Selling to clients on credit always comes with the risk of them not paying you back on time.

To write off any uncollectible payments that your clients can’t fulfill, businesses use an account called bad debt expense.

In this guide, we will go through everything you need to know about bad debt expenses and how to calculate them, with practical accounting examples.

Read on to learn about:

- What is a Bad Debt Expense?

- How to Report Bad Debt Expenses

- How to Calculate a Bad Debt Expense

- Automate Expenses with Accounting Software

- Bad Debt Expense FAQ

What is a Bad Debt Expense?

Imagine you sold something to a customer, and they owe you $300. Now that customer has an accounts receivable (AR) debit balance of $300.

After trying to collect this receivable for an extended period of time and getting no response (not even an expressed refusal to pay), the customer’s AR account becomes uncollectible.

This type of defective, unrecoverable payment is known in accounting as a bad debt expense. To fix your financial statements and recognize the default, you have to write-off the bad debt.

You can do this through two methods: by creating an allowance for doubtful accounts, or from a direct write-off.

We’ll explain both cases in detail, with concrete examples as we go along.

What Causes Bad Debt Expenses?

A bad debt expense usually arises due to one of three reasons:

- When the customer is intentionally engaging in fraud, and simply doesn’t want to pay the seller (or is unreachable)

- The client has insufficient resources and wants to delay payment

- The client is unhappy with the service/product received and refuses to pay.

Regardless of the reason, too many bad debts can easily derail a small business. That’s why it’s important to have a reliable credit policy, with a limit to the number of uncollectible accounts.

Want to learn how to send invoices that get paid on time? Check out our guide on how to send an invoice (invoice email examples included).

Bad Debt vs Doubtful Debt

As the name suggests, doubtful debt refers to debt that is unlikely to be paid.

Bad debt, on the other hand, is debt that will definitely not be repaid and so needs to be written off. A debt may start off as doubtful, and then transition to bad debt in the future if it becomes clear that payment cannot be collected.

There are many indicators that can inform your decision of whether (and when) to write off a debt as bad.

Lack of contact is usually a clear sign, but also look at the age of the receivable: common thresholds are the 90-day or even 120-day mark. Some companies have a reputation for taking longer to pay. If you have limited info, go by gut instinct.

How to Report Bad Debt Expenses

There are 2 ways to report bad debt expenses:

#1. Direct Write-Off

With the direct write-off method, you dismiss the receivable as soon as it’s clear that the customer won’t pay you.

The journal entry for the direct write off method includes:

- A debit to the bad debt expense account to record the cost,

- And a credit to accounts receivable to zero out the balance of the customer.

To explain this better, let’s look at a practical example:

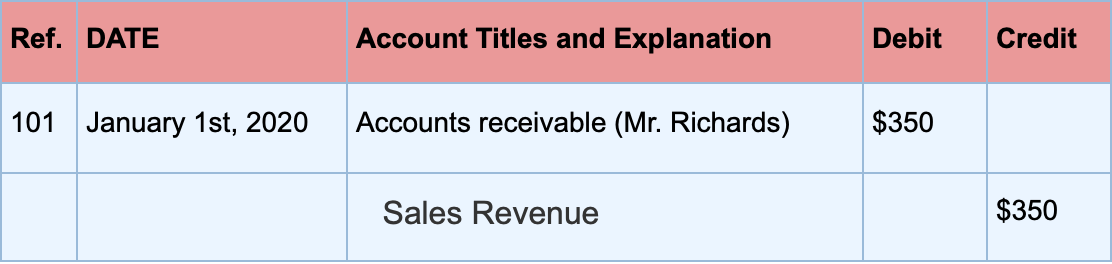

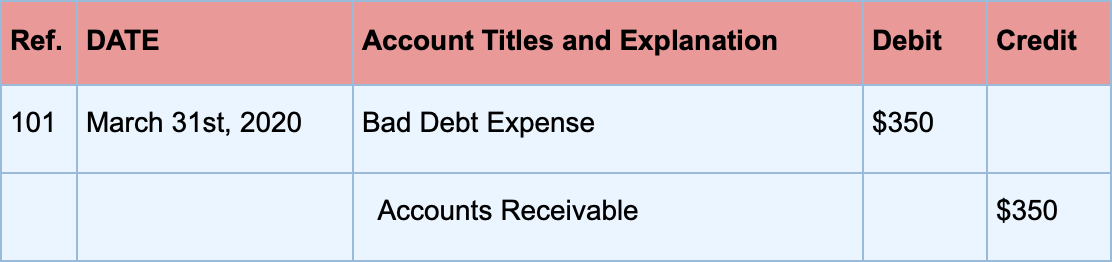

Your client Mr. Richards purchases $350 worth of merchandise on January 1st, 2020. This transaction is recorded as a journal entry as shown below:

After 3 months of consistent phone calls and emails, Mr. Richards won’t respond and still hasn’t paid you the $350 for the merchandise. It’s time to record the uncollectible amount as bad debt through the following entry:

Now, there’s a significant downside to using the direct write-off method.

