Accrual accounting is the standard accounting method most businesses use to recognize their financial transactions.

Under accrual accounting, revenue is recorded when it is earned, and expenses when they get billed, regardless of when the cash exchange happens.

So, if a business buys merchandise on credit, the expense is recorded at the time of purchase, rather than when the business pays for the bill in the future.

Now, you may be wondering: what makes accrual accounting so important? Is there an alternative to accrual accounting businesses can opt for?

That’s exactly what we will be answering in this guide, along with everything else you need to know about accrual accounting for your small business.

Read along to find out:

- What Is Accrual Accounting?

- Who Uses Accrual Accounting?

- Advantages of Accrual Accounting

- Disadvantages of Accrual Accounting

- Categories in Accrual Accounting

- Automate Accrual Accounting with Online Software

- Accrual Accounting FAQ

What Is Accrual Accounting?

Accrual accounting is an accounting method, used under the double-entry bookkeeping methodology, that records revenue and expenses when they occur, rather than when money exchanges hands.

This method follows the matching principle, which says that revenues and expenses should be recognized in the same accounting period.

So, for instance, if a business were to provide a good or service on credit, the transaction would be recognized into the accounting reports at the time of sale, not when cash is received from the client in the future.

Accrual accounting is considered the standard accounting practice for most businesses, large or small, across industries and the world. In fact, public companies are legally obligated to use accrual accounting as their accounting basis.

Whereas smaller businesses have the freedom of choosing between accrual and cash accounting.

Accrual vs Cash Accounting

The other alternative to accrual accounting is cash accounting.

In cash accounting, revenue is recognized when it is received, and expenses are recognized only when they are paid. The method is simpler and more straightforward to use, however, it can greatly distort the financial wealth of a business.

Say, for example, a business purchases $500 dollars of raw materials on credit. Because there’s no cash exchange at the time of the transaction, the cash account won’t suffer any change, and the business will appear more profitable than it actually is.

This can cause the business owner to overspend an extra $500 they can’t afford, or even forget about the outstanding invoice altogether, as there isn’t any recording of it in the accounting books.

With accrual accounting, on the other hand, business owners have a more realistic and accurate picture of their finances.

As soon as a product is sold or purchased on credit, it gets recorded into the appropriate receivable or payable account, so that businesses are fully aware of their cash flow, and never miss a payment.

This method also makes it easier to make strategic decisions about the future of the business, even when clients delay payments for months, because everything is accounted for.

If you’re still hesitant on what method to use for your business or want to know more about the difference between cash and accrual accounting, head over to our guide on the basis of accounting.

Who Uses Accrual Accounting?

As far as the law is concerned, public companies, businesses dealing with inventory, and companies that generate more than $25 million in revenue for 3 consecutive tax years, are legally required to use accrual accounting.

With that being said, a wide variety of other businesses that don’t fall under the mentioned category opt for accrual accounting as well.

These include businesses that use double-entry bookkeeping, those that sell on credit, small businesses expanding their operational activities, companies wanting to take out a loan or looking for investors, and more.

Very small businesses, with few employees and no inventory, usually use cash accounting instead.

Advantages of Accrual Accounting

More Accurate Bookkeeping

Not every financial transaction between two parties is immediately completed through one exchange. Sometimes businesses sell merchandise on credit, pay interest expenses or purchase equipment on account.

Accrual accounting allows accurate bookkeeping for these types of transactions (that have only been partially completed) by recording them as they occur, and again later on when cash is exchanged.

With this information, businesses can have full control over their finances, client past due invoices, and liabilities towards vendors. At the same time, the data provides them with a realistic and accurate number of the profit that they’re generating.

Easier Financial Planning & Forecasting

With accrual accounting, businesses generate financial statements at the end of the year. And these reports provide insights that can be extremely helpful in guiding future financial decisions.

Businesses can get data on what goods and services are selling best, what product departments are growing, and which ones might need re-investments in the future.

GAAP Compliance

Accrual accounting complies with the Generally Accepted Accounting Standards (GAAP) adopted by the US commission, thus it is suitable for all types of businesses, regardless of their size, industry, or purpose.

