No, we are not referring to 007 - James Bond. We are here to explain what bonds are from a financial perspective.

A bond is a loan taken by the company or business. Instead of traditionally going to a bank, the company gets the money from investors who buy the companies bonds. In return for the capital, the company pays an interest coupon.

The annual interest rate is paid on a bond, which is expressed as a percentage of the face value. The company pays the interest at predetermined intervals, usually annually or semiannually, and returns the principal on the maturity date, ending the loan.

Bonds are investment securities where - an investor lends money to a company or a government for a period of time in return for regular interest-based payments. Once the bond reaches its maturity level, the bond issuer returns the investor’s money per the interest rates. Fixed income is often used to describe bonds since your investment earns fixed payments over the bond’s life.

Bonds can differ significantly based on the terms of their indenture, a legal document outlining the characteristics of the bond. Since each bond issue is different, it is essential to understand the precise terms before investing.

Basic Characters of Bond

There are six essential features to look at in a bond -

Maturity

Maturity is the date when the principal or par amount of the bond is paid to investors, and the company’s bond obligation comes to an end. Hence, it defines the lifetime of the bond. A bond’s maturity is a crucial consideration an investor looks into based on the investment goals. The maturity of a bond is classified in 3 ways:

- Long-term: bonds which mature over more extended periods of time

- Medium-term: Maturity dates of these bonds usually are over ten years

- Short-term: tend to mature within one to three years

Secured/Unsecured

A bond can be of two types - secured or unsecured. Typically, a secured bond pledges certain assets to bondholders in case the company cannot repay the obligation for any particular reason. This asset may also be called collateral on loan. This is so, if the bond issuer defaults, the asset that is pledged is then transferred to the investor instead. Mortgage-backed security or MBS is a type of secured bond. These are usually backed by the titles to the home of the borrowers.

While unsecured bonds, on the other hand, are not backed by any assets or collateral. In this case, the interest and principal are only guaranteed by the issuing company. They are also called debentures. These bonds return little of your investment in case the company fails. Hence, unsecured bonds are much riskier than secured bonds.

Liquidation Preference

When a company goes bankrupt, it usually repays investors in a particular order as and when it liquidates. Once a firm sells off all its assets, it begins first to pay out its investors. Senior debt is debt that has to be paid first, followed by junior (subordinated) debt. Stockholders get whatever is left.

Coupon

The coupon amount usually represents interest paid to bondholders. Either annually or semiannually. This coupon may also be called the coupon rate or nominal yield. In order to calculate the coupon rate, we can divide the payments by the face value of its bond.

Tax Status

Corporate bonds are all taxable investments. Most of the government and municipal bonds are tax-exempt. Some of the income and capital gains are not subject to taxation. Tax-exempt bonds usually have a lower interest than equivalent taxable bonds. An investor will calculate the tax-equivalent yield to compare the return with that of taxable instruments.

Callability

An issuer can pay off certain kinds of bonds before their maturity. In case a bond has a call provision, it may be paid off at an earlier date. Or at the option of the company mostly at a slight premium to par. Some companies may choose to call their bonds if interest rates allow them to borrow at a better rate. Most callable bonds appeal to investors as they offer better coupon rates.

What are the Risks of Buying Bonds?

Bonds are one good way to earn income since they tend to be relatively safe investments. Like an investment, bonds come with certain risks. Some of them are stated below:

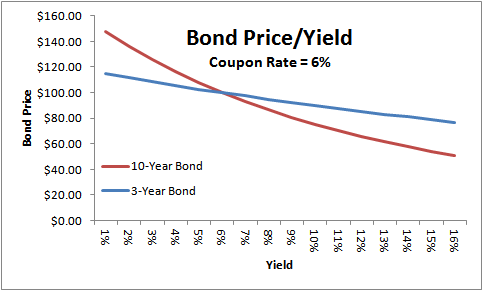

Interest Rate Risk

Interest rates share an inverse correlation with bonds, so bonds tend to fall when rates rise and vice versa. Let’s say interest rates decline significantly; the investor faces the possibility of prepayment. In case interest rates rise, the investor will be stuck with an instrument yielding below market rates. The longer the time for maturity, the greater the interest rate risk an investor bears. This is because it is harder to predict market developments in the future.

Credit/Default Risk

Every corporate bond has the possibility that the company may default on the debt. An investor needs to weigh in both the operating income and cash flow as compared to the debt. If it’s the other way around, then there is a higher possibility of credit or default risk. Hence, a credit or default risk is the risk that interest and principal payments due on the obligation is not being met.

Prepayment Risk

Prepayment risk is considered bad news. It is the risk that a given bond issue will be paid off earlier than expected. This is usually done through a call provision. This risk happens when the company only has an incentive to repay earlier when interest rates have declined. Hence, investors are left to reinvest funds in a lower interest rate environment.

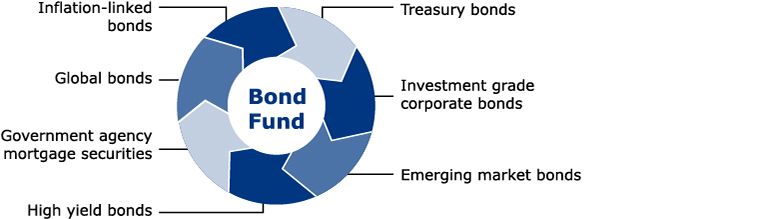

Different Categories of Bonds

There are 4 primary categories of bonds sold :

- Corporate Bonds - are issued by businesses and companies. Mostly companies issue bonds rather than take bank loans for debt financing. This is cause in most cases, bond markets offer lower interest rates and better terms.

