In accounting, depreciation points to two aspects: first, a drop in the fair value of an asset, for example, the decline in the worth of production line hardware every year as it is utilized and wears down. The second, the allocating the asset cost in the accounting statements for periods in which the resources are utilized.

The depreciation is calculated over a period of years and this introduces another close relative of depreciation known as Accumulated Depreciation.

More about Accumulated Depreciation in this article:

- Introduction and details of accumulated depreciation

- Formula, calculation, and example of accumulated depreciation

- Relation between accumulated depreciation and depreciation expense

- We shall learn if accumulated depreciation is an asset or a liability

- Finally, we get to know the importance of accumulated depreciation

What is Accumulated Depreciation?

Cumulative depreciation of an asset up to a point in its life is called accumulated depreciation. In simple terms, it is the addition of all the depreciation expenses up until that period. It is a negative asset account. It means that its balance is a credit that offsets the value of the asset.

According to the matching principles under generally accepted accounting principles -GAAP, the expenses are supposed to match the generated revenue of the same accounting period. Depreciation is a process that allows businesses to expense a part of the asset’s value each year across its useful life. Simply put, this means every year when the asset is used, it generates revenue and the amount associated with utilizing the asset needs to be recorded.

Understanding Accumulated Depreciation

While the asset is being used, the total of the amount calculated as depreciation up to a certain point is called accumulated depreciation. For each year or period, the depreciation is recorded to the beginning of the accumulated depreciation balance. The asset’s original cost and the accumulated depreciation is termed as assets carrying value on the balance sheet. Also, at the end of the asset’s useful life, the carrying value on the balance sheet matches the salvage value.

Accumulated Depreciation Formula and Calculation

Now let’s move on to the formula and calculation of accumulated depreciation.

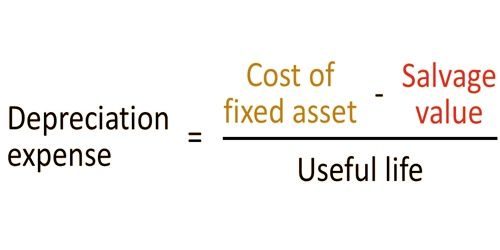

Formula:

A simple example to understand calculation:

A company purchased equipment for $200,000 on January 1, 2015. The asset’s residual value is $20,000 and the useful life is 8 years. What would be the accumulated depreciation of the equipment on December 31, 2017?

($200,000 - $20,000) / 8 = $22,500 is the depreciation expense each year.

Now, the net asset value is calculated as:

In our next section, we shall understand the accumulated depreciation by bringing along a depreciation method. Let’s dive in.

Example of Accumulated Depreciation

ABC constructions Pvt. Ltd. purchases building equipment worth $200,000 that has a useful life of 5 years. The company does not expect a salvage value at the end of the equipment’s useful life. Further, the company uses the straight-line method to depreciate the equipment. How to determine the depreciation for the 1st and the 3rd year?

The accumulated depreciation calculation on the balance sheet is as follows:

The equipment has a useful life of 5 years, therefore, the cost of the equipment should be distributed across 5 years of its use.

Using the straight-line method, the annual depreciation for the equipment is calculated as:

Using this formula, we get:

So, the annual depreciation will be $40,000 over the 5 years.

Now, the calculation for the 1st year will be:

This is explained as:

Accumulated depreciation at the end of 1st year = Accumulated depreciation at the start of the 1st year + Depreciation for 1st year

= 0+ 40,000

= $40,000

Similarly, for the 2nd year the calculation will be:

Accumulated depreciation at the end of 2nd year = Accumulated depreciation at the start of the 2nd year + Depreciation for 2nd year

= 40,000+ 40,000

= $80,000

So, finally the calculation for the 3rd year will be shown as:

Accumulated depreciation at the end of 3rd year = Accumulated depreciation at the start of the 3rd year + Depreciation for 3rd year

= 80,000+ 40,000

= $120,000

How are Accumulated Depreciation and Depreciation Expense Related?

From the observations made in the examples in the previous sections, we know that accumulated depreciation is the sum of the depreciation of the asset till a particular point in its useful life. On the other hand, depreciation is the amount allocated for depreciation expense since the asset was utilized.

Accumulated Depreciation and Book Value

This also brings us to discuss how the accumulated depreciation helps in the calculation of an asset’s net book value. The net book value can be obtained by subtracting the asset’s cost from its accumulated depreciation.

