America's employers hired 467,000 new positions last month, a sign of the economy's strength despite a wave of omicron infections. The public authority's report additionally revised up its estimate of occupation gains for November and December by a consolidated 709,000. This brings light to the efforts that went behind the hiring process which also involves Hiring Paperwork.

Hence this article focuses on the New Hire Paperwork Requirements in Arkansas for 2020. We have covered the following topics:

- What is the new hire law?

- Steps to Hiring your First Employee in Arkansas

- Why is new hire reporting required?

- New hire paperwork list

- New hire reporting

- How frequently should the data be reported?

- PRWORA Compliance

- What is the penalty in the event that the report is late?

- PRWORA Enforcement

- How might the data be utilized?

- Key takeaways

A newly hired worker or New Hire signifies any worker, whether full-time or part-time, employed by the organisation and who is as yet employed as of the date of new worker orientation. It likewise incorporates all workers who are or have been previously employed by the organisation.

For those past workers, for purposes of this article just, the "date of hire" is the date whereupon the workers' employment status changed to such an extent that the workers were put in the CSEA unit.

What is the new hire law?

The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 was passed as a feature of the larger welfare reform legislation. This Act expects that all businesses report data on individuals they hire or re-hire to a state directory soon after they are employed.

Albeit a Federal law, this regulation looks to the individual states to carry out the law and to keep up with the directories of new hires. Arkansas Code, Title 11, Chapter 10, Section 902 is the execution of PRWORA within the State of Arkansas.

Steps to Hiring your First Employee in Arkansas

Hiring your first worker as another entrepreneur is both a thrilling and terrifying experience. Besides the fact that you have an individual depending on you to pay them so they can accommodate their family while balancing the cash flow of your business, yet, there is additionally a ton of paperwork alongside government and state regulations and guidelines to comply to.

The following are 8 steps a business should make while hiring their first worker in Arkansas.

Step 1 - Register as an Employer

Managers should initially get a Federal Employer Identification Number (FEIN) - Form SS-4 from the Internal Revenue Service (IRS) in spite of the Withholding Tax Number from the Arkansas Department of Revenue and an Unemployment Insurance Tax Account Number from the Arkansas Department of Workforce Services.

Step 2 - Employee Eligibility Verification

Each new worker should finish up the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is utilized to confirm citizenship and qualification to work in the U.S.

The worker should finish Section 1 by their first day of work, and the business will finish Section 2 before the finish of the third workday after the worker begins.

Managers who don't present the I-9 form yet are expected to save the form on file for a long time after the date of hire or one year after the worker's end, whichever is later.

Step 3 - Employee Federal Withholding Allowance Certificate

Every worker will furnish their employer with a signed Withholding Allowance Certificate (Form W-4) prior to the date of employment. The W-4 form decides how much federal income tax will be kept from the worker's check.

The business doesn't commonly submit Form W-4 to the IRS yet will keep a copy of the document.

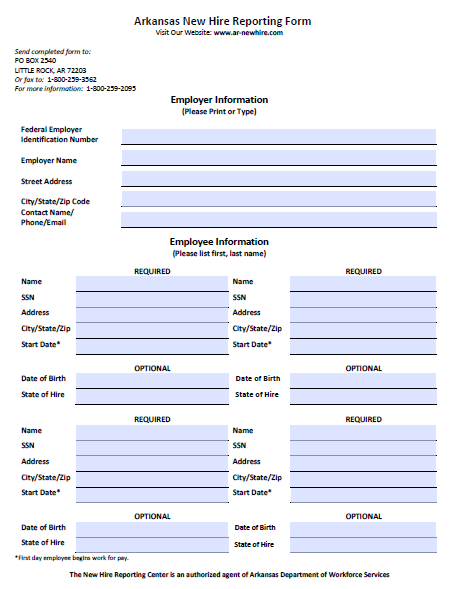

Step 4 – Arkansas New Hire Reporting

Arkansas employers are expected to report all newly hired and re-hired workers with the Arkansas New Hire Reporting Center within 20 days of employment or their rehire date. The Arkansas New Hire Reporting Form can be finished online, sent via mail to PO Box 2540 Little Rock, AR 72203, or faxed to 800‐259‐3562.