Most businesses use the accrual basis of accounting since it provides greater financial clarity and is considered mandatory by most accounting guidelines. An essential principle of accrual accounting is the matching principle.

The matching principle says that we have to match revenues with expenses. And by dismissing bad debt expenses directly with the direct write-off method, we violate this principle.

For example, let’s assume this transaction with Mr. Richards happened in October 2019, and we make this bad debt recognition in March of 2020, after 6 months.

That’s a direct violation of the matching principle as we made the revenue entry in 2019, and the expense in 2020.

For that reason, companies usually write off their bad debt by using another process called the allowance method.

#2. Allowance Method

With this method, businesses create an allowance, specifically to prepare for cases of bad debt expenses, so that money is taken out from that allowance.

If a customer's accounts receivable is identified as uncollectible, it is written off by deducting the amount from Accounts Receivable.

The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No expense or loss is reported on the income statement because this write-off is "covered" under the earlier adjusting entries for estimated bad debts expense.

Here’s an example.

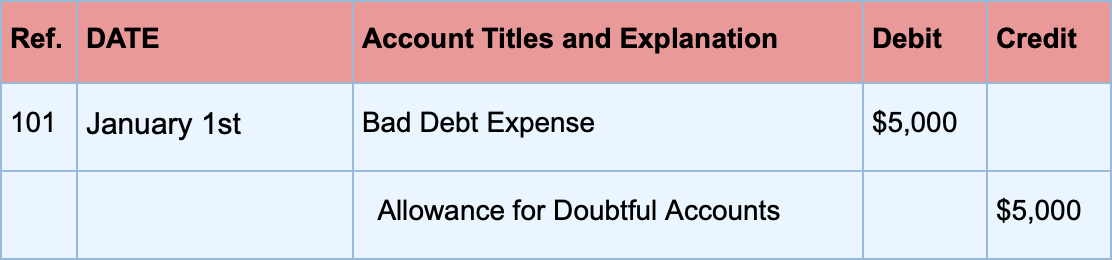

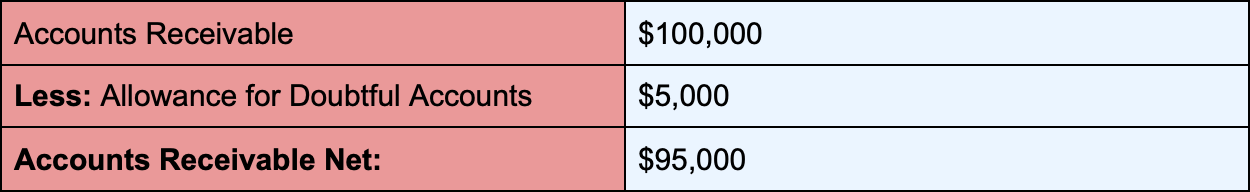

Let’s say the historical bad debt experience of a company has been 5% of sales, and the current month’s sales are $100,000. Based on this information, the bad debt allowance is set at $5,000 ($100,000 x 5%).

The journal entry for $5,000 allowance for our doubtful accounts would look like this:

The allowance for doubtful accounts is considered a contra-asset, which is a credit balance account that is associated with a normal asset account in the balance sheet.

In our case, the allowance for doubtful accounts is linked to accounts receivable.

To understand better, this is how the balance sheet entries for our previous example would look like:

Now, what happens if a client actually doesn’t pay?

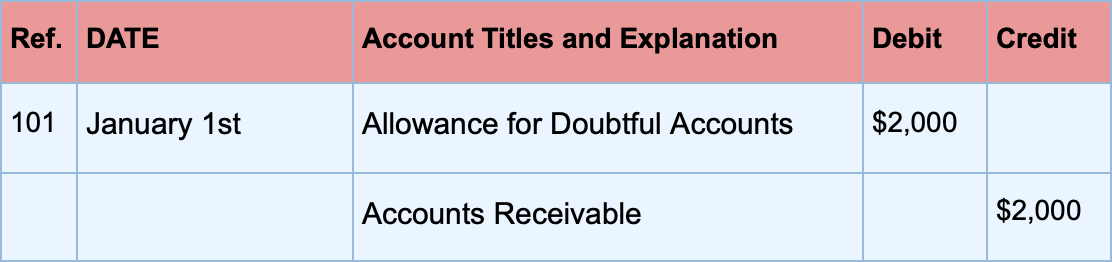

Let’s assume that Jim (irresponsible client) purchased $2,000 worth of merchandise, and is unwilling to pay his accounts receivable. Here’s how you’d write off that receivable through a journal entry:

