Do you live in a state that expects you to file yearly income tax returns? Then, at that point, you should know, that your Adjusted Gross Income AGI can affect your state taxable income. This is on the grounds that many states utilize your government AGI as the beginning stage for computing your state taxable income.

Adjusted gross income, or AGI, is your total gross income before taxes minus certain tax deductions and different adjustments. In this article, we shall dive into various aspects involved in understanding AGI. We will cover the following topics:

- What is Gross Income?

- What is AGI?

- Modified adjusted gross income (MAGI)

- Taxable Income

- Comparison between AGI, MAGI, and Taxable Income

- Special Considerations

- The significance of adjusted gross income (AGI)Reporting on Form 1040

What is Gross Income?

Gross income is basically the amount of all the money you earned in a year, which might incorporate:

- Wages

- Retirement distributions

- Capital gains

- Capital losses (Losses on personal assets are not deducted)

- Premium pay

- Net gains for disposal of assets

- Interest income

- Share of income from partnerships

- Rental income

- Before-tax

- Bonuses

- Dividends

- Income tax refunds

- Annuities

Gross income incorporates "all income from whatever source," and isn't restricted to cash received.

What is AGI?

While setting up your tax return, you presumably focus closer on your taxable income than your adjusted gross income (AGI). Be that as it may, your AGI is additionally deserving of your consideration, since it can straightforwardly affect the deductions and credits you're qualified for-which can end up decreasing how much taxable income you file on the return.

Adjusted gross income, or AGI, is your gross income minus certain adjustments. The IRS involves this number as a reason for working out your taxable income. The items deducted from your gross income to ascertain your AGI are alluded to as adjustments to income, and you report them on Schedule 1 of your tax form when you document your yearly tax return.

Some of the most well-known adjustments are recorded here, alongside the different tax forms on which a couple of them are determined:

- Student loan interest deduction

- Alimony payments

- Student loan interest

- Self-employment tax (the deductible portion)

- Moving costs for individuals from the military (Form 3903)

- Early withdrawal penalties on savings

- Educator expenses

- Contributions to a retirement account

- Health Savings Account (HSA) deductions (Form 8889)

- Employee business expenses for armed forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses (Form 2106)

- Self-employed Simplified Employee Pension (SEP), Savings Incentive Match Plan for Employees of Small Employers (SIMPLE), and qualified plans

- Self-employed health insurance deduction

Your AGI won't ever be more than your Gross Total Income on your return and sometimes might be lower. In the wake of ascertaining a citizen's AGI, the following step is to take away deductions to decide their taxable income.

The IRS additionally utilizes other income metrics, for example, modified AGI (MAGI), for explicit projects and retirement accounts. As recommended in the United States tax code, AGI is an adjustment of gross income. AGI makes specific changes in accordance with your gross income to arrive at the figure on which your tax liability will be determined.

Calculating adjusted gross income AGI

To compute your adjusted gross income, begin with your gross income. Essentially include your salaries to get your total gross income then, at that point, subtract any adjustments or above-the-line tax deductions. The IRS gives definite guidelines on the best way to finish up your tax form (Schedule 1 for Form 1040) and any tax preparation service can guide you through this process.

However, you for the most part do exclude child support, life insurance payments, gifts, loan proceeds, or inheritances in your AGI. As a general rule, the equation for computing AGI is to decide your gross income. This incorporates pay from the elements we discussed above.

And then subtract:

- Certain business expenses.

- Deductible HSA contributions.

- Deductible tuition and fees.

- Deductible IRA contributions.

- Deductible self-employment taxes.

- Moving expenses for the military.

- Contributions to retirement plans or health care coverage for independently employed individuals.

- Penalties on early withdrawals of savings.

- Alimony paid.

- Student loan interest.

- Educator expenses.

- Up to $600 of charitable contributions assuming you're taking the standard allowance.

Tax software or your tax manager will work out your adjusted gross income as a feature of the most common way of setting up your tax return. Assuming you reported independent work business income on Schedule C, you would include that for your gross income also. Rewards, tips, divorce settlement, and in any event, betting rewards are likewise essential for gross income.

Tax calculators are accessible online to assist you to decide your deductions without breaking a sweat. There are likewise a few over-the-line tax deductions to think about while working out your AGI, which could assist you with amplifying your return, or limit the sum you owe.

To decide your taxable income, take away either the standard deduction or your complete itemized deductions from your AGI. By and large, you can pick whichever gives you the most benefit. Some tax deductions, be that as it may, have limits. Student loan interest, for instance, is covered at $2,500 and Educator costs have a $250 limit.

