Even though Alabama ranks with one of the lowest state-level payroll taxes, the average combined state and local taxes is 9.42%. The individual income tax is at a lower rate of 2.00% to 5.00% and a 6.50% corporate income tax rate.

Alabama is one of the most accessible states where you, as an employer, can run your company’s payroll taxes through only one state form. Although a few local payroll taxes are issued to consumers, companies in Alabama usually follow federal rules for their state payroll taxes.

Don’t be misguided by this simple facade because you cannot expect to make an error when it comes to counting your payroll taxes. So, here is a step-by-step guide on how you can proceed through completing and submitting the payroll taxes for your business in Alabama:

For the sake of easy understanding, this article has been divided into the following sections:

- Step 1: FEIN Number

- Step 2: Registration with the State of Alabama

- Step 3: Payroll Process Creation

- Step 4: Employees to Fill out Relevant Forms

- Step 5: Tracking Employee Working Time

- Step 6: Calculation of Employee’s Gross Pay and Taxes

- Step 7: Employee Benefits, Wages, and Taxes Payment

- Step 8: You Must Save your Company’s Payroll Records

- Step 9: Filing of the Payroll Taxes to Federal Government and State Government

- All About the Alabama Payroll Taxes

- Employer Unemployment Alabama Payroll Taxes

- Ensuring Worker’s Compensation

- Income Taxes

- Alabama Payroll Taxes for Employees and their Wages

- Bottom Line

- Key Takeaways

Step-by-Step Guide

Step 1: FEIN Number

A Federal Employer Identification Number is required to pay your payroll taxes in Alabama. In case you are a new company, you have to access the Electronic Federal Tax Payment System (EFTPS) to register yourself and attain a FEIN number for your company. Your FEIN is needed for your company to qualify as a federal taxpayer and to file your payroll taxes.

Step 2: Registration with the State of Alabama

If your business is new in Alabama, the first thing you must do is register your company with the Alabama Secretary of State as well as with the Alabama Department of Revenue. These two registrations must be done for your company to qualify to pay payroll taxes.

Step 3: Payroll Process Creation

To finalize this step, you need to specifically state the process of payment and intricate details on how you will pay them. This will broadly include:

● How often you will pay your employees

● When will you be paying your employees

● What is the process of onboarding that will work for your company

● Selection of the method you will use to make their payments, whether it is through direct deposit or paper cheques

● An update on employee information

To make this process easier, you can hire some payroll tax service or set up a payroll tax template that will guide you through how you can calculate your Alabama payroll taxes and meet the deadlines frivolously.

Step 4: Employees to Fill out Relevant Forms

Your business will only be qualified to file payroll taxes in Alabama if your employees fill out the relevant forms required for the process. The following forms need to be filled out by your employees:

● I-9 Verification Form for Payroll Taxes

● W-4 Form(especially Form A4, which is Employees Withholding Tax Exemption Certificate) for Payroll Taxes

Step 5: Tracking Employee Working Time

You must start calculating your employee’s working time and other taxes before the due date. For this, the hourly and nonexempted employees need to provide you with the documented work time, which you then have to cross-check to be certain. This will allow you a smoother process for payroll tax payment in Alabama.

Step 6: Calculation of Employee’s Gross Pay and Taxes

Here is an idea of the average Alabama Payroll Tax Rate

|

for Alabama |

Single Filers, Married but Filing Separately, and Head of Household |

Tax Income For Married Filing Jointly |

|

2% |

$0-$500 |

$0-$1000 |

|

4% |

$501-$3000NHh |

$1001-$6000 |

|

5% |

$3001 and up to |

$6001 and u |

It is not recommended to calculate your company’s payroll by hand, but you must rely on recommended specific calculators that aid in determining your payrolls.

Step 7: Employee Benefits, Wages, and Taxes Payment

The state of Alabama does not hold a record of a minimum wage rate, but according to the federal minimum wage rate, you must pay your employees at least $7.25 per hour and nothing below that to qualify to file payroll taxes.