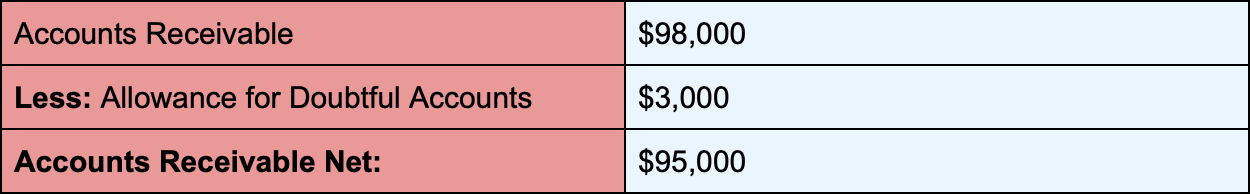

This journal entry creates a change in the balance sheet as well, dropping the allowance from $5,000 to $3,000 since we used $2,000 to cover Jim’s bad debt.

At the same time, accounts receivable drops by $2,000, going from $100,000 to $98,000.

And as you can see, the AR net doesn’t change. All that changes is the information we have regarding clients with past due invoices.

How to Calculate a Bad Debt Expense

We previously mentioned that our allowance for bad debt is just an estimate. It’s nearly impossible to always know when and how people will pay.

With that being said, there are two main methods you can use to estimate bad debt expense for your small business accounting: the percentage of sales, and the percentage of receivables method.

#1. Percentage of Sales

To estimate bad debt by using the percentage of sales method, you multiply a flat percentage by the total amount of bad debt.

Let’s take an example.

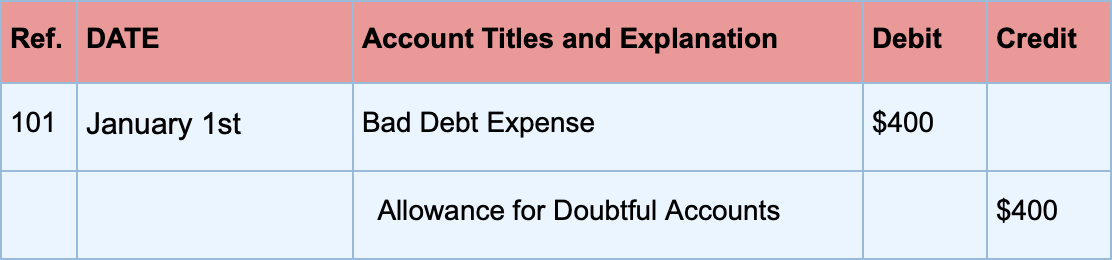

Assume Company XYZ currently has $10,000 worth of receivables (or credit sales). Based on past history, this company has concluded that around 4% of its customers who purchase goods and services on credit don’t pay.

Now, to estimate the bad debt expense with the percentage of sales method, the business has to multiply the 4% with the entire $10,000 owed.

The bad debt expense will amount to $400. The journal entry for this estimation would be:

#2. Percentage of Receivables

Under this method, we find the estimated value of the bad debt expense by calculating bad debts as a percentage of the accounts receivable balance.

Again, let’s check out an example to understand how these calculations work.

Assume that at the end of the year 2019, company XYZ has $30,000 in accounts receivable. The historical records of the business (which differ from company to company) tell us that an average of 4% of these accounts receivable is uncollectible.

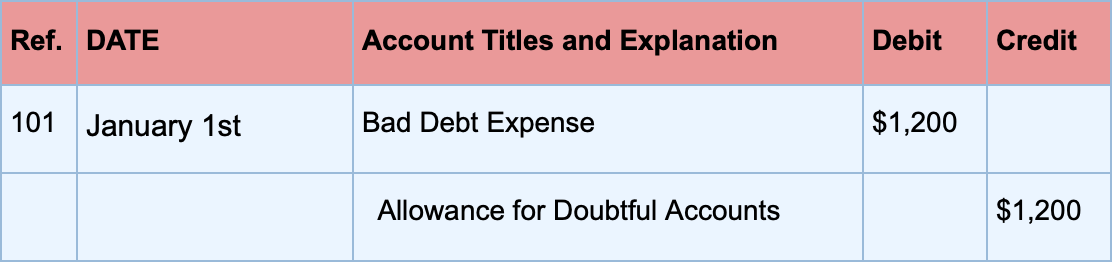

To calculate the bad debt expense, the business needs to multiply the $30,000 worth of receivables by the estimated 4%. That would give them $1200 worth of bad debt expense, which would be recorded as follows:

Automate Expenses with Accounting Software

Stay on top of your finances by automating your entire accounting cycle with Deskera, the cloud accounting platform that’s built with your business needs in mind.

