As a business owner, there is no way you can escape indulging in accounting activities. You can own a tiny restaurant or a multimillion-dollar Automobile company, the accounting books will always be there.

There are millions of accounts and formulas to know and understand in business accounting. One of the most important accounting calculations for any business dealing with customers would be the receivables turnover ratio.

It’s fine if you are not aware of the details of this calculation. We are here to tell you all about the receivables turnover ratio that goes into double-entry bookkeeping.

To learn in this article -

- What is Account Receivables Turnover Ratio?

- How to calculate Receivable Turnover Ratio?

- High Account Turnover and Low Account Turnover

- What the Receivables Turnover Ratio Can Tell You?

- Example of How to Use the Receivables Turnover Ratio

- Receivables Turnover vs. Asset Turnover

- Limitations of Using the Receivables Turnover Ratio

- What Do Efficiency Ratios Measure?

- Determining a Firm's Percentage of Credit Sales

- Know Accounts Receivable and Inventory Turnover

- 5 Tips to Improve Your Accounts Receivable (AR) Turnover Ratio

- How Can Deskera Help With Accounting?

What is Account Receivables Turnover Ratio?

The name accounts receivables turnover ratio gives away half of the story. For the rest, this account deals with the credits receivable from the customers. This account precisely measures the ratio of the number of times the business is able to collect its account receivables in a year. These receivables are the credits due with customers for the business.

The number of times implies the number of times your business was able to recover the average receivables. For example, if the business has due receivable credits of $ 11,000, but the company was able to retrieve $22,000, the number of times will be counted as 2.

The calculation of this ratio will be a great help to your company. The ratio helps the accountant in -

- Estimating the efficiency of payment collection by business

- Understanding the receivable amount on an average for the year

- Gives a base to compare the accounts with competitors

- Helps in analyzing financial growth

How to Calculate Receivable Turnover Ratio?

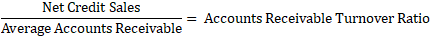

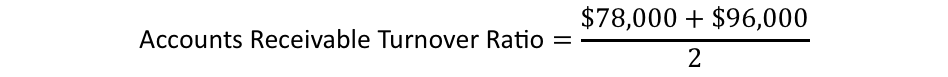

If the receivable turnover ratio has to go in the books of the business, it has to be calculated first. Here is the formula that will help you calculate the receivable turnover ratio for your business.

Formula –

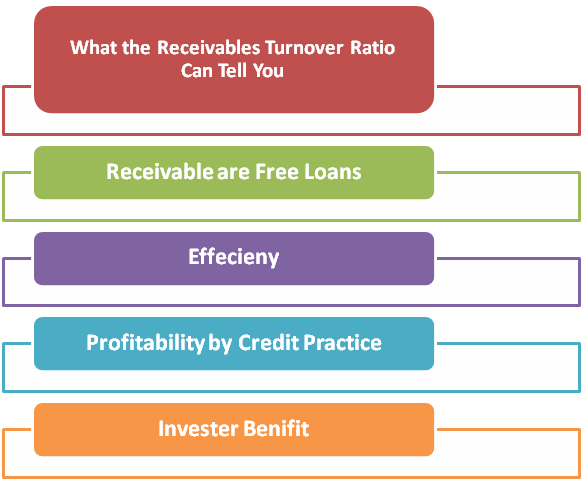

What the Receivables Turnover Ratio Can Tell You?

The receivable turnover ratio indirectly speaks a lot. You do not need a keen eye to understand it all. Your accountant is well skilled to manage all the accounts. But here are things receivables turnover ratio can tell you.

Receivable are Free Loans

The receivable amount is the amount a customer owes to your business. This amount is supposed to be paid when the purchase is made. However, a business is liable to give a time frame of 30 – 60 days to the customer to make the payment while billing. The time frame a customer takes to make the payment is treated as interest-free time. The credit amount is similar to a loan. But the business charges no interest on the amount. Thus it can be considered as an interest-free loan.

Efficiency

Receivable turnover ratio helps in understanding the efficiency of collecting the receivables of the company. The ratio also ensures to measure the number of turns the receivable turnover took. This gives the information on how much cash has been generated by the company in a month, in a quarter, and in a year.

