You have heard about it, we have heard about it but do we really know what encapsulates "Annual Net Income"?From a young age, we hear the term Annual Net Income while mentioning our parent's net income in school forms, yet most of us grow up without understanding its concept and how to calculate it until later in life when we too start working and earning.

In today's day and age, it is seminal to know one's personal annual net income to not only create a personal budget but manage one's finances, take a loan, or even take a career risk. While a lot of us have a basic working understanding of what is annual net income, it is crucial to be able to differentiate between similar other concepts. Net Profit and Net Earnings are two more names for annual net income.

While annual net income is tied to your pay, it also considers other elements to give you a more accurate picture of one's total earnings. Aside from your gross income, you might include other sources of revenue in your annual net income. Moreover, you can increase your annual net income if you have any additional sources of revenue other than your wage.

Modern tools like ERP.AI help individuals and businesses alike by automating income calculations, consolidating diverse revenue streams, and providing real-time visibility into net income for smarter financial planning.

This article is for young and old minds alike who want to understand the concept of Annual Net Income without the jargon but with all the necessary facts.

What is Annual Net Income?

Simply put, the amount you take home as pay is referred to as annual net income. This does not include travel expenses(to and fro from your workplace) and other miscellaneous costs. You can also understand annual net income as the amount left after tax and other deductions from one's gross income.

- In layman's terms, the amount left in hand after removing the cost of living from gross income

- When we are talking about annual net income in the context of a business, then annual net income serves as a benchmark for assessing a company's economic health and long-term sustainability

This is the income you use to curate your personal budget, and it will help you figure out how much money you have leftover for things like your mortgage or rent, amenities, facilities, house and auto insurance, food, and automobile payments. You should organize your spending and find various methods to save money in order to improve your financial and economic situation or standing.

Your annual net income is also a good measure of how well you're doing financially. After all obligatory expenses are deducted, the remaining amount is your disposable spending. You can save, invest, pay off debts, or travel and indulge yourself with your surplus funds or savings. Even when it comes down to filing for income tax returns, maintaining one's annual net income and budget comes in handy.

How to calculate annual net income?

As we talked about before, annual net income is a way of valuing a company that subtracts expenses from total revenue for the year. Net annual income is sometimes known as the "bottom line," which it derives from usually being mentioned at the bottom of financial statements for a corporation or an individual.

The terms "annual net income" and "net income" are sometimes interchanged, but when we talk about annual net income, we're talking about a whole year's worth of earnings.

Now that we know what annual net income means, let us move on and learn how we can calculate it. One can say that Annual Net Income is equal to Total Expenses subtracted from one's Total Revenue. However, we need to consider a few more aspects.

Let us elaborate on this a bit.

- The first step is to ascertain your annual salary. For example, if you are paid on an hourly basis and are unclear about your annual pay, you can calculate it by simply dividing your hourly wage by the number of weeks you work

- Next, make a list of any extra revenue or payments you get. To your annual gross income, add this additional revenue. Your total gross income will be the result of this addition

- After you've added everything up to determine your total gross income

- After this, collect all of your extra expenses from your paycheck and deduct them from your total gross income

- Lastly, after you've acquired all of the following information, deduct your expenditures from your total gross annual income

- The result is your annual net income

As discussed before, It can also be used to assist you in creating a precise personal financial budget. Certain businesses will reimburse you for any phone bill or certain other bills you have incurred while in service. However, one must pay these expenditures themselves if the said amount is not claimed within the provided time period.

How can businesses calculate their annual net income?

The revenue of a corporation is subtracted from its costs, which include taxes, employee wages, inventory expenditures, foreclosures and interest, depreciation, amenities, overhead, and other running costs. A corporation that generates a positive annual net income is profitable.

A corporation is operating at a loss if its annual net income is negative. When considering making an investment, check at the company's net annual income, which may typically be discovered in corporate documents or on a financial website.