Accumulated depreciation never surpasses the asset’s cost. In the case when the company sells or disposes of the asset, the accumulated depreciation corresponding to it is removed from the balance sheet.

Accumulated Depreciation vs Depreciation Expense

Depreciation is the measure of the drop in the value of an asset over its useful life. Assessing the depreciation expenses helps companies monitor the true worth of the asset at the end of its valuable life.

At times, you may face confusion associated with using accumulated depreciation or depreciation expense. It is, therefore, important to know when to use depreciation expense rather than accumulated depreciation.

While both, depreciation and accumulated depreciation relating to the deterioration of an asset, are fundamentally very different. Depreciation is an expense on the income statement whereas the accumulated depreciation is a contra asset recorded on the balance sheet.

Despite these differences, both play a crucial role around the following areas:

- In estimating the true value of the asset

- Making year-end tax calculations and deductions

- Present with the right figures when the company is sold.

Is Accumulated Depreciation an Asset or Liability?

Accumulated depreciation is a contra asset which implies that it contains a negative balance that offsets the asset account and results in net book value. Therefore, accumulated depreciation is classified neither as an asset nor a liability owing to the reasons here:

- It is not considered as an asset as the balance in the account does not help with raising an economic value over numerous accounting periods. As a fact, accumulated depreciation is a representation of the economic value consumed.

- It cannot be considered a liability as the balance in the account does not signify any obligation to a third party. Effectively, it is utilized solely for internal recording purposes.

You can learn more about in this article.

Why is Accumulated Depreciation Important?

Say, a company buys cars for office use worth $100,000 in the year 1990 and never depreciated it. Since the time the cars were put in use, the company has never recorded a depreciation which shows the asset’s worth as $100,000 even today. However, we know it’s not even remotely true.

The cars have likely become degraded in these years due to constant use, or those models have now become obsolete. At best, the company can estimate the scrap value of the cars and dispose of them or sell them off.

This is where the accumulated depreciation comes into the picture and helps identify the real worth of the assets. With gradual and yearly deductions, the company could have recorded a value to estimate a cumulative depreciation, until the value came to zero.

The importance of accumulated depreciation lies in the fact that it allows businesses to accurately monitor the profits and the net values over time.