Most employers pay their employees their wages through direct bank deposits and very few hand out cash or cheques. There is a greater degree of proof and accountability of payment when an employer pays through direct deposit instead of cash.

Step 8: You Must Save your Company’s Payroll Records

It is a good and effective practice for Alabama-based employers to maintain their employee payroll taxes records in case of emergency requirements or otherwise. This should be done even though the State of Alabama does not require employers to keep payroll records of their employees.

Step 9: Filing of the Payroll Taxes to Federal Government and State Government

For filing payroll taxes to the Alabama State Government, file it to the Alabama Department of Revenue through an online portal.

As far as federal payroll taxes are concerned, you can file them online means using your EFTPS through two means:

● Semiweekly- For payments made on Wednesdays, Thursdays, and Fridays, file the employer’s tax by the following Wednesday, and for payments made on Saturdays, Sundays, Mondays, and Tuesdays, the filing should be done by the following Friday.

● Monthly- On a monthly schedule, you must file the employer’s taxes every 15th of the month.

All About the Alabama Payroll Taxes

In addition to the Alabama State payroll taxes and Alabama Federal Payroll Taxes, most of the time, barring a few exceptions, employers and employees need to pay Medical(1.45%) and Social Security Taxes(6.2%) according to the Federal Insurance Contributions Act.

There are a host of other taxes that employers need to pay according to the payroll taxes guidelines of Alabama:

Employer Unemployment Alabama Payroll Taxes

According to the State Unemployment Tax Act, known as SUTA, all businesses must pay this tax at any cost. Whether a small business, large business, new or old, every business operating in Alabama has to pay SUTA taxes under their payroll taxes.

The current rates range from 0.65% to 6.8%, which brings the base payment to $8000. All the brand new employers in the state of Alabama will pay a 2.7% SUTA rate for their first year.

Also, the businesses that successfully pay the taxes on time and in the full amount are subject to retracting a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes.

Such an arrangement deliberately encourages businesses to make their payments on time to retrieve the tax credits.

Ensuring Worker’s Compensation

The general rule of thumb in Alabama is that businesses with more than 5 employees need to pay the worker’s compensation as a way to make up for the injuries suffered on the job during their work hours, and this must be included while filing your payroll taxes in Alabama.

The State of Alabama usually pays unemployed workers money that compensates their loss of income and medical expenses for two to three weeks after they lose their jobs. However, there are exceptions.

If your business has no casual employees, domestic workers, and agricultural workers, you won’t fall under the category under which you have to make the worker’s compensation payments.

Income Taxes

Depending on where your employees reside, some local payroll taxes may be levied. So if your employee lives in another state and works in Alabama, they are subject to double payroll taxes.

However, here are some local taxes that the state levies on employees working in Alabama.

Bessemer- 1%

Birmingham- 1%

Gadsden- 2%

Macon County-1%

Alabama Payroll Taxes for Employees and their Wages

The Minimum Employee Wages

In 2008, the minimum age requirement under federal law for paying wages to employees in Alabama was set to $7.25 per hour.

In case the employees get tipped, the company must pay at least $2.13 to make up for the minimum wage anyhow.

Payment for Overtime Work

According to the Fair Labour Standards Act(FLSA), Alabama ensures that they follow the protocol of the act to make their payments for overtime working employees.

This means that the company must pay their employees 1.5 times more than their hourly wage if and only they work for more than 40 hours in a workweek. This must be added to the payroll taxes in Alabama.

Using an overtime calculator will ensure what you pay the employees is not less or more than the desired amount.

Alabama Pay Stub Laws

There is no law in Alabama that forces companies to make payroll taxes for stub laws. However, for transparency and security, we recommend you do so. It gets simpler if you adhere to using a payment stub law calculator.