Employee Information that will be required incorporates the worker's name, address, Social Security Number, date of birth, state of hire, and the worker's date of hire.

Employer Information incorporates Federal Employer Identification Number, employer’s name, address, and contact telephone number.

This filing is expected through the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA). New hire data is recorded in the National Directory of New Hires (NDNH) and is matched against the State Directory of New Hires and federal child support information bases to locate parents who owe child support.

Stage 5 - Payroll Taxes

Subsequent to hiring workers, payroll taxes should be paid. Payroll taxes include:

Federal Income Tax Withholding: Employers keep money from every worker's check to pay the worker's federal income taxes in view of the data given in their W-4. The business pays no part of the saved portion tax however is answerable for gathering and dispatching the kept duties.

Federal income tax withholding reports are filed utilizing Form W-2, Wage, and Tax Statement with the IRS. Moreover, IRS Form 941 is expected quarterly, and IRS Form 940 is documented every year to report any unemployment taxes due.

State Income Tax Withholding: Similar to the government income tax withholding, state taxes are kept from a worker's check for state income taxes: Use Form AR4EC, Employee's Withholding Exemption Certificate from the Arkansas Department of Finance and Administration.

Medicare and Social Security: Medicare and Social Security taxes are paid under the Federal Insurance Contributions Act (FICA). The business pays half of FICA, and the other half is paid from the worker's wages.

Unemployment Insurance: Employers pay state and federal unemployment taxes in view of a level of every worker's compensation. This tax is known as State Unemployment Taxes (SUTA) and Federal Unemployment Taxes (FUTA).

Organizations will enroll with the Arkansas Department of Workforce Services for a state unemployment insurance (SUI) tax account number.

Step 6 - Workers' Compensation Insurance

All organizations with workers even a single part-time worker are expected to carry workers' compensation insurance coverage to take care of clinical expenses assuming that workers are injured at work. Worker’s Compensation Insurance is directed through the Arkansas Workers' Compensation Commission.

Step 7 - Labor Law Posters and Required Notices

Arkansas organizations should show Federal and State of Arkansas labor law posters where workers can easily view them. These posters illuminate workers regarding their employer responsibilities and rights under labor laws. Arkansas labor law posters can be separately printed from the Arkansas Department of Labor and Licensing's site.

Step 8 - Stay updated

It is critical to get the differences among workers and self-employed entities. Businesses will once in a while inappropriately classify workers as self-employed entities who have various principles on minimum wage, payroll taxes, overtime, and other labor laws. A singular's status as a worker or a self-employed entity is not entirely set in stone by recording IRS Form SS-8, Determination of Employee Work Status for Purposes of Federal Employment Taxes, and Income Tax Withholding.

There is a great deal to stay aware of while hiring workers for your business, yet your commitments and responsibilities as a business don't end there. Labor laws are complex and always showing signs of change. Make certain to stay updated with the Arkansas Department of Labor and the U.S. Division of Labor.

Why is new hire reporting required?

New hire reporting was intended to accelerate any child support withholding order processes by expediting the collection of child support from guardians who change occupations every now and again. It likewise finds non-custodial guardians to help in laying out paternity and child support orders. In this way, employers fill in as key partners in ensuring financial stability for some kids and families by assisting them with getting the monetary help they deserve.

New hire paperwork list

Before a new hire’s first day working, you need to set up a series of agreements and forms to appropriately onboard them. A portion of these records is expected by labor law, while others are discretionary.

A couple of things to remember:

- Take a look at your local labor regulations to ensure you follow the law consistently.

- When you collect signed agreements from new workers, securely store these documents in computerized or manual form as they contain private information.

Utilize this new hire paperwork checklist as an aide when you're onboarding new workers:

Set up an employment contract and receive signed, if relevant

You can send this agreement alongside your job offer email or letter. An employment contract ought to include:

- Termination conditions

- Compensation and benefits

- Work schedule

- Job information (job title, department)

- Length of employment

- Employee responsibilities

Ensure you and new hires complete employment forms legally necessary

These forms will give you new hire data, so you appropriately classify and remunerate workers. Regulation might contrast in view of your state or nation, so ensure you complete all vital forms within cutoff times. The most well-known kinds of business forms to finish are:

Federal and state new employee hire forms:

Equivalent opportunity data (EEO) form

An equivalent opportunity data (EEO) information form isn't needed for each business, yet a document utilized to comprehend a business' hiring practices. Numerous businesses incorporate the EEO-1 Survey with the application process in a digital form.