Common adjustments utilized while determining AGI

Adjustments to income are explicit deductions that straightforwardly diminish your total income to show up at your AGI. There is a wide range of adjustments that may be made while computing AGI, contingent upon the monetary and life conditions of the filer. Gross income is reduced by specific things to result in adjusted gross income. These include:

- Costs of carrying on an exchange or business including most rental activities, other than as a worker.

- Health savings account deductions

- The certain operational expenses of instructors, reservists, performing craftsmen, and fee-basis government authorities,

- Certain moving costs

- Penalties forced by monetary foundations and others on early withdrawal of reserve funds,

- One-half of self-employment tax

- Domestic production activities allowance

- Jury obligation pay remitted to the juror's employer

- Admissible contributions to specific retirement schemes of action (SEP-IRA, SIMPLE IRA, and qualified plans) and Individual Retirement Accounts (IRAs),

- Divorce settlement paid which the beneficiary should consider for gross income,

- Schooling cost, fees, and student loan interest, with constraints and special cases,

- Certain different items of restricted applicability

Additionally, since the tax regulations can be changed by legislators, the list of available adjustments can change over the long run. Probably the most well-known adjustments involved while ascertaining AGI incorporate reductions for the provision and student loan interest payments.

The types of adjustments that you can deduct are dependent on future developments every year, but a number of them reliably appear on tax forms without fail.

Effect of adjusted gross income AGI on tax payments

Your AGI is the reason for your taxes, not your gross income since it addresses your actual income. Your AGI likewise decides how you meet all requirements for specific tax deductions and tax credits.

Adjusted gross income (AGI) is basically your income for the year subsequent to accounting for all applicable tax deductions. It is a significant number that is utilized by the Internal Revenue Service (IRS) to decide the amount you owe in taxes. AGI is determined by taking your gross income from the year and taking away any deductions that you are qualified to claim.

Accordingly, your AGI will be less than or equal to your gross income. A significant number of the deductions and credits that citizens usually take benefit of every year are dependent upon AGI restrictions. Some tax deductions and credits can help you more assuming that your adjusted gross income is lower.

If, for instance, your cash-based clinical and dental bills surpass 7.5 percent of your AGI in a year, you can deduct the sum that surpasses 7.5 percent of your AGI. Hence, the lower your AGI is, the greater amount of clinical and dental costs you can deduct. For 2021, this cutoff is still 7.5% of your AGI.

Indeed, even a portion of your adjustments to income is dependent upon AGI constraints notwithstanding the way that those deductions are important to work out your AGI. In the event that you're qualified to deduct a portion of your educational cost payments, your modified adjusted gross income (MAGI) decides if you qualify.

AGI-related cutoff points likewise apply to deductions for charitable contributions. You can for the most part deduct qualified charity commitments you made uniquely until the deduction sum comes to half of your AGI. Thusly, your AGI significantly affects which credits and deductions you can take, as well as the amount they're worth.

Modified adjusted gross income (MAGI)

Certain tax computations depend on modified versions of AGI. As per the IRS, for most citizens, modified adjusted gross income, or MAGI is essentially adjusted gross income prior to taking away deductible student loan interest. The meaning of "modified AGI" differs as indicated by the reason for which the connected estimation is being utilized.

These modified forms of AGI might add specific items to AGI that were barred in registering both gross income and adjusted gross income. Normal additions incorporate tax absolved interest, the excluded piece of Social Security benefits, and tax-exempt foreign earned income.

Assuming you're documenting Form 1040 and itemizing with the goal that you can take specific deductions, you might need to work out your MAGI. It can likewise be a standard for deciding the phaseout level of certain credits and tax-saving strategies, and sometimes the equation for MAGI can rely upon the sort of tax break it applies to.

In the United States income tax system, adjusted gross income (AGI) is a person's total gross income minus specific deductions. For most individual tax purposes, AGI is more applicable than gross income. A few deductions, for example, clinical costs and incidental itemized deductions are limited in view of a level of AGI.

Certain phase-outs, including those of lower tax rates and itemized deductions, depending on degrees of AGI. Many states base state income tax on AGI with specific deductions. Adjusted gross income is determined by taking away Above-the-line deduction from gross income.

Taxable Income

This is your AGI minus either the standard deduction or total of itemized deductions whichever is more prominent and the certified business income deduction if appropriate. Your taxable income you'll use to decide your Tax section.

