Are you on the road to success as you set out to be in terms of business finances?

Your company’s balance sheets can help you measure if you are on the right track as you estimated. The balance sheets along with the other financial documents are the most efficient way of assessing the economic progress of your business.

If you are seeking to step up your finances with the help of your balance sheets, calculating your balance sheet ratios could just be the perfect metric to track.

Here’s what we shall learn about them in this post:

- Balance Sheet: An Overview

- What is a Balance Sheet Ratio?

- Types of Balance Sheet Ratios

- Efficiency Ratio

- Solvency Ratio

- Liquidity Ratio

- Profitability Ratio

- How can Deskera Help You?

- Key Takeaways

Balance Sheet: An Overview

One of the four crucial financial statements, the balance sheet assists in keeping a close tab on the financial wellbeing of your business. It can be bifurcated into three parts given as follows:

- Assets: What you own

- Liabilities: What you owe

- Equity: The amount that remains with you after covering all expenses

In this overview, we recall that the balance sheet’s total must be equivalent to the total liabilities and the equity. If both sides do not tally the final total, you will need to run through the figures to spot where the discrepancy arises.

The following equation can be helpful:

To summarize, we can state that your balance sheet provides a glimpse into the future and the current financial health of your business. This brings us to talk about the balance sheet ratios, which further our cause of estimating the company's financial structure.

What is a Balance Sheet Ratio?

Providing a complete interpretation of a company's results quantitatively, balance sheet ratios are used to compare two items on the balance sheet or analyze balance sheet items. Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders, and business owners to fetch an insight into the financial status of the organization.

Balance sheet ratios are a great means to estimate the financial standing. These are essential formulas that can lead you to gain in-depth information about the commercial aspects of the organization.

These financial ratios, which primarily involve balance sheet components like assets, liabilities, and shareholders' equity, are used to evaluate predicted returns, related risk, financial stability, etc.

In the subsequent sections, we shall go through the balance sheet ratios and their sub-types.

Types of Balance Sheet Ratios

Although the types of balance sheet ratios are not limited to what we shall discuss in this article, the table below shows the essential balance sheet ratios.

These balance sheet ratios are further divided into different types. Let’s visit them in the following table:

Efficiency Ratios

The efficiency ratios evaluate how effectively a business uses its resources. It represents the company's overall operational performance. We will learn about the various sub-types of the efficiency ratios.

Inventory Turnover Ratio

The inventory turnover ratio shows how quickly a company's inventory is moving off the shelves. This ratio is used to evaluate how effectively a business uses its resources. It represents the company's overall operational performance.

They demonstrate how frequently a corporation has replaced its whole inventory after selling it. A low inventory turnover ratio may be a sign of reduced sales or that the company is holding onto unsold inventory. A high inventory turnover ratio, meanwhile, is not always a sign of a strong company unless it's accompanied by strong sales numbers.

The formula for calculating the inventory turnover ratio is given as follows:

Inventory Turnover Ratio Example

Assuming your COGS was $400,000 and the average inventory value stands at $75,000, then your inventory turnover ratio would come up as follows:

Thus, your inventory turnover ratio will be 5. This shows that your company can sell and also replace its stock five times a year.

Receivable Turnover Ratio

The receivable turnover ratio is used to determine how soon the company recovers its receivables from its clients and customers. A high ratio of accounts receivable to total revenue shows that clients are having trouble paying their invoices, which is indicative of blocked credit. The credit length offered to customers differs from industry to industry, so it is important to compare receivable turnover to the company's peers in the same industry.

It is calculated with the help of the following formula:

Receivable Turnover Ratio Example

Let's say net credit sales for the year of your company was $200,000 with average accounts receivable of $40,000. To assess your accounts receivable turnover ratio, you apply the formula as shown in the following:

This calculation gives you 5 as your receivable turnover ratio.

Payables Turnover Ratio

The Payables Turnover Ratio shows how quickly a business can pay its creditors. It signifies the promptness with which a business is paying its suppliers.

Additionally, a low payables turnover shows that the business is not making use of any potential advantages from the suppliers' longer credit terms.

The Payables ratio needs to be examined based on the industry the company operates in, much like the Accounts Receivable Turnover Ratio. The formula to calculate it is given as follows:

Payables Turnover ratio Example

Assuming that your company has made purchases worth $25,000,000. Also, at the end of the year, it has an open accounts payable balance of $400,000. Then your payables turnover ratio will be calculated as shown here:

This gives you the payables turnover ratio as 6.25.

Asset Turnover Ratio

The asset turnover ratio denotes the efficiency of the company while utilizing its assets to generate revenue. The more effectively a corporation uses its assets to generate revenue, indicates a greater asset turnover ratio. A corporation is not effectively employing its assets to produce sales if it has a low asset turnover ratio.

It is only natural that the purchase or sale of a large asset will affect the asset turnover ratio which the companies should be mindful of.

Here is the formula to calculate the ratio:

Asset Turnover Ratio Example

Imagine a startup that needs funds for its operations and is considered for investment by an angel investor. However, the investor wants to estimate how the startup utilizes its assets to generate sales and also demands to see the financial statements.