Form I-9

Form I-9 additionally alluded to as an Employment Eligibility Verification Form is utilized to decide new employee's work qualification and legal approval. As per the United States Citizenship and Immigration Services (USCIS), numerous businesses are expected to hold onto this record, and sometimes may likewise be expected to request additional information from the worker. Contingent upon the data given in the I-9, the business might have to demand a work visa or extra qualifications.

Form W-4

Form W-4 is utilized for tax reporting. As per the IRS, new workers should finish up a Form W-4 before they accept their first check. The workers will finish up Form W-4, including data like their legal name, marital status, wards, and withholding amount. Moreover, a few workers might decide to keep a bigger sum, and this is the form they will use to request that.

A record that proves employment eligibility

Employment eligibility documents are instrumental in recruiting new workers. This record helps in finishing up the I-9, as it proves your new recruit has the right to work in the United States. This document might be a Certificate of Naturalization, proof of permanent residency, or a birth certificate. Native American tribal documents additionally satisfy this role.

Notice of Coverage Options: Under the Affordable Care Act (ACA), businesses should give a Notice of Coverage Options to all new hires within 14 days of their beginning date. This prerequisite applies regardless of whether the business offer health care coverage or potentially the worker isn't qualified for health care coverage.

Compensation and hours: Under federal law, employers that utilize the tip credit should initially notify tipped workers of:

- The minimum wage that will be paid;

- The tip credit sum, which can't surpass the value of the tips really received by the worker;

- That all tips received by the tipped worker should be held by the worker aside from a valid tip pooling plan restricted to workers who generally and routinely get tips.

State and local notices: Many states and local jurisdictions additionally expect that businesses give specific notices to workers at the time of recruitment. These required notices might cover state disability insurance, leave entitlements, harassment and discrimination, state-run retirement programs, workers' remuneration, unemployment, and other work-related advantages and insurances. Many states expect employers to provide, in writing, the business name, address, and phone number; the worker's rate of pay and regular payday; and certain other data. Provide new hire sees as per your state and local prerequisites.

New hire reporting

New employee hire forms generally incorporate reporting documents, as organizations should report new workers in 20 days or less. Government regulation mandates that businesses report new hires to the relevant state agency within that number of days, however, states might require reporting in a shorter time-frame.

Internal new worker forms

Employee application

An application for employment is a form that businesses provide for interested candidates. It usually incorporates fields like name, address, contact data, past experience, and education. A few businesses may likewise demand references on the work application. Numerous organizations will hold on to a worker's application even after they have been employed. The application will turn into a part of the official employee file.

Worker contract

A Worker contract is a signed agreement between the business and the worker. The Worker contract records the requirements and expectations for the position with the goal that the two parties are clear about the agreement. The worker contract could likewise incorporate data about temporary employment assuming the worker is employed on a temporary premise.

Offer letter

The offer letter is the letter that comes directly after the business has consented to employ the candidate. While a business could initially give a verbal offer, this should soon be followed up with a written offer letter. The written offer letter incorporates significant details concerning the employee’s terms of employment, including their beginning date, pay rate, and any additional benefits that might be offered. On the off chance that the worker consents to the terms of the offer letter, they will sign it and return it to the business to be filed.

Copy of background verification

A few employers require background verification for new hires. Assuming a background verification is finished and the worker is recruited, a copy of the background check might be remembered for the worker's file. As a rule, the background verification doesn't meticulously describe the situation however illuminates the business whether they have passed or failed.

Direct deposit form

A lot of workers today prefer to get payment directly deposited into their bank balance. An immediate store structure gives the business the position to naturally store assets into the representative's financial balance. It additionally allows them to store the bank data. To finish the process, the business should have a direct deposit form on record.