Alabama Paycheck Deductions with Payroll Taxes

There is no law in Alabama that states that the employers cannot deduct money from the employee’s wages and are also not obliged to make paycheck deductions on the employee’s cheques while filing for the payroll taxes. However, under the following circumstances, a company can resort to deducting money from their employee’s paychecks.

● Any shortage related to cash

● Stolen company property, damages, and unprecedented losses

● An extra requirement for work uniform and tools for the business

According to the Department of Labour, no cause can deduct money from the paycheck if the employee earns less than the federal minimum wage ($7.25 per hour) for that pay period. This is a very strict law that gives liberty to the employer but at the same time ensures that the employee’s rights are maintained.

Making Payments to the Employees

Alabama employers have no pressure from compulsory laws to make payments to their employees at a certain time with a certain definitive frequency, and the state also does not specify the process to follow while making the payment to their employees or filing payroll taxes in Alabama.

However, this is the pay schedule almost all employers follow in Alabama:

● Cash

● Paper check

● Direct deposit

● Payroll card

The Final Paychecks of Employees Under Termination

Again, Alabama law does not dive down into specifics under which the employers are obliged to pay their terminated employees a certain amount at a certain period of time.

What is best followed is to ensure your terminated employees get their final paycheck is to pay it in the month after on the regular set date of payment. Don’t forget to include the information in the payroll taxes in Alabama.

Crucial Alabama Laws that Affect Payroll Taxes of Companies

Meals and Break Times Provided to Employees,

Unfortunately, Alabama law does not specify any meal timings or breaks when it comes to employees who are aged 16 years and above. As an employer, you will not be persecuted for not allowing your employees mealtime, but it is recommended that you give them breaks to improve performance.

New Hire Reporting in Alabama

To enforce child support orders, the employee’s name, address, and Social Security number should be included when you report a new hire to your company to the Alabama Department of Labor New-Hire program. This is a mandatory step that you need to follow.

According to the law in Alabama, minors who are aged 14 and 15 must receive a 30-minute break if they have to work for 5 to 6 hours a day. However, there is no obligation that these breaks need to be paid breaks.

Alabama Strict Child Labor Laws

Here are some thumb rules, and companies are obliged to follow them if they hire minor employees aged 14 and 15.

● They can work up to 40 hours per non-school week.

● No working for more than 18 hours of work in a school week

● No more working than three hours on a school day

● No working before 7 a.m. or after 7 p.m. during the school week

The Alabama law strictly prohibits the working of 16 and 17-year-olds under the following category of industries and professions

● Working in a mine or a quarry

● Wrecking, demolition, and shipbreaking

● Roofing, scaffolding, and sandblasting

● Profession of logging

● Working in a sawmill

● Working in railroads

● Firefighting

● Working in a distillery

Alabama Payroll Taxes Required Forms

Here are the mandatory forms that need to be filled and submitted to the Alabama State and Federal Department for filing payroll taxes:

- W-4 Form: Essential employee withholdings elucidates which will help you calculate and withhold their federal state income payroll taxes in Alabama and calculate it

- W-2 Form: Total annual wages for each employee are reported through this form

- W-3 Form: This is a summary form of W2, which is sussed to report the annual income of all the employees working for the company

- Form 940: Report unemployment payroll taxes in Alabama due to the IRS and calculate them

- Form 941: The filing of quarterly income payroll taxes in Alabama

- Form 944: The filing of annual income payroll taxes in Alabama

- 1099 Forms: Gives information for non-employee contract work

Leave Requirements and Time Off Work

No Alabama State Law guides such leaves and time off work, but their federal laws are subject to certain obligations when it comes to leaving requirements.

Alabama Family Leave

The Family and Medical Leave Act (FMLA) requires employers to provide up to 12 weeks of unpaid leave for employees who account for covered disability. Such qualification includes pregnancy and care for an ill family member. The FMLA does force the employers to make this a paid leave but requires that such leave must ensure that the job the employee is kept secured and ready for when they decide to join back.