Profitability by Credit Practice

For any business, it is important to understand the cycle of credit and the churn of credit in sync with profitability. The receivable turnover ratio helps a business in analyzing if the company is making a profit with the credit or not. It also helps in analyzing how often the company is carrying out a collection cycle, and if there is a recurring pattern formed or not.

Investor Benefit

The receivable turnover ratio also helps investors making the right decisions. When the receivable turnover ratio of a business is lower than its competitors, it means the business is making less profit. This helps the investors understand which business will be the best fit for their investment.

High Account Turnover and Low Account Turnover

|

High Account

turnover |

Low account

turnover |

|

Indicates that company is churning out

profit and has some high paying capacity client. |

May indicate that the profitability

churn of the business is on the lower side or the clients are not high on

quality. |

|

May have a major portion dealing in

cash. |

May or may not have a heavy cash flow

coming in. |

|

High account turnover can also imply

that the company’s policy does not leverage the credit account much and deals

in straight payments. This also indicates that the company

will hardly have any receivable credits and affects the financial reports.

|

Low account turnover can also imply

that the company’s policy runs majorly on receivable credit account. This also indicates that the company

will directly have a larger number or receivable credits. |

|

High account turnover can be due to a

rapid and effective recovery cycle. This will help the company in keeping the

ration on the higher side. |

Low account turnover can be due to a

rapid and effective recovery cycle. This protects the company to recover the

receivables on faster pace thus affecting the accounts of the company. |

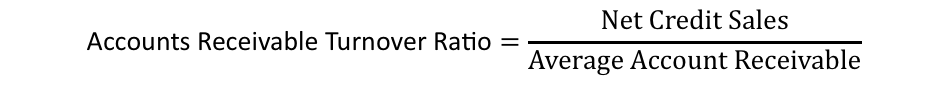

Example of How to Use the Receivables Turnover Ratio

By now you must have received a fair and precise idea of the receivable turnover ratio. We have already discussed the formula of how to calculate the ratio. To be more accurate with the learning, let’s see how to find out the ratio through a calculation.

Example –

Let’s have a look at Mirolta Enterprise’s financial results

- Net credit sales - $500,000

- Receivable account at the beginning of the year – $78,000

- Receivable account at the end of the year$96,000

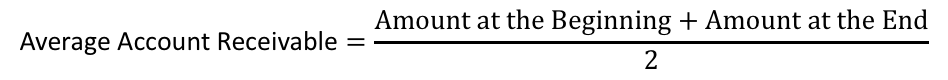

Formulas –

ACR – Average Account Receivable

ARTR - Accounts Receivable Turnover Ratio

= $87,000

= 5.7

Mirolta Enterprise recorded net sales of $500,000. Proceeding with the same, the receivable account at the beginning of the year was reported at $78,000. The receivable account at the end of the year was reported at $96,000. By the calculation done, we found that the account receivable turnover ratio of the business stands at 5.

Receivables Turnover vs. Asset Turnover

As the name suggests, the asset turnover ratio deals with the assets of the company. A company uses various means to generate revenue. The assets turnover ratio compares the revenue generated to the value of the assets of your business. This helps in identifying the efficiency of the business in comparison to the assets it owns. If a company is making enough or more sales and revenue than the value of its assets, it is a profitable business.

The receivable turnover ratio and assets turnover ratio are similar in aspects. Both ratios are used to assess the efficiency of a business in different verticals. Both the ratios also help the investors and the company in analyzing if the business is running profitably or not.

When the receivable turnover accounts are low, it implies that the business has given out more credit and is making a loss. When the Asset turnover account is low it implies that the company is not leveraging the assets efficiently to generate profits.

If you see the asset turnover ratio of your company falling, understand that it is time to enhance the system of generating revenue. Target the strategy and efficiently use the assets to generate more revenue and increase sales.

There are certain limitations attached to assets turnover ratio when it comes to comparing companies on the same. While assets can be of numerous sizes, you cannot practically compare various companies for the same. A company dealing in the manufacturing of plastic bottles will have a different assets size than a telecom company.