Here is how things play out thereafter:

Initial or beginning assets = $50,000

Ending assets = $100,000

Net Sales = $25,000

Thus, the asset turnover ratio will look like this:

The ratio comes out to be 0.33. This translates into the startup generating only 33 cents for every dollar.

Net Working Capital Ratio

The net working capital ratio signifies whether or not the company utilizes its working capital efficiently to sustain its operations. Fundamentally, it is the difference between the total current assets and the current liabilities of the company.

Here is how it is calculated:

Net Working Capital Ratio Example

A retail store has listed down the following figures for the various aspects concerning its finances:

Accounts Payable = $7,500

Cash = $10,000

Accounts Receivable = $5,000

Accrued Expenses = $2,500

Inventory = $15,000

Other Trade Debt = $5,000

The net working capital ratio of the store can be estimated through the above formula:

$30,000 - $15,000 = $15,000

This signifies that the working capital of the retail store is positive and that they are financially sound in the short-term. This also implies that they could use this extra liquidity to expand and grow the business further.

Solvency Ratio

A company's capacity to pay off its financial commitments is gauged by its solvency ratio. It also shows whether the business generates adequate cash flow to pay off both its short-term and long-term debt obligations. This ratio is useful for prospective business lenders as it provides insights into the overall financial health of the firm.

Let’s learn about the various types of Solvency ratios.

Debt to Equity Ratio

The debt-to-equity ratio is a financial metric that shows how much debt and shareholder equity were utilized to finance the assets of a company. The ratio, often known as risk, gearing, or leverage, is directly connected to leveraging. In other words, it denotes the amount of equity available to the company to repay its debt obligations.

Debt to Service Coverage Ratio

The debt to service ratio denotes the company’s ability to repay the debt obligations. It is a crucial indicator used in commercial real estate loans that aid the analysts in determining how much can be borrowed by the business.

Debt to Asset Ratio

The debt ratio is a leverage ratio that shows what percentage of assets are financed with debt. The degree of debt and financial risk increases as the ratio rises. It is calculated by dividing the entire debt of a company by the total assets of the company. This implies that a company with $100 million in total assets and $10 million in total debt has a ratio of 0.1.

Liquidity Ratio

The liquidity ratio is also known as the banker’s ratio and shows how capable a company is of meeting short-term obligations. Different sectors have varied standards of liquidity ratio; which is to say that the liquidity ratio is directly dependent on the industry.

Current Ratio

The current ratio essentially represents the efficiency with which you liquidate your current assets to pay off your debts or current liabilities. High liquidity is indicative of your company being able to generate funds quickly in times of sudden expenditure. This also goes to denote that your company can avoid getting into business debt if it can generate sufficient money to cope with an unexpected expense.

Let’s look at the equation to derive the current ratio:

A current ratio explains how your current assets and liabilities are related. Current assets are valuable possessions that your company intends to use or convert to cash within a year. Current or short-term liabilities are paid within a year after the date of occurrence.

Divide your current assets by your current liabilities to obtain your current ratio. The optimal current ratio is greater than 1:1. Let’s understand this with the help of an example.

Current Ratio Example

Suppose a company has $40,000 in current assets and $20,000 in current liabilities. You can arrive at your current ratio by dividing your current liabilities by your current assets.

Your current ratio would be 2:1; which implies your assets are double your liabilities.

Quick Ratio

Quick ratio can be defined as a metric that lets us estimate a company’s potential to meet its short-term obligations utilizing its most liquid assets.

The quick ratio is similar to the current ratio in the way that both examine the liquidity of your company. Despite this similarity, the quick ratio still maintains a few differences from it. The main distinction between quick and current ratios is that quick ratios require that inventory must not be included.

Due to the fact that the carried-over inventory can't always be turned into cash at its book value, some organizations decide to exclude it from the ratio. A good quick ratio must be greater than 1. Here is how you can calculate the quick ratio:

Quick Ratio Example

Assume you have $4,000 in inventory. Considering that you have $40,000 in current assets and $20,000 in current liabilities, your quick ratio can be calculated as follows:

Cash Ratio

Cash is by far the most liquid asset on the balance sheet; therefore, the cash ratio shows how much of the company's short-term obligations are covered by the cash on hand. It is typically applied to a struggling business.

Profitability Ratio

Companies often monitor the profitability of their business and this ratio helps them achieve just that. Let’s catch the different types of profitability ratios here.

Return on Asset

Return on asset helps estimate the net profit generated from the company’s total assets. It is good to have a higher return on asset ratio, as it indicates good utilization of the assets.

Return on Equity

Return on Equity is a profitability measure that contrasts a company's profits with the value of the equity owned by its shareholders. ROE is expressed as a percentage and is computed as net income divided by shareholders' equity.