No Alabama State Law calls for additional leave.

Paid Time Off

This venture is completely up to your company’s policy because Alabama state law does not direct companies on whether they should follow paid time off. The companies are free to follow their own policies and create them for their employees.

If you offer PTO and need help calculating employees’ PTO accrual to include in the payroll taxes.

Holiday Leave

A company may choose to give their employees a holiday leave of their own will, and if they decide to do so, they must comply with the FLSA. This is because Alabama does not have any laws to define this.

Paid Sick Leave

There is no law in Alabama that supports this, so employers are free to create a sick leave policy for their employees and must add these to the payroll taxes when they file them.

Jury Duty Leave

As Alabama is one of only eight states to require this, companies in Alabama must pay their employees for jury duty leaves.

A company is not allowed to make the employee take PTO to comply with a jury summons.

Bereavement Leave

In the case of bereavement leaves as well, Alabama does not provide any law to go about it, so companies can create their own paid or unpaid bereavement leave policies but must adhere to them once created.

Bottom Line

Alabama payroll taxes are simple and easy to understand, given the minimum number of forms required in the process and the lack of complex laws that the companies are not obliged to follow.

How Can Deskera Assist You?

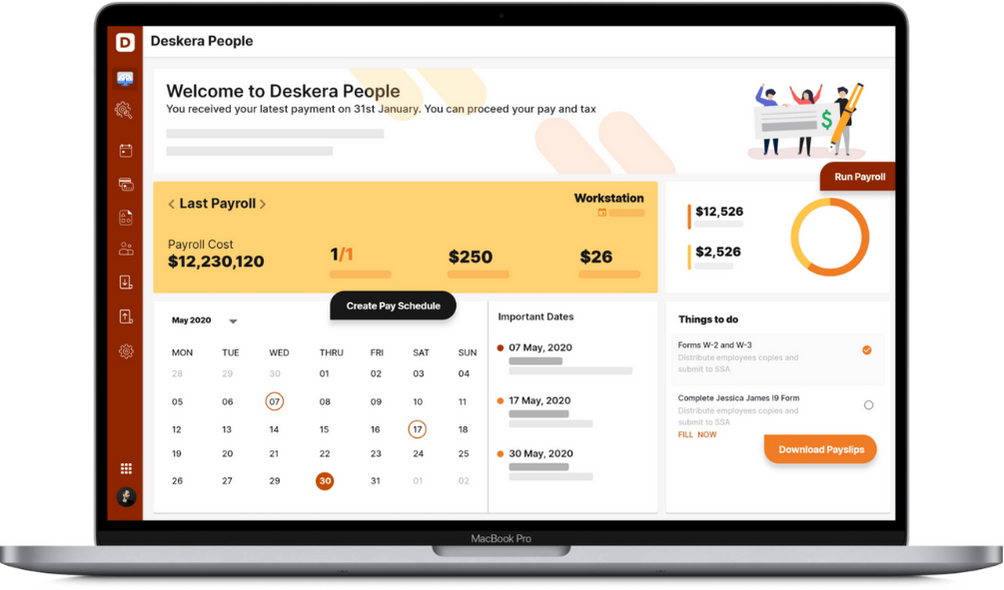

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Although a few local payroll taxes are issued to consumers, companies in Alabama usually follow federal rules for their state payroll taxes

- A Federal Employer Identification Number is required to pay your payroll taxes in Alabama

- If your business is new in Alabama, the first thing you must do is register your company with the Alabama Secretary of State as well as with the Alabama Department of Revenue

- The state of Alabama does not hold a record of a minimum wage rate, but according to the federal minimum wage rate, you must pay your employees at least $7.25 per hour and nothing below that to qualify to file payroll taxes

- For filing payroll taxes to the Alabama State Government, file it to the Alabama Department of Revenue through an online portal

Related Articles