’ll be using.

Nowadays, there are three common types of accounting systems businesses use:

1. Manual Systems

As the name suggests, using a manual system means journalizing transactions and financial statements manually, whether it is by hand or with a spreadsheet.

Now, this method can be time-consuming and prone to error, especially if it’s being managed by an untrained bookkeeper.

At the same time, the manual method opens up the possibility for the documents to get lost, stolen, or damaged, if not kept very carefully.

So, it takes extra time and effort to keep track of financial transactions by hand. That’s why only businesses with simple finances and few operations, opt for a manual accounting system.

2. Cloud Accounting Systems

With cloud accounting software, instead of using physical notebooks, papers, or Excel spreadsheets, all of your accounting data can be stored in a digital format, under multiple layers encryption.

The software doesn’t just store your data, but it also comes with features that automate almost every part of your accounting software.

You can easily fill out invoices, pay bills, generate financial statements, and so much more, in just a few clicks.

For a lot of small business owners, going online with accounting software is the better solution. It will keep your books accurate at all times, save you time, money, and a lot of headaches.

One of the best accounting software for small businesses today is Deskera.

Deskera is intuitive accounting software that integrates directly with your bank accounts so that every time money is paid or received, the transaction is automatically recorded, and the corresponding journal entries are created.

And because it’s cloud-based, information is accessible at any time and anywhere, from any device with an internet connection, making it super easy for different team members and departments to collaborate on bookkeeping and accounting.

You can even manage your entire bookkeeping from your phone, by simply downloading the Deskera mobile app.

Still not sure? Just take it for a spin using our completely free trial. No credit card required!

3. ERP (Enterprise Resource Planning)

An ERP is software used by huge organizations that need a system to integrate all of their departments together. The tool is extremely useful and high-tech, but it requires over $10,000 a month to maintain.

ERPs are much more complex than cloud accounting software. In order for your team to use it, you’ll likely need to onboard and train your employees, which means extra costs. As such, ERP software is not very relevant to small businesses.

5. Set Up a Chart of Accounts

A chart of accounts is a listing of all the different accounts of a business, all in one place.

There are five primary types of accounts in the chart of accounts:

- Assets are the resources a business owns, such as cash, accounts receivable, and equipment.

- Liabilities represent what a business owes, so accounts payable, notes payable, interest payable, and any other form of debt.

- Owner’s equity is the owner’s investment in the business.

- Revenue is the cash generated from product sales or from providing service.

- Expenses represent cash spent on rent, insurance, interest, and so on.

As you can probably notice, the different types of accounts vary from business to business.

That’s why each company needs to create a special chart of accounts depending on the industry they’re a part of, the financial activities they take part in, as well as the accounting methods they use.

If you want help figuring out which accounts you need to include in your chart, we have a full guide on the chart of accounts with tips and examples.

6. Journalize Transactions

Whenever there’s a transaction, you have to record it. The process of recording your financial transaction is known as making journal entries.

The main thing you need to know about journal entries in accounting is that they all follow the double-entry bookkeeping method.

And as we’ve previously mentioned, in a double-entry system, for every transaction, at least two accounts will change. One account is debited and the other one is credited.

Debits and credits are terms bookkeepers use to reflect the duality of business transactions. They let you see where cash is coming from, and where it’s going.

Debit and credit entries either increase or decrease the main account categories in the chart of accounts that were previously explained.

More specifically, a debit (Dr) is an entry that either:

- Increases an asset or expense

- Decreases a liability, owner’s equity, or revenue

While a credit (Cr) entry, has an opposite effect, meaning it either:

- Increases a liability, owner’s equity, or revenue

- Decreases an asset or expense

Debits are always on the right side of a journal entry, and credits on the left.

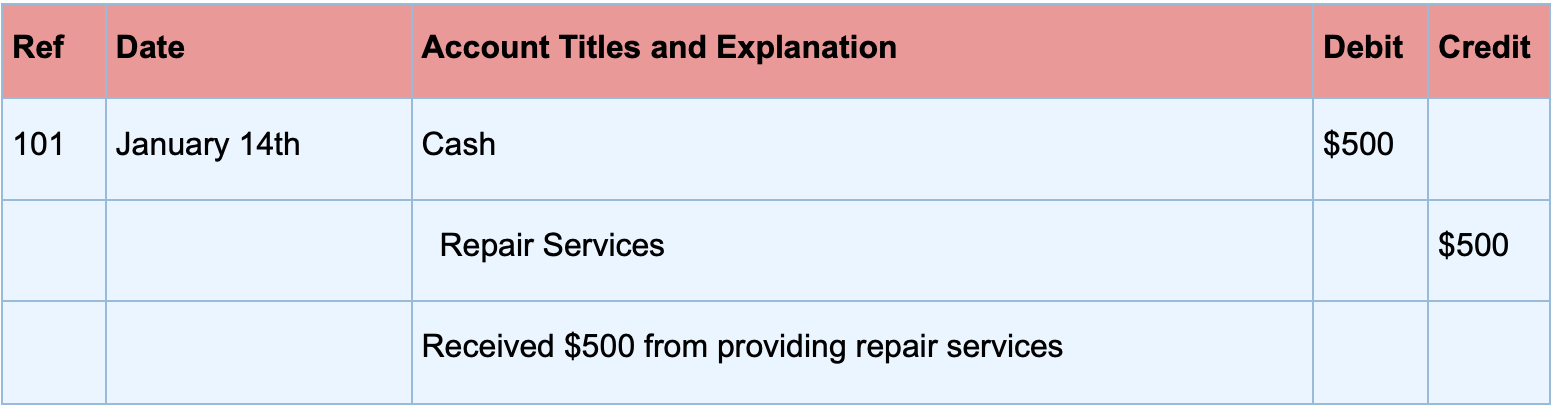

Journal Entry Example

Let’s take an example to illustrate these rules.