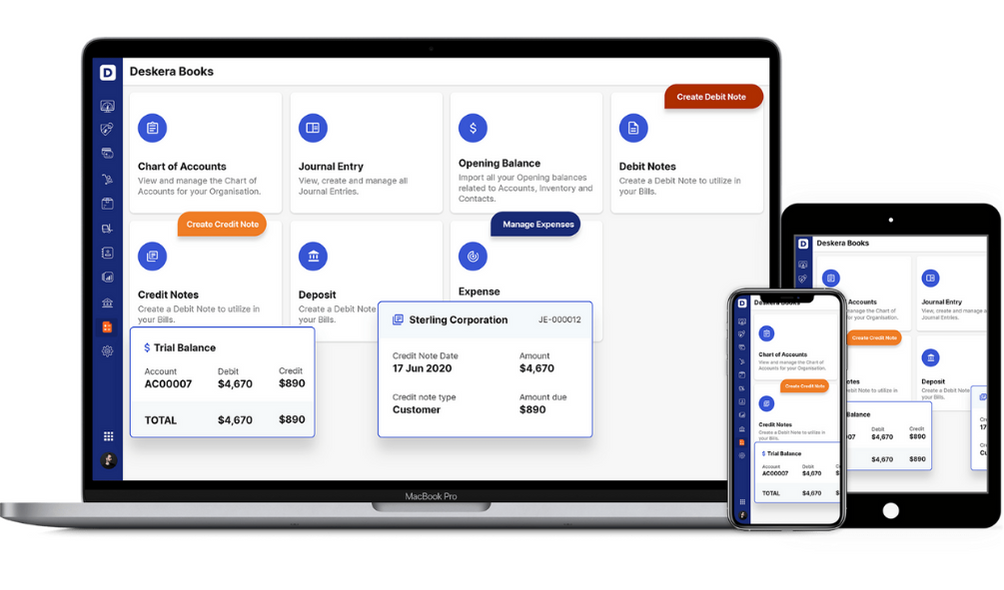

How can Deskera Help You?

Deskera Books can assist you in automating and reducing your company's risks. Deskera makes it simpler to create invoices by automating many additional tasks and lowering the administrative burden on your team.

Register right away to receive further Deskera benefits.

Find out more about the outstanding and all-inclusive software here:

Key Takeaways

- If you are seeking to step up your finances with the help of your balance sheets, calculating your balance sheet ratios could just be the perfect metric to track.

- Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders, and business owners to fetch an insight into the financial status of the organization.

- The efficiency ratios evaluate how effectively a business uses its resources. It represents the company's overall operational performance.

- Inventory turnover ratio, receivable turnover ratio, payables turnover ratio, asset turnover ratio, and net working capital ratio are the types of efficiency ratios.

- The inventory turnover ratio shows how quickly a company's inventory is moving off the shelves. This ratio is used to evaluate how effectively a business uses its resources.

- The receivable turnover ratio is used to determine how soon the company recovers its receivables from its clients and customers. A high ratio of accounts receivable to total revenue shows that clients are having trouble paying their invoices, which is indicative of blocked credit.

- The Payables Turnover Ratio shows how quickly a business can pay its creditors. Additionally, a low payables turnover shows that the business is not making use of any potential advantages from the suppliers' longer credit terms.

- The asset turnover ratio denotes the efficiency of the company in the process of utilizing its assets to generate revenue. The more effectively a corporation uses its assets to generate revenue is shown by the greater asset turnover ratio.

- The net working capital ratio signifies whether or not the company utilizes its working capital efficiently to sustain its operations. Fundamentally, it is the difference between the total current assets and the current liabilities of the company.

- A company's capacity to pay off its financial commitments is gauged by its solvency ratio. It also shows whether the business generates adequate cash flow to pay off both its short-term and long-term debt obligations.

- The solvency ratio is of three types which are known as debt to equity ratio, debt to service coverage ratio, and debt to asset ratio.

- The debt to equity ratio is a financial metric that shows how much debt and shareholder equity were utilized to finance the assets of a company. The ratio, often known as risk, gearing, or leverage, is directly connected to leveraging.

- The debt to service ratio denotes the company’s ability to repay the short-term debt obligations. It is a crucial indicator used in commercial real estate loans that aid the analysts in determining how much can be borrowed by the business.

- The debt to asset ratio is a leverage ratio that shows what percentage of assets are financed with debt. The degree of debt and financial risk increases as the ratio rises.

- The liquidity ratio is also known as the banker’s ratio and shows how capable a company is of meeting short-term obligations. The current ratio, quick ratio, and cash ratio are the three types of liquidity ratios.

- The current ratio essentially represents the efficiency with which you liquidate your current assets to pay off your debts or current liabilities.

- The quick ratio can be defined as a metric that lets us estimate a company’s potential to meet its short-term obligations utilizing its most liquid assets.

- Cash is by far the most liquid asset on the balance sheet; therefore, the cash ratio shows how much of the company's short-term obligations are covered by the cash on hand. It is typically applied to a struggling business.

- Profitability ratios help companies to determine the profitability of their business. Return on asset and return on equity are the two types of ratios under this category.

- Return on assets helps estimate the net profit generated from the company’s total assets.

- Return on Equity is a profitability measure that contrasts a company's profits with the value of the equity owned by its shareholders.

Related Articles