Plan and get signatures on internal forms

Try to get signatures on forms your organization uses to lay out its relationship with workers. These could include:

- Non-compete agreements: Similar to an NDA, a non-compete agreement protects an organization from workers who might leave one business and look for work in another within a similar industry. Working for another organization that is a direct competitor of the past employer could be viewed as a conflict of interest. A non-compete agreement keeps the worker from working with a direct competitor during a specific time frame and within a specific geographic region.

- Non-disclosure agreements: A non-disclosure agreement, likewise alluded to as an NDA or confidentiality agreement is utilized to protect proprietary data in an organization. New workers will usually access an organization’s business plans, worker contacts, client data, and other proprietary information. In the event that the worker was to leave the organization and share those secrets, it very well may be unfavorable to the organization. A non-disclosure agreement requires the worker to confidentiality, regardless of whether they proceed with work with the organization or not.

- Employee invention forms

- Employee handbook acknowledgment forms: Many organizations incorporate an employee handbook filled with advice, rules, and other data for new hires. It could likewise contain significant data concerning the safety and legal liability. Thusly, it's typical for organizations to require an acknowledgment of the data in the handbook. This guarantees that all new hires are in total agreement and comprehend key data that will assist them with succeeding at their new organization.

- Confidentiality and security agreements

- Drug or alcohol test consent agreements

- Employee equipment inventory lists

- Job analysis forms goals, responsibilities, and performance evaluation criteria

Plan employee benefits documents

Assuming you offer worker benefits, you should give new hires paperwork that depicts agreements and, at times, get them signed. The most widely recognized worker benefits are:

- Employee wellness perks (e.g. gym memberships)

- Life and health insurance

- Sick leave

- Mobile plan

- Paid time off/vacation policies (including any paid holidays)

- Company car

- Stock options

- Retirement plan

- Disability insurance

- Tuition reimbursement

Get workers' personal data for emergencies

To support health and safety in the work environment, it's ideal to track workers'':

- Emergency contacts

- Food sensitivities or inclinations ex., vegan

- Brief clinical history

How frequently should the data be reported?

Managers are expected to submit new hire reports in no less than 20 days after a worker is employed, rehired, or gets back to work. Assuming that you have various new hires in a month and are submitting monthly transmissions, these documents should be submitted in two monthly transmissions not over sixteen days apart.

PRWORA Compliance

To comply, you need to report to your State Directory of New Hires (SDNH). It could be its own department or part of a bigger division-typically the Department of Health and Human Services or the Department of Labor. The state will share data with the NDNH, which then, at that point, cross-references new hire data with other state reporting centers.

What is the penalty in the event that the report is late?

A penalty of $25 per worker each month might be evaluated for every failure to report a new hire. Additionally, a penalty of $500 might be assessed for the failure to report new hire data in the event that the failure is the consequence of conspiracy between the business or government entity and the worker.

PRWORA Enforcement

Each quarter, the federal government sends each state organization a list of employers that are not complying with reporting necessities. The state then, at that point, has the choice about how to continue with enforcement, which can include:

- A civil fine of up to $500 per unreported new hire when the business and worker conspired not to report.

- A letter informing the business regarding their necessities with data on the most proficient method to report.

- A civil fine of up to $25 per unreported new hire.

How might the data be utilized?

Government and State laws contain strict guidelines on how new hire reporting data might be utilized. New hire reporting data is matched against any open child support orders to find non-custodial guardians and authorize these orders. This data will likewise be taken care of into a public registry to give more current data to situating out-of-state noncustodial guardians.

New hire data may likewise be utilized by states to help detect and prevent fraudulent payments to beneficiaries of unemployment insurance, welfare benefits, and worker’s compensation. The utilization of this data keeps up with financial stability in Arkansas families and assists with holding down the cost of welfare, worker’s compensation insurance, and unemployment.