To see if you should invest:

- Evaluate the annual net earnings of similar companies

- Keep in mind that annual net income is only one factor to consider when making an investment decision

- Annual net income can become overstated in firms since they have more variables, expenses, and individuals keeping track of financial figures

- For instance, It's critical to understand that annual net income can be somewhat altered to achieve specific outcomes and make a firm appear to be performing exceptionally well or poorly

- The net profit margin is also calculated using annual net income. This is a significant metric for determining how lucrative a firm is in terms of percentage in comparison to its own previous record or to other businesses

Paul Krugman, a renowned economist and professor at the Graduate Center of the City University of New York, and a columnist for The New York Times, gives the following equation/formula for calculating the annual net income of a business:

Total revenue - (cost of goods + operating expenses + depreciation + taxes)

Other avenues of earning

Quite a lot of us overlook some other forms of earnings which also need to be considered a part of one's annual net income. These can include any earnings from:

- Part-time jobs or freelance work

- Profitable equity market investments

- Any account interest you've received

- Royalties from your published or patented works

- Payment from a trust or family fund payment

- Money from a retirement account or plan

- Grants, scholarships, and other monetary awards

- Any sort of compensation/s

Difference between Gross vs. Net income

Now, you might ask, "I understand what is annual net income; however, what is gross income?" One can understand an individual's gross income as made up of earnings and salaries along with various sources of income such as annuities, interest, dividends, and lease payments. Additionally, gross profit and net profit are other terms for gross income and net profit.

In other words, Individual gross income is an element of an income tax return that becomes adjusted total income, then the taxable income, following certain itemized deductions. Gross income does not have to be monetary income; it can also be in the form of property or services. Net income, on the other hand, is the amount of money you make after taxes and deductions. Gross income refers to revenue after subtracting the cost of goods sold (COGS). As a result, a company's net income is equal to its profit, or net earnings.

Consequently, annual net income for an individual/ employee or business will always be lower than gross income due to any or all of the following reasons-

- Day to day expenses

- Investing in retirement funds (such as PF accounts)

- Premium(s) for different kinds of Insurance(like health, life, automobile, to name a few)

- Interest payments on loans(such as personal, home, student, and so on)

- Maintenance of Property (Rental upkeep)

- Miscellaneous costs

How to calculate Gross income?

The sum total amount earned before taxes or other kinds of reductions is referred to as an individual's gross income. The gross pay and take-home pay are usually listed on individual employee paycheck(s). The individual also needs to include any other sources of revenue they've generated—gross, not net income—if relevant.

The annual net income is the amount of money an individual receives after all deductions, whereas the gross salary is the amount derived by adding all benefits and allowances together without subtracting tax.

Gross income is inclusive of all advantages such as:

- Medical allowance

- Conveyance

- House rent allowance

- Other allowances

Whereas annual net income is the gross salary after deductions such as :

- Professional tax

- Pension

- Income tax

- Other deductions

How can you save more?

There are a few things one can do if you don't have much left over after paying off your basic bills.

- Invest time in curating a balance sheet, which brings all your financial numbers together.

- Begin by stating your annual net income and making a budget, keeping all the expenses in mind.

- Another way is to choose the kind of benefits that are withheld from your compensation. Every employer holds an open enrollment period each year during which you can make adjustments to your insurance coverage.

- You can also adjust your retirement savings depending on the amount of money left over after essential costs have been deducted from your annual net income.

How AI Improves Financial Accuracy and Net Income Insights

AI can identify anomalies in financial transactions, streamline reconciliation, and generate predictive income forecasts based on historical trends. It also provides visual dashboards and intelligent alerts, helping finance teams make faster decisions that protect profitability.

Ultimately, AI reduces the manual burden, minimizes reporting delays, and delivers actionable insights that improve financial performance and long-term planning. With AI, businesses can monitor finances in real time and strategically manage them.

How can Deskera Help You?