GAAP compliance also helps businesses appear more trustworthy in the eyes of financial and tax institutions, government authorities, investors, and other interested third-parties.

Disadvantages of Accrual Accounting

As financially advantageous as accrual accounting is, it requires a professional understanding of double-entry bookkeeping and the accounting cycle, in order for it to be properly managed, manually.

So, if you’re running your own small business and don’t have any professional accounting help, accrual accounting can take up extra time and resources to manage.

The good news is, there are many affordable and intuitive accounting software that can help streamline your entire accrual accounting for you.

All you have to do is use the software to issue your sales invoices, issue purchase orders, pay for bills, and integrate with your bank accounts, and the appropriate accrual accounting entries will be made for you.

Categories in Accrual Accounting

There are two main types of accruals in accounting: accrued revenue and accrued expenses.

1. Accrued Revenue

Businesses often earn revenue during one accounting period but they do not bill the client until a future date. This revenue that is earned but not yet recorded is known as accrued revenue.

Accrued revenue in accrual accounting is recorded through an account known as accounts receivable (AR).

As soon as a business extends credit to a customer, the money is recorded into accounts receivable to keep track of the cash owed.

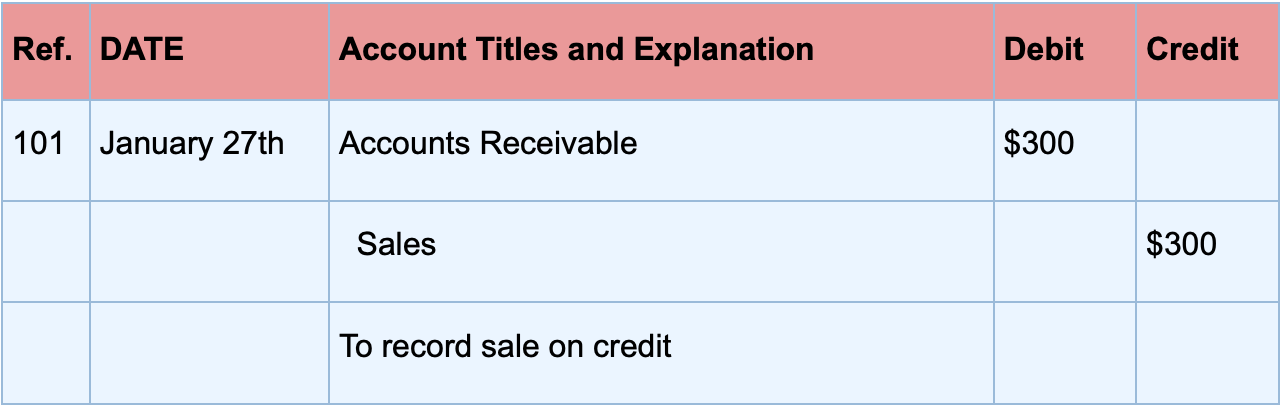

Let’s check out an illustrative example of how this recording is done.

Assume that on January 27th, Company XYZ provides $300 worth of service to a client, with a 30-day payment term.

In accrual accounting, this transaction would be journalized as shown below:

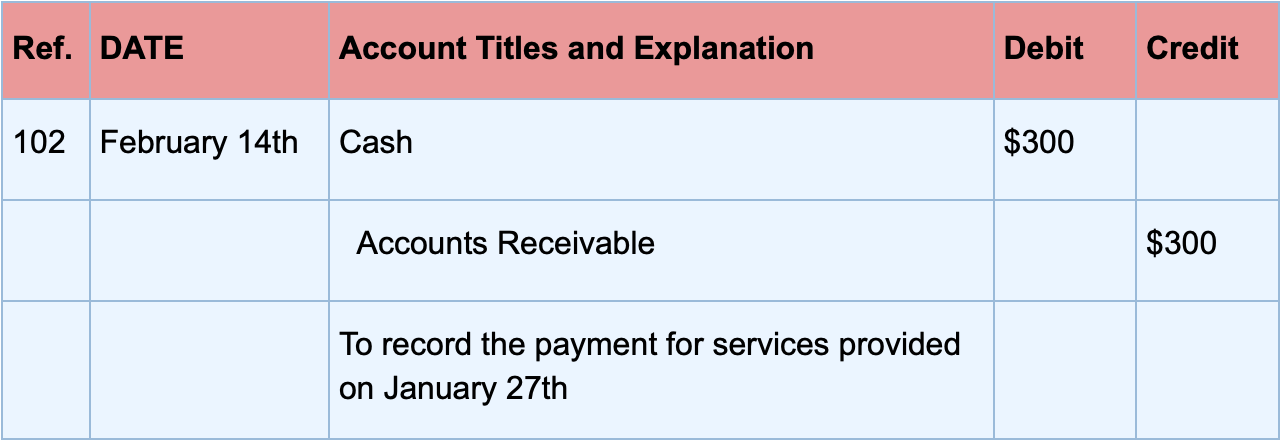

If on February 14th the client makes full payment, this would be the appropriate journal entry:

2. Accrued Expenses

An accrued expense is a current liability account that refers to the accumulated expenses a business hasn’t paid for yet. They’re considered “current” because payment is typically done within one year of the date of the invoice.

Some common examples of accrued expenses include the purchase of merchandise on account, employee refunds, and so on.

The accrued unpaid expense is kept on track through an account called accounts payable (AP). So, in simpler words, AP represents outstanding invoices that the buyer has yet to pay for.