Note, with changes from the Tax Cut and Jobs Act, individual and dependent exclusions, which might have brought down your taxable income, were eliminated from 2018 through 2025.

Comparison between AGI, MAGI and Taxable Income

Your AGI isn't the income figure on which the IRS will actually tax you. Your final income number, or taxable pay, comes from taking away much more deductions from your AGI.

For the 2021 fiscal year, by far most of the citizens will probably utilize the standard deduction as opposed to itemized derivations. Under current regulations, the standard deductions for 2021 are $12,550 for single filers, $25,100 for married couples recording together, and $18,800 for heads of the family.

For the fiscal year 2022, what you record in mid-2023 the standard deductions is $12,950 for single filers, $25,900 for joint filers, and $19,400 for heads of the family.

Modified adjusted gross income, or MAGI, is one more term connected with taxable income and adjusted gross income. MAGI becomes possibly the most important factor while you're attempting to sort out whether you fit the bill for specific deductions.

For example, assuming that your MAGI is over certain pay cutoff points and you have a workplace retirement plan, you will be unable to take the full derivation for adding to an IRA.

AGI and modified adjusted gross income (MAGI) are basically the same, then again, MAGI adds back specific deductions. Therefore, MAGI would be bigger all of the time than or equivalent to AGI. Normal instances of deductions that are added back to compute MAGI incorporate income earned on U.S. savings bonds, foreign earned income. reserve funds securities, and losses emerging from a public traded organization.

Special Considerations

You report your AGI on line 11 of IRS Form 1040, which is the form you use to document your income taxes for the year. Keep that number convenient subsequent to finishing your taxes, since you will require it again if you e-file your taxes one year from now. The IRS involves it as a method for confirming your identity.

Additionally, note that as of January 2022, nearly anybody might utilize the IRS Free File program to record their government taxes electronically at no charge.

The Significance of Adjusted Gross Income (AGI)

- Your AGI is usually the beginning stage for ascertaining your tax bill. From that point, you'll make different adjustments and take away your allowable deductions to observe the sum on which you'll pay on tax: That's your taxable income. You'll see the term adjusted gross income (AGI) rehashed all through your tax documents.

- AGI is the premise on which you could meet all requirements for some allowances and credits. For instance, you might have the option to deduct unreimbursed clinical costs, however just when they're over 7.5% of your AGI. So the lower your AGI, the more prominent the allowance.

- Your state tax return could likewise involve your government AGI as a beginning stage. Assuming that you record charges on the web, your product will ascertain your AGI.

Reporting on Form 1040

Gross income is accounted for on U.S. government individual income tax returns Form 1040 series type of income. Supporting forms and schedules are expected at times, e.g., Schedule B for dividends and interest.

Income of business and rental activities, including those through associations or S organizations, is accounted for net of the expenses of the business. These are accounted for on Schedule C for business income, Schedule E for rental pay, and Schedule F for a farm income.

Finding your prior-year adjusted gross income on your 1040

Your earlier year AGI can be utilized to approve your electronic return with the IRS. To find your Adjusted Gross Income on Form 1040 from the earlier year, you'll require a copy of last year's return. For 2020, you can observe the sum recorded on the accompanying lines in light of the form you utilized.

- Assuming that you recorded Form 1040, your AGI will be recorded on Line 11.

- Assuming that you recorded Form 1040-NR, your AGI will be recorded on Line 11.

How Can Deskera Help with Adjusted Gross Income?