Deskera allows you to keep tabs on all of your expenses via a single user-friendly dashboard.

Take paperless recording to a new level, by making orders, sending payments, and setting up your recurring expenses, all in one dashboard!

Automating your receivables is just as easy!

Send your clients sales invoices, request advance deposits, and receive payment in just a few clicks, from the Deskera Books platform.

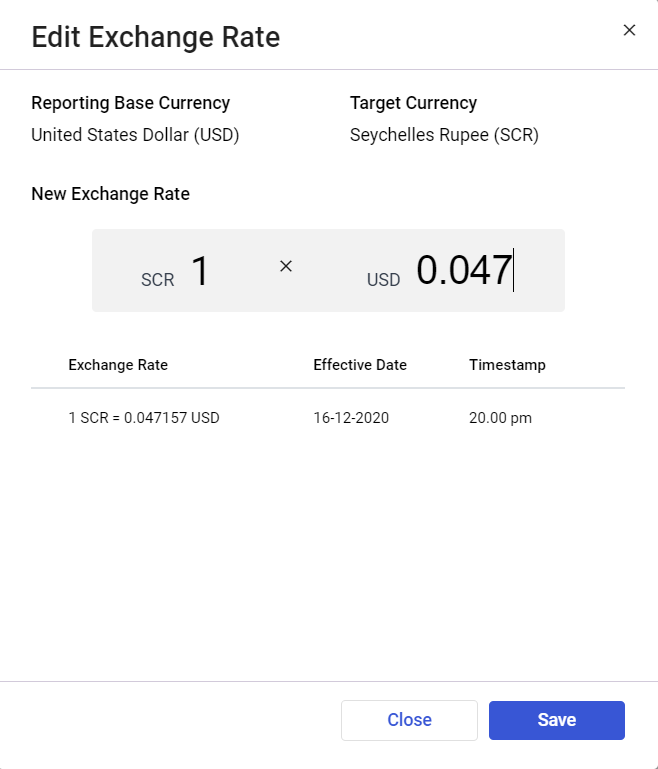

Do you work with international clients or purchase merchandise worldwide?

Deskera comes with multi-currency support for over 120 different currencies, so you don’t have to worry about exchange rates and forex gain/loss.

The best part? You can access the software anytime, anywhere by downloading the Deskera mobile app on your phone, tablet, or desktop.

Sign up for our free trial right away! No credit card details required.

Bad Debt Expense FAQ

#1. Is a Bad Debt Expense a Debit or a Credit?

When using the direct write-off method the bad debt expense is debited while the accounts receivable account is credited.

With the allowance method, on the other hand, bad debt is again debited, but allowance for doubtful accounts is credited instead.

#2. Is Allowance for Bad Debt an Expense?

No, an allowance for bad debt isn’t considered an expense, but a contra asset.

Contra assets are negative assets that have a credit balance, unlike assets that usually have a debit balance. They are associated with another asset, which for allowance of bad debt is the accounts receivable account, and reduce the balance of that asset.

Key Takeaways

And that’s a wrap! We hope our guide on bad debt expenses answered all of your questions.

Before leaving, here’s a recap of some of the main points we’ve covered today:

- Bad debt means uncollectible payments from clients refusing or unable to pay.

- Reasons commonly stem from customer dissatisfaction, insufficient funds, or fraud.

- Doubtful debt is money suspected to turn into bad debt, but that still has a chance of turning into payment.

- You can record bad debt either through a direct write-off or by utilizing the allowance method.

- The direct write off method dismisses the bad debt immediately, by debiting the bad debt expense and crediting accounts receivable. This method doesn’t comply with the accrual basis of accounting, so most businesses don’t use it.

- In the allowance method, an allowance is created in anticipation of cases of bad debt. It’s recorded by debiting the bad debt expense and crediting the allowance of doubtful accounts.

- The sum of the allowance is usually a set percentage of the company’s sales or receivables.

- Manage your business finances with an easy to use all-in-one accounting software like Deskera.

Related Articles