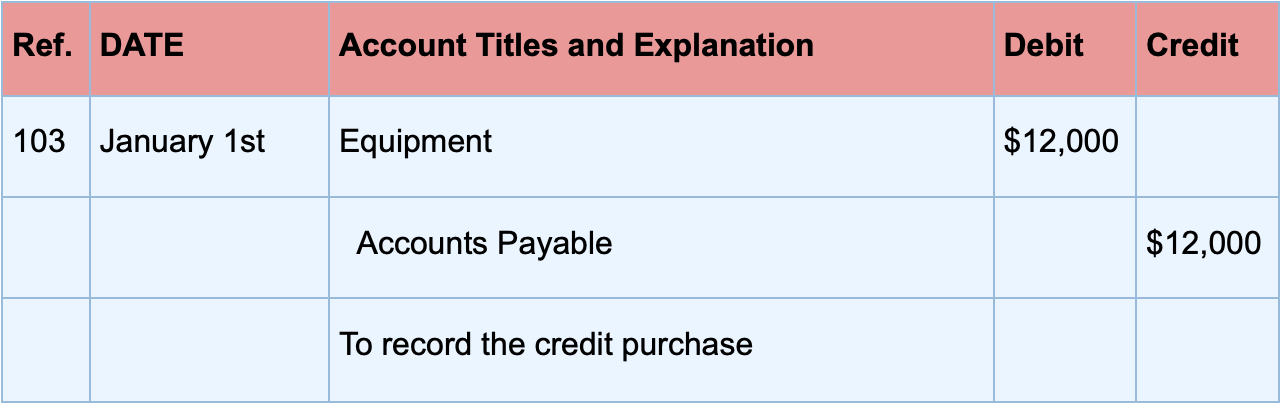

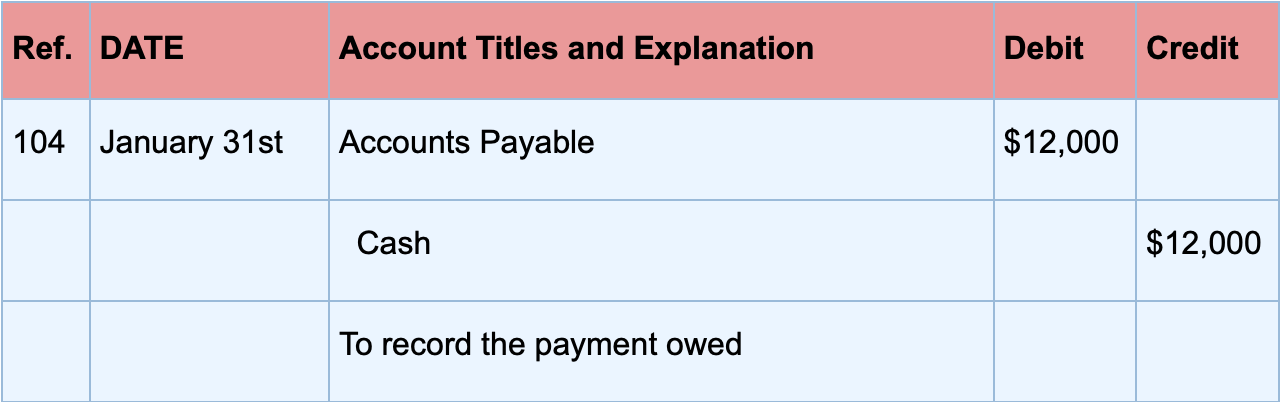

Now, let’s assume that on January 1st, Company XYZ purchases equipment on account for $12,000. The payment is due in 90 days. They pay for the bill 30 days later, on January 31st.

The first journal entry is made on January 1st, to record the sale:

30 days later, when the company pays, the payment gets recorded as:

Automate Accrual Accounting with Online Accounting Software

Recording your accrual accounting entries in a spreadsheet, and journalizing transactions by hand with pen and paper is regarded as for a reason.

Nowadays, you can use cloud accounting software like Deskera, instead, to completely automate your accrual accounting, with just a few clicks!

Through direct bank account integrations, any payments or purchases made will immediately post into the appropriate ledger account. Without you having to lift a finger!

And that’s not even the best part.

The accounting software has a professional invoice creation tool that allows you to easily send invoices and receive bills that are once again automatically entered into the corresponding payable and receivable accounts.

Not convinced Deskera is the right choice for you?

Well, you can try it out yourself with our free trial! No credit card required.

Accrual Accounting FAQ

#1. What Is An Accrual in Simple Terms?

To accrue, in simple terms, means to add up.

An accrual in accounting is the accumulation of interest or different investments over a specific period of time.

The two main accruals in accounting are accrued expenses and accrued revenue.

#2. What’s the Difference Between Prepaid Expenses and Accrued Expenses?

Prepaid expenses and accrued expenses have opposite meanings.

A prepaid expense, or prepayment, refers to payments made in advance, for a good or service that has not yet been received. Prepaid expenses are an asset, part of the balance sheet.

Accrued expenses, on the other hand, are accumulated expenses an individual or business hasn’t paid for yet, such as rent or utilities. They’re a liability account on the balance sheet.

#3. Can You Change From Cash Basis to Accrual Basis?

Short answer: yes.

Long answer: yes, but it’s a lengthy process that requires getting permission from the IRS. You’d have to add up your accrued and prepaid expenses, subtract customer prepayments, and much more adjustments.

#4. Should a Startup Use Accrual Accounting?

That depends on the long-term goals of the startup.

If the startup owner wants to exist independently, and not expand their financial operations, then cash accounting may be the easier and most convenient option to implement. But in case the plan is to further expand the startup and potentially turn into a public company, the startup should go with the accrual basis of accounting.

If you want to learn more about how to handle accounting for your new startup, we have a complete guide on accounting for startups you can check out.

Key Takeaways

And that’s a wrap!

Here are some of the main points we’ve covered today:

- Accrual accounting is one of the two accounting methods businesses can use to record their transactions.

- With accrual accounting, revenue and expenses are recorded immediately as they occur, rather than when money exchanges hands.

- The alternative to accrual accounting is cash accounting, mainly used by small businesses with little to no inventory. While accrual accounting is mainly implemented by public companies and those wanting to expand their business operations.

- The two main types of accruals are accrued expenses and accrued revenue.

- With accounting software like Deskera, you can automate accrual accounting and your entire accounting cycle in just a few clicks.

Related Articles