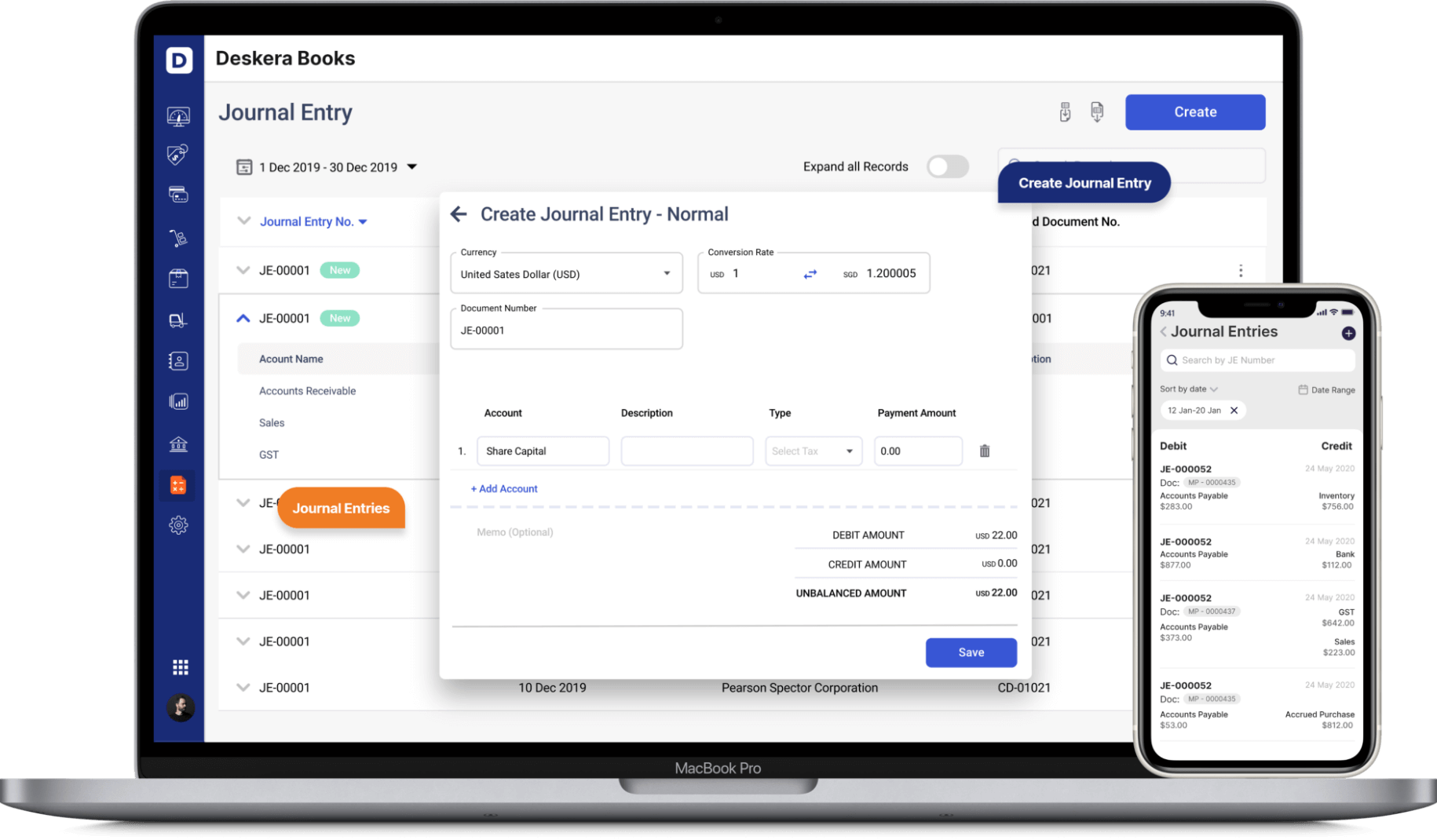

Journal Entries for Accumulated Depreciation

Fundamentally, journal entries for depreciation debit the depreciation expense and credit the accumulated depreciation. Gradually, the accumulated depreciation balance goes on increasing as depreciation gets added to it, till the time its value becomes equal to the asset’s original cost. At this stage, the company stops recording depreciation as the asset cost is now reduced to zero.

Journal Entry Example of Accumulated Depreciation

A company that estimates a depreciation of $30,000 in the current month makes an entry as:

How can Deskera help your Accounting and Business?