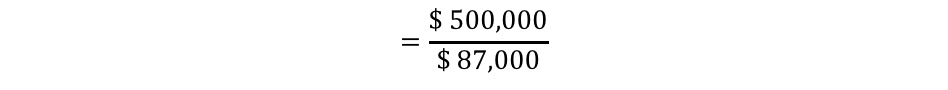

Limitations of Using the Receivables Turnover Ratio

When you are an investor or a business owner, you have to understand the limitation of the receivables turnover ratio. When you are making a decision to invest in a business it is vital to understand the limitations of the receivables turnover ratio to make a favorable judgment.

Let’s look at the considerable limitations we can find with the receivable turnover ratio:

False Estimation of Sales

Be it deliberately or by a mistake, some companies give out false estimates of their sales. Several companies at times calculate the value of receivable turnover ratio on total sales instead of net sales. This wrongly inflates the results and ratios. Thus, companies end up giving out a false estimate of the ratio and profitability of the company.

No Periodic Generalizing

Another limitation that comes with the receivable turnover ratio is that it cannot be constant or generalized throughout the year. A lot of businesses make the most part of their sales and revenue in the peak season. In the off-season, the sales can be as low as negligible. This implies that while the peak season the receivables ratio will be very high in comparison to the off-season. In the off season, the receivable turnover ratio can fall in the low account category too.

No Customer Paying Capacity Assurance

The receivable turnover ratio is able to analyze which customer has paid the credits by when. It helps in the identification of the payment style and routine of the customers. But the ratio will fail to analyze which customer is returning for purchases next time. The ratio will also not identify a customer moving towards bankruptcy ultimately discontinuing as a customer.

Different Receivable turnover patterns in B2B and B2C- Mass scale producers and manufacturers generally provide raw materials to other businesses. These cycles work entirely on credits. The payment term is longer in these businesses. This creates a greater impact on the receivable turnover ratio. The process creates a barrier in the analyzing process and the profitability graph cannot be understood in the most efficient way.

What Do Efficiency Ratios Measure?

In simple words, efficiency ratios measure the efficiency of the company. Just like the name suggests, the ratio helps an organization in measuring the efficiency of your business.

When you wish to understand it precisely, the efficiency ratio analyses how efficient a business is at managing the liabilities and leveraging the assets. There are various different aspects that a business works on. This is why there are several different efficiency ratios measuring varied factors of a business. Even though there are a lot, most of the ratios measure efficiency in relevancy with liquidating the inventory to generate income.

There are three most important efficiency measuring ratios that are considered by every business. These ratios are the receivable turnover ratio, assets turnover ratio, and inventory turnover ratio.

Usage of factors and elements

These ratios prove vital when an investor wishes to analyze a business. The banks and the investors both use ratios to back their decisions to invest in a business or to provide a loan. These ratios also help in understanding the usage of equity, the turnout time for liabilities, and turnover time for receivables. It also helps the company understand the usage of the machinery and the inventory present with the business.

Calculations

Another common thing about all these efficiency ratios measures their results on the basis of the current numbers produced by the business. These numbers are current revenue, current liabilities, and current assets under the name of the company.

Determining a Firm's Percentage of Credit Sales

Running a monetary business does not always imply upfront money. Businesses receive their payments in several different ways. A lot of business-to-customer dealing businesses keep their payments in cash and upfront. Some business-to-customer businesses work with both upfront cash payments and credits. But most business-to-business businesses work with credit and cash systems together.

The credit allowance could be because of multiple reasons and the business policies. With general practice, a business allows its client 30 to 60 days to pay the credit allowed. The process works entirely depending on the nature of the business.

For a company working with cash and credit both, the differentiation and determining of credit sales percentage can be tricky. This cannot be done manually. To find out the percentage of credit sales, the company has to practice accounting best practices. The records of sales can be found in the accounting books and sales books. The records can also be found on transactions recorded digitally. Once found, a separation process can be conducted to analyze the number of sales made in credit.

While this is the only authentic way of determining credit sales, most companies do not practice the records. However, digitized software like Desekra Books can give out the required information to mark the difference and find percentage.

Know Accounts Receivable and Inventory Turnover

A business works on a simple method. Sell inventory and received revenue. While this may be a straight equation, you are allowed to take time to understand each account. The two main accounts involved here are the receivable account and the inventory turnover account.