On January 14th, a business receives $500 worth of revenue from providing repair services. In this case, the revenue account Repair Services would increase, and get credited, and the asset Cash would also increase, and get a debit entry.

As a journal entry, these changes in accounts would look like this:

If you want to learn more about manually creating journal entries, check out our guide on journalizing transactions.

7. Create Accounting Reports

Accounting reports are financial declarations that provide you with information about where your business stands financially, either at a specific date or over a certain time period.

The most common financial reports you’ll need to issue for your small business include:

- The income statement, also known as the profit & loss statement, details revenues and expenses, for an accounting period, usually a full fiscal year.

- The balance sheet, or the statement of the financial position, provides a representation of assets, liabilities, owner’s equity, at a specific date.

- The statement of cash flows summarizes cash that has been used for operating, investing, and financial activities.

If you want to learn more about the specifics of these reports, and how to create each one from scratch, head over to our guide on accounting reports.

8. Set Up a Schedule

When you’re a business owner managing an entire business all on your own, there are always a million things to get done. It can be easy to neglect or forget to take care of bookkeeping duties.

A good way to avoid this is to set aside one day, once a week or month (depending on your time availability) to deal with bookkeeping.

Use that day to enter any unrecorded financial transactions, reconcile bank account statements, check for any unpaid invoices, or make any other adjustments to your accounting and bookkeeping.

9+ Small Business Bookkeeping Tips

- Automation can be a lifesaver for your small business accounting. The more you automate, the more accurate your bookkeeping will be, and the more free time you’ll have to focus on managing your business.

- Consider making monthly reconciliations for both your bank account and credit card statements, to prevent possible accounting errors from loitering around your books.

- Use the accrual basis of accounting and double-entry bookkeeping, instead of cash accounting and single-entry, as the methods provide you with a full financial picture of the business, and allow you to make better financial decisions.

- To avoid missing payment deadlines, set reminders as soon as an expense occurs.

- Consider opening a business savings account to set aside a percentage of your business’ earnings every month.

- Invest in cloud-based accounting software that meets all of your business needs.

- Keep copies of all types of invoices and receipts you deal with, even if they’re low in value. This will make it easier to balance your accounts at the end of the year.

- Try to establish and maintain a good relationship with vendors, so that you can take advantage of discounts, and extend your payment terms.

- Offer as many payment options as possible, such as cash, check, credit card, bank transfers, mobile payments, etc. This way, you can encourage faster payments, and avoid past due invoices.

Bookkeeping FAQ

#1. Should I Hire a Bookkeeper For My Small Business?

Here are some situations that may indicate it’s time to hire a bookkeeper:

- Your taxes have become way too complex for you to manage on your own.

- You’re spending more time on accounting than managing and growing the business.

- Your business is expanding.

Now, keep in mind that bookkeepers charge high rates, that range from $20 to $1000 per hour, depending on how much work needs to be done, the level of expertise you’re requiring, and the location of the business.

Consider investing in intuitive accounting software, instead, as a more cost-effective alternative.

#2. Is Double-Entry Bookkeeping Hard?

Learning how to manage double-entry bookkeeping can be difficult to understand, and it requires a lot of effort to maintain unless you’re a trained bookkeeper.

Luckily, though, in today’s digitalized world, there is plenty of software that completely automates the process for you. All you have to do is enter the transaction details into the system and the corresponding debit and credit entries will get automatically posted into the ledger.

#3. What’s The Best Bookkeeping Software for Small Business?

The best bookkeeping and accounting software for small businesses today is Deskera Books. Deskera is an intuitive, cloud-based application, you can easily access from any device with an internet connection.

It allows you to integrate directly with your bank accounts and credit cards, so any payments and expenses are tracked automatically.

You can create and send an invoice in minutes.

Then, Deskera will automatically create the corresponding journal entry to record the invoice and then adjust it again, once the customer pays. Without you having to lift a finger!

And to top it off, the software comes at an incredibly affordable price - starting at just $9 per month.

Want to try it out? Sign up for your free trial now!

Key Takeaways

And that’s a wrap!

We hope our guide was useful in understanding the ABCs of bookkeeping.

Familiarizing yourself with these basics can be extremely helpful in better managing your finances, whether you’re a business owner taking on bookkeeping yourself, or if you’re using software to automate the process.

You’ll gain invaluable insights into your business’s potential, open investment opportunities, build business credit, prevent errors, and so much more.

Want more bookkeeping tips? Check out the Deskera Blog for more insights and articles on bookkeeping, accounting, human resources, business, finance, and more!

Related Articles