- Municipal Bonds - are bonds issued by the states or municipalities. Some municipal bonds offer tax-free coupon income

- Government Bonds - are bonds that are issued by the U.S. Treasury. The category of bonds issued by a government is collectively referred to as treasuries. The bonds issued by the Treasury with a year or less to maturity are called Bills. Bonds which are issued with 1–10 years to maturity are called Notes. Bonds that are issued with more than 10 years to maturity are called Bonds. Government bonds that are issued by national governments is known as sovereign debt

- Agency Bonds - are those issued by government-affiliated organizations such as Fannie Mae or Freddie Mac.

Exploring the World of Bonds

We are gonna look into examples of varieties of bonds below:

- Fixed Rate Bonds - have a coupon that remains constant throughout the life of the bond

- Floating Rate Bonds - are notes have a variable coupon that is linked to a reference rate of interest

- Zero-Coupon Bonds - are issued at a substantial discount to par value, so that the interest is effectively rolled up to mellowness

- High-Yield Bonds - are bonds that are rated below investment grade by the credit rating agencies

- Convertible Bonds - let a bondholder exchange a bond to a number of shares of the issuer’s common stock

- Exchangeable Bonds - allows for exchange to shares of a corporation other than the issuer

- Inflation-Indexed Bonds - in which the principal amount and the interest payments are indexed to inflation.

- Asset-Backed Bonds - as explained before, are securities whose interest and principal payments are backed by underlying cash flows from other assets

- Subordinated Bonds - are those that have a lower priority than other bonds of the issuer in case of liquidation

- Covered Bonds - are backed by cash flows from mortgages or public sector assets

- Perpetual Bonds - are also often called perpetuities or ‘Perps’. They have no maturity date

- Bearer Bond - is an official certificate issued without a named holder

- Registered Bond - is a bond whose ownership is recorded by the issuer, or by a transfer agent

- Treasury Bond - or government bond as explained before is issued by a national government

- Supranational Bond - is issued by a supranational organisation like the World Bank

- Municipal Bond - is a bond issued by a state, U.S. Territory, city, local government, or their agencies

- Book-entry Bond - is a bond that does not have a paper certificate

- Lottery Bonds - are issued by European and other states

- War Bond - is a bond issued by a government to fund military operations during wartime

- Serial Bond - is a bond that matures in installments over a period of time.

- Revenue bond - is a special type of municipal bond distinguished by its guarantee of repayment

- Climate Bond - are bonds issued by a government or corporate entity in order to raise finance for climate change mitigation and projects

- Dual Currency Bonds

- Retail Bonds - are a type of corporate bond mostly designed for ordinary investors

- Social Impact Bonds - are an agreement for public sector entities to pay back private investors

Measuring A Bond’s Returns

How do you understand and measure the value of a bond? It is by the value of its return. Bond yields are all measures of return on your investment. Yield to maturity is the measurement often and commonly used. However, it is important to understand several other yield measurements that are used in certain situations.

Yield to Maturity (YTM)

As noted above, yield to maturity is the most cited yield measurement.It's an estimate of the value, if the bond is held to maturity and all coupons are reinvested at the YTM rate. It measures what the value of the return on a bond.

The coupons will mostly not be reinvested at the same rate. Hence, an investor’s actual return will differ slightly.

Current Yield

Current yield is calculated to compare the interest income provided by a bond to the dividend income provided by a stock. Current yield is most useful for investors concerned with current income only.

This yield is calculated by dividing the bond’s annual coupon by the bond’s current price. The formula incorporates only the income portion of the return, ignoring possible capital gains or losses.

Nominal Yield

The nominal yield is simply the percentage of interest to be paid on the bond periodically. Nominal yield is calculated by dividing the annual coupon payment by face value or par of the bond. Kindly take note that the nominal yield does not estimate return accurately. Hence, nominal yield is only used for calculating other measures of return.

Yield to Call (YTC)

A callable bond has a probability of being called before the date of maturity. Usually for yield to call, the investor will check in on the prepayment risk, as they will want to know what yield will be realised if the bond is called at a particular call date. The investors will realize a slightly higher yield if the called bonds are paid off at a premium.

Realized Yield

Realized yield of a bond is calculated when an investor plans to hold a bond only for a certain period of time, rather than wait for it to mature. In such a case, the investor will sell the bond. The projected future bond price is estimated for the calculation.

Key Takeaways

- Characteristics of bonds include - their maturity, their coupon rate, their tax status, and their callability

- Types of risks associated with bonds include - interest rate risk, credit/default risk, and prepayment risk

- Most bonds come with measures that describe their investment grade

- Bond's yield (multiple types)measure their returns

Wrap Up

Though the bond market appears complex, it is really driven by the same risks and return tradeoffs as the stock market. Once you have gotten a hang of the lingo, the rest is easy.

If you masters these few basic terms and measurements to learn the familiar market dynamics, then you can become a competent bond investor even if you can't become James bond.