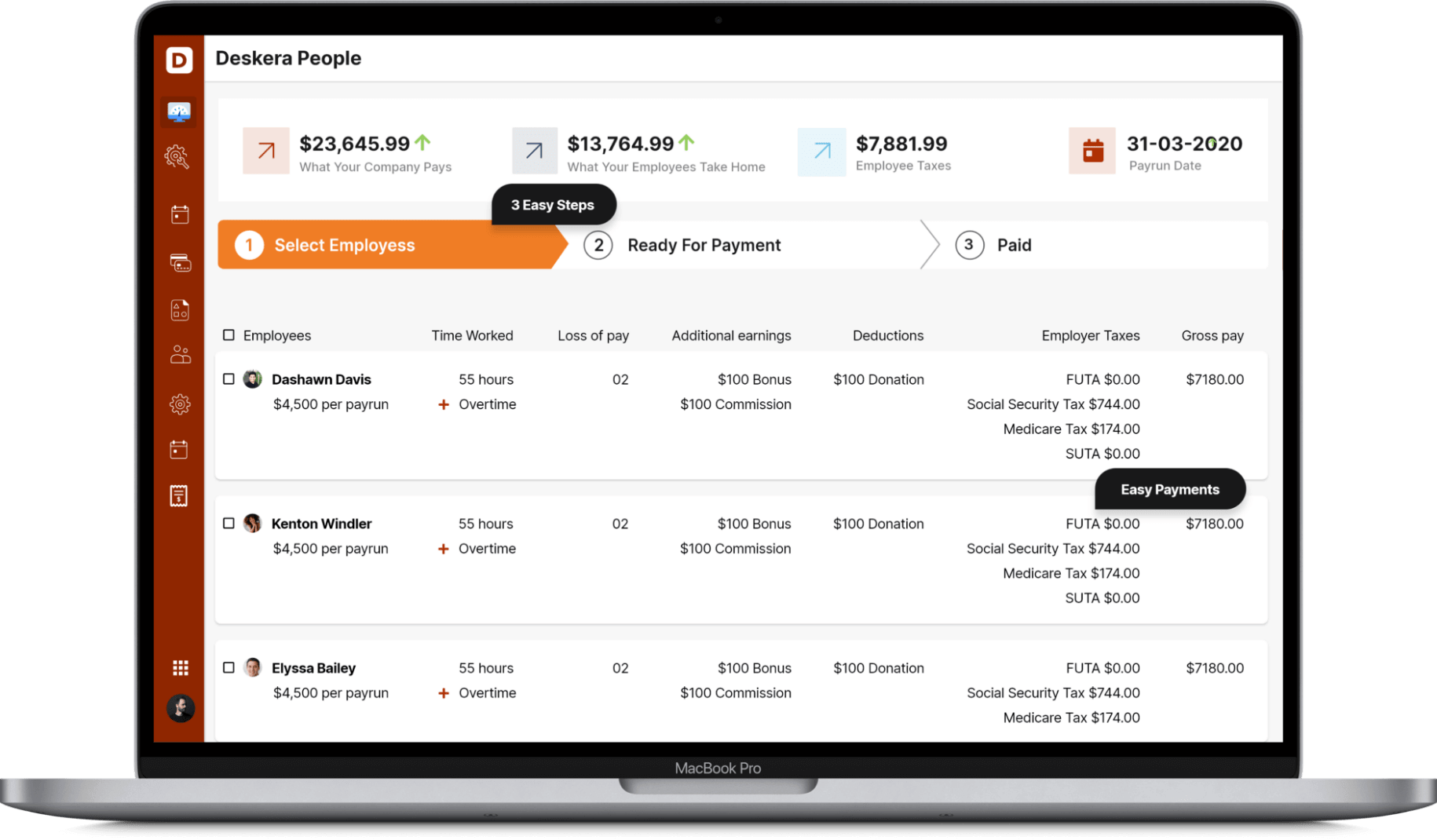

How Deskera can help you?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- New Hiring Paperwork is especially significant for entrepreneurs as far as their new hire reporting prerequisites. Organizations should report personal identification data about newly hired workers as per government rules, in addition to extra reporting requirements which contrast from one state to another.

- Whenever a new hire is found to have public support, the state government will remove the person from the support program. Commonly, nothing further is expected from the business, however, there are situations where the state will attempt to recover incorrect assistance payments. States do this through income withholding.

- A driver's permit and state ID are the most common types of ID for work. Be that as it may, they're not by any means the only acceptable IDs. A Social Security card, residency license, and passport are generally reasonable types of identification proof. The US or foreign birth certificate can likewise prove ID.

Related articles