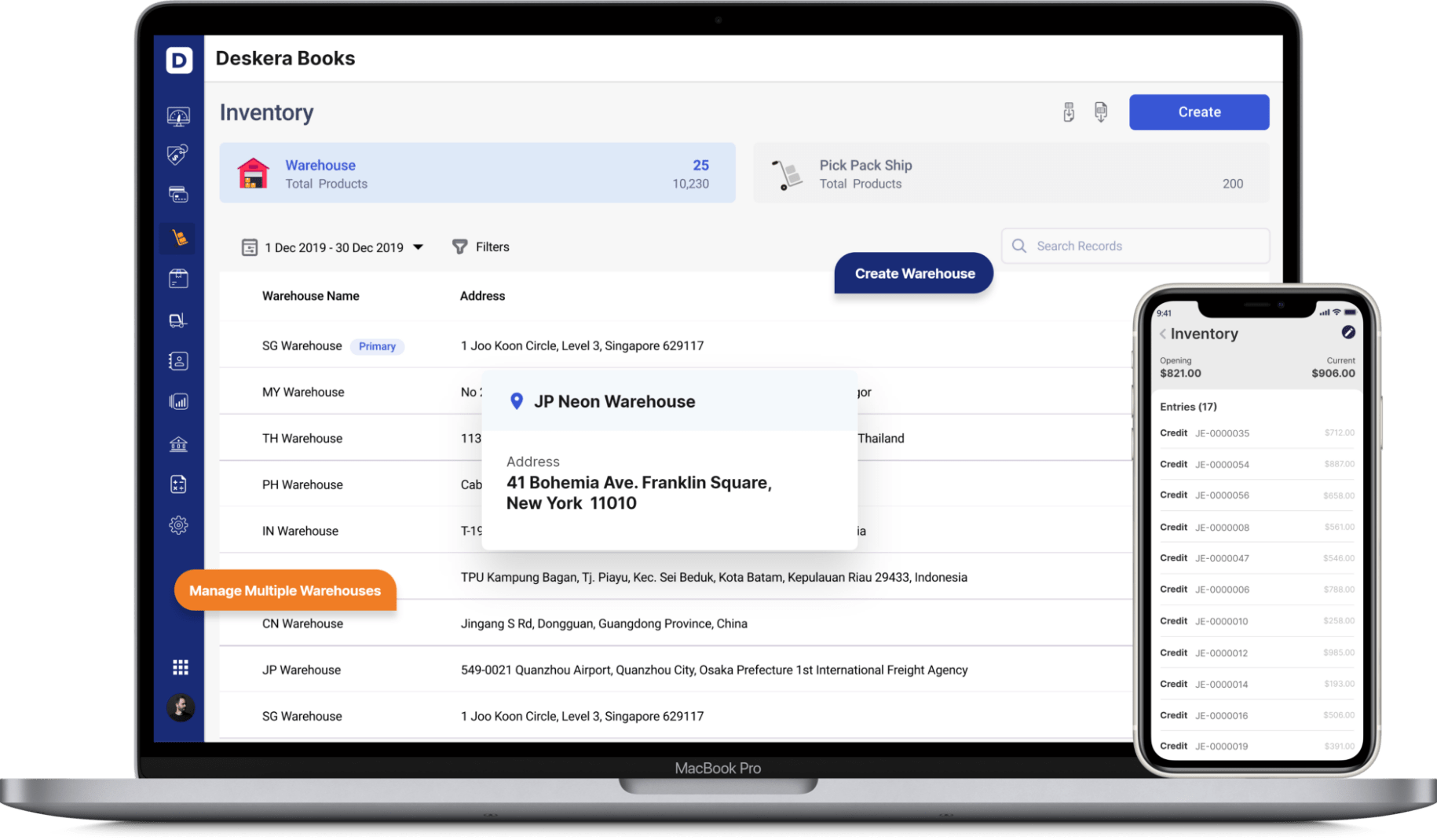

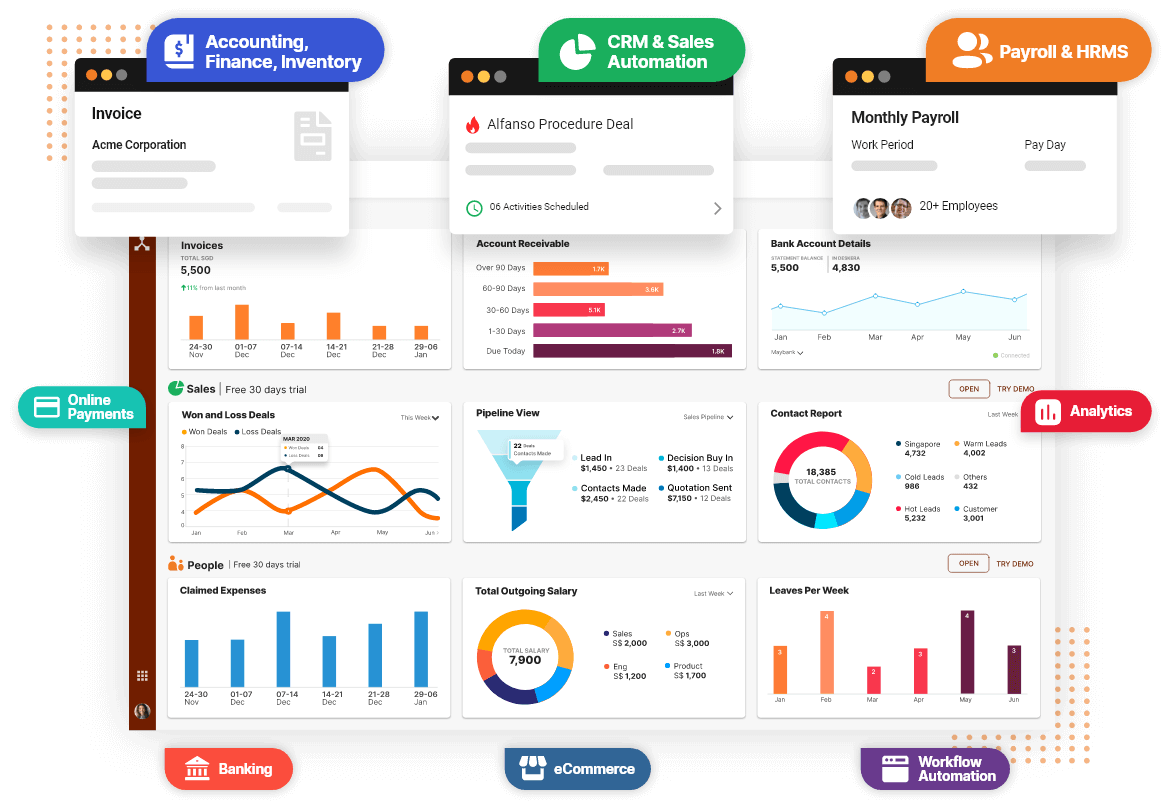

As a business owner, you can invest in accounting softwares that can help you keep track of your journal entries, balance sheet, inventory and production costs.A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