Receivable Account

The receivable account as the name suggests is the account that collects all the revenue on credit. When the business initiates the churn of collecting receivable money given as credit, the revenue collected goes into the receivable account. The account is a determiner of whether the business is profitable or not. This account also helps in generating relevant and reliable information that helps investors make decisions with their investments in the business.

The receivable account also can also be the cause of liabilities and losses to the business. This account helps the business in foreseeing the future and understanding the financial relationships of the business with the clients.

Inventory Turnover

Inventory turnover account is the account in books that works precisely for inventory entries. This account records and shows the ratio of how many times a company has bought, sold, and re-bought the inventory in a given time frame. The account also holds entries for the replacement of inventory. The company this way keeps inventory control under check.

The inventory turnover ratio can be higher or lower.

Higher Inventory Turnover

Higher implies more rotation of the inventory and more revenue generation. This states the profitability and growth of the business.

Low Inventory Turnover

Low suggests slow rotation inventory. This states that the business may be facing low season or is struggling to survive.

5 Tips to Improve Your Accounts Receivable (AR) Turnover Ratio

The Accounts Receivable Turnover Ratio is the determiner of if financial profitability or loss status of the company. If the ratio is high the company is growing and making a profit. If the ratio is on the lower side the company is making losses.

If you are a business owner, you will always wish to run the company while making profits. A company can make profits by enhancing and improving its Accounts Receivable (AR) Turnover Ratio. If you do not know some of the ways to do so, keep reading.

Make Billing and Efficient Task

Billing may take a lot of time when done manually. As per the stats, 20% of time spent on billing is wasted. To avoid manual labor and do the task efficiently, manual billing should be eliminated.

Introduce an automation software for billing. This will consume less time, commit almost no errors, and will build a strong record of sales for the company. The data entry will be enhanced and the business will be able to save a lot of energy on manually billing each sold product.

To incorporate this, make sure you choose the payment method in advance along with the terms of the purchase made.

The team should also be proactive in invoicing. Every billing should be done with an invoice.

Invoice Everything Strictly

Invoice production is a factor that determines when the revenue comes in. Several companies commit the mistake of not producing an invoice right after the sale. At times companies also produce a complicated and elongated invoice that the customer is unable to understand easily.

By producing invoices after the purchase on delayed times, the company promotes delayed payments causing a fall in the accounts receivable turnover ratio.

Invoicing of every sale should be rapid, strict, and particular. The errors should be eliminated and the team should be encouraged to practice instant invoicing.

Once the invoicing is done rapidly, the company should start refusing from receiving delayed payments.

Focus on Enhancing Customer Relationships

Focus on enhancing the customer relationship. Provide a great experience to the customer. Work on improving the bonds with customers. A business with great bonds with its customer is able to win the trust of the customer. When the business and the customer follow this close relationship, the customer tends to make the payment faster. The delays are often avoided by the customer deliberately as they are satisfied with the company.

Implement Usage of the Software

We live in a digitized world. Digitization has made all our lives easier. Every business should emphases on doing the same as well. Implement usage of software in your business. The software can be to maintain the books of the company. It can be to generate invoices and carry out the billing process along with tackling inventory management. It can be to enhance the experience of the consumer.

Using software improves the efficiency of the entire process. It also helps save time and money in manual labor.

Reward Upfront Payments

Humans tend to take rewards as appreciations. To encourage instant payments a company can begin giving out rewards for upfront payments. This will enhance the customer-business relationship. It will also help the business understand the paying capacity of the customer for future engagements.

