Most business owners tend to panic and jump to the conclusion that an “audit” refers to the IRS (Internal Revenue Service) auditing their business accounts for tax indiscrepancies. But an IRS audit is not the only type of inspection a business can encounter or should be prepared for. With that in mind, let's give you an idea of what we'll be covering today.

Index

- Auditing defined

- Types of audits

- What does auditing mean for your business: Benefits of auditing

- Embrace the power of audits

Introduction to Auditing

Most organizations conduct business or self-audits every year to ensure the accuracy of their books. But what are these self-audits, and what do these mean for a small business? Let's try and comprehend this.

A business audit is simply a measure of quality control that ensures the accuracy of financial information or data that is reported to the government. Similarly, a small business audit is an examination of a business' accounting records and tax returns to assure that everything is in line and complies with the government's relevant rules and regulations. Many business owners conduct company audits on an annual basis; some prefer to do it bi-annually as well.

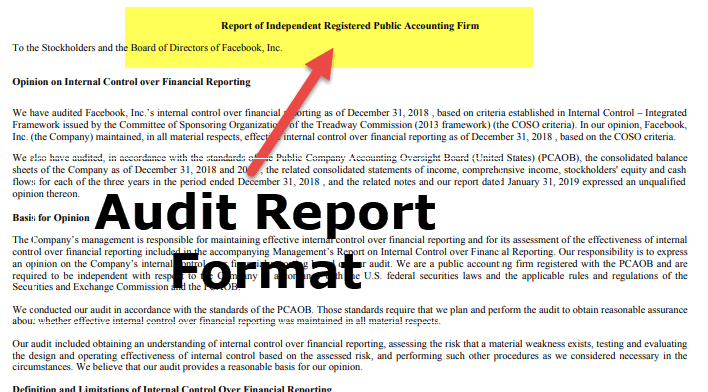

Here’s what a typical audit report looks like:

Now that we have learned about the meaning of business audits, let’s try and understand what other types of small business audit reviews are there.

Types of Small Business Audits

Internal Audit

Commonly known as self-audit, an internal audit is scheduled and conducted by a representative of a company, usually an auditor or accountant. Internal audits are conducted to check a business' finances as well as company policies, procedures, processes, compliance with local and federal state laws, etc. Such audits are carried out at least once a year to ensure their books and tax accuracy. An internal audit report remains within the company, and the findings are not submitted to any external organization.

When it comes to larger organizations, they have a dedicated audit review department that ensures everything complies with the law. On the other hand, small businesses might employ one or two professionals to conduct such audits. Following are the types of audit reports carried out by internal auditors:

External Audit

An external audit program, referred to as an independent audit, is an inspection that's conducted by a professional outside the company. This is called an independent audit program as the auditor is under no obligation or inclined to the business in any way. This eliminates any conflict of interest that may otherwise arise between the company and the auditor.

Typically, businesses that conduct independent external audit programs are complying with some kind of legal requirement. For instance, the SEC or/and the U.S.A. tax authorities require independent audits for specific organizations.

An external auditor provides a business with a financial audit review report that follows the (GAAP) Generally Accepted Accounting Principles. This report encompasses an opinion as to whether the company passed the audit or not. The auditor gives one of the following opinions in a business audit:

- Clean opinion wherein everything checks out.

- Qualified opinion wherein the auditor disagrees with some of the company's financial records, but the scope of which is too limited to raise a red flag.

- Adverse opinion wherein the auditor finds that the business' financial records have been tampered with or misrepresented.

- Disclaimer of opinion wherein the auditor doesn't provide any opinion on certain financial records.

Basically, an external audit program is conducted to ensure the IRS doesn't come knocking on your door.

Following are the types of audit reports carried out by external auditors:

IRS Audit

Here’s where things can go horribly wrong for any business. An IRS audit occurs when the tax authorities come across potential errors in a business’s tax returns. Typically, the IRS is the one that schedules inspections for tax returns filed in the last three years. To check for substantial errors or to detect fraud, the IRS may even go further back in time.

Few of the many factors that trigger an IRS auditing may include too many deductions, claiming losses for multiple years in a row, reporting high-income levels, etc.

Here’s how the IRS compliance activity chart looks like for the financial year 2019.