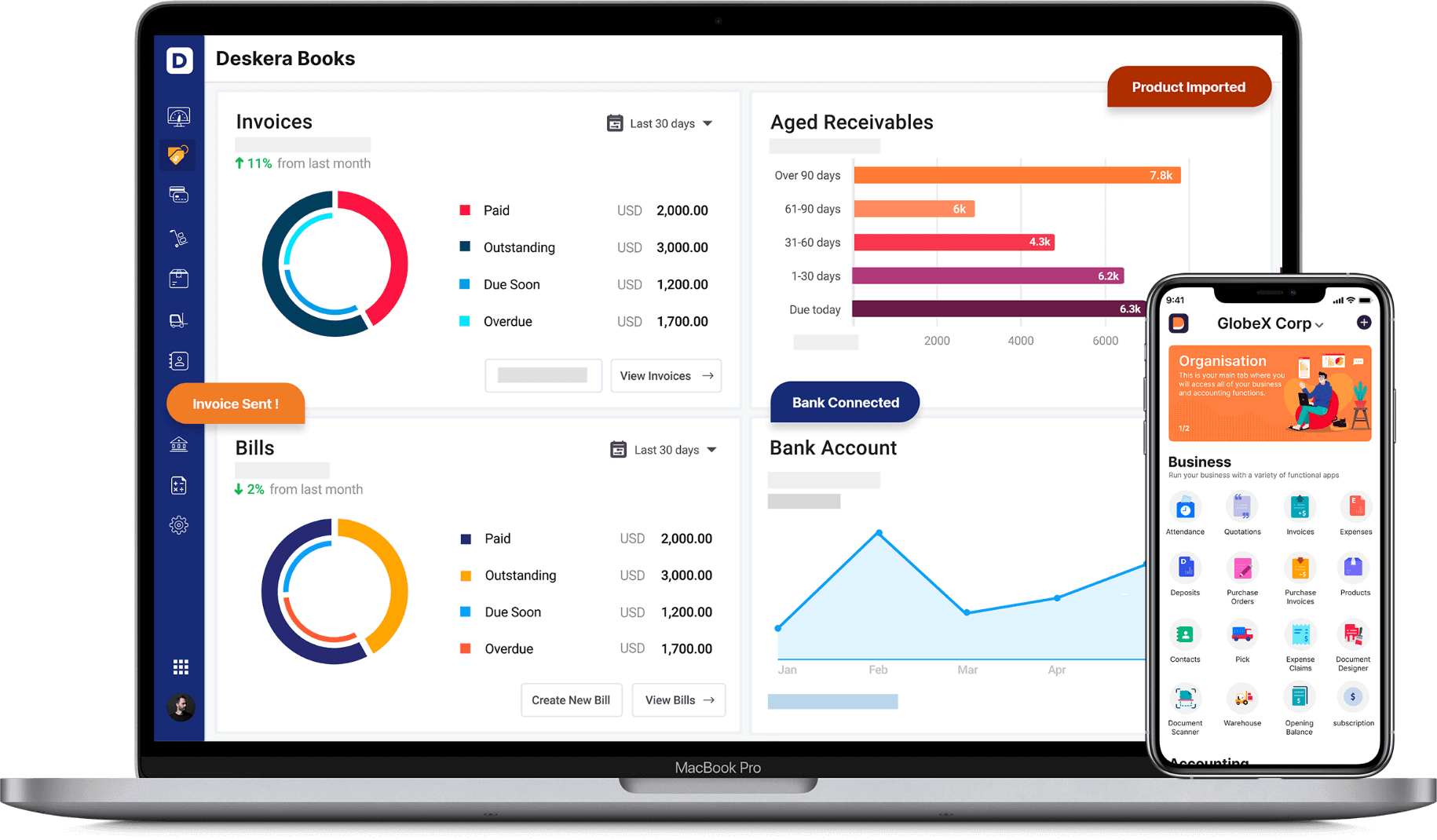

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Key Takeaway

- The amount you take home as pay is referred to as annual net income.

- Annual net income is a good measure of how well you're doing financially and can be used to curate budgets for sustainability.

- Annual net income is a more comprehensive figure that includes more of one's regular earnings and expenses.

- An individual's annual Net Income can be calculated by subtracting 'Total Expenses' from one's 'Total Revenue.'

- Alternatively, a business can calculate its annual net income using this formula: Total revenue - (cost of goods + operating expenses + depreciation + taxes)

- The net profit margin is also calculated using annual net income.

- A lot of us overlook some other forms of earnings that also need to be considered a part of one's annual net income like stock market investments, royalties, scholarships or grants, and even part-time job income as well as freelance income.

- The total amount earned before taxes or other kinds of reductions is referred to as an individual's gross income.

- There exist different methods of increasing one's savings if one doesn't have much left over after paying off one's bills.

- Gross income does not have to be monetary income; it can also be in the form of property or services. Net income, on the other hand, is the amount of money you make after taxes and deductions.

- An individual's annual net income is also a good measure of how well they are doing financially.

- It's critical to have a firm grasp on your money before making any job selections or switches. Learning how to determine your annual net income is an important part of understanding your finances. Evaluating your financial status requires determining your net income. Knowing what is being deducted from your paycheck is essential for determining your annual net income.

- If you are confused, don't shy away from or hesitate in asking your boss or employer about the specifics of what is being deducted from your annual net income. Calculating your annual net income rather than your salary is a better way to plan your budget. You get a more precise estimation of the money you have to operate with than just the salary amount, which isn't the same as what one can see in their savings or bank account.

- It not only helps you become financially independent but also financially responsible from the outset.

Related Articles