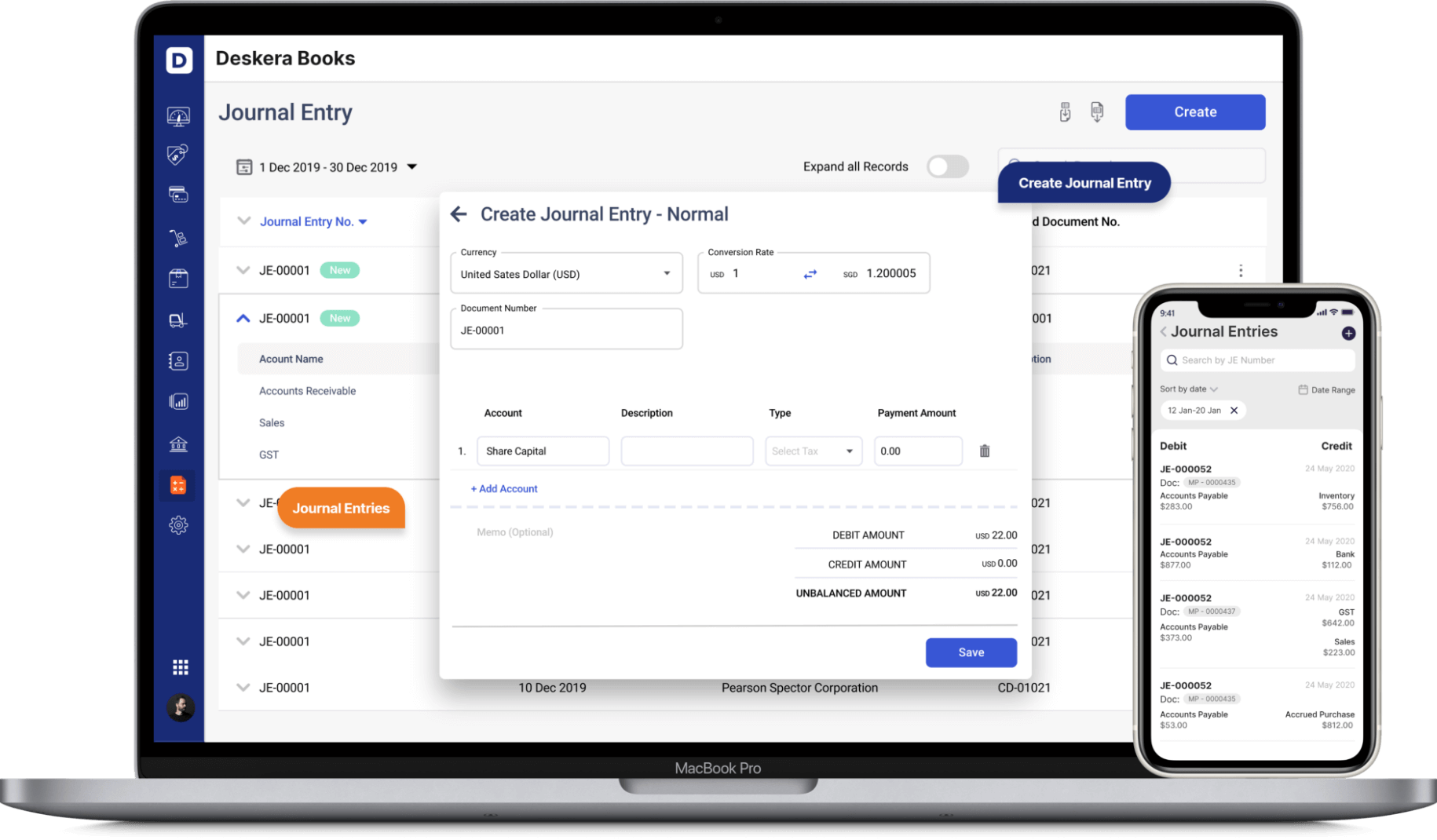

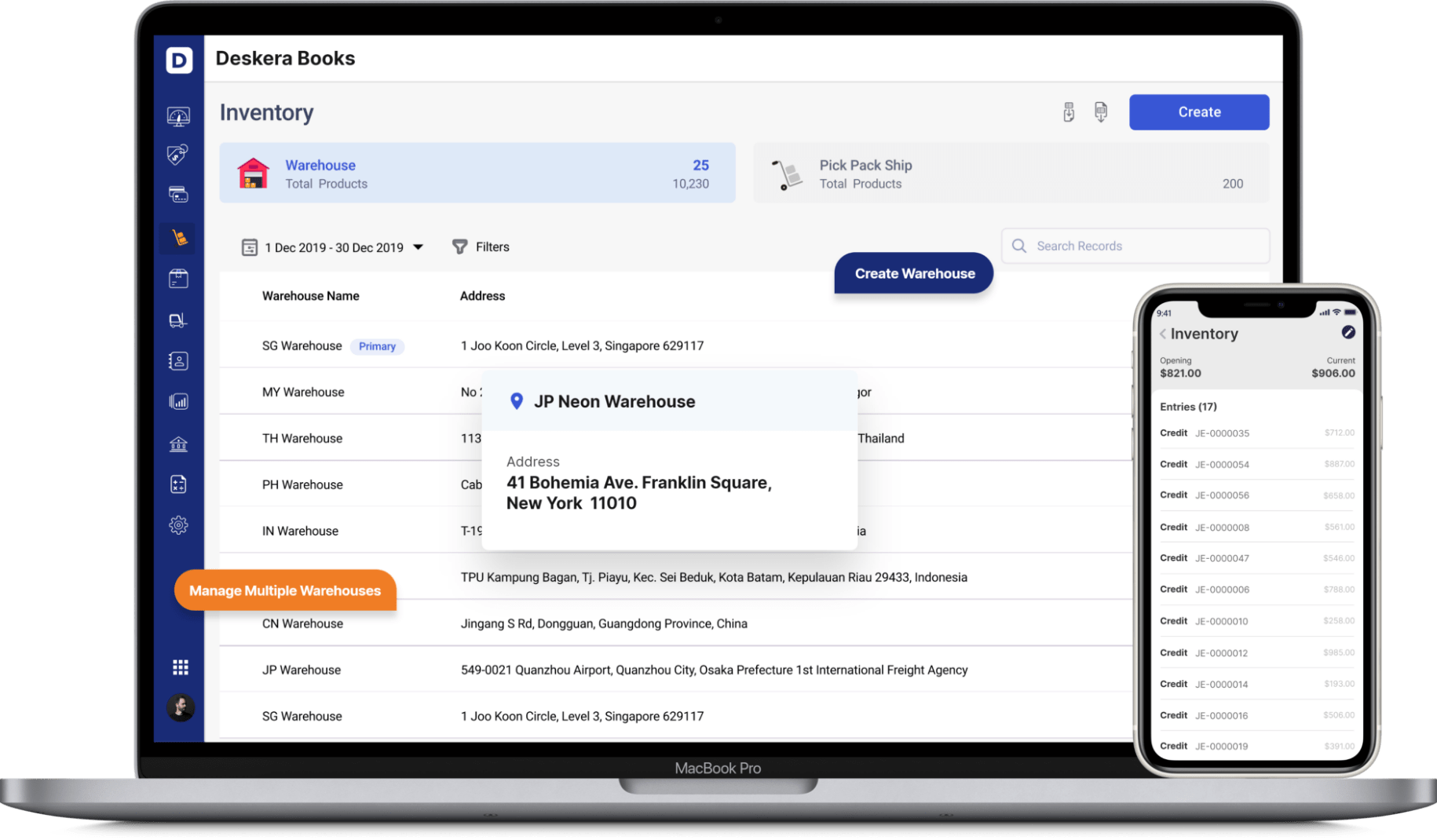

How Can Deskera Help With Accounting?

Accounting can be a hefty job to carry out with efficiency. But you do not have to worry.

Desekra offers Deskera Books for your accounting needs. Deskera Books is cloud-based accounting software that backs you up. It takes care of the accounting and financial aspects of the business while you are busy generating revenue.

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

Using the software protects you from investing your valuable time in the sheets for hours on end. Deskera also offers other financial tools to ensure the accounts are taken care of.

The software is breezy to use. You can peak inside the books with just a few clicks in no time. It is an error-proof system that enhances the quality of the task while ensuring an easy interaction between data and the business.

In a single software, you can create multiple balance sheets and journal entries. Irrespective of the size of your business, Deskera provides highly compatible financial aids and accounting solutions. In Deskera Books you can also find a readymade Profit and Loss balance sheet as well.

Key Takeaways

- The receivable turnover ratio is an important aspect of the financial growth of the company.

- The ratio depends on the turnover of credit transactions into cash transactions.

- The receivable turnover transaction is among one of the three other efficiency measuring ratios for a company.

- A higher receivable turnover ratio implies growth and profitability for a company.

- The efficiency of the receivable turnover ratio can be influenced in 5 ways.

Related Links