What Does Auditing Mean for Your Business: Benefits of Auditing

A Guide to Accuracy - One of the Most Significant Benefits of Auditing

An audit may help your company spot small mistakes before they lead to penalties or prosecution. And, non-IRS audit programs can catch errors before you file your business tax return, which further prevents IRS audits.

Improvements are on the Way

An auditing process can motivate you to implement improvements or updates in accounting processes. If your auditor cannot reach a conclusive statement, they can nevertheless help you improve your records for the next audit.

To keep your audits hassle free , it's a good idea to invest in a cloud accounting software which can help you keep your accounts accurate, complete and process driven. The chances of error and thus issues with audit are minimised.

Learn which accounting software is right for your business.

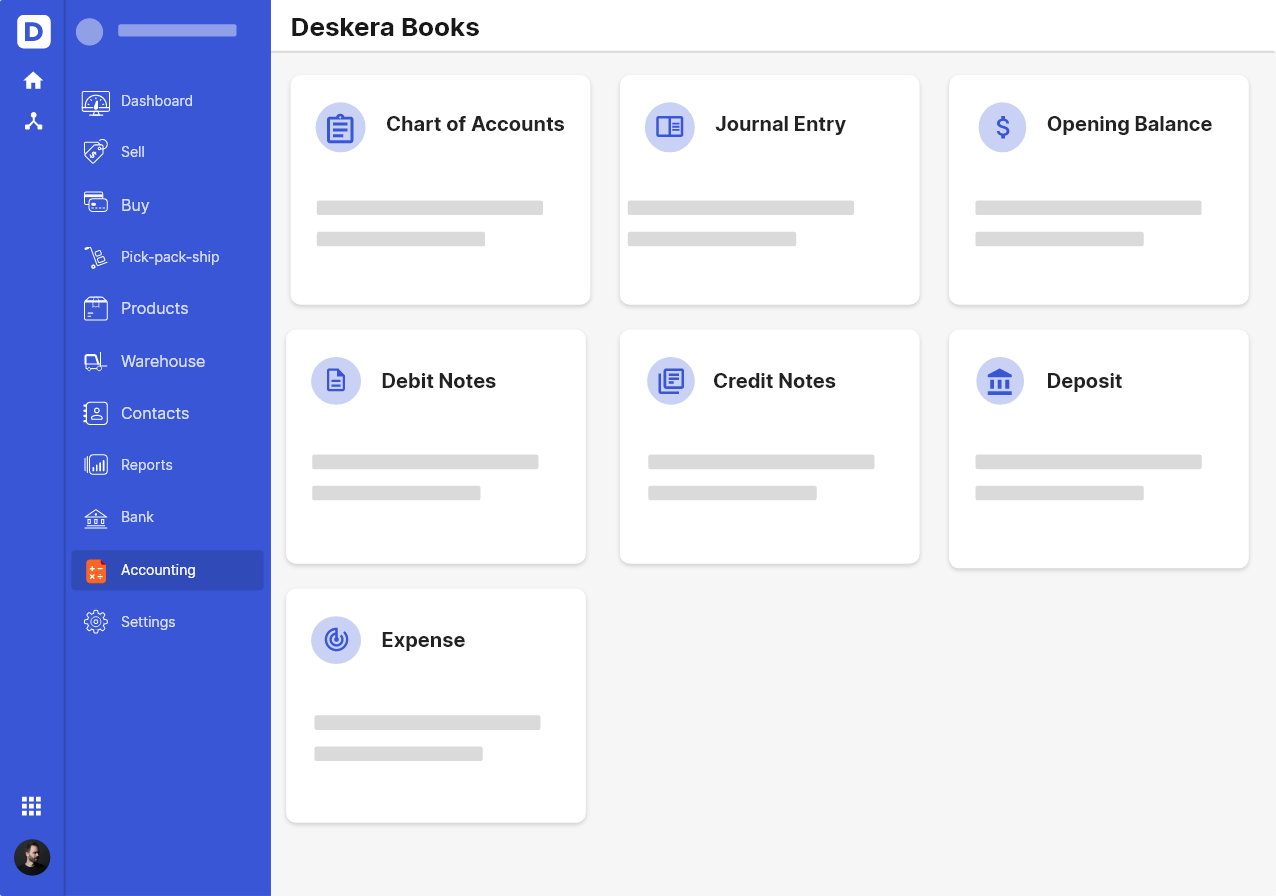

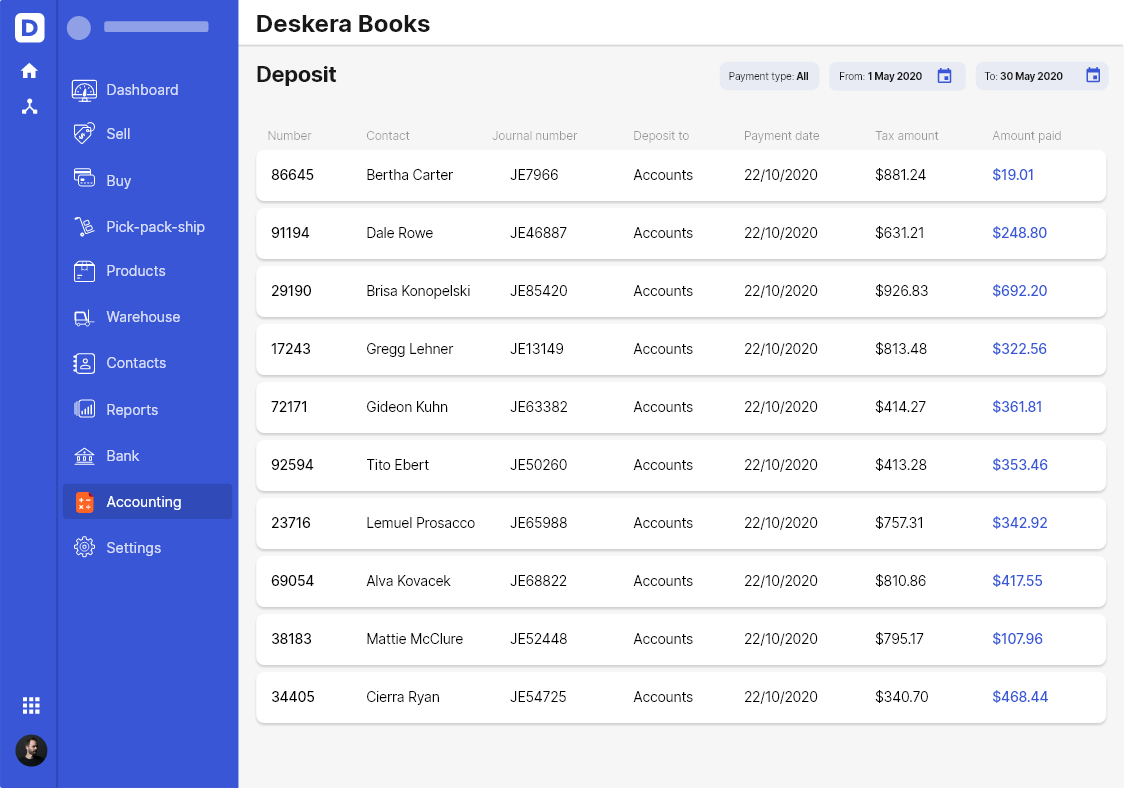

Here is a sample of accounting software template from Deskera that can help you keep your finances in check:-

Run your business better with these integrated solutions from Deskera.

Strengthen Your Bottom Line

Almost all business owners rely on financial statements to make business decisions. What happens if your financials are not up-to-date or accurate? You can end up making a disastrous business decision, or worse, invest in something you don’t have the funds for. By conducting a business risk audit, you are not only making sure that your finances are accurate but also making informed business decisions.

Send a Strong Message to the Investors and Lenders

If you are looking to expand your operations, you need capital and funds for your activities. Having audited financial statements that back your financial records can boost investors’ and lenders’ confidence in your company.

Embrace the Power of Audits

Small business audits or business risk audits are nothing to be afraid of. If you are running a legit business, these audit risk programs will only help you grow, improve, and remain in the good books of the IRS. Accounting software like that of Deskera can help you stay on top of your finances so that whenever you want to conduct a business risk audit, you have all the financial information in one place.