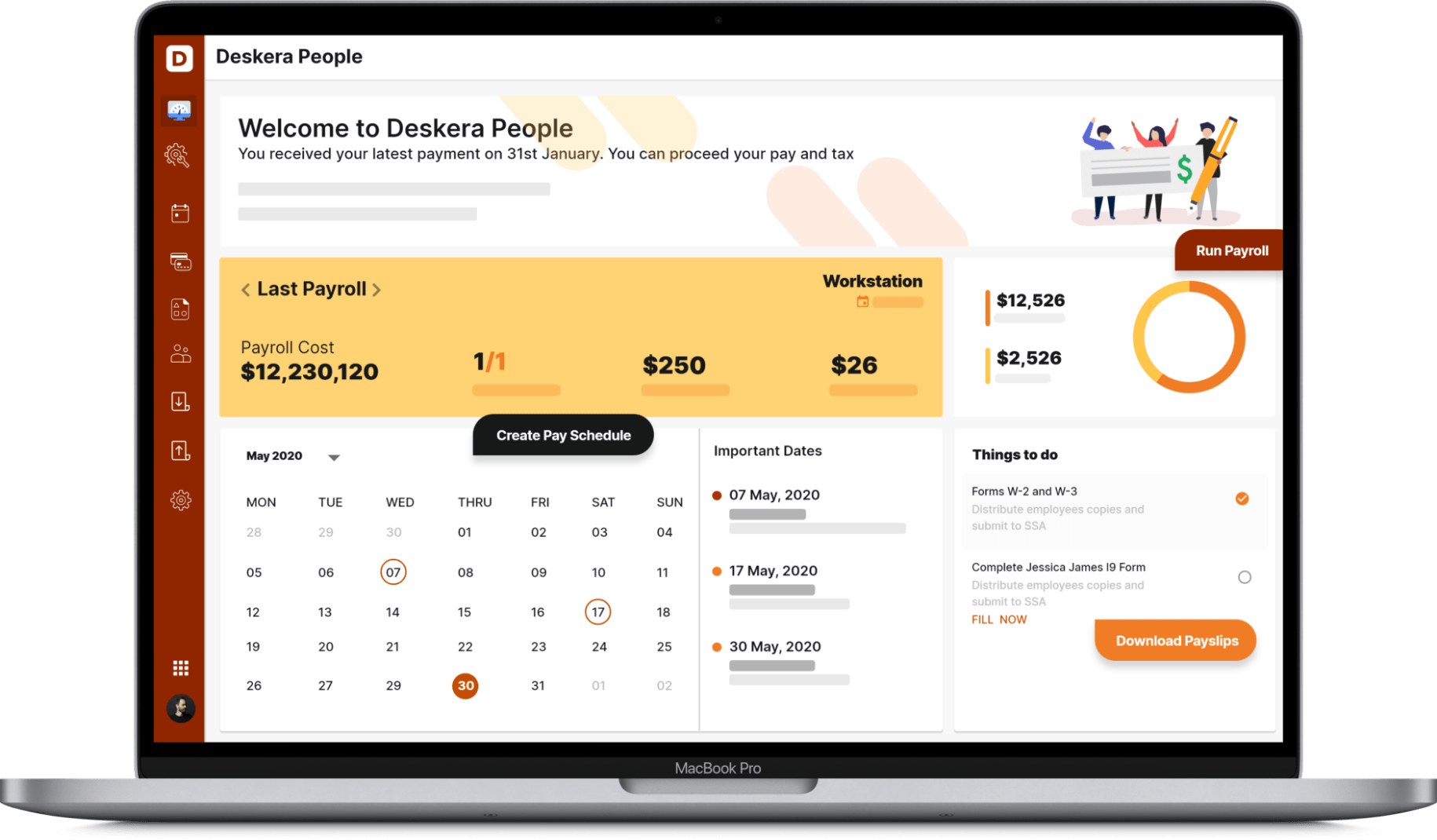

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

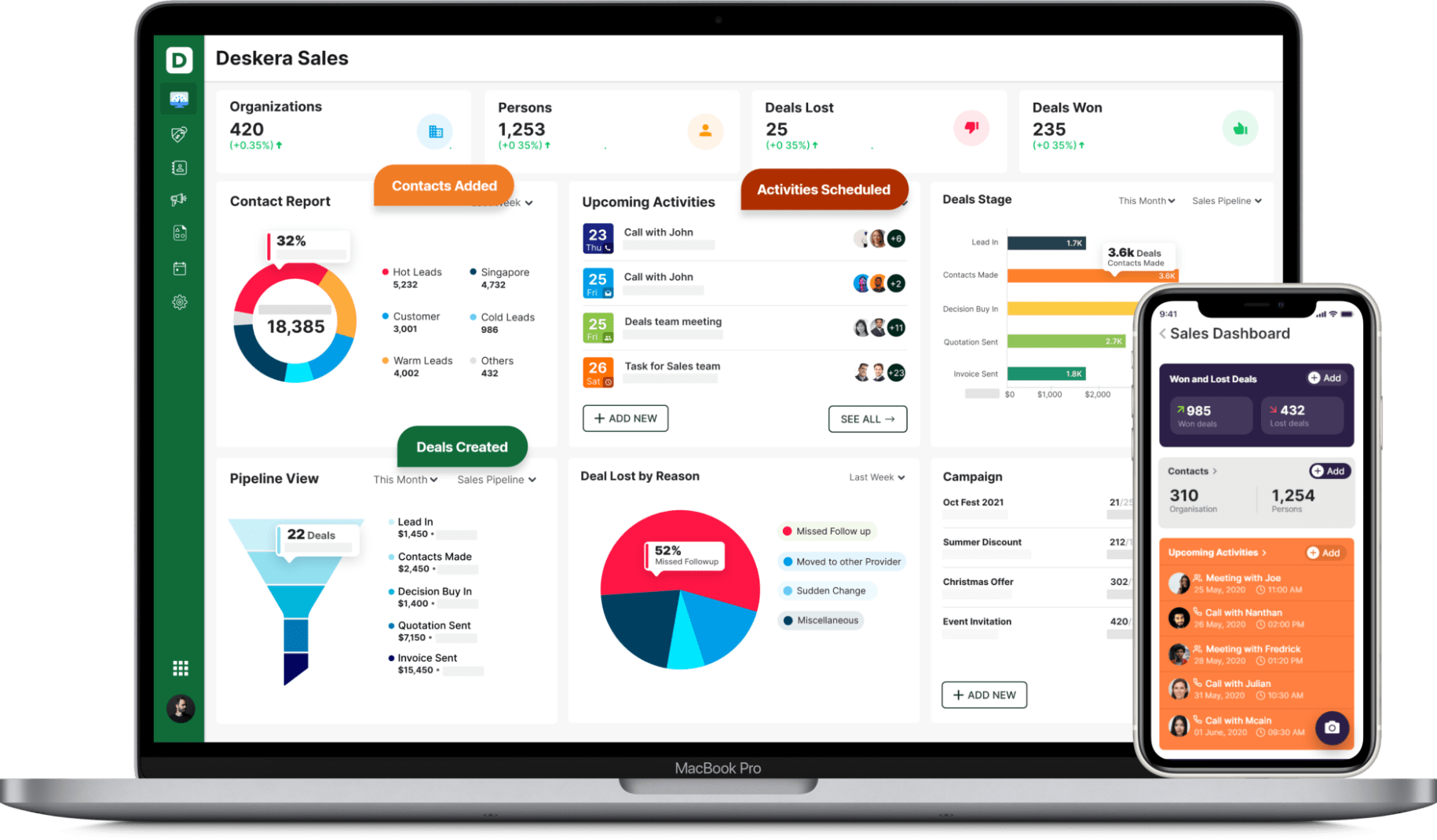

With Deksera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

Before we wind up, let’s walk through the highlights of the article.

- Accumulated depreciation is the grand total of the depreciation of an asset until a point in the useful life of a fixed asset.

- Depreciation is an expense on the income statement whereas the accumulated depreciation is a contra asset recorded on the balance sheet.

- Accumulated depreciation is an effective way for businesses to assess the true values of profits and overall performance over time.

- The journal entries for accumulated depreciation are made in the account books where the depreciation is debited and the accumulated depreciation is credited.

Related Articles