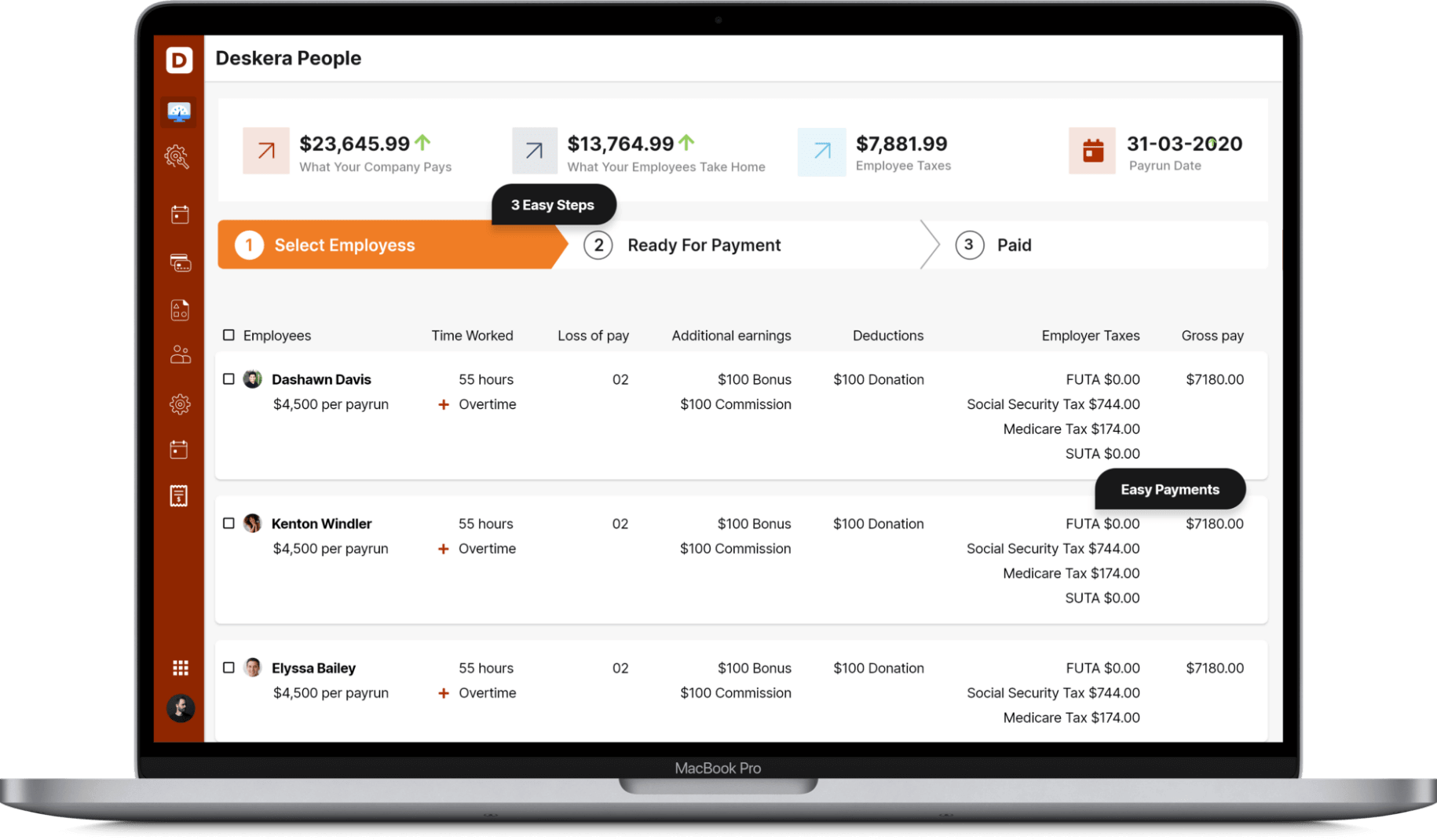

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions which also incorporates Adjusted Gross Income.

You simply need to access the dashboard, and you have all your employee's data aligned together. The People Dashboard portrays all the relevant data like the cost of the past pay run and evaluates the upcoming one. Simply set up employee rewards, voluntary deductions, taxes, etc.

Key takeaways

- Adjusted Gross Income is essentially your total gross income minus specific deductions. Computing your AGI is a significant stage towards discovering the amount of your income is taxable. It tends to be generally straightforward assuming you have a smart thought of which parts of your income establish the figure.

- With changing tax laws and forms, notwithstanding, a portion of these situations can get interesting. It's savvy to work with an accountant or utilize a reliable tax software system to take care of you. Additionally, numerous monetary counsels offer duty planning and tax preparation services.

- Your AGI intensely influences what credits and deductions you're qualified for in a fiscal year. For instance, on the off chance that you have a low AGI, you'll probably have the option to claim more in deductions and credits than somebody with a higher AGI.

- Modified adjusted gross income (MAGI) is your AGI for certain suitable deductions added back in. For some individuals, AGI and MAGI will be something very similar.

- Gross income is the aggregate sum of money you earn in a year prior to income taxes or different deductions being taken out. In view of this differentiation, AGI is regularly the establishment for ascertaining the amount you'll owe in taxes.

- Your AGI can influence the size of your tax deductions as well as your qualification for certain sorts of retirement plan contributions, for example, a Roth individual retirement account (Roth